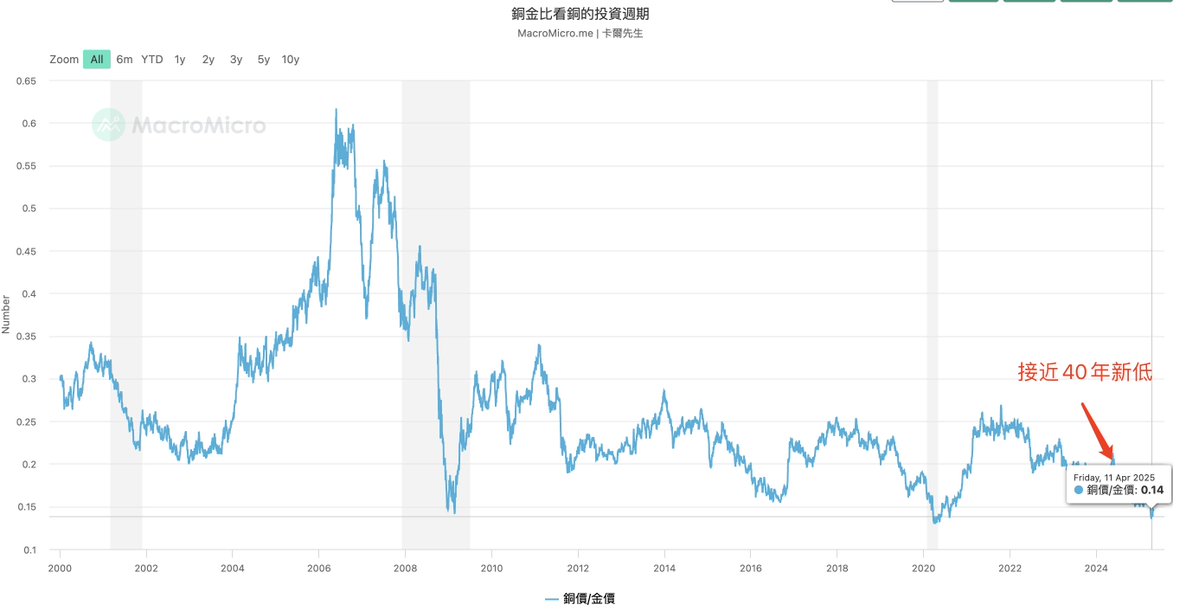

铜金比率创下40年左右的新低,这是典型的全球衰退信号,不要误把熊市陷阱当作牛市信号,下行周期中,稳健驶得万年船,追高不可取,逢低DCA策略,是最佳方案!

当前无论宏观还是地缘政治,都不太乐观:

• 美联储利率维持高位,企业贷款投资难

• 全球制造业仍处在低迷区间(PMI多在50以下)

• 消费者信心指数持续下滑

• 美国股市估值回调后,依旧处于历史高位

• 印巴冲突加剧,断水,断航,断贸易(万斯前脚到访印度,后脚起冲突,想想都知道缘由)

• 伊朗最大港口沙希德拉贾伊港被炸,处于瘫痪状态,这个港口占伊朗85%集装箱吞吐量。

巴菲特持有那么多西方石油股票,包括这次川川背后的资助集团,也主要是能源巨头为主。中东局势,只会越来越复杂,石油这个价格,未来大概率要冲突不断,引发原油价格上涨,带来更大的利益。

目前这个铜金比率破底,是一个相当危险的领先衰退信号!拭目以待🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。