Banning offshore stablecoins like Tether could undermine the global dominance of the dollar, trigger inflation risks, and pave the way for geopolitical rivals to fill market gaps.

Author: Tom Howard

Translation by: Deep Tide TechFlow

The following is an opinion piece by Tom Howard, Head of Financial Products and Regulatory Affairs at CoinList.

Given the issues with offshore operations, the currently circulating draft of the "Stablecoin Act" may effectively ban Tether and other non-U.S. stablecoin issuers from entering the U.S. market.

This approach is a significant policy misstep.

The vitality of a strong global reserve currency lies in its ability to project itself into overseas markets rather than retracting back domestically.

Attempting to force all dollar-denominated stablecoins to transfer their deposits to U.S. banks ignores a key monetary principle—the "Triffin’s dilemma." This theory states that exporting currency overseas can enhance international demand, but if too much currency flows back domestically, it can trigger inflation risks.

While bringing innovation back home is indeed good economic policy, "repatriating" the dollar falls under monetary policy, which is generally not ideal for a nation.

In fact, the innovation of stablecoins provides the dollar with an opportunity to project more dollars overseas, thereby enhancing the strength and liquidity of the dollar as a global reserve currency.

But why can't the above goal be achieved through U.S. domestic issuers?

Market Preference for Non-U.S. Issued Stablecoins

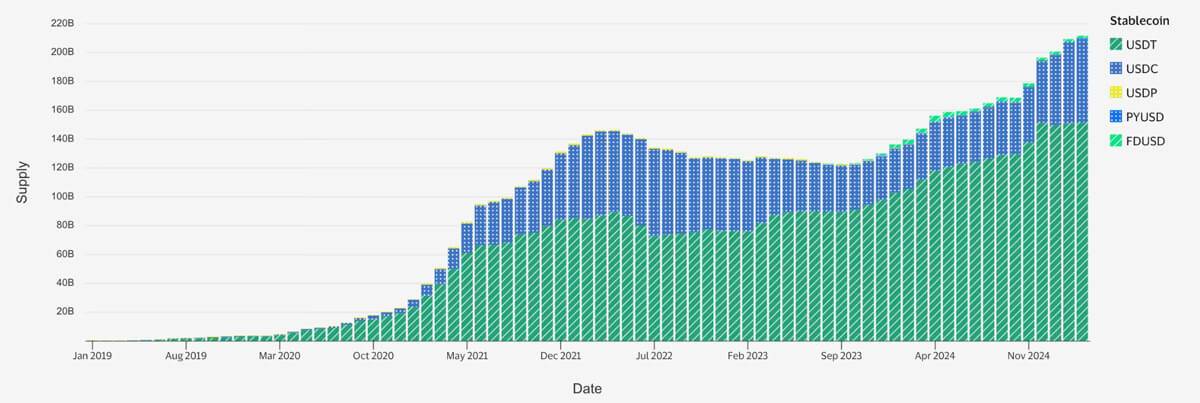

Clearly, in non-U.S. markets (from Asia to Africa to Latin America), USDT is the global preferred stablecoin. This is not because its competitors (like the second-ranked Circle) have not made efforts to enter these markets. In fact, Circle has made significant attempts.

In my user research on developing stablecoins and stablecoin wallets, I found that U.S. bank-backed stablecoins are often seen as a direct extension of the U.S. government, while non-U.S. issued stablecoins are viewed as more autonomous. Setting aside practical operations, this perception is very common in the market.

Many users choose to use stablecoins because their home governments exhibit oppressive monetary or banking policies, and they fear potential government abuse of power. They want access to the dollar but do not want to be exposed to the U.S. banking system.

These concerns have been further exacerbated by significant events, such as the overuse of sanction powers and more common issues like the freezing of funds in cross-border or remittance payments.

Stablecoins give users more confidence in the safety of their funds, and actual usage data shows that many markets prefer non-U.S. issued stablecoins. This preference was evident even before Tether began disclosing its reserve audits.

Tether may also recognize that fully transferring its system to the U.S. banking system would lead to a loss of a large user base, while creating opportunities for other market participants to fill this clear demand.

What "Banning" Means

Several drafts currently circulating may impact different types of bans.

First, non-U.S. registered stablecoins would be banned from issuance within the U.S. This is certainly reasonable; U.S. issued stablecoins should be subject to U.S. regulation!

Second, the "use" of unregistered stablecoins may be prohibited. This could cover everything from usage by payment providers to trading on exchanges to transactions between individuals. Such a ban limits market choices, brings negative externalities internationally, and may even be difficult to enforce.

The third type of ban is to restrict any financial service cooperation with U.S. entities. In this case, if regulations are not met, U.S. financial institutions would have to cease all related activities, including purchasing U.S. Treasury bonds. For Tether, this could mean needing to sell over $100 billion in U.S. Treasury bonds.

Any Form of Ban Would Be Counterproductive

Reduced Global Dollar Liquidity: Trading bans would weaken the liquidity between stablecoins and the dollar, increasing transaction costs, thereby harming user interests and weakening global demand for the dollar.

Inflation Risks: Reducing dollar reserves at foreign banks could increase domestic inflationary pressures.

Geopolitical Risks: External competitors may exploit unmet market demand to develop dollar stablecoins backed by non-dollar assets.

Repatriation of Foreign Bank Dollar Reserves

If forced to transfer reserves to U.S. institutions, Tether would bring a large amount of dollars back to the U.S., potentially exacerbating domestic inflation. Meanwhile, the international market's demand for offshore dollar tokens will persist, prompting competitors to quickly fill the gap left by Tether overseas.

When dollars flow back from international circulation to the domestic banking system, it increases the loan supply of domestic banks, which could potentially drive inflation.

Additionally, this would reduce the dollar holdings of foreign banks, which are crucial for international dollar liquidity and help facilitate international trade. At the same time, it would increase the demand for purchasing U.S. Treasury bonds, as these banks would invest deposits in risk-free assets.

Besides Tether, other issuers may also expand the use of dollars in specific markets. For example, countries like Cambodia have effectively "dollarized" their economies. Although the country has issued its own currency, economic activity is primarily conducted in U.S. dollar cash.

If companies or banks in these countries wish to promote further adoption of the dollar through digital dollars, stablecoin innovation would be an excellent way to achieve this goal. These stablecoins may not operate according to U.S. or EU stablecoin regulatory standards, but encouraging their existence is still beneficial for the U.S. as it increases foreign banks' dollar reserves.

Rivals May Replace the Dollar

As Tether and other stablecoin businesses have discovered, there is significant market demand for non-U.S. issued stablecoins.

Banning non-U.S. issuers could create opportunities for foreign competitors to replace the dollar by issuing dollar tokens backed by foreign currencies, gold, or other assets.

This would effectively weaken demand for the dollar while reducing its supply. If this situation scales up, it would significantly undermine the global position of the dollar.

Other countries may also launch dollar-denominated stablecoins backed by gold or the renminbi.

U.S. policy should actually encourage more dollar reserves to be held in foreign banks to strengthen the global position of the dollar.

A Better Path Forward

By amending the "Stablecoin Act" to create exemptions for foreign-issued stablecoins, the aforementioned issues can be avoided.

Allowing these stablecoins to operate, trade, and be used within the U.S. while clearly labeling them as unregistered, higher-risk alternatives, distinguishing them from fully U.S. regulated stablecoins. At the same time, providing U.S. registered stablecoins with advantages that match their lower risk.

Such exemptions could:

Encourage global innovation to meet offshore dollar demand.

Enhance the global use of the dollar while avoiding imported inflationary pressures.

Maintain market-based competition, allowing consumers to choose based on transparent risk disclosures.

This can be achieved by explicitly excluding foreign-issued stablecoins from the definition of "payment stablecoins," or by creating a lighter registration process that only requires disclosure of information rather than meeting the higher standards required for U.S. approved stablecoins (or corresponding benefits).

By allowing stablecoins like Tether to coexist under regulation rather than outright banning them, the U.S. can strategically consolidate the global position of the dollar, mitigate inflation risks, and encourage fintech innovation worldwide.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。