Macroeconomic Interpretation: The year 2024 has come to a close, and during this year, the global financial markets experienced multiple reversals and discrepancies in expectations, shifting from loose trading at the beginning of the year to the Trump trade at the end. In this context, we further interpret the main themes of the market for 2025 and analyze their impact on the cryptocurrency market.

I. Review of Market Characteristics and Patterns in 2024

The global asset market in 2024 appeared chaotic, yet it contained certain patterns and characteristics.

(A) Strong U.S. Stocks, Led by Tech Giants.

U.S. stocks continued to perform well in 2024, especially the tech giants. The Nasdaq index rose by 31%, significantly outpacing the S&P 500 and Dow Jones indices. The communication technology and information technology sectors within the tech sector benefited from profit support, leading the gains. Additionally, large-cap stocks outperformed small-cap stocks, with a clear concentration effect among top performers; tech giants represented by MAAMNNG saw gains of 50%, driving the overall market upward.

(B) The Dollar Shines Alone, Global Capital Reallocation.

The dollar index rose by 7% in 2024, reaching its highest point since November 2022, reflecting the relative strength of the U.S. economy. Emerging market currencies generally depreciated, while global capital flowed into U.S. stocks and bond funds, significantly outpacing other markets. The underlying logic here is the resilience of U.S. economic growth, particularly strong performance in the tech sector.

(C) Gold Rises Against the Trend, Increased Demand for Safe Havens.

Gold prices remained strong in 2024, briefly surpassing $2800 per ounce, with an annual increase of 21%. This diverged from the rising U.S. Treasury yields and the strengthening dollar, largely driven by overseas demand for safe havens and a trend towards de-dollarization. The rise in gold also further supported the logic of a stronger dollar.

(D) Commodities Lag Behind, U.S. Growth Not a Global Improvement.

Commodity performance in 2024 was relatively weak, with both copper and oil prices retreating. This reflects that U.S. economic growth was more concentrated in the tech sector rather than a broad-based improvement. Other markets have yet to recover, which also affected commodity performance.

(E) U.S. Treasury Yields Fluctuate, Repeated Rate Cut Expectations.

U.S. Treasury yields experienced multiple fluctuations in 2024, rising above 4.7% in the first quarter, dropping to a low of 3.6% in the third quarter, and then recently rebounding to 4.6%. This change reflects the repeated expectations of rate cuts, indicating that U.S. economic growth does not face significant pressure and does not require many rate cuts.

II. Reasons for the "Expectation Gap" in Market Predictions for 2024

Several consensus views in the 2024 market showed significant deviations, rooted in:

(A) Linear Extrapolation and Static Thinking.

The market overly relied on linear extrapolation in the absence of a trend, leading to deviations in expectations regarding rate cuts, dollar movements, and U.S. stock performance. Conversely, when a trend was present, there was an emphasis on mean reversion, overlooking the dynamic changes in interest rates and growth environments, thus missing allocation opportunities.

(B) Ignoring Relative Changes in Costs and Returns.

When assessing U.S. stock valuations, the market often overlooked the offsetting effect of rising short-term natural rates on risk premiums, leading to overly pessimistic judgments about the upside potential of U.S. stocks.

III. Analysis of the Main Themes for the Market in 2025

Based on the review of market characteristics and patterns in 2024, we believe the key themes for the market in 2025 hinge on two aspects: whether the internal growth in the U.S. can diffuse and whether the U.S. can converge with external markets.

(A) Can U.S. Internal Growth Diffuse?

If the growth points in the U.S. can diffuse, it would indicate a restart of the credit cycle and a recovery of pro-cyclical sectors, which would boost the fundamentals of the U.S. economy and stock performance. In terms of asset performance, the dollar may remain strong, with the Dow Jones index, representing cyclical styles, showing greater elasticity. If growth points do not diffuse, reliance will still be on tech trends, but growth volatility may increase.

(B) Can the U.S. Converge with External Markets?

If the U.S. and external markets can converge, it would mean that other markets are gradually recovering and closing the growth gap with the U.S., leading to greater elasticity and opportunities. A relative weakening of growth advantages may lead to a weaker dollar, with capital flowing to other markets. If convergence does not occur, it indicates that the recovery in other markets is weak, and the widening growth gap will continue to push the dollar higher.

IV. Analysis of Key Variables:

(A) The Sequence and Degree of Trump’s Policy Implementation.

The sequence and degree of Trump’s policy implementation will directly impact growth and asset trading directions. If overly aggressive policy implementation leads to a significant rise in inflation, the pace of rate cuts may be further delayed. Therefore, close attention should be paid to changes in Trump’s policies.

(B) The Impact of AI Trends on U.S. Tech Stocks.

The trend in the AI industry currently provides significant support for U.S. tech stocks, and AI-related capital expenditures are also a major component driving fixed asset investment. If the AI industry trend continues and profits gradually materialize, the U.S. tech sector will continue to boost U.S. stocks and growth.

V. Analysis of the Impact on the Cryptocurrency Market:

In recent years, the cryptocurrency market has become an important part of the global financial market, attracting a large number of investors due to its volatility and high returns. In 2024, Bitcoin led global assets with a 122% increase, demonstrating the immense potential of the cryptocurrency market. Looking ahead to 2025, we believe the cryptocurrency market will be influenced by the following factors:

(A) The Impact of Dollar Movements.

As the world’s primary reserve currency, the dollar's movements significantly affect the cryptocurrency market. If the dollar strengthens, it may lead to some capital flowing out of the cryptocurrency market in search of safer assets. Conversely, if the dollar weakens, it may attract more capital into the cryptocurrency market.

(B) The Impact of Global Economic Growth.

Improvements in global economic growth will boost investor confidence, driving more capital into risk assets, including the cryptocurrency market. Additionally, as the global economy recovers, the application scenarios for blockchain technology will continue to expand, providing more growth momentum for the cryptocurrency market.

(C) The Impact of Regulatory Policies.

The regulatory policies of various countries towards the cryptocurrency market will directly affect its development prospects. If regulatory policies become more lenient, it will benefit innovation and development in the cryptocurrency market. Conversely, if regulatory policies tighten, it may suppress the vitality of the cryptocurrency market.

Conclusion: The main themes of the market in 2025 will revolve around the internal diffusion of the U.S. and external convergence. Key variables such as the sequence and degree of Trump’s policy implementation and the impact of AI trends on U.S. tech stocks will directly influence market trends. For the cryptocurrency market, factors such as dollar movements, global economic growth, and regulatory policies will collectively shape its development prospects. Close attention to these factors will be essential to seize future investment opportunities.

BTC Data Analysis:

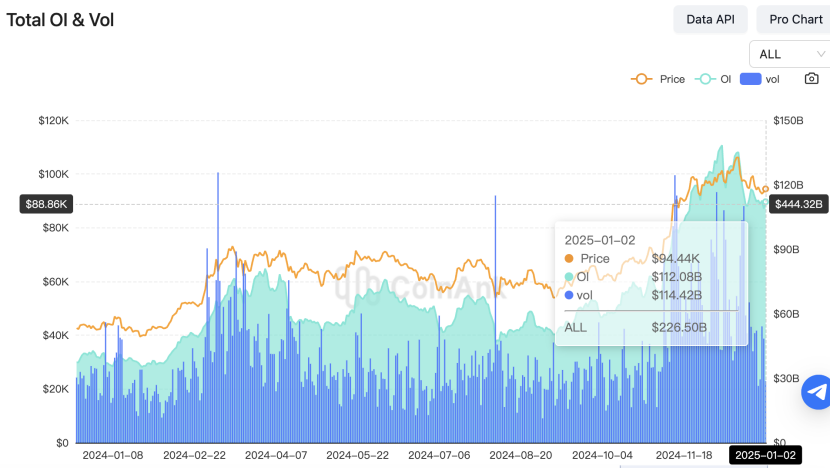

The total open interest in BTC futures contracts has dropped to $112 billion, a decrease of about $18.3 billion compared to the peak on December 8.

Meanwhile, trading volume peaked at nearly $500 billion on November 13, and according to CoinAnk data, it has now fallen to $114.4 billion. As the saying goes, "high volume sees high prices," and Bitcoin's price reached a new high of over $108,350 on December 17. In this round of correction, both trading volume and open interest peaked before BTC prices, which can serve as a predictive leading indicator.

Therefore, if we are to predict Bitcoin prices for 2025, we should pay more attention to changes in open interest and trading volume, which may play a role in price discovery 10-30 days in advance.

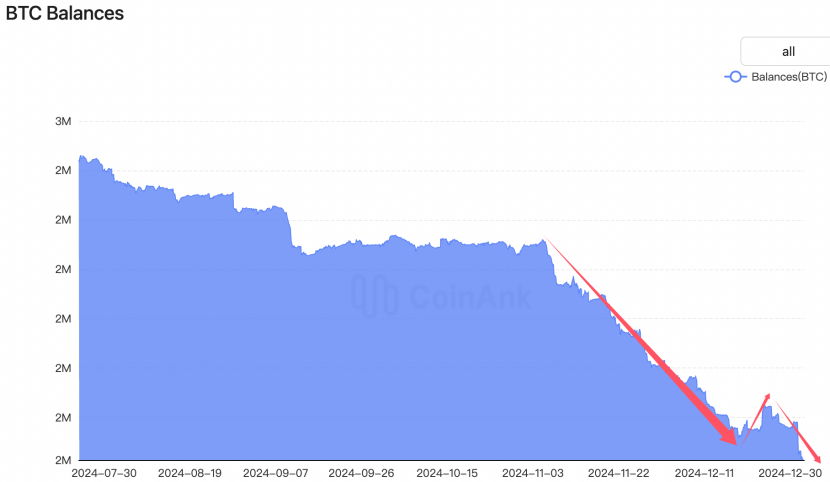

The balance of Bitcoin on centralized exchanges has shown a continuous downward trend, currently at 2.2087 million BTC, reflecting a change in investors' holding strategies towards Bitcoin. Investors are increasingly inclined to transfer Bitcoin to personal wallets, which may indicate confidence in Bitcoin as a long-term store of value, especially in the context of increased market volatility.

The short-term rise and subsequent decrease in BTC balance may relate to the market's dual expectations regarding Bitcoin's short-term price fluctuations and long-term growth potential. During price volatility, investors may transfer Bitcoin to personal wallets to avoid potential market risks. At the same time, long-term holders may wait for prices to reach their psychological expectations before trading, which helps reduce selling pressure in the market, potentially positively impacting Bitcoin's price stability.

This trend has a dual impact on market liquidity. On one hand, the decrease in exchange balances may reduce immediate market liquidity due to the reduced number of Bitcoins available for trading. On the other hand, the increase in long-term holders may enhance market stability, as these holders are less likely to sell Bitcoin during market fluctuations. This data also indicates the maturation of participant behavior in the Bitcoin market and the evolution of market structure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。