整理:栾鹏,RootData

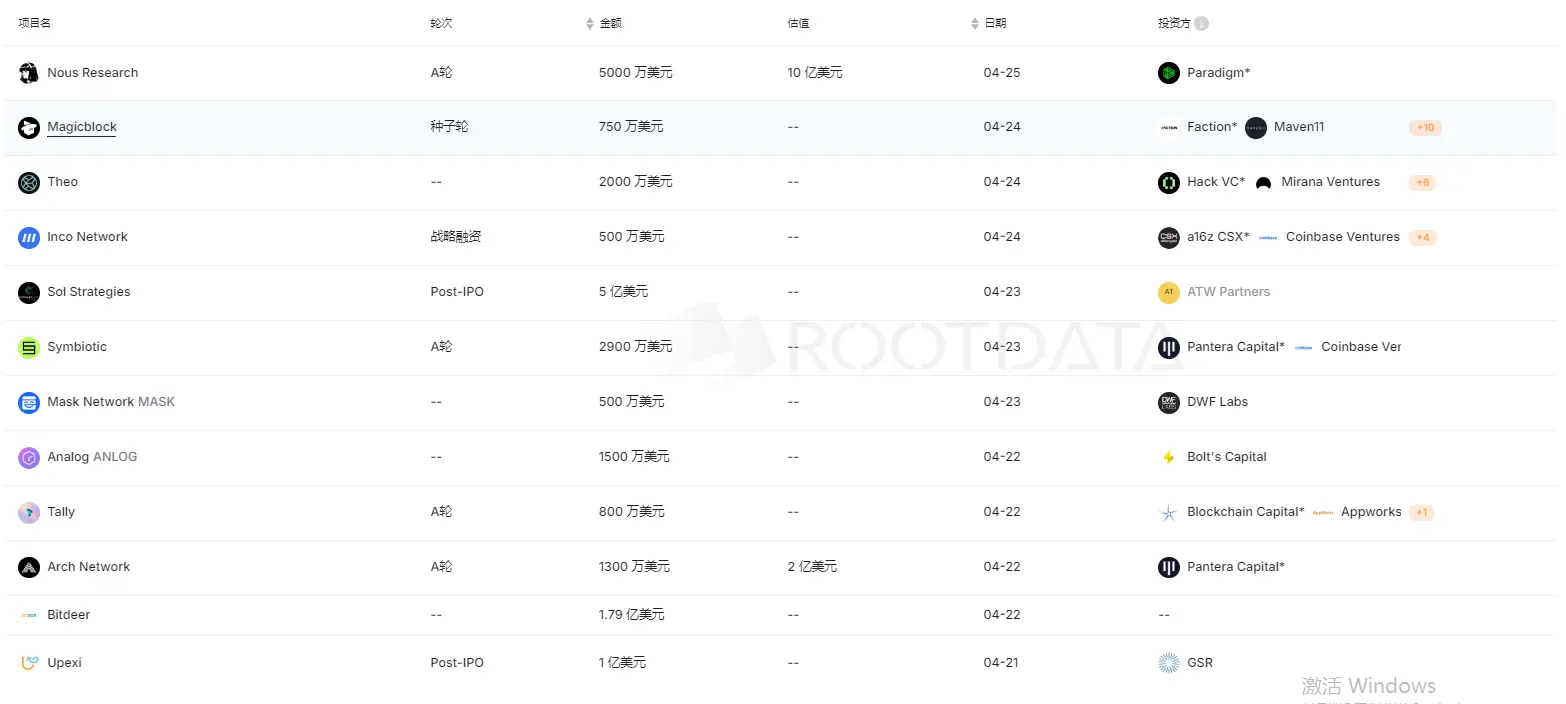

据 RootData 不完全统计,2025 年 4 月 21 日- 4 月 27 日期间,区块链和加密行业共发生 18 起公开投融资事件,累计融资约 9.35 亿美元。

从赛道分布来看,获得融资的项目主要分布在基础设施和 DeFi 赛道。热门项目包括链上游戏引擎 MagicBlock、全链流动性基础设施 StakeStone、金融科技公司 WineFi 、支付网关 Inflow。

此外,“Solana 版微策略”SOL Strategies 宣布已与 ATW Partners 达成 5 亿美元可转换票据融资协议,拟用于增持 SOL。

(上周融资大于 500 万美元的项目名单,数据来源:Rootdata)

一、基础设施

去中心化 AI 初创公司 Nous Research 完成 5000 万美元 A 轮融资,Paradigm 领投

据 Fortune 报道,去中心化 AI 初创公司 Nous Research 完成 5000 万美元 A 轮融资,Paradigm领投,该轮融资对 Nous Research 估值达 10 亿美元。

Nous Research 计划在 Solana 区块链上推出去中心化训练系统,通过区块链技术实现分布式 AI 模型训练。该公司此前已从 Distributed Global、North Island Ventures 和 Delphi Digital 等机构获得约 2000 万美元种子轮融资。

Nous Research 联合创始人 Karan Malhotra 表示,公司采用区块链技术主要用于协调和激励机制,使用户可以贡献闲置算力参与 AI 模型训练。该系统将首先允许拥有数据中心访问权限的用户参与,公司目前正在考虑是否发行原生代币作为奖励。

链上游戏引擎 MagicBlock 完成 750 万美元种子轮融资,Faction 领投

链上游戏引擎 MagicBlock 宣布完成 750 万美元种子轮融资,本次融资由 Lightspeed 旗下 Faction 领投,Maven11、Mechanism Capital、Robot Ventures、Delphi Ventures、Equilibrium、Pivot Global 等机构以及 Solana 联合创始人 Toly 等天使投资人参投。

去中心化交易平台 Theo 累计完成 2000 万美元融资,Hack VC 等领投

据 Fortune 报道,去中心化交易平台 Theo 已完成总计 2000 万美元的融资。该轮融资包括两个部分:2024 年 3 月完成由量化投资公司 Manifold Trading 领投的 450 万美元种子轮,以及最近完成由加密货币投资机构 Hack VC 和 Anthos Capital 领投的 1550 万美元融资。

Theo 由三位来自高频交易公司 Optiver 和 IMC Trading 的前员工创立。该平台允许普通投资者使用通常仅限于顶级高频交易公司的交易策略。

Web3 保密协议 Inco 完成 500 万美元战略融资,a16z crypto CSX 领投

Web3 保密协议 Inco 完成 500 万美元战略融资,a16z crypto CSX 领投,Coinbase Ventures、1kx、Orange DAO、South Park Commons 和 Script Capital 等参投。

据悉,Inco提供了一个与现有区块链无缝集成的保密层,开发人员可以选择使用该加密层来构建保密的 dapp。

Web3 基础设施初创公司 Catalysis 完成 125 万美元 Pre-Seed 融资,Hashed Emergent 领投

据 Chainwire 报道,Web3 基础设施初创公司 Catalysis 宣布完成 125 万美元 Pre-Seed 融资, Hashed Emergent 领投,Presto Labs、Spaceship DAO、Funfair Ventures、Cosmostation 和 Crypto Times 等参投。

据悉,这笔资金将用于开发首个专为再抵押协议设计的“安全抽象层”,以统一多个再质押协议的经济安全性,简化开发者和节点运营商部署共享安全服务的流程。该平台已与 EigenLayer、Symbiotic 和 Kernel DAO 等再质押协议集成,计划于 2025 年第二季度上线公开测试网。

再质押协议 Symbiotic 完成 2900 万美元 A 轮融资,Pantera Capital 领投

据 Cointelegraph 报道,加密货币再质押协议 Symbiotic 完成 2900 万美元 A 轮融资,由 Pantera Capital 领投,Coinbase Ventures、Aave、Polygon 及 StarkWare 等逾 100 家机构与天使投资人参与。

融资将用于推出区块链安全协调层“通用质押框架”。该框架允许任意组合的加密货币(包括 L1/L2 链资产)参与网络验证,目前已获 Hyperlane 等 14 个网络采用,预计还将接入 20 个生态项目。

区块链互操作性协议 Analog 通过代币销售完成 1500 万美元募资

据 CoinDesk 报道,区块链互操作性协议 Analog 已通过代币销售筹集了 1500 万美元,数字资产融资公司 Bolts Capital 完成代币购买,使 Analog 的总支持额达到 3600 万美元,Analog 计划利用这笔资金开发互操作性工具,如 Omnichain 模拟代币标准(OATS)和 RWA 市场 Firestarter。

比特币基础设施公司 Arch Labs 完成 1300 万美元 A 轮融资,Pantera Capital 领投

据 Chainwire 报道,比特币基础设施公司 Arch Labs 完成 1300 万美元 A 轮融资,估值达 2 亿美元。本轮融资由 Pantera Capital 领投。

融资资金将用于加速开发和推出 ArchVM 虚拟机,以便在比特币上实现智能合约功能。ArchVM 将为比特币带来可编程多重签名、跨程序调用以及应用程序间的可组合性等功能,使去中心化应用和协议能够在比特币生态系统中原生运行。该项目已在测试网完成超 5000 万笔交易处理,计划于今年夏季推出主网。

Arch Labs 此前曾获得由 Multicoin Capital 领投的 700 万美元融资,OKX Ventures、Portal Ventures 等机构参投。

二、DeFi

全链流动性基础设施 StakeStone 获 Animoca Ventures 投资

全链流动性基础设施 StakeStone 发文表示已获 Animoca Ventures 投资。该笔投资将加速 StakeStone 三大关键领域:引入 RWA 和 IP 支持资产、完善 Web3 消费经济的基础设施以及开发协同金库和 DeFi 策略。

三、CeFi

WineFi 完成 150 万英镑种子轮融资,由英国葡萄酒集团 Coterie Holdings 领投

据 Crowdfund Insider 报道,总部位于伦敦的金融科技公司 WineFi 宣布完成 150 万英镑(约 200 万美元)种子轮融资。本轮融资由英国高端葡萄酒集团 Coterie Holdings 领投,SFC Capital、Founders Capital 及天使投资人联合参投。

据报道称,WineFi 由前富达国际和摩根大通资产管理人 Oliver Thorpe 和 Callum Woodcock 创立。该平台将与数字资产提供商 Lympid 合作,在区块链平台上实现优质葡萄酒资产的分散化所有权,最低投资额为 3,000 英镑。此次融资将用于增强分析工具和扩展其葡萄酒投资组合服务。

四、社交

Mask Network 获得 DWF Labs 500 万美元投资

DWF Labs 官方发文称,已向 Mask Network 投资 500 万美元,以加速去中心化社交基础设施的发展。

五、其他

SOL Strategies 达成 5 亿美元可转换票据融资协议,拟用于增持 SOL

“Solana 版微策略”SOL Strategies 宣布已与 ATW Partners 达成 5 亿美元可转换票据融资协议,拟用于增持 SOL。

据悉,这是截至目前 Solana 生态系统中同类融资规模最大的一笔交易,SOL Strategies 拟推动发展机构质押平台。

支付网关 Inflow 完成 110 万美元种子轮融资,Rockstart 等参投

支付网关 Inflow 完成 110 万美元种子轮融资,Rockstart、GnosisVC、Alliance、Plug And Play、Stake Capital 参投。天使投资人包括 Ledger 联合创始人 Nicolas Bacca、Primonial REIM 联合创始人 Stephanie Lacroix、TEMPUS SHOP 创始人 Tempus。

DAO 操作平台 Tally 完成 800 万美元 A 轮融资,Appworks 和 Blockchain Capital 领投

据 CoinDesk 报道,DAO 操作平台 Tally 完成 800 万美元 A 轮融资,Appworks 和 Blockchain Capital 领投,BitGo 等公司参投,新资金用于扩展其去中心化自治组织(DAO)的治理技术。

Tally 协议主要为基础设施提供支持,帮助协议对其 DAO 进行有效的链上治理,包括 Arbitrum、Uniswap DAO、ZKsync、Wormhole、Eigenlayer、Obol 和 Hyperlane。

比特小鹿正在加大财务杠杆力度,全力推进其比特币 ASIC 矿机制造计划。

根据其最新年报披露,公司已通过贷款和股票增发累计筹得 1.79 亿美元资金。公司已与 Matrixport 签署高达 2 亿美元贷款协议,并于今年初增发超 600 万股 A 类股票,融资 1.188 亿美元。

加密交易平台 Swapped.com 收购 Web3 支付基础设施公司 Kado Software,以扩展美国业务

据 Blockworks 报道,Web3 支付基础设施公司 Kado Software 被 Swapped.com 收购。尽管团队未透露交易条款细节,但据悉此次收购旨在扩大丹麦公司 Swapped.com 的美国业务。

加密做市商 GSR 向上市公司 Upexi, Inc. 进行 1 亿美元股权私募投资,后者承诺制定 Solana 财务战略

据 Chainwire 报道,加密做市商GSR 宣布向纳斯达克上市公司 Upexi, Inc. 进行 1 亿美元的股权私募投资。

Upexi 是一家专注于消费品开发、制造和分销的品牌所有者。此次投资是在 Upexi 宣布战略转型至基于加密货币的财务战略之后进行的,旨在为股东创造长期增值和收益。Upexi 已承诺制定 Solana 财务战略,其中包括 Solana 的增持和质押。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。