作者:Chi Anh, Ryan Yoon和Yoon Lee

编译:深潮TechFlow

简要总结

-

西方中心化交易所(CEX)瞄准亚洲市场:Robinhood和Coinbase等公司正在亚洲扩张,依托监管友好的枢纽和本地化战略开拓市场。

-

区域性平台保持强势地位:本地交易所凭借其强大的市场地位,继续占据竞争优势,这使得西方交易所在争夺亚洲市场主导权时面临强劲对手。

-

制胜关键在于本地化:成功的关键在于与金融机构的合作、遵守监管要求,以及推出符合当地用户行为的定制化产品和服务。

1.探索加密市场中的东西方动态

亚洲在全球加密领域占据主导地位,其优势体现在以下三方面:1)交易量领先,2)零售市场广泛采用,3)机构创新活跃。该地区充满活力的经济体和强大的零售参与度,使其成为全球加密生态系统中的核心力量。

因此,许多已在本土市场趋于饱和的西方交易所,正日益将目光投向亚洲,视其为下一个扩张前沿。例如,Robinhood计划在新加坡设立总部,而Coinbase则通过本地化稳定币进军东南亚市场,这些举措都凸显了亚洲的战略重要性。

然而,这个市场远非空白。各国的本地中心化交易所(CEX)已经拥有极高的用户渗透率,而像币安(Binance)这样的全球交易所也广受欢迎。这些因素表明,西方新进入者将面临巨大的竞争压力。

本报告深入分析了亚洲加密市场不断演变的竞争格局,探讨了西方和区域性参与者的战略举措、他们所面临的挑战,以及在这一快速发展的生态系统中涌现的合作机会。

2.西方参与者如何进入亚洲市场

2.1 Robinhood的“合规优先”战略

Robinhood进军新加坡,标志着其在亚洲快速增长的数字资产市场中的一次战略性布局。该公司通过宣布以2亿美元收购欧洲数字资产交易所Bitstamp,借此获得监管审批并融入新加坡的加密友好框架。Bitstamp已获得新加坡金融管理局(MAS)的原则性批准,这为Robinhood提供了显著的监管优势,简化了其市场进入流程。

据彭博社报道,Robinhood计划在2025年通过新成立的实体在新加坡推出加密产品。尽管对Bitstamp的收购尚未完成,但其已获得的新加坡金融管理局的原则性批准,为Robinhood的合规性布局奠定了良好的基础。

Robinhood通过优先考虑监管合规,与那些在法律灰色地带运营的离岸平台形成了鲜明对比。公司旨在通过确保合规性和提供安全的交易环境,吸引注重合规的零售交易者和机构投资者。

Robinhood在新加坡的扩张是其更大国际增长战略的一部分。公司已经在欧洲推出了加密交易,并在英国启动了股票期权交易。随着许可范围的扩大,Robinhood正努力在多个地区提供包括数字金融和传统金融在内的全面服务。

选择新加坡作为区域基地并非偶然——该国拥有透明的监管框架、高度集中的机构资本,以及日益增长的加密用户群体。这些因素使新加坡成为Robinhood测试并扩展其亚洲加密业务的理想跳板。

这一战略性立足点反映了西方中心化交易所(CEX)的一个更广泛趋势:通过像新加坡这样的监管枢纽进入亚洲市场,然后逐步扩展到更复杂的市场。随着整个地区的监管清晰度不断提升,Robinhood预计将把服务范围从新加坡扩展到其他市场,并以此为跳板实现更大规模的增长。

2.2 Coinbase的稳定币与基础设施战略

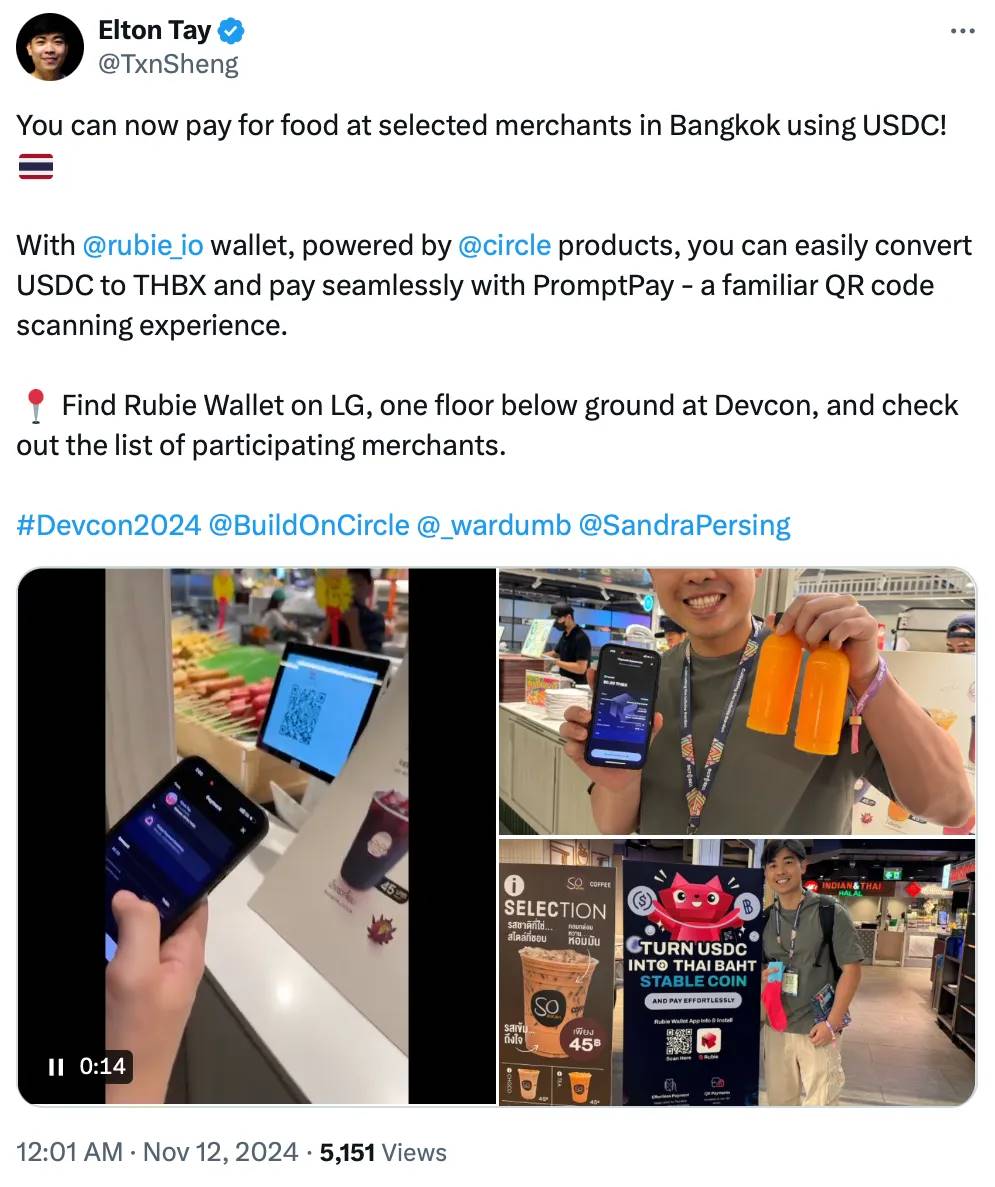

Coinbase正通过一项以稳定币为核心的战略扩展至东南亚市场。泰国和菲律宾正在推动与本地货币挂钩的稳定币项目,这与Coinbase的战略方向高度契合。泰国正在通过普吉岛沙盒计划(Phuket Sandbox Initiative)测试稳定币,而菲律宾央行则批准了一项与菲律宾比索挂钩的稳定币试点项目,这些都表明了当地监管机构对这些创新的开放态度。

来源:X(@TxnSheng)

为推动这一趋势,SCB 10X近期推出了一款基于Base的Ruby Wallet。这款钱包基于Fireblocks的“钱包即服务”(wallet-as-a-service)基础设施构建,支持泰铢($THBX)和美元稳定币。这一举措助力了符合Coinbase整体目标的本地基础设施发展,尤其是在推广Base和泰铢稳定币的使用方面。

此外,Coinbase在2022年将Transak集成到其钱包中,使用户可以通过本地货币和支付系统购买加密货币。这反映了Coinbase更广泛的市场进入策略:与其直接扩展交易所业务,不如专注于钱包服务和Base,与政府主导的数字货币计划保持一致。这种策略与Robinhood的直接交易所扩张战略形成鲜明对比。

通过这些战略合作,Coinbase正逐步嵌入亚洲不断发展的数字经济。这种方法体现了西方企业试图通过基础设施建设而非直接与区域性主导交易所竞争的努力。

这两种案例展现了不同的市场进入方式:Robinhood优先考虑监管合规和吸引机构投资者,而Coinbase则聚焦于金融基础设施和稳定币的实用性。两种策略都具备增长潜力,但其成功与否将取决于这些公司在亚洲复杂的监管和竞争环境中的应对能力。

3.市场动态:区域强者与西方新势力

亚洲多样化的监管环境导致了本地交易所在某些地区的主导地位,同时也为全球中心化交易所(CEX)在其他地区的发展提供了机会。对于希望在亚洲扩张的西方CEX来说,理解这些不同的市场结构至关重要。

(注:在原图上使用AI进行翻译,可能存在一定文字误差)

3.1 本地交易所主导市场

韩国是本地交易所主导市场的典型代表,其严格的监管框架使本地平台如Upbit和Bithumb蓬勃发展。这些平台通过遵守严格的合规措施(包括“旅行规则”要求和财务报告义务)占据优势。这些法规形成了较高的准入门槛,使得西方CEX在没有大量许可和合规投入的情况下,很难进入韩国市场。

日本同样是一个高度监管的市场,本地交易所如BitFlyer和Coincheck继续占据主导地位。日本金融厅(FSA)实施严格的许可要求,确保只有高度合规的实体才能运营。像KuCoin和Bybit这样的外国交易所曾收到监管警告,这进一步凸显了西方公司在进入日本市场时面临的障碍。

另一方面,Binance通过与泰国大型企业集团Gulf Energy的战略合作成功进入泰国市场。双方成立了合资企业,推出受监管的数字资产交易所。这一合作使Binance获得了泰国证券交易委员会(SEC)的许可批准,既确保了合规性,又借助了Gulf Energy在泰国的深厚商业网络。

通过与具有影响力的本地公司结盟,西方交易所能够找到进入限制性市场的合规且可扩展的路径。这种方式不仅减少了监管摩擦,还能受益于现有的商业网络支持。与其直接与本地强势玩家竞争,西方交易所或许可以通过建立本地合作伙伴关系、专注于机构服务或提供符合区域需求的专业化金融产品,获得更大的成功。

3.2 全球交易所主导市场

越南等国家呈现出截然不同的市场格局。由于缺乏针对加密货币交易所的明确监管,当地交易平台的发展受限。即使存在本地交易所,高额税率也驱使投资者转向全球交易所寻求替代方案。

在这种监管真空下,全球交易所如Binance、OKX和Bybit显著扩大了其影响力。这些平台通过提供低手续费政策和点对点(P2P)服务,成功满足了用户需求,尤其是在本地交易所难以满足的领域中获得了市场份额。

作为市场进入策略,全球交易所积极采用了草根营销手段以快速吸引用户。这些策略包括推出本地化的Telegram社区、提供推荐奖励计划以及增强本地语言支持。这些举措通过与本地用户建立直接沟通渠道,有效提升了市场渗透率。

然而,许多平台通常在缺乏明确监管框架的法律灰色地带运营。然而,随着全球范围内监管趋严,遵守当地法律要求的必要性显著提升。这一变化正促使全球交易所进行重大运营调整。

一些引人注目的案例进一步凸显了这一趋势。例如,2024年1月,印度金融执法机构要求屏蔽包括Binance在内的九家外国交易所的IP地址,直到Binance承诺遵守监管规定后才恢复访问。2023年11月,菲律宾证券交易委员会因未经授权的运营向Binance发出警告,并在2024年3月正式指示屏蔽Binance网站和应用的IP地址。这些行动清楚地表明了日益严格的监管监督。

作为应对,全球交易所正逐步放弃在法律灰色地带运营的模式,转而调整其业务以适应明确的法律框架。合规性已不再是可选项,而是构建可持续、长期运营的关键基础。随着加密货币行业的不断成熟,这一趋势预计将进一步加剧。

4.市场渗透策略

OKX在越南的广告牌 来源:OKX

要在亚洲的加密市场取得成功,需要深度本地化——不仅仅是简单的语言翻译。交易所必须整合本地货币,紧跟区域性资产趋势,并与本地支付系统对接。

在越南,支持越南盾(VND)的点对点(P2P)服务以及战略性户外广告活动帮助中心化交易所(CEX)建立了强大的市场立足点。同样,举办与当地节庆相契合的活动也能提升品牌认知度和市场可见性。

理解用户行为是另一个关键因素。在汇款需求旺盛的经济体(如菲律宾),像Coins.ph这样的平台通过提供基于加密货币的汇款解决方案吸引了大量用户。Coinbase也采取了类似的策略,引入与泰铢和菲律宾比索挂钩的稳定币,以提高法币与加密货币之间的转换便利性。这些量身定制的金融产品解决了本地化需求,推动了零售用户的采用。

最后,与本地金融机构建立战略合作伙伴关系对于建立信任和扩大覆盖范围至关重要。例如,在泰国,与银行的合作促进了法币入金渠道的建立,降低了零售投资者的准入门槛。

要在亚洲复杂且迅速变化的加密市场中有效竞争,西方CEX必须优先考虑监管合规、生态系统合作以及本地化创新。

5.未来展望:合作优于竞争

与其试图取代市场中的主导者,西方CEX或许能通过合作战略获得更大的成功。它们可以选择与本地交易所合作,而非直接竞争——将自己定位为合规盟友或基础设施提供者,与监管机构协调配合。

如今的亚洲既是一个巨大的机会,也是一个巨大的挑战。要在这一市场中取得成功,不仅需要扩大运营规模,更需要对区域市场动态、用户行为以及不断变化的监管框架有深刻的理解。

加密货币的监管正在各国迅速演变,尤其是在亚洲,这一变化尤为迅猛。希望扩张的西方交易所必须采取“合规优先、合作驱动”的策略。对于任何计划进入亚洲市场的CEX来说,最重要的一课是:这不是一个可以征服的市场,而是一个需要融入的市场。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。