撰文:Frank,PANews

近期,Sui 治理代币及其生态系统经历了一场引人注目的飙升,SUI 代币本身在一周内涨幅超过 75%,远超同期市场表现。这一现象背后是复杂的驱动因素交织,既有市场传闻引发的投机热情,也有资金流动的显著变化,更有生态系统基本面的持续改善。本文 PANews 深入剖析 SUI 此轮上涨的资金面动向、关键消息催化剂、链上数据表现以及潜在风险,力图全面解读这场生态狂欢背后的逻辑。

交易所热钱涌入,合约持仓激增

从近几个月的链上资金流动来看,Sui 的资金变化并不明显,在三个月的周期内,Sui 的资金呈现出净流出 3200 万美元,这个金额不算高。而在进一步观察近一个月和近一周的链上资金流变化,Sui 的资金流动更是变化甚微,在公链当中甚至未能排进前二十。

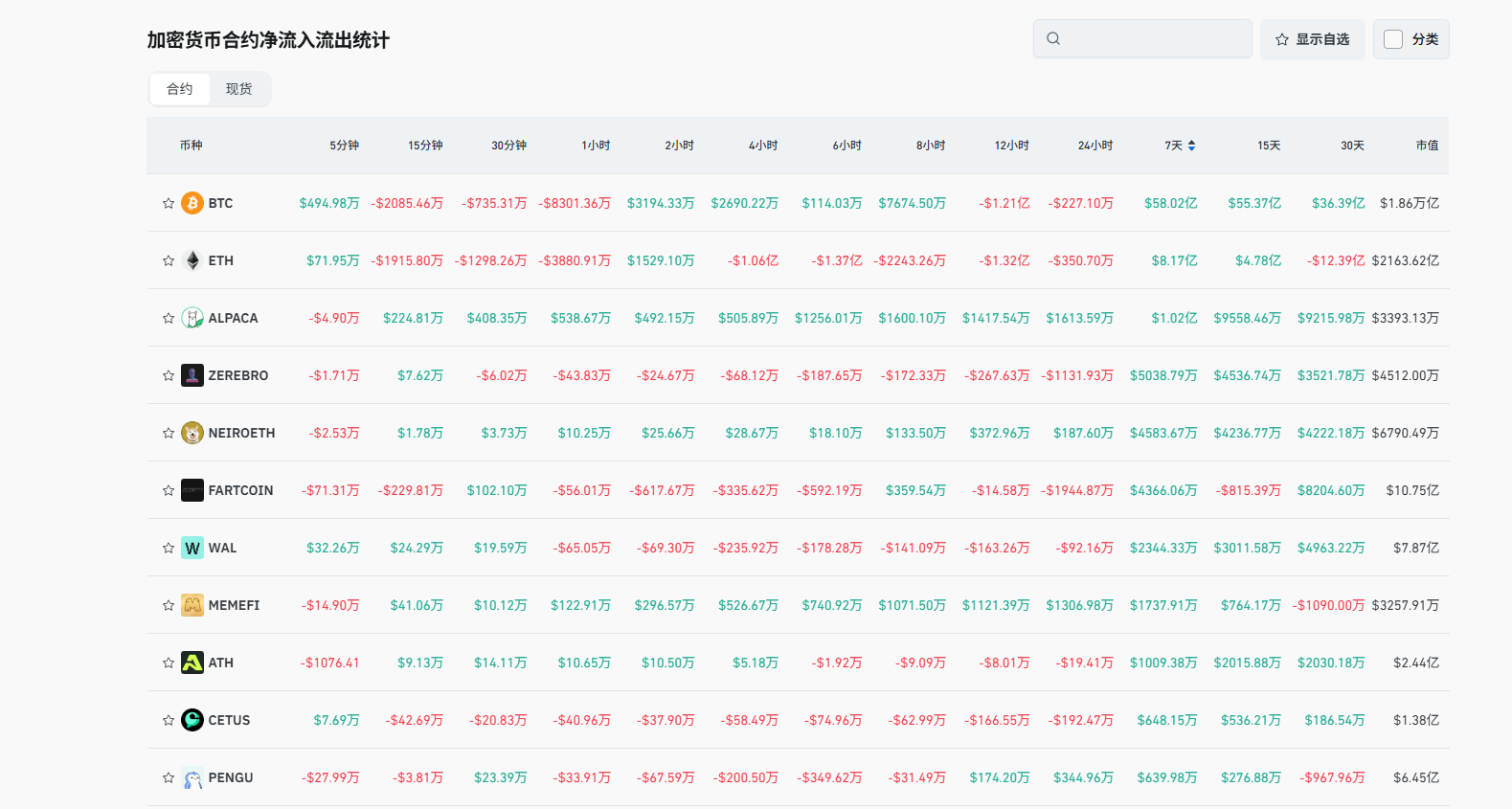

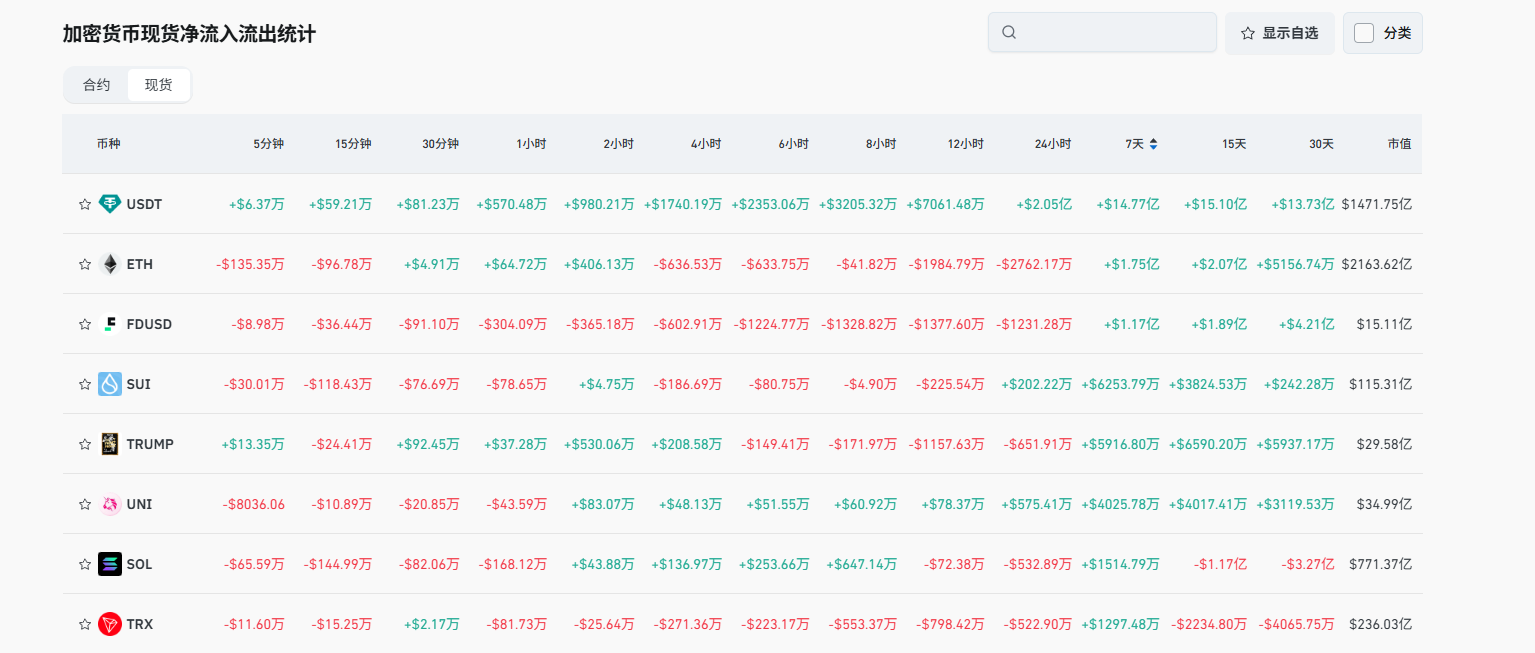

不过在交易所的资金流动上,Sui 生态的资金涌入较为明显。根据 Coinglass 的数据显示,近七天内 SUI 的现货资金流入达到 6286 万美元,排名所有币种的第四位,仅次于 USDT、ETH、FUSD。而在近七天的合约的资金流入排行榜当中,WAL、MEMEFI、CETUS 等几个 Sui 网络的生态代币也都跻身前十,也进一步反映出 Sui 生态的资金活跃度。

在合约的持仓数据上,SUI 代币的持仓量从 4 月 21 日开始迎来暴涨,短短一周时间从 7 亿美元增长至 14.19 亿美元,这一数据已经逼近此前的高点 15 亿美元。

除了 SUI,其生态中多数代币在一周内也都迎来大幅上涨。在 CoinGecko 收录的 Sui 生态代币当中,近一周内有 35 代币的涨幅超过 100%,占 Sui 生态项目的 20%,有 37.5% 的代币涨幅超过 50%,可谓是全面开花。

从资金的层面来看,这次上涨是一次对 Sui 生态全面的集体拉升,虽然多数项目并没有什么实际利好进展,但盘面的价格异动却表现的十分明显。

多重利好助推市场情绪

4 月 21 日,几乎所有主流代币开始同步反弹,Sui 的最初反弹上涨也同样随着大盘的节奏开始启动,并随后有不少的利好消息传出。但这些消息很难确认究竟是 Sui 大涨的「发动机」,还是为了配合价格拉升发布的「烟雾弹」。

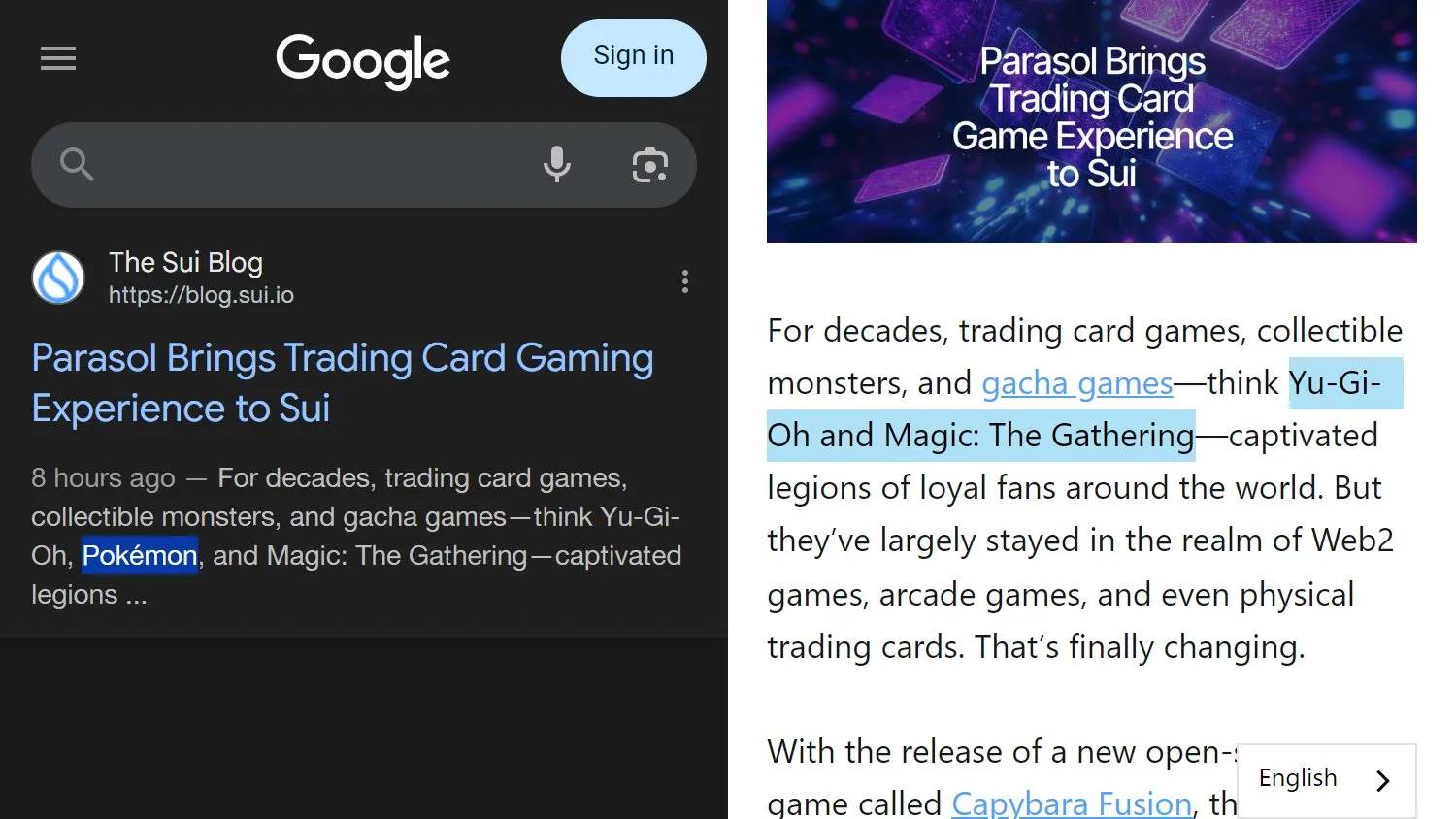

一方面,Sui 传出多个生态合作消息。比如,Pokémon 合作传闻:该传闻始于 2025 年 4 月 23 日,当时 PokémonHOME 应用更新了其隐私政策,将「Parasol Technologies」列为允许接收用户数据的授权开发者之一。Parasol Technologies 是一家区块链游戏工作室,已于 2025 年 3 月被 Sui 的核心开发团队 Mysten Labs 收购。这一直接联系迅速点燃了市场的想象力,加密意见领袖和社交媒体用户纷纷猜测 Pokémon 可能计划将其 IP 整合到 Sui 区块链上。市场叙事集中在潜在的 NFT 集成或基于区块链的收藏品,甚至可能与 PokémonHOME 新推出的「奖牌」功能有关。

值得注意的是,Sui 基金会于 4 月 23 日发布的关于 Parasol 在 Sui 上推出集换式卡牌游戏的官方博客文章中,并未提及 Pokémon。然而,有用户声称该博客的早期版本曾提及 PokémonNFT,但随后被编辑删除,这进一步加剧了市场的猜测。

再例如,xMoney/xPortal 合作:4 月 24 日,Sui 宣布与金融平台 xMoney 及加密超级应用 xPortal 达成合作。此次合作的核心是在欧洲推出一款 Sui 品牌的虚拟万事达卡(Mastercard),该卡集成在拥有 250 万用户的 xPortal 应用内。用户可以将该虚拟卡添加至 ApplePay 或 GooglePay,在数万家商户处使用 SUI 及其他加密货币进行支付,如同使用现金一样便捷。实体卡计划于 2025 年晚些时候推出。

另一方面,ETF 叙事也被认为是推动 Sui 上涨的重要因素之一。近期,21Shares 设立「SUI ETF」法定信托实体的消息被传播。这个消息实际上并不是新的动态,据特拉华州公司注册信息,早已于 2025 年 1 月 7 日,编号 10058451 的「21SHARES SUI ETF」法定信托实体设立,注册类型为普通法定信托。随着这一消息在近期被曝光,似乎也为 SUI 的上涨提供支持。

除此之外,Sui 网络在近一两个月内还有不少利好消息传来,比如雅典证券交易所集团于 4 月 16 日宣布,完成了在 Sui 上构建链上募资平台的技术设计;Nautilus 在 4 月 15 日推出为 Sui 带来可验证的链下隐私解决方案;Canary Capital 提交 SUI ETF 申请等等。

总体来说,Sui 近期在 Web3 游戏、隐私、开发环境等多个领域取得的进展汇集成一个整体的利好面。在这一点上,与 Sui 之前的单一消息引发爆发有所区别。

空投事件带动 DEX 交易量暴增,面临代币解锁和应用建设双重压力

自 4 月份以来,Sui 网络的 DEX 交易量始终保持高位水准,尤其是在 3 月 29 日创下 9.98 亿美元的历史峰值,随后多日突破 4 亿美元的日交易量。而生态内的 DEX 龙头项目 Cetus Protocol 则带动了整个生态的增长,其交易量近一周内增长 84.5%,且代币 CETUS 也在一周内接近翻倍。

除此之外,另一个重要贡献者是 Kriya,在 3 月 29 日 Sui 网络交易量突破记录的当天,Kriya 贡献了 7.8 亿美元的份额,占据了当日交易量的重要份额。而这一数据相较前一天的 728 万美元,增长了 100 多倍。

结合来看,这两个 DEX 交易量在 3 月 28 日数据暴涨,主要原因可能是因为 Walrus 的空投导致的交易量飙升。3 月 27 日,融资 1.4 亿美元的去中心化存储项目 Walrus 发布空投,当日该代币的交易额就达到了 3.8 亿美元。这或许成为 Sui 网络近期交易量上涨的主要原因。

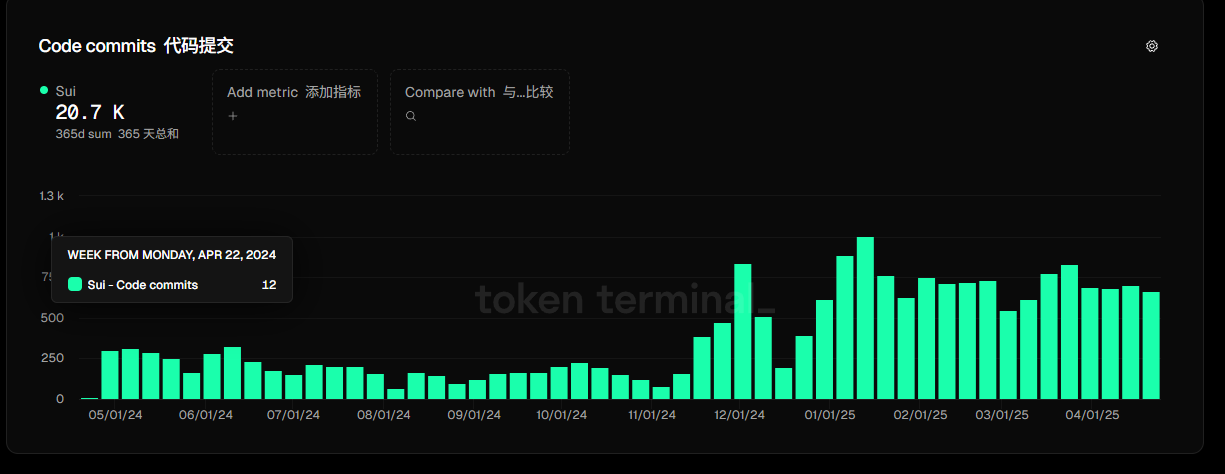

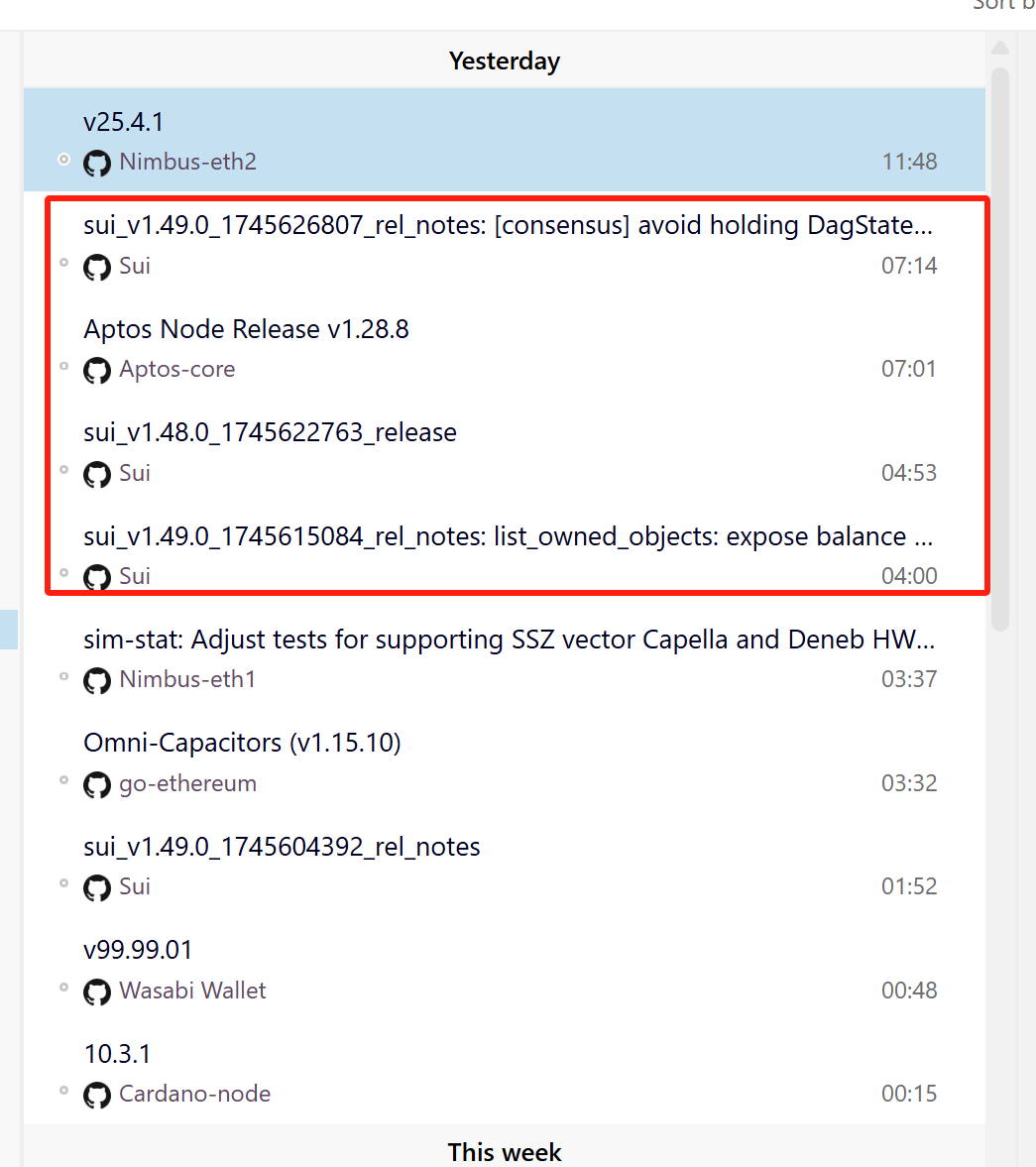

此外,开发者的活跃也是 Sui 网络增长的底层原因之一。在 Github 上,Sui 网络的代码提交近期也较为频繁,从 2024 年 12 月开始,Sui 网络的代码提交频率就进入高峰,基本都维持在每周 500 次以上,而此前的这一数据基本维持在 250 次左右。作为对比,Solana 和 Aptos 的的代码提交频率基本维持在 100 左右。

不过,在市场集体狂欢的过程中,还有几个风险点可能值得注意。一方面,SUI 的代币解锁是一个持续的抛售压力,基本每周都会释放数千万枚代币,使其成为市场上的最大供应方,这些解锁后的代币始终是 SUI 代币上涨周期中的一个不定时炸弹。

另一方面,Sui 生态的上涨结构目前主要是由 Dex 或基础设施类项目引领,但 MEME 代币或者应用 / 游戏等项目表现尚未突出,同时目前市值在 1000 万以上的代币基本仍是早期项目。从这个角度来看,如果把 Sui 比作一个城市,在这个城市中,围绕 Walrus、Deepbook、Parasol 等项目构建了去中心化存储、DeFi、游戏等主题的商场。但这些商场中现在还缺乏一些「网红商户」出现,来进一步吸引大规模用户真正入场。

由此来看,近期 SUI 代币及其生态的飙升,是市场投机热情、资金涌入和合约市场预期的推动,以及坚实基本面进展共同作用的结果。然而,在关注 Sui 价格亮眼表现的同时,也需警惕代币持续解锁带来的抛售压力,并关注其应用生态能否进一步繁荣,诞生出真正吸引用户的爆款应用,这将是决定 Sui 能否将当前热度转化为长期价值的关键。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。