Original Author: @castle_labs

Original Compilation: zhouzhou, BlockBeats

Editor's Note: This article analyzes the main derivatives protocols on the Solana chain, including GMX-Solana, Jupiter Perps, and Drift, comparing their liquidity, trading volume, capital efficiency, and risk management. Jupiter and Drift show continuous growth but have lower capital efficiency, while GMX-Solana has higher capital efficiency but less liquidity. As protocols introduce better features and incentives, market competition on Solana will intensify, and the ratio of derivatives trading volume between DEX and CEX has reached a historical high, from which Solana will benefit.

The following is the original content (reorganized for better readability):

BitMEX launched perpetual contracts in 2016, becoming an important part of the crypto derivatives market. Perpetual derivatives are futures contracts without an expiration date, meaning users will not be liquidated until they add margin. They allow users to go long or short on selected assets and provide the best leverage opportunities to define their risk tolerance.

The on-chain derivatives market has developed over the years and successfully achieved product-market fit, first appearing on Ethereum and then expanding to other ecosystems. Among these ecosystems, Solana's perpetual contracts have achieved great success, with @Jupiterexchange and @Driftprotocol becoming the main trading platforms.

Recently, one of the most important perpetual trading platforms on Arbitrum and Avalanche, GMX, has also launched on Solana, operating under the name @gmx_sol, marking another sign of the maturing Solana DeFi ecosystem. This study will analyze the rapidly developing perpetual contract ecosystem on Solana, focusing on the two mainstream perpetual protocols, Jupiter and Drift, as well as the important EVM perpetual protocol GMX that recently landed on Solana.

1. Platform Overview

This section will compare the operation, key data, and product offerings of the aforementioned protocols.

1.1 GMX-Solana

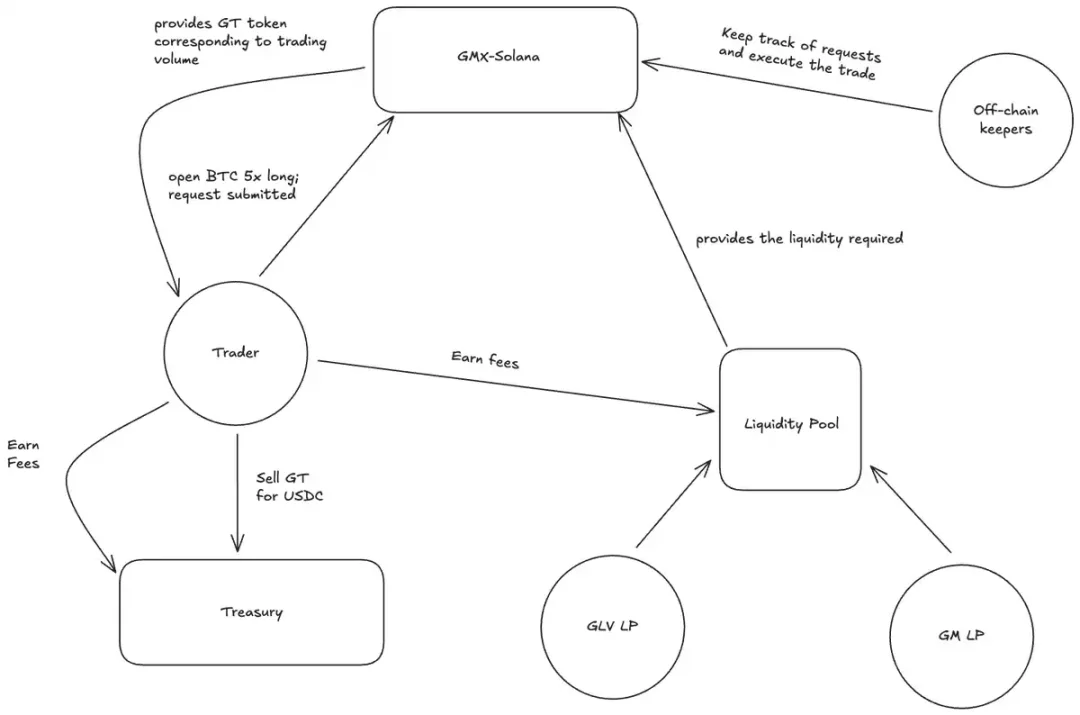

GMX-Solana is a decentralized leveraged perpetual trading platform that recently launched on Solana, continuing its leading trading product position in the EVM ecosystem.

GMX-Solana is a slightly modified version of GMX V2, optimized for the Solana blockchain. Users can engage in leveraged trading, provide liquidity, and exchange tokens. It introduced a unique feature at launch—Trade-to-Mint mode, where traders earn GT tokens based on the trading fees they pay. These GT tokens can be exchanged for stablecoins through the treasury, offsetting users' trading costs.

The GT token economic model is similar to Bitcoin: the more GT tokens in circulation, the higher the price, and the more difficult it becomes to mint. Additionally, once the minting volume of GT tokens exceeds 82.53 million, GMX-Solana may conduct a TGE for GT tokens pending governance approval.

Liquidity providers can choose to provide liquidity to the Global Liquidity Vault (GLV) or the GM pool.

GLV consists of SOL/USDC and dynamically adjusts liquidity to support various synthetic markets based on SOL/USDC; while GM is an independent pool suitable for LPs looking to gain exposure to specific assets.

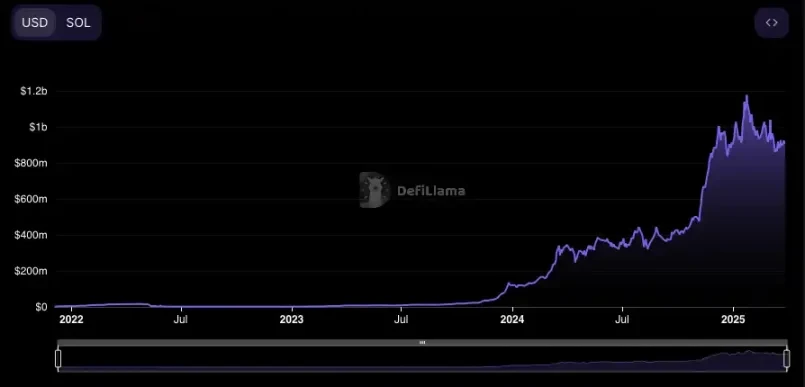

As of now, GMX-Solana's total trading volume has exceeded $2.4 billion, with a TVL of approximately $6.5 million.

1.2 Jupiter

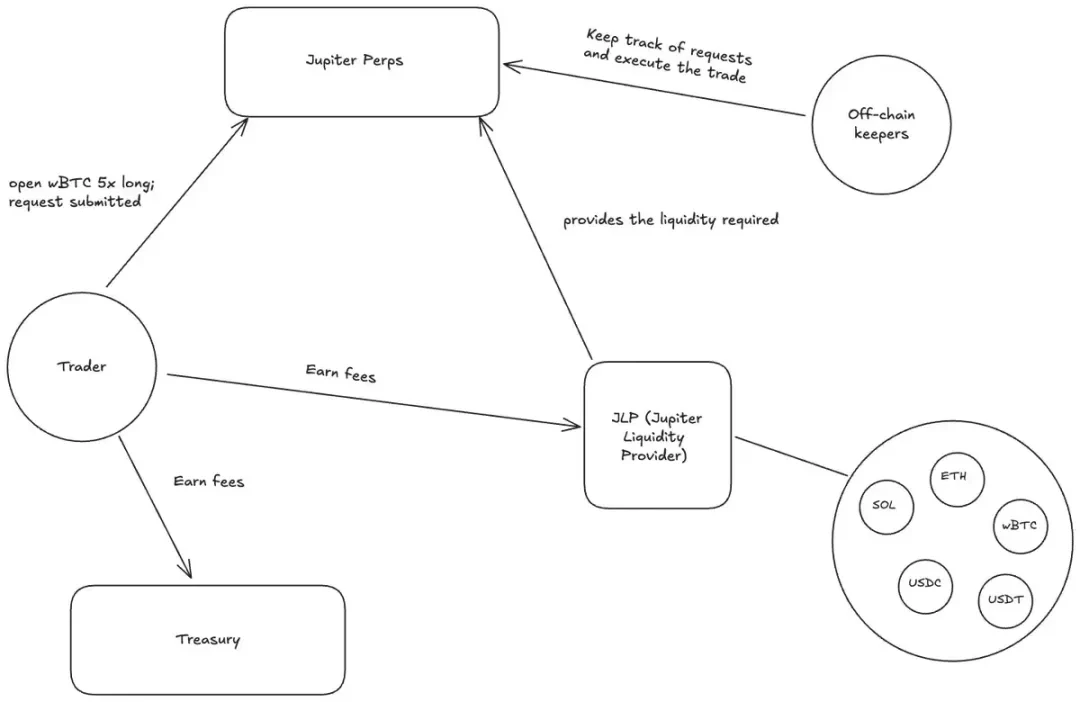

Jupiter is a spot aggregator on Solana and one of the largest leveraged trading platforms on-chain, providing perpetual contract trading services through its product Jupiter Perpetuals.

Similar to GMX-Solana, Jupiter adopts a pool-based design, where liquidity pools act as counterparties to traders. In this design, when traders incur losses, the liquidity pool profits, and vice versa.

Jupiter allows traders to open positions with up to 100x leverage on major assets such as SOL, ETH, and wBTC. In Jupiter's perpetual contracts, long positions are collateralized with tokens identical to the index asset, while short positions are collateralized with stablecoins to ensure efficient settlement.

Liquidity providers offer liquidity through JLP, which operates similarly to GMX-Solana's GLV. JLP consists of five major assets: SOL, ETH, wBTC, USDC, and USDT.

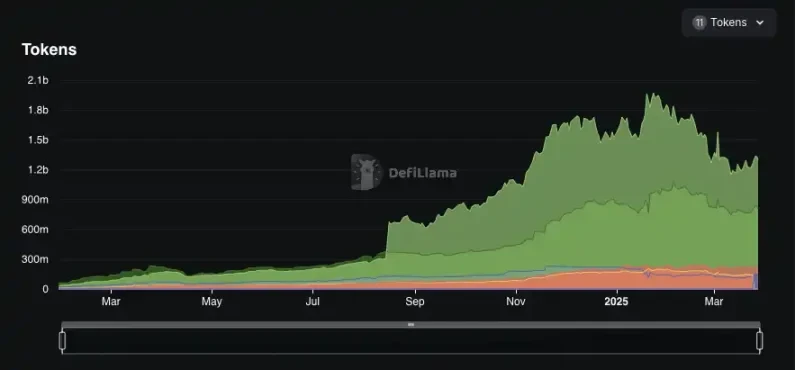

As of now, JLP's market capitalization is approximately $1.4 billion, equivalent to the total liquidity available for Jupiter's perpetual contracts. The platform's total trading volume has exceeded $268 billion.

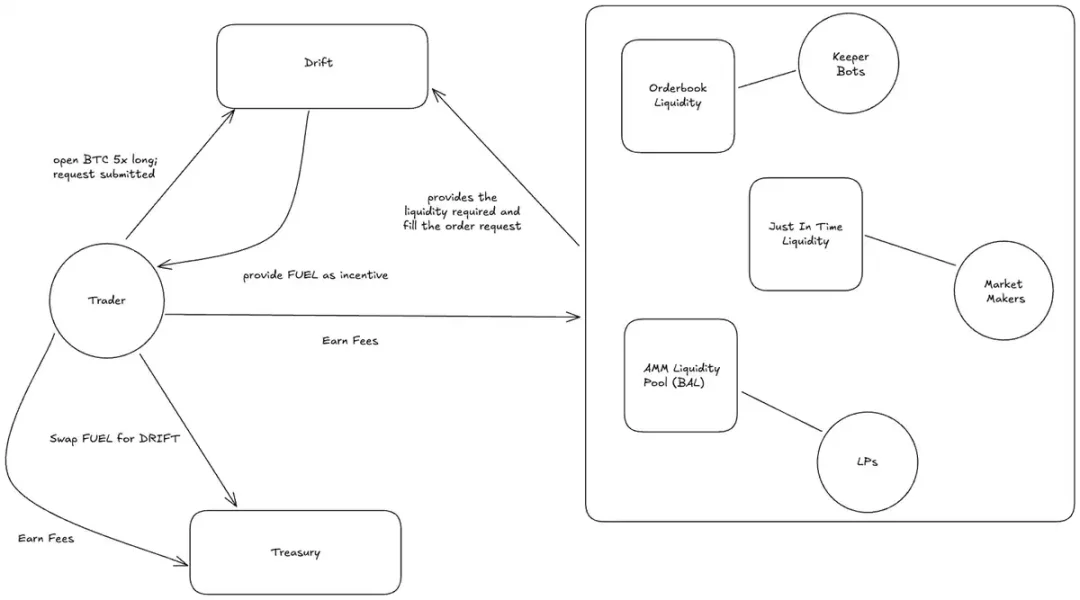

1.3 Drift

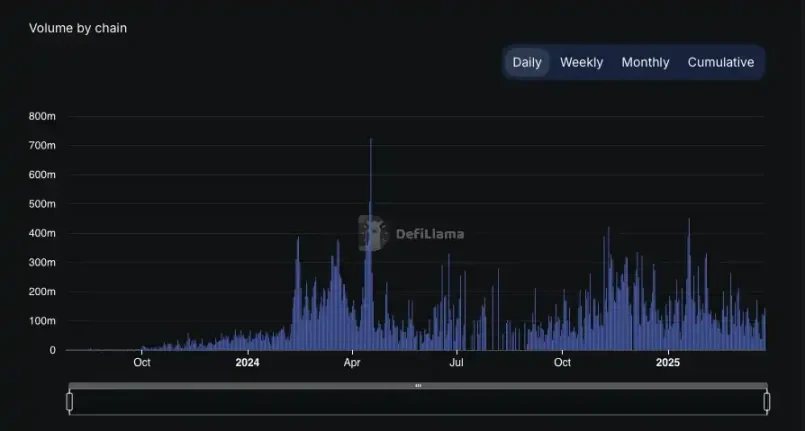

Drift is also one of the largest on-chain perpetual contract exchanges on Solana. Since the launch of its V2 version, the platform's TVL has approached $900 million, with a total trading volume of $59.2 billion.

Drift offers trading with up to 20x leverage, while also supporting liquidity provision, spot trading, and lending markets.

Drift employs a hybrid design, sourcing liquidity from multiple channels to ensure efficient trade execution, deep liquidity, and appropriate profit and loss settlement mechanisms.

Its liquidity sources include:

Just-In-Time (JIT): Managed by market makers (MM), matching orders through short-term auctions;

On-chain Orderbook: Managed by off-chain bots, interacting with AMM to provide liquidity for orders;

Automated Market Maker: A liquidity pool containing different assets used for matching trades.

Liquidity providers can provide liquidity to multiple channels, including Strategy Vaults, Insurance Funds, lending pools, and Backup AMM liquidity (BAL). The liquidity in the lending pool can be used not only for borrowing but also as margin to open trading positions, attracting more traders to participate.

Additionally, Drift incentivizes traders through the FUEL token, where users can earn FUEL by generating trading volume on the platform, which can then be exchanged for the platform governance token $DRIFT.

2. Comparative Analysis

This section will cover all the platforms mentioned above and compare their KPIs.

To provide a good perpetual contract trading experience, a DEX needs to meet the following conditions:

Low fees (opening/closing fees & exchange fees)

Excellent UI/UX (fast RPC and backend servers)

Low-latency price oracle / anti-manipulation mechanisms (to avoid malicious liquidations)

High liquidity (to reduce slippage)

Convenient collateral methods & multi-market support (to enhance trading flexibility)

2.1 GMX-Solana

Fees: Opening/closing and exchange fees are approximately 4-7 bps (0.04%-0.07%), with specific rates depending on the impact of market balance on the trading pair. If the trade improves market balance, the fees are lower; if it exacerbates market imbalance, the fees are higher. Currently, traders can also offset some fees through GT token incentives.

Oracle: Uses @Chainlink for price data.

RPC Service: Utilizes @Heliuslabs, which is industry standard.

Market Support: Supports 25+ markets, including BTC, ETH, SOL, DOGE, etc., allowing users to trade both long and short, with various tokens available as collateral (depending on pool liquidity).

2.2 Jupiter Perps

Fees: Fixed trading fee of 6 bps (0.06%) for opening/closing.

UI/UX: Jupiter Perps is part of the Jupiter spot aggregator, featuring a user-friendly interface and easy operation.

Market Support: Currently only supports SOL-PERP, ETH-PERP, WBTC-PERP, with fewer tradable assets.

Oracle: Similar to GMX-Solana, relies on external price oracles for data.

2.3 Drift

UI/UX: Compared to other platforms, Drift has more features, making its interface relatively more complex.

Fees: The fee rate ranges from 3 bps to 10 bps (0.03%-0.1%), with specific rates depending on user level (related to 30-day trading volume and the amount of $DRIFT staked in the insurance fund).

Market Support: Offers over 50 perpetual contract trading pairs, far exceeding GMX-Solana and Jupiter Perps.

Risk Management Mechanism: Drift classifies perpetual contracts by risk level and determines which trading pairs can use the insurance fund to protect LPs from losses.

Oracle: Utilizes price data provided by @PythNetwork and @Switchboardxyz.

3. Liquidity & Trading Volume

Liquidity is crucial for any perpetual contract exchange. As the on-chain derivatives market grows, the liquidity and trading volume of these platforms continue to rise.

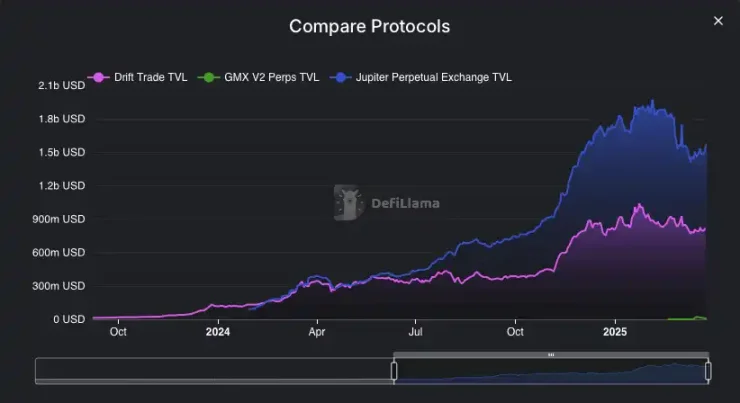

TVL of perpetual contract protocols on Solana

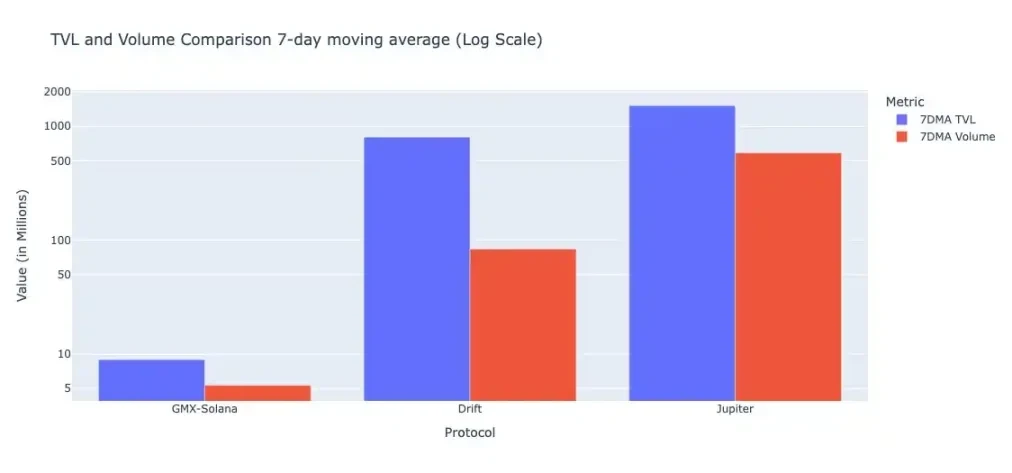

7-day moving average of TVL and trading volume

Due to the significant differences in TVL and trading volume among these protocols, a better comparative metric is capital efficiency, typically measured as trading volume (24H) / TVL. This value reflects the utilization of the protocol's TVL on the exchange, indicating how much capital generates fees and returns for liquidity providers through trading. If capital is not fully utilized, efficiency is low.

The higher this value, the more efficient the protocol's liquidity. Although this value fluctuates based on market conditions and trader interest, a capital efficiency above 1 is generally considered ideal.

Currently, GMX-Solana's capital efficiency is approximately 0.59, while Jupiter and Drift are at 0.38 and 0.15, respectively. GMX's capital efficiency is higher than that of Jupiter and Drift, partly due to its current lower liquidity.

Additionally, when calculating Drift's capital efficiency, we excluded the TVL of the platform's Strategic Vaults, as the funds in these vaults may not be directly used for trading. However, these funds are still included in Drift's total TVL.

Note: To avoid data bias caused by single-day performance and market fluctuations, the above calculations use the 7-day trading volume moving average / 7-day TVL moving average as the formula for capital efficiency.

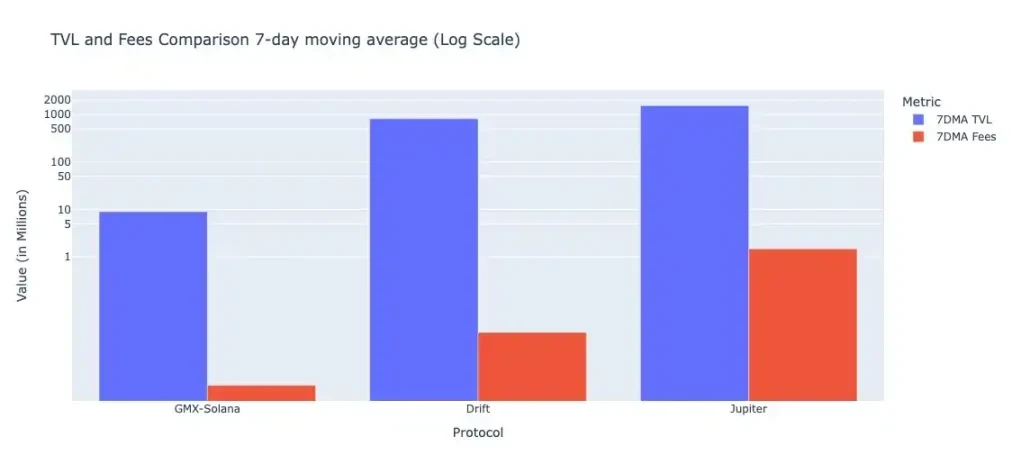

7-day moving average of TVL and fees

Another analyzable metric is fees (24H) / TVL, calculated as the 7-day moving average of fees / 7-day moving average of TVL. This value indicates how much of the protocol's fees are generated from locked liquidity.

GMX-Solana's value for this metric is 0.0002, Jupiter is 0.00097, and Drift is 0.00003.

In this metric, Jupiter generates the highest proportion of fees relative to the locked value.

3.1 GMX-Solana

GMX-Solana obtains liquidity from the GLV (Global Liquidity Vault) and GM pool. The GLV pool is yield-optimized and rebalanced based on market conditions, with liquidity allocated according to demand. Not all markets obtain liquidity from the GLV. Instead, the GM pool is an isolated pool for users who wish to focus on specific assets. These pools earn fees through perpetual trading and spot markets. Currently, the GLV provides an approximate yield of 6% APY.

Most of the active liquidity on the platform comes from the GLV, as the APY for specific GM pools is significantly lower, typically ranging from 1-5%, and liquidity is thinner.

Additionally, due to insufficient liquidity, reduced trader interest, and market volatility, GMX-Solana has currently failed to capture most of the on-chain trading volume on Solana.

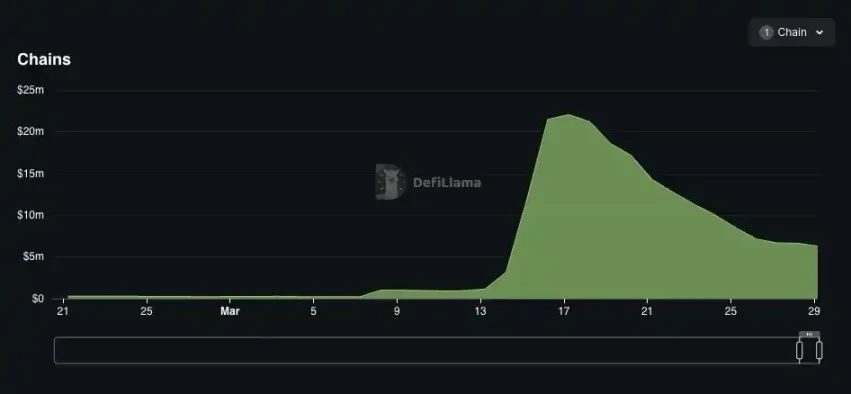

TVL of GMX-Solana

Daily trading volume of GMX-Solana

3.2 Jupiter Perp

The liquidity of Jupiter Perp comes from the JLP token, which is an index fund composed of SOL, ETH, wBTC, USDC, and USDT. JLP accumulates value through the fees generated by Jupiter Perps. JLP is an excellent choice for providing liquidity, as it offers liquidity providers flexibility to easily add or remove liquidity.

At the time of writing, JLP offers a 10% annualized yield.

TVL of Jupiter Perp

3.3 Drift

Drift's liquidity comes from multiple channels, as described in the overview section. Since users can provide liquidity in different ways, the annualized yields vary for each method.

The platform offers a maximum APY of 338% through Strategic Vaults, which are managed by external parties. Other pools, including lending pools and insurance funds, provide 10-15% APY.

LPs can also provide liquidity through BAL, where they automatically open opposing positions for traders and earn fees from the market's funding rates. Additionally, 80% of the order fees collected are distributed to BAL providers, resulting in annualized yields of 10-25%, depending on the market in which they provide liquidity.

Daily trading volume of Drift

4. Risk Management

Risk management is crucial in every perpetual contract exchange. Although risks associated with smart contracts still exist, an ideal risk management protocol should efficiently settle positions under highly volatile market conditions and minimize harm to liquidity providers.

4.1 GMX-Solana

GMX-Solana has two types of markets: fully collateralized markets and synthetic markets.

Each GMX-Solana market contains three tokens:

Index token

Long token

Short token

Long and short tokens jointly support the market. Long tokens support long positions, while short tokens are typically stablecoins that support short positions.

The index token is the token users use to go long or short. However, it is worth noting that GMX-Solana also supports collateralizing only one token in specific markets, which may pose risks to short positions.

When the long token and index token are the same, the market is fully collateralized, meaning that in highly volatile market conditions, traders' profits and losses can be settled quickly. In synthetic markets, when the long and index tokens differ, this may lead to profit and loss settlement issues during high volatility.

To ensure efficient profit and loss settlement, GMX-Solana employs an Automatic De-leveraging (ADL) mechanism, which partially or fully closes certain profitable positions to maintain market solvency.

To manage risks, protect liquidity providers, and maintain pool balance, several fees are involved, including:

Price impact fees: Fees paid when LPs or traders cause pool imbalance

Dynamic borrowing fees: Fees paid by traders to LPs for borrowing assets from the liquidity pool

Funding fees: Fees that incentivize the other side of the market to trade in the opposite direction

These fees are crucial for incentivizing liquidity providers and protecting the exchange in the event of solvency issues.

4.2 Jupiter Perps

Jupiter Perps operates similarly to GMX-Solana, with the only difference being that it does not allow synthetic markets where the long backing token differs from the index token. This further protects the exchange and positions, maintaining stability even under high volatility.

4.3 Drift

Drift takes a different approach, as it employs a hybrid liquidity model. Drift utilizes an insurance fund to manage risk and efficiently maintain the exchange's solvency. The insurance fund accumulates funds through the protocol's revenue, liquidations, and trading fees. Since BAL is an automated market maker (AMM), LPs may be prevented from burning their shares when pool imbalances occur.

5. Current Status and Future Trends

Currently, most of the derivatives liquidity is concentrated on Solana, with the main contributors being Jupiter and Drift. As of now, Solana accounts for approximately 52% of the total on-chain derivatives liquidity, amounting to about $2.7 billion, while the total liquidity is $5.2 billion.

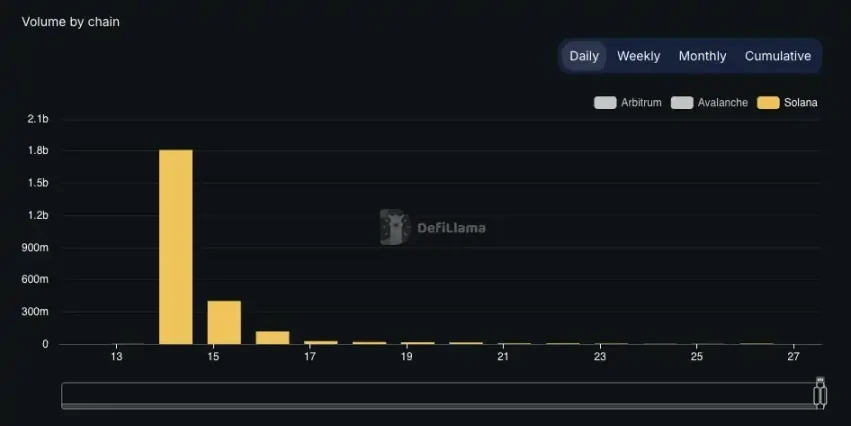

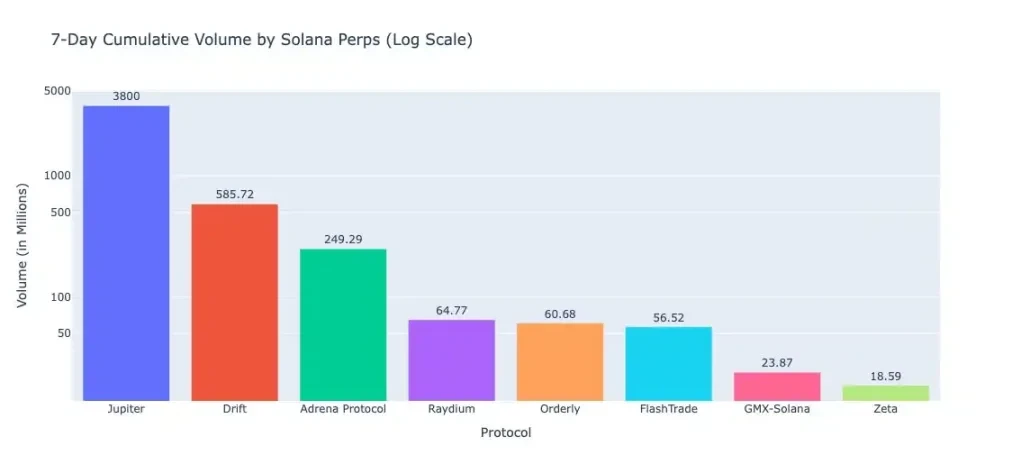

7-day cumulative trading volume: Solana perpetual contract platforms

Currently, the trading volume of Solana perpetual contracts is led by Jupiter, followed by Drift. GMX-Solana still has a long way to go in challenging the existing competitors in the market.

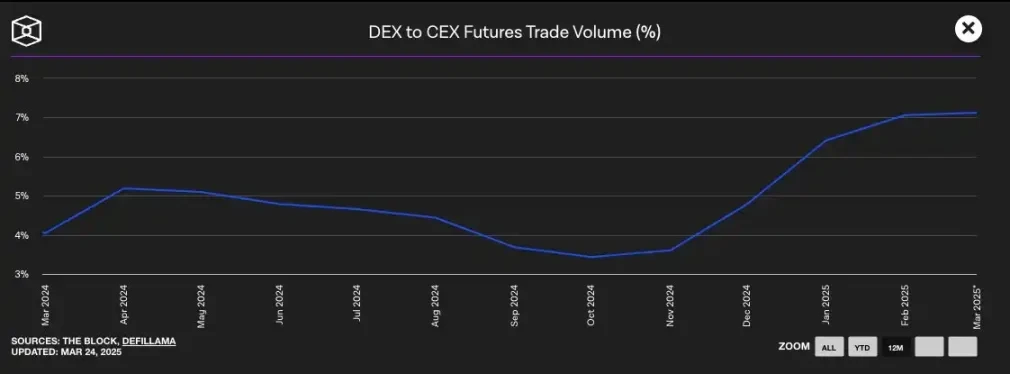

Futures trading volume from DEX to CEX, source: The Block

The on-chain derivatives market is thriving, with increasing competition among protocols, leading to the launch of many excellent products. The trading volume ratio from DEX to CEX is rising, currently around 7%, indicating significant growth potential in the future.

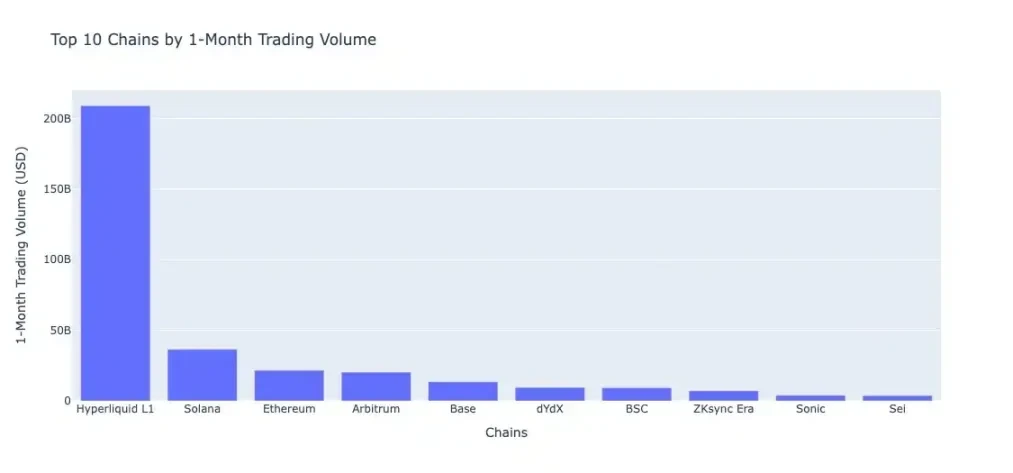

Top ten blockchains ranked by 1-month trading volume

Solana is the second-largest chain in terms of trading volume in the on-chain derivatives space. The trading volume of Hyperliquid is significantly lower compared to other chains. As the industry develops and Solana protocols introduce better features and incentives, this gap will eventually narrow. With the increased throughput from the Firedancer verification client, Solana protocols can achieve speeds and efficiencies comparable to their competitors.

6. Conclusion

Jupiter and Drift demonstrate a sustained growth pattern but lack capital efficiency. While GMX-Solana has a slight advantage in capital efficiency, partly due to lower liquidity, it still needs to work hard to catch up.

Jupiter promotes simplicity through its JLP token, allowing LPs to purchase and hold JLP to provide liquidity to the platform. Although GMX and Jupiter follow similar patterns in handling trades, their approaches to liquidity differ, with little similarity between GLV and JLP.

Drift offers cross-margin accounts for advanced traders seeking better risk allocation. It allows for lower leverage and focuses on risk management through incentivizing the insurance fund.

Currently, the ratio of DEX to CEX derivatives trading volume is at a historical high. As Solana is the most significant liquidity contributor in the on-chain derivatives market, its ecosystem will benefit from the trading volume generated from this segment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。