The decline in token value does not devalue the products being developed by developers.

Author: R48

Translation: Deep Tide TechFlow

If you have opened this article, you may be interested in tokens for venture capital investment. I hope you do not consider the ideas and opinions expressed here as investment advice.

All risks related to buying and selling assets are borne by the readers themselves.

Disclaimer: The "VC tokens" mentioned by the author refer to tokens with a relatively low circulation in the analysis, which are expected to undergo a series of unlocks leading to valuation dilution.

More precisely, it refers to tokens with low circulation/high fully diluted valuation (FDV).

Background

Since the beginning of this year, every ordinary resident of the crypto world has realized the importance of this year, as the growth season has particularly motivated exchanges that are ready to list 3-4 times a week. In fact, everything went smoothly until the market started to adjust.

I divide the stages of greed and disappointment into two time periods:

Greed. November 2023 - March 2024.

Disappointment. March 2024 - July 2024 (we are currently in this stage, with similar emotions).

Greed

The characteristic of the period of greed is that capital continues to flow from one category to another, and almost all assets are rising. Here are some examples of inflated sales:

The overall positivity is supported by $BTC, which gained an ETF in January and surged from 40k to 70k within a few months. Altcoins also flourished, and newly issued tokens received enthusiastic support from speculators and investors, who snapped up every token.

During this period, what the market lacked was liquidity. Funds were so scarce that while one ecosystem was growing, another was lifeless, and once the first was pushed to the limit, liquidity would be redirected to the next, and so on in a cycle.

ETH —> Sol —> Avax or Sui

In terms of categories, there were not many choices:

L2 —> AI —> BTC-fi (and BRC-20) —> Game-fi —> Meme

Although it cannot be said to be cyclical, it can be certain that each category showed growth during these six months.

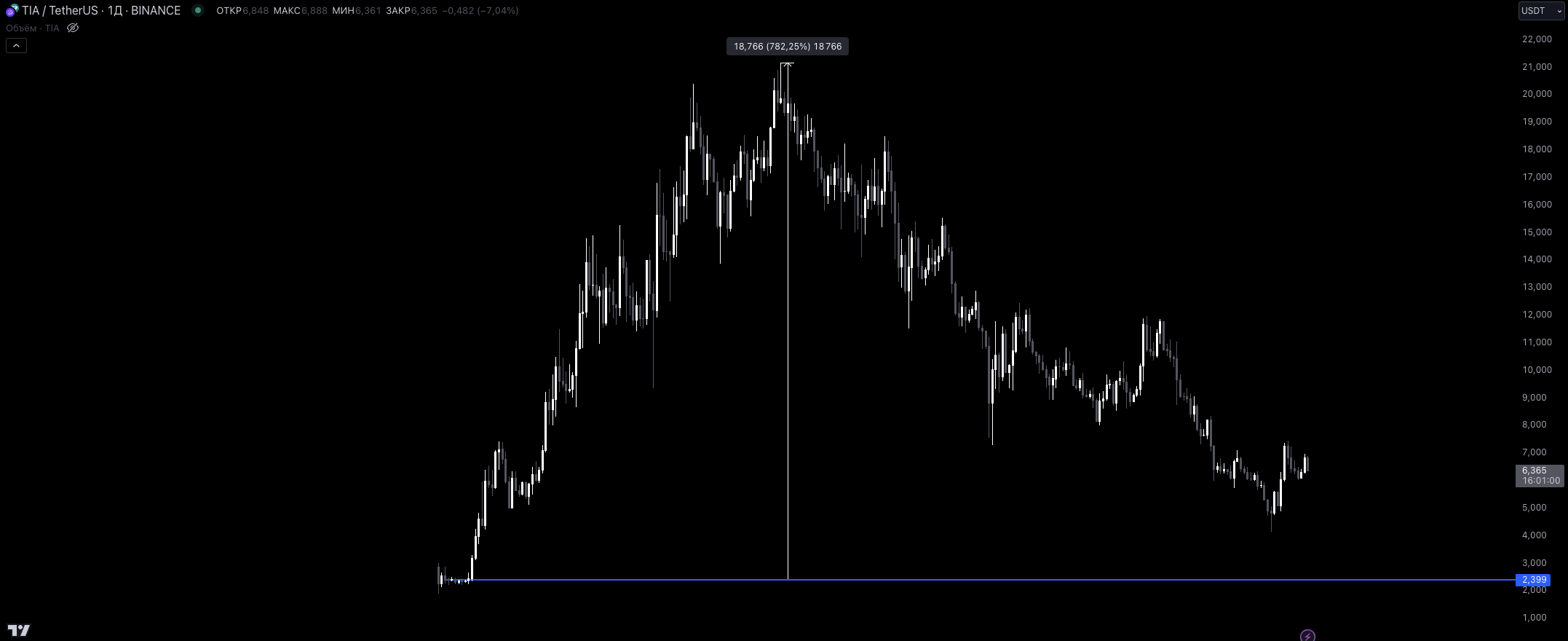

No negative tweets related to FDV were seen, such as $TIA. It had a market value of 200 million USD when listed on Binance, while the FDV was 20 billion USD.

$TIA l 1D l Price Performance

Market makers took full advantage of this, and it was not difficult to sell such charts to the community. So, let's summarize:

— Greed

— Low liquidity

— Performance of major categories (the well-known ones)

Disappointment

The period of disappointment gradually began with the surge of $PEPE in February of this year. At that time, the market was experiencing the second meme season, which was more intense than the previous one. Although the listing on Binance was still relatively good, the growth range of new tokens decreased from 200%-300% to 50%-100%. The idea of buying new "cheap" tokens was still viable, but interest in them gradually began to wane.

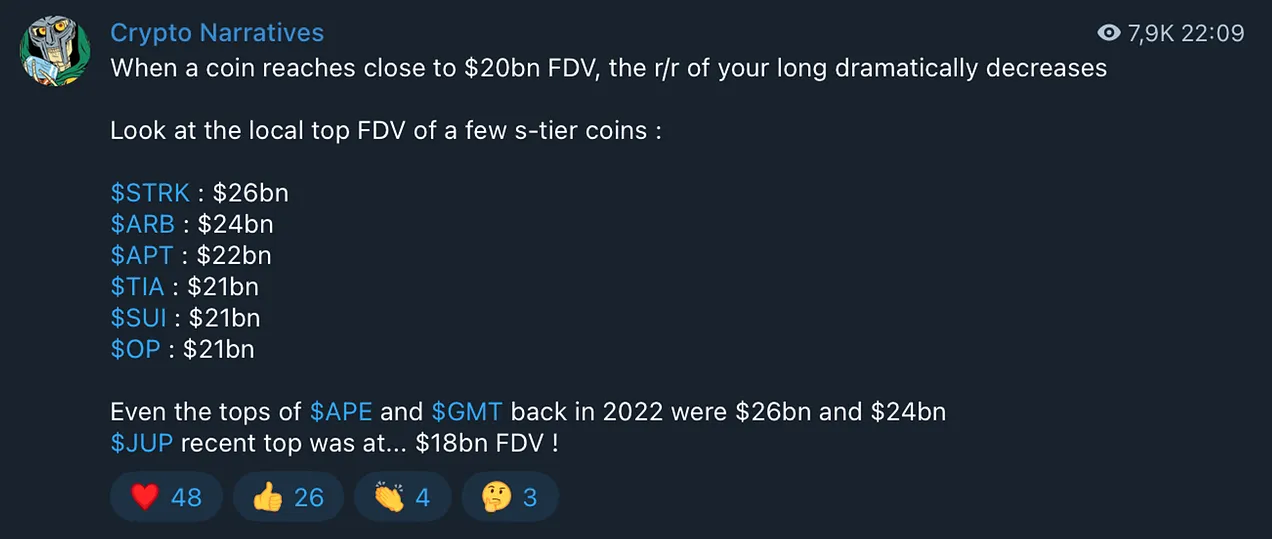

The first sign of an overheated market was the launch of the L2 solution Starknet ($STRK), which raised significant doubts about the prospects of a token ranked in the top 15 of cryptocurrencies by FDV. This raised a simple question: "How much further can it rise from here?"

Source: Viktor's channel

When the market fell into chaos, $BTC decided to test the strength of a new wave of altcoins, and the result was… disastrous. Bitcoin fell by about 15%, while high-tech tokens plummeted by 30%-40%.

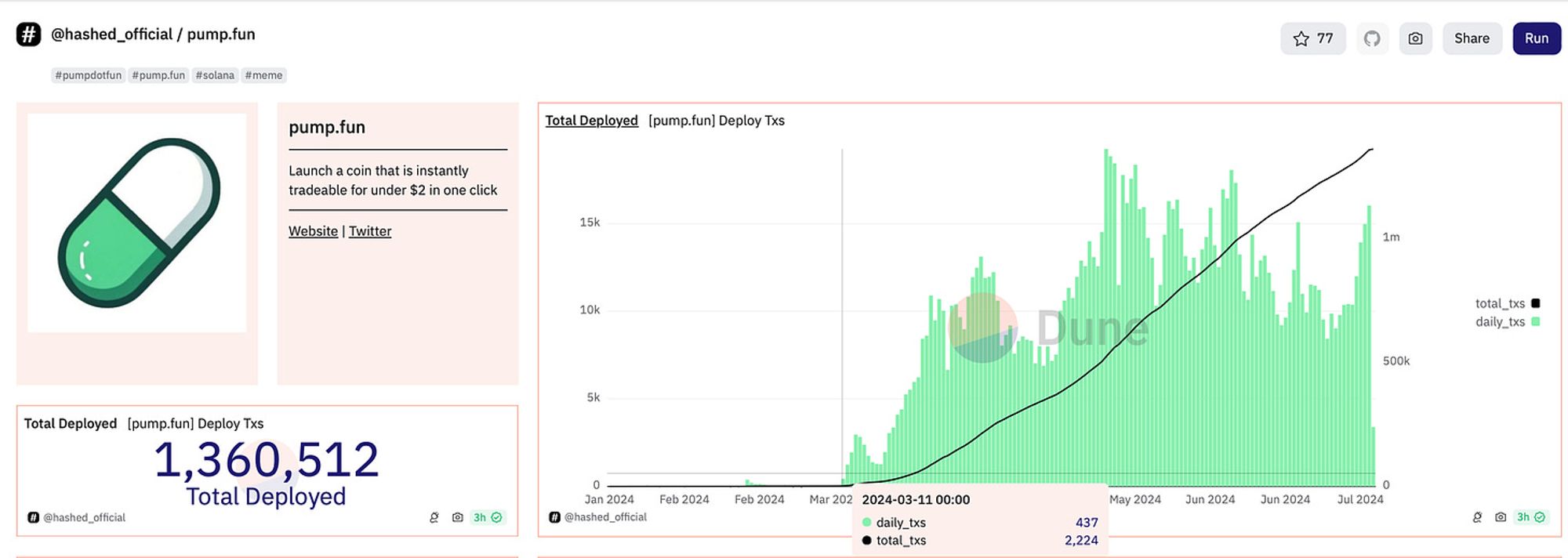

The first sign of weakness in the altcoin market forced users to look for alternatives, and they found them in memes. In my opinion, the revival of the meme season began at the moment when the indicators on pump.fun began to show exponential growth on March 11, 2024. The result of such growth was the successful launch of new meme categories, such as:

WIF, BOME, MEW, MICHI, BRETT, BONK (in no particular order).

Source: Dune

Cryptocurrency traders (CT) clearly saw the accumulation of capital in memes and their strong hold during the decline of Bitcoin and Ethereum. This led to a conclusion: "Where there is attention and funds, there is the greatest profit."

In addition, the impressive results of speculators provided additional support for memes. By weighing each factor and observing the strong rise of memes in the first half of the year, we can now see that every major event in the world has been meme-ified on the Solana blockchain.

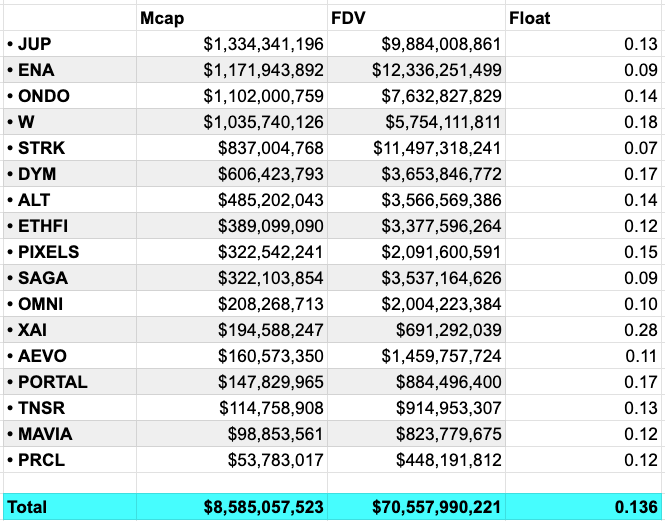

As for tokens funded by venture capital, the situation can be said to be extremely bad. Cryptocurrency traders have come to this conclusion for several reasons:

Concerning market cap/FDV ratio.

Poor token economics (small cliffs, high releases).

High profits for venture capitalists (assuming a startup company is financed with a 50 million USD FDV, but enters the market with 1 billion USD, which is 20 times the pure profit for an average project on a secondary exchange).

Market pressure from airdrop candidates (selling tokens immediately upon receipt).

What do we end up with?

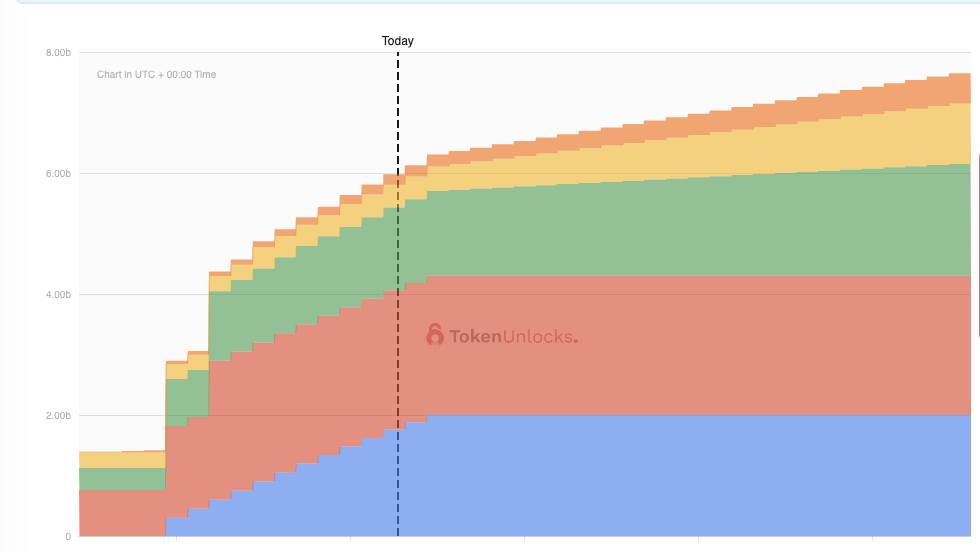

Tokens severely diluted in value, huge multiples for funds, very few tokens in circulation (subsequent unlocks will destroy prices), and huge FDV.

This situation has become worse due to the large number of tokens for these projects. Each project promotes itself as the best solution to solve N problems in cryptocurrencies. This situation was effective last autumn for the following reasons:

Liquidity was not diluted by memes.

Projects were not queued for launch, but were waiting for better conditions.

The disdain for "VC tokens" reached its peak with the rise of Worldcoin ($WLD), as market makers have been accumulating it since its listing. Worldcoin is a project led by Sam Altman, who owns OpenAI (ChatGPT comes from this company). Cryptocurrency traders see $WLD as a bet on the growth of OpenAI and try to use every new update in their trading strategies.

"Fear, uncertainty, and doubt (FUD)" about Worldcoin, source

Only 1.14% of the tokens are available in the market, creating ideal conditions for market manipulation.

Source: Viktor's TG channel

On paper, $WLD is currently ranked among the top ten cryptocurrencies, current.

The arguments about venture capital tokens were consolidated in April, when the altcoin market began experiencing intense sell-offs in the second phase, directly conflicting with the power behind memes from developers/venture capitalists. Although I cannot be sure who won, the influx of users into pump.fun indicates that traders and speculators prefer memes over mundane infrastructure. In addition, the price dynamics of newly listed tokens are dismal, with almost no one willing to buy anything.

Source: X

Summary:

- Behavior of cryptocurrency traders (CT) during the greed stage:

a. FDV is irrelevant; what matters is the hype of the project and the number of tokens at launch (the fewer, the easier to hype).

b. A new token that fits the current narrative (btc-fi, ai, game-fi, social-fi…) is attractive regardless of its token economics (consider Shrapnel).

c. Preference for risk-taking over balanced analysis.

- Behavior of cryptocurrency traders (CT) during the disappointment stage:

a. Listed tokens are not profitable; looking for alternatives, found in memes, as all listed tokens are being traded, 100% belonging to the community, significant cough.

b. Looking for catalysts favorable to the meme sector (FDV/low circulation).

c. Disappointment with infrastructure tokens is not due to their technical complexity, but due to lack of liquidity. It's difficult to sell something that's falling to the community.

This provides a rough background of the past 7-8 months. My main question is: "How strong is the argument that new tokens will not recover and show their performance?"

What happened in the previous cycle?

For a strong analysis, I believe we need to review history and assess the overall background of the development of altcoins. The more data I collect, the richer the article becomes.

Listings

I often hear the claim: "Binance has now listed many projects, significantly diluting liquidity, which did not exist before."

Initially, I thought this argument made sense and did not need further analysis.

However, I decided to independently analyze the number of tokens launched on Binance, and the results surprised me.

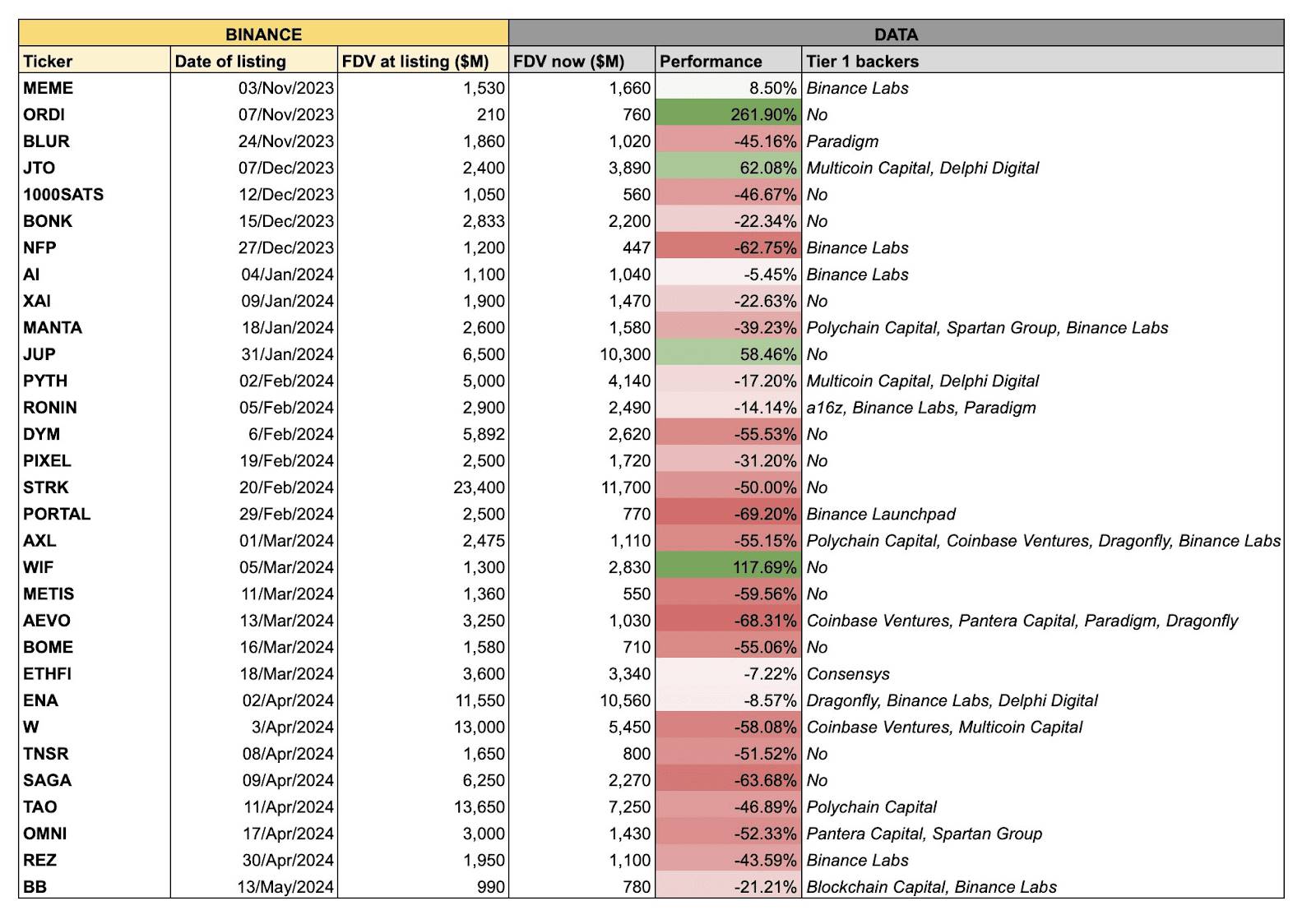

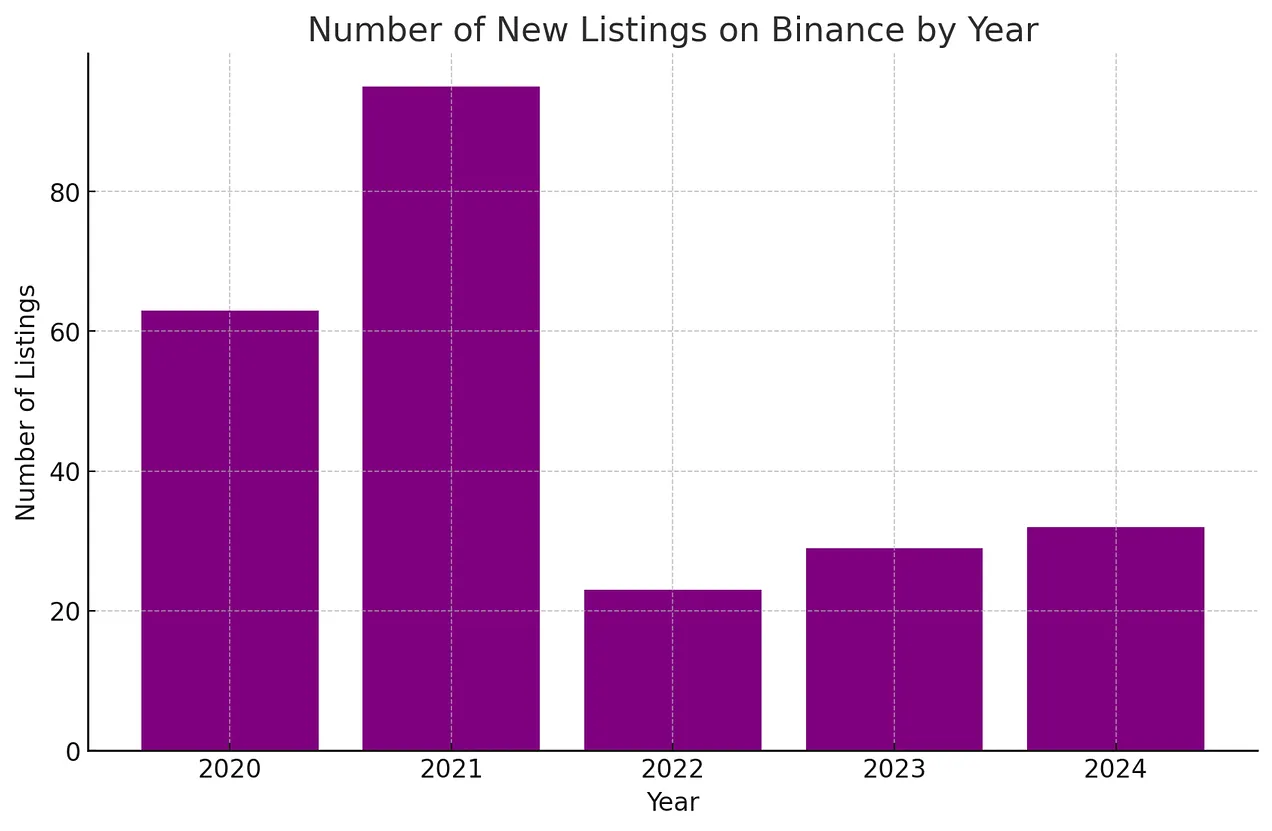

Created by ChatGPT

Preliminary calculations allow for a deviation of 2-3 points in either direction, which is an acceptable level of accuracy.

After some thought, I concluded that the above argument stems from the author remembering 5-10 projects that survived and performed well in the bear market.

However, in reality, many projects were launched, hyped, and then shrunk. Due to the short lifecycle of tokens, their memory fades over time, known as "survivorship bias," while projects that achieve product-market fit (PMF) and maintain demand are remembered.

Try to think, do you remember any tokens from 2020-2021? For me, I think of SOL, AVAX, FTM, UNI, LDO. However, there are actually more than ten times as many tokens; either they did not achieve PMF or quickly shrank.

Based on this information, we cannot say the previous cycle was made up of N successful projects.

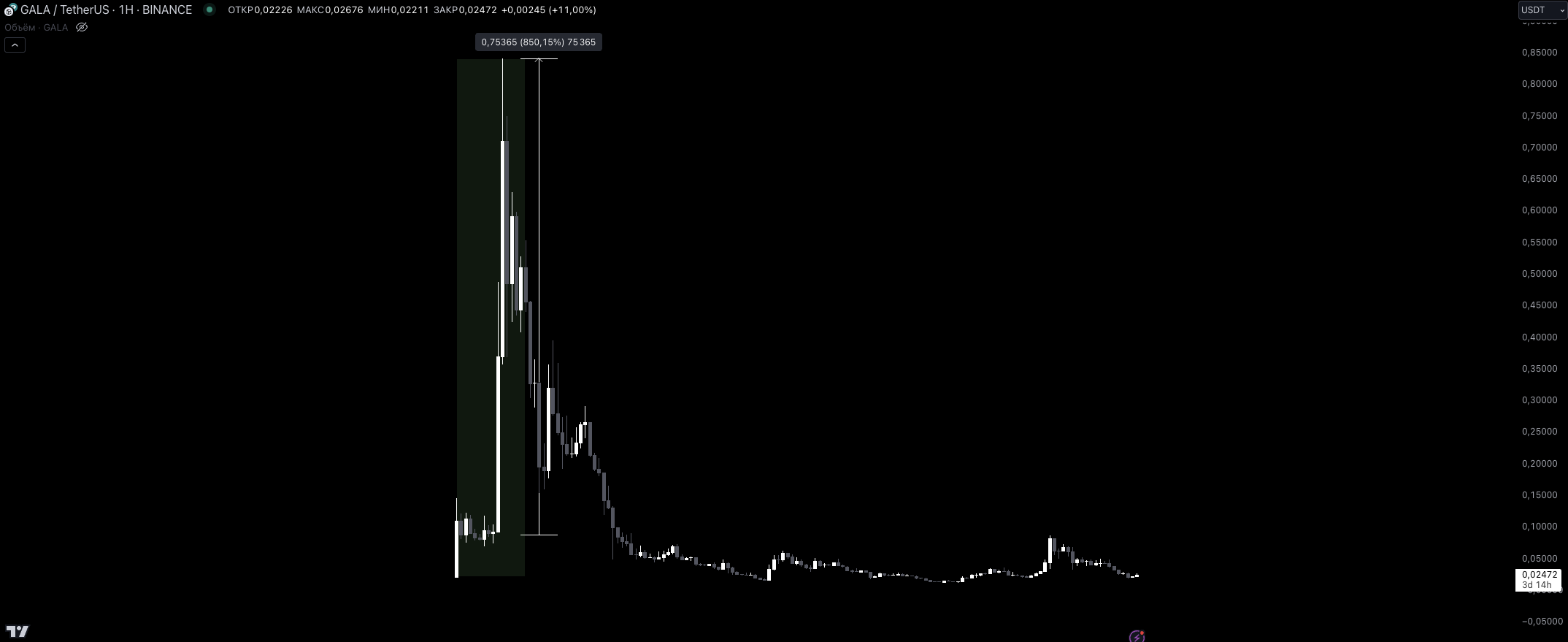

Here are some examples of tokens from the previous cycle:

More examples are as follows:

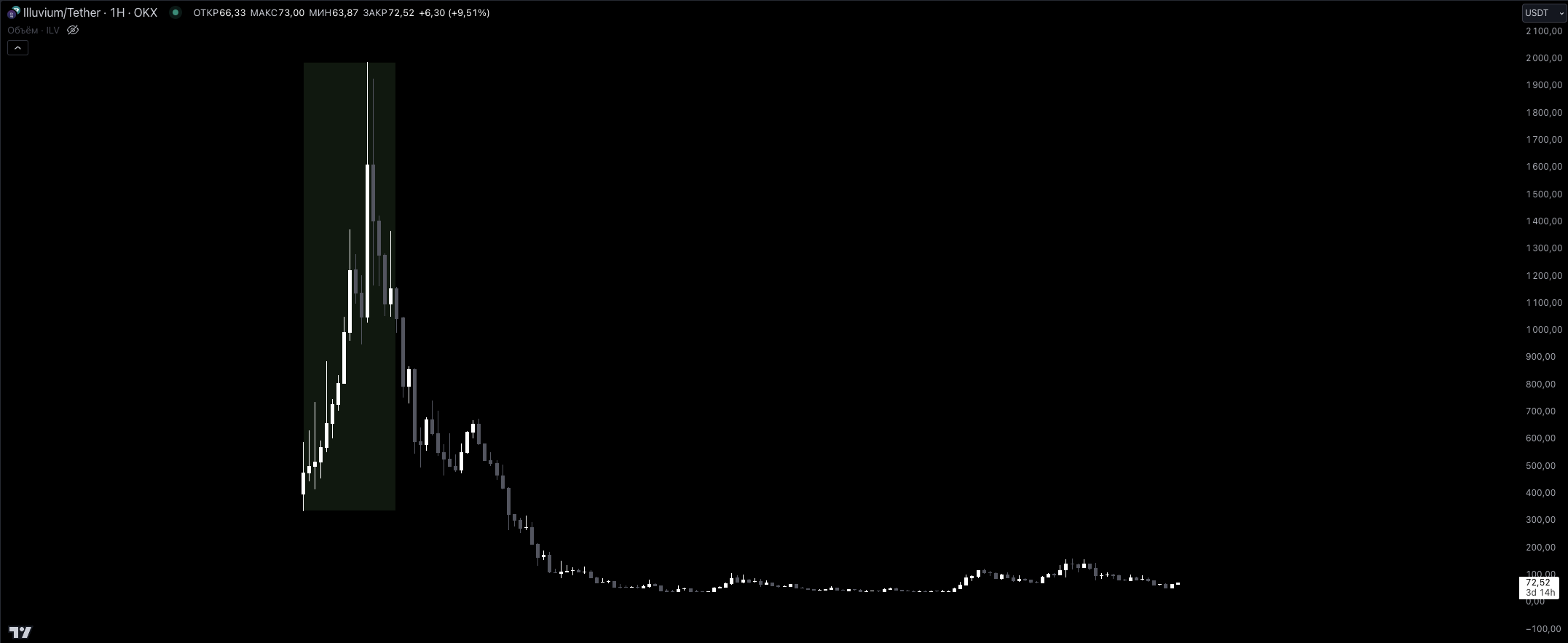

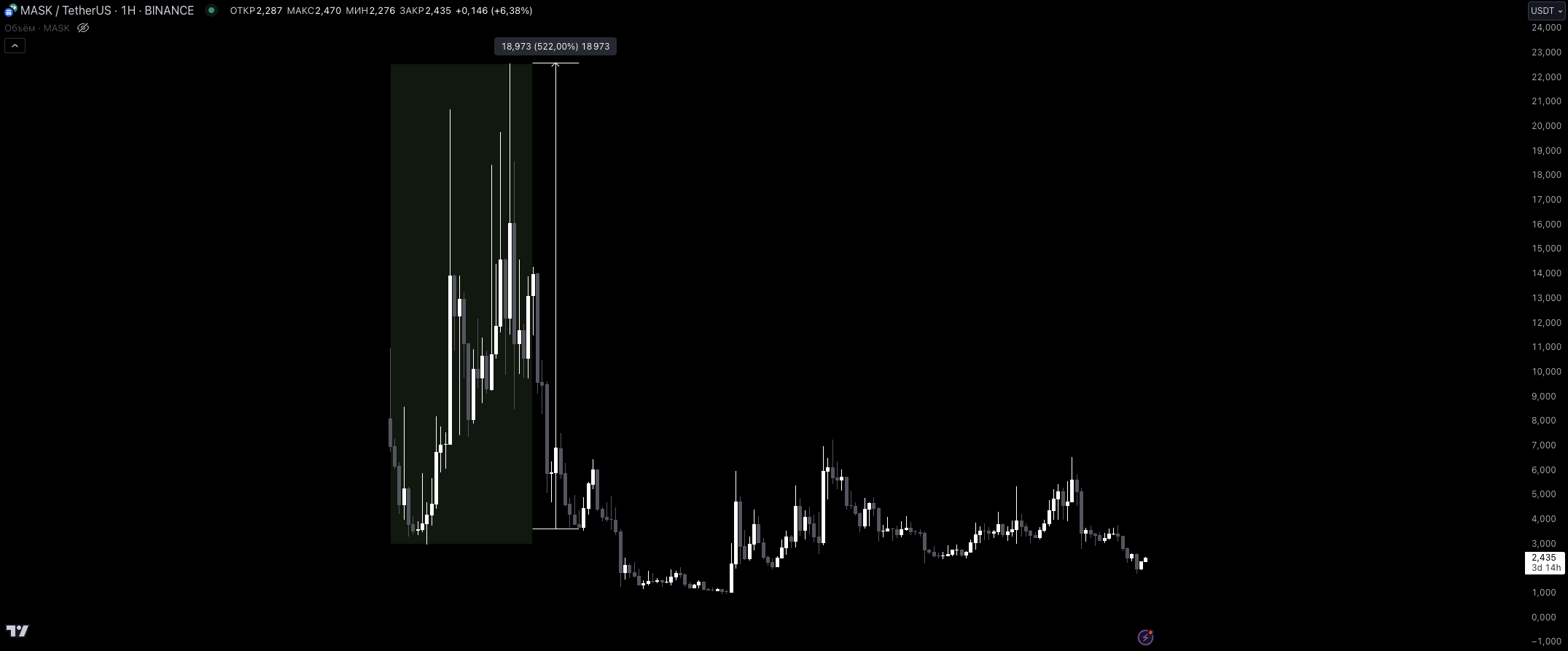

- $ALICE, $SKL, $ROSE, $AKRO, $AUDIO, $ORN, $ILV, $MASK.

You can check the charts of these projects yourself.

I have a question for you: Have you heard of these projects? Are you currently using any of them?

Bear markets tend to weed out weak products or tokens with poor token economics, but every token has a chance to prove itself during a bull market. Among these projects, some are infrastructure, and some are applications.

You might ask, what about the number of tokens in the market?

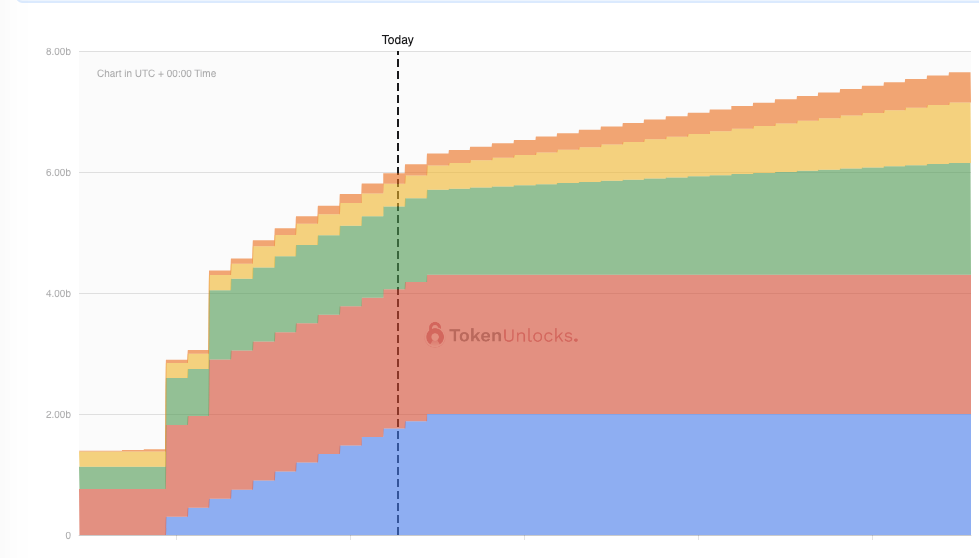

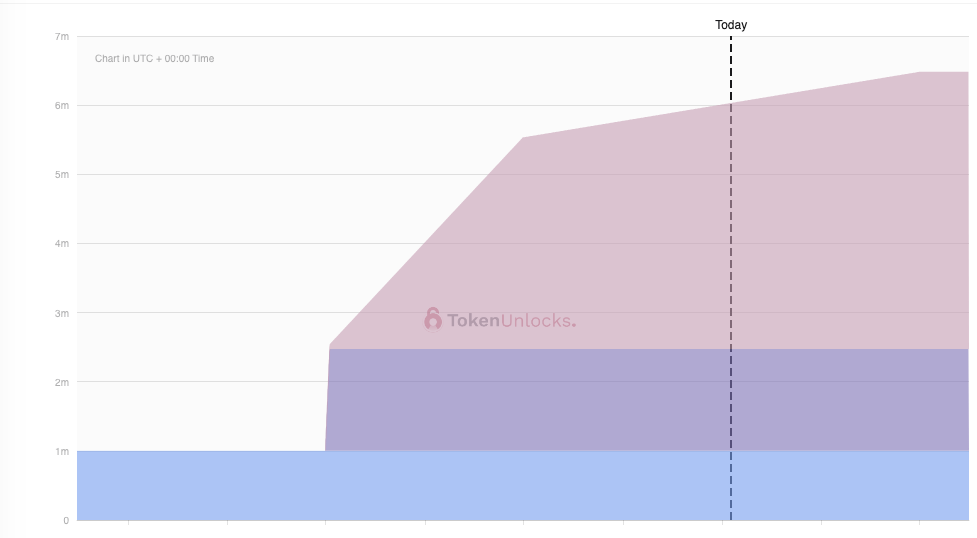

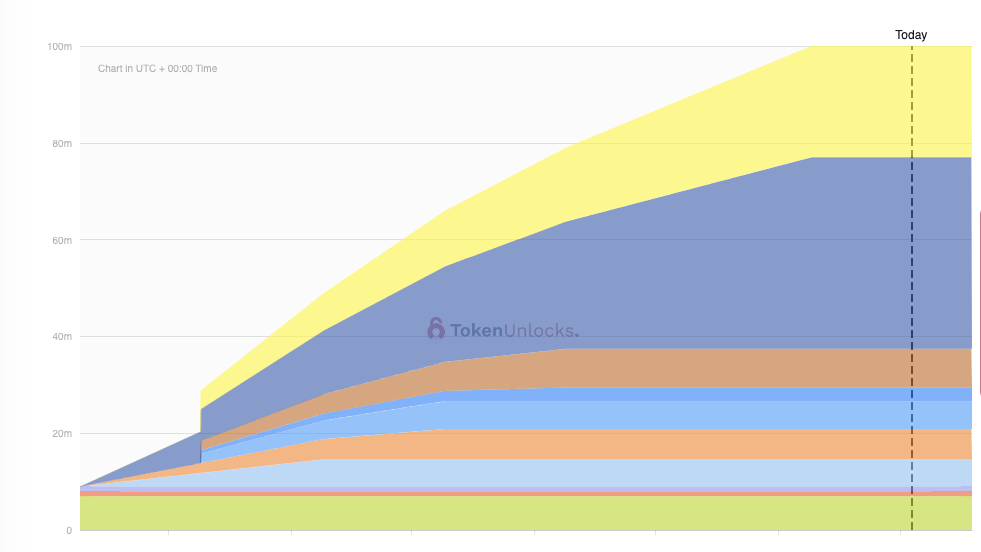

These projects received strong support from venture capitalists, and it was evident at their launch that they had low circulation/high FDV. However, this did not prevent them from showing multiples growth when investors and teams unlocked tokens from TGE (token generation event).

Conclusion

Low circulation/high FDV is part of the lifecycle of any altcoin in search of Product Market Fit (PMF). The current market's better point is that most investors have a one-year cliff, followed by a two-year unlock period.

The survivorship bias of projects compared to those that did not achieve PMF is not a valid argument.

Comparing after Binance listings, a simple conclusion can be drawn: Binance is becoming more cautious with projects (although the effect from March to July is not significant), and listing tier-one (2) projects, as well as projects incubated by themselves.

Where are we now, and what's next?

First, I want to point out that we haven't even deviated 1% in the cycle of new tokens. Here are some comparisons:

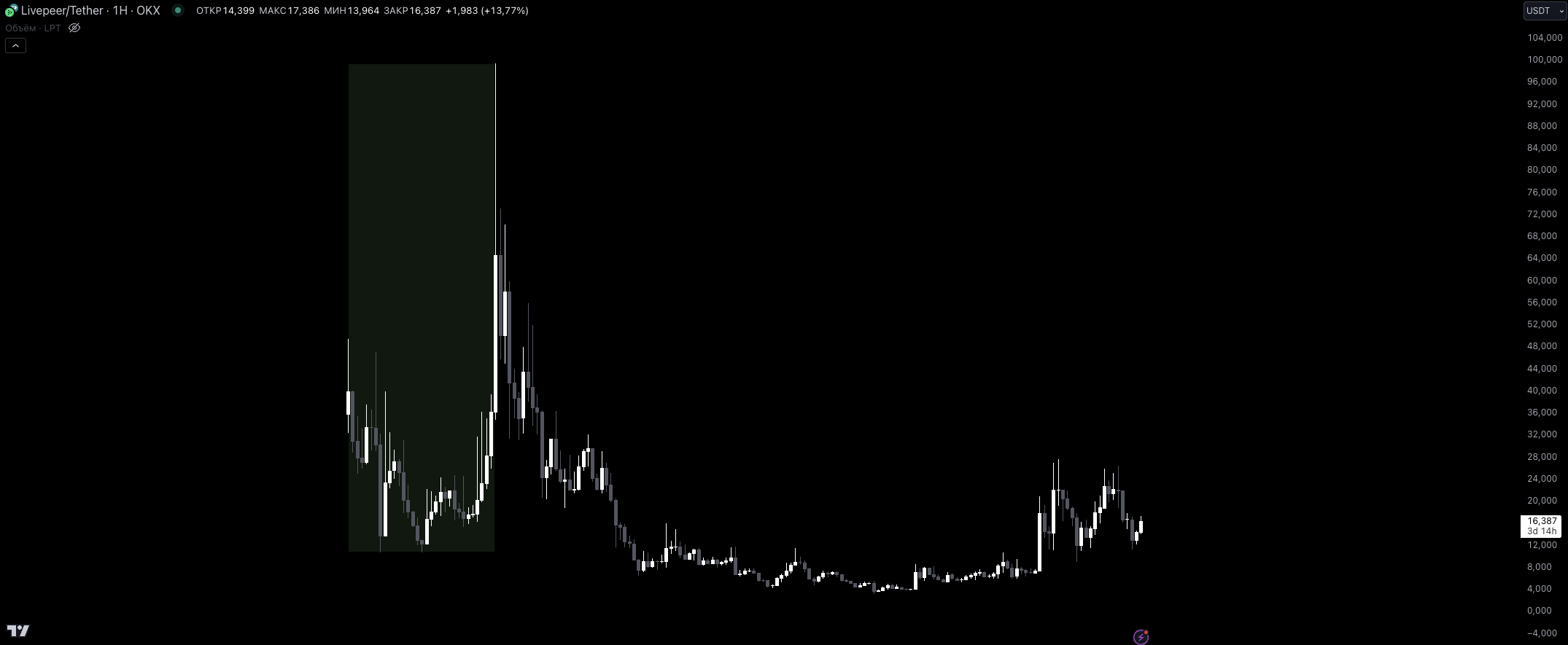

$UNI, -50% and -79%. See Trading view chart.

$SOL, -68% and -79%. See Trading view chart.

$NEAR, -59%. See Trading view chart.

Price performance since the TGE event.

Based on these charts, if a token has dropped by about 50%, is it a bad idea to buy $UNI? Or to buy $SOL, which has dropped by about 70%?

Argument: A token's decline does not devalue the product the developers are building.

In my view, tokens are a necessary means of attracting attention. Product growth in the crypto space happens through the following avenues:

Token price increase. The community begins to question whether the token's growth is related to the uniqueness of the product. What narrative is driving the token?

Possible retroactive reward operations.

Endorsement = promotion of the product by influencers (important). Again, it must have a monetization element.

In a weaker market environment, short-term declines are normal for both weak and strong projects.

About current projects?

I want to point out that I could be wrong, and that's normal. There will always be a portion of projects launched for the purpose of cashing out (e.g., $SAGA, no line of blockchain code). Therefore, before determining the future price trend of new tokens, I want to add some filters:

Simple, clear, ordinary (app user) products.

Wide user base, application not dependent on the token.

Strong team, ecosystem, investors.

Alignment of the token with the narrative.

I'm not saying that every token released in 2023-2024 will perform strongly. Although it's possible in a high market liquidity, I don't like to spread funds across boring and complex protocols (have made mistakes in overestimating projects like $NGL, $MASA, and other junk).

Let's assume a token list and briefly analyze them:

ZRO (LayerZero) — Infrastructure for transferring funds between one blockchain and another. Cheap, fast, efficient. Brian earned >50 million in protocol operations over two years, no token.

$ZK (zkSync) — An L2 solution aimed at scaling the Ethereum ecosystem. zk technology ensures secure and fast transactions. For more information about zk, please refer to this and Vitalik's thoughts. Top-tier team and ecosystem, you can evaluate metrics here.

$OP (Optimism) — Also an L2, but using a different transaction processing method optimistic rollups. Based on OpStack, the Coinbase team has launched their own L2 blockchain — Base, currently ranking in the top three of all launched rollups.

Some may argue that these tokens are useless, they have no utility, no one needs them, and so on. The cycle of 2020-2021 shows that none of these are important until greed gives way to disappointment. In turn, I want to say that we haven't even reached greed yet, in my humble opinion, the situation from autumn to spring of 2023-2024 is just a beginning.

Let this tweet support my point.

Here are some considerations for TA (technical analysis):

German coin shortage

Mt. Gox compensation in progress

FTX repaying $16 billion to crypto users

70% probability of a crypto-friendly president being elected

Vice president is a crypto-friendly millennial

Global liquidity cycle just beginning

Inflation rapidly cooling down

September rate cut almost certain

Stock market continues to rise

AI speculation driving a major bull market in the economy

BTC ETF becomes the most successful ETF in history

ETH ETF to be launched next week

Trump to speak at a Bitcoin conference next week

Solana ETF application pending

Larry Fink endorsing Bitcoin as "digital gold"

Cryptocurrency becoming a bipartisan issue

Source: X

I don't know how much my or your investment portfolio will grow, the purpose of this article is to compare and analyze altcoins in this cycle and the previous cycle. Additionally, to analyze the trend of meme coins.

To me, it doesn't matter who is right, what matters is who made money and who didn't.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。