编译:深潮TechFlow

随着由@SmokeyTheBera和@codingwithmanny主导的@berachain POL(Proof-of-Liquidity,流动性证明)机制正式上线,这篇文章旨在为读者提供关于POL机制的最全面概述,并探讨其对整个生态系统,尤其是$BERA代币价格的潜在影响。文章内容涵盖了基本机制、发行计划、代币经济模型(Tokenomics)以及吸收最高通胀性奖励来源的策略与技巧。

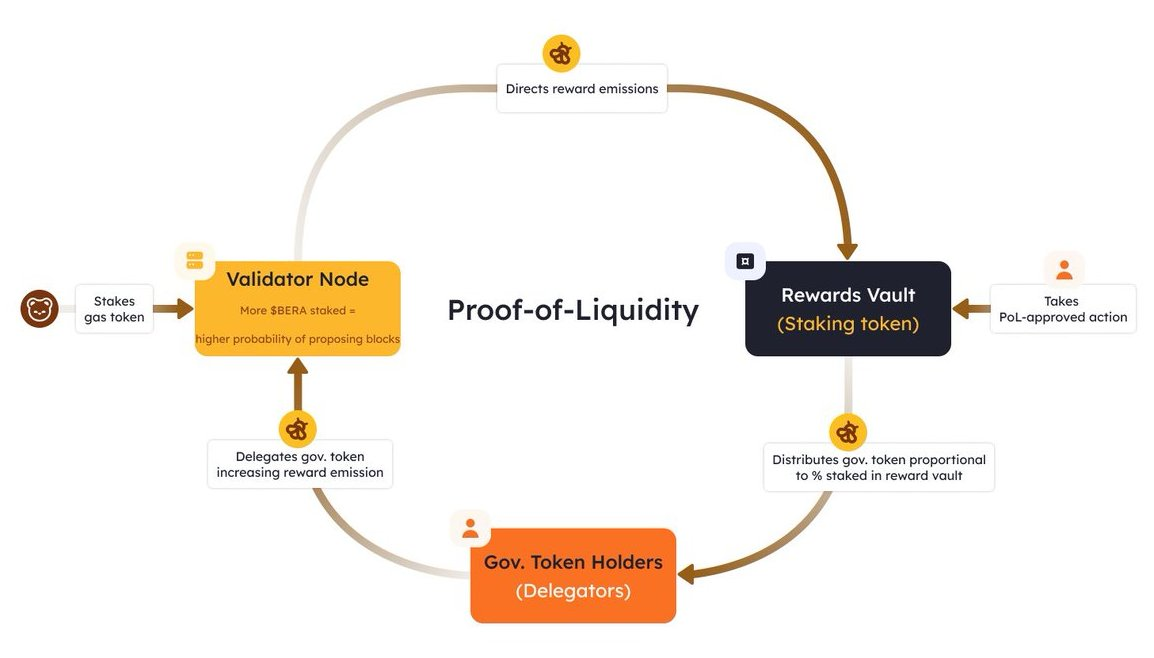

@berachain的流动性证明(Proof-of-Liquidity, PoL)机制旨在解决传统权益证明(Proof-of-Stake, PoS)区块链中存在的共识机制激励不匹配问题。在传统PoS机制中,用户需要锁定资产以换取质押奖励。然而,这种模式导致了激励不匹配,因为在这些区块链上构建的DeFi项目同样需要资产和流动性,从而与PoS机制直接竞争资产使用权。PoL通过重构激励机制,优先激励DeFi活动而非资产锁定,同时增强网络的安全性和去中心化特性。

基本机制

Berachain生态中有两个核心原生资产:$BERA 和 $BGT:

-

$BERA

-

$BERA是生态系统中的燃料费(gas)和质押代币;它负责验证者的选择(详见下文)。

-

-

$BGT

-

$BGT是治理代币(不可转让),可以按1:1比例兑换为$BERA;

-

它还决定了可分配至白名单dApp奖励金库(Reward Vaults)的经济激励或代币发行量。

-

值得注意的是,$BGT可以按1:1比例兑换(或销毁)为$BERA,但$BERA无法再转换回$BGT。

注意:验证者在生产区块时,如果持有更多的$BGT,将获得更高的奖励。然而,验证者是否有资格被选中生产区块以获取这些奖励,则完全取决于其质押的$BERA数量。

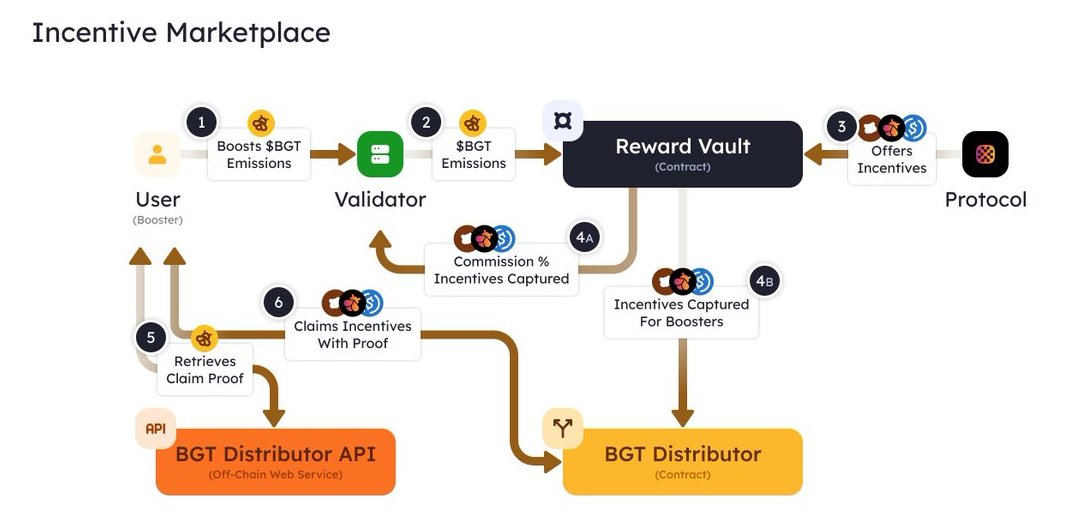

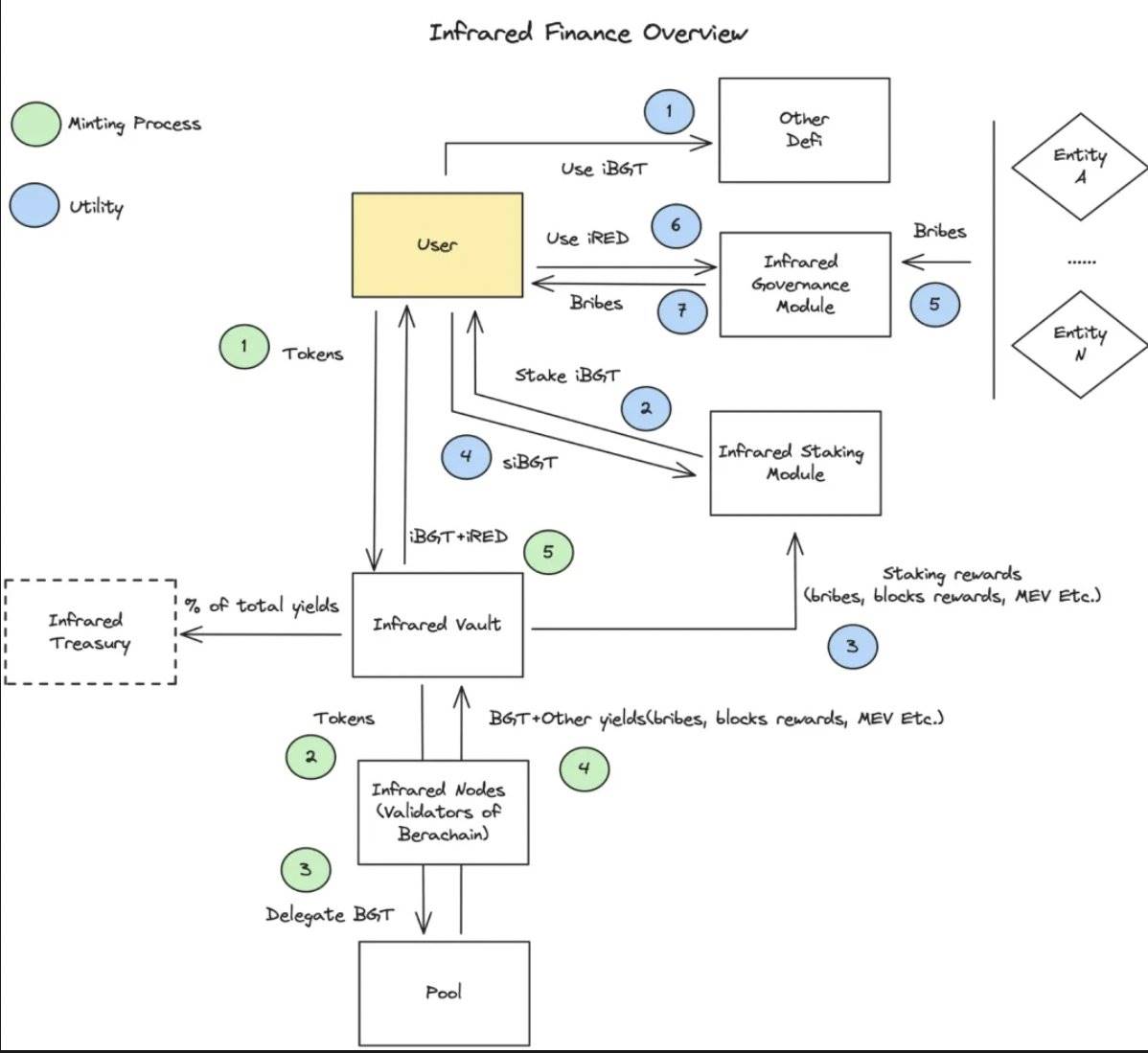

与传统PoS(权益证明)不同,在Berachain中,验证者并非直接通过验证交易获得区块链发放的奖励,也不是由委托者根据其质押份额获得奖励的一部分。在Berachain中,验证者通过$BGT获得奖励($BGT由BlockRewardController合约铸造,并发送至Distributor智能合约)。但验证者必须将大部分$BGT直接分配至白名单dApp的奖励金库(Reward Vaults)。在这种机制下,各协议将通过贿赂验证者来竞争,这些贿赂通常以各种代币(通常是协议的原生代币)形式提供,并根据每1个$BGT的排放量设定不同的激励比率。贿赂越有吸引力,验证者就越有可能将他们的$BGT分配到提供最高贿赂的去中心化应用(dApp)的奖励金库中。

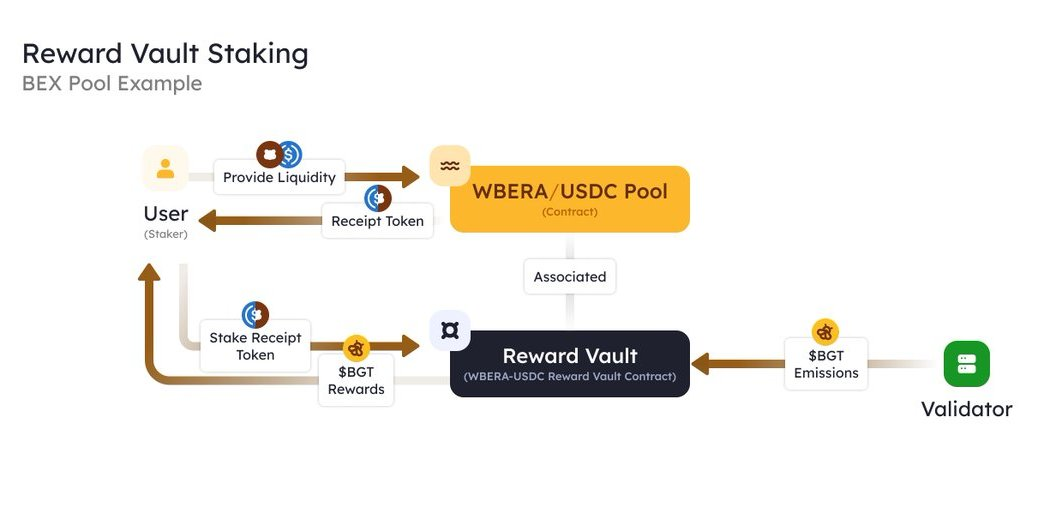

验证者倾向于将$BGT分配给提供最高贿赂的dApp奖励金库。例如,用户可以在原生去中心化交易所(DEX)中为某些流动性池提供流动性以赚取LP费用,然后将LP代币存入特定交易对的奖励金库中,获得额外的$BGT奖励。用户可以选择将获得的$BGT委托给验证者或质押$BERA,从而增加验证者的$BGT排放量。

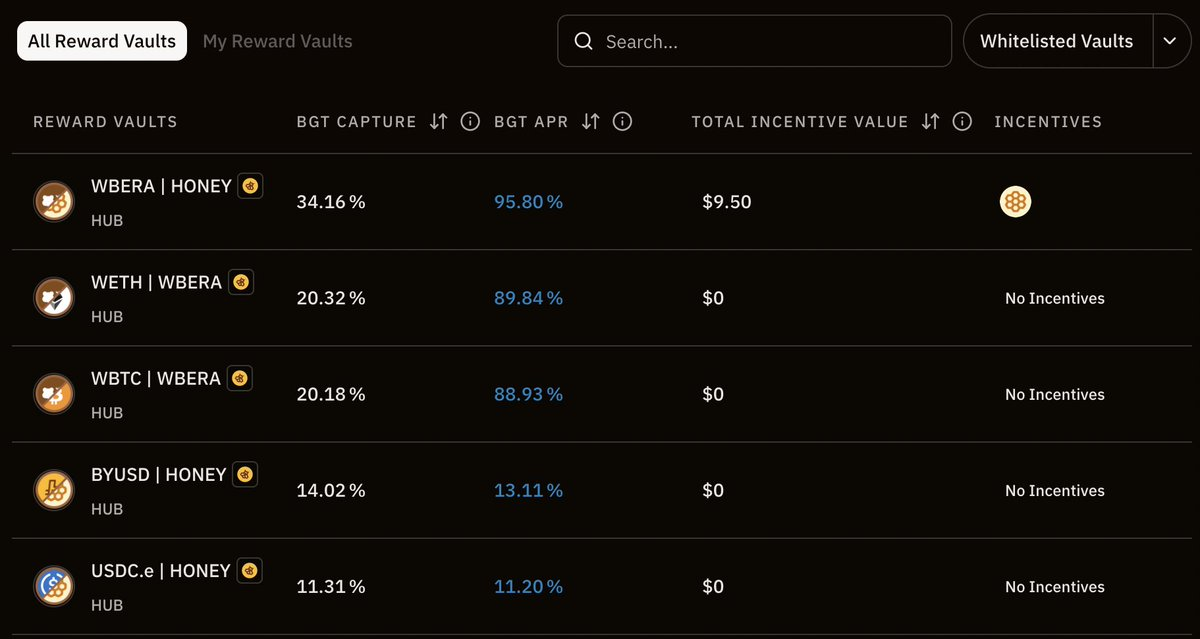

由于POL现在已上线,现有更多的白名单: https://t.co/EC0LUJKGGk

-

$BGT委托:验证者可以主动或被动地根据dApp提供的贿赂金额决定将$BGT排放分配到哪些奖励金库。用户作为委托者,可以根据验证者的策略和预期收益选择委托对象。那些能为委托者带来最高回报的验证者,往往会吸引更多的$BGT委托。

-

$BERA质押:质押者为验证者的自担保(self-bond)贡献力量,因此可以获得验证者赚取的$BGT和$BERA奖励的一部分。

区块生产与$BGT排放机制

验证者选择标准:仅质押$BERA数量排名前69名的验证者有资格参与区块生产(最低质押250,000 $BERA,最高质押10,000,000 $BERA)。区块提议的概率与质押的$BERA数量成正比,但这并不影响分配至奖励金库的$BGT排放量。

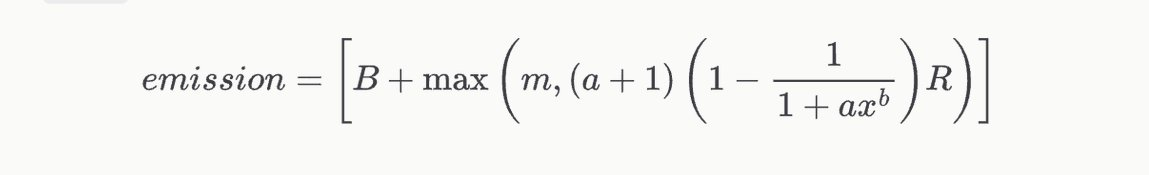

$BGT排放量:这部分很重要,因为$BERA的锁定量取决于公式的设计如何。

$BGT的排放由两部分组成:基础排放(Base Emission)和奖励金库排放(Reward Vault Emission)。基础排放是固定的(当前为每区块0.5 $BGT),直接支付给区块生产验证者。而奖励金库排放则与“激励提升”(boost)密切相关,即验证者的$BGT委托量占全网总委托量的比例。激励提升的权重越大,奖励金库排放的影响也越显著。

简而言之,质押更多$BERA的验证者更有可能被选中生产下一个区块;委托更多$BGT的验证者将获得更多$BGT排放,并将其分配至不同的奖励金库,从而通过奖励金库获得协议提供的更多激励(通常以代币形式)。

在区块生产中,排名前69的验证者通过$BERA质押资格参与区块生产,并将$BGT排放分配至奖励金库。协议通过奖励金库向验证者提供贿赂,验证者再根据佣金率分配奖励,剩余部分则根据每1 $BGT的激励率分配给委托者。奖励金库中的$BGT最终流向为对应流动性池提供流动性的用户。这些用户获得不可转让的$BGT后,可以选择将其委托给验证者以赚取其他协议的贿赂收益,或直接兑换为$BERA以获取即时利润。

PoL上线初期的规模

在Berapalooza 2活动中,仅在RFRV提交的前24小时内,贿赂金额就超过了50万美元。如果这种势头持续并在PoL上线前翻倍,每周贿赂金额可能达到100万美元,这将为Berachain生态系统注入巨额激励。

与此同时,Berachain每年排放54.52M $BGT,约为每周1.05M $BGT。由于1 $BGT可以按1:1比例兑换为$BERA,而$BERA当前价格为8.43美元,这意味着Berachain每年分发价值约880万美元的激励。其中,仅16%的排放直接分配给验证者,其余84%(约740万美元/年)分配至奖励金库。因此,对于每100万美元的贿赂,协议可能获得价值740万美元的$BGT激励,投资回报率极高。

贿赂如何提升资本效率

对于协议而言,这种基于贿赂的模型改变了游戏规则。协议无需花费大量资金吸引流动性,而是通过贿赂机制成倍放大激励效果。

对于用户而言,在PoL上线的最初几周内,这意味着极高的年化收益率(APY)。随着协议竞相吸引流动性,它们将提供更高的$BGT奖励,从而创造出令人难以置信的“农耕”机会。如果你希望最大化收益,现在正是准备、计算并抓住Berachain PoL激励浪潮的最佳时机。

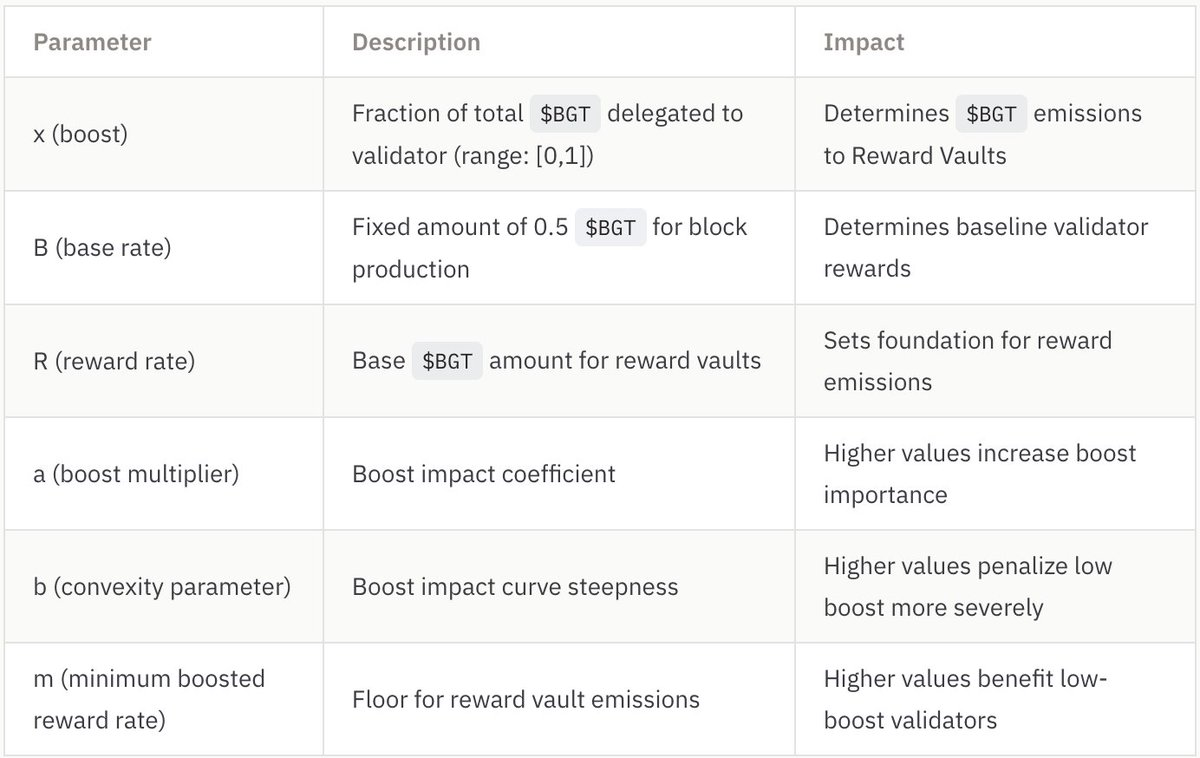

自我驱动的生态飞轮

Berachain的生态系统形成了一个正向反馈循环:更多的$BGT因贿赂而被委托,更多的$BGT激励被用于启动交易对的流动性,吸引更多流动性池资金,降低滑点,促进交易量增长,从而增加平台费用收入。这又进一步吸引更多$BGT排放至对应池,形成一个自我维持的增长飞轮。

Berachain的流动性证明(PoL)机制形成了一个自我强化的循环:

-

更多流动性 → 用户获得更多奖励

-

更多$BGT委托 → 验证者获得更多激励

-

更多验证者激励 → 更高的网络安全性与DeFi生态增长的协同

PoL创造正和经济

与传统质押机制不同,PoL不仅提升了资本效率,还持续扩展了Berachain的经济活动。其运作模式如下:

-

用户提供流动性 → 获得$BGT → 将$BGT委托给验证者;

-

验证者分配排放 → 激励DeFi协议;

-

更多流动性 → 吸引更多用户 → 提供更多奖励 → 循环重复。

为什么这很重要?

-

更多流动性:改善交易条件,降低滑点,深化借贷市场。

-

流动性稳定且增长的区块链更能吸引开发者。

这种飞轮效应确保随着流动性进入生态系统,它能吸引更多用户、开发者和资本,从而增强网络的长期安全性与可持续发展。

Berachain代币经济学的“魔法”

无论各团队如何设计和表述代币经济模型,其核心要点最终都归结为一件事:最大程度地减少抛售压力,优化初期资金积累的过程。这一点可以从两个维度进行解析:

-

通胀性来源(Inflationary Faucets)

-

$BGT部分兑换为$BERA(部分兑换是因为兑换得到的资金由Bera生态系统中其他协议的激励代币补贴)。

-

-

通缩性消耗(Deflationary Sinks)

-

$BERA质押以获得区块生产资格,并增加被选中生产下一区块的概率;

-

$BGT委托给验证者以获取更高收益;

-

$BGT兑换的不可逆性(尤其是在二级市场无法获取$BGT的情况下,这种机制对持有者的抛售形成威慑);

-

通过PoL机制启动更多流动性,降低滑点,促进更高交易量,从而产生更多手续费并进一步增强通缩效应。

-

在传统的PoS(权益证明)质押模型中,验证者的选择和奖励增幅通常由质押的原生代币数量相对于总质押量来决定。而这里使用了一个巧妙的设计:通过将燃气费和安全性质押与治理及经济激励分离,关键在于将经济激励的分配功能赋予一种缺乏流动性的代币。这种设计提高了获取经济激励的门槛(即人们无法简单地通过二级市场获取代币),从而抑制了持有者大规模抛售的动机。

以投票锁仓代币(如$veCRV)为例,但$BERA更进一步——虽然$veCRV可以通过$CRV转换而来,而$CRV可以在二级市场购买,但$BGT却既无法通过二级市场获取,也无法通过$BERA转换而来。这种设计对$BGT持有者形成了更强的抑制效应:如果持有大量$BGT灵魂绑定(soulbound)代币的用户选择抛售大部分代币,那么当他们希望在生态项目获得发展时重新获取经济激励,将面临极高的门槛。他们必须通过为某些交易对的流动性池(与白名单奖励金库关联)提供流动性,才能重新获得$BGT并享受经济激励。

此外,值得关注的是Berachain的双代币分离式PoS模型:验证者必须质押$BERA,但这仅仅决定了他们参与区块生产的资格。因此,验证者需要质押更多的$BERA,以提高生产下一个区块的概率。同时,验证者还需要从协议中获取更多激励代币,用于吸引$BGT委托者,从而争取更多的$BGT委托。这种动态机制能够产生强大的通缩效应,有效吸收由于最初高通胀的$BGT排放计划所带来的巨大抛售压力。原因在于:验证者为了提高生产区块的概率,必须不断质押更多$BERA;而用户为了获得高收益,也需要持有并委托$BGT。

不过,目前能想到的一个致命风险是:如果$BERA的内在价值超过了$BGT的收益,那么$BGT持有者可能会选择排队赎回并抛售$BERA。这一风险的实现取决于一种博弈动态,即$BGT持有者需要判断持有$BGT以获得收益的利润是否高于直接赎回并抛售$BERA的收益。这又进一步依赖于Bera DeFi生态系统的繁荣程度——激励市场越具竞争力,$BGT委托者的收益率就越高,从而降低这种风险的可能性。

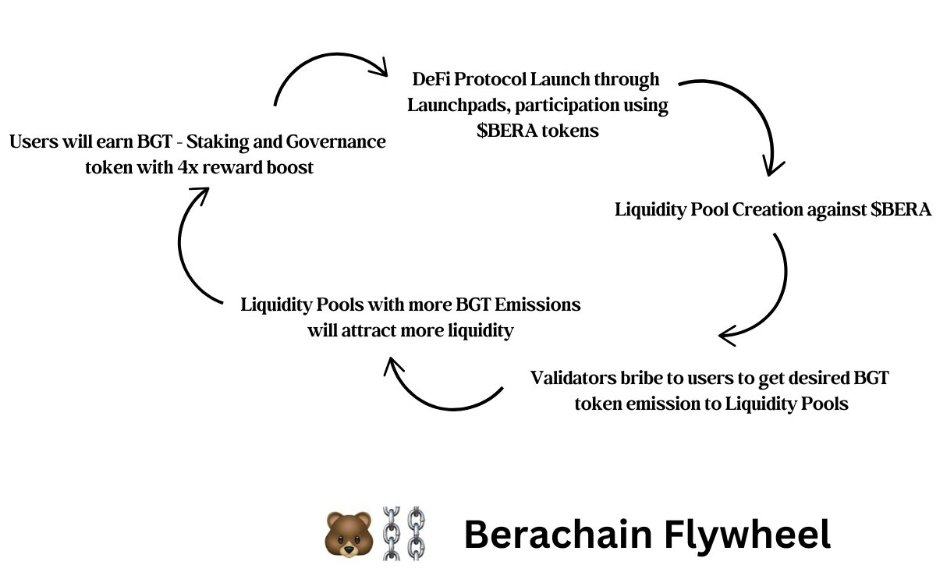

Infrared Finance ——一个拥有超20亿美元 TVL 的领先流动性质押协议

简单来说,它提供了$iBGT和$iBERA,分别是质押$BGT和$BERA的流动版本,使用户在获得质押奖励的同时,仍能保持流动性,用于其他DeFi活动,例如在去中心化交易所(DEX)进行交易或参与借贷市场。

$iBGT 以1:1的比例由$BGT支持,值得注意的是,与$BGT的灵魂绑定(soulbound)性质不同,$iBGT可以直接转移。@InfraredFinance作为验证者运行,允许用户将PoL资产存入金库以赚取$iBGT,该代币可以在Berachain的DeFi生态系统中使用。用户还可以选择进一步质押$iBGT以获得质押版的$iBGT(即$siBGT),从而捕获$BGT的收益。$siBGT可以放大来自$BGT的收益,因为$iBGT持有者选择了流动性而非收益,这种选择会对$siBGT持有者的收益产生倍增效应。同时,$iBGT旨在建立其货币溢价,反映其作为流动性代币的潜在效用。

虽然不想深入探讨生态系统中每个协议的细节,但从Bera的设计中可以看出,它非常以DeFi为核心。自Luna生态系统崩溃以来,@AndreCronjeTech 的@soniclabs与Bera是否能让DeFi重现昔日辉煌,将会是一个值得关注的话题。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。