Key Points

The total market capitalization of global cryptocurrencies is $2.75 trillion, down from $2.9 trillion last week, representing a decline of 5.17% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $36.24 billion, with a net inflow of $196 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.41 billion, with a net outflow of $8.64 million this week.

The total market capitalization of stablecoins is $237 billion, with USDT having a market cap of $144.2 billion, accounting for 60.84% of the total stablecoin market cap; followed by USDC with a market cap of $60.2 billion, accounting for 25.4% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 2.27% of the total stablecoin market cap.

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $92.4 billion, an increase of 0.7% from last week. By public chain classification, the top three public chains by TVL are Ethereum, accounting for 50.96%; Solana, accounting for 7.5%; and Bitcoin, accounting for 6.1%.

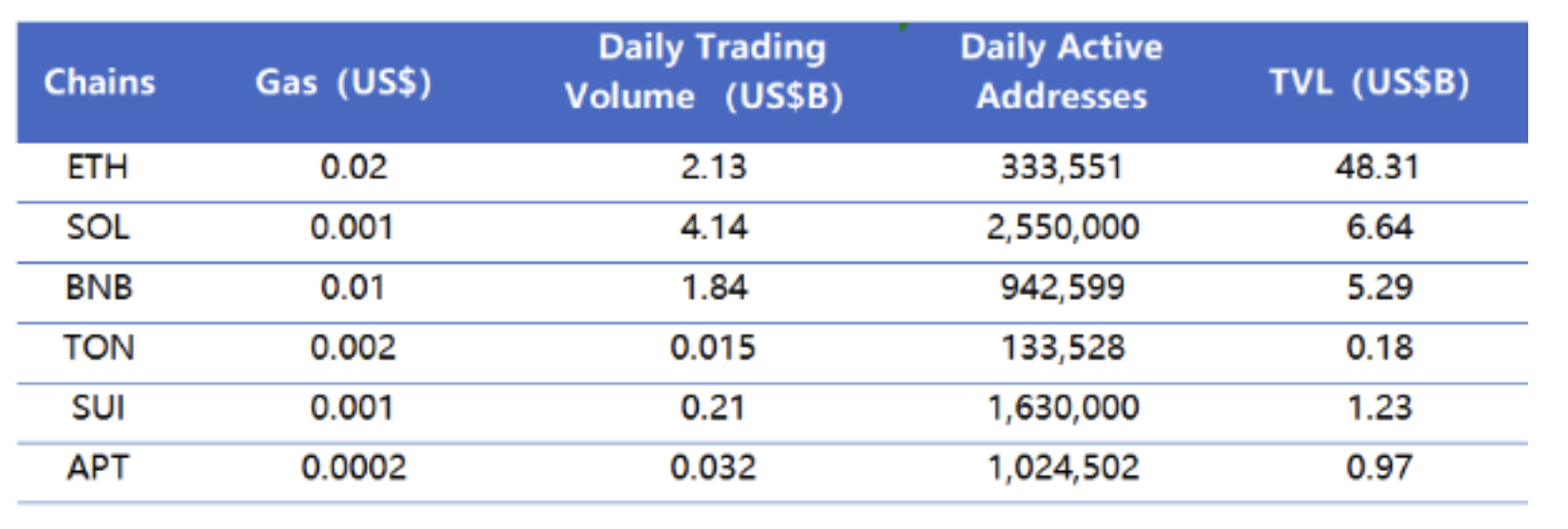

From on-chain data, the daily transaction volume of Layer 1 public chains has generally increased this week, with BNB showing the most significant growth, up approximately 50% from last week; in terms of transaction fees, SOL has seen a notable increase, up 66.7% from last week. In terms of daily active addresses, aside from a slight increase in ETH, other public chains are showing a downward trend, with BNB showing a significant decline of 16.6% from last week; the overall TVL of public chains has not changed much this week.

Innovative projects to watch: Coldlink.xyz is a universal blockchain asset verification application that allows blockchain users to securely link any blockchain address to any content. It is currently in beta testing and has opened some API access features; exit.tech is a DeFi protocol based on Arbitrum that can convert locked DeFi positions into flexible assets; subs.fun is a Solana-based application platform that integrates online communities, artificial intelligence, and token economics into an innovative platform.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Proportion

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

7. Stablecoin Market Cap and Issuance Situation

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Upcoming Events Next Week

3. Important Financing and Investment from Last Week

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Proportion

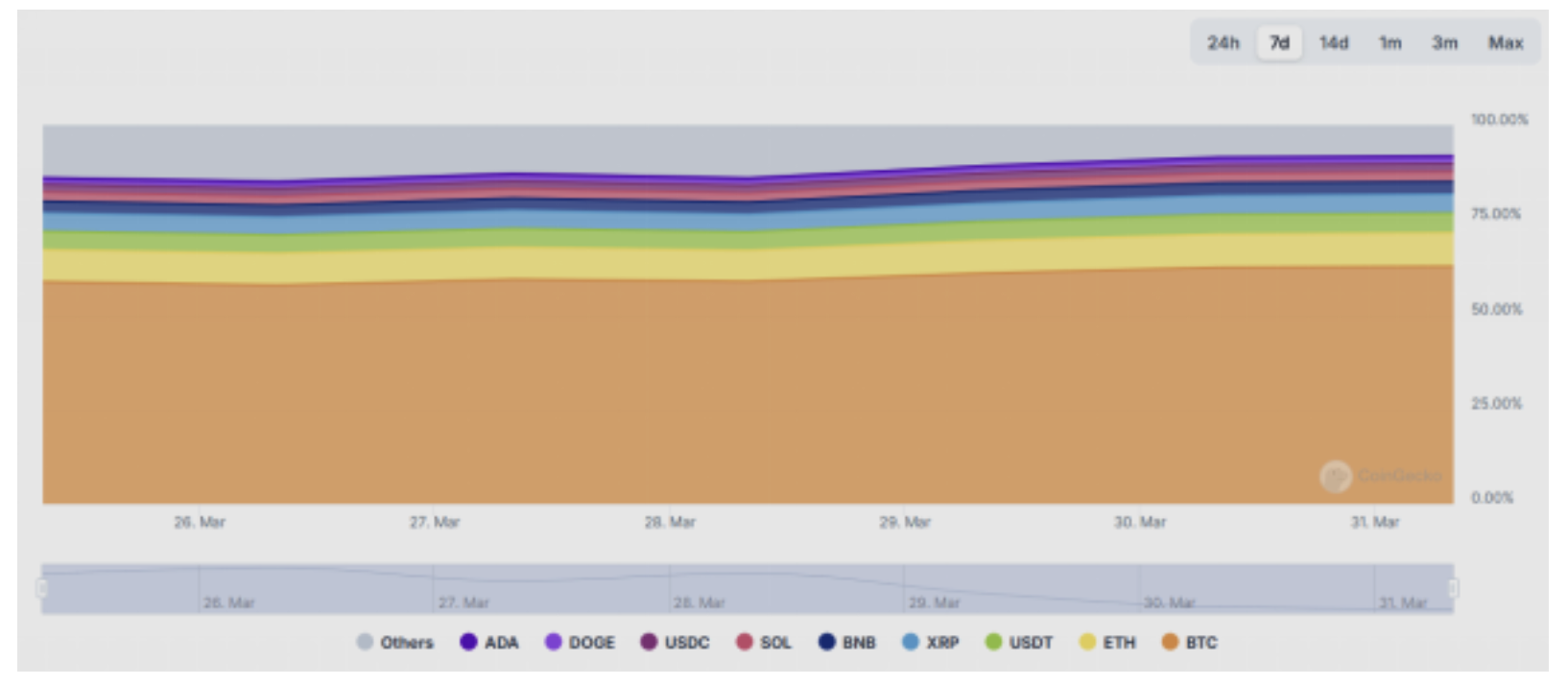

The total market capitalization of global cryptocurrencies is $2.75 trillion, down from $2.9 trillion last week, representing a decline of 5.17% this week.

Data Source: cryptorank

As of the time of writing, Bitcoin's market cap is $1.63 trillion, accounting for 59.3% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $237 billion, accounting for 8.62% of the total cryptocurrency market cap.

Data Source: coingeck

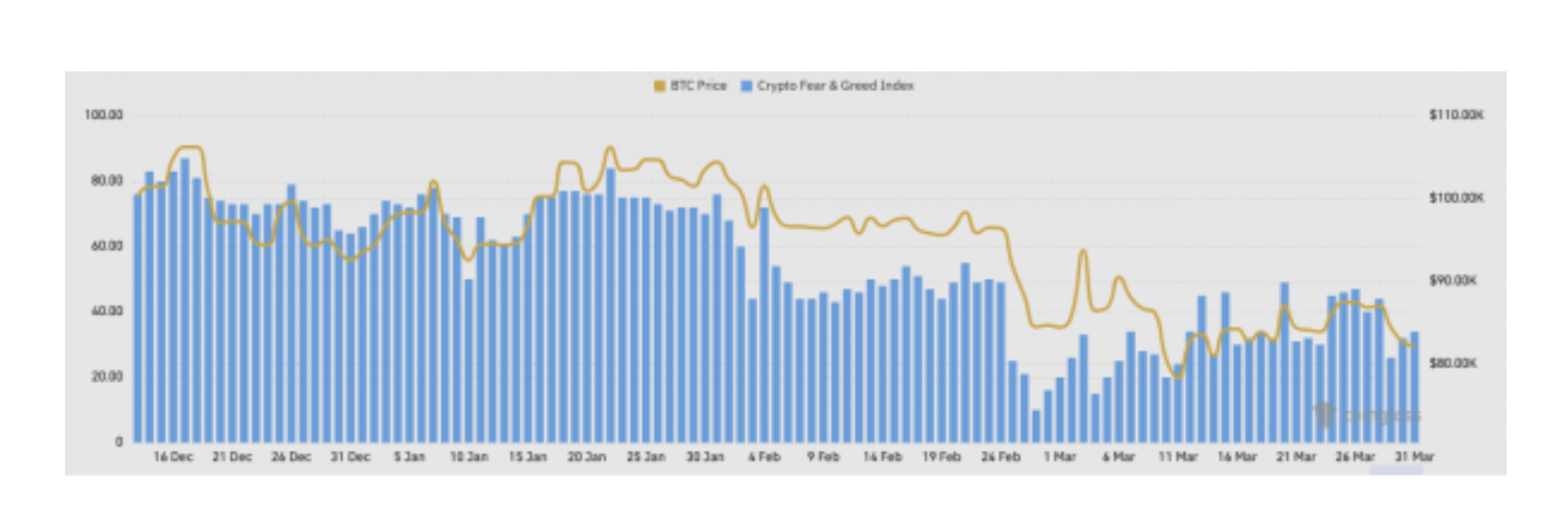

2. Fear Index

The cryptocurrency fear index is at 34, indicating fear.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $36.24 billion, with a net inflow of $196 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.41 billion, with a net outflow of $8.64 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $1,809, historical highest price $4,878, down approximately 62.81% from the highest price.

ETHBTC: Currently at 0.022130, historical highest at 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

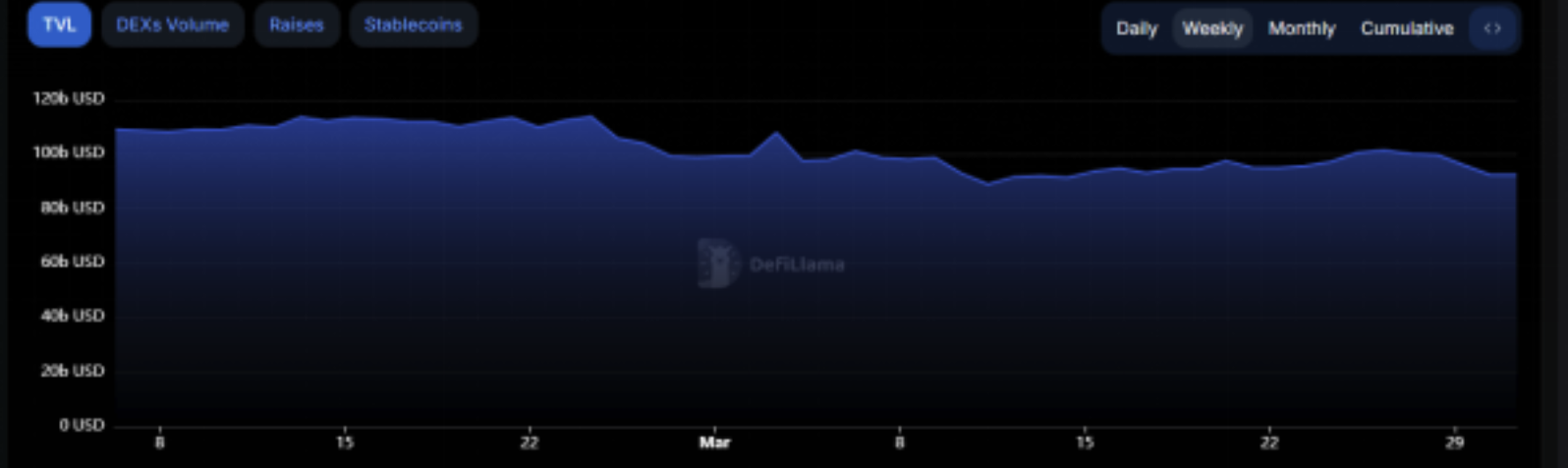

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $92.4 billion, an increase of 0.7% from last week.

Data Source: defillama

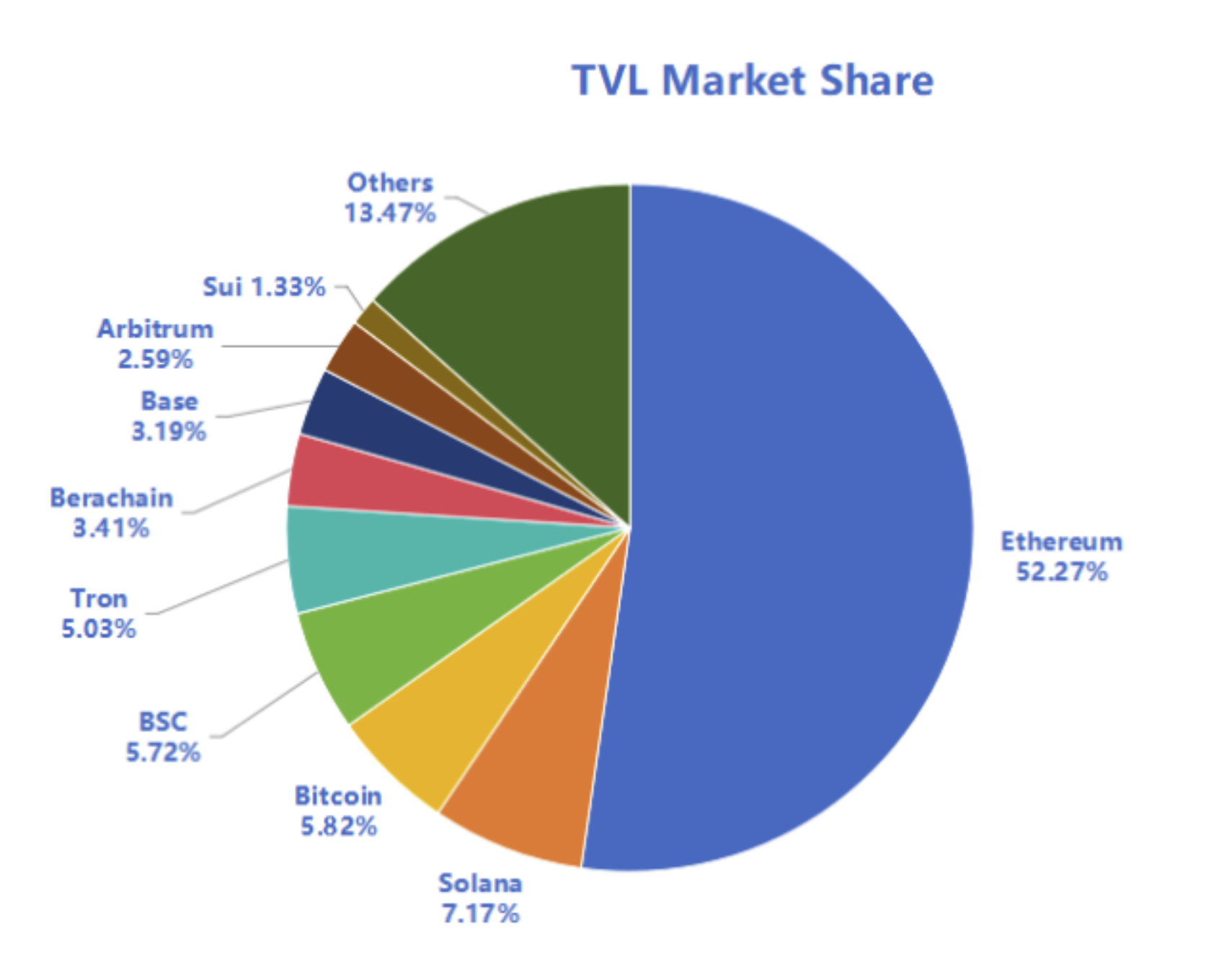

By public chain classification, the top three public chains by TVL are Ethereum, accounting for 52.27%; Solana, accounting for 7.17%; and Bitcoin, accounting for 5.82%.

Data Source: CoinW Research Institute, defillama

Data as of March 30, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing daily transaction volume, daily active addresses, and transaction fees for major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of March 30, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, the daily transaction volume of public chains has generally increased, with BNB showing the most significant growth, up approximately 50% from last week; in terms of transaction fees, SOL has seen a notable increase, up 66.7% from last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, aside from a slight increase in ETH, other public chains are showing a downward trend, with BNB showing a significant decline of 16.6% from last week; the overall TVL of public chains has not changed much this week.

Layer 2 Related Data

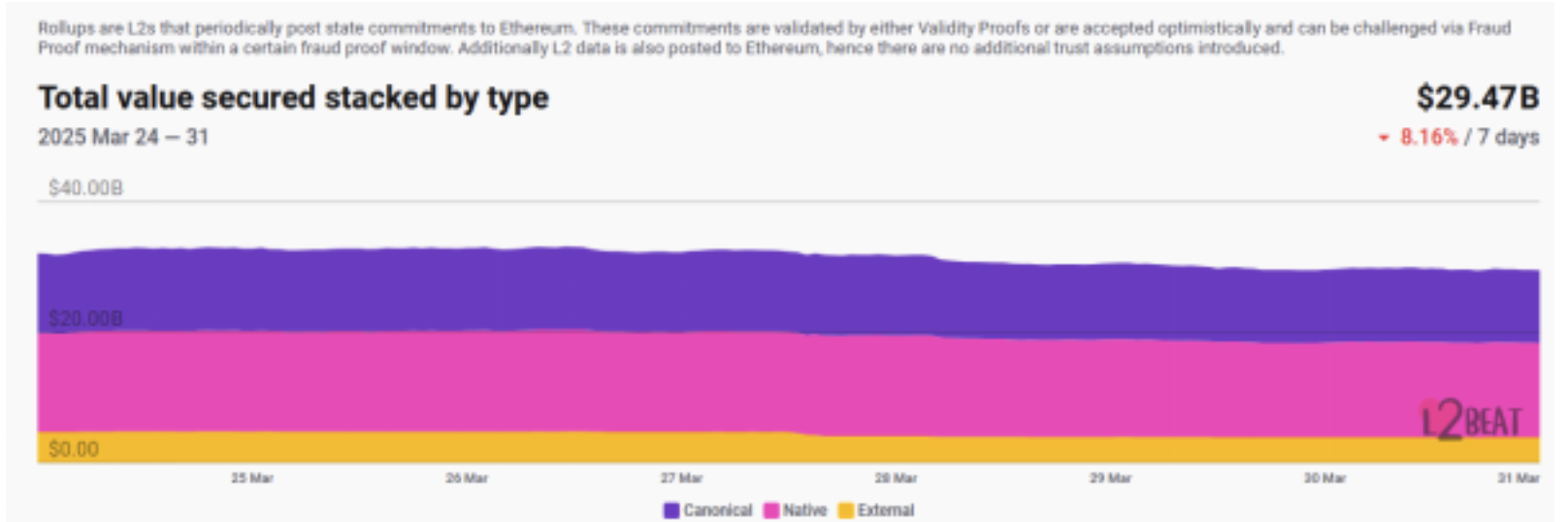

● According to L2Beat, the total TVL of Ethereum Layer 2 is $29.47 billion, with an overall decline of 8.16% from last week.

Data Source: L2Beat

Data as of March 30, 2025

● Arbitrum and Base occupy the top positions with market shares of 32.79% and 30.73%, respectively, but their overall proportions have increased.

Data Source: footprint

Data as of March 30, 2025

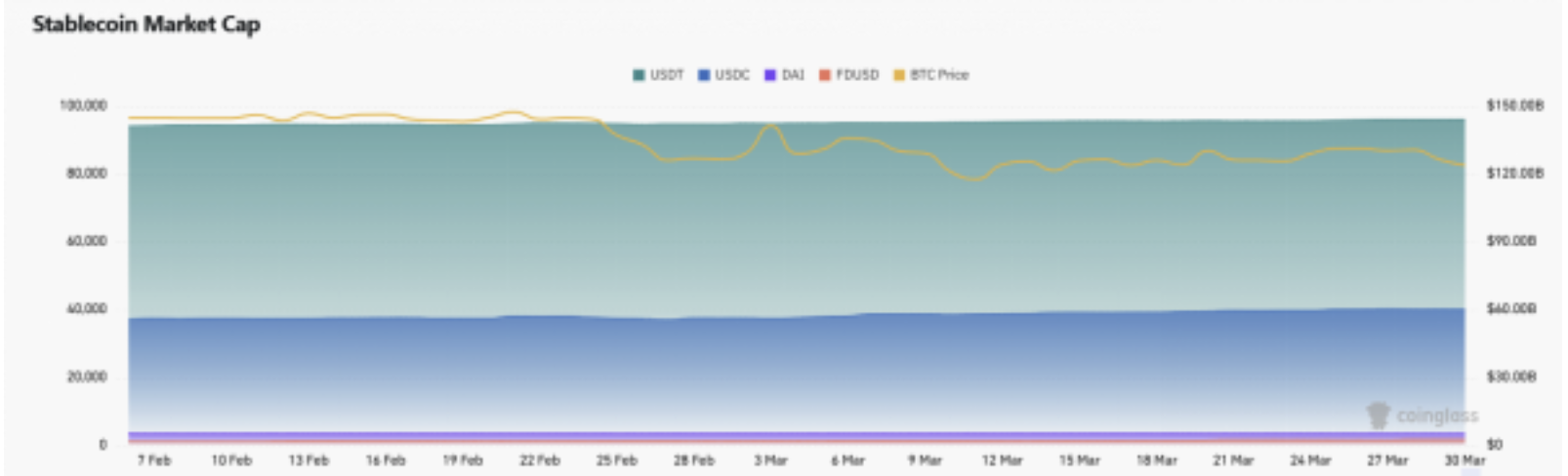

7. Stablecoin Market Cap and Issuance Situation

According to Coinglass, the total market cap of stablecoins is $237 billion. Among them, USDT has a market cap of $144.2 billion, accounting for 60.84% of the total stablecoin market cap; followed by USDC with a market cap of $60.2 billion, accounting for 25.4%; and DAI with a market cap of $5.37 billion, accounting for 2.27%.

Data Source: CoinW Research Institute, Coinglass

Data as of March 30, 2025

According to Whale Alert, this week USDC Treasury issued a total of 1.375 billion USDC, and Tether Treasury issued a total of 1 billion USDT, with a total issuance of stablecoins this week amounting to 2.375 billion, representing an increase of approximately 7% from last week.

Data Source: Whale Alert

Data as of March 30, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

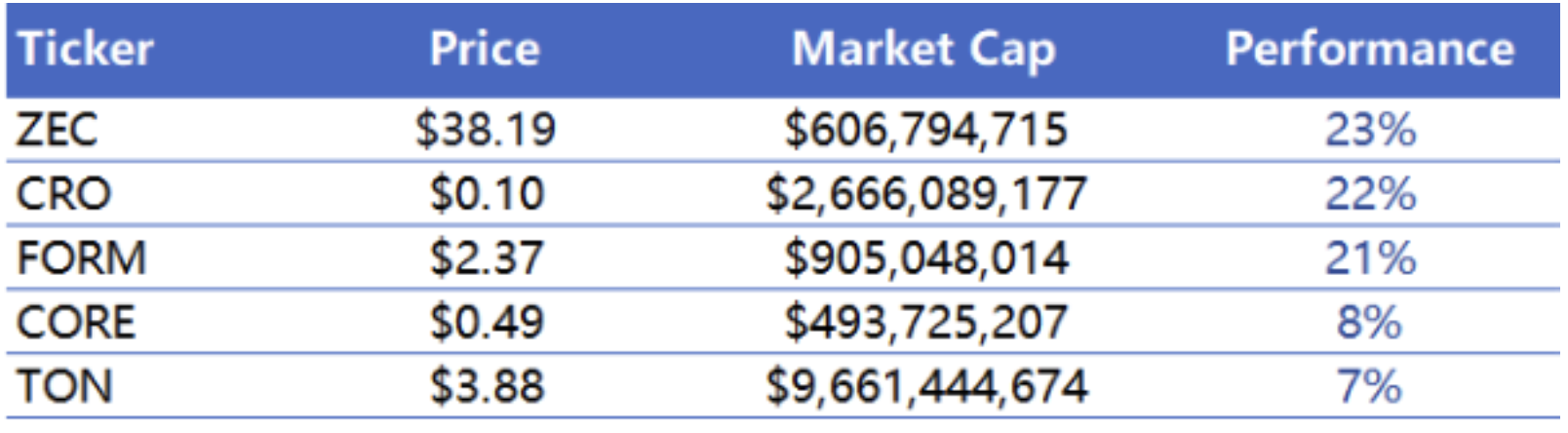

The top five VC coins by growth over the past week:

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 30, 2025

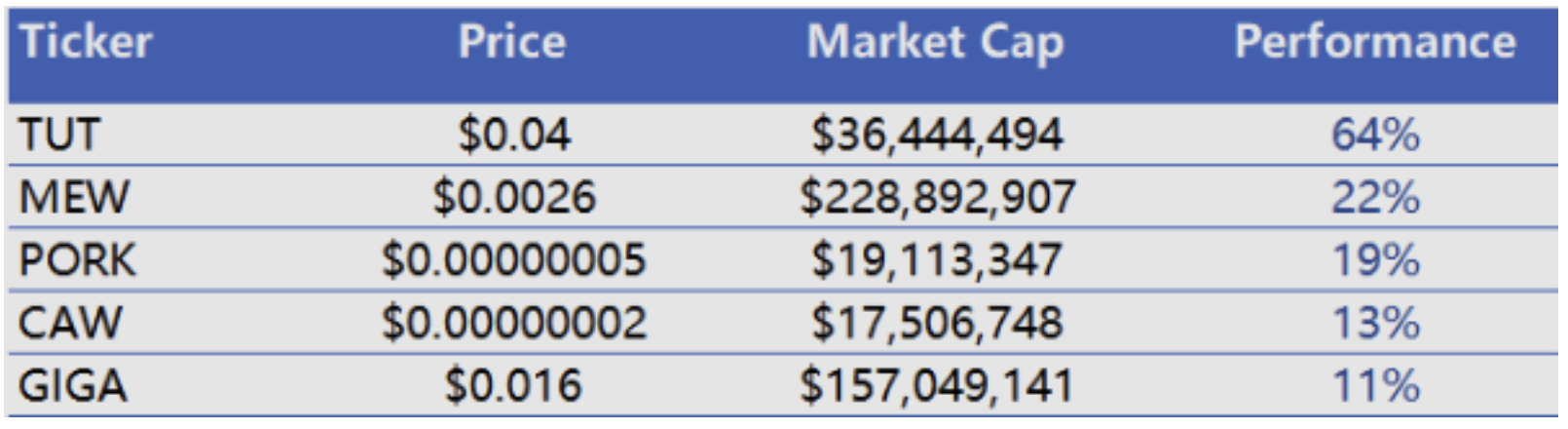

The top five Meme coins by growth over the past week:

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 30, 2025

2. New Project Insights

Coldlink.xyz: Coldlink is a universal blockchain asset verification application that allows blockchain users to securely link any blockchain address to any content. It is currently in beta testing and has opened some API access features.

exit.tech: A DeFi protocol based on Arbitrum that can convert locked DeFi positions (such as esGMX) into flexible assets while converting exit assets into rewards for stakers.

subs.fun: An application platform based on Solana, it is an innovative platform that integrates online community, artificial intelligence, and token economy. Community users can earn token rewards for posting, and the ecosystem is collaboratively managed by AI and the community.

III. New Industry Dynamics

1. Major Industry Events This Week

BNB Chain's re-staking infrastructure KernelDAO announced that the first quarter airdrop eligibility query tool is now online. This airdrop reward accounts for 10% of the total supply of KERNEL tokens, with the TGE expected to launch in early April 2025. Users must accumulate at least 150 Kernel points or Kelp Grand mileage by December 31, 2024, to qualify for the first quarter airdrop. Wallet addresses that do not meet the first quarter point requirements will have their points automatically carried over to the second quarter and used for subsequent airdrop eligibility calculations. Currently, the second quarter activities are ongoing.

ParagonsDAO announced that PDT stakers will receive 90% of the PROMPT rewards during the Pre-TGE period in the form of an airdrop, with the remaining 10% deposited into the treasury. The reward distribution is divided into two phases: the first phase targets completed staking periods and will be executed as soon as possible after the TGE; the second phase targets staking periods still ongoing at the time of the TGE, with rewards distributed after the period ends. Additionally, after the TGE ends, the Prompt Points program will be terminated, and subsequent PROMPT rewards will flow directly into the staking contract, using the same distribution method as the current $PRIME.

KiloEx stated that some users did indeed encounter insufficient or incorrect reward distributions during the TGE period. The first batch of airdrop compensation involves 2,271 addresses, requiring the redistribution of 1,203,428.34 KILO. KiloEx will continue to follow up based on feedback from the Google form and compensate users with abnormal reward distributions.

2. Major Upcoming Events Next Week

Investment management company VanEck announced that from March 13 to March 31, 2025, the Bitcoin spot ETF HODL will waive management fees. If the fund size exceeds $150 million before the deadline, a management fee of 0.2% will be charged on the excess amount. Starting March 31, 2025, management fees will revert to 0.2%.

The DAG-based order book DEX Vite Labs will close the Vite gateway in April, but users can still use community gateway operators and will need to transfer funds to exchanges or community gateways.

Four.Meme announced a liquidity pool update on March 31. The platform's liquidity provision method will switch to PancakeSwap V2, and all newly created and published token LPs will be directly burned after launch. The platform stated that in order to improve operational efficiency and ensure the long-term interests of the community, it has decided to discontinue the use of the PancakeSwap V3 LP locking scheme and instead adopt the PancakeSwap V2 liquidity pool scheme, optimizing the platform's sustainable development by burning new LP tokens.

3. Important Financing and Investment from Last Week

Tabit raised $40 million, with the investing institutions undisclosed. Tabit provides innovative insurance solutions for the digital asset industry and is a global (re)insurance company licensed by the Barbados Financial Services Commission as a Class 2 Independent Unit Company, primarily engaged in insurance/reinsurance, digital assets, and technology business. (March 24, 2025)

Chronicle Protocol, seed round, raised $12 million, with investors including Strobe Ventures, 6th Man Ventures, and BH Digital. Chronicle Protocol is a decentralized Oracle solution that has protected over $10 billion in collateral since 2017. It continues to protect MakerDAO while establishing an independent brand and business proposition and building the world's first fully verifiable, economically efficient, scalable, and decentralized Oracle. (March 25, 2025)

Abound raised $14 million, with investors including NEAR Foundation, Circle Ventures, and Times Internet. Abound is a cross-border remittance platform supported by the Times of India, established in 2023, focusing on providing cross-border remittance services for Indian-Americans in the United States. (March 27, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。