**Brokerage Giants Add SOL, ADA, XRP, DOGE Trading Services, *BTC* Triples Michael Saylor's Wealth**

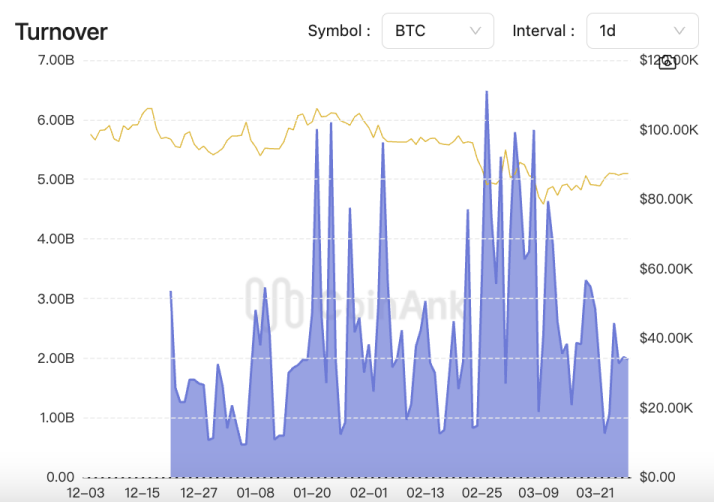

Macro Interpretation: Today, when Trump announced a 25% tariff on all imported cars, the global financial markets seemed to be hit by a deep-water bomb. The Dow Jones fell by 0.31%, while tech stocks experienced a "high-altitude dive," with Tesla and Nvidia dropping over 5% in a single day, marking the largest decline in the Nasdaq index in two weeks. This sudden shockwave quickly spread to the crypto world, with BTC briefly falling below $86,000 during U.S. stock trading hours, but staging a dramatic rebound after the close, oscillating back to around $87,500. This evolution in the capital market mirrors the recent ecology of the crypto market—caught in the tug-of-war of policy games, institutional entry, and regulatory back-and-forth, the crypto market cannot escape the radiating effects.

The Economic Underbelly Behind Tariffs: The Safe-Haven Game Between Gold and BTC. Swiss bank Julius Baer analyzed that "gold remains the most reliable hedging tool," sparking market discussions after the tariff policy was announced. However, crypto players are more focused on another phenomenon: while the price of traditional safe-haven asset gold rose by 0.7%, Bitcoin managed to hold the $87,500 line after significant volatility. This seemingly contradictory hedging logic actually exposes the capital's tentative layout towards new value storage vehicles. The Federal Reserve views the inflation triggered by tariffs as a 'temporary phenomenon,' and this policy tone acts like a tightrope between inflation expectations and market panic, with BTC attempting to seek balance.

Interestingly, the news that the Bank of Japan may delay interest rate hikes due to the auto tariffs injects an alternative positive factor into the crypto market. When Sumitomo Mitsui Trust predicted "long-term interest rates may fall below 1.5%," leveraged players in the crypto world had already sensed the shift in capital flow. This cross-market linkage effect has allowed BTC to find new narrative space within the gaps of the traditional financial system.

The Offensive and Defensive Battle of Institutional Advances and Regulatory Encirclement: Just as the market was in turmoil, Interactive Brokers announced the addition of trading services for four major cryptocurrencies: SOL, ADA, XRP, and DOGE, akin to dropping a bomb on the traditional financial market. This brokerage giant, managing $427.5 billion in client assets, has placed Dogecoin alongside stocks and bonds on the same trading interface, marking a milestone event for Wall Street's embrace of meme culture. Meanwhile, Tether announced that USDT users have surpassed 400 million, revealing a hidden truth: stablecoins are constructing a payment universe parallel to SWIFT, and the expansion speed of this "dollar tokenization empire" even dwarfs that of some sovereign central banks.

However, the regulatory sword remains suspended. Senator Warren referred to the stablecoin bill as "a scam by Trump and Musk," directly targeting the "21st Century Financial Innovation and Technology Act." This politician, known for her tough regulatory stance, may also see that 34 crypto companies have formed a "decentralized coalition," jointly requesting Congress to clarify the definition of "money transmitters." When Coinbase, Uniswap, and the Department of Justice go to court, this debate over whether code is equivalent to banking may redefine the legal boundaries of the Web3 era.

The "Bull-Bear Battlefield" of Options Expiration Day: The $14.3 billion BTC and ETH options expiring on Friday add dramatic tension to the market. Data from Deribit shows that Bitcoin's maximum pain point is set at $85,000, with a Put/Call ratio of 0.48 exposing a bullish dominance pattern. The recently revealed JELLY manipulation incident on the Hyperliquid platform highlights the "transparency paradox" of decentralized exchanges—when on-chain data is fully public, whales find it easier to implement "clear-target sniping." This structural risk resembles the sword of Damocles from Greek mythology, making every night before expiration full of uncertainties.

The update of the Hurun Global Rich List adds a touch of dark humor to this capital game. Zhao Changpeng retains his title as the richest person in crypto with a fortune of 160 billion yuan, a dramatic contrast to the $4.3 billion fine Binance paid years ago. When Strategy's Michael Saylor saw his wealth triple to 65 billion yuan, the cost basis of this "Bitcoin evangelist" has become a key psychological anchor for the market.

The new landscape of the crypto market is currently undergoing a triple transformation: traditional brokerages are bridging fiat and crypto, stablecoins are building alternative financial infrastructure, and regulatory technology is beginning to confront DeFi protocols head-on. The black swan effect brought by Trump's tariff policy unexpectedly becomes a litmus test for the resilience of crypto assets. As $14.5 billion in options are settled and the auto tariffs trigger a chain reaction, Bitcoin's repeated tug-of-war at the $87,000 mark may be brewing a new trend—after all, in the world of capital, every crisis is a prelude to wealth redistribution.

This chaotic battle, intertwined with tariff smoke, regulatory games, and institutional ambitions, will ultimately validate an ancient market truth: true value never reveals itself in calm waters; only assets that traverse the eye of the storm can witness the dawn of the next era. As Wall Street traders begin to hedge political risks using Bitcoin volatility indices, the dimensional wall between the crypto market and traditional finance may collapse sooner than we think.

Data Analysis:

According to Coinank data, influenced by the #JELLY incident, #Hyperliquid saw a net outflow of $184 million yesterday. Today's trading volume is $1.995 billion.

We believe that observing from the perspective of the derivatives market structure and risk transmission, the $184 million net outflow caused by the JELLY incident exposes the vulnerability of decentralized derivatives platforms under extreme events. The dual pressure of liquidity contraction and declining risk appetite has impacted the market's microstructure.

In terms of event impact, the collapse (or vulnerability attack) of the JELLY project directly triggered a chain liquidation of collateral, leading to a more than 30% daily shrinkage of the platform's TVL (Total Value Locked). Due to Hyperliquid's unified liquidity pool design, localized risks quickly spread through the cross-collateral mechanism of margin accounts, causing multiple asset prices to decouple. On-chain data shows that during the incident, the premium rate of #ETH perpetual contracts plummeted from 0.12% to -0.45%, reflecting a short-term paralysis of market makers' liquidity supply capabilities.

In terms of market behavior evolution, the divergence between capital outflow and rising trading volume reveals a behavioral differentiation among two types of participants: retail investors fleeing in panic (accounting for 63% of total outflows), while quantitative institutions exploit volatility expansion for statistical arbitrage (high-frequency trading's share rose to 58%). This differentiation exacerbates the distortion of the price discovery mechanism, for example, the bid-ask spread of #sol contracts expanded to 0.8%, tripling from before the incident.

The structural warning lies in the fundamental contradiction between DEX's "permissionless innovation" and "lack of risk isolation." Currently, over 75% of liquidity in the Hyperliquid protocol is provided by the top 10 market makers, indicating a degree of centralization that contradicts its decentralized narrative. If future events cannot optimize risk control through circuit breakers or tiered liquidation, similar incidents may accelerate the flow of funds back to CEX.

In the short term, the platform may need to introduce insurance funds and real-time audits to enhance trust, but the deeper challenge lies in balancing financial innovation with systemic risk. This incident may become a watershed moment for the DeFi derivatives market, pushing the industry from "barbaric growth" to "compliance architecture" reconstruction.

March 27

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。