作者:Fairy,ChainCatcher

编辑:TB,ChainCatcher

加密行业正上演一场奇特的"实体化"运动:发卡。

用 USDT 点外卖、京东购物,甚至在街头便利店刷卡买单,原本只存在于屏幕中的数字资产,如今正借助一张张加密卡,悄无声息地闯入现实世界。

发卡,是打通 Web3 与现实世界的黄金钥匙,还是一场短暂喧嚣的流量游戏?

本文将拆解这波加密支付热潮背后的驱动因素、竞争格局与潜藏风险,看清这场产业跃迁。

加密卡大战全面打响

资本在下注,项目在竞速。据 RootData 收录,当前专注于加密卡业务的项目已达 37 家,其中不少获得了头部机构的重注。例如,加密信用卡项目 KAST 完成由红杉中国与红杉印度联合领投的 1000 万美元种子轮融资;加密卡发行商 Rain 则在 Norwest Venture Partners 领投、Coinbase Ventures、Circle Ventures 等跟投下,斩获 2450 万美元融资。

加密卡项目一览:

图源:RootData

从万链、万所,如今再演进至“万卡时代”。这场竞赛,不止是创业公司的舞台。越来越多的头部玩家亲自下场,交易所、钱包、公链都不甘落后,试图在链上资产走向线下消费的关键入口中占据一席之地。

市面上的加密卡产品已琳琅满目,以下为部分代表项目对比:

与此同时,更多卡片在路上:

- OKX 将与万事达卡合作推出 OKX Card

- Kraken 与万事达卡达成合作,将推出加密借记卡

- MetaMask、CompoSecure 和 Baanx 将联合推出“metal card”

- ....

一张卡片,成为打通 Web3 与现实世界的关键跳板,亦是加密资产从“投机品”迈向“使用品”的象征标志。既是桥梁,也是战场,在这场表面热闹的发卡潮背后又酝酿着什么?

加密卡的生意经

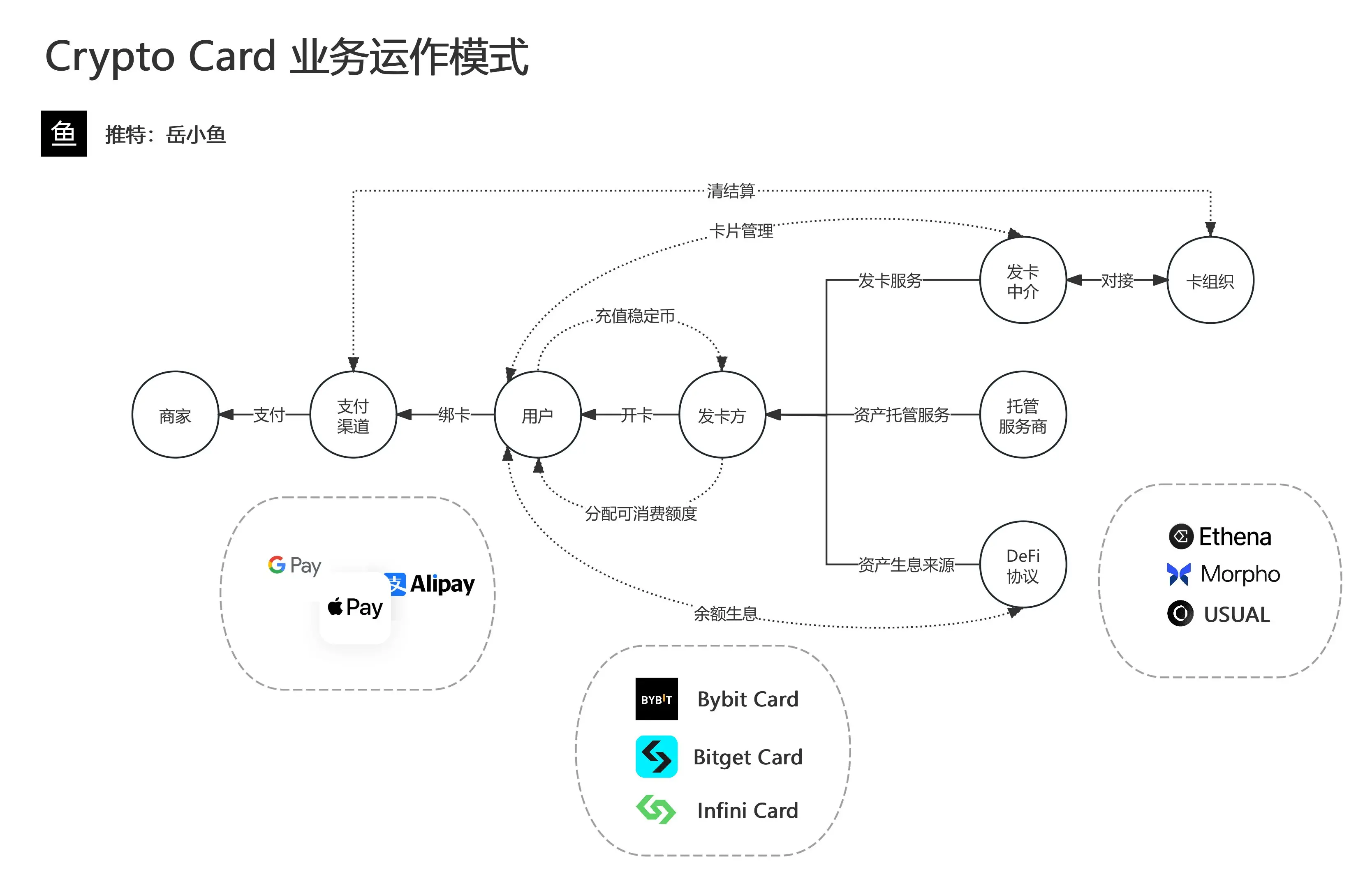

加密卡本质上其实是一种预付卡产品。当用户把 USDT、USDC 等稳定币充值进这张卡时,并不是将这些资产“变现”成了卡内余额,而是由发卡方在 Visa / Mastercard 等传统卡组织体系内开设的银行账户中,为用户分配一个对应额度。

其背后的运作机制,是一种高度中心化的资金模式,主要分为三部分:资产托管(用于满足用户提现需求)、资产生息(用于获取收益)、资产垫付(兑换法币额度)。

图源:@yuexiaoyu111

在这种模式下,发卡平台的盈利来源也相对清晰,一方面是卡面费用和兑换手续费,另一方面则是平台沉淀资金带来的运营收益。然而,从前文的加密卡对比图可以看出,卡费和手续费的竞争已然“开卷”,几乎所有平台都在压低费用门槛以吸引用户,甚至加码各种“糖衣”——空投、消费返利、折扣。

因此,加密卡实际上是一门薄利生意,平台只有在实现大规模流水和资金沉淀时,才能获得可持续盈利。对于平台而言,这场生意的本质其实是争夺用户的“支付入口”。真正的较量,不仅在于品牌塑造和渠道占领,更是一场围绕用户流量的博弈。

此外,交易所和钱包拓展这一业务具备天然优势,不仅有助于丰富其业务矩阵,还能提升市场潜力和发展天花板。

热潮与暗礁

这波“发卡潮”带来了诸多机遇,但背后也隐藏着不少挑战与风险。关于加密卡的价值和难题,业内已有多种解读。

从地域视角看,不同市场对U卡的接受程度也存在差异。研究员 @sjbtc9 指出,在澳洲、欧美和拉丁美洲,加密卡因能规避高通胀并弥补当地金融服务不足,广受欢迎。相比之下,新加坡等合规体系较为完善的地区,用户已有畅通的出金渠道,对加密卡的需求相对较冷淡。而在国内市场,加密卡则常用于支付ChatGPT等海外服务订阅。

此外,加密卡在某些区域也承担了“替代中间商”的角色。比如在 OTC 交易风险偏高的背景下,U 卡在一定程度上提供了更直接、稳定的资金出入口。

但暗礁同样在涌动。合规与风控始终是加密卡绕不开的挑战。加密KOL 岳小鱼曾分享,OneKey Card 曾因出色的产品体验迅速走红,但在合规压力下先后暂停大陆KYC、彻底下线Card业务。这不仅暴露了政策监管下的高不确定性,也反映出加密卡业务难以在用户增长乏力的前提下持续扩张。

如社区用户@agintender所言,加密卡水面之下是“风控地狱”:如何应对资金被冻结、被盗、被追偿,如何配合调查、分级管理用户资金流向,如何建立合理的客户侧写与故事叙述能力,都是加密卡必须解决的核心问题。

安全风险也是一个不容忽视的隐患。今年2月,卡商Infini遭遇攻击,损失超过4900万美元。加密KOL @_FORAB透露,事故发生后,多个U卡服务商进入维护状态,甚至暂停了发卡。这一事件体现出安全性和风险防范是加密卡持续发展的关键之一。

发卡潮涌动,不只是卡片在竞争,更是Web3与现实世界之间的通行权之争。每一张金属卡片闪烁的,不仅是品牌Logo,更是加密经济叩击主流社会的敲门声。

成败与否,谁将脱颖而出,时间会给出答案。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。