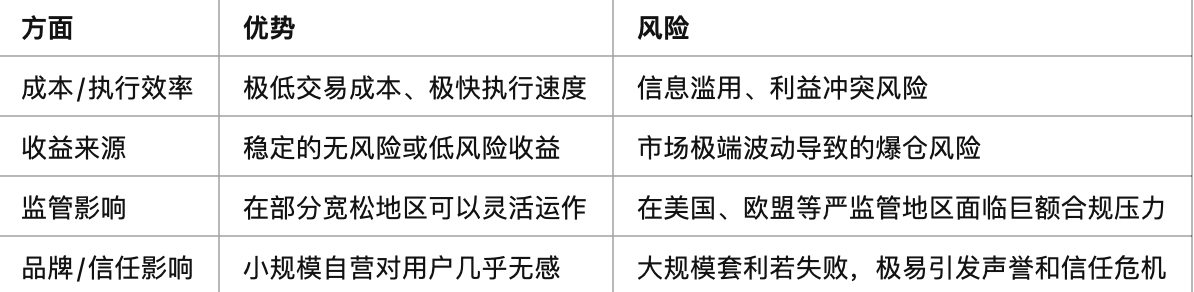

I remember that #coinbase previously promised not to engage in proprietary trading in the SEC investigation documents. It seems that for the sake of profit, they are no longer upholding their principles, and they only provide services to non-U.S. institutional investors, which is the key point here. This is because U.S. investors are strictly regulated by the U.S. SEC, CFTC, and other national regulatory agencies (such as the EU MiCA).

Once an exchange is involved in proprietary trading, conflicts of interest are bound to arise, such as prioritizing their own orders, manipulating the order book, and delaying the execution of others' orders. Especially in extreme market conditions like the 312 black swan event, there is a high probability of liquidation risk.

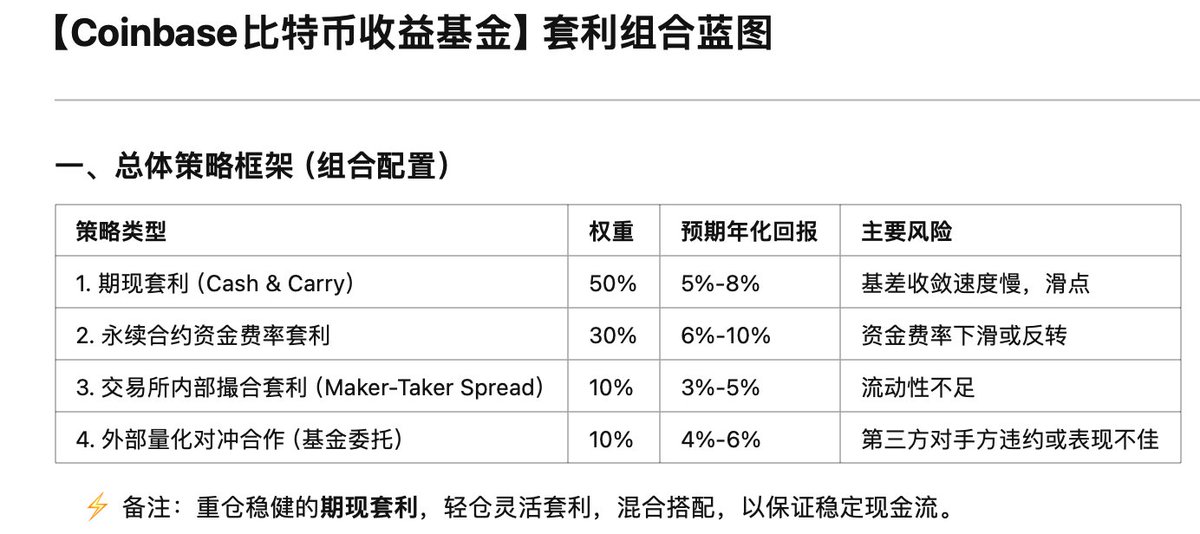

We then conducted some research on a combination model of arbitrage strategies that could achieve an annual return of 4%—8%.

1️⃣ Cash & Carry Arbitrage 50% Position

• Buy BTC in the Coinbase spot market

• Simultaneously short an equivalent amount of BTC futures on CME (Chicago Mercantile Exchange) or Coinbase Derivatives

• Lock in the futures premium (Contango Premium)

• Settle once a month and dynamically adjust the position

Characteristics: Almost risk-free, low volatility, meets institutional stability requirements

2️⃣ Funding Rate Arbitrage 30% Position

• Hold BTC in the spot market

• Open short perpetual contracts on major exchanges like Binance/Bybit/OKX

• Capture positive funding rate returns (especially when funding rates spike before and after major market movements)

• Dynamically monitor and take profit or close positions when negative rates are detected

Characteristics: Returns fluctuate significantly, but overall positive, with opportunities to increase the overall portfolio return rate

3️⃣ Internal Maker-Taker Arbitrage 10% Position

• Become a liquidity provider (Maker) within Coinbase

• Place limit orders to earn maker rebates

• Simultaneously take low-cost orders (Taker) to arbitrage small price differences

• Requires a high-frequency trading robot system with low slippage and high success rates

Characteristics: Small profits accumulate, almost risk-free, but with high technical requirements

4️⃣ External Quantitative Hedging Delegation 10% Position

• Choose high-performing quantitative funds or arbitrage teams (e.g., GSR, Amber Group, Jump Trading)

• Delegate part of the funds for statistical arbitrage and options volatility arbitrage by external teams

• Set up a daily net value observation mechanism with an automatic redemption stop-loss line (-2%)

Characteristics: Diversifies risk, exposes to more market opportunities, but increases external counterparty risk

In summary: Arbitrage is an enticing profit for exchanges, but it is also a double-edged sword. Small-scale, transparent arbitrage is feasible; large-scale, proprietary arbitrage can easily trigger fatal risks. If Coinbase sets a precedent, more exchanges will follow suit. It may seem fine during normal times, but once a systemic risk occurs, it could be disastrous. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。