Today's homework focuses on the macro aspect of the White House's adjustment of tariffs on automobiles. Overseas brands can enjoy tariff reductions if 85% of their parts are sourced from the U.S. This reduction will be gradually implemented over three years to help these foreign car manufacturers establish factories in the U.S.

From the perspective of the automotive sector, Trump indeed intends to use tariffs to pressure foreign companies to relocate some manufacturing to the U.S., providing more jobs for Americans. Therefore, companies need to weigh the costs of tariffs against the expenses of building factories, while also considering whether the Democrats will maintain this tariff system if Trump and the Republicans leave office in 2028.

In addition, tomorrow we will see the GDP and PCE data. The consensus is that the impact of PCE is minimal, while opinions on GDP's impact vary. Some believe that GDP data is too lagging, and the market has already priced in expectations, so even poor data will have a low impact on risk markets. Others think that a low GDP might actually favor more rate cuts from the Federal Reserve, making worse data more beneficial.

This second viewpoint is similar to the hope for an increase in the unemployment rate in 2024 to secure additional rate cuts from the Fed.

Some believe that the current stability in the U.S. stock market is due to the earnings season, as four out of the seven sisters will report earnings this week. Earnings reports can influence the market in the short term, and expectations surrounding these reports may be affecting the current market. All these possibilities exist, and no one can definitively say which is correct; we will only know once it happens, as only the market's results are accurate.

Therefore, my personal view is to refrain from opening positions in highly uncertain situations and to wait for results and certainty to emerge.

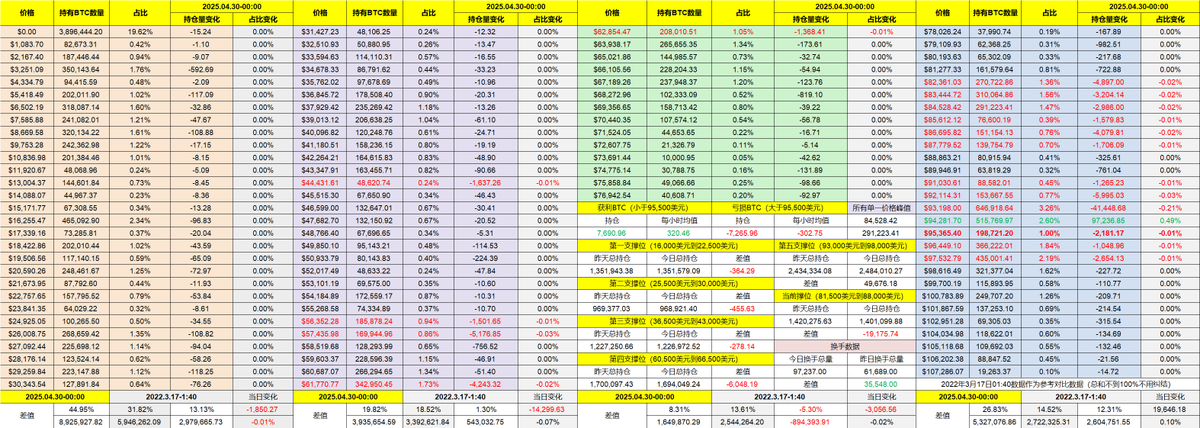

Looking at Bitcoin's data itself, the continued price fluctuations have not led to significant turnover, and investors remain relatively restrained. The trading volume data also shows that as uncertainty increases, both buyers and sellers are decreasing.

This is completely different from last week's event-driven situation; it feels like a return to the post-FOMO emotional decline. This was the case during the elections, where the market waits for new positive or negative news to make decisions.

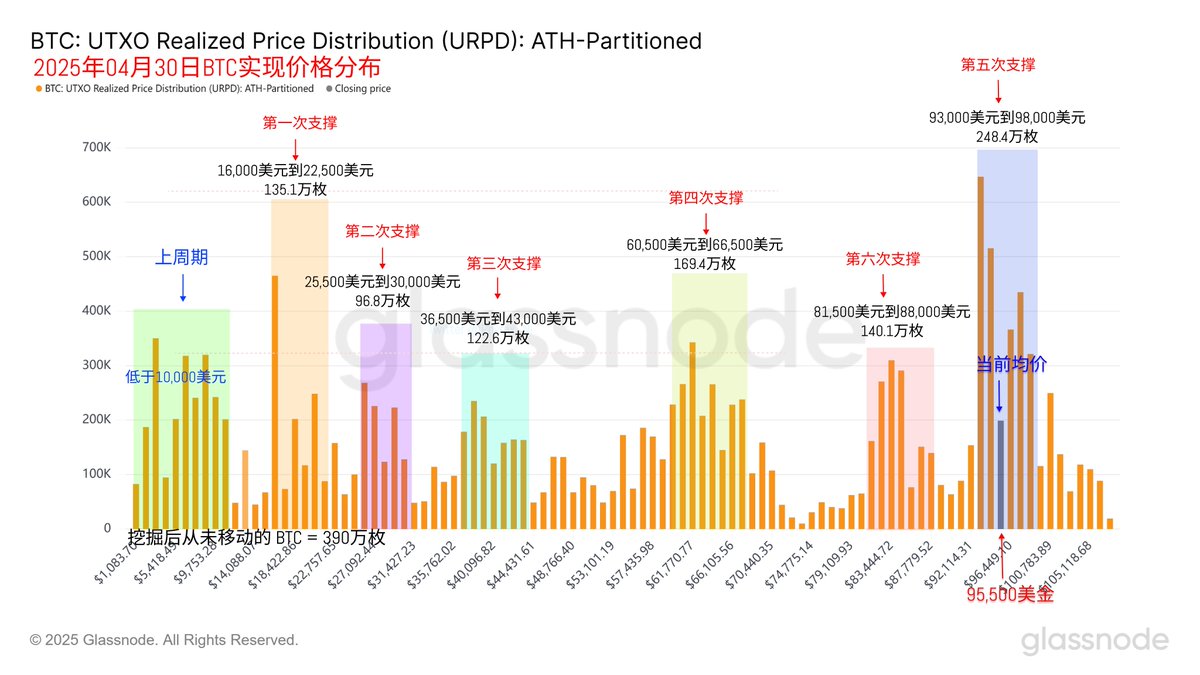

On the support side, there is still not much to say. The on-chain support between $93,000 and $98,000 has once again proven to be a strong support level that attracts investors, with the largest volume of chips concentrated in this area. In the short term, there is still some support around $83,000, but due to the predominance of short-term investors, a long period of consolidation is still needed.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。