Original | Odaily Planet Daily (@OdailyChina)

After experiencing the "Hyperliquid 50x leverage whale" liquidation incident (related content can be found here: Why did the Hyperliquid whale self-liquidate? Who bears the millions in losses?), Hyperliquid faced a similar crisis again last night. This time, the attackers targeted the smaller and more manipulable altcoin JELLY as their entry point.

In a short period, the price of JELLY fluctuated dramatically, with the 15-minute candlestick chart showing increases of over 100% and decreases of over 50%, plunging the market into extreme conditions, with short-term traders exclaiming, "It's a nerve-wracking situation; retail investors are facing liquidation at any moment." How did this hunting operation unfold? Odaily Planet Daily will provide an in-depth review of the entire event.

JELLY 15-minute candlestick chart

Event Overview: Hyperliquid's treasury takes over JELLY short positions, from near liquidation to "forced" risk-free settlement

A trader opens a massive short position on JELLY

At 20:53 yesterday, a trader (opening address link: https://hypurrscan.io/address/0xde9593fe5cdc5cb0917f5d5618a111f1174f5c91) transferred 3.5 million USDC into Hyperliquid as margin and opened a short position of 430 million JELLY (worth approximately $4.08 million), with an opening price of $0.0095.

Hyperliquid's treasury receives a massive short position due to trader's automatic liquidation

A price manipulation address (manipulation address link: https://intel.arkm.com/explorer/address/Hc8gNSMaQiahiRiGjUfTaW8AXudRJHeGoeGpAn8WRcwq) collaborated with the trader to drive down the price of JELLY after the short position was opened, creating a floating profit space for the short. At 21:03 yesterday, the trader closed 30 million JELLY short positions at a price of $0.0103 (worth approximately $310,000), subsequently withdrawing $2.76 million in margin, leading to the forced liquidation of their remaining 398 million JELLY short positions (worth approximately $4.5 million) taken over by Hyperliquid's liquidation address at a price of $0.0113.

JELLY price rapidly surged, Hyperliquid's treasury faced a floating loss of over $10 million

At 21:45 yesterday, the manipulation address's intensive buying further amplified the treasury's floating loss, with Hyperliquid's treasury facing a floating loss of over $10 million at one point. According to on-chain analyst @ai_9684xtpa, if the market pushed the price up to around $0.17, the treasury would face liquidation and lose the current holding of $240 million. Based on the treasury's deposit and withdrawal records at that time, some treasury funds were already fleeing, but the amounts were small, possibly retail behavior.

Hyperliquid treasury under attack

Hyperliquid delists JELLY as OKX and Binance launch JELLY contract trading

According to KOL Wang Xiaoer (@brc20niubi) on the X platform (CZ also commented on this content), just minutes before OKX and Binance announced the launch of JELLY contract trading, Hyperliquid was already prepared to concede and completely delisted JELLY trading. The following image shows Wang Xiaoer's review of Hyperliquid's operations and CZ's comments.

KOL Wang Xiaoer's review of the Hyperliquid incident

"Pulling the plug" conclusion: settling JELLY at $0.0095 not only avoided losses but also made a profit

"I heard you wanted to liquidate me, so I just settled the position directly." After Hyperliquid delisted JELLY, it settled at a price of $0.0095 (the same price at which the trader opened their short position), involving 392 million JELLY tokens, ultimately not only avoiding losses but also making a profit of $703,000.

Not only avoided losses but also made a profit of $700,000

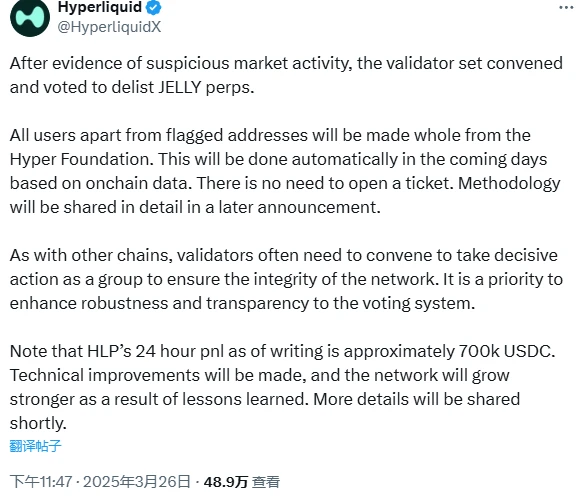

Official Response: Validator votes to delist JELLY, user losses will be covered by Hyper Foundation

In response to the "Hyperliquid delisting JELLY and completing the settlement at a favorable price of $0.0095" such a "centralized" operation, the official responded promptly to the incident, with the following details:

Due to abnormal market activity, the validators voted to delist the JELLY perpetual contract. After collective discussion among the validators, it was ultimately decided to remove the JELLY trading pair to maintain market fairness. Apart from the marked addresses, all users' financial losses will be compensated by the Hyper Foundation, with compensation automatically executed based on on-chain data, and users do not need to submit support tickets. The specific calculation method will be detailed in a subsequent announcement;

The collective decision-making mechanism of validators helps maintain network stability. Similar to other blockchains, validators sometimes need to make collaborative decisions to respond to emergencies and ensure network integrity. Currently, the system's transparency and the robustness of the voting mechanism will be key areas for improvement to enhance governance effectiveness;

HLP currently has a 24-hour profit of approximately 700,000 USDC, and technical improvements are underway. Through this incident, the team will optimize the system and enhance risk resistance, making the network more robust after learning from the experience. More detailed information will be announced later.

Official response to "settling JELLY at a favorable price"

Although the official emphasized that the removal of the JELLY trading pair was the result of collective discussion among validators, Hyperliquid, as a decentralized trading platform, making such a "pulling the plug" centralized operation inevitably raises more questions. Odaily Planet Daily has compiled industry insiders' views on this incident.

Industry Discussion on Hyperliquid JELLY Liquidation Incident: Centralized Manipulation, Trust Crisis, and Systemic Risk

Arthur Hayes: Stop pretending to be decentralized; HYPE will return to square one

BitMEX co-founder Arthur Hayes sharply criticized the "Hyperliquid JELLY liquidation incident" on the X platform, stating, "HYPE cannot bear the impact of the JELLY incident. Let's stop pretending Hyperliquid is decentralized; and let's not pretend traders really care; I bet HYPE will soon return to square one because gamblers are ultimately gamblers."

ZachXBT: Hyperliquid officials are indifferent to North Korean hackers using stolen funds to short, yet manipulate market prices

On-chain detective ZachXBT criticized Hyperliquid on the X platform, stating, "It's outrageous that Hyperliquid officials can arbitrarily manipulate prices, yet they remain indifferent when North Korean hackers use stolen funds from Radiant to hold significant short positions."

Bitget CEO: Hyperliquid May Be Heading Towards FTX 2.0

Bitget CEO Gracy Chen posted on the X platform that Hyperliquid's handling of the JELLY incident is immature, unethical, and lacks professionalism, leading to user losses and severely damaging its credibility. Although the platform claims to be an innovative decentralized exchange with bold visions, its actual operations resemble those of an offshore centralized exchange, lacking KYC/AML mechanisms, which fosters illegal fund flows and misconduct. The decision to close the JELLY market and forcibly settle positions at a favorable price sets a dangerous precedent. For any exchange (whether CEX or DEX), trust is more important than funds; once lost, it is nearly impossible to recover.

Additionally, the platform's product design has serious flaws: the mixed liquidity pool exposes users to systemic risks, while the unrestricted position sizes provide opportunities for market manipulation. If these issues are not addressed, more altcoins may be used against Hyperliquid, putting it at risk of becoming the next major collapse case in the crypto industry.

Andre Cronje: Position Size Is Not a Fixed Function of Leverage; DeFi Should Not Have Fixed Leverage Values

In response to Hyperliquid's treasury facing liquidation and losses, Sonic Labs co-founder Andre Cronje stated on the X platform: "Position size is not a fixed function of leverage; it depends on available liquidity and realized volatility. A small position can have 1000x leverage, while a large position may only have 1.2x. There should be no fixed values in DeFi."

CZ Cites Old Tweet Indicating DEXs Are Inferior to CEXs, Emphasizing No Relation to Hyperliquid Liquidation Incident

Furthermore, CZ referenced a previous tweet on the X platform, stating: "I know I'm not smart. When I don't understand, I admit it, and I often feel that those who are impressive must have some tricks I don't know to do what I can't. But occasionally, I find that the most basic rules still apply." Notably, CZ clarified that to avoid confusion, this tweet is unrelated to today's Hyperliquid liquidation incident; it refers to his previous experience with the AstherusHub on the BSC chain, which is a project in the Labs portfolio. They do not display liquidation prices and use an automatic deleveraging mechanism (ADL), so issues similar to today would not occur.

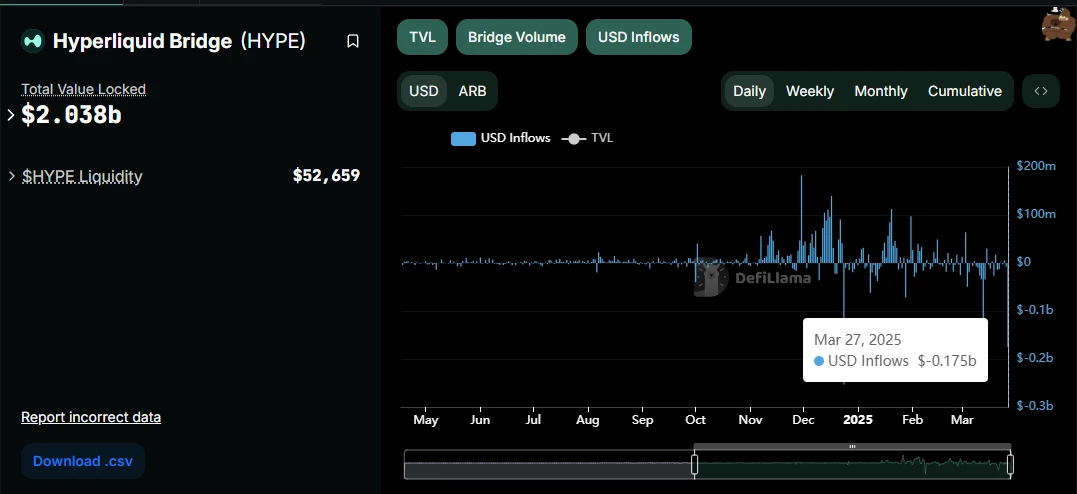

Impact on Hyperliquid: Significant Decrease in TVL, Clear Trend of USDC Outflow

Hours have passed since the incident, and on the surface, the storm seems to have calmed, but its impact on Hyperliquid remains profound and "heavy." According to data from Hyperliquid's official website, the TVL of HLP was as high as $240 million before the incident, but it has now significantly dropped to $195 million, losing nearly 20% of funds in a short period. This drastic fluctuation reflects the market's wavering trust in the platform, and investor confidence has clearly not yet recovered.

Additionally, according to DefiLlama data, after the Hyperliquid liquidation incident, there was a massive outflow of USDC funds from the platform, with a total net outflow of up to $175 million. The total USDC holdings plummeted from $2.217 billion before the incident to $2.004 billion.

USDC net outflow data on Hyperliquid

Summary

The Hyperliquid hunting incident has thoroughly exposed the governance and transparency issues of decentralized perpetual contract exchanges. Although the official reason given is that the validators voted to delist the trading pair, the direct "pulling the plug" forced settlement has led many to question just how decentralized DeFi exchanges truly are.

This incident also serves as a reminder to all DeFi projects that merely relying on the "decentralization" label is far from sufficient. When faced with extreme market conditions, the key is whether the platform can stabilize the situation while maintaining fairness and transparency. In the future, for decentralized on-chain DeFi projects to gain market trust, they must find a better balance between transparency, governance mechanisms, and risk control; otherwise, similar crises are unlikely to be the last.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。