撰文:深潮 TechFlow

2024 年,Sui 生态的 DeFi 赛道就已经展现出令人瞩目的增长态势。在 2025 年,这股势头不减反增。

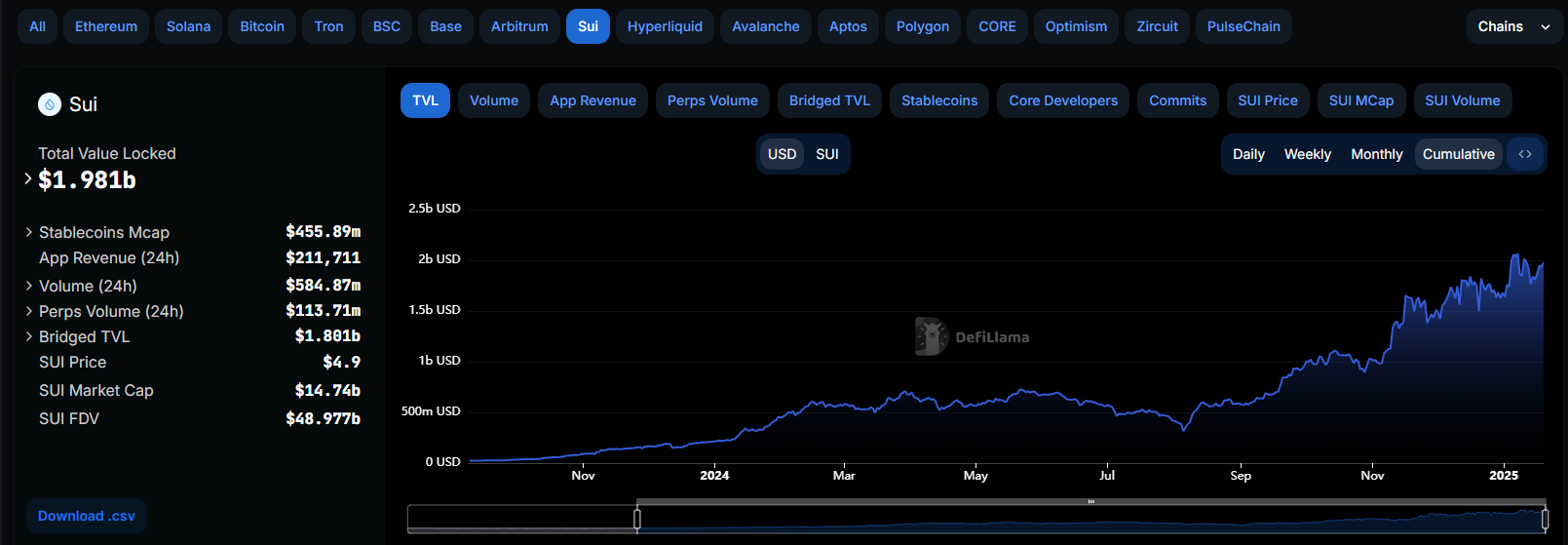

据 defillama 数据显示,2025 年第一季度,Sui 生态 TVL 最高突破 20 亿美元大关,较去年第四季度伊始实现了 341% 的跨越式增长。生态内 DEX 交易量持续走高,用户活跃度屡创新高。这一系列亮眼数据的背后,不仅印证了市场对 Sui 网络的信心,更预示着 2025 年 Sui 生态将迎来新一轮爆发。

生态腾飞的同时,生态应用的丰富和用户基数同步扩大,SUI 代币质押需求呈现出几何级增长。

只是对于质押这回事,Sui 生态用户仍有纠结:一是如何在流动性与质押收益之间找平衡,再就是与 ETH 和 SOL 相比,目前 Sui 的质押年化收益率较低。

这些 Sui DeFi 绕不开的问题,在 Haedal 团队眼中成了一个绝佳的突破口。

作为 Sui Liquid Staking Hackathon 的获奖项目,Haedal 以其创新的流动性质押方案重新定义了质押玩法。项目上线后快速获得市场认可,TVL 突破 1.88 亿美元。这一成绩的背后,是 Haedal 在产品设计和技术创新上的深度思考。

Haedal:从黑马到领跑者

在蓬勃发展的 Sui 生态中,Haedal 无疑是 DeFi 领域的佼佼者.

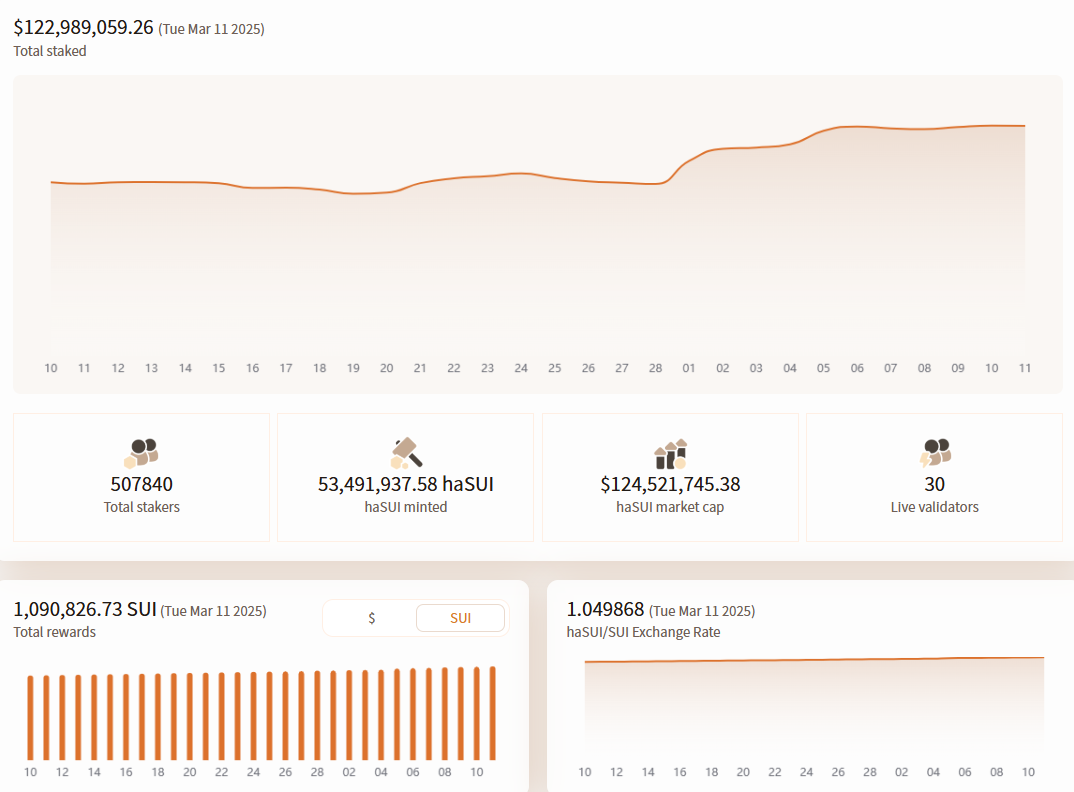

从数据看,即便在市场环境不佳的当下,Haedal 仍保持 1.2 亿美元的 TVL,稳居 Sui 网络 LSD 赛道榜首。在其发行的流动性质押代币 haSUI 上,已有超过 1.5 亿美元的活跃流动性在各大 DEX 和 DeFi 协议中流转。

通过与 Cetus、Turbos、Navi、Scallop、Mole 等各类 Sui 生态 DeFi 应用头部项目的战略合作,Haedal 构建起了一个高度协同的 DeFi 生态系统。haSUI 已成为这些平台上最活跃的 LST 资产之一,特别是在 Hae3 上线后,协议通过创新的收益分配机制,实现用户、合作伙伴与平台的多方共赢。

除了注重收益,Haedal 始终将安全性和生态可持续发展置于核心位置,采用多重签名机制和实时风险监控系统保障用户资产安全,同时引入 Certik、SlowMist 等顶级安全审计机构进行定期审查。截至 2025 年 3 月,Haedal 的智能合约系统已通过五轮专业审计,累计处理超过 10 亿美元的资产流转,实现零安全事故。

多维产品,提升 Sui 生态质押收益

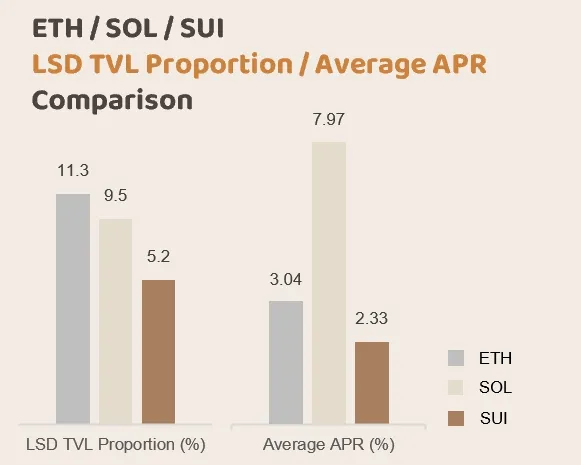

正如前文所说,Sui 生态质押收益较低的问题让不少用户对质押不感冒:

目前 Sui 生态中 LST 的平均 APR 约为 2.33%,而许多验证者的直接质押 APR 甚至达不到这一数值。

相比之下,Lido 的 APR 约为 3.1%,而 Jito 的 APR 则高达 7.85%。对于 Sui 原生代币的持有者来说,这样的收益不足以激励他们将代币从中心化交易所移到 Sui 的链上环境中。

那如何让 Sui 的质押更有吸引力?Haedal 决定从「降本」与「增收」两方面入手。

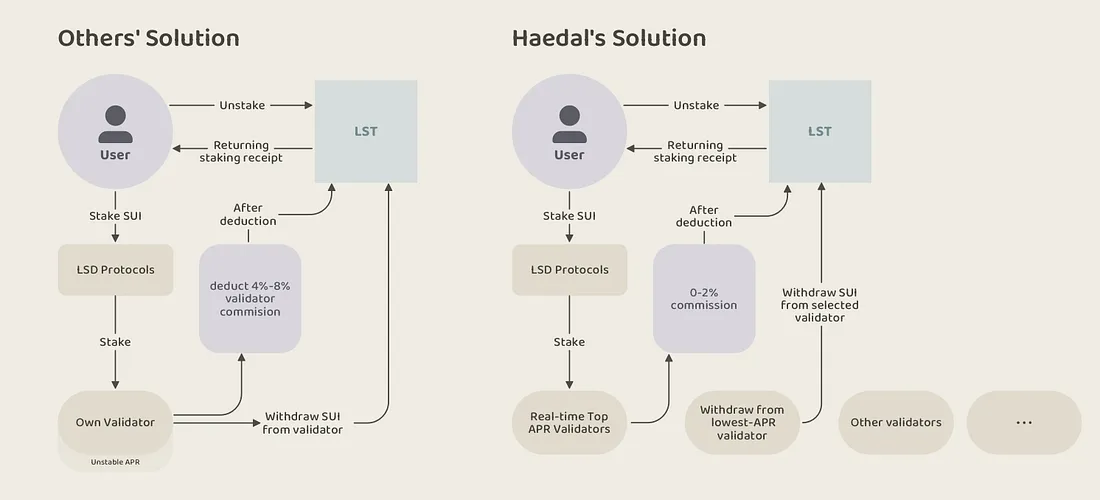

先说降本,由于 Sui 上的大多数 LST 是基于验证者的,意味着每个 LST 代币都与特定的验证者绑定。

虽然这本身并没有问题,但却无法保证该验证者的 APR 是最高的。此外,大多数验证者收取 4%-8% 的佣金,这进一步降低了 LST 的最终 APR。

针对此现象,Haedal 提供动态验证者选择功能,持续监控网络上所有验证者的状态,并在质押过程中选择净 APR 最高的验证者(这些验证者通常收取 0%-2% 的佣金)。同样,在用户解除质押时,Haedal 会选择 APR 最低的验证者进行提取。这种动态方法确保了 haSUI 始终在整个生态系统中保持最高的原生 APR。

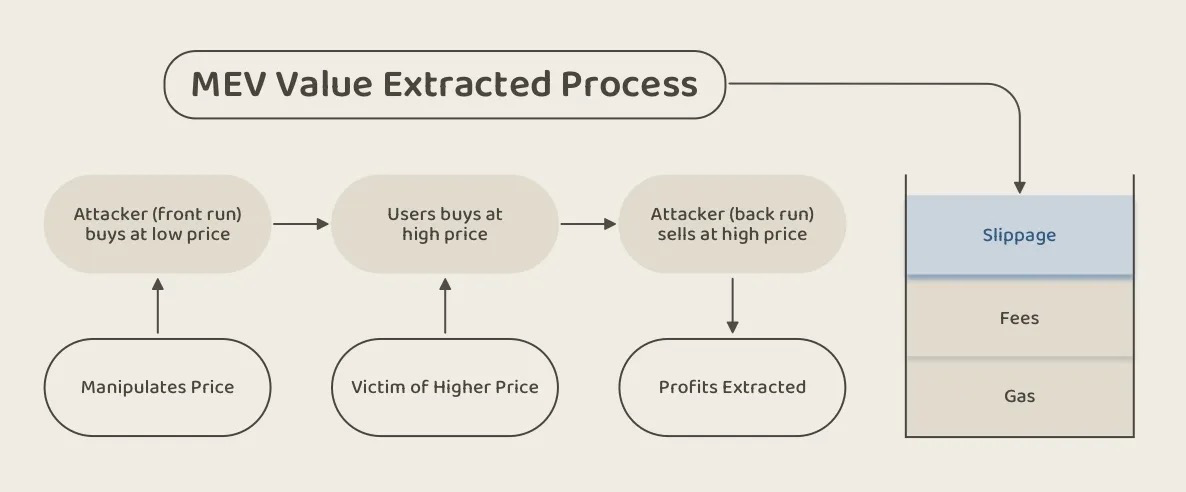

用这种降低成本的改进,能在一定程度下实现更高的 APR,但还是无法突破根本的系统制约限制——MEV 成本困扰。

Sui 生态将 MEV 视为 DeFi 不成熟的产物,如果将其视为固定交易成本,可能会导致链上交易成本比中心化交易所高出十倍甚至百倍,从而难以与中心化产品竞争。此外,MEV 带来的滑点成本会让用户体验更差。

图:三明治攻击严重影响交易体验和结果

由此,Haedal 推出多角度增加质押收入的产品:Hae3。

Hae3:从生态交易流中提取价值

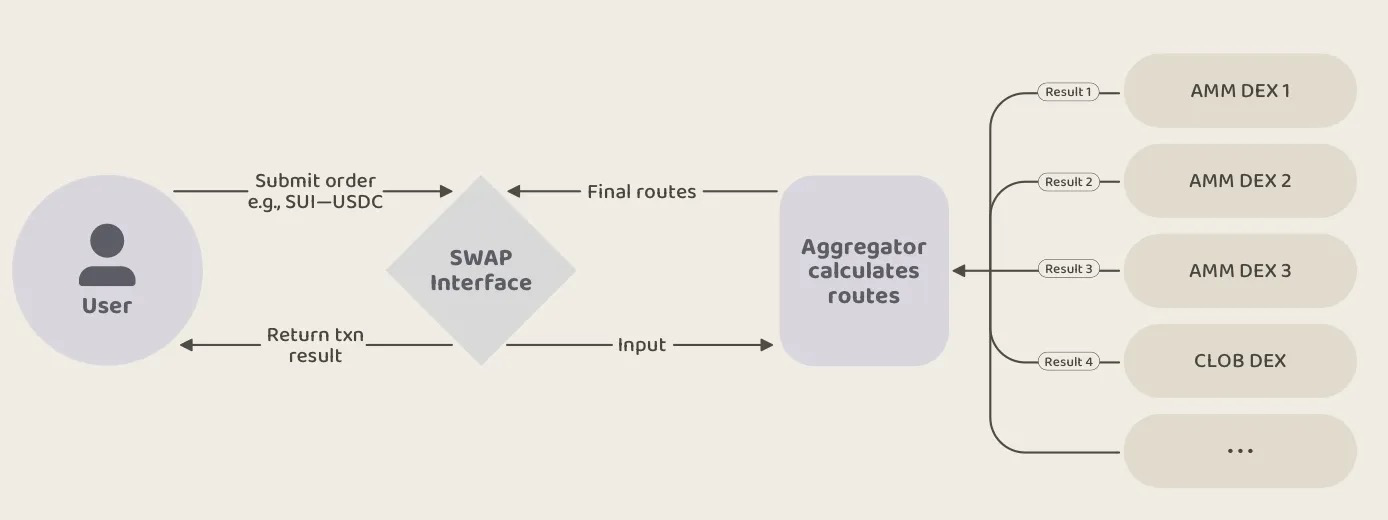

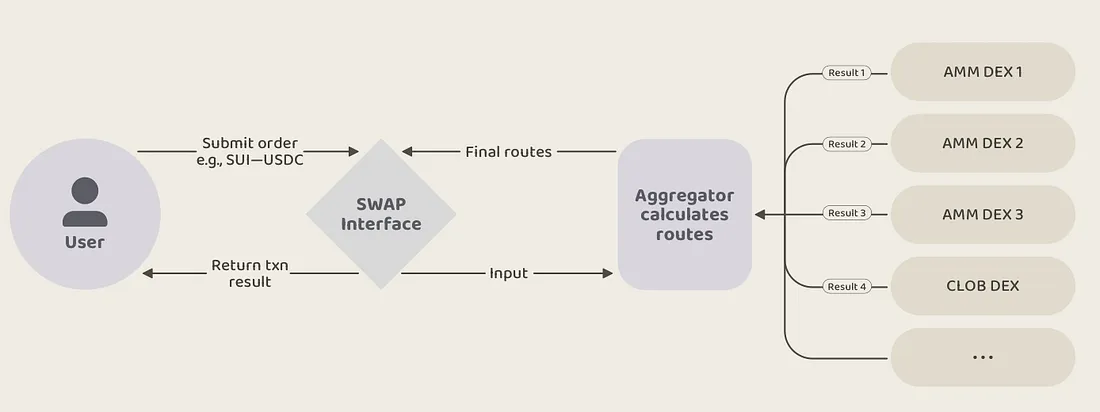

目前,Sui 上的大部分交易是通过聚合器发起的(大多数生态系统亦是如此)。用户发起交易后,各种 AMM DEX(如Cetus)和 CLOB DEX(如 Deepbook)会根据资金池或订单状态提供报价,路由系统计算最佳路径并完成交易。

如何在这套流程中为用户提供额外收益,同时搭建一个完整的系统?Hae3 提供两款强大的收益提升产品 HMM 与 haeVault 以及成熟的 DAO 社区 haeDAO。

-

HMM:高效做市,收益加码

交易始终是市场中最纯粹和经典的盈利模式。Haedal 显然深谙其道。通过 Haedal Market Maker(HMM)系统,Haedal 能够在保证基础质押收益的同时,为质押用户开辟全新的收益来源。

HMM具有以下三大核心功能:

-

基于预言机定价提供集中流动性:与其他根据资金池状态决定价格的 DEX 不同,HMM 的价格始终基于预言机定价。预言机以高频率(每0.25秒)提供价格更新,确保聚合器中的流动性始终与“公平市场价格”保持一致。

-

自动再平衡与做市:HMM 的流动性会根据资产的状态自动再平衡,通过捕捉市场波动,利用“低买高卖”的策略,有可能将无常损失转化为“无常收益”。

-

反MEV:HMM 天然能够防御 MEV 攻击,确保交易利润不会因抢跑或三明治攻击而被侵蚀。

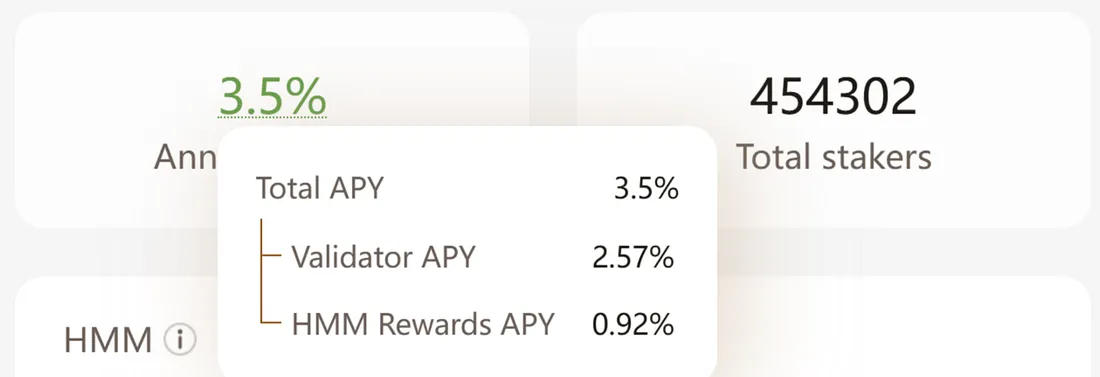

经过两个月的测试,HMM 已捕获约 10-15% 的 DEX 总交易量,haSUI APR 稳步增长,目前已稳定在 3.5%,远超 Sui 上的其他 LST。其中,HMM 为 haSUI 贡献了 0.92% 的额外 APR。

-

haeVault:让普通用户获取专业的做市收益

除了从各环节中提取价值,Haedal 还为普通用户提供一条额外收益路径:专业链上 LP。

流动性提供者(LP )对于熟悉链上操作的用户来说必然不陌生。为热门交易对添加流动性也是链上高玩们的基本操作。

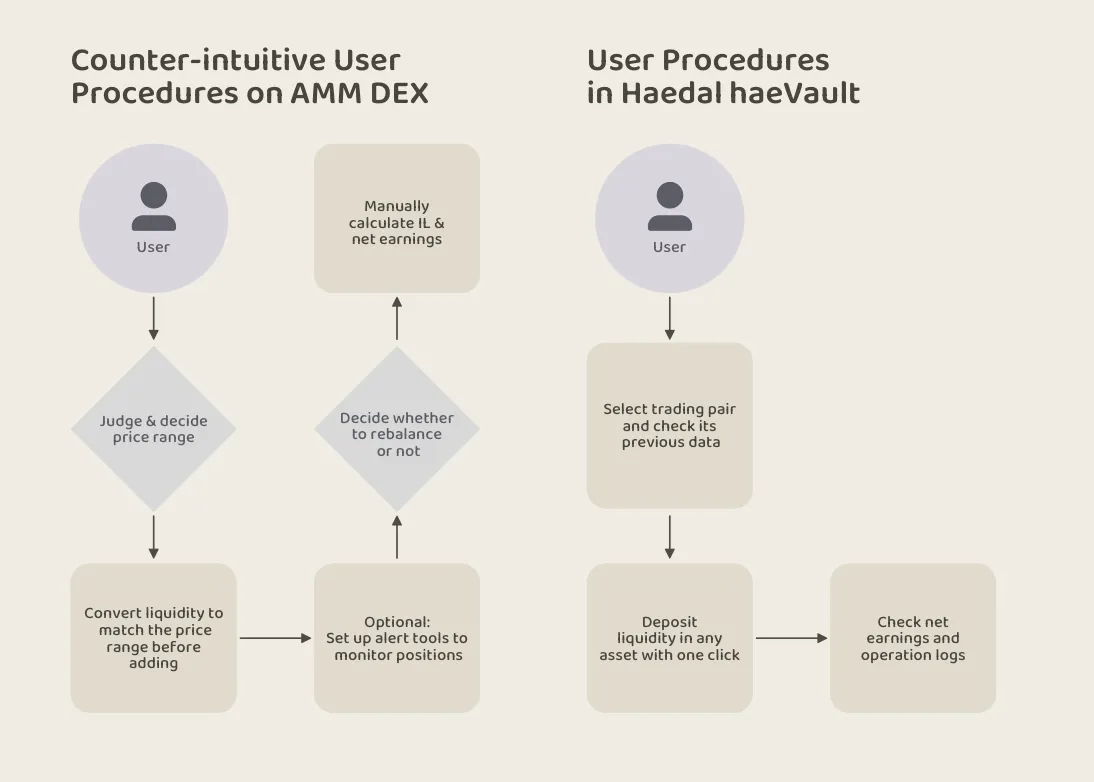

但对于更多的普通用户来说,成为 LP 的门槛过高。在目前 Sui 上最常用的 CLAMM 算法中,如果用户想为 SUI-USDC 资金池提供流动性,需要处理以下复杂事项:

-

决定价格区间:用户需要对价格范围进行主观判断。

-

调整流动性:根据设定的价格范围动态调整流动性。

-

监控头寸状态:持续关注自己的流动性是否“超出区间”。

-

决定是否再平衡:判断是否需要对头寸进行再平衡操作。

这整套流程走下来,既不自然同时效率低下。并且诸如无常损失等各种可能出现的意外情况也让许多人不愿意投入大量资金,亦或是只在相当保守的价格区间内提供流动性,这样自然捕获不到 LP 最大的收益。

参考来看,Sui 上 SUI-USDC 资金池的平均 APR 约为 150%,而全区间或超宽区间的流动性提供者可能只能获得 10%-20% 的APR。有些用户甚至对低或零无常损失风险有更执着的追求,因此他们倾向于选择借贷或质押,这些方式的 APR 通常只有个位数。

而专业的链上 LP 通过模拟 CEX 的市场做市策略,通常在超窄区间内提供流动性,并通过自建的监控机器人和程序执行再平衡和资金对冲操作用以赚取相对普通用户而言的超高回报。

对此,haeVault 提供一种方法,让普通用户也能轻松参与流动性提供,并享受类似专业做市商的收益策略。

haeVault 基于 AMM DEX 构建了一个自动化的流动性管理层。能够根据代币价格波动自动调整流动性,并基于关键指标对头寸进行再平衡。haeVault 针对 DEX LP 用户设计了类似 CEX 做市商的专业策略。区别在于 CEX 市场做市商通过“低买高卖”获利,而 haeVault 则不断从其在 DEX 上的活跃流动性产生的交易费收入中赚取收益。

haeVault 的核心功能:

-

操作简便:用户只需一键存入任意资产,即可参与。

-

透明化:用户可以清晰地查看自己的盈亏。

-

全自动管理:除了存取款操作外,用户无需进行其他操作。

-

高收益:借助专业策略,与其他 LP 相比,用户将获得更具竞争力的收益。

与 HMM 不同,haeVault 将直接向所有用户开放,其设计天然适合吸引大量资金。当 haeVault 积累足够的 TVL 后,便有潜力捕获主流资产在 DEX 上的大量手续费收入。

目前,Haedal 计划在未来几周内推出 haeVault 的 Alpha 版本,敬请期待。

-

haeDAO:社区与协议自控流动性

随着 HMM 和 haeVault 两款核心产品 TVL 的持续增长,可以预见的事,Hae3 系统将捕获 Sui 生态中大量的交易手续费收入。

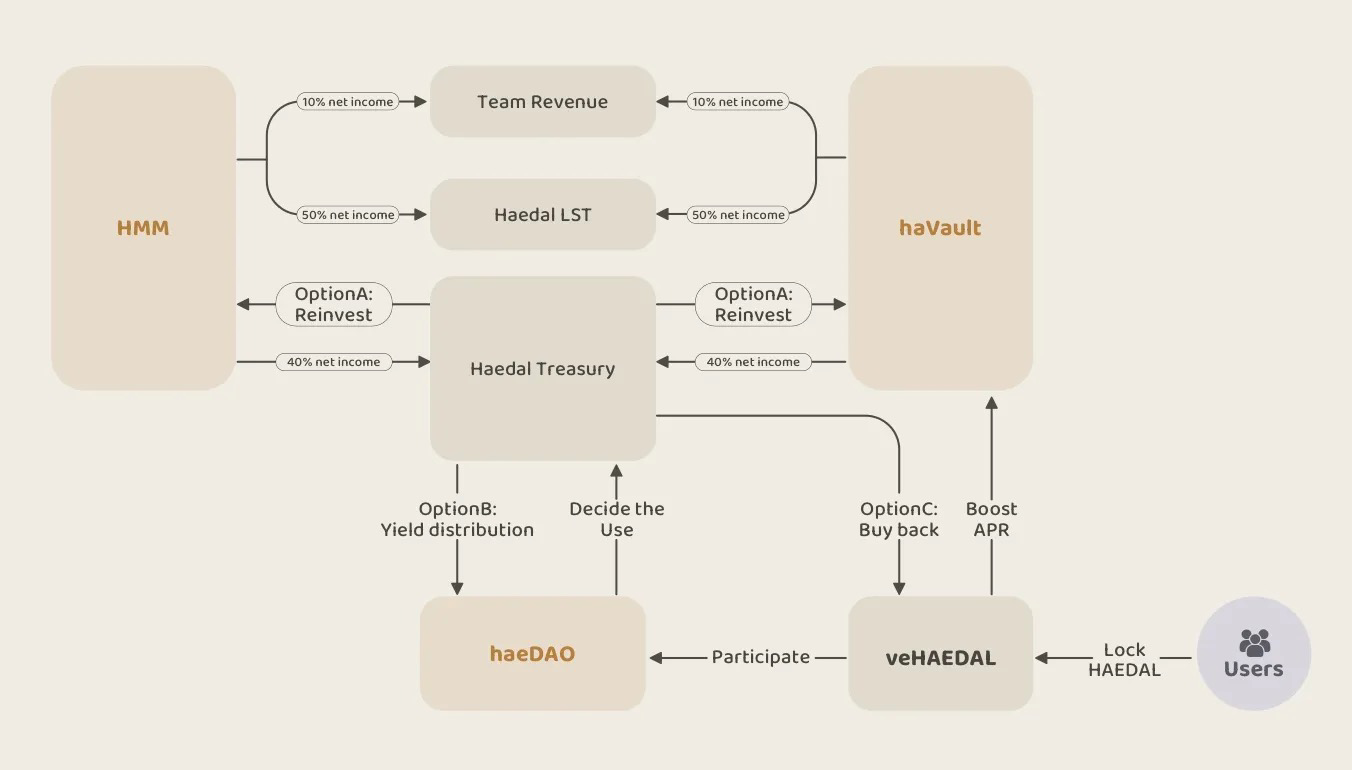

对于收益分配,Hae3也有规划:

-

50%:用于提升 Haedal LSTs 的 APR。

-

10%:分配给团队,以确保协议的长期可持续发展。

-

40%:分配至 Haedal 国库,作为协议自有流动性。

在初期,国库资金将被重新投资到 Haedal 的产品中以扩大流动性。随着产品的成熟,Haedal 将引入 HaeDAO 来管理国库,为 Haedal 代币和社区赋能。

Haedal 代币 $HAEDAL 将可以通过锁定为 veHAEDAL(名称暂定),以获取在haeDAO中的所有权益。这些权益包括:

-

对 Haedal 金库的管理:决定金库的资产比例、不同产品模块或不同协议间的流动性分配、奖励分配方式等。

-

提升 haeVault 收益:用户在 haeVault 中的权重可以被提升以享受更高的年化收益率。

-

提案和投票:协议的一些重大决策将通过 DAO 投票进行,例如关键产品方向、金库使用等。

HaeDAO 预计在 2025 第二季度推出,成为完善 Hae3 产品组合的最后一环。随着 Hae3 经济体系逐渐成长为一个可持续且不断扩大的国库,Haedal 生态也将实现长期的可持续发展与增长。

从"效率"到"生态"

从最初专注的流动性质押产品,到现在已经构建起包含 Hae3 在内的完整流动性质押产品矩阵,Haedal 始终在用技术创新回应市场需求。

随着核心产品矩阵完善,Haedal 的发展将进入一个新的阶段。在阶段中,如何平衡产品创新与用户体验,如何在保持技术领先的同时深化生态合作,将是团队面临的新课题。市场也将继续关注 Haedal 在这些新挑战面前的表现。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。