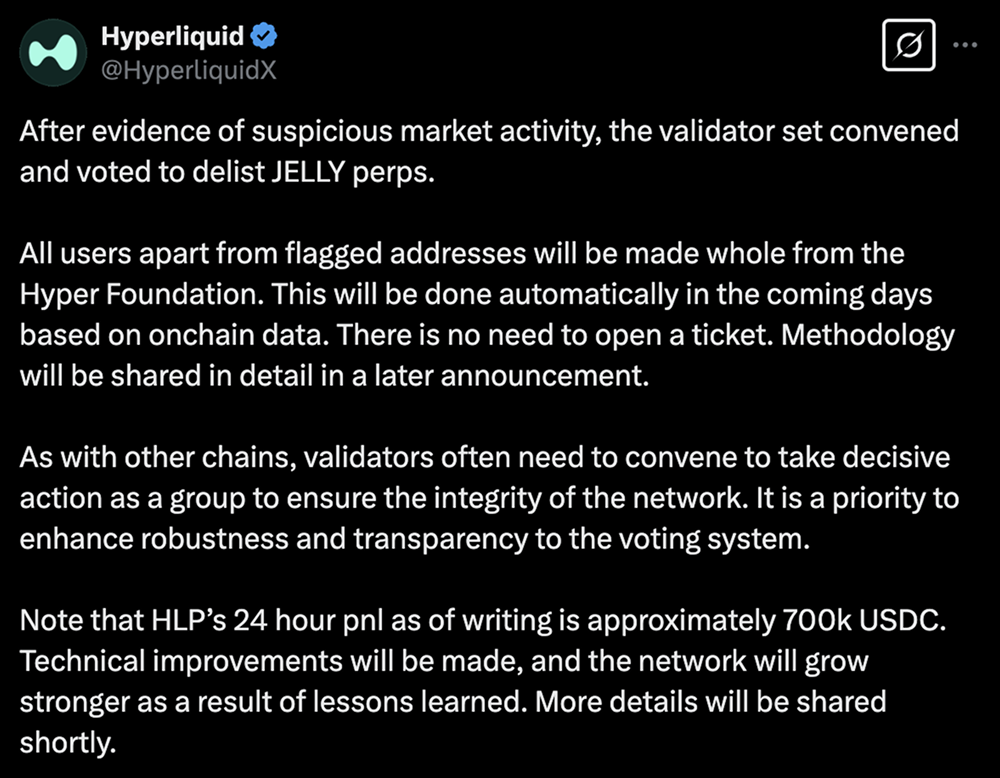

The decentralized perpetual futures trading platform Hyperliquid has recently attracted attention due to unusual market activity surrounding the Solana ecosystem meme coin JELLY (jellyjelly). According to a statement released by Hyperliquid on March 26 at 23:47 (Hong Kong time), the platform's validator committee quickly convened and unanimously voted to delist the JELLY perpetual contract after discovering "evidence of suspicious market activity." This move not only avoided potential massive losses but also sparked widespread discussions both within and outside the industry regarding the governance mechanisms of decentralized finance (DeFi) platforms, market integrity, and centralization controversies. Meanwhile, Hyperliquid pledged to provide full compensation to all affected users except for those with "marked addresses." While this initiative aims to reassure users, it has also left many curious about the details behind the incident.

Event Timeline: From Price Fluctuations to Urgent Delisting

According to Hyperliquid's statement and publicly available information, the trigger for this incident was the dramatic fluctuation in JELLY's price. On March 26, JELLY's market performance was unusually active, with its price soaring over 230% in a short period, reaching a peak of $0.043. At the same time, there was a large volume of JELLY perpetual contract trading on the Hyperliquid platform, including a short position with a leverage of 20 times amounting to $6 million. This trade quickly became the focus of market attention, as the rise in JELLY's price led to significant losses for the short position, which was ultimately taken over by the platform, triggering a chain reaction.

Blockchain analysis firm Arkham Intelligence pointed out that a trader suspected of being an "attacker" (address starting with 0xde95) opened a short position of up to 430 million JELLY on Hyperliquid, and then triggered a price squeeze by withdrawing collateral, forcing Hyperliquid's liquidity provider pool (Hyperliquidity Provider Vault, HLP) to absorb massive losses. It is estimated that if JELLY's price continued to rise to $0.17, HLP could face catastrophic losses of up to $240 million. This potential risk prompted Hyperliquid's validator committee to take decisive action within just four hours of the incident, delisting the JELLY perpetual contract and forcibly settling all related positions at a price of $0.0095.

Notably, almost simultaneously, centralized exchanges Binance and OKX announced the launch of JELLY perpetual contracts, further boosting the market interest in the token. Some analysts speculate that this may not be a coincidence, but rather evidence that the attacker deliberately created price fluctuations by exploiting cross-exchange arbitrage opportunities. However, Hyperliquid did not directly accuse specific participants in its statement, only indicating that necessary measures were taken after "suspicious market activity" was discovered.

Full Compensation and Market Response

To quell user dissatisfaction and maintain the platform's credibility, Hyperliquid pledged that the Hyper Foundation would provide full compensation to all affected users who were not marked. The statement noted that compensation would be automatically executed based on on-chain data, without requiring users to submit applications, and is expected to be completed in the coming days. This initiative has been recognized by some users but has also raised more questions: Which addresses were marked as "suspicious"? How will the specific compensation amounts be calculated? Hyperliquid stated that detailed compensation plans would be announced in subsequent announcements, but as of the time of publication, no further details have been disclosed.

Meanwhile, Hyperliquid emphasized that its HLP achieved a net profit of approximately $700,000 in the past 24 hours, attempting to convey a message of "platform fund safety" to the market. However, following the incident, the price of Hyperliquid's native token HYPE did not escape unscathed. According to AiCoin data, HYPE fell over 16% within hours, retreating from a historical high of $35.02 (on December 21, 2024) to around $12.3. Additionally, the platform recorded over $340 million in USDC outflows within hours after the incident, indicating a significant loss of user confidence. This scenario inevitably brings to mind the $300 million capital outflow triggered by the Ethereum whale liquidation incident on March 12, highlighting Hyperliquid's vulnerability in the face of market anomalies.

Centralization Controversies and Industry Criticism

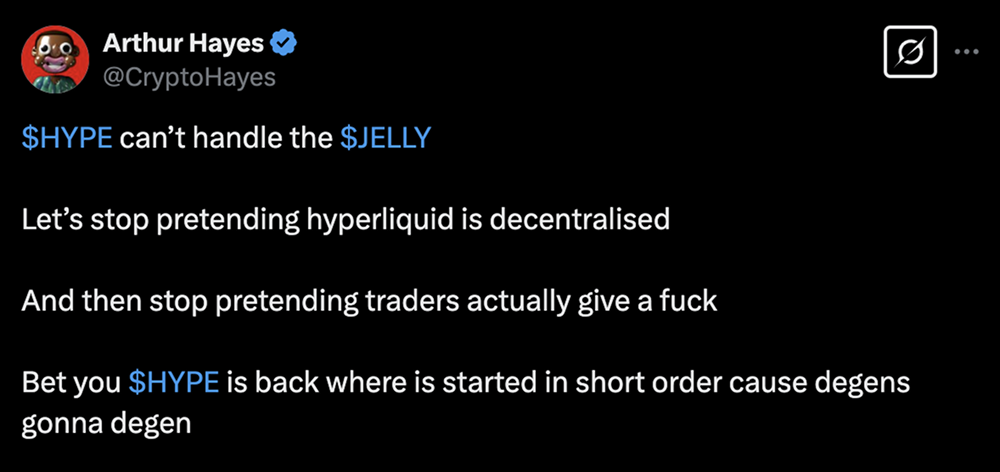

Although Hyperliquid claims to be a decentralized exchange (DEX), this incident has exposed the "centralized" characteristics of its governance mechanism. According to L2Beat data, Hyperliquid's validator network consists of two groups of a total of eight validators, a relatively small group that can quickly reach consensus and execute delisting decisions at critical moments. BitMEX co-founder Arthur Hayes commented on the X platform: "Let's stop pretending Hyperliquid is decentralized." He believes that manually overriding the oracle price of JELLY and forcibly delisting the contract goes against the decentralized spirit of DeFi.

Bitget CEO Gracy Chen's criticism is even sharper. In an interview, she stated that Hyperliquid's handling of the JELLY incident exposed "fatal flaws" in its system design, including issues such as mixed liquidity pools and unlimited position sizes. She warned that if these issues are not addressed, Hyperliquid could become "FTX 2.0," repeating the mistakes that led to the collapse of FTX in 2022. Chen also pointed out that the fact that JELLY's price surged 230% in one hour, resulting in a $10.6 million loss for HLP, highlights the platform's shortcomings in risk management.

Hyperliquid's Response and Future Outlook

In the face of external skepticism, Hyperliquid acknowledged the limitations of its current voting system in its statement and stated that "enhancing the robustness and transparency of the voting system" is a priority. The platform also promised to implement technical improvements to prevent similar incidents from occurring in the future. However, whether these commitments can be fulfilled remains to be seen.

From a broader perspective, the JELLY incident exposes the common challenges faced by the DeFi sector in its rapid development: how to balance market freedom and user protection in a complex environment of high-leverage trading? As a leader in the perpetual futures market (with a market share of about 70% according to a January report by VanEck), this turmoil is undoubtedly a severe test for Hyperliquid. Industry observers point out that although the platform avoided potential losses of up to $240 million by delisting JELLY, restoring its reputation and user trust may take much longer.

Conclusion: The Growing Pains of DeFi

The JELLY incident at Hyperliquid is not only a major highlight in the cryptocurrency market in March 2025 but also serves as a wake-up call for the DeFi industry. While pursuing high returns and high liquidity, how decentralized platforms respond to market manipulation, ensure system stability, and maintain user trust remains an urgent issue to be addressed. For Hyperliquid, this crisis is both a challenge and an opportunity. If it can reshape market confidence through technological upgrades and governance optimization, it may continue to lead in the fiercely competitive DeFi space; conversely, it may fall into the shadow of "FTX 2.0," as critics have warned.

As more details are disclosed and the compensation plan is implemented, the subsequent developments of the JELLY incident are worth close attention. For the entire cryptocurrency community, this is undoubtedly a profound reflection on the contradictions between the ideals of decentralization and the realities of operational practices.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。