Original author: Murphy, on-chain data analyst (X: @Murphychen888)

Friends may subconsciously think that only paid data is valuable, but in fact, a lot of free data is also very useful. For example, Binance publishes relevant data after each LaunchPool event ends. Hidden within this data are traces of market sentiment, capital flows, and the competition between large holders and retail investors.

We all know that Binance has the best on-exchange liquidity, gathering a massive number of users and funds. Although we cannot directly access the relevant backend data, we can still observe some clues from the limited public data.

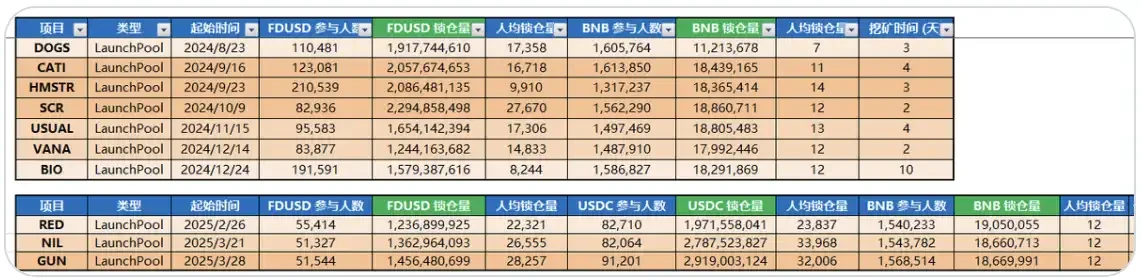

(Figure 1)

Figure 1 shows the relevant data I compiled from all LaunchPools from August 2024 to the present. In 2024, only FDUSD and BNB could participate in LaunchPool, while in 2025, USDC was added, so we can compare the data in two parts.

From the 64th period RED to the 66th period GUN, the number of participants remained stable, but the locked amount of FDUSD and USDC increased each time. Since swapping stablecoins on Binance is fee-free, theoretically, all idle stablecoins would have the willingness to "farm," including USDT. The more stablecoins that participate, the more idle purchasing power there is within the Binance exchange.

At the same time, we also noticed that in the three events of 2025, the scale of FDUSD+USDC was roughly around 3 billion to 4 billion dollars, while in the activities from August to December 2024, the amount of FDUSD was around 1.5 billion to 2 billion dollars, indicating that the capital scale in Q1 2025 is much larger than in 2024. Friends might think this is due to the addition of USDC in 2025, but I may have a different understanding.

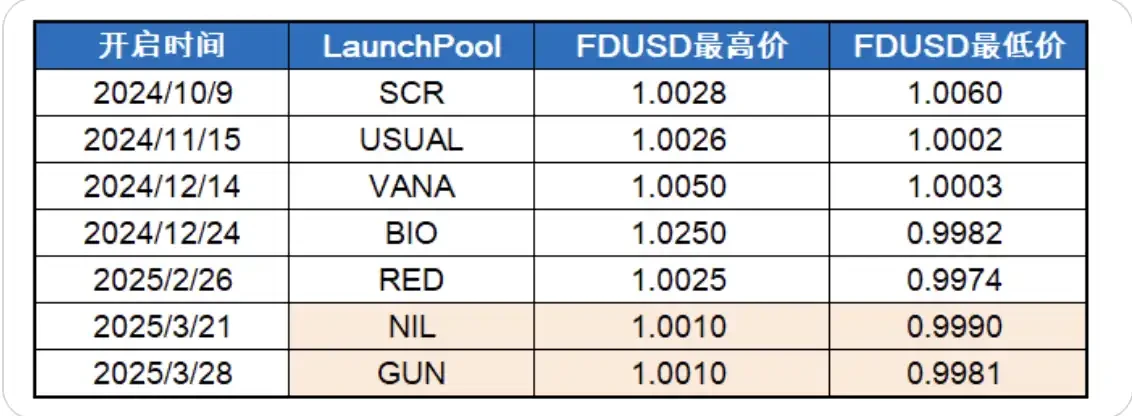

(Figure 2)

We can observe a detail: as shown in Figure 2, during each LaunchPool opening in 2024, the premium of FDUSD was very high. This indicates a large demand for FDUSD at that time, as all holders of USDT and USDC would exchange for FDUSD to participate in mining, thus temporarily driving up the exchange rate of FDUSD.

However, by the time the 2025 events began, the premium of FDUSD started to decline, indicating that the demand for FDUSD was not as high as before. The fundamental reason is that USDC diverted the original demand for FDUSD. Investors holding USDC do not need to exchange for FDUSD, and some investors holding USDT have also exchanged for USDC (because after mining ends, USDC is more stable than FDUSD).

In other words, as long as there is idle capital, most will participate in LaunchPool. The FDUSD+USDC participating in 2025 and the FDUSD participating in 2024 should be viewed as the vast majority of idle funds settled within the exchange. It is not solely because Binance opened a participation channel for USDC in 2025 that led to a significant increase in capital data.

Additionally, the "average locked amount" in Q1 2025 is also higher than in November-December 2024, indicating a shift towards a phase dominated by large holders. This means that the user group with idle purchasing power is becoming more "institutional."

This also seems to indicate a reality: during November-December 2024, more large holders primarily held "coins," while in February-March 2025, large holders primarily held "USDT." At this point, the market has completed a round of wealth transfer, and large holders have also completed their encirclement of retail investors. They hold a large amount of idle funds and are patiently waiting for the next opportunity.

Based on the above observations, we can draw several conclusions:

The idle funds on the exchange have not decreased compared to 2024; in fact, they are increasing. However, the overall sentiment is cautious, and effective purchasing power has not formed.

The increase in the number of participants in LaunchPool indicates that more people have cashed out, but the funds remain on the exchange and are unwilling to leave, meaning that although the sentiment is cautious, it is far from complete despair.

The increase in average locked amount indicates that idle purchasing power is controlled by more large holders; after a round of wealth redistribution, purchasing power has returned to the hands of large holders. They generally believe that the bull market has not ended, so they are still waiting for opportunities within the exchange.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。