作者:Mosi

编译:深潮TechFlow

在代币领域,认知即一切。就像柏拉图的“洞穴寓言”一样,许多投资者被困在阴影中——被不良行为者扭曲的价值投影所误导。在本文中,我将揭露一些由风险投资(VC)资助的项目如何系统性地通过以下方式操控其代币价格:

-

将代币的虚假流通量(FALSE float)尽可能维持在高位。

-

将代币的真实流通量(REAL float)尽可能压低(以便更容易拉高代币价格)。

-

利用真实流通量极低的事实来推高代币价格。

从“低流通量/高FDV(完全稀释估值)”的模式转向“虚假流通量/高FDV”的模式。

图:不!我不是低浮动/高FDV代币!我是“社区优先”!

今年早些时候,模因币(memecoins)人气飙升,将许多VC支持的代币挤出了主流视野。这些代币被称为“低流通量/高FDV”代币。然而,随着Hyperliquid的推出,许多VC支持的代币变得难以投资。面对这种情况,一些项目并没有解决其存在缺陷的代币经济模型,也没有专注于开发真正的产品,而是选择加倍努力,通过人为压低流通供应量,同时公开声称相反的内容。

抑制流通量对这些项目有利,因为这使得价格操控更加容易。通过幕后交易——例如基金会将锁仓代币出售换取现金,然后在公开市场回购——可以显著提高资本效率。此外,这种做法对做空者和杠杆交易者带来了极大的风险,因为低真实流通量使这些代币极易受到价格拉高和暴跌的影响。

接下来,让我们看看一些实际的例子。这绝不是一个详尽的列表:

-

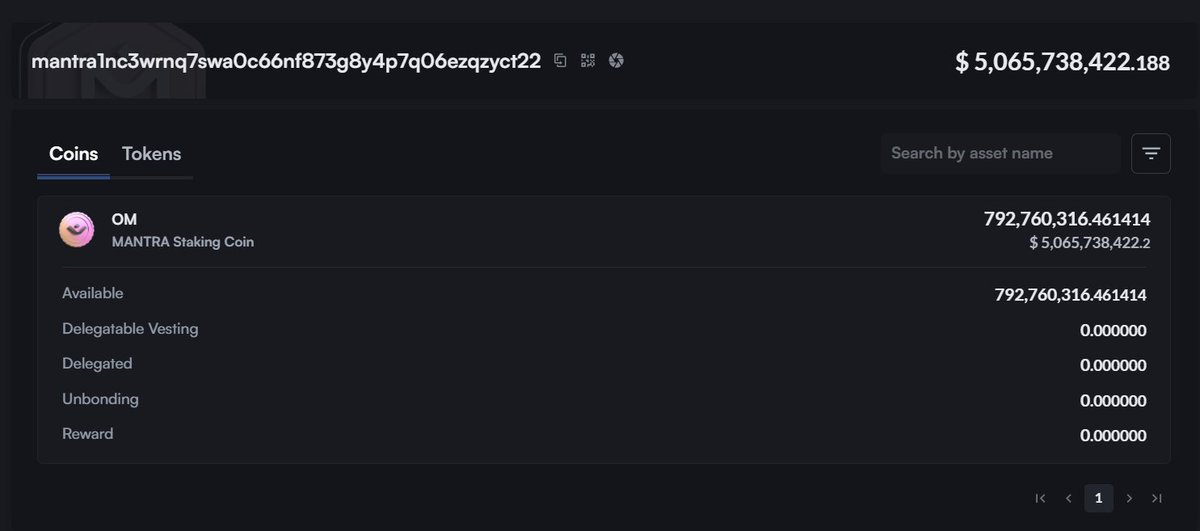

@MANTRA_Chain 这是最明显的一个例子。对于那些好奇一个仅有400万美元总锁仓价值(TVL)的项目,如何能拥有超过100亿美元完全稀释估值(FDV)的人来说,答案非常简单:他们掌控了大部分的$OM流通量。Mantra在一个单一的钱包中持有792M $OM(即90%的供应量)。这并不复杂——他们甚至懒得将这些供应分散到多个钱包中。

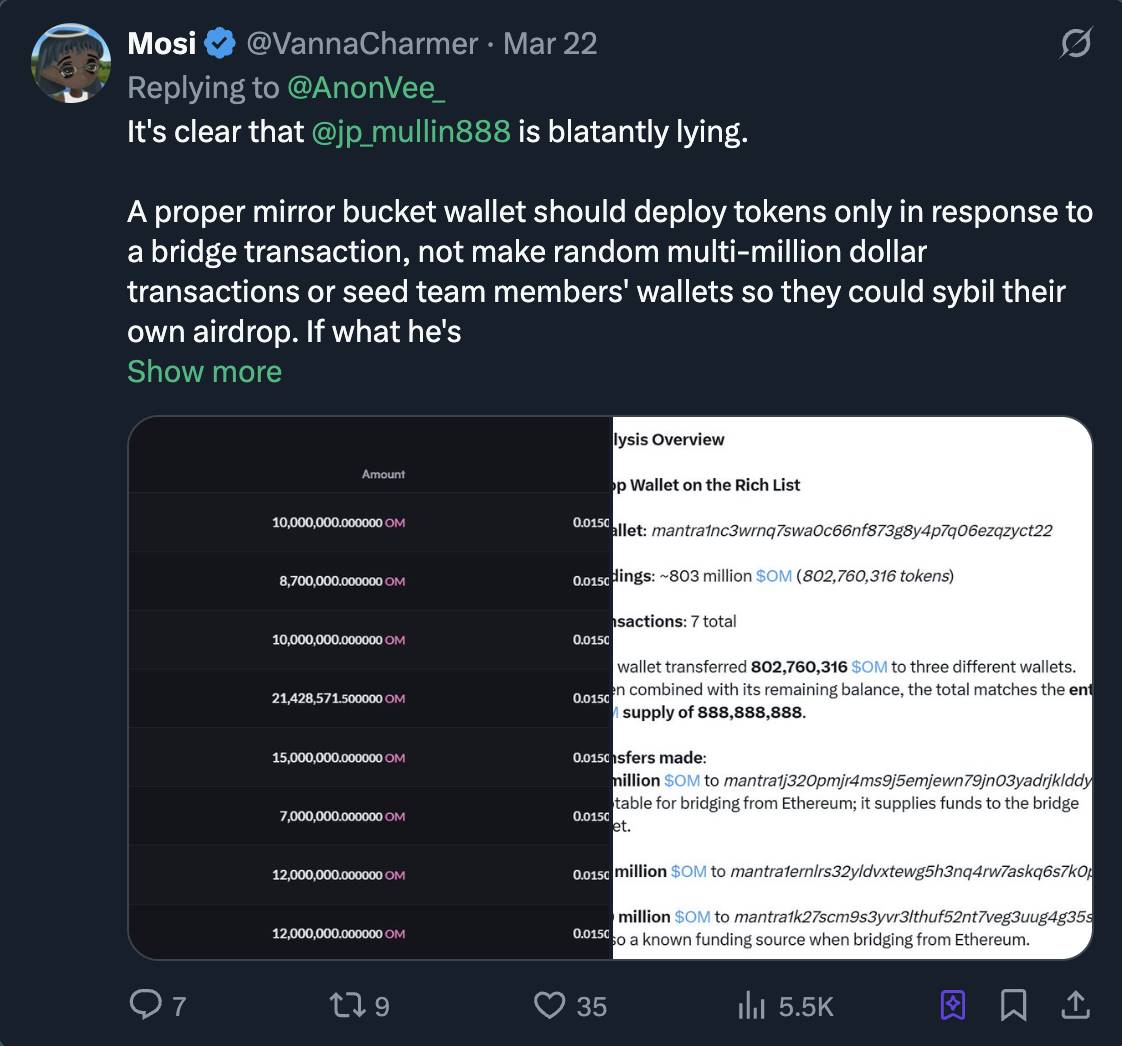

当我向@jp_mullin888询问此事时,他声称这是一个“镜像存储钱包”。这完全是胡说八道。

那么,我们如何得知Mantra的真实流通量(real float)呢?

我们可以通过以下计算得出:

980M(流通供应量) - 792M $OM(团队控制的部分) = 188M $OM

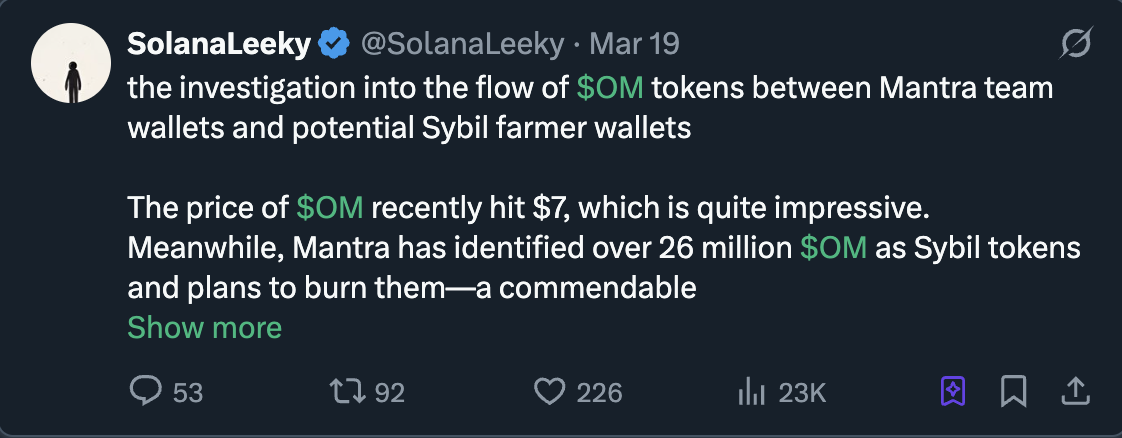

然而,这188M $OM的数字可能也并不准确。团队仍然控制着相当一部分的$OM,他们利用这些代币对自己的空投进行女巫攻击(sybil attack),进一步榨取退出流动性(exit liquidity),并继续控制流通量。他们部署了约100M $OM用于女巫攻击自己的空投,因此我们也需要从真实流通量中扣除这部分代币。更多相关信息可以在此查看:

最终,我们得出的真实流通量是……咚咚锵……仅有88M $OM!(假设团队没有控制更多的供应量,但这个假设显然很不靠谱)。这使得Mantra的真实流通量仅为526万美元,与CoinMarketCap上显示的63亿美元形成了巨大的差距。

较低的真实流通量(real float)让操控$OM的价格变得轻而易举,同时也能轻松清算任何做空仓位。交易者应该对做空$OM感到恐惧,因为团队掌控着大部分流通量,可以随意拉高或砸盘价格。这种情况就像试图与@DWFLabs在某个垃圾币(shitcoin)上对赌一样。我怀疑当前的价格走势背后可能涉及Tritaurian Capital——这家公司从@SOMA_finance借贷了150万美元(@jp_mullin888是SOMA的联合创始人,而Tritaurian由Jim Preissler拥有,后者是JPM在Trade.io的老板)——以及中东的一些基金和做市商。这些操作进一步压缩了真实流通量,使其计算变得更加困难。

这或许也解释了他们不愿意释放空投并决定实施锁仓期的原因。如果他们真的进行了空投,真实流通量将显著增加,可能会导致价格大幅下跌。

这并不是什么复杂的金融工程,但看起来像是一个有意为之的计划,目的是减少代币的真实流通量并推高$OM的价格。

-

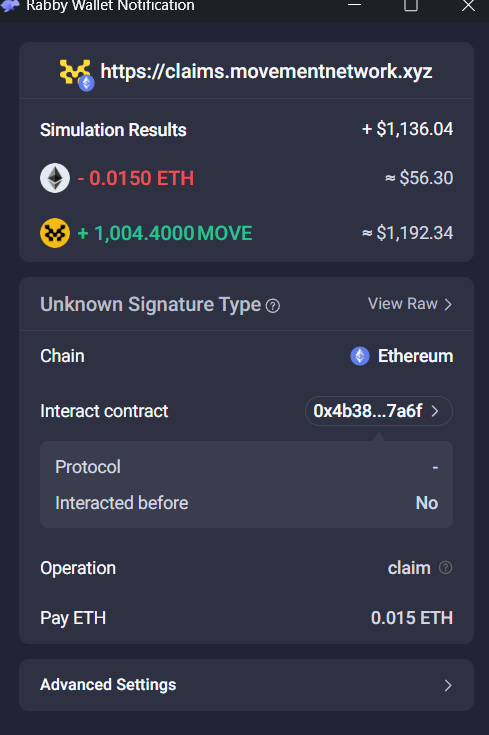

@movementlabsxyz:在空投领取过程中,Movement允许用户选择以下两种方式之一:在以太坊主网(ETH Mainnet)领取空投;为了获得少量奖励,在他们尚未推出的链上领取空投。然而,在领取开启仅数小时后,他们采取了一系列操作:

-

对所有在以太坊主网领取的用户增加了一笔费用,该费用为0.015 ETH(当时约为56美元),外加以太坊的燃气费(Gas Fee),这让许多小额余额的测试网用户望而却步;

-

将领取时间限制在非常短的期限内。

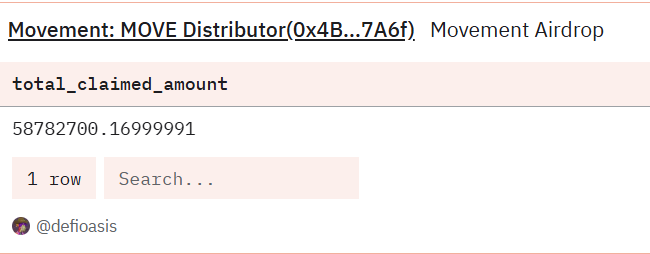

结果显而易见,只有5870万枚MOVE被领取。也就是说,在原本计划发放的10亿MOVE中,仅有5%被成功领取。

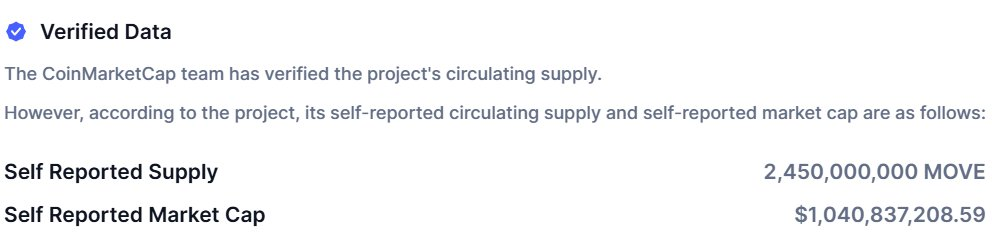

接下来,让我们像分析Mantra一样,对MOVE进行相同的计算。据CoinMarketCap显示,MOVE的自报流通供应量为24.5亿(2,450,000,000)。

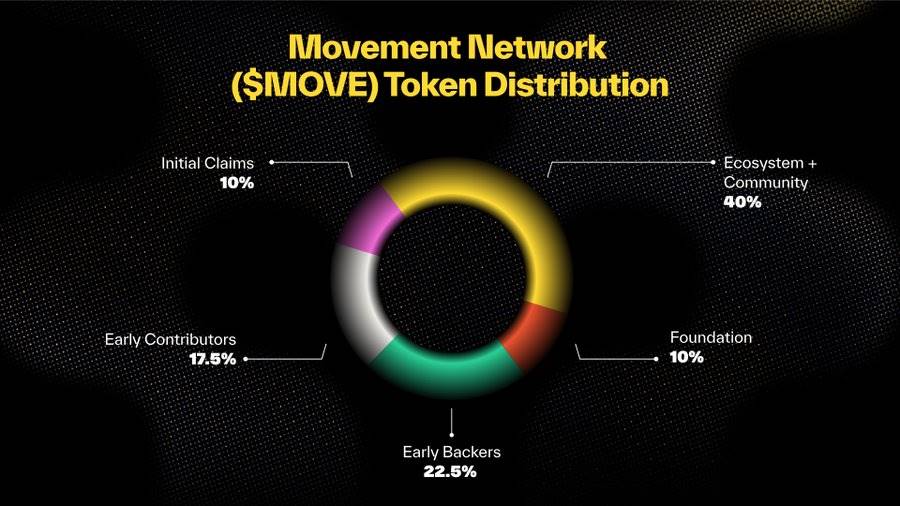

然而,根据Move的饼图数据,空投后应该只有20亿(2B,基金会+初始领取)代币在流通。因此,这里就已经开始出现可疑操作,因为有4.5亿(450,000,000)MOVE无法被解释。

计算如下:

2,450,000,000 MOVE(自报流通供应量) - 1,000,000,000 MOVE(基金会分配) - 941,000,000 MOVE(未领取供应量) = 5.09亿(509,000,000)MOVE,或2.03亿美元的真实流通量(REAL float)。

这意味着,真实流通量仅为自报流通供应量的20%!此外,我很难相信这5.09亿MOVE中的每一枚都在用户手中,但暂且不论这一点,我们假设这就是实际的真实流通量。

那么,在这段真实流通量极低的时期里,发生了什么?

-

Movement向WLFI支付费用,要求他们购买MOVE代币。

-

Movement向REX-Osprey支付费用,要求他们为MOVE申请ETF。

-

Rushi(相关负责人)去了纽约证券交易所(NYSE)。

-

Movement与基金和做市商进行了一系列复杂操作,将锁仓代币出售给他们以换取现金,从而让这些机构可以竞价并推高价格。

-

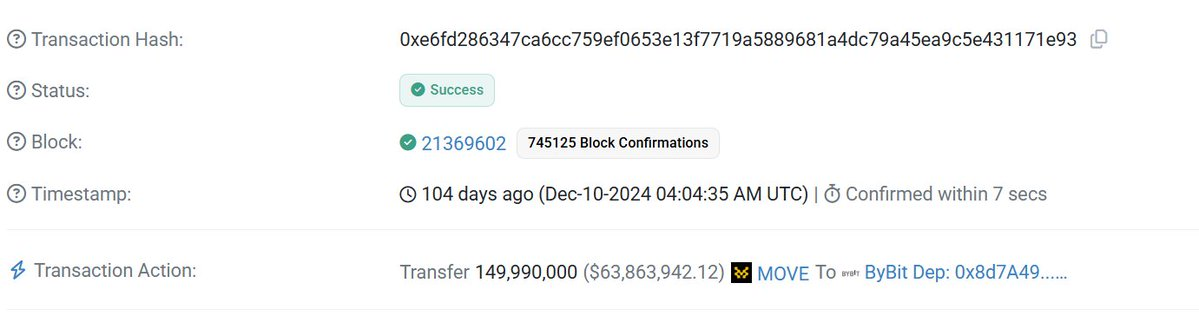

团队在Bybit平台的价格顶点时存入了1.5亿(150,000,000)MOVE代币。他们可能从价格顶点开始抛售,因为自那之后代币价格一直在下跌。

-

在代币生成事件(TGE)前后,团队每月向一家中国的KOL(关键意见领袖)营销机构支付70万美元,以便在Binance(币安)上架,从而在亚洲市场获取更多退出流动性。

这是巧合吗?我不这么认为。

正如Rushi所说:

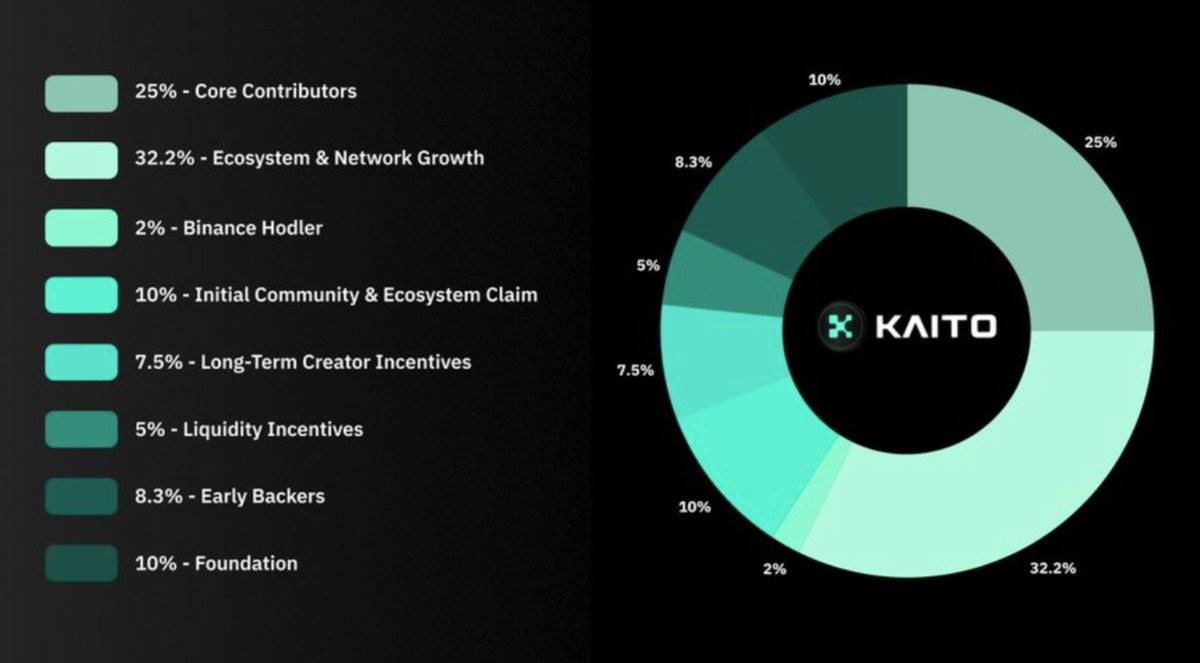

Kaito:

@Kaitoai是这个列表中唯一一个拥有真正产品的项目。然而,他们在当前的空投活动中也采取了类似的行为。

正如CBB上文指出的那样,Kaito分发了他们的空投,但只有很小一部分人实际领取了。这同样影响了真实流通量(Real Float)。让我们来计算一下:

根据CoinMarketCap的数据,Kaito的流通供应量为2.41亿(241,000,000),市值为3.14亿美元。我假设这个数字包括了:币安持币用户、流动性激励、基金会分配以及初始社区和领取份额。

让我们拆解这些数据,找出真实流通量:

真实流通量 = 241,000,000 KAITO - 68,000,000(未领取的数量) + 100,000,000(基金会持有) = 7300万(73,000,000)KAITO

这意味着真实流通量对应的市值仅为9490万美元,远低于CMC报告的数值。

Kaito是这个列表中唯一一个我愿意给予一定信任的项目,因为他们至少拥有一个能够产生收入的产品,并且据我所知,他们并没有像其他两个团队那样参与过多的可疑操作。

解决方案与结论

-

CMC和Coingecko应列出代币的真实流通量,而不是团队提交的那些不可信的数字。

-

币安等交易所应以某种方式积极惩罚这种行为。 当前的上币模式存在问题,因为正如Movement所做的那样,你可以简单地支付一家KOL营销机构以在TGE前提升在亚洲的参与度。

-

价格可能在我写这篇文章时已经发生了变化,但作为参考,我取的价格是:Move为$0.4,KAITO为$1.3,Mantra为$6。

-

如果你是一名交易者,远离这些代币。 因为这些团队可以随心所欲地操控价格。他们掌控了所有的流通量,因此也控制了资金流动和代币价格。(非财务建议,NFA)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。