You can rest assured that this chain indeed has a bear.

Author: knower

Translation: Deep Tide TechFlow

The Honeypaper has officially been released. To help everyone understand, I have summarized its contents briefly.

For a long time, we have seen many L1 and L2 blockchains trying to solve the "blockchain trilemma" (i.e., the trade-off between decentralization, security, and scalability) in different ways, focusing on technical performance, especially on reducing transaction costs and increasing throughput—these two factors directly determine the user experience of the blockchain.

While these issues are indeed crucial for the scalability of blockchains, we have not seen innovative economic models introduced at the protocol level—until today.

We are pleased to release this Honeypaper and explain what makes this L1 unique: how its architecture opens new directions for blockchain economics, the underlying mechanisms, and how these elements work together. Moreover, you can rest assured that this chain indeed has a bear (the logo of Berachain).

The design goal of Berachain is to coordinate the incentive mechanisms among the main stakeholders on-chain, including decentralized applications (dApps), users, and validators.

More importantly, the design of this chain allows the applications developed and used on it to create value for the chain itself through mechanistic means, while the chain can also empower the applications in return.

The design inspiration for Berachain comes from observations of existing L1 and L2 chains—many chains invest too much in economic security but fail to effectively utilize these resources. Instead of continuing this industry practice that allows validators to profit easily, Berachain innovatively designed a dual-token system: BGT and BERA. This design ensures that rewards can truly be used for the actual needs on the chain, rather than just simple distribution.

All of this is based on Berachain's unique consensus mechanism: Proof-of-Liquidity (PoL). If you have followed Berachain's blog, you may already have some understanding of PoL.

(The original image is from knower, compiled by Deep Tide TechFlow)

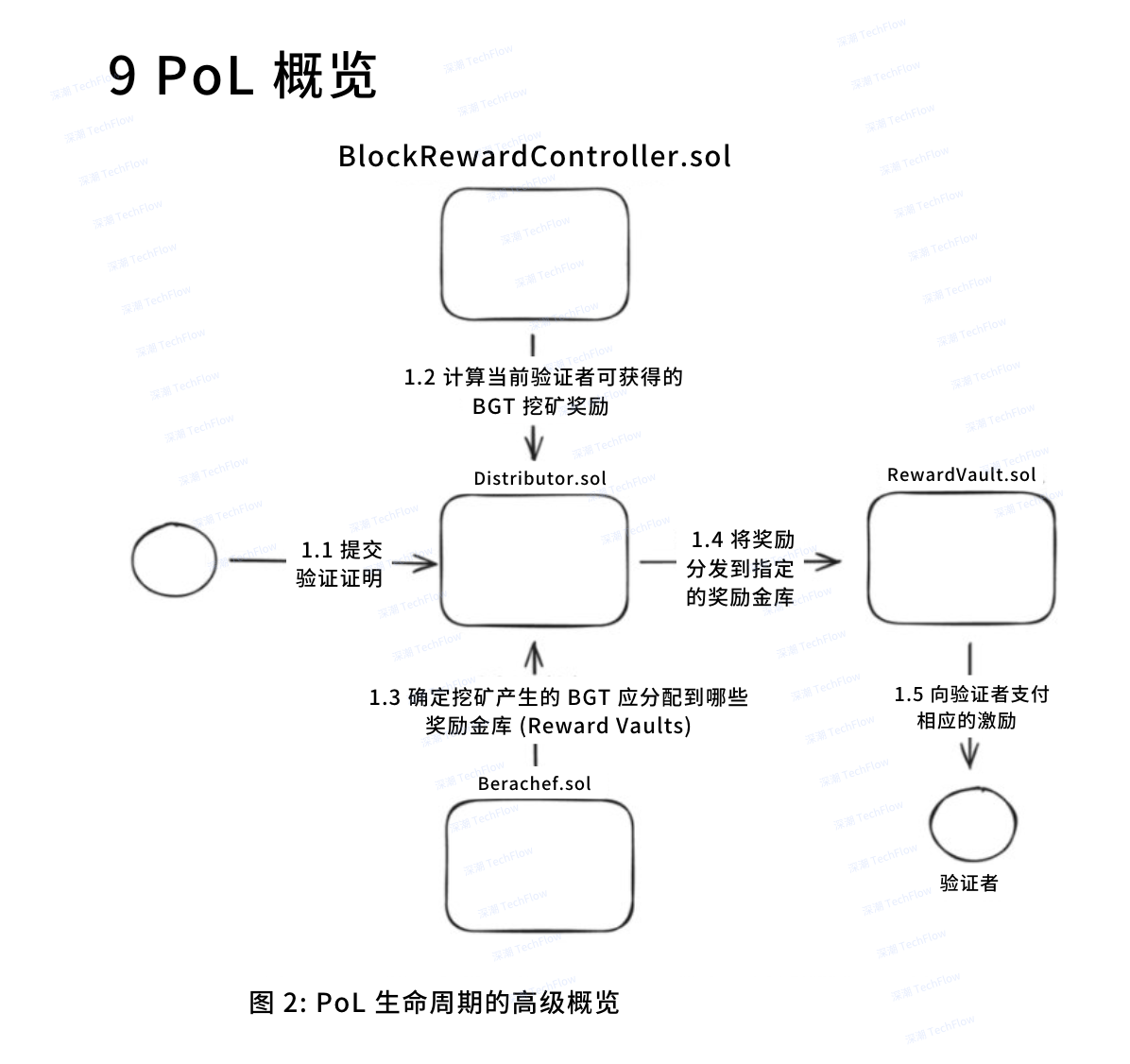

In fact, this is how PoL works, but explaining it in simpler terms makes it easier to understand.

Under the PoL model, the priority of users and dApps is higher than that of validators, but all three need to collaborate to build a more secure and economically cooperative blockchain network.

As mentioned earlier, the issue of excessive spending on economic security often creates an unhealthy relationship between new chains and validators. This relationship leads to a lack of shared incentive mechanisms among the main stakeholders. If users and dApps (as core components of the L1 blockchain) cannot fairly receive returns on their economic output, then paying rewards to validators solely for security is counterproductive.

The biggest difference between Berachain's PoL and other consensus mechanisms lies in the distribution of rewards. In PoL, most rewards flow into the application reward vault rather than directly into the validators' accounts. This does not deny the importance of validators but rather promotes the economic innovation we described by adjusting the reward distribution mechanism.

On Berachain, applications can incentivize various user behaviors through the reward vault. For example, they can guide more liquidity into specific liquidity pools or optimize economic activities by leveraging the unique behavior patterns of on-chain users.

Additionally, Berachain adopts a delegated proof-of-stake (dPoS) model, which combines the staking of BERA and the delegation mechanism of BGT. This design ensures that validators not only profit but also need to actively interact with other main stakeholders to participate in on-chain governance and ecological development.

In the PoL model, the interaction between validators, dApps, and users is crucial for the healthy development of the entire ecosystem. Competition and market dynamics will naturally encourage users and dApps to align with the most active validators, thus promoting the efficient operation of the entire network.

However, most proof-of-stake (PoS) based blockchains typically have only one network token. This design forces users to use the same token to pay transaction fees, stake assets, and participate in governance. This single-token model may not meet the needs of different types of users and is unlikely to encourage healthy behavior among long-term token holders.

An ideal design would allocate these different functions to separate tokens to meet diverse user needs and encourage long-term token holders to make choices that benefit the ecosystem.

In Berachain, this multi-token system is realized through BERA and BGT. BERA serves as the gas and staking token, primarily used to pay network transaction fees, while users can also pay validators' activation fees by staking BERA. BGT, on the other hand, is the governance and economic incentive token, which is non-transferable; users can only obtain it by staking assets that meet PoL standards in the reward vault.

This dual-token design not only makes Berachain's economic model more flexible but also better meets the diverse needs of users and the ecosystem, while promoting healthy long-term economic behavior.

In simple terms, the separation of BERA and BGT ensures that all stakeholders have direct interests in the system, and in an economic system like Berachain, those who participate more actively tend to receive greater rewards.

The functions of BGT include voting on governance proposals and can be exchanged for BERA at a 1:1 ratio (but by design, BERA cannot be exchanged for BGT). Additionally, users can participate in the economic activities of validators by delegating BGT to them and receive corresponding incentives.

The BGT yield for validators is directly related to the amount of BGT delegated to them and also depends on how they utilize these delegated BGT. This design creates an interesting dynamic mechanism that accelerates user adoption of the application layer through newly issued incentives.

When the growth rate of incentives for delegated BGT is lower than the new issuance rate of BGT, users can choose to burn (Burn) BGT and exchange it for BERA. More exchange actions will reduce the circulating supply of BGT, thus forming a cycle of supply and demand interaction, ultimately helping the system achieve greater stability.

If you have read this far, you may start to wonder about Berachain's mathematical model. All white papers involve mathematical formulas, and the honeypaper is no exception. Although these formulas may seem complex, they are an important foundation for the operation of Berachain and the various dynamic parts of the PoL model.

The PoL model defines the issuance schedule of BERA and BGT as well as the block generation mechanism. The rewards for validators are based on their participation in PoL, specifically represented as a variable rate dependent on the validator's boost. The block generation mechanism selects N validators from the set of active validators, who are chosen based on the amount of BERA they have staked, with the specific selection probability being proportional to the amount of BERA staked.

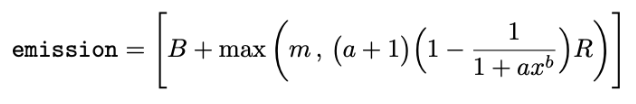

If you are interested in the mathematical formulas and want to delve deeper, here are the relevant formulas:

The following is the formula used to calculate how much BGT is generated in each block, based on the validator's boost value x. The boost value x is a ratio between [0,1] that represents the percentage of BGT allocated to a particular validator out of the total BGT allocated to all validators.

B (Base reward rate): The fixed BGT reward a validator receives for successfully generating a block.

R (Reward rate): The amount of BGT that needs to be allocated to the reward vault before applying the boost coefficient.

a (Boost coefficient): Used to adjust the impact of the boost value on the allocation to the reward vault. The higher the boost coefficient, the greater the impact of the boost value on reward distribution.

b (Convexity parameter): Used to adjust the sensitivity of the boost value on reward distribution. The higher the convexity parameter, the more severe the penalty for validators with low boost values.

m (Minimum reward): Sets the minimum limit for the allocation to the reward vault. A higher minimum reward can ensure that validators with low boost values still receive some rewards.

Alright, let's leave the technical details here and see what practical value Berachain's dual-token system and PoL model can bring.

In the Honeypaper, there is a section dedicated to exploring the potential real-world applications of PoL, such as real-world assets (RWAs), automated market makers (AMMs), and layer 2 solutions (L2s).

The significance of PoL in the DeFi space is particularly prominent, especially in how it can efficiently integrate the interests of users and dApps. However, the potential of PoL extends far beyond this; other fields can also benefit from it.

Real-world assets (RWAs) have long been regarded as one of the "ultimate goals" of blockchain technology. If we believe that traditional finance professionals will trade with our tokens in the future and interact with us on-chain, then a series of products closer to traditional finance will gradually take shape.

For example, if you want to tokenize clear offline assets like real estate or government bonds into ERC20 tokens, the asset issuer can utilize the reward vault to solve the problem of finding asset initiators and rewarding them. These reward vaults, along with users who deposit assets into them, can also benefit from secondary market liquidity and validator incentives.

Suppose there is a built-in decentralized exchange (DEX) on Berachain; then users can create new liquidity pools without permission. These pools can not only earn native rewards on-chain but also enjoy BGT incentives.

Sounds a bit complicated? In simple terms, dApps can establish reward vaults based on these liquidity pools through governance proposals, all supported by PoL. This mechanism can easily solve the "cold start problem" many dApps face when launching on a new chain while promoting efficient collaboration among validators.

Depending on the different stages of development of the dApp, it can choose to offer BGT rewards or native rewards above or below market value to attract different types of users on-chain. Compared to traditional PoS liquidity pools, PoL-based liquidity pools (with reward vaults) provide more refined decision-making capabilities—this flexibility was difficult to achieve in the past.

The Honeypaper also mentions other interesting content, such as how incentive markets and reward vaults can be whitelisted. If you're interested, you can delve deeper, but the above content should be sufficient.

Beras cannot read or write, so if you have managed to read this far, it is truly a miracle. If you want to learn more on your own, you can refer to the honeypaper.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。