In the numerous Layer 1 blockchain projects emerging in 2025, Berachain is attempting to achieve a deep binding of validators and ecosystem interests through its innovative liquidity incentive mechanism. Although the project had a mediocre performance in its early stages, its unique design concept is worth exploring in depth. This article will analyze the long opportunities for $BERA from the perspectives of architectural design, market dynamics, and potential catalysts.

Berachain Architecture Overview

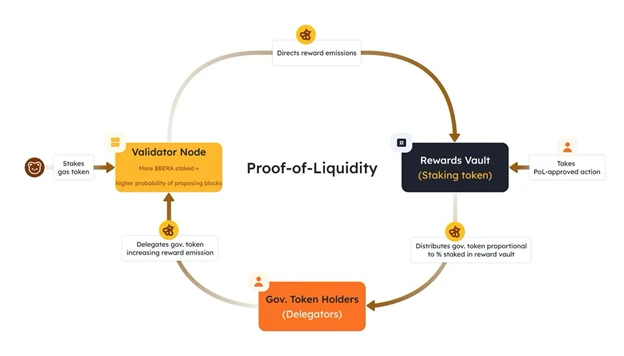

Berachain represents a significant breakthrough in blockchain design. Its main feature is the innovative bundling of the common interests of ecosystem projects and L1 through the Proof of Liquidity (PoL) mechanism, along with a major innovation in the issue of liquidity launch. The system consists of three interrelated tokens:

$BERA: The mainnet token used for paying transaction fees and staking for network security

$BGT: A non-transferable governance token that creates a deflationary effect through a 1:1 burn mechanism with $BERA

$HONEY: The native stablecoin of the ecosystem, facilitating DeFi operations

This three-token model constructs a sophisticated economic system that closely ties the success of ecosystem dApps to $BERA, effectively addressing the core issues faced by other Layer 1 platforms.

Market Analysis

Since the token generation event (TGE) in early February 2025, $BERA has exhibited the following characteristics:

Early price volatility was significant, peaking at $14.83, and then stabilizing in the $6-8 range

In response to community skepticism about venture capital financing, the Berachain Foundation publicly stated it would increase its holdings of spot $BERA

The futures market has consistently maintained a negative funding rate (often below -100%), indicating strong short sentiment. As prices gradually recover, this could trigger a significant short squeeze

Catalytic Effect of Proof of Liquidity

The activation of the PoL mechanism on March 24 is an important milestone in Berachain's development. Data from the first week of implementation shows:

Protocol participation: 37 whitelisted liquidity pools actively competing for liquidity

Yield efficiency: Market-driven incentive distribution creates sustainable yield opportunities

Growth in locked value: Total locked value (TVL) has exceeded $3 billion and continues to grow

Benchmark Analysis: $BERA May Be Significantly Undervalued

With a current market capitalization of $900 million for $BERA, Berachain's market cap/DeFi TVL ratio is the lowest among the top 15 Layer 1s.

We believe the following factors may drive $BERA to regain market attention:

Technological innovation: The PoL mechanism represents a substantial improvement over traditional PoS systems

Market structure: The current concentration of short positions may trigger a significant squeeze

Institutional interest: Limited circulation and growing TVL may attract large institutional investments

Risk Assessment

Despite the optimistic investment outlook, the following risks should be noted:

Technical risk: As a new consensus mechanism, PoL still needs to validate its security and scalability

Market risk: Overall trends in the cryptocurrency market may overshadow project-specific advantages

Competitive risk: Other Layer 1 platforms may adopt similar functionalities, weakening differentiation advantages

Trading Strategy Recommendation: Long Target of $12-15

For the investment layout of $BERA, the following strategies are recommended:

Spot accumulation: Current prices hold mid-term investment value

Basis trading: The negative funding rate environment provides a cushion for leveraged long positions

Current market structure indicates that prices may return to previous highs. Considering the market landscape, a technical target of $12-15 seems reasonable. However, given that the asset is in its early stages and highly volatile, position management and risk control are crucial.

As an emerging crypto asset, thorough due diligence and cautious risk management are essential. While the technical and fundamental aspects show good opportunities, investors should closely monitor key indicators and adjust their positions in response to market changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。