In a constantly evolving market, stagnation is death.

Authors: Joel John and Siddharth

Compiled by: Deep Tide TechFlow

Hello!

A few days ago, I noticed an issue with the way we write. Most of the time, our articles are technical topics aimed at founders and investors. That's fine. We skip the drama, politics, and fraud, willingly playing the nerd, spending weeks researching topics that can be read in a few minutes. But we are not in academia; we are in a free market, investing and building alongside founders. Therefore, it is crucial to stay updated on what is happening around us.

If I were to confide in a psychologist about my experiences in the crypto industry over the past six months, I would summarize it like this:

A 13-year-old launched a meme coin and then dumped it. Scotty Pippen of the Chicago Bulls somehow predicted Bitcoin's price after dreaming about Satoshi Nakamoto. Speaking of which, Jack Dorsey might be Satoshi. A Frenchman made 28 million dollars betting on Trump’s election. By the way, Trump launched a meme coin just days before taking office. Two weeks ago, the President of Argentina also tried something similar, resulting in a loss of 4 billion dollars in value. Now his opposition is trying to oust him. People lost money on Su Zhu's exchange. Oh, and the Hawk Tuah girl also launched a token, which turned out to be a rug. Dave Portnoy also launched a token, which similarly got “rugged.” Cz talked about his dog Broccoli, and it seems that token hasn't been “rugged” yet—at least not for now.

Meme coins now have the power to oust a president, truly a far-reaching social effect.

It's not to say that there aren't good things happening in our industry. In October, the UAE clarified that there would be no taxes on cryptocurrencies. In the U.S., banks can now custody Bitcoin. Someone made $25,000 by tricking agents into transfers. Oh, and Marc Andreessen transferred $50,000 to an agent, prompting a token's market cap to rise to $1 billion. Rumors are circulating that the U.S. government is developing a strategic cryptocurrency reserve. OpenSea may eventually issue a token to rescue NFT traders who suffered heavy losses in 2022. FalconX acquired Arbelos. Coinbase clarified that the SEC has dropped all lawsuits against it. Last week, Bybit survived the largest hack in human history.

The key is, we are a resilient bunch. But much of our collective psyche is entangled in bad news—news driven by prices, mixed with fraud and a lot of embarrassment. You can't help but wonder, “Am I really in league with these clowns? Am I in a circus? Am I the monkey in this game?” It's all so exhausting, especially considering that the human brain can only process 10 bytes of information per second when thinking.

In the live stream of fraud frenzy in 4K ultra HD, how do I cope with it all?

If you don't consciously set boundaries, working in the crypto industry is like throwing your brain cells into a whirlpool of headlines, spinning at the speed of light until the sun's heat evaporates all your cherished memories.

A process marked by a stream of news that is both liquidated and endless, yet often meaningless. It's like circling in Dante's hell, jumping from one sin to another.

That's why, as a current affairs media outlet, we tend to keep our distance from daily dramatic events.

But given the state of the market and the feedback we hear when communicating with founders, I feel it's time to do a “vibe check” on the current cultural atmosphere. You could say it's to cope with the fleeting “ vibecession ” we are experiencing.

The Era of “Memesis” (Meme Imitation)

David Perell's article on Peter Thiel's investment philosophy is one of the significant enlightenments in my career.

One of the themes is “mimesis.” The concept of “mimesis,” defined by René Girard, revolves around the human tendency to imitate and compete with others.

Think about the career choices you made at 17: you would look at what the smartest peers were doing or an adult with the lifestyle you aspired to, and then choose their career path. As humans, we are inherently inclined to imitate and compete with our peers because forging new paths requires an extremely high cognitive load. We like the security of “the crowd.”

This also applies to startups.

Lock enough smart people in a room, and you will see them imitate and compete with each other. Label an accelerator or investment fund (like Sequoia Capital or YCombinator) as a “top-tier” entity, and we will see a group of smart people scrambling to join—not just for the financial resources unlocked, but for the status it brings.

YC knows this well, which is why it claims its acceptance rate is lower than Harvard's. Status is not a clearly priced commodity, but it is absolutely implicit in people's hearts. That’s why those young, energetic, and ambitious twenty-somethings pack their bags and head to San Francisco, paying exorbitant rents in hopes of climbing the status ladder.

“Mimesis” drives us to strive to be the best in our fields to satisfy our craving for status.

Image from Luke Burgis's blog

At 15, I often wondered why so many Indian VCs formed their worldview based solely on tweets from A16z partners.

After working in venture capital for a decade, I realized they were just imitating the practices of “big money.” If you can “copy” the best, why innovate? Is it an advantage? Not necessarily. But it can make money. That’s why a slew of “me-too” products appear in the market. Many people imitate and iterate on a concept.

Just like Facebook was not the first social media platform. Instagram was not the first media-sharing platform, and Spotify was certainly not the first service to allow users to stream.

Repetitive iteration benefits consumers. Initially, the market becomes crowded, but over time, the market will decide who can survive. Therefore, you need multiple founders and multiple VCs to tackle a problem, often using similar solutions.

Keith Gill is the Soros of meme stocks. Murad is the Soros of meme coins. I am striving to become the Soros of newsletters.

This situation is common in liquid markets. George Soros became famous for shorting the pound and breaking the Bank of England. Keith Gill—known as “Roaring Kitty”—is famous for igniting the GameStop frenzy. Both excel at pulling most market participants into trades they have already entered. Soros persuaded traders to short the pound, putting pressure on the Bank of England. GameStop investors pushed the stock price up until Robinhood intervened to restrict shorting.

What Roaring Kitty did is merely a modern version of Soros's “reflexivity theory”—both are designers of self-reinforcing cycles. A big trade attracts attention, people follow, prices rise, more people flood in, and assets suddenly hit new highs.

In Soros's era, there was no Twitter for endless debates. In fact, he once left the market to study philosophy and write books. But today, you can pull people into trades just by posting a ranking of meme coins. The reflexivity Soros spoke of is what we now refer to as the meme coin frenzy.

People often argue that financial nihilism is the reason ordinary people invest in meme coins. They believe this generation finds itself at 30 without a stable job, partner, or house, so they bet on random codes on Twitter, hoping to crack the financial system that has bankrupted them (and continues to bankrupt them). But I think this argument is untenable.

The real reason is “mimesis,” or imitation.

That's right, the same thing that determines your career choices, which startup YC invests in, and how Keith Gill makes money is also the reason you lose big on a bunch of tokens with names like TrumpShibuInuWallDoesnotExistcoin.

Image source: Murad's tweet

Let me explain what happens when the internet breaks down the barriers to entering financial markets and information barriers.

Things usually develop like this:

You see a 17-year-old on TikTok or Instagram telling you about the “path to wealth” while sharing the meme coin he traded the day before. The social media marketing manager at the office showcases a $150,000 NFT on LinkedIn. You watch your bills pile up and feel like you've found another way out. A friend shares a ticker in a WhatsApp group. An exchange lists a new coin with an icon of a dog wearing a hat. You think, this is the opportunity. You invest $100, and it rises to $117. You wonder, what if I invested $1,000? Or $10,000? Before you know it, your credit card is maxed out, and you’re deep in it.

Note: It should be specifically mentioned that Murad is referenced out of respect for his significant influence on the meme coin market, not as a mockery. He defined today’s meme coin category just as Keith Gill once defined meme stocks.

Pump It

The emergence of Bitcoin in 2009 completely disrupted the way capital operates online.

You could provide “labor” through “proof of work” (PoW, the thing that secures the network) and receive Bitcoin as a reward. Since the value of assets is expected to rise further in the future due to demand and deflationary pressure, the future value of current labor is higher.

This motivated people to provide computing power for the network and hold Bitcoin. But with the advent of ICOs, asset issuance became decoupled from labor proof, allowing you to mint tokens without labor.

From March 2017 to 2018, ICOs raised about $28 billion.

Venture capitalists claimed this was the future of “finance,” enabling individuals to coordinate capital and resources to launch new networks. This sounded reasonable until you discovered that VCs often invested at low valuations (like $10 million) and then raised funds at much higher valuations (like $100 million) within months.

This kind of madness had already occurred in the traditional venture capital world during the internet bubble 18 years ago, and cryptocurrency replicated this madness.

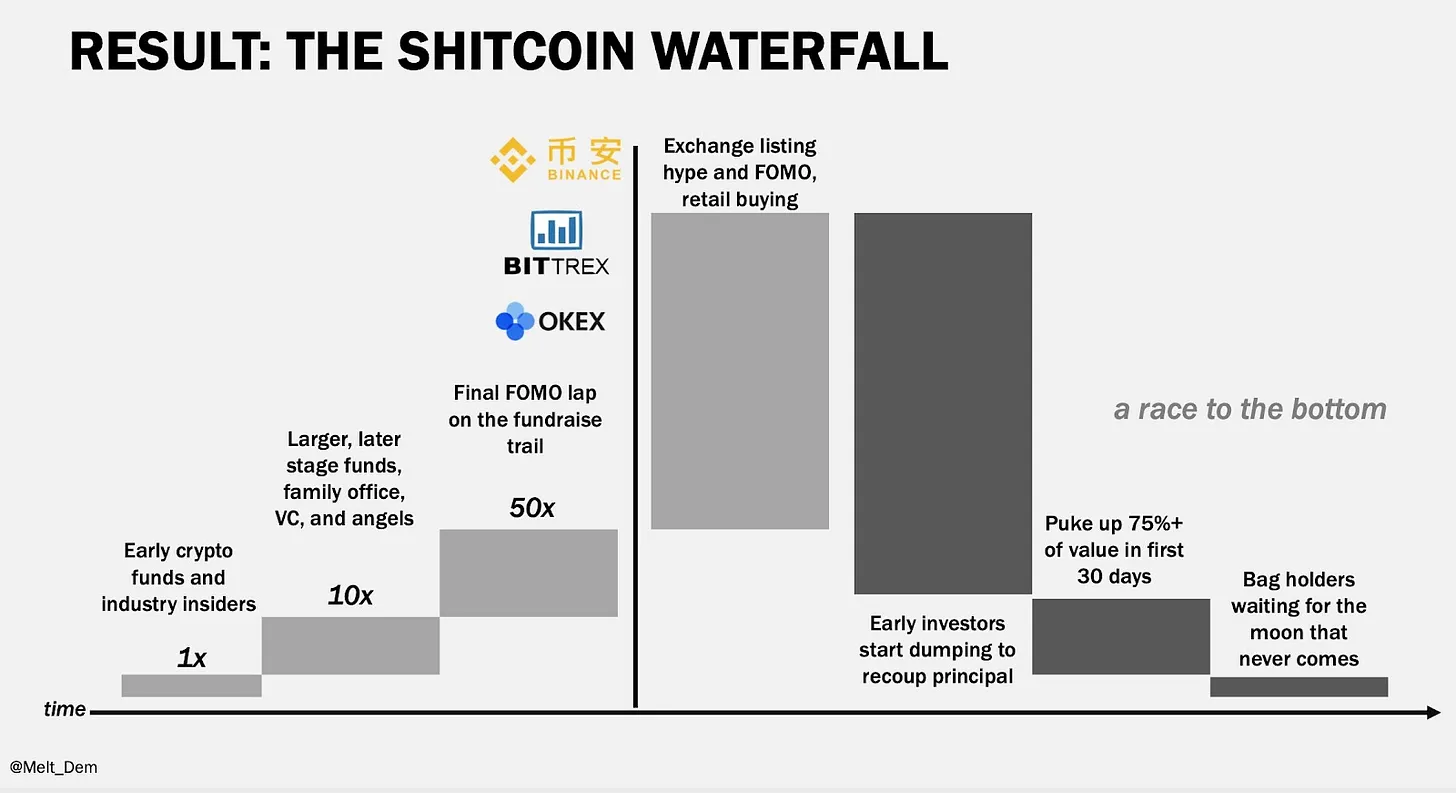

From 2018 to 2023, the token issuance market gradually matured. We no longer have the ICO craze, but VCs are still keen to invest at low valuations, trying to go public at high valuations. This is arbitrage.

Image: Meltem Demirors's video explains how capital allocation in cryptocurrency begins free-falling the moment tokens go public.

There is nothing wrong with raising capital at low valuations, but reselling it to retail investors at a high premium without substantial progress to support it is predatory behavior. Chamath used a similar strategy during the COVID market in 2020 with SPACs (Special Purpose Acquisition Companies). Currently, the SPACs he launched have averaged a 42% decline.

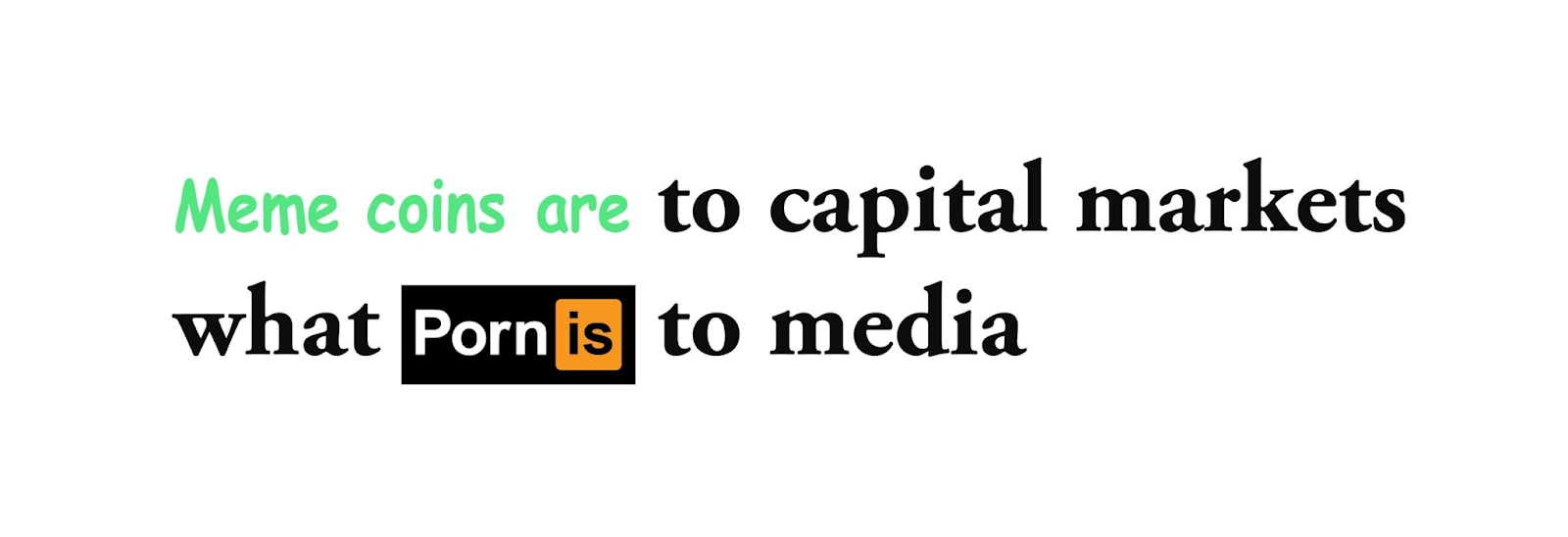

Now, anyone can become their own Chamath or venture capital fund with a single click through PumpFun. PumpFun is either the most innovative financial product of the last century or the most predatory platform. The truth may lie somewhere in between. Meme coins in the market are like pornographic content in the media. Just as pornographic content will not disappear, as long as greed and speculation exist, meme assets will persist. Moreover, many memes will drive meaningful innovation, just as pornographic content has driven technological advancement.

While discussing its morality is beyond the scope of this newsletter, I still want to share two interesting numbers.

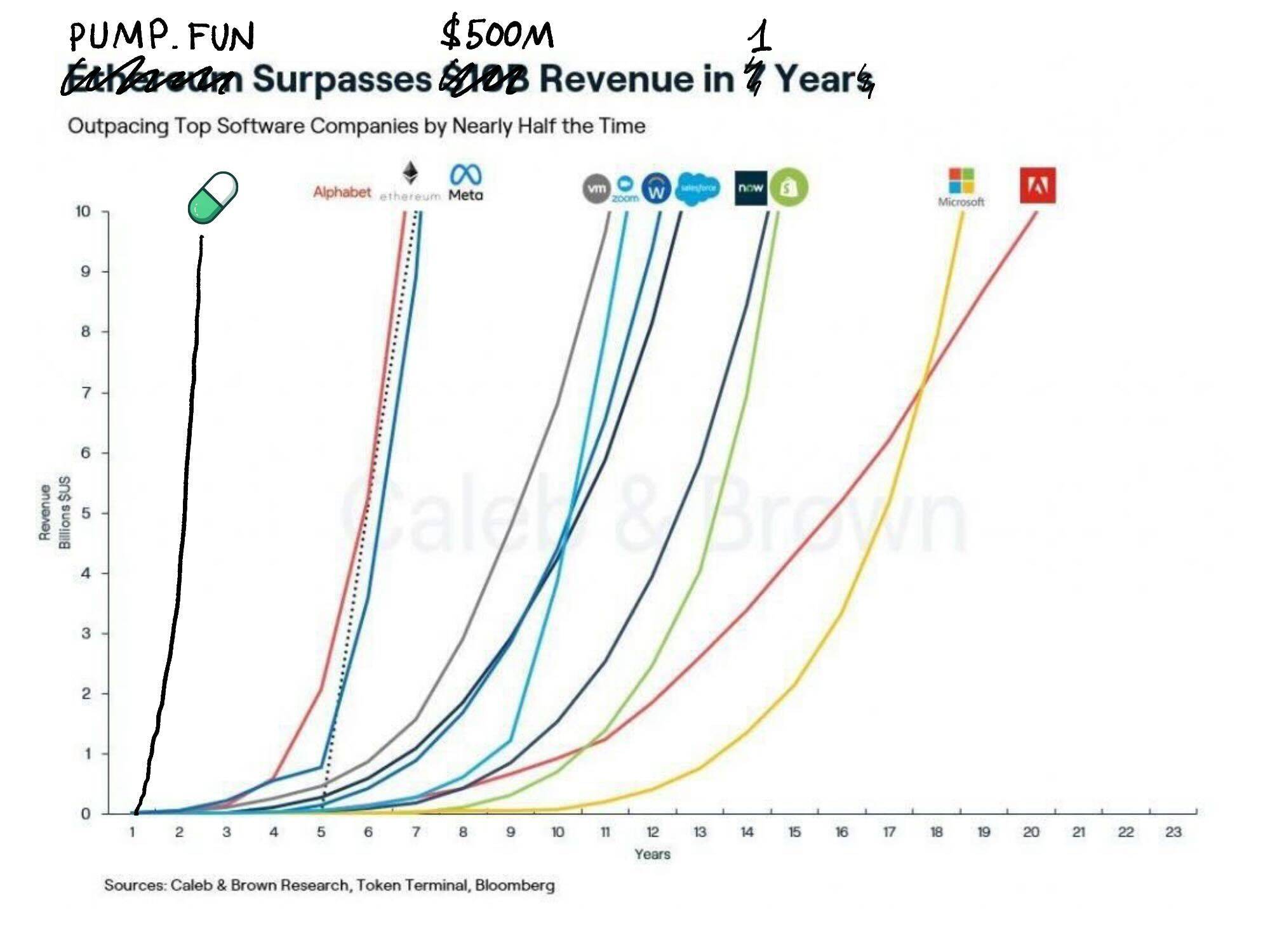

PumpFun's cumulative revenue chart. Their total revenue last year was $500 million.

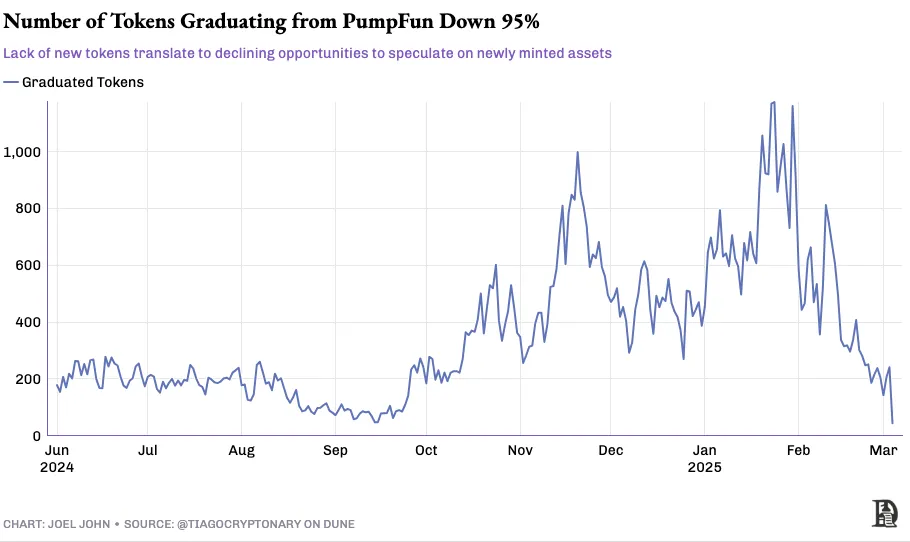

Another chart shows the number of new assets issued on Pump over the past few months.

The second chart is strikingly similar to previous hype cycles.

I can overlay it with charts of ICO or NFT issuance numbers, and they look identical. I am grappling with (or adjusting to) two parallel realities: one is that PumpFun may be one of the most profitable startups in history; the other is that it starkly showcases the most primitive operation of cryptocurrency. Dave Portnoy curiously questioned in a tweet what a “rug” is.

When we say blockchain can coordinate capital, we do not specify for whom the capital is coordinated. It can be used for cancer research or urban planning, but the marginalized on the internet often care little about these. Everyone cares about profits and avoiding losses. We are adults with bills to pay and dreams to pursue. Thus, everyone in the market is betting on the most speculative investments, while capital and attention flow away from what truly matters. This is the state of the market.

The real impact of PumpFun is that it has transformed cryptocurrency from a niche area into a mass tool. When influencers, presidents, and nations issue tokens and watch their prices plummet, we are not creating wealth through cryptocurrency like in 2009; we are destroying it. But just as personal expression on the internet cannot be defined by creators, market outcomes cannot be determined by tools. The creators of TCP/IP cannot dictate what I write in this newsletter today.

This frenzy is the price of releasing the “genie from the bottle.”

Image: This chart was inspired by a joke from a conversation with CK from ThirdPrime. I assure you, I have 0.0042 ETH in my cold wallet. I am “Ethereum派”.

Without being prepared to be offended, there is no real freedom of speech. Without providing tools for the free market, it is impossible to avoid the fact that most tools fuel greed and speculation. Especially in an era when regulators are “asleep,” the consequences of launching “rug pull” assets are minimal. Free speech is effective because there are consequences for saying the wrong thing. How does a free market operate without consequences? This is the big question cryptocurrency is trying to find answers to. But like most things, the market will ultimately find its own solutions.

The meme market has many similarities to blogs and personal expression on the internet.

In the early days, blogging was a niche activity. You could start one, but not everyone would read it. I love seeing old WordPress blogs online because they remind me of a time when people wrote to express rather than to influence. A few years ago, meme assets were similar. Doge was special precisely because its creator did not launch it to make it a “meme.” With the development of meme asset tools, anyone can launch a meme coin, just as anyone can start a Facebook page.

In social networks, attention ultimately concentrates on a few creators.

In meme assets, capital will also eventually concentrate on a few key names. The challenge is that people will lose money in the maturation process.

Image: Wassielawyer's tweet captures the thoughts of many of us.

So, where do we go from here?

Are we “screwed,” as Zoomers say? Will there be light at the end of the dawn? Do I need to look for other industries to develop my career? What should we do!?

If I don’t admit that I’ve thought about these questions multiple times over the past two quarters, I would be lying. This is not because I have lost faith in the potential and future of cryptocurrency, but because of the way attention is distributed. The only antidote I have found is to root my reality in human interactions rather than the noisy discourse on Twitter.

Every time I see my feed filled with the latest scams, I talk to a founder in our portfolio for a mental massage to restore confidence. **This may be the greatest privilege of working at Decentralised.co—we gain perspectives from founders that transcend the information flow.

So if you ask me to zoom out and see what is exciting and what will define the next decade, I would lay it out like this: consider it a blueprint.

Respect the Pump

You just listened to my ten-minute rant about fraud and lack of substance in cryptocurrency. If you’re still here, buckle up for a dose of optimism and the logic behind it.

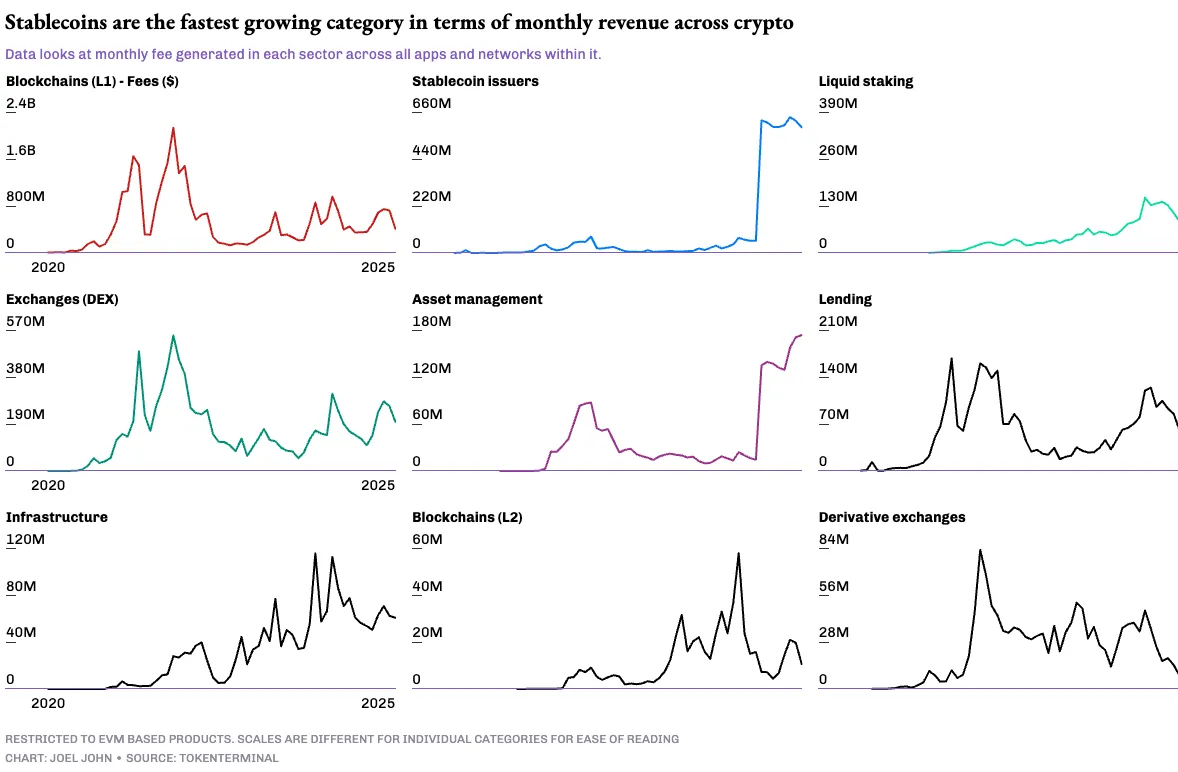

First, let’s take a look at the applications that can actually make money, as this will give us a direction to judge whether they are worth our time. TokenTerminal does not track all the applications we want to see; it slightly favors EVM (Ethereum Virtual Machine), but it has the best data on price, revenue, and profitability. So, I started my investigation by observing the top ten revenue-generating categories.

The revenue data you see below is the monthly revenue for each year over the past decade. The data is detailed because we want to play the skeptic. We want to see growth because—hey, what’s the point of staying in a stagnant industry? We want “hockey stick” growth.

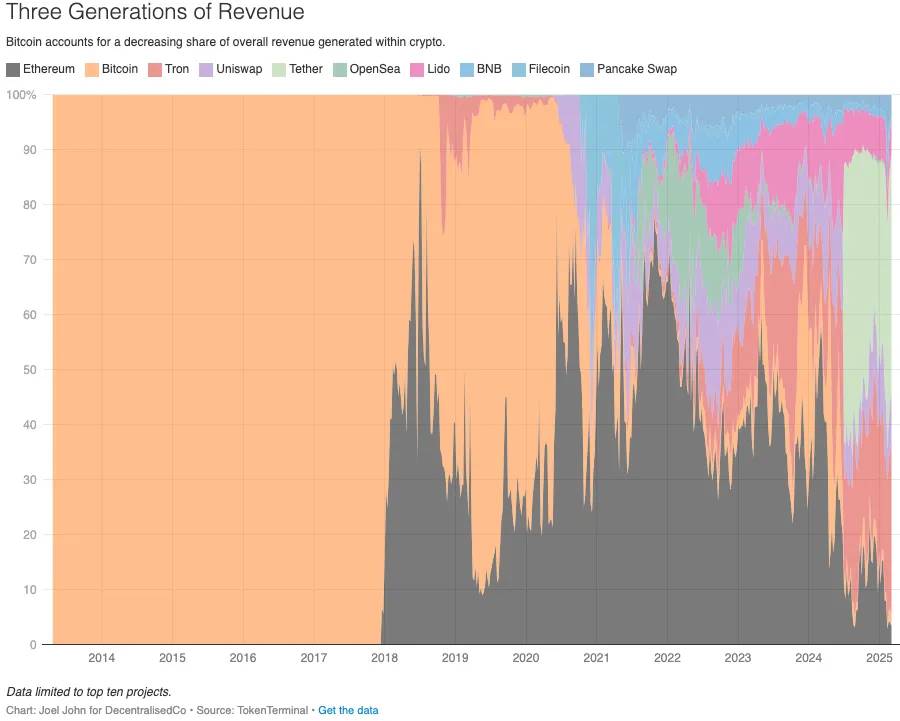

When considering revenue, you will find that the growth of the industry has three stages.

- The first stage, which I call the “Dark Ages.”

Before the rise of Ethereum smart contracts. Before 2018, blockchain transaction fees were the primary economic output of the industry. Of course, you could consider miner income and related businesses (like Coindesk), but this does not apply to the marginalized. Developers did not directly benefit from it.

- Then from 2018 to 2022, applications and use cases exploded.

Revenue was no longer limited to transaction fees but expanded to on-chain businesses. You can see that “blockchain Layer-1” fees gradually decreased, making way for businesses like exchanges and lending. I consider this the “Enlightenment Era” of cryptocurrency—a magical time when people questioned the limitations of blockchain, defying the dogma of Satoshi as the “savior,” and created alternative business models.

It was during this “Enlightenment Era” that models like Play-to-Earn (Axie Infinity) and yield farming took off. Of course, some chapters ended in failure, much like political alliances in medieval Europe. But it paved the way for people to question possibilities and explore new paths.

- After 2022, a new category emerged at an astonishing speed.

Guess what I call it? It’s the “Industrial Era” of cryptocurrency. Just as humanity discovered the convenience of machine manufacturing and transportation, cryptocurrency practitioners also discovered the potential for income that could scale without human intervention.

The “alchemy” of this era is stablecoins.

Everyone wants yield and quick capital flow. Fintech companies still rely on banks, and banks rely on governments to determine the rules of capital flow. Stablecoins abstract away the rules that fintech companies have historically faced, giving rise to a new generation of businesses. Tether and Circle made over $5 billion in just one year.

According to The Economist, last year the value transfer of stablecoins reached $2.76 trillion, accounting for about 2/5 of all transaction value on the blockchain, compared to only 1/5 in 2020. The same article noted that by March 2024, stablecoin transactions accounted for 4% of Turkey's GDP. This article does not specifically discuss stablecoins, so I won’t elaborate further.

Now that we have established that this industry can make money and has reached a scale of billions of dollars, it is worth exploring how “sticky” these revenues are. Cryptocurrency revenue may be seasonal, but at scale, it can change lives. Think about OpenSea, PumpFun, or the Play-to-Earn craze. Of course, some might argue that NFTs and meme assets have created a massive “bubble,” ruining many lives.

Exploring whether the market is a zero-sum game is beyond the scope of this article (and I don’t want to drag you into a deeper survival crisis). But one way to think about it is that the revenues during these cycles are high enough for companies to earn what they would not have made in a lifetime.

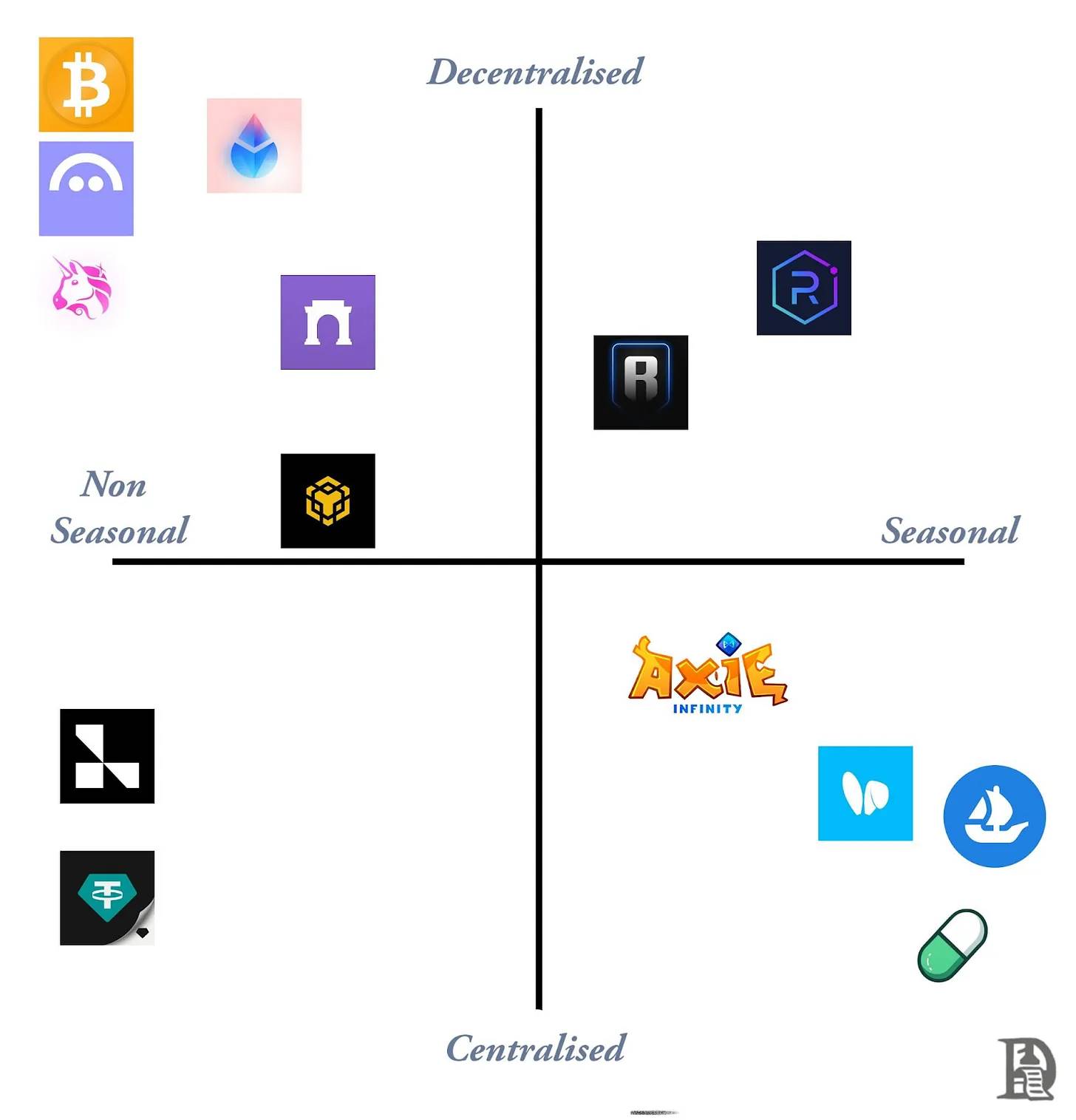

A mental model applicable to blockchain-native applications is that product maturity will vary.

Depending on the market cycle, the speculative premium of a product will increase. Take stablecoins, for example; they have developed to the point where large enterprises can use them for remittances. This is why Stripe made a $1 billion acquisition in this space last year.

On-chain analytical tools sold to governments (like Chainalysis) and smart contract auditing firms (like Quantstamp) have also reached mature revenue scales. These businesses have substantial cash flow and sufficient profit margins, attracting the attention of traditional capital.

Image: For reference only, not as an absolute basis; many of the positions here are subjective.

If you overlay these questions, you get a matrix. One end is centralized and decentralized, and the other end is seasonal. Highly seasonal applications like FriendTech may be centralized but struggle to bring value to the ecosystem because they rarely pass value to marginal users. Uniswap, while mostly decentralized, finds it difficult to return value to shareholders. This is why they started adding fee switches to the front end last year. Since then, Uniswap Labs has generated nearly $103 million in fees.

The commercial demands of entities—revenue, profit margins, and capital allocation control—often conflict with our desire to decentralize and pass value to users.

A few companies have found a balance—innovating and decentralizing while passing value to users and having enough room for growth.

My personal favorite is Layer3.

If you’re hearing about Layer3 for the first time, think of it as an advertising network that aggregates one of the largest user bases in the cryptocurrency space. They help new users discover native crypto products and reward early adopters with dollars or cryptocurrencies. So, if you are a new application or a communication platform like us, you wouldn’t run ads on Google to attract aimless eyes; instead, you go to Layer3 to get a carefully selected group of crypto-native users. Unlike Google, Layer3 returns most of the value generated in the form of incentives to users.

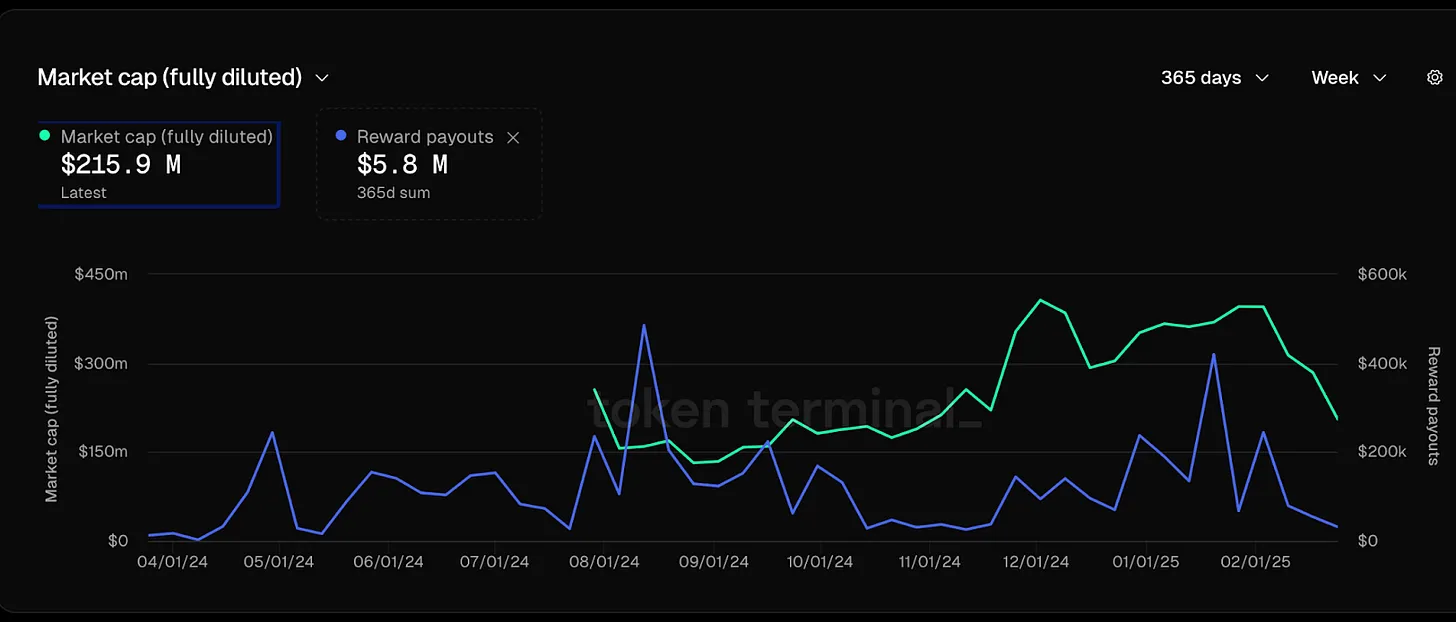

In the past, I wrote about how they aggregate users. On average, about 60,000 users trade on their products daily. Just last quarter, they returned about $1.4 million to users. The total for the year reached $5.8 million.

In the advertising world, $5.8 million may seem trivial. Kanye West spent more than that on a Super Bowl ad. But the point is, this $5.8 million is interesting because it is an early instance of a product returning value to users. It is an open advertising network where consumers (i.e., early adopters) receive real dollar compensation through a global funding pipeline.

Anu from Working Theorys has a brilliant framework on zero-sum versus positive-sum products. She points out that some products reduce the usage of others. For example, you either use Google Docs or Notion. Companies rarely switch between the two because each product suite has a lock-in effect, and you need to manually migrate the entire team. But some products are positive-sum—you can use Perplexity, Claude, and ChatGPT on the same day for different use cases. These products do not erode each other's market share until user preferences become as clear as Google versus Bing.

Predatory products are often zero-sum because they make (ordinary) users worse off. If there are potential economic reasons, the market is not a zero-sum game. People who bought Tesla stock in 2018 profited from the subsequent rise without needing others to lose money. You could argue that stock performance is related to Tesla's output. But in the meme market, the game increasingly resembles a negative-sum.

The reason is simple:

Users need others to invest capital for asset prices to rise. This is fair in itself—all capital markets operate this way. But users also need this “atmosphere” to last a long time. From the beginning, you expect the frenzy to continue. This works because the “greater fool theory” allows people to buy into assets. But as prices rise, people reassess their “net worth” based on weak liquidity pools. For example, there’s a token related to the Congo with an FDV (Fully Diluted Valuation) of $1 billion, but there’s less than $5 million in the trading pool. People “reassess” their net worth based on this illusory capital, and when the game inevitably ends, they are often worse off.

Products like Layer3 are positive-sum because they do not directly extract value from users. If you use their tools and stick around long enough, just as an early adopter, you can earn thousands of dollars. As cryptocurrency crosses the user chasm, we will see more products optimized for positive-sum because this is the way to build user critical mass. The more users Layer3 has, the more capable the team becomes at negotiating better deals for users.

Marketers also prefer positive-sum games because they know that users brought in by Layer3 are more skilled and experienced—they have already used multiple related products.

One way to think about the current revenue state of cryptocurrency is through what I call the “marginal adjacent user” perspective. In emerging fields, founders are often better suited to solve niche problems. In the 1970s, Jobs and Wozniak built products for enthusiasts who were familiar with computer technology but needed portable and affordable home computers—niche, technical, expensive, and targeted. In contrast, in the 1990s, Jobs was obsessed with pushing technology to the masses—less technical, more general, price-sensitive, and extremely user-friendly.

If you were building in the crypto space before 2021, creating products for on-chain active users was feasible because the revenue per customer was high enough. In a curious market, selling novelties was effective. But as users lost money and interest in the following years, expanding the market became important. A few chains and applications (mainly on Solana) have done well, capturing the next wave of on-chain users. The risk is that these products may repeat the mistakes of DeFi in 2019—just a bit faster, a bit cheaper, and a slightly better experience, but essentially doing the same thing.

According to Mary Meeker's latest report, there are approximately 3 billion people on the internet today. At the most optimistic estimate, the monthly active users of cryptocurrency range between 30 million and 60 million. This is already quite generous. But think about it, there are multiple products competing for these users. Essentially, this is "industry infighting"—the market growth is insufficient to accommodate multiple participants.

So, teams are competing either on (i) pricing, (ii) incentives, or (iii) features until they perish due to insufficient margins—a true "race to the bottom."

What is the alternative? It is to build something that can go mainstream, as mainstream markets have both "moats" and profit margins. The "popularity contest" in the crypto space about whose TPS (transactions per second) is highest and who is more "aligned" is useful for information flow but does not pay the bills. Layer3 attracts me because they are not chasing existing users but are expanding the market and capturing a portion of the value from it.

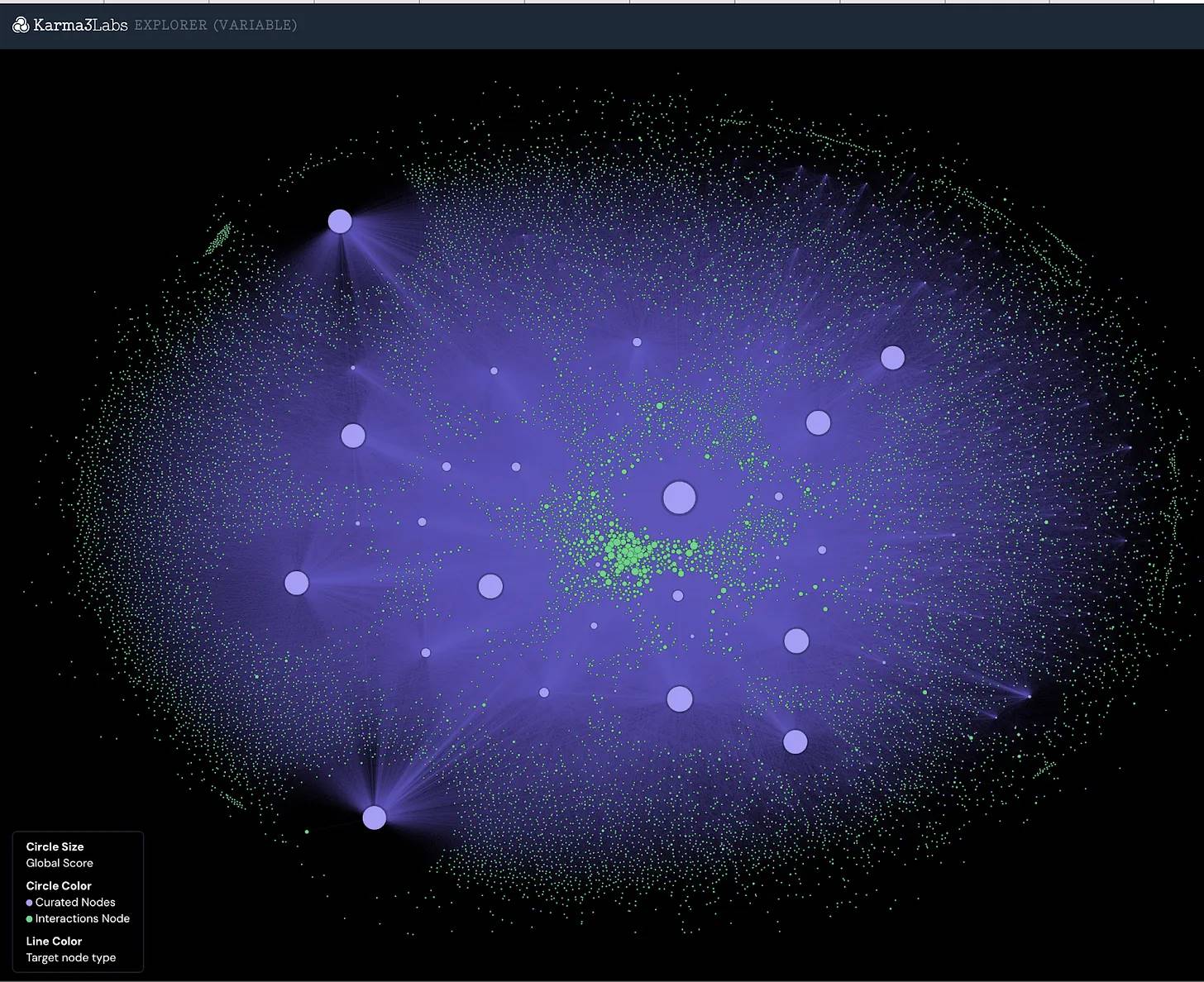

The theme of “expanding the market” is not limited to Layer3. OpenRank is a product built on Farcaster. Since user activity on Farcaster is often relayed on open networks (blockchains), it is easy to assess which users are valuable and which communities are natural. OpenRank helps identify the right users and directly incentivizes them with tokens, NFTs, or early access. This means any developer can target any user on social networks.

Image: Karmalabs mapping Farcaster users in their filter

Layer3 and OpenRank represent two different approaches to advertising in the blockchain era.

One curates protocols, users, and incentives, while the other allows the market to identify users on open networks and target them directly. While it remains to be seen how Farcaster will evolve and which advertising model will endure, it is certain that blockchain is changing the way value is transferred for content on the web. Of course, this market is still niche at the moment, but they have the potential for exponential growth.

One example I have witnessed is stablecoins. In 2019, the total market cap of stablecoins was about $1 billion, and it was hard to imagine that five years later, their market cap would reach $204 billion. But today, that is the total market cap of stablecoins.

So, the key question is, can the market for cryptocurrency-related users be equally large? Can they grow to hundreds of millions of users in the next five years? What is needed to build such a world?

In the sector that interacts directly with hardware networks, we have already seen some early clues.

For example, Frodobots and Proto incentivize users to map geospatial data using points or tokens (like USDC). Frodobots delivers physical robots to users, who ride them around towns, and the product uploads data to create the world's largest urban navigation dataset. Proto incentivizes users to help map dense urban networks with their smartphones. What attracts me to these models is that they can capture data from third parties in a trustless manner (through device sensors) while incentivizing users with a global capital network.

UpRock is leveraging crowds to provide data for website monitoring, which is a variant.

UpRock's SaaS platform Prism offers an alternative uptime monitoring system with accuracy comparable to DePIN (Decentralized Physical Infrastructure Network). Their network consists of nearly 2.7 million devices globally, forming the backbone of UpRock—this is the core consumer product powering Prism. When developers need insights, they can leverage UpRock's user base—many users collect data by running mobile and desktop applications to earn rewards. Can this be achieved on fiat rails? Absolutely.

But try making millions of small payments daily across 190+ countries and see what happens. UpRock uses blockchain to accelerate payments and maintains a verifiable, public record of past payments. They connect everything with a core token (UPT). As of this writing, the team destroys UPT when generating external revenue through Prism.

This is not to say we are on the verge of a radical wave of innovation that will make tokens "defy the odds" like Iron Man.

No, we are not there yet. The best example is agentic tokens, which showcase the gap between innovation and token performance. Let me start with a set of charts.

After the hype cycle, we can confidently ask ourselves: is there something valuable lurking in this field?

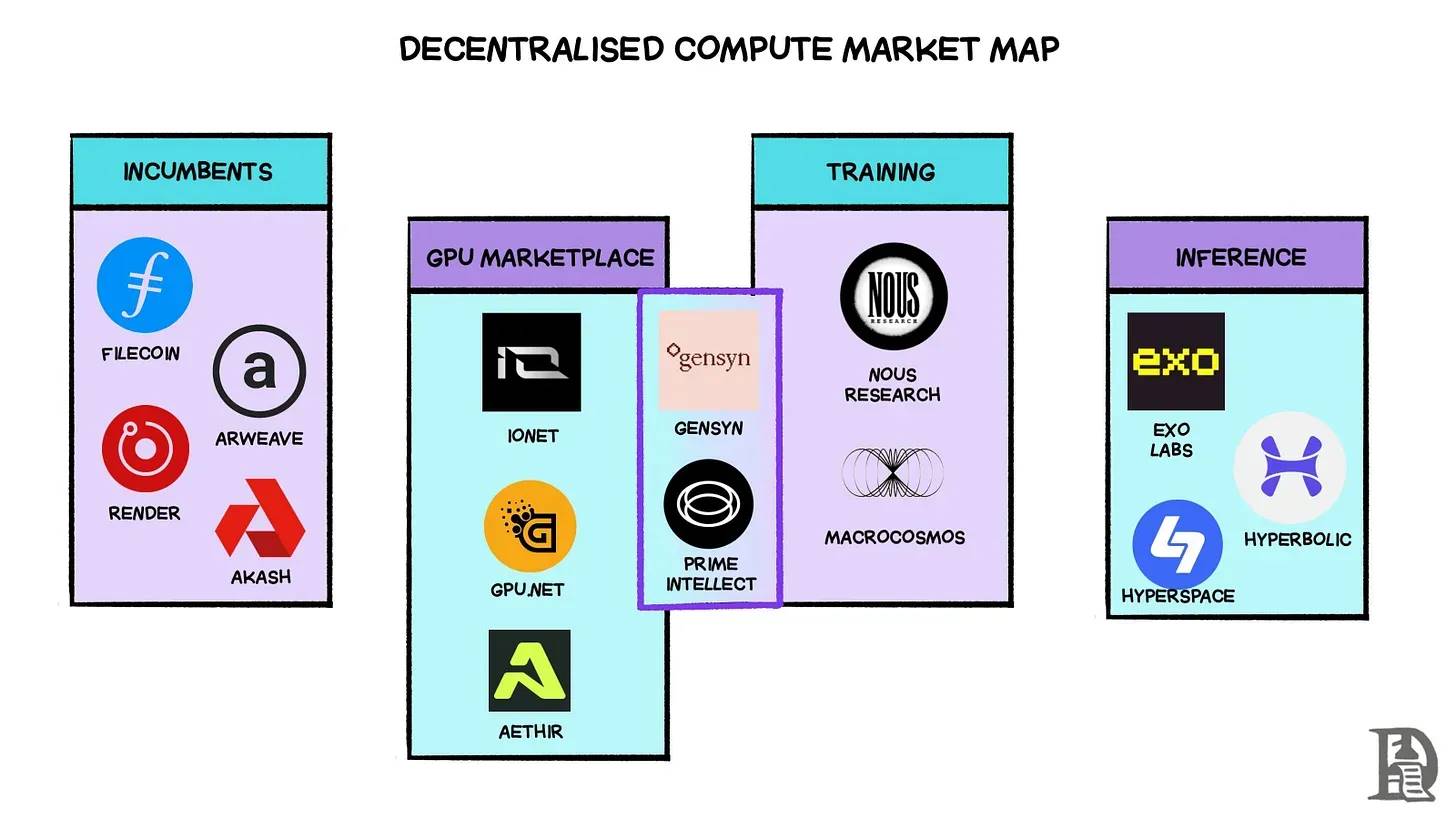

The most striking intersection of cryptocurrency and AI is not in the agents themselves but in decentralized training and computing networks—training and serving AI models on globally distributed computers and GPU networks through token incentives.

You can see early iterations of this model through Pond's model factory. They are incentivizing the creation of a model with machine learning capabilities that simulates how judges rank open-source contributions.

So, you can collect data (like UpRock) or find people to build models (like Pond). But in a world where energy and computing power are scarce, where do you run these models? Shlok explained this in a previous article, and I will share his words:

Who are these new AI-native markets? io.net is one of the early leaders in the enterprise-level GPU supply aggregation space, with over 300,000 verified GPUs on its network. They claim to save 90% of costs compared to centralized existing enterprises and generate over $25,000 in daily revenue (annual revenue of $9 million). Similarly, Aethir aggregates over 40,000 GPUs [including over 4,000 H100s] to serve AI and cloud computing use cases. Previously, we discussed how Prime Intellect creates large-scale decentralized training frameworks. In addition to these efforts, they also provide a GPU marketplace where users can rent H100s on demand. Gensyn is another project making a big bet on decentralized training, adopting a similar training framework and GPU marketplace approach.

In other words, cryptocurrency has evolved to the point where we can access the physical infrastructure needed to gather data, build models, fine-tune models, and assemble the resources to run AI models. Meanwhile, ordinary people in the crypto space are still asking, "When will it go up?"—completely unaware that they are sitting on a pile of "uranium" that can take us further. Some developers have realized this. Teams like Gud.Tech and Nomy are working to create trading agents that can accept user input, understand context, and execute trades.

What does this mean?

Chatbots have existed since at least 2015. It is not new to get information from bots. What attracts me to Gud and Nomy is how they abstract the complexity of purchasing assets across chains. Nomy provides a simple chat box where you input "buy 50 po on base with my eth," and the agent automatically completes the transaction without requiring multiple signatures from the user. Similarly, Gud is developing a trading product that almost always provides the best price for users by optimizing liquidity sources. These products blur the lines between how we consume information (Twitter, messaging, etc.) and executing trades, all built on advancements in AI.

Why do I specifically mention these two teams? Because they embody the essence of everything we have discussed so far.

They target cryptocurrency-related users rather than competing for the existing small user base.

They are not zero-sum, as their growth relies on continuous user engagement.

They package critical infrastructure (like gasless transactions) into a single product that users can utilize.

They build at the intersection of cryptocurrency and AI in a way that is relevant to ordinary internet users.

I emphasize Gud and Nomy because they are built by teams that transitioned to the application layer after deeply engaging in the infrastructure space. This reveals a simple fact: the era of applications has arrived. If cash flow, revenue, moats, and user retention truly matter, then applications will take on this mission. The infrastructure has matured to the point where debating TPS (transactions per second) is no longer meaningful. Our reluctance to abandon these heuristics is just another sign of stagnation.

To evolve, we need to change the way we converse. Perhaps, we even need to develop a shared language of optimism.

Cathedrals, Not Trenches

In the mid-1940s, as the threat of World War II diminished, the aviation industry faced a new challenge—building aircraft that mimic birds, specifically pigeons (by the way, this comes from “Where Is My Flying Car?”, a great book). The challenge was to build an aircraft that could land in a backyard without a long runway. Despite significant improvements in efficiency regarding passenger capacity and fuel efficiency, we still do not have retail-owned flying aircraft today.

Does this mean the aviation industry failed? Not at all. In 1961, John F. Kennedy said:

We choose to go to the moon. We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one we intend to win.

Fueled by this optimism, decades later, America's investments and efforts during the Cold War laid the groundwork for today's Silicon Valley. Interestingly, in 1903, the media publicly argued that we would not have flying machines for another million years. A million years!? It sounded like they were counting on evolution to help us. But we did not wait blindly.

We made it happen. In 1969, we landed on the moon.

However, between 1903 and 1969, there were many failed attempts at flight. The feeling in cryptocurrency is quite similar—we are too focused on perfecting the "engine" rather than making it truly serve to "transport passengers." Kennedy's political will injected new energy and direction into aviation—mobilizing people, resources, and policies toward a mission. This is not a one-time event but a pattern.

In David Perell's article about Peter Thiel, he emphasized how medieval Europe came together to build cathedrals during times of destruction and danger. These buildings were symbols of hope, taking hundreds of years to construct and consuming vast resources. They required coordination of finances, security, talent, and labor—far beyond everyday efforts.

The ordinary workers building the cathedrals could only hope to see their completion in their lifetime. Today, similar behavior is spending 4-5 years expanding a consumer application while most of the industry is obsessed with technical details.

Today, through Meme coins, we can see that when the speed of asset issuance and trading is as fast as texting, humanity is struggling to solve the problem of how to utilize currency. We have experienced similar situations before. In the 1400s, we adapted to the impact of interest rates on capital. In the 1700s, we discovered the power and chaos of trading company stocks. The South Sea Bubble was so severe that the Bubble Act of 1720 prohibited the creation of joint-stock companies without royal charter.

Bubbles are a feature, even a necessity. Economists view them negatively, but bubbles are a way for capital markets to identify and evolve into new structures. Most bubbles begin with a surge of energy, attention, and obsession for emerging fields. This excitement pushes capital toward anything investable, driving up prices. Recently, I have seen this obsession in agent projects. Without the combination of financial incentives (token prices) and hype, we would not have so many developers exploring this space.

We call them "bubbles" because they burst. But price declines are not the only outcome. Bubbles drive radical innovation. Amazon did not become "useless" in 2004; rather, it laid the foundation for today's AWS, which powers the modern web. Could investors in 1998 foresee that Jeff Bezos would succeed? Probably not. This is the second aspect of bubbles—they create enough experimental variants that ultimately produce a winner.

But how do we conduct enough experiments to witness a winner?

This is why we need to focus on building "cathedrals" rather than dancing in "trenches." My argument is that Meme assets themselves are not bad. They are excellent testing grounds for financial innovation. But they are not the long-term, revenue-generating, PMF (Product-Market Fit) seeking game we should be playing. They are test tubes, not laboratories. To build our "cathedral," we need a new language.

We have already seen the early forms of this new language in projects like Kaito and Hype. I do not hold their tokens, but they have become category leaders in their own right. Their token prices have also found a stable foundation, unlike many venture-backed "star projects" that yield nothing after 36 months of discussions. As people realize that the core metagame of cryptocurrency has evolved, more will gather around this new language.

Image: To end stagnation, one must confront the "monster" within

In 2023, as I write “Has Crypto Failed?”, I believe we are moving toward a market where founders and venture capitalists recognize the importance of revenue and PMF. That was my post-traumatic stress after the FTX incident, hoping the industry would trend toward rational participants. By 2025, I fully realize that this is no longer a reality, and hope is no longer a strategy.

Next, high-energy individuals will create a parallel game, building their own "cathedrals." They will not chase fame on crypto Twitter but will listen and build for the marginalized on the internet. They will make money through actual product revenue rather than relying on the "blessings" of exchanges. The driving force behind this comes from the crisis of faith I mentioned at the beginning of the article.

People will start asking, "Why am I here?" and then shift the game they are playing.

The distinction between revenue-generating tools and non-revenue-generating tools will be a significant watershed in cryptocurrency. Ultimately, we will no longer talk about "working in crypto," just as today no one says, "I work on the internet" or "I work on mobile applications." They will talk about what the product does. This is the language we should use more frequently.

When I started writing this article, I tried to figure out what truly troubled me. Was it fraud? Was it Meme assets? Not entirely. I think the real pain comes from recognizing the gap between efforts in the crypto space and their impact—especially compared to AI. Of course, we have stablecoins, but there are many other innovations that people are almost unaware of or do not discuss. This makes me feel stagnant.

In an ever-evolving market, stagnation is death.

If you stagnate, you die. But if you end stagnation, you survive. This is the irony behind "ending stagnation"—to protect life, you must be willing to end core parts of yourself. This is the cost of evolution and the cost of remaining relevant. Cryptocurrency is at that crossroads. It must choose to end certain parts of itself to allow those that can evolve and dominate to have the opportunity to grow beyond the primitive stage.

Revering the Cathedral,

This article was largely inspired by the end of bubbles and stagnation. If you haven't read it yet, I highly encourage you to do so.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。