Barring an immediate & substantive deterioration in hard data (unemployment, retail sales, job creation, GDP growth, etc.), the Fed is still months away from cutting.

The June 2025 meeting is the earliest that I'm willing to entertain... because that's what the bond market is telling me.

Personally, I don't expect to see this deterioration.

I do expect to see more evidence of steady disinflation.

But the key word here is "steady". It likely won't be fast enough to justify a cut (from the Fed's eyes) in May, particularly if hard data remains resilient & dynamic, as I expect.

This combination makes it much more likely for the Fed to announce a further tapering of QT in May or June, and then the first cut in the meeting after that (so either June or July, depending on the QT taper announcement).

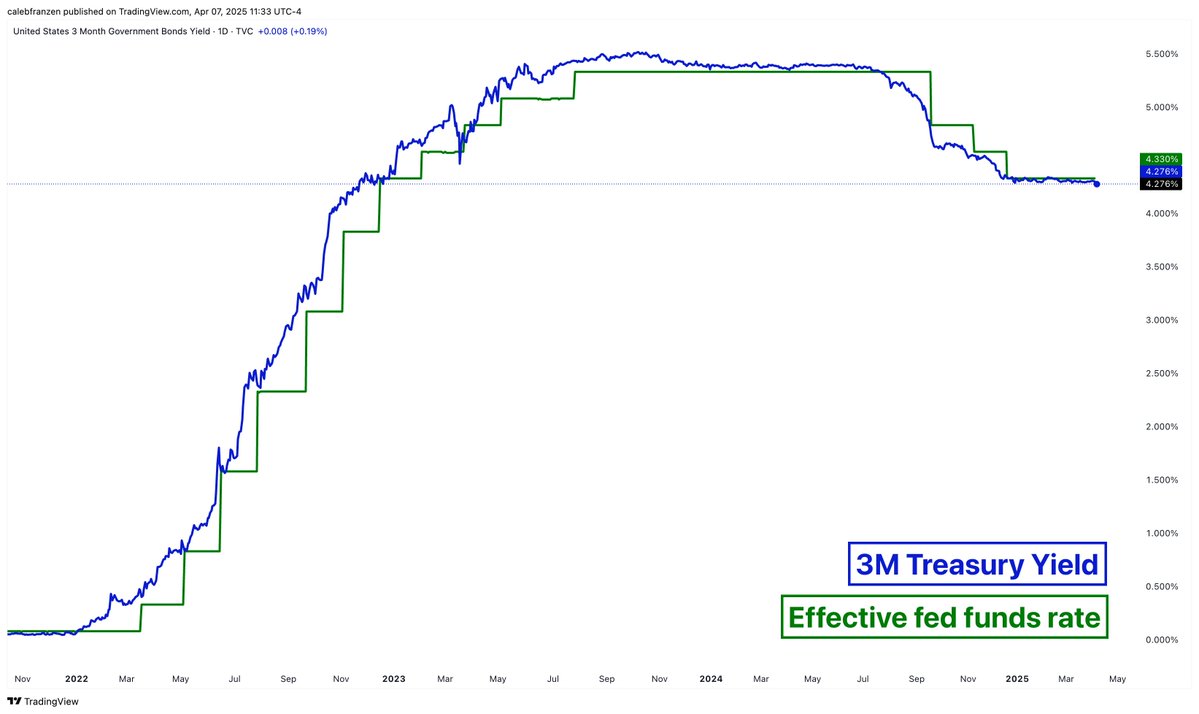

If/when the data does deteriorate, the bond market will promptly reflect that deterioration and the repricing of rate cuts (in other words, the 3M yield will fall below 4%).

Until we have evidence of that, no cuts for at least 2 months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。