1.BeraChain 概述

Berachain 是一条专注于 DeFi 生态的高性能 Layer 1 区块链,基于 Cosmos SDK 构建,并结合 CometBFT 共识引擎,实现更快的交易速度和更低的交易成本。它采用流动性证明(Proof of Liquidity, PoL)共识机制,通过自研 Polaris Ethereum 模块增强 EVM 兼容性,使开发者能够无缝集成现有 EVM 工具和应用。

作为一条开发者友好、具备强跨链互操作性的区块链,Berachain 旨在连接 EVM 与 Cosmos 生态流动性,打造高效且流动性最强的多链网络。

2.创新

2.1 PoL共识机制

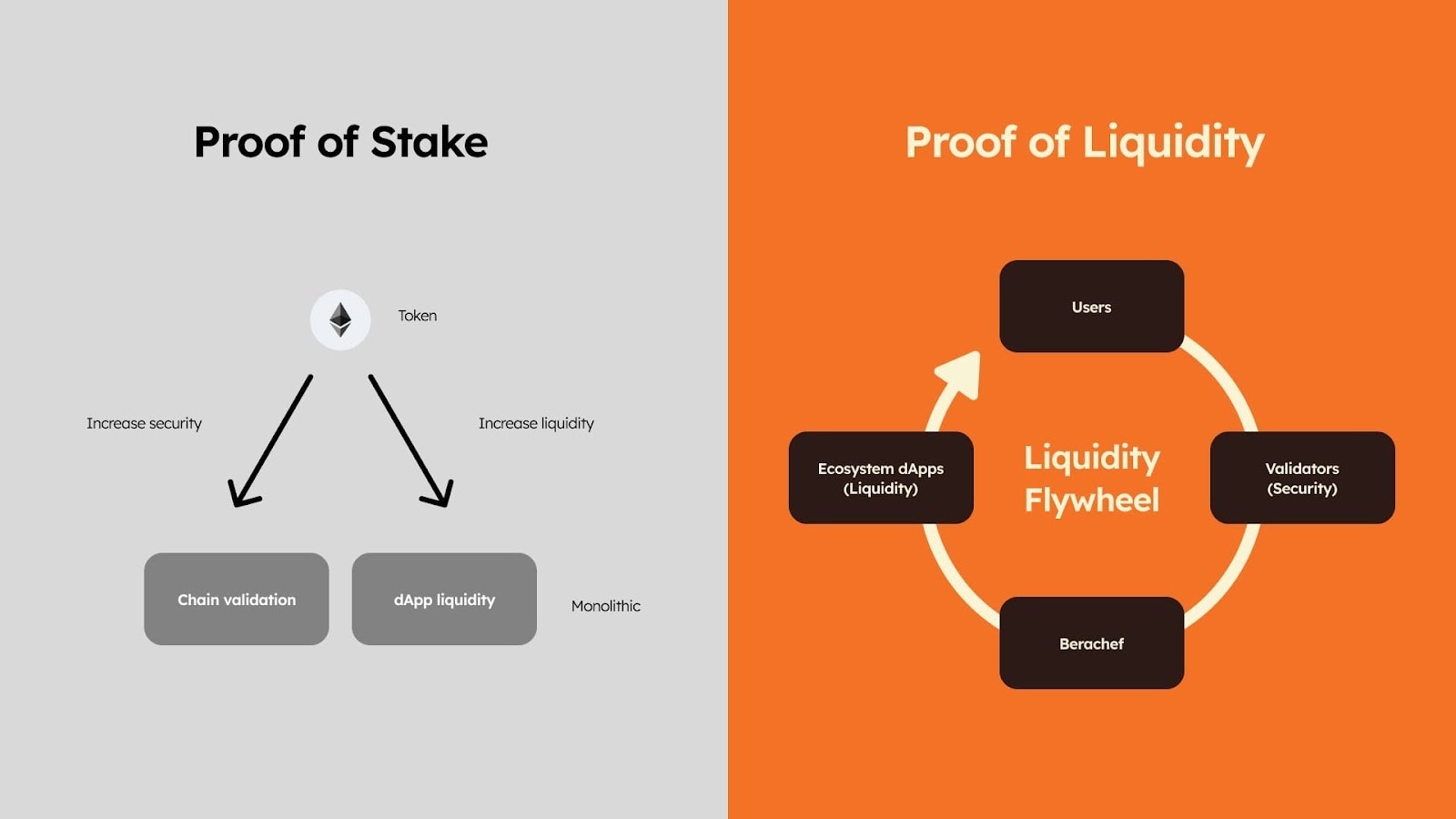

BeraChain 并没有采用目前流行的权益证明(Proof of Stacking,PoS)共识机制,而是选择了独特的流动性证明(Proof of Liquidity, PoL)共识机制,这是一种新颖的共识机制,旨在通过增加链上流动性来提升安全性;它借鉴了 PoS 的概念,以原生 Gas 代币($BERA)作为初始质押保障网络安全,但在此基础上进一步扩展,引入了治理代币($BGT)机制。用户可以通过委托治理代币来获得奖励,从而增强生态激励。简单来说,PoL 将支付 Gas 和提供安全性的代币($BERA)与治理和分配链上奖励的代币($BGT, Berachain Governance Token)分离,使网络运作更加高效。

2.1.1 PoS 的不足

PoS 共识机制在提高区块链的安全性、去中心化程度和交易速度方面有所进步,但在激励开发者和普通用户方面仍有不足。以太坊(ETH)就是一个典型的例子。在以太坊网络中,ETH 主要用于支付 Gas 费、交易流通和验证者质押。验证者需要质押 ETH 以参与交易验证和新区块创建,从而维护网络安全,并通过成功验证区块来获得奖励。然而,普通用户和开发者在协议层面并没有直接的激励,这可能会降低他们的参与积极性。

此外,PoS 还面临 质押 vs. 流动性 的矛盾。同样以以太坊网络为例,用户要么选择质押 ETH 以保障网络安全,要么用于链上交易,但无法同时做到两者兼顾。更多的质押意味着更高的安全性,但也会减少生态的资金流动;而降低质押比例可能提升流动性,却会削弱网络的安全性。这种“同一笔资金既要保护网络又要支持交易”的机制,天然存在权衡问题,使 PoS 网络在安全和流动性之间难以找到完美的平衡点。

2.1.2 PoL如何解决问题

上文我们提到 PoS 主要存在两个问题:

无法从协议层同时很好的激励三方参与者:验证者、用户、应用(开发者)

难以同时兼顾链上质押安全性和流动性的矛盾

PoL 可以更好的激励区块链网络中的各方参与者,在平衡网络的安全性和流动性的同时实现二者的同步拓展,并给链上应用带来实际价值。

图片来源:Berachain 博客

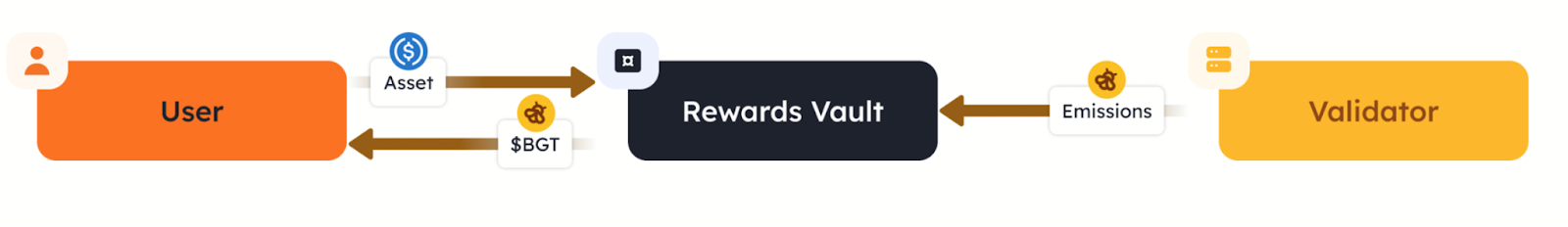

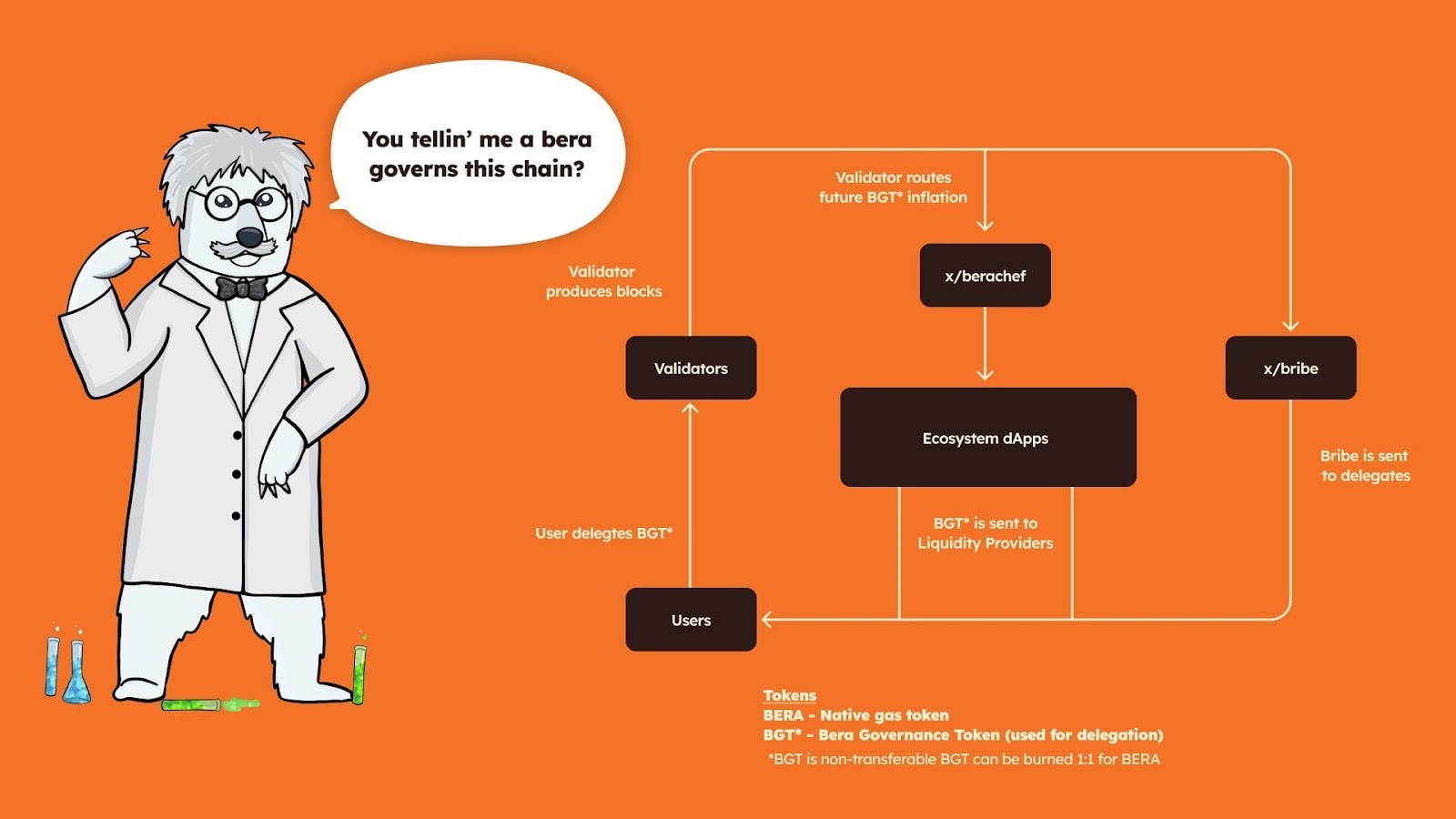

在 PoS 机制中,区块奖励主要分配给验证者和质押者,生态应用难以受益。而 Berachain 设立了各个应用的奖励金库(Rewardvault)和相关机制来帮助验证者、应用和用户三方协作产生收益。奖励金库本质上是一个智能合约,它能从验证者那里接受 $BGT、从用户那里接受质押代币。三方参与过程如下:

验证者产生区块获得 $BGT 奖励后,可以选择将 $BGT 排放至不同应用的奖励金库中;此时为了争取到验证者的 $BGT 排放,应用可使用其原生代币(或其他有价值的流动性代币)“贿赂”验证者,使验证者将获得的部分 $BGT 奖励排放至自己的奖励金库中;

应用收到来自验证者的 $BGT 排放,可以将这些 $BGT 作为奖励分配给为自己的 LP 池增加流动性的用户,以此吸引用户将流动性放进自己的池子里;

用户在选择为不同应用的 LP 池子添加流动性时,为了获得来自应用的 $BGT 分成,会选择获得更多 $BGT 奖励排放的应用;同时,用户可根据自己作为 LP 的比例领取 $BGT 奖励。例如,若验证者向 A 应用金库分配 10 个 $BGT,而用户在该金库的 LP 权重为 10%,则可获得 1 个 $BGT 奖励。

此时,用户可以选择将获得的 $BGT 奖励 1:1 烧毁成 $BERA,或者可将获得的 $BGT 重新委托给验证者。当验证者获得来自应用的代币“贿赂”时,该用户作为委托者又能获得来自验证者的应用代币分成。例如,验证者X 排放了10个 $BGT给 A 应用金库,并由此获得了来自的 A 应用的 100 个 AToken,那么这 100 个 AToken 中大部分代币会回流给将 $BGT 委托给验证者X 的用户。

为什么验证者需要用户的 $BGT 委托?因为在 Berachain 上,当一个验证者产生了区块时,他所能够获得的 $BGT 奖励和他收到的委托权重成正比。根据 Berachain 官方文档,目前 Berachain 上每产生一个新的区块的基础奖励是 0.5 个 $BGT,需要通过 “distributor” 智能合约计算并分发。

由此,验证者需要更多 $BGT 委托来提升区块奖励,而更多奖励又能进一步通过应用回流至用户,且能够帮助应用在此过程中获得更多来自用户的流动性,形成激励循环,增强 Berachain 生态的活力与流动性,也就形成了 Berachain 的飞轮效应。

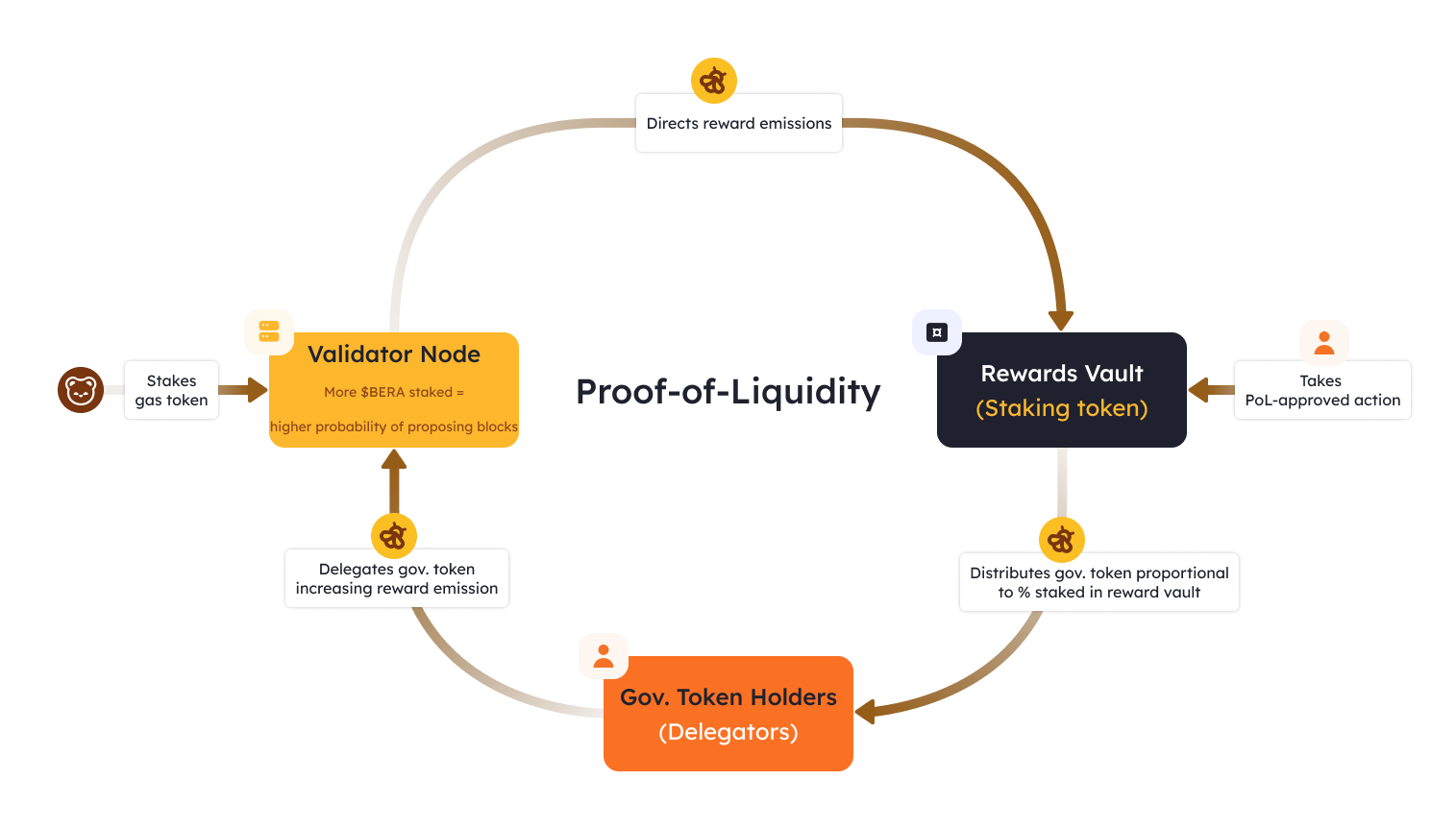

图片来源:Berachain Docs 中文版

同时,针对 PoS 难以同时兼顾链上质押和流动性的矛盾。Berachain 将链上支付代币 $BERA 和治理代币 $BGT 分开,$BERA 作为网络的 gas 代币,用于支付交易费用,支持网络的基本操作。而 $BGT 则用于治理,不可转移,确保决策权归属于真正关心网络发展的长线持有者。再配合上文提到的 PoL 机制,构建一个流动性与安全性协同共存的生态,使流动性不仅能增强链的安全性,还能为链上应用创造实际价值。

2.1.3 飞轮效应

在 2.1.2 小节中我们描述了 Berachain 的飞轮效应形成过程,本质上它是验证者、应用和用户之间通过密切协调形成的相互激励的过程。

Berachain飞轮效应(Flywheel)。图片来源:Berachaib core docs

上图是Berachain 官方发布的飞轮效应框架,这里我们再次回顾并理解飞轮效应的实现过程:

首先是验证者需要质押一定数量的 $BERA 作为节点保证金,以启动一个节点。

当验证者产生一个新的区块时,获得 $BGT 作为区块奖励;而此时验证者能够获得的 $BGT 奖励的多少取决于他收到的来自用户的 $BGT 委托权重。

验证者此时可以决定将获得的 $BGT 区块奖励排放到不同的应用金库中,排放的比例由验证者自己决定。

此时,应用为了让验证者将 $BGT 奖励排放到自己的金库中,可以贿赂验证者。

应用会将获得的 $BGT 奖励分发给为自己提供流动性的用户,根据用户在该池子里仓位的权重,分发对应比例的 $BGT。

假设 A 应用拥有 A-Token。该应用希望增加 A-Token/Bera 池子的流动性。为此,A 应用决定用 100 个 A-Token 贿赂验证者,同时验证者将他的 10 个 $BGT 排放给 A-Token/Bera LP池。

用户希望赚取 $BGT,因此会为该 LP 池增加流动性。假设用户在 A-Token/Bera LP 池中的权重为10%,那么 A 应用会将获得的来自验证者的 $BGT 分成 10*10%=1个 给到该用户。

用户拿到 $BGT 后,可将获得的 $BGT 再次委托给验证者,当验证者获得来自应用的“贿赂”时,该用户也会根据该用户的委托权重获得相应的代币分成。

如此,验证者、应用和用户之间形成了三方利益共同体,也就是飞轮效应:

验证者获得产生区块的 $BGT 奖励,以及来自应用的“贿赂”激励。

应用吸引了来自用户的流动性。

用户通过为应用提供流动性,获得来自应用的 $BGT 分成;通过委托 $BGT 获得来自验证的区块奖励分成。

应用也可以选择自己运行一个节点,成为验证者。此时作为验证者,可以将获得的 $BGT 区块奖励排放至自己的应用金库中,吸引用户将流动性放进自己的池子。如此,可以实现同时作为验证者和应用的双重奖励。

2.2 三代币经济模型

不同于传统公链常用的单原生代币经济模型,为了更好的满足验证者、用户和应用之间的平衡需求,BeraChain 采用了三代币经济模型。其三种代币分别是 Gas 代币 $BERA,治理代币 $BGT 和原生超额抵押美元稳定币 $HONEY。

2.2.1 经济模型

$BGT - 治理代币

用于链上治理,投票决定白名单资产等关键事项。$BGT 不可转让,仅能通过在 Berachain 原生去中心化交易所 BEX 中质押 $BERA 或提供流动性产生,以确保持有者的长期参与和链上激励一致性。

$BERA - Gas 代币

主要用于支付 Berachain 网络的 Gas 费用,可由 $BGT 1:1 单向燃烧得到,以 10% 的通胀率发行,供应量随时间增加。用户可通过质押资产获得 $BERA 作为奖励,同时参与协议收入分成。因为存在治理代币 $BGT,用户能自由使用 $BERA 代币进行质押而不减弱区块链的验证能力,无需在质押和交易中二选一。

$HONEY - 稳定币

Berachain 原生超额抵押稳定币,至少 150% 超额抵押,以确保与美元挂钩。$HONEY 作为 Berachain 生态中的交易媒介,同时用于协议收入分配,支持在 BEX 及应用程序内购买和使用。

图片来源:Berachain 博客

生态赋能

$BERA 赋能链上交易,用户通过质押 $BERA 可获得 $BGT 治理代币,并赚取协议收入(部分以 $HONEY 形式支付)。

$BGT 作为治理核心,用户可利用其投票影响 Berachain 生态规则,同时推动流动性增长。

$HONEY 作为稳定价值媒介,流通于生态系统,为用户和协议提供稳定的支付方式,同时回馈给 $BERA 质押者。

2.2.2 项目收益

Berachain 的主要收入来源包括流动性挖矿奖励、区块链基础设施服务费用、开发者工具和支持收费,以及与合作伙伴的合作收入。通过 Proof-of-Liquidity(PoL)共识机制,项目可从流动性挖矿中获取收益;同时,提供高性能区块链基础设施、开发者工具和支持服务也可能带来收入。此外,与其他区块链项目和企业的合作也构成重要的收入来源。

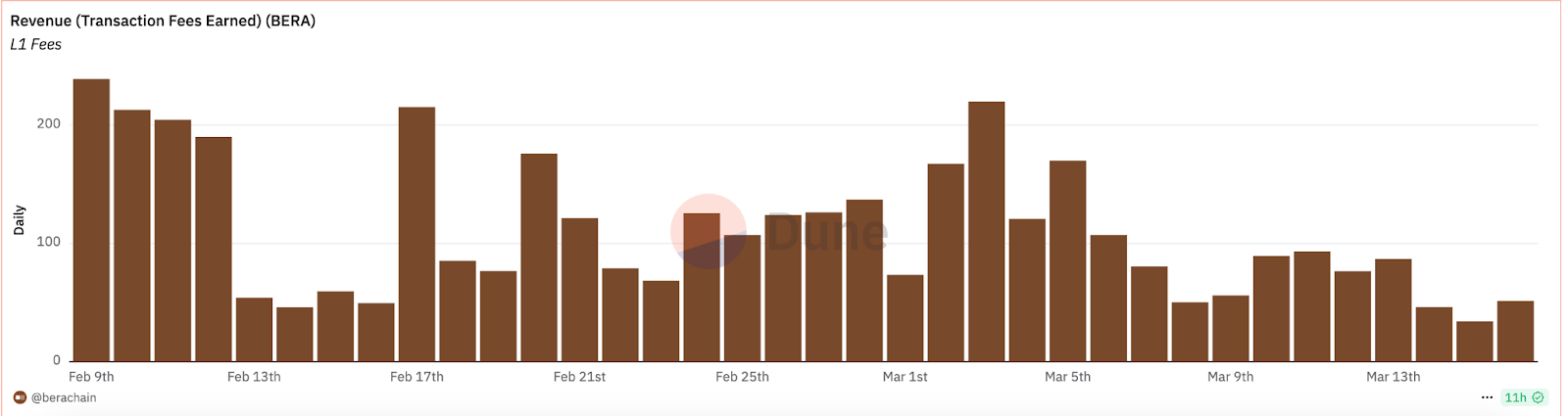

Berachain交易费收益。数据来源:Dune Analytics

3. 生态

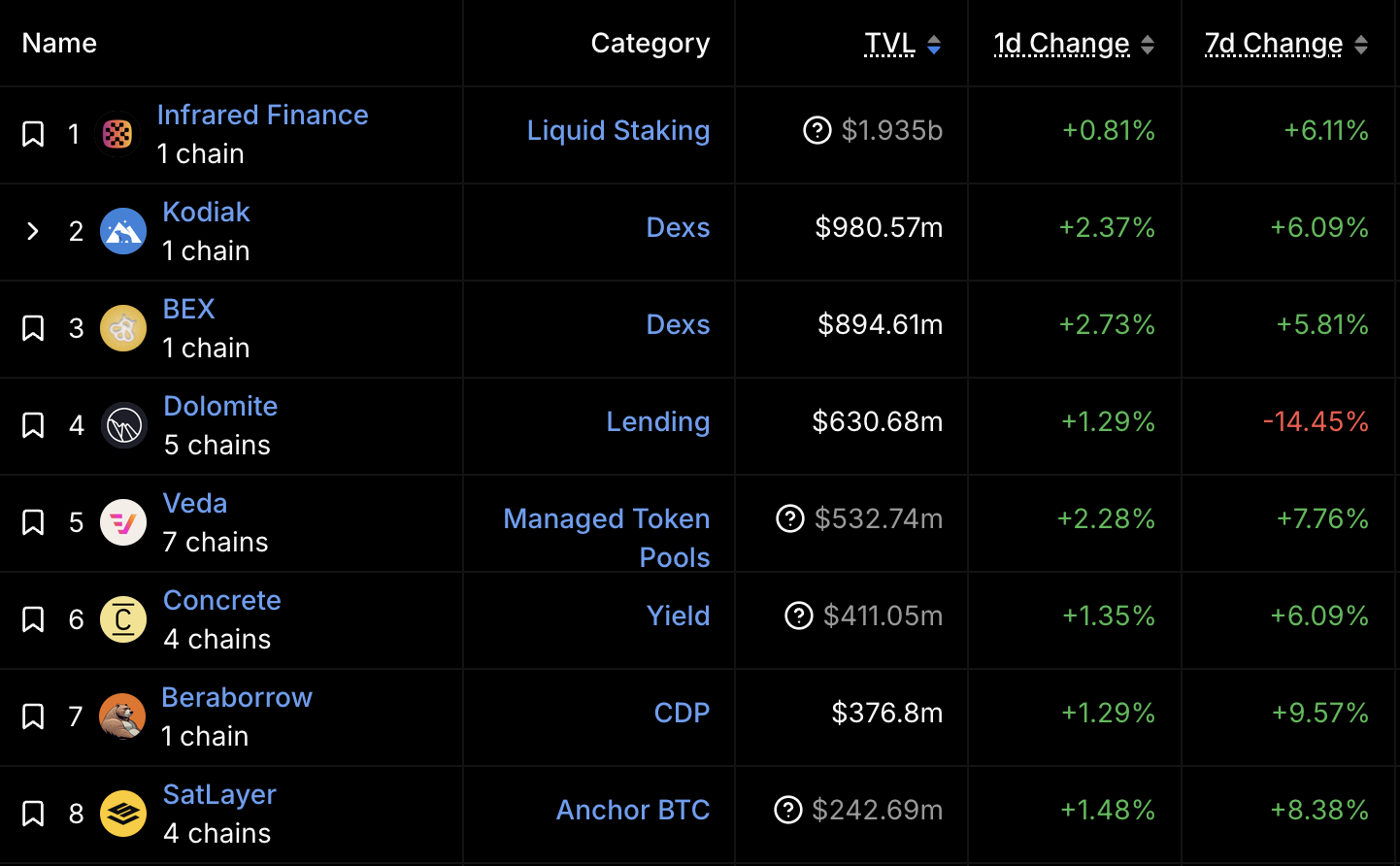

Berachain 自从测试网便有很大的关注量,其生态系统目前已十分成熟,涵盖了Defi、NFT、Meme、Gamefi、AI 等领域。根据 Defillama 数据显示,Berachain 上目前TVL排名靠前的项目如下,当前 TVL 最高的是流动性质押类项目 Infrared Finance,其 TVL 现为 $19.35亿,其次为 Berachain 原生DEX Kodiak 和 BEX,TVL 分别为 $9.8亿 和 $8.94 亿。

Berachain 生态TVL排名。数据来源:defillama

3.1 生态项目

DeFi

目前 Berachain 的 Defi 矩阵已覆盖交易、借贷、衍生品等场景,形成了一块完整的版图。

DeFi - DEX

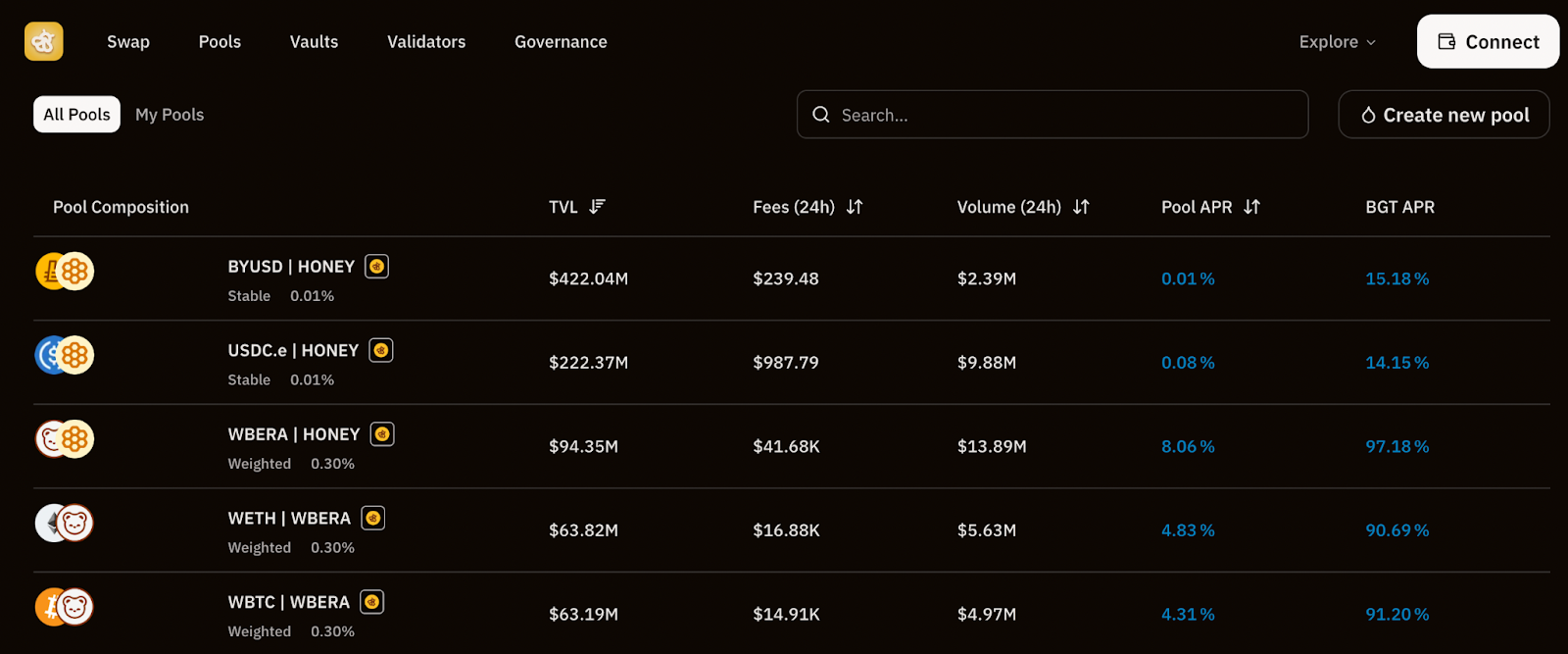

BEX 是 Berachain 推出的原生 Dex,用户可以直接在这里买卖各种代币,比如用链上的原生代币 $BERA 兑换稳定币 $HONEY,或者交易其他生态项目代币;同时用户可以向特定交易池(如USDC/$HONEY、W$BERA/$HONEY等)中存入资金,获得流动性凭证代币(LP代币),然后质押这些凭证赚取$BGT。鉴于 BEX 的存在,Berachain 生态中的其他 Dex 也积极准备各种更便利且高效的服务和策略,来吸引用户和流动资金。目前 BEX 的 swap 中支持多种代币,其流动性池中 TVL 最高的 LP 接近 4亿美金。

BEX流动性池。图片来源:BEX 官网

BEX 采用 AMM(自动做市商)模型,以流动性池取代传统的订单簿市场。BEX 的架构设计具有灵活性、高效性,并优化了交易体验:

全范围流动性池:支持传统的 “Uniswap V2 形式” 流动性池,提供简单流畅的交易体验。

可定制池权重:支持自定义权重分配(如 80/20),满足个性化投资需求。

稳定币兑换曲线:针对锚定资产交易进行优化,降低滑点。

统一金库架构:提升资金效率,同时降低 Gas 费用。

Kodiak 是 Berachain “Build-a-Bera” 加速器计划孵化的唯一一个 DEX,专为 Berachain 生态引入集中流动性和自动化流动性管理。它不仅为交易者提供最深的流动性和最佳交易执行,还赋予协议和流动性提供者更高的灵活性和控制权。

同样作为 Berachain 生态的原生 Dex,对于 Berachain 生态来讲,Kodiak 和 BEX 是互补的流动性解决方案:BEX 作为多资产 AMM,提供广泛的流动性交易选项,但 BEX 并不提供聚合流动性的相关功能,而 Kodiak 专注于集中流动性解决方案,它会将存入“Kodiak Islands”的资金自动汇集至一个价格区间内,从而集中高效地为生态提供流动性,免去了人工操作,提升资本效率和灵活性。

Kodiak 提供以下关键功能,通过集中的流动性和自动化流动性管理,为交易者和流动性提供者(LPs)提供最佳的交易体验,并简化流动性提供的复杂性:

Kodiak DEX:一个非托管的去中心化交易所,采用集中流动性自动做市商AMM,提升资本效率。智能优化交易路径,提高收益。

Kodiak Islands:自动化流动性管理金库,提供自动化 LP 工具,让流动性提供者无需手动调整资金范围,通过自动调整位置以适应市场条件来最大化盈利能力。

Sweetened Islands:一个创新的激励层,为流动性提供者提供额外的代币奖励。通过 Berachain 的 PoL 机制,激励流动性提供者,确保生态流动性充裕且稳定。

Panda Factory:支持任何人无代码部署具有初始流动性的新代币,简化代币创建流程。这种无许可解决方案降低了新项目的门槛,促进创新并扩展Berachain生态系统。

Kodiak 目前已获得了来自 Amber Group、Shima Capital 等知名 VC 机构的 200万美元融资。凭借这些核心功能,Kodiak 在未来有望成为 Berachain 上最重要的流动性提供平台之一,助力 DeFi 生态的可持续发展。更多信息: https://documentation.kodiak.finance/kodiak-boyco

除了以上提到的两个原生Dex之外,Bearchain目前还包括了许多其他Dex项目,这些项目都在为 Berachain 主网的高效交易与流动性管理打造强大基础设施。

Honeypot Finance 是一个围绕 Berachain PoL 机制设计的流动性管理协议,帮助协议高效管理和增长流动性,通过智能策略优化收益,为流动性提供者提升资本效率。作为 Berachain 生态中的 PoL 加速器,Honeypot 旨在通过一整套 DeFi 工具赋能社区,提升流动性效率。其核心产品包括 DreamPad、HelonDEX 和 HiveNode,共同构建流动性获取、留存和激励的完整闭环。整个 Honeypot 生态以 DreamPad 为流动性入口,用户完成发射的代币对可直接注入 HelonDEX 进行交易和流动性提供,并最终通过 HiveNode 获得 PoL 激励,持续增强 Berachain 生态的资本效率与用户收益。

Ooga Booga 是 Berachain 上的流动性聚合器,整合多个 DEX 订单流,提高交易效率,优化交易成本,汇集多个 DEX 的流动性,为用户提供最优交易路径和最低成本的交易执行。根据其官网数据,平台累计交易量已达 6 亿美金。

Shogun 是一个跨链抽象交易协议,允许用户无缝在多个链上执行交易,简化 Berachain 生态内外的跨链交易流程,提升互操作性和用户体验。

Beradrome:Berachain 上的 ve(3,3) 机制 DEX,类似于 Velodrome,采用投票锁定经济模型,激励流动性提供者和交易者,同时优化交易效率和资本利用率。

Yeet:Berachain 上的去中心化杠杆交易协议,支持高效的杠杆交易,允许用户在链上进行无须信任的保证金交易,同时利用 Berachain 生态的深度流动性提高交易体验。

DeFi - 流动性质押

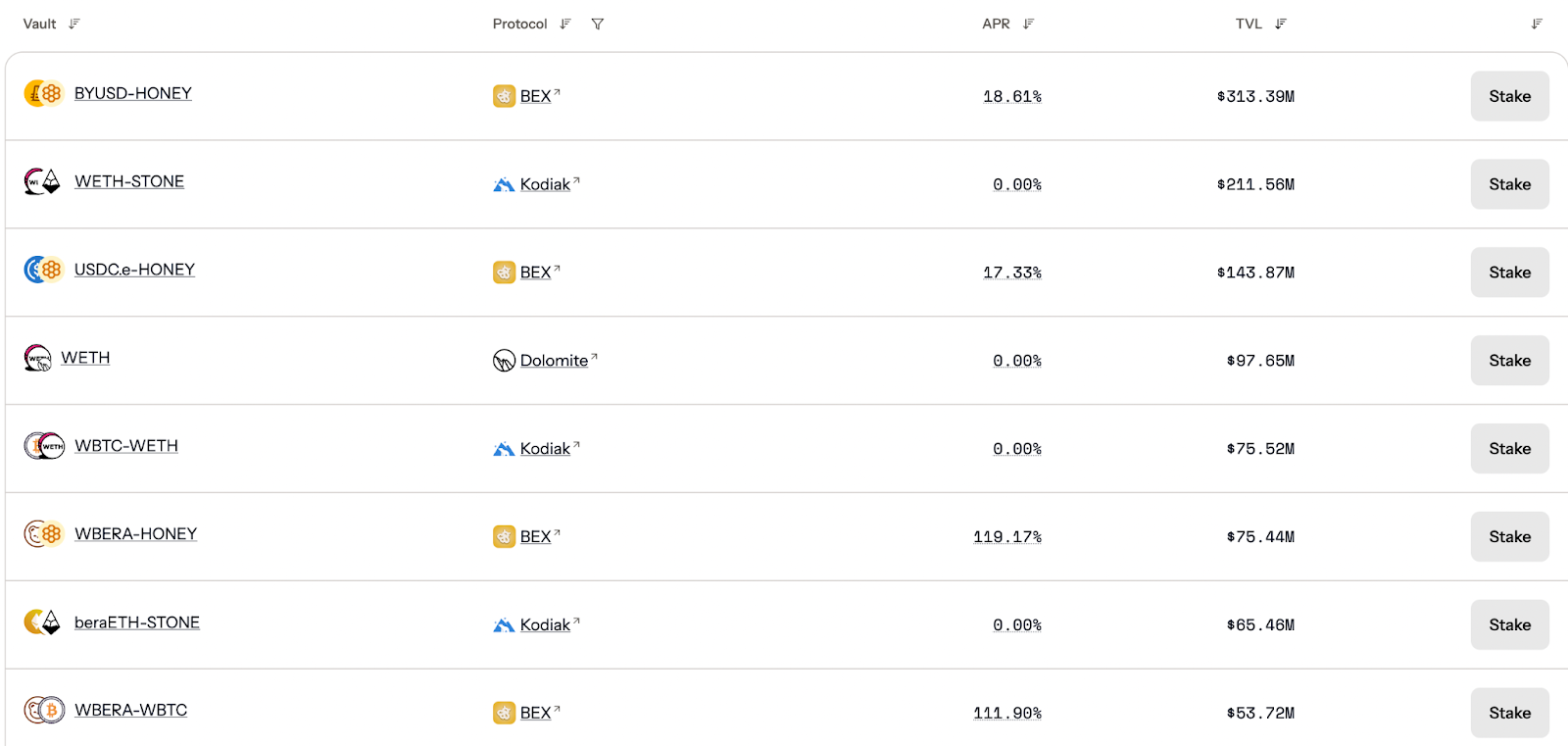

Infrared Finance 通过创新的解决方案,简化了用户参与 Berachain 流动性证明 (PoL) 机制的流程,并提升 Berachain 生态的流动性。根据 Defillama 数据显示,目前 Infrared Finance 上的 TVL 约为 $18.71 亿,是 Berachain 链上 TVL 最高的 Defi 协议。

Infraed 流动性池。图片来源:Infraed官网

在 Berachain 的原有模式下,用户需先将资产存入 BEX(Berachain 原生dex),获取 LP 代币,再将 LP 代币存入 $BGT 金库以赚取治理代币 $BGT。然而,由于 $BGT 灵魂绑定、无法交易,缺乏流动性,限制了 DeFi 用户的灵活性。

Infrared Finance 通过托管 LP 代币,并发行 1:1 兑换的 $i$BGT($BGT的流动性封装),使其具备流动性,用户可直接使用 $i$BGT 参与 DeFi 生态,同时仍能获取 $BGT 收益。用户将 LP 代币存入 Infraed 流动性池,Infrared 运作的储存库可以接受来自流动资金池的 LP 代币,并使用这些代币来产生 $BGT,同时为用户分发与其存入代币数量1:1对应的 $i$BGT。获得 $i$BGT 的用户可以在 Infraed 中质押 i$BGT,获得节点产生的奖励;也可以在其他 DeFi 协议中使用 i$BGT;或者出售自己的 i$BGT。

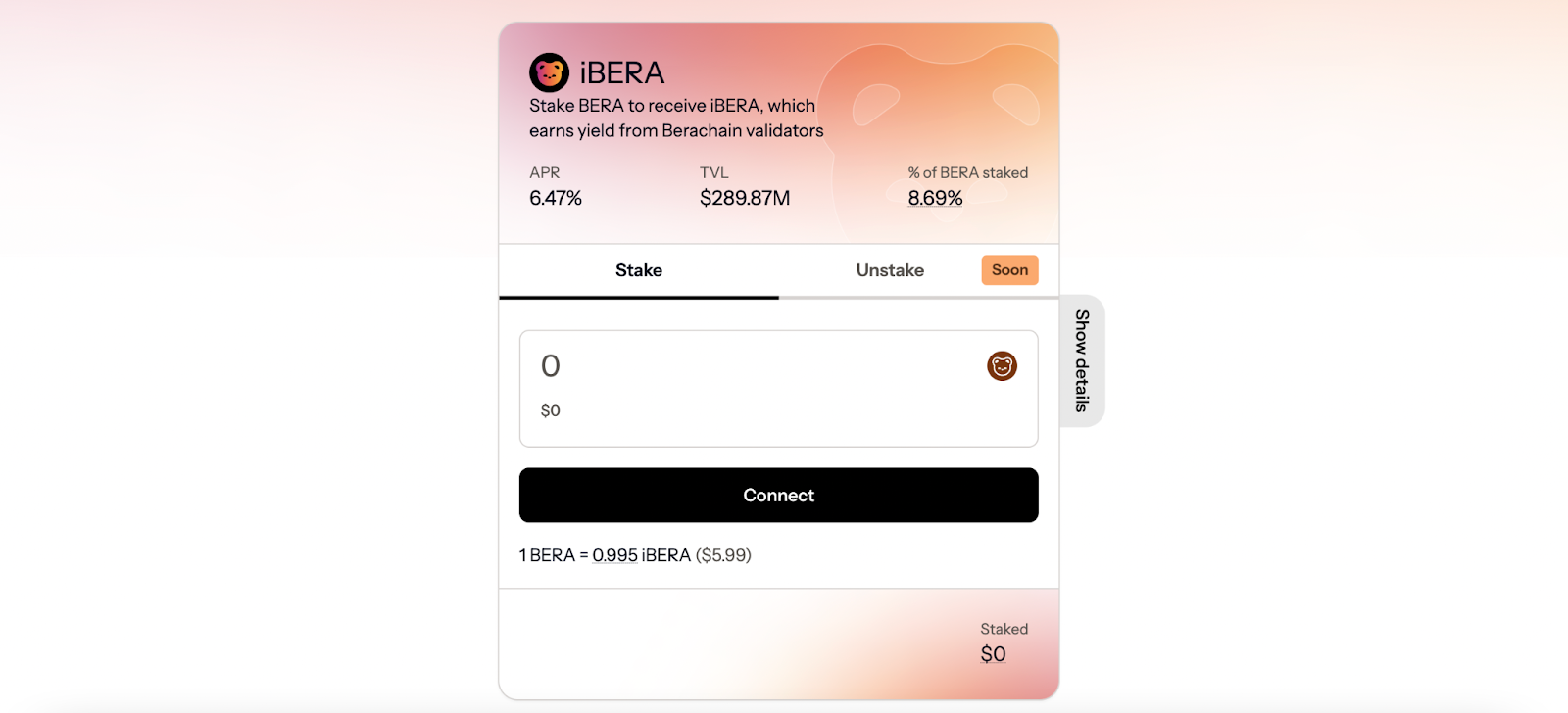

此外,Infrared Finance 还推出流动性质押代币 (LST) $iBera,降低 Berachain 质押门槛。Berachain 验证者要求质押 25 万 $BERA (约 150 万美元),相比以太坊的 32 $ETH (约 6 万美元) 要求更高,而Infraed 的 $iBera 产品支持用户质押 $Bera 获得 iBera, 让普通用户也能参与质押。

流动性质押代币 $iBera。图片来源:Infraed 官网

凭借 $i$BGT 赋予治理代币流动性 与 $iBera 降低质押门槛,Infrared Finance 为 Berachain 生态提供更便捷的 DeFi 参与方式,值得期待未来发展。

截至 2025 年 3 月 4 日,Infrared 已完成总额 1875 万美元融资,包括此前由 Binance Labs 领投的 225 万美元战略轮融资和 250 万美元种子轮融资,以及最新由 Framework Ventures 领投的 1400 万美元 A 轮融资。

BeraPaw 是 Berachain 生态的流动质押协议,专为 流动性证明(PoL)共识机制 设计,简化并自动化 PoL 交互,使用户能够 高效解锁 Berachain 治理代币 $BGT 的潜力。该协议引入 可转让的流动质押代币 $L$BGT,允许用户在治理权与流动性之间取得平衡,同时推出 治理代币 $PAW,赋予持有者协议治理权,并享受国库奖励。BeraPaw 通过 $L$BGT 赋能质押者获取收益和治理权,同时允许 $PAW 质押者 决定 $BGT 的委托结构,构建了一个 更加灵活、高效的 Berachain 质押生态。

DeFi - Lending

Dolomite 是 Berachain 上的下一代借贷协议,支持比传统借贷协议更广泛的资产范围,提供更高的资本效率。它允许用户在借出资产的同时,仍可用于质押、解锁、投票、赚取奖励,甚至参与 Berachain PoL 机制,极大提升资产的利用率。此外,Dolomite 提供资产循环利用、交换、策略部署和资金管理等功能,使用户能够更高效地管理资金并优化收益。

Dolomite 在 Berachain 上推出原生代币 DOLO,总供应量为 10 亿枚,其中 20% 分配给社区空投,包括 9% 给活跃借贷用户(基于借款和存款数据)、10% 以期权空投形式分配给 Minerals 持有者(可按 0.045 美元价格购买 DOLO),1% 给核心社区贡献者。2025 年 3 月 5 日,Dolomite 宣布开放空投查询,并计划在未来几周内进行 TGE。

此前,Dolomite 总融资额达 340 万美元,其投资机构包括了 NGC Ventures、Draper Goren Holm、Coinbase Ventures、Optic Capital 及多位知名投资人。Dolomite 目前已在 Berachain 主网上线,支持超过 25 种资产,并计划利用 Berachain 的流动性证明(PoL)系统优化资本利用率。

根据官网数据,截至 2025 年 3 月,Dolomite 平台总交易量已达8.7亿美金。借款额超 8062万美元。用户现在到平台存入 $BERA 能享受超 40% 的 APR,存款供应上限为 550 万枚。

图片来源:Dolomite官网

Beraborrow 是 Berachain 生态的去中心化借贷协议,推出 首个由流动性证明(PoL)驱动的稳定币 Nectar($NECT),为 Berachain 资产提供 即时流动性。用户可将 i$BGT(质押衍生品)、LP 代币及原生资产存入 Dens 作为抵押,以超额抵押的方式铸造 $NECT,并在 Berachain 生态中使用,同时保持对原始资产的敞口。该协议通过 PoL 机制提升杠杆和收益率,让用户无需牺牲收益即可解锁更多 DeFi 机会。Beraborrow 作为 Berachain 的 核心基础设施,从 CDP 平台(抵押债仓)起步,逐步扩展至更全面的 DeFi 产品,推动生态增长。

Stacking Salmon 是 Berachain 生态中的去中心化借贷协议,采用一组智能合约实现 非托管、无需许可 的借贷和杠杆收益挖矿市场。该协议支持用户 利用 Kodiak V3 头寸进行杠杆操作,同时优化资金可得性,为市场做市商提供更高效的资本利用率,并提升放贷者的收益。Stacking Salmon 通过 动态 LTV(贷款价值比)、隔离市场 以及 Kodiak V3 TWAP 预言机 确保资金安全和市场稳定,为 Berachain 生态构建一个 高效、安全、灵活 的借贷环境。其app目前暂未正式上线。

其他

Origami 是一个自动化杠杆协议,致力于提升 DeFi 资本效率。通过与第三方借贷服务的集成,Origami 实现了折叠策略的自动化,从而最大化资本效率,并减少清算和坏账风险。用户无需监控健康因子或管理头寸,只需一键即可实现杠杆操作。Origami 最初在以太坊上线,目前已扩展到 Berachain。

Origami Finance 已完成了 150 万美元的种子轮融资。参与者包括 Ouroboros Capital、Fjord Foundry、Good Partners、Upside、BeraLand、TempleDAO、Boba Tea Capital、Three Three Ventures、Smokey The Bera 和 janitooor.eth。目前尚未披露估值信息,新增资金将用于构建其已在以太坊和 Berachain 上推出的自动化杠杆协议。

Veda 是协议和应用程序的原生收益基础设施,专为去中心化金融(DeFi)生态系统构建。用户将资产存入 Veda 的合约中,然后合约通过 DeFi 协议安全地部署该资金。通过提供自动化和代币化的收益机会,Veda 简化了整个过程,让用户无需面对 DeFi 的复杂性即可轻松通过资产赚取奖励。Veda 的使命是通过透明且可获取的收益来实现加密货币的大规模采用,旨在彻底改变用户和协议与收益生成的交互方式。这一创新方法不仅造福于个人用户,还增强了各类协议的能力,使收益生成更加便捷高效。

ApiologyDAO 是一个在 Berachain 生态系统 中起核心作用的去中心化自治组织(DAO),其运作方式类似于一个蜂巢结构,与 Berachain 生态系统的整体相互协作。通过将 生产蜂群 和 超充蜂巢 部署在 Berafi Fat Bera Flywheel 中,ApiologyDAO 旨在为生态系统提供高效的支持与增长,促进 可持续发展 和 协作共赢。该项目由 @0xhoneyjar 孵化,推动 Berachain 生态中的创新与合作。

Ramen Finance 是一个基于 Berachain 的生态系统(3,3)代币发行协议,旨在为 Berachain 上的新资产提供流动性引导。该协议由社区拥有和治理。

Concrete是生成信贷产品和衍生品的原生基础协议,它打开了使用 Concrete 作为计算基础层为链上资产构建一套全新的金融原语的大门。为用户资产提供安全、自动化的收益策略和衍生产品。帮助用户赚取最高的回报率、降低交易风险。Concrete 推出后将为 Aave、Compound、Silo 和 Radiant 等货币市场的用户提供服务,并定期添加成熟和新兴的贷款机构。

GameFi

BeraTone 是一款基于 Berachain 生态的多人在线生活模拟游戏,适用于 PC 和移动设备。游戏的核心体验是农业和生活模拟,玩家可以在虚拟世界中拥有自己的土地,自由定制和扩展,进行种植、寻找资源、饲养动物与牲畜、与其他农民交易等活动。BeraTone 的丰富游戏经济通过 Berachain 创新的流动性证明(PoL)共识机制得到增强,玩家能够在游戏内访问 Berachain 原生的去中心化应用(dApp)和合作协议,所有系统都是可选的,且不会干扰游戏体验,旨在为 Web2 玩家提供无缝的体验。

Wizzwoods 是一款链间合成的模拟游戏,结合了 Web2 社交流量与 Web3 游戏体验,玩家可以通过收集并组合来自不同 EVM 链的 NFT,提升农场管理效率,丰富冒险旅程。该游戏的核心玩法是建设农场,玩家通过不断优化管理提高效率,体验跨链合成的乐趣。在大约 6 个月的时间里,Wizzwoods 在 TG 上积累了超过 300 万玩家,月活跃用户超过 200 万,日活跃用户超过 50 万,游戏内购买收入超过 400 万美元。

Beramonium 是在 Berachain 上开发的一个大型游戏项目,其首款游戏《Gemhunters》是一款放置类角色扮演游戏。玩家可以派遣他们的 Beramonium Genesis Beras 执行任务,获取装备和宝石。这些宝石可以兑换成其他 Berachain 相关项目的 NFT,例如 Honey Combs、Beradoges 等。

Beramonium Chronicles: Genesis 是一系列包含 6000 个独特 NFT 的收藏品,最初铸造价格为 0.045 ETH。这些 NFT 作为进入 Berachain NFT 和游戏生态系统的门户,旨在吸引真正的玩家进入加密世界,探索 NFT 的魅力,同时享受游戏乐趣。 玩家可以通过访问 Beramonium 的官方网站,参与《Gemhunters》游戏,派遣他们的 Beras 执行任务,收集宝石,并将其兑换成其他 Berachain 项目的 NFT。

Meme

Memeswap 是一个建立在 Berachain 上的游戏化社交 DEX,允许用户发行代币、赚取收益并建立自己的社区。该平台专注于 Meme 币的启动,提供低成本发币、AI 功能集成、反机器人和鲸鱼机制、时间锁定流动性池等创新特点。用户无需筹集资金即可通过租赁质押金库的流动性来部署 LP 池,并利用 AI 自动生成或调整代币图像。平台设有反鲸鱼机制,通过限制每个地址每 30 秒只能进行一次交易,并对每次交易设置上限,以防止多次交易和囤积。流动性池将至少锁定 1 天,以确保初期交易的安全。此外,开发者需要在限定时间内满足流动性标准,否则流动性池会自动解散,流动性退回金库。通过 PoL 机制,达标的流动性池将被永久锁定并质押在 DeFi 协议中,赚取 PoL 奖励。

Henlo 是由 Berachain 上最大的社群 The Honey Jar(简称 THJ)构建的 Meme 币项目。$HENLO 作为一个主网上的 Meme 币,灵感来自于英文“hello”(你好),但采用了更具特色的表达方式,已经成为 Berachain 社区中的主流词汇。THJ 与多个生态项目建立了合作关系,因此在社区内拥有重要影响力。Henlo 不仅是一个问候语,它还代表了一种生活方式和社群文化,成为了 Berachain 上的象征之一。

$PLUG 是 Berachain 社区的首个 ERC20 代币,背后由 Beraplug 提供动力。Beraplug 是一个(3,3)强化协议,旨在奖励长期社区对齐,并通过概率性地将资产供应从弱手转移到强手。$PLUG 代币是 Beraplug 协议的首个实现,主要面向 The Honey Jar 的 Honey Comb NFT。这个代币设计旨在增强社区的长期稳定性,并推动资产在持有者之间的优质分配。

SocialFi

Honey Chat 是一款去中心化的社交网络与金融(SocialFi)应用,旨在将 社交互动与加密创新相结合,重新塑造数字互动的格局。该平台将控制权、所有权和货币化直接交到内容创作者和受众手中,让粉丝、创作者和影响者能够无缝连接。在 Honey Chat,你的社交互动不仅仅是点赞和分享,它们还被赋予了数字货币的价值。这是一个将消费者加密货币与创作者经济 无缝融合的地方,平台不仅是聊天,而是创造了一股 SocialFi 领域的巨大蜂潮。点击此处参与 HoneyChat。

RWA

BurrBear 是 Berachain 生态中的稳定币流动性中心,专注于为稳定币发行方、RWA(现实世界资产)代币、稳定币及硬件资产代币提供创新的 DeFi 流动性池。这些流动性池不仅能增强 流动性,还能提升收益率,为链上和链下资产提供更高效的资本利用方案。

HiveBits 是一个 RWA(现实世界资产)项目,利用 DePIN(去中心化物理基础设施网络)将 蜂群上链,推动可持续养蜂和蜂巢健康。该项目结合区块链技术与传统农业,通过代币化蜂巢 让全球用户参与生态友好型养蜂产业,共同支持可持续发展。

Fortunafi 是一个跨链 RWA(现实世界资产) 代币化发行平台,专注于为稳定币发行方、协议金库和传统金融机构提供一体化流动性解决方案。其投资产品涵盖私募和公募债务,并支持在顶级区块链上原生铸造与赎回,助力传统金融资产的链上流动性化。

NFT

Kingdomly 是 Berachain 原生的 NFT 启动平台和市场,旨在为创作者和收藏家提供无代码的 NFT 创建、铸造和交易服务。通过 Kingdomly Creator,任何人都可以在无需技术知识的情况下创建高质量的 NFT 收藏。平台还提供 NFT Bridge 功能,支持跨链 NFT 转移,增强了数字资产的流动性和可访问性。 此外,Kingdomly Mint 是专门用于 Berachain 主网收藏铸造的中心化平台,提供无缝且经济高效的铸造体验。 目前,Kingdomly 正在开发质押功能,预计将进一步增强平台的用户体验和生态系统参与度。

点击此处了解更多Berachain生态项目。同时,FenTech根据@Berasearch 的数据,整理了一份关于 Berachain 的原生项目的整理列表,涵盖了 80 多个项目的简要介绍,点击此处查看详情。

3.2 Boyco预存款活动

Boyco 是一种预存款活动,为用户提供了一种早期参与 Berachain 生态系统的方式,由 Brachain 官方与 @roycoprotocol 的合作推出。参与者可以通过存款获得 $BERA 代币和项目方代币的奖励。Boyco 的目标是在 Berachain 主网启动之前募集足够的流动性,确保主网启动后能够支持各种应用和交易。参与者可以通过提前存入资金(包括预预存款)来参与这一流动性市场。合作方有四个:StakeStone、Lombard、Ethena Labs 和 etherfi。

3.6.1 BeraChain & Stakestone

参与入口:https://app.stakestone.io/u/vault/detail/bera

用户将可以使用 StakeStone 旗下的流动性资产 STONE、ssBTC、STONEBTC 参与 Berachain 生态并获取收益。StakeStone 是一个全链流动性资产协议,专注于构建 ETH、BTC 和稳定币的流动性分发,推出了全链生息ETH资产——STONE,为用户持续优化收益结构。

StakeStone 与 Berachain 达成战略合作,推出了 Berachain 预存 Vault。该产品通过智能策略引擎实现三大核心功能:

1. 自动化收益聚合系统:基于实时链上数据构建动态收益模型,支持跨链资金智能调优

2. 流动性优化架构:采用分层风控机制保障资产安全,同时实现多生态资金的无缝流转

3. 一键式收益增强:通过算法驱动的资产再平衡策略,帮助用户自动捕获$BERA最佳投资窗

区别于传统收益聚合器,该方案创新性地引入模块化收益策略组合,在保证底层资产可验证透明度的前提下,实现跨链DeFi生态的收益复合增长。系统通过持续监控20+收益参数,动态调整资金配置方案,确保用户资产始终处于最优收益曲线。

StakeStone Berachain Vault 实现了对 LP 的深度利用和收益放大,用户参与 StakeStone Berachain Vault 可获得多层收益。

用户将资产(如ETH)存StakeStone中,获得 STONE 等全链流动性资产,捕获PoS底层生息收益。

用户将 LP 资产(如 STONE)存入 Berachain 生态,Vault 会自动为用户最大化流动性挖矿和治理收益。同时用户会获得生息资产 Vault LP Token(如 beraSTONE)。

用户可将这些生息资产用到其他Defi项目中去,如 Uniswap 流动性挖矿、Aave/Morpho 抵押借贷等,产生多重收益。

根据官网数据显示,Berachain 和 StakeStone 自上线以来获得广泛关注,其预存 Vault 目前已经产生 $3.27 亿 TVL。

3.6.2 BeraChain & Ethena

参与入口:https://ethena.concrete.xyz/

Ethena 是一个稳定币协议,旨在通过衍生品基础设施,使以太坊资产转化为可产生收益的稳定币 USDe。USDe 由加密资产和 Delta 中性对冲策略支持,Ethena 通过捕获 CeFi、DeFi 和 TradFi 之间的资金利率差,为用户提供收益,并推动不同金融体系间的资本和利率趋同。

Ethena与Berachain的合作以激励性预存款金库为核心载体,形成了跨生态收益聚合的创新模式。根据官方公告,双方合作的首批产品由Concrete平台推出,包含两个预存款金库,支持用户存入USDe、sUSDe以及USDC/USDT等资产。该设计的核心价值在于:用户无需直接接触Berachain原生资产即可参与其生态激励,同时保留美元稳定币敞口,实现风险可控的跨链收益捕获。

合作形式的技术架构包含三层:

资产层:Ethena通过其USDe稳定币的Delta中性机制(基于ETH质押收益与期货对冲)提供底层资产支撑,用户存入的USDe/sUSDe将自动触发Ethena的收益策略(质押收益+套利收益),形成基础收益来源;

协议层:Berachain的流动性证明(Proof of Liquidity)机制被整合至金库中,将用户存款转化为验证节点所需的流动性凭证,通过其双代币系统($BERA作为Gas代币,$BGT作为治理代币)实现流动性贡献与网络安全的绑定;

激励层:用户可同时获得四类奖励——Ethena协议的原生收益、Concrete积分(用于未来治理权分配)、Berachain主网代币$BERA空投,以及生态内白名单协议(如DEX、借贷平台)的额外激励。

用户参与路径可分为三个阶段:

预存期:在Berachain主网上线前,用户通过Concrete平台存入资产,此时资金暂存于以太坊链上托管合约,系统根据存款比例分配Concrete积分和Ethena奖励;

部署期:主网上线后,资金将自动跨链至Berachain,按预设策略分配到白名单协议,开始累积$BERA代币和生态奖励;

收益复合期:用户可选择将获得的$BERA重新质押至验证节点,通过流动性证明机制提升$BGT治理代币的获取效率,进而参与生态治理或兑换为$BERA实现收益循环。

该合作模式创新性地将Ethena的链上稳定币收益引擎与Berachain的流动性证明共识深度耦合,形成“稳定币收益+公链生态增长”的双螺旋模型,Ethena 预存款金库 TVL 已达1.35亿美金。

3.6.3 Berachain & Etherfi

参与入口:https://app.ether.fi/liquid/bera-eth

Etherfi 是一个基于以太坊网络的非托管质押协议,允许用户在质押以太坊(ETH)时掌控自己的密钥,从而减少节点运营商和协议的交易对手风险。其核心机制是通过 EigenLayer 进行再质押,为以太坊扩容解决方案、预言机等外部系统提供经济安全性,从而提升质押收益。

ether.fi 与 Berachain 合作推出的激励性预存款金库支持用户存入多种资产,包括 包括:weETH(Wrapped eETH)、WETH(Wrapped ETH)、stETH(Lido质押ETH)、eBTC(ether.fi的比特币锚定资产)、wBTC、cbBTC(Coinbase托管BTC)以及LBTC(流动性BTC衍生品)。用户可将上述支持的资产存入 ether.fi 的 Berachain 激励性预存款 Vault 来参与此合作。在 Berachain 主网启动后,存款将被锁定 90 天,期间不可提取,用户将获得 Berachain 协议的奖励,以及 ether.fi 提供的额外激励。

通过这种合作,用户不仅可以参与 Berachain 生态系统,还能在锁定期内获得多重收益,进一步推动以太坊质押和去中心化金融的发展。

3.6.4 BeraChain & Lombard

参与入口:https://www.lombard.finance/berachain/

Lombard 是比特币再质押生态系统中的新兴项目,基于 Babylon 协议,提供 比特币的跨链流动性质押,让比特币持有者无需信任地参与 PoS 生态并获得收益。其核心产品 LBTC 是一种 收益型、跨链、流动性强的比特币资产,1:1 由 BTC 支持。用户可通过 Babylon 质押协议 质押 BTC 以铸造 LBTC,并在以太坊及 Layer 2 生态的 DeFi 协议(如借贷、交易、质押)中使用。LBTC 解决了比特币在 DeFi 领域 缺乏原生收益和跨链可组合性 的问题,释放比特币的流动性,推动整个 DeFi 生态的发展。

Lombard作为BTC流动性协议,与Berachain合作推出Boyco市场预存款金库,支持用户存入LBTC(流动性BTC衍生品)和wBTC(Wrapped BTC)两种资产。

用户可将LBTC或wBTC存入Berachain指定金库后,将获得代表存款权益的收据代币,用于后续奖励分配和赎回。用户的积分从存款起累积至2025年4月14日(限时14周),之后可提现本金及收益。主网上线后,资金将自动部署至Berachain的DeFi协议中,持续产生实际收益。

参与者可同时获得以下奖励:

$BERA代币空投:作为Berachain原生代币,$BERA奖励由官方分配总量的2%(即1000万枚),预计于2025年5月初发放。

多项目积分叠加:包括4倍Lombard积分(可能与Lombard Lux积分相关)、1倍Babylon积分、4倍Concrete积分、1倍Kodiak积分及1倍Dolomite积分,这些积分未来可兑换合作生态的代币或权益。

潜在DeFi收益:主网启动后,资金将自动投入流动性挖矿等策略,进一步获取收益。

用户通过简单存款即可叠加多项目积分与$BERA代币奖励,同时为主网DeFi生态注入流动性。

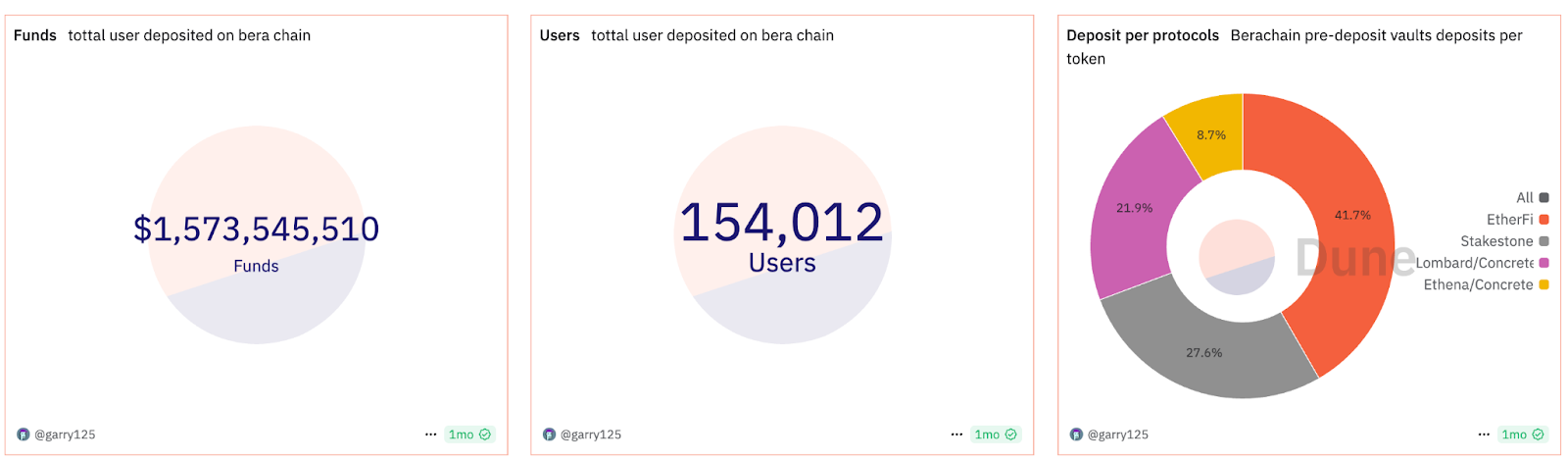

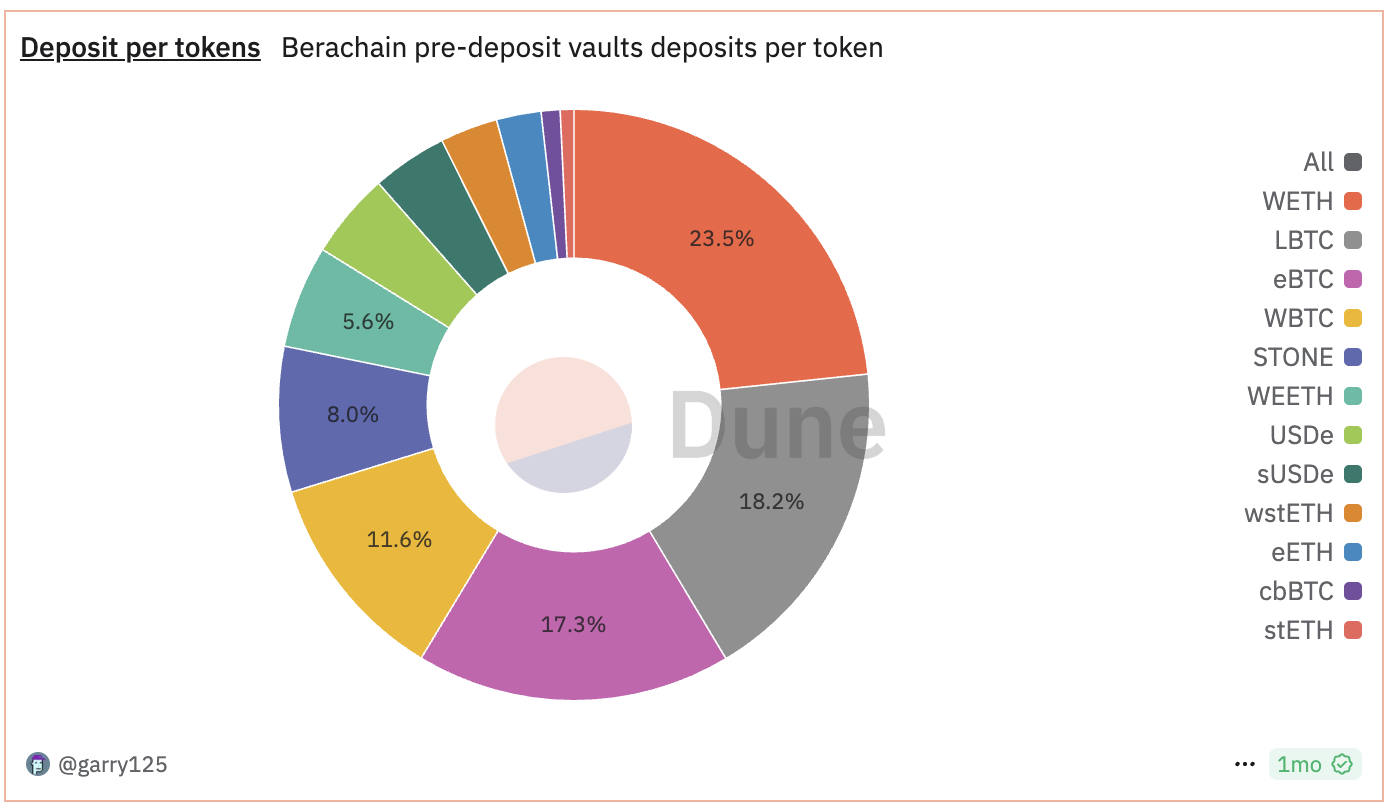

Boyco 预存款活动为 Defi 用户提供了一种门槛低且能够获得多重收益的机会;也帮助 Berachain 协议在主网上线前快速吸引了资金和关注、刺激了社区活跃度。根据 Dune Analytics @Zero_Labs 数据分析,Boyco 活动期间,共有15.4万个地址参与活动,质押资金量达15.7亿美金,其中Etherfi上的质押量最高,占比41.7%,Ethena上质押量最低,占比8.7%。最受欢迎的质押资产前三分别是 WETH、LBTC 和 eBTC。

Boyco活动数据。来源:Dune Analytics

Boyco活动数据。来源:Dune Analytics

4. 现状

4.1 主网

Berachain 主网于 2025 年 2 月 6 日上线,截至 3 月18 日,其 TVL 为 $29.02 亿。根据 Defillama 数据显示,Berachain 的 TVL 目前已经超越 Base 和 Sui 链,紧随Ethereum、Solana、Bitcoin、BSC、Tron,在所有公链中排名第6。从下图的折线图中可以看出,主网上线以来,Berachain 的 TVL 处于稳步增长的态势,3月后略有下调,最高时期达到 $32.3亿。

公链TVL折线图,数据来源:Defillama

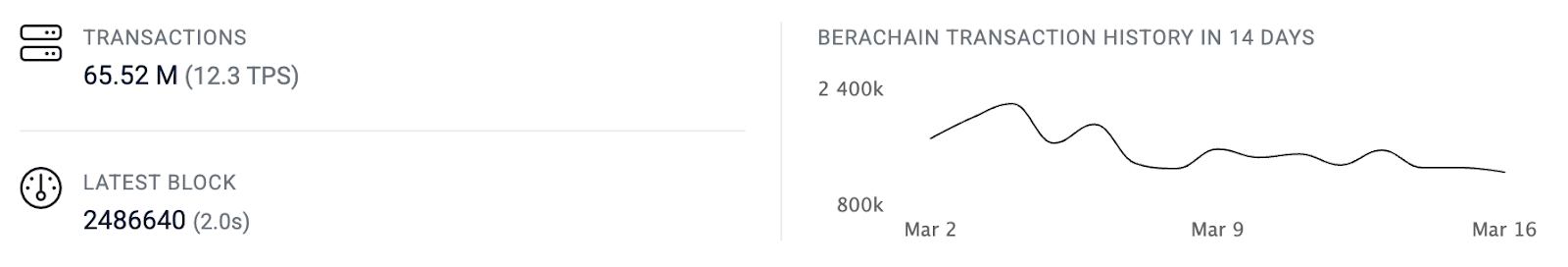

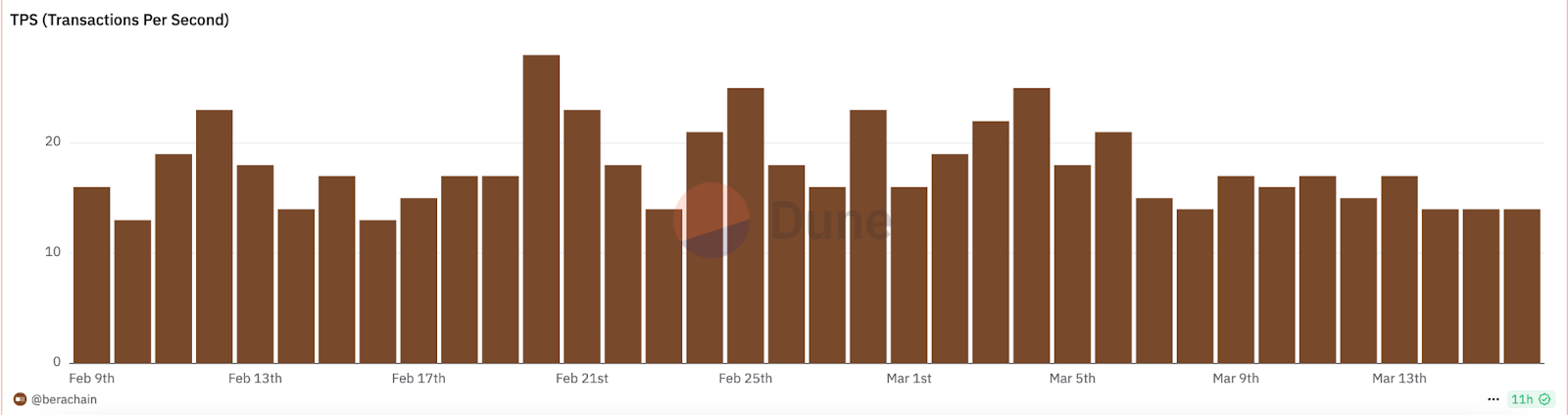

根据下图数据显示,截至 3 月18 日,Berachain 主网上累计交易量达 65.52 M,当前区块高度为 2,486,640,TPS 为 12.3,上线以来最高 TPS 为 28, 目前平均区块时间为 2 秒。当前总共有 57,256个智能合约 部署在 Berachian 上。

Berachain主网数据。数据来源:Berascan。日期:2025.03.18

Berachain TPS数据。来源:Dune Analytics

4.2 节点

根据 Berachain 官方文档描述,Berachain 中节点类型分为两类,分别是验证节点和 RPC 节点。每个节点可以配置为全节点或归档节点,每种类型的节点都是执行客户端和共识客户端的组合,Berachain 是一个与 EVM 等效的 Layer 1 链,这意味 Berachain 在执行层支持任意EVM 执行客户端,这些客户端与 Berachain 构建的共识客户端和框架相互协作,共同组成BeaconKit。

成为 Berachain 的节点需要首先质押 250,000 枚 $BERA。运行节点需要满足以下硬件要求:

操作系统:Linux AMD64、Linux ARM64、MacOS ARM64

CPU:8核

内存:48GB

存储:4TB(高IOPS的SSD)

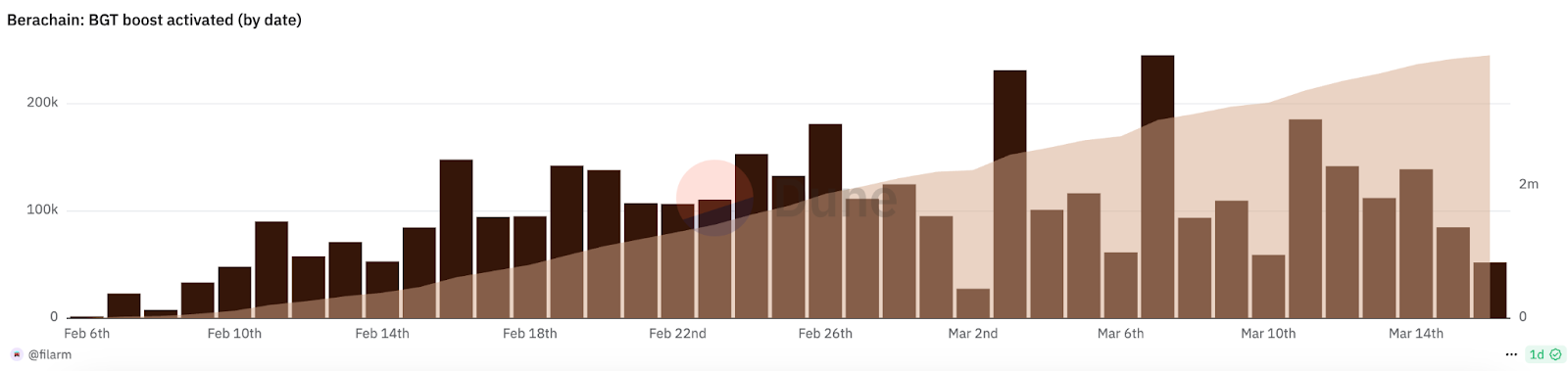

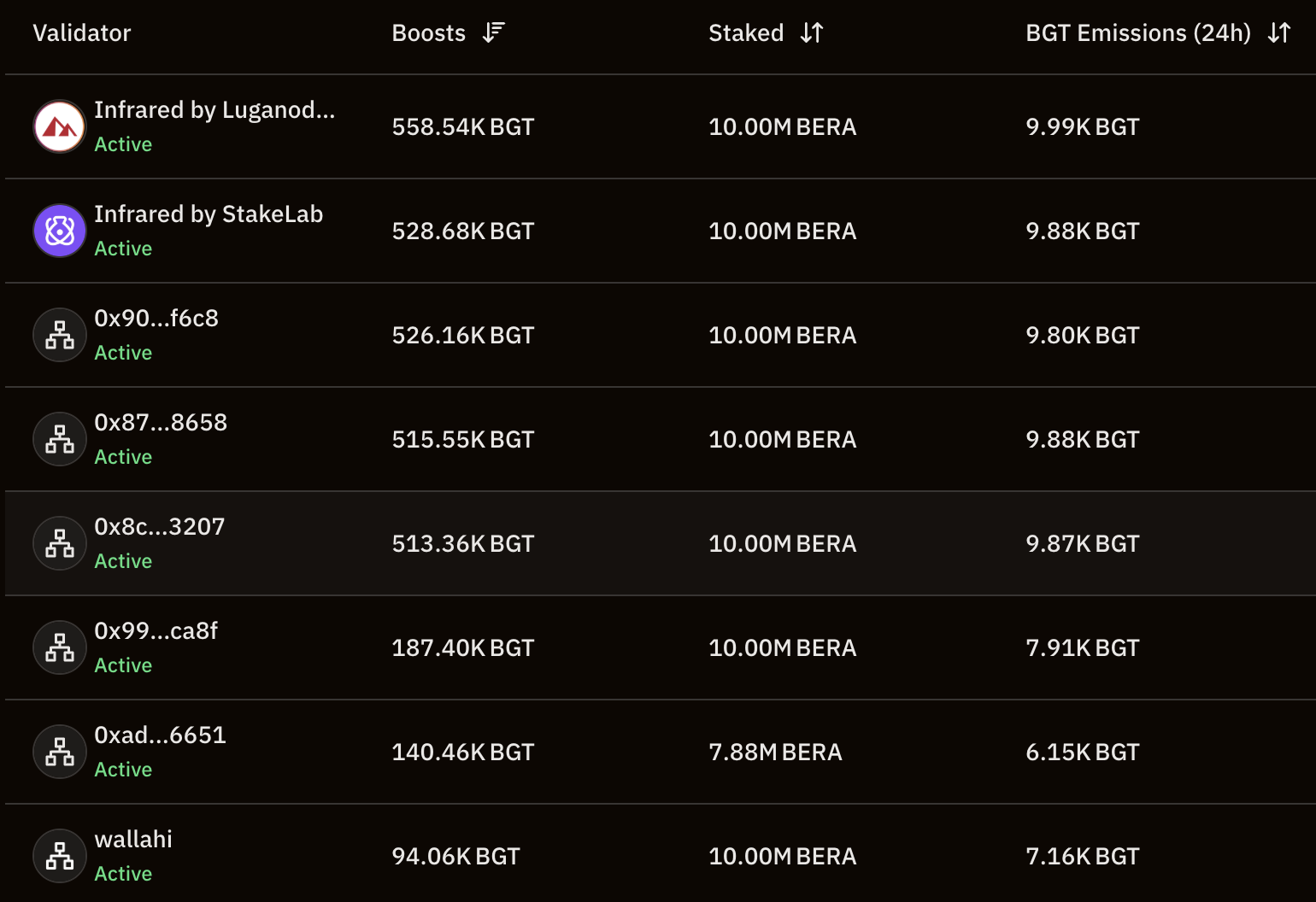

区块奖励的形式为 $BGT,主网上每个区块的基本奖励为 0.5 $BGT。奖励不会自动分配,需要通过 Distributor 合约进行分配。Berachain 上允许运行的最大节点数量是 69,目前已经部署了 60 个,总共产生了 388万枚 $BGT,质押了 1.84亿枚 $BERA。根据 Dune Analytics,主网上线以来,单日最高 $BGT 产量为 245,175 枚。

数据来源:Berachain 官网

Berachain $BGT奖励产生情况。数据来源:Dune Analytics

Berachain 官网列出了当前 60 个所有验证者的信息,产生 $BGT 最多的是 Infrared by Luganodes,共产出了 55.85万枚$BGT,由 Infrared Finance 运营。

Berachain 节点排名。数据来源:Berachain 官网

4.3 代币 $BERA

目前其原生 Gas 代币 $BERA 已上线 Binance、OKX、Coinbase、Bybit 等多家交易所。

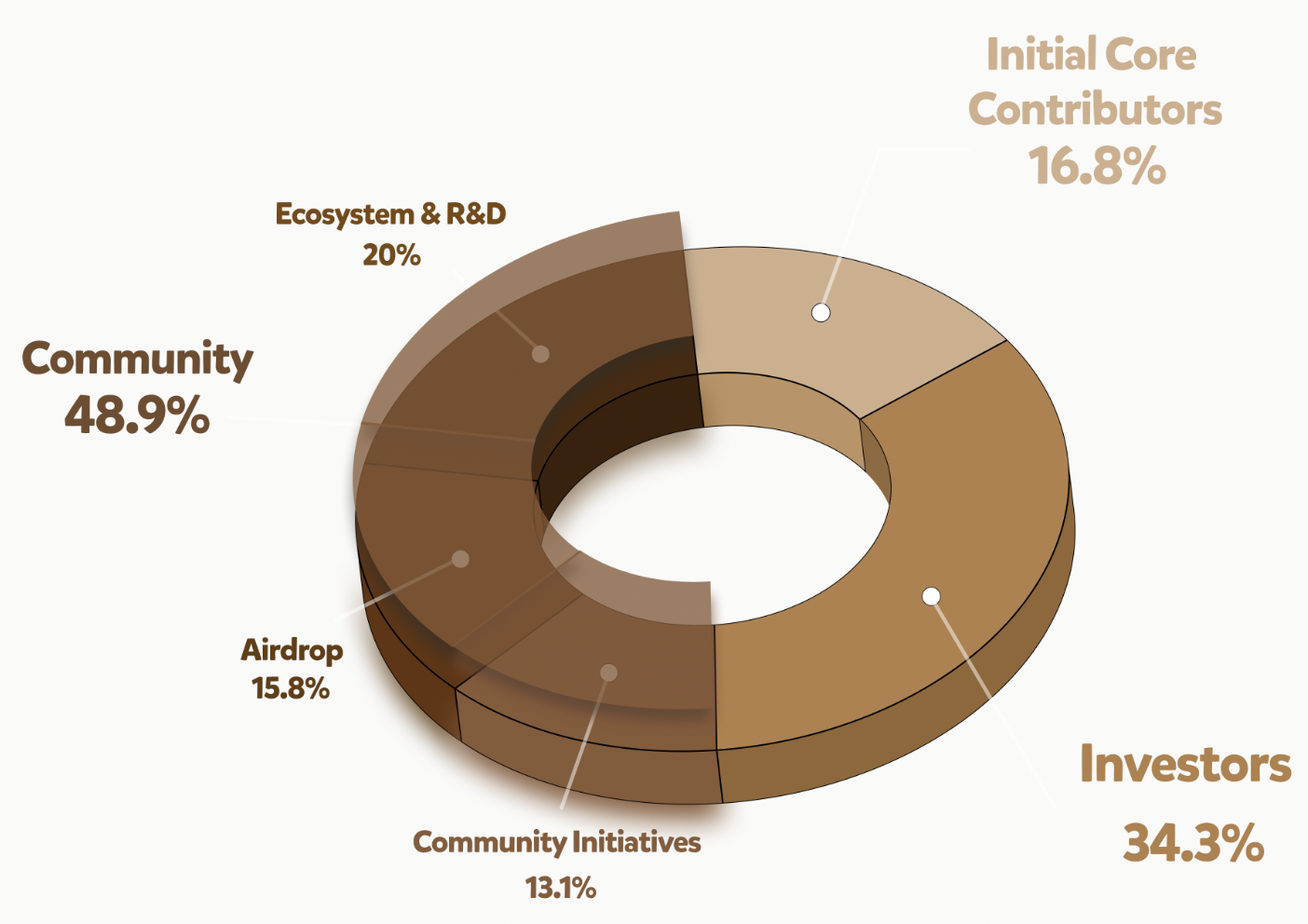

BEAR 代币分配

总供应量:500,000,000 $BERA

核心贡献者 - 84,000,000 枚 (16.8%)

针对顾问及核心贡献者,支持 Berachain 生态的建设。

投资者 - 171,500,000 枚 (34.3%)

针对种子轮、A 轮和 B 轮投资者。

社区分配 - 244,500,000 枚 (48.9%)

Berachain 的发展依赖于强大的社区和开发者生态,社区分配包括以下三大部分:空投 - 79,000,000 枚 (15.8%):适用于测试网用户、Berachain NFT 持有者、生态 NFT 持有者、社交支持者、生态项目 dApp、社区建设者等。

未来社区激励 - 65,500,000 枚 (13.1%): 通过激励计划、资助等方式,支持应用、开发者和用户,具体方案由社区投票 (Snapshot、RFP) 决定。

生态系统 & 研发 - 100,000,000 枚 (20%):用于支持生态发展、研发、增长计划及 Berachain 基金会运营,重点涵盖:

开发者与建设者激励 (Boyco 计划)

节点运营者(验证者)激励

质押证明 (Proof-of-Liquidity) 和 BeaconKit 迭代

额外说明:

其中 9.5% 的 $BERA 代币在启动时解锁,用于生态增长、开发工具/基础设施、流动性提供等。

锁仓规则:所有分配主体(团队、投资者、社区)均需 1 年锁定期,之后分阶段解锁:第 1 年结束后解锁 1/6;剩余 5/6 在 24 个月内线性释放。

根据 CMC 数据显示,$BERA 自 2 月上线多家交易所后,币价在6至8刀左右波动,目前$BERA币价为 $6.4,市值约为$698.59M。

$BERA币价走势图。数据来源:CoinMarketCap

5.团队与融资背景

Berachain 核心团队由资深业内人士组成,涵盖技术、开发者关系、DeFi、研究和业务拓展等领域。联合创始人包括 Smokey 和 Dev Bear(此前担任 CTO)。团队成员包括 Camila Ramos(开发者关系负责人,曾任 Fuel Labs 和 PayPal 工程师)、Jack Melnick(DeFi 主管,曾任 Polygon DeFi 主管)、knower(加密研究员) 和 Leslie Song(亚太区 BD,曾任 AAVE 亚洲区业务增长主管)。

近期,Berachain 基金会正式任命 Paul O’Leary 为新任首席技术官(CTO)。O’Leary 曾担任 Polygon Labs CTO,在区块链和大数据领域拥有 20 年创业及高管经验。今年初加入 Berachain 后,他已领导团队推进主网启动,并将继续推动 Berachain 发展。

自诞生以来,Berachain 便备受瞩目。作为基于 Cosmos SDK 构建、兼容 EVM 的 Layer 1 区块链,Berachain 采用创新的 PoL 共识机制,并通过三代币系统($BERA、$HONEY、$BGT)赋予网络强大的功能性和灵活性。

关键融资事件:

2023 年 4 月,Berachain 完成 4200 万美元 A 轮融资,由 Polychain Capital 领投,OKX Ventures、Hack VC、Dao5、Tribe Capital、Shima Capital、Robot Ventures、Goldentree Asset Management 等机构及 Celestia 创始人 Mustafa Al-Bassam、Tendermint 联合创始人 Zaki Manian 等 20 位 DeFi 项目创始人参投。

2024 年 3 月,Berachain 获得 6900 万美元融资,投后估值达到 15 亿美元。

2024 年 4 月,Berachain 宣布 B 轮融资规模增至 1 亿美元,比此前报道高约 45%。本轮由 Brevan Howard Digital(阿布扎比分公司)和 Framework Ventures 领投,Polychain Capital、Hack VC、Tribe Capital 等机构参投,资金将用于国际扩张和进一步开发。

6. 挑战

Berachain 作为新兴 Layer 1 公链,尽管凭借流动性证明(PoL)机制和创新的经济模型吸引了市场关注,但仍面临多重挑战,需从监管、技术安全、生态发展等多维度评估:

监管风险:政策不确定性与合规压力

Berachain 的稳定币 $HONEY 锚定 USDC,虽声称“超额抵押至少150%”,但若抵押机制或实际储备透明度不足,可能面临类似 Tether 的监管审查。此外,若 $HONEY 因市场波动脱锚,可能触发系统性风险,引发监管介入。

通过Boyco计划整合的跨链资产(如wBTC、LBTC等)若涉及未合规的发行方或托管方,可能面临资产冻结或跨链桥关停风险。

技术安全风险:PoL机制的长效性与治理漏洞

作为一种新型共识机制,PoL 及其三代币模型在安全性和稳定性方面仍需经过市场与时间的检验。其核心设计,包括 $BGT 代币的不可转让性、和依赖贿赂机制的奖励分配,尚未经历大规模网络压力测试。若激励机制失衡或流动性过于分散,可能会导致验证者集中化或网络安全性下降。此外,技术部署过程中潜在的漏洞、流动性激励设计的长期有效性,以及跨链互操作性等问题,都有待在实际运行中持续优化与改进。

生态发展风险:增长可持续性与竞争压力

当前 Berachain 的 TVL(超30亿美元)主要依赖 Boyco 计划的预存款和短期投机资金,与 Ethereum、Solana、BNB Chain 等既有成熟生态依旧存在差距。若主网上线后实际应用未能吸引真实用户和交易需求,可能陷入“高TVL低活性”的困境,导致资金撤离和代币抛售。如何与大型成熟公链生态竞争,吸引更多Defi协议和用户,依旧是需要 Berachain 长期努力的课题。

代币经济模型风险:螺旋式下跌的可能性

$BGT 可 1:1 兑换为 $BERA 的设计,虽延缓抛压,但若生态收益不及预期,用户可能集中兑换并抛售 $BERA,形成“$BGT需求下降→$BERA价格下跌→生态吸引力减弱”的负反馈循环。

7. 总结

Berachain 通过 PoL 共识机制、Boyco 预存款计划 和 多层次生态布局 构建差异化竞争力,吸引了超 30 亿美元存款,为主网上线奠定坚实基础。

其 PoL 机制允许用户用多种资产参与验证,将流动性转化为安全性和生态价值;Boyco 计划通过提前锁定 ETH、BTC 资产,提供多重奖励,增强生态稳定性;此外,Berachain 深度整合 DeFi、GameFi、SocialFi,并通过治理代币 $BGT 提升资本效率。

凭借技术创新、生态激励与社区驱动,Berachain 正在 Layer 1 竞争中占据独特生态位,未来若持续优化性能并提升资本留存率,有望成为 DeFi 生态的重要基石。

虽然 Berachain 的创新性使其在Layer 1竞争中具备独特叙事,但其风险亦不容忽视:监管对稳定币的审查、PoL机制的长效性验证、生态从“资金驱动”向“需求驱动”的转型,均是关键挑战。投资者需警惕短期投机热潮褪去后的价值回归风险,并密切关注后续的实际数据表现。

Berachain 社区

Website | Whitepaper | Twitter | Telegram | Discord

参考

Battle for $BGT: Exploring user, validator and protocol demand for $BGT

What's possible on Berachain: A look at key dApps and strategies on mainnet

原文链接:Berachain: Web3 底层创新与生态裂变的全景解析

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。