To reduce the staking rate of ETH, Ethereum's monetary policy may be adjusted.

Written by: Christine Kim, Vice President of Galaxy Research

Translated by: Luffy, Foresight News

This report comprehensively outlines the operation of staking, staking on Ethereum, and important considerations for stakeholders participating in staking. This is the first part of the staking series (out of three parts), which will delve into the risks and rewards of various staking activities, including restaking and liquidity restaking. The second report will outline the operation of restaking on Ethereum and Cosmos, as well as the important risks associated with restaking.

Introduction

Ethereum is the largest proof-of-stake (PoS) blockchain by total staked value. As of July 15, 2024, ETH holders have staked over $111 billion worth of ETH, accounting for 28% of the total ETH supply. The staked amount of ETH is also referred to as Ethereum's "security budget" because stakers may be penalized by the network in the event of double-spending attacks and other protocol violations. As a reward for maintaining Ethereum's security, stakers can earn rewards through protocol issuance, priority fees, and maximum extractable value (MEV). Users can easily stake ETH through a liquid staking pool without sacrificing the liquidity of their assets, leading to a demand for staking beyond the expectations of Ethereum developers. Based on the current staking status, developers anticipate further growth in the staking rate of ETH in the coming years. To mitigate this trend, developers are considering significant changes to the protocol's issuance policy.

This report will outline the staking situation on Ethereum, including the types of stakers on Ethereum, the risks and rewards of staking, and the prediction of the staking rate. The report will also provide insights into the proposals by developers to change the network issuance to suppress staking demand.

Types of Stakers

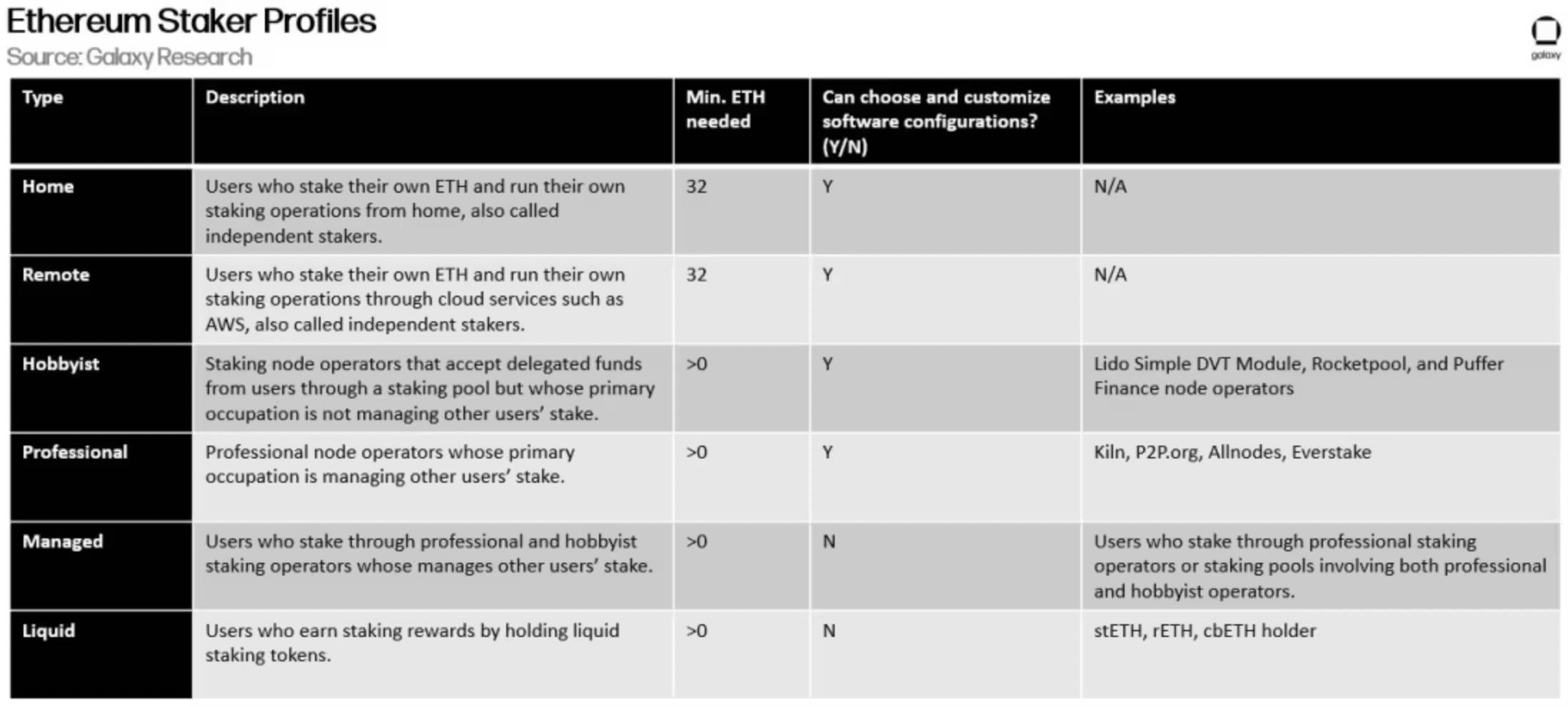

There are six main types of Ethereum users who can earn rewards through staking. The table below details their respective profiles:

Among these stakers, the most numerous are custodial stakers, who are stakers that delegate their ETH to professional staking node operators. While the number of professional operators is small, they manage the most staked ETH among staking entity types.

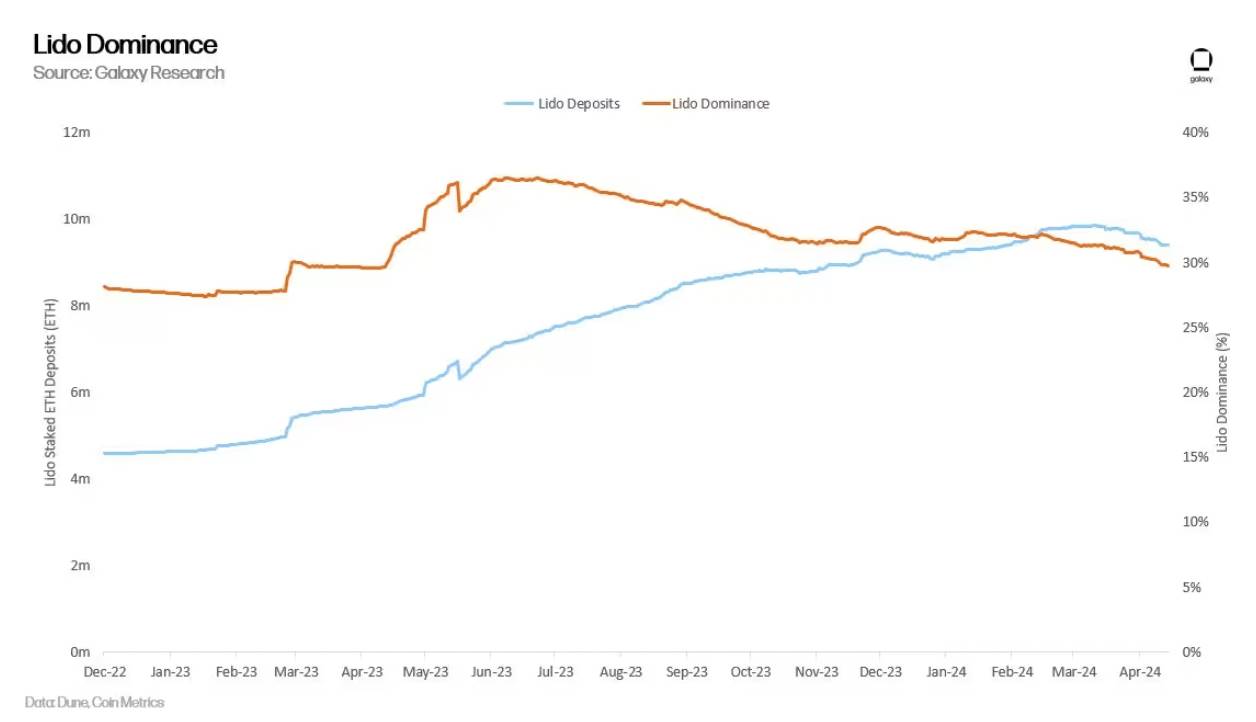

Liquidity staking, restaking, and liquidity restaking pool protocols are not considered in this analysis, as these entities do not directly operate staking infrastructure or provide funding for its use. However, these entities do receive a certain percentage of rewards from stakers using their platforms; they act as intermediary entities that facilitate the relationship between custodial stakers and professional (or amateur) stakers, making them important participants in the Ethereum staking ecosystem. Lido is a liquidity staking protocol and is the largest staking pool operator on Ethereum to date, accounting for 29% of the staked ETH. Given the adoption and critical role of liquidity staking pools on Ethereum, understanding the risks of liquidity staking is crucial.

The next part of this report will delve into the risks of staking based on the technical and entity used to earn staking rewards.

Staking Risks

The risks associated with staking largely depend on the method and technology of staking. The following are the three main categories defining staking methods and their associated risks:

Direct staking: Users or entities directly operate their proprietary staking hardware and software. Risks of directly staking ETH include staking penalties and slashing risks. Staking penalties due to reasons such as prolonged machine downtime may result in users losing a portion of their staking rewards; additionally, slashing events due to reasons such as misconfiguration of validator software may lead to users losing a portion of their staked ETH balance, up to a maximum of 1 ETH.

Delegated staking: Users or entities delegate their ETH to professional or amateur stakers for staking. Risks of delegated staking include all the risks of direct staking, as well as counterparty risks, as the entity to which you delegate staking may not fulfill its responsibilities or obligations. ETH holders can delegate their ETH to trust-minimized staking service providers, such as entities controlled by smart contract code, but this introduces additional technical risks as the code may contain vulnerabilities or the system may be susceptible to hacking.

Liquidity staking: Users or entities delegate their staking to professional or amateur stakers and receive liquidity tokens representing their staked ETH in return. Risks of liquidity staking include all the risks of direct staking and delegated staking. Additionally, due to market fluctuations and delays in validators entering or exiting, liquidity risks may lead to uncoupling events, where the value of liquidity staking tokens significantly deviates from the value of the underlying staked assets.

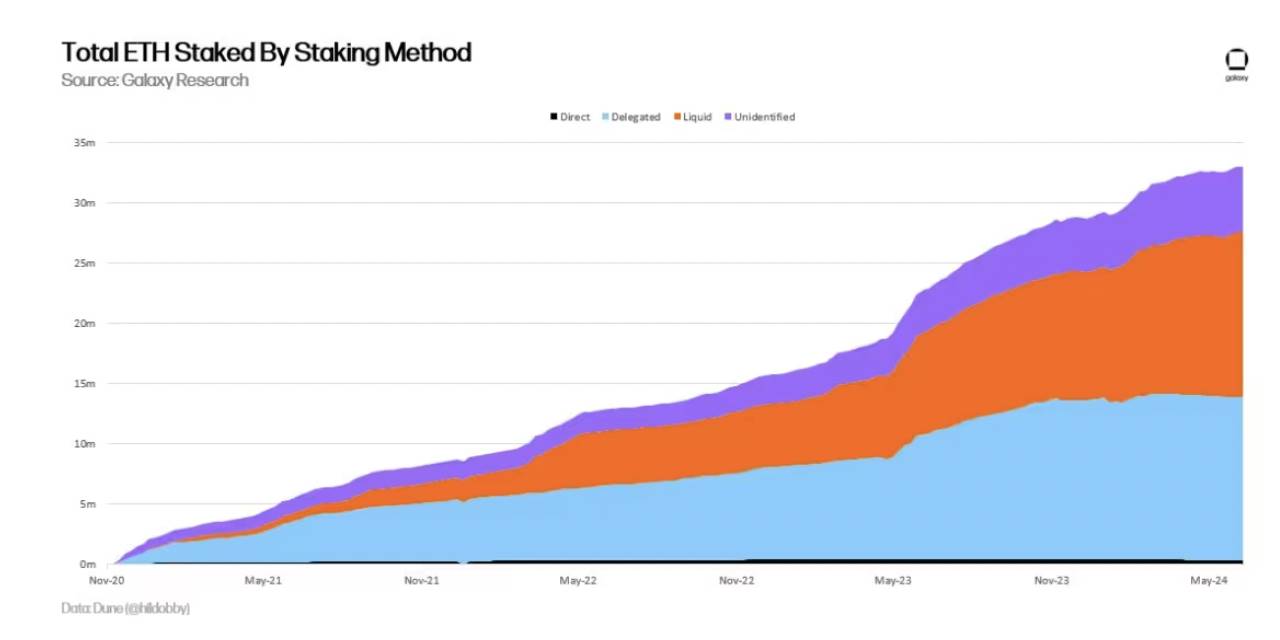

Total amount of ETH staked using the three different staking methods

Another risk to note with these three staking methods is regulatory risk. The further ETH holders are from their staked assets, the greater the regulatory risk of staking activities. Delegated staking and liquidity staking require ETH holders to rely on different types of intermediary entities. In the eyes of legislators and regulators, these entities may need to comply with certain rules and regulatory frameworks to operate, depending on their structure and business model.

In addition to regulatory risk, it is important to detail the protocol risks associated with these three types of staking activities. Protocol risks stem from the network being able to penalize users who intentionally or unintentionally fail to meet the standards and rules of the Ethereum consensus protocol. Penalties primarily come in three types, listed below in order of severity:

Offline penalties: Penalties incurred when a node is offline and fails to fulfill its duties (e.g., proposing blocks or signing block attestations). Generally, validators are penalized only a few dollars per day.

Initial slashing penalties: Penalties incurred when a validator's behavior violating network rules is detected by other validators. The most common example is if a validator proposes two blocks for a slot or signs two attestations for the same block. Penalties range from 0.5 ETH to 1 ETH, depending on the validator's effective balance, with the current maximum being 32 ETH. Protocol developers are currently considering increasing the maximum effective balance of validators to 2048 ETH and reducing initial slashing penalties in the next network-wide upgrade, Pectra.

Related slashing penalties: After an initial slashing event, validators may face a second penalty based on the amount of staked ETH slashed within 18 days before and after the slashing event. The motivation for related penalties is to penalize validators based on the amount of staked ETH they manage after violating network rules. Related penalties are calculated based on the effective balance, total balance, and proportionate slashing multiplier of malicious validators.

In addition to the above three penalties, special penalties can be imposed on validators if the network fails to achieve finality. (For a detailed overview of Ethereum finality, please refer to this Galaxy Research report) When the network fails to achieve finality, it imposes more severe penalties on offline validators. By gradually burning the staked shares of validators who have not contributed to network consensus, the network can rebalance the validator set to achieve finality. The longer the network fails to achieve finality, the greater the severity of the penalties.

Staking Rewards

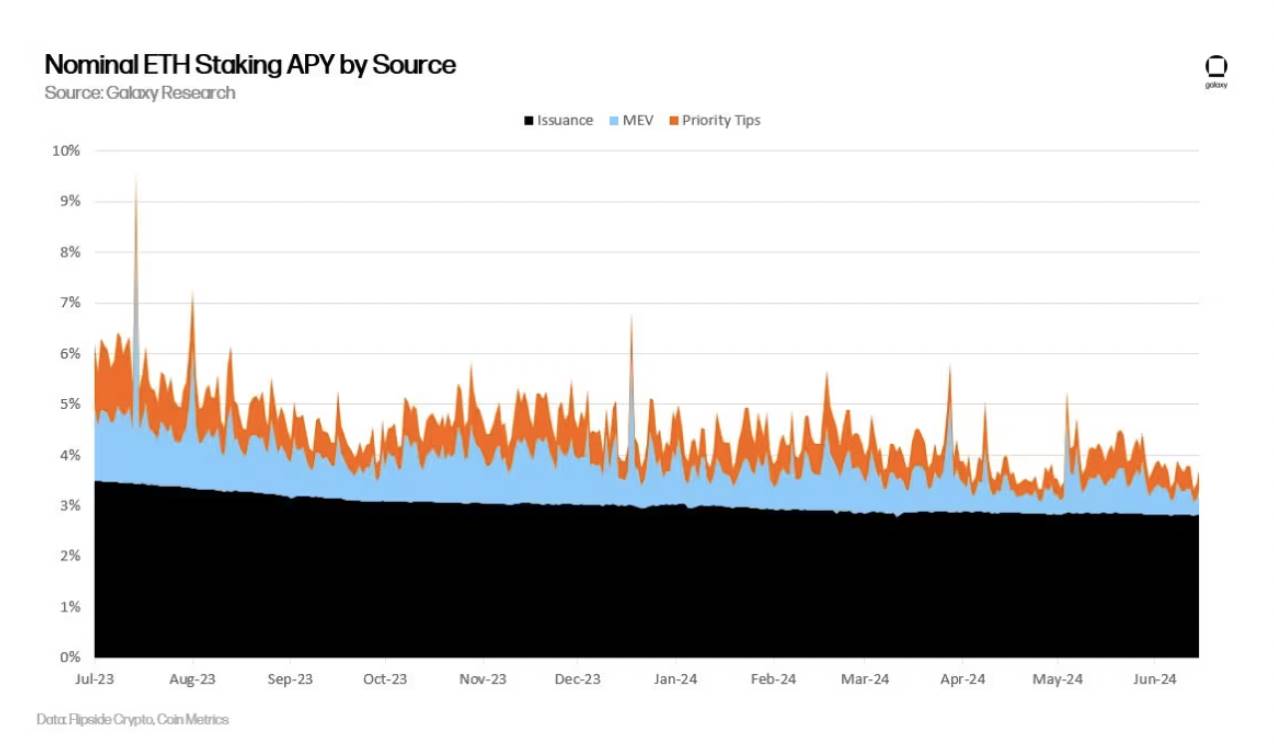

Of course, while stakers bear risks, they can also earn approximately a 4% annualized return from staking ETH. These rewards come from new ETH issuance, priority fees attached by Ethereum users in their transactions, and MEV.

Nominal staking yield of ETH

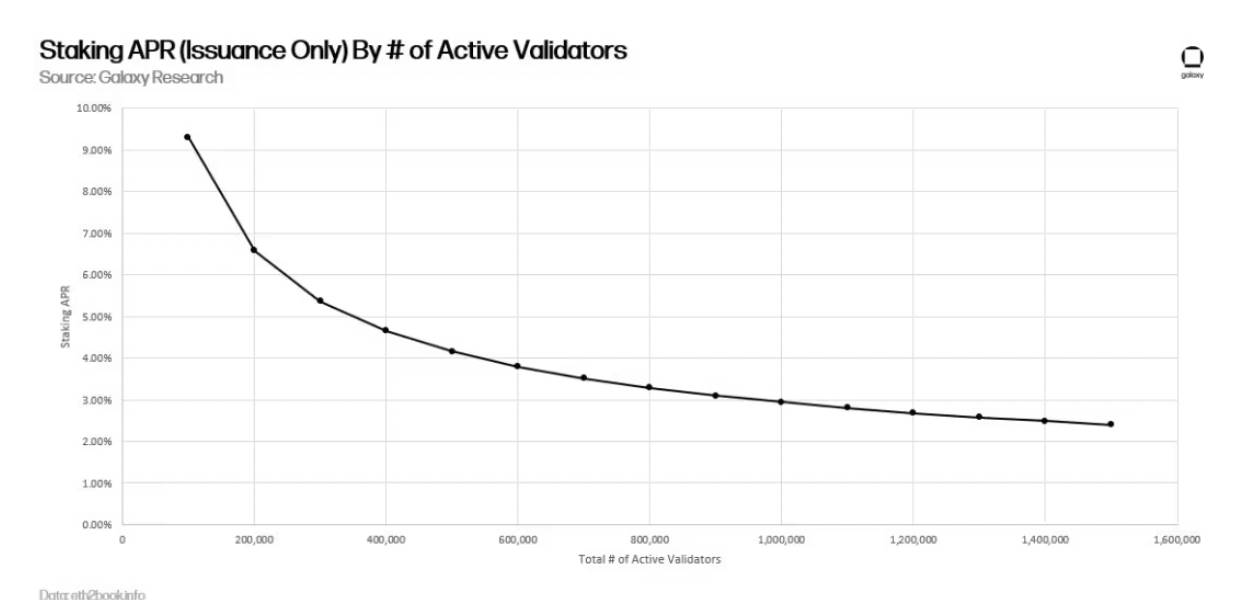

Please note that over the past 2 years, stakers' rewards have been steadily declining, mainly due to two reasons. Firstly, the total amount of staked ETH and the number of validators have increased. When the value of staked assets increases, the issuance rewards for validators are diluted, as shown in the following chart:

Staking yield paid only by ETH issuance

While issuance rewards can be calculated based on the total number of active validators and the amount of staked ETH on Ethereum, the other two sources of income for validators are difficult to predict as they depend on network transaction activity.

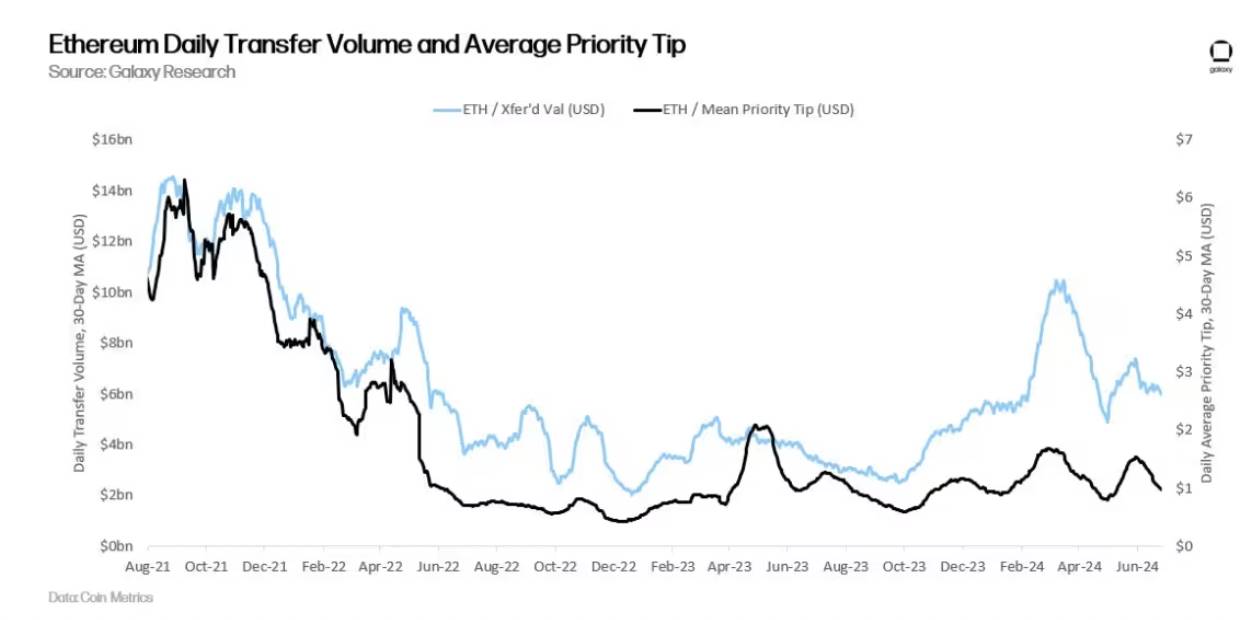

Over the past two years, transaction activity has decreased, leading to a reduction in validators' base fees, priority fees, and MEV. Generally, the higher the value of assets transferred on-chain, the greater the willingness of users to pay fees to prioritize these transactions in the next block, and the higher the MEV gained by searchers from reordering within blocks. As shown in the following chart, the daily value of USD transferred on Ethereum is related to transaction priority fees:

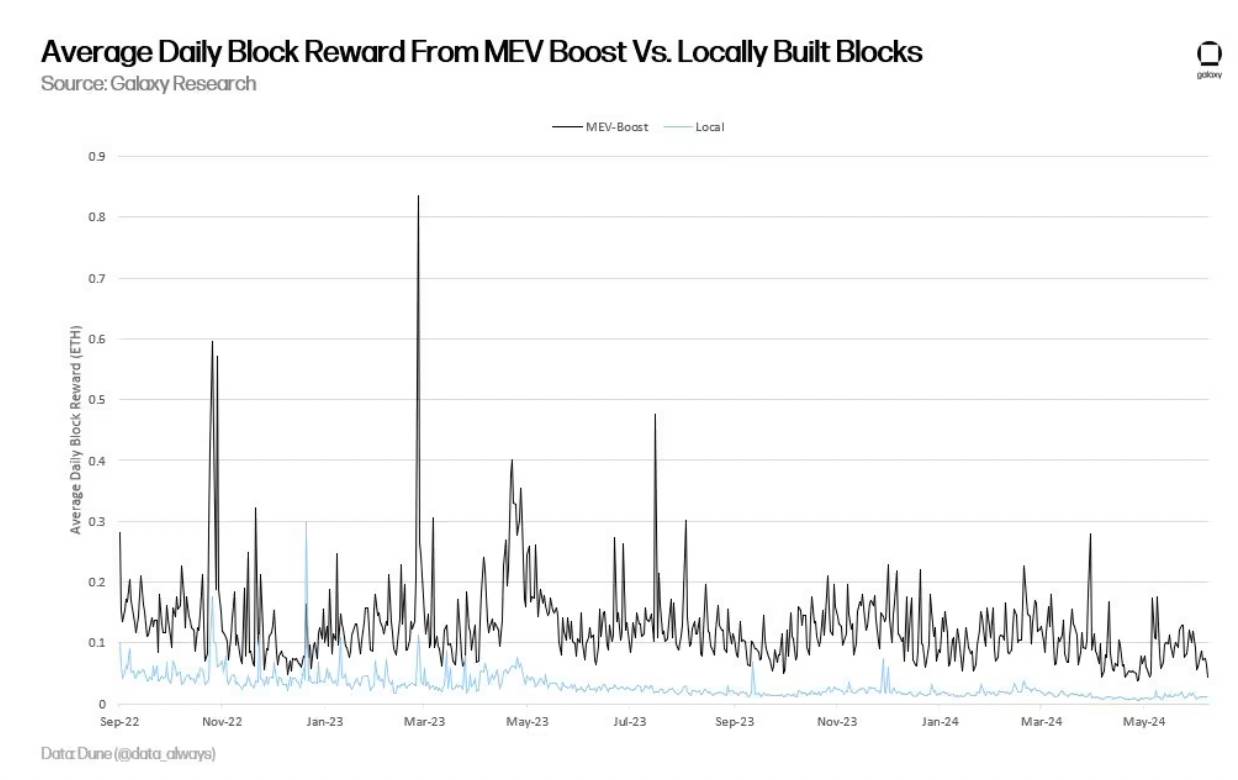

According to Galaxy's calculations, MEV can increase validator yield by approximately 1.2%. Compared to other types of validator income (including new ETH issuance and priority fees), validator rewards from MEV account for approximately 20%. Some attribute MEV to the additional value given to block proposers, which does not come from priority fees or ETH issuance. However, others argue that if priority fees are obtained through successful front-running or back-running trades, they themselves can represent MEV profits. To illustrate the fact that priority fees may contain MEV profits, other methods compare the value of blocks constructed using MEV-Boost software and blocks constructed without MEV-Boost software.

The above chart indicates that the scale of MEV may be much larger than the 20% of validator rewards. According to Ethereum Foundation researcher Toni Wahrstätter's analysis in October 2023, if validators receive blocks through MEV-Boost instead of constructing blocks locally, median block rewards will increase by 400%.

Staking Rate Prediction

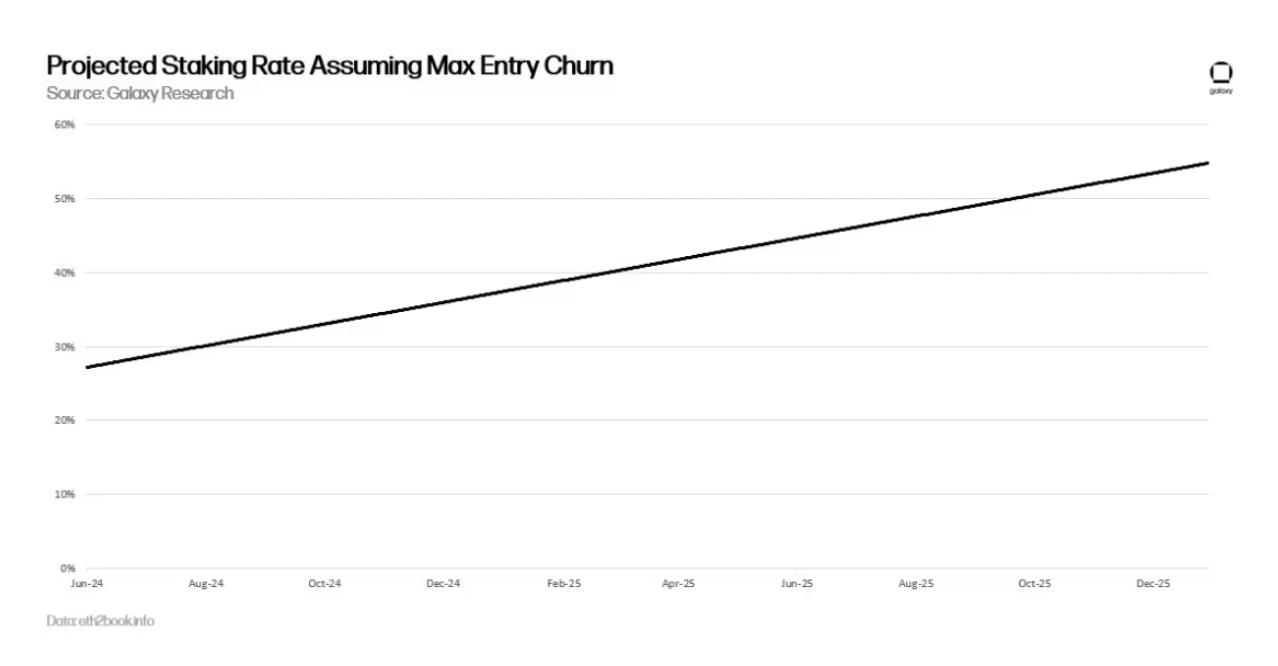

Assuming that staking demand on Ethereum grows linearly as it has over the past two years, the staking rate is expected to exceed 30% in 2024. As mentioned earlier in this report, a higher staking rate will reduce the returns from new ETH issuance. The liquidity staking services on Ethereum allow users to easily stake and bypass staking restrictions such as entry queues. Users only need to purchase stETH to receive staking rewards. A large purchase of stETH may cause a mismatch between the value of stETH on the open market and the value of the underlying staked assets, leading to a premium on stETH until more ETH is staked on Ethereum. Unlike purchasing stETH, staking activities on Ethereum will experience delays. Only 8 new validators or a maximum of 256 ETH in effective balance can be added to Ethereum in each epoch (i.e., 6.4 minutes). Therefore, assuming the maximum number of validators per epoch is reached from now until the end of 2025, it will take over a year (specifically 466 days) for Ethereum to reach a 50% staking rate.

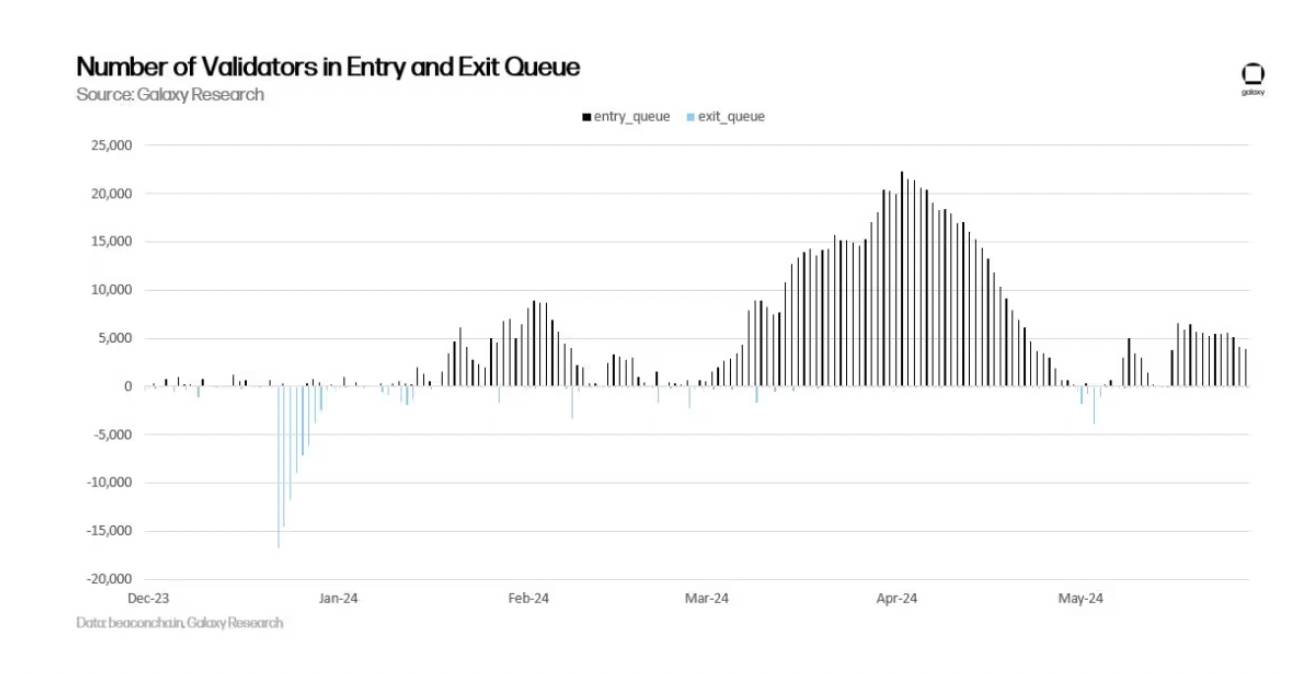

Historically, the demand to enter the Ethereum staking queue has been higher than the demand to exit. Although the activity of validators entering the queue has decreased in recent days, staking demand is expected to soar again for various reasons, including but not limited to additional income from restaking, an increase in MEV due to the revival of DeFi activities, and regulatory changes supporting staking activities in traditional financial products such as ETFs.

Validators entering and exiting the queue

Developers are aware that the resurgence of the staking rate and the decline in staker rewards are only a matter of time, so they are considering several proposals to change the network issuance to suppress staking demand.

Discussion on Changes to New ETH Issuance

ETH holders should be aware that there will be significant changes in future staking yields. Ethereum developers are weighing multiple options to ensure that the staking rate of Ethereum tends towards a target threshold, such as 25% or 12.5%. Ethereum Foundation researcher Caspar Schwarz Schilling explains that the main reasons for maintaining a low staking rate include:

Dominance of Liquidity Staking Tokens (LST): If the staking rate increases, the amount of ETH concentrated in a staking pool (such as Lido) may increase, leading to centralization risks for an entity or smart contract application, as well as risks of excessive impact on Ethereum security.

Credibility of Slashing: Related to concerns about the dominance of LST, a high issuance flowing into a single entity or smart contract application may reduce the credibility of large-scale slashing events on Ethereum. For example, if a slashing event affecting the majority of stakers occurs, the protocol may face pressure from ETH holders who may want a state change to restore the slashed staked ETH balances. Ethereum has only undergone one irregular state change in its history, which was the infamous response to The DAO hack in 2016. While unlikely, the possibility of an irregular state change in response to a large-scale slashing event is not impossible. In fact, some Ethereum researchers believe that this outcome is more likely in the case of high issuance.

Trustless Nature of ETH as the Base Currency: High issuance may lead to a shortage of native ETH in circulation and a surge in liquidity staking tokens issued by third-party entities. Ethereum researchers indicate a preference for promoting the use of native ETH for activities other than staking, rather than using less decentralized liquidity staking tokens.

Minimum Viable Issuance (MVI): Although staking costs are negligible compared to mining costs, they are not to be overlooked. Professional staking providers need to operate the hardware and software required to run validators, and therefore incur operational costs. Users must pay fees to these providers to stake through them. Additionally, even if users obtain liquidity staking tokens by staking native ETH, they bear additional risks if the staking operation fails through staking with third parties. Therefore, keeping staking costs at a minimum level is in the network's interest, as the additional costs of supporting staking activities mean higher issuance, leading to ETH supply inflation.

Ethereum developers and researchers are weighing various proposals to lower the staking rate of Ethereum. These proposals include, but are not limited to:

In the short term, reducing staking rewards: In February 2024, Ethereum Foundation researchers Ansgar Dietrichs and Caspar Schwarz-Schilling once again proposed a one-time reduction in staking yield. This idea was originally proposed by Ethereum Foundation researcher Anders Elowsson. In the latest article by Dietrichs and Schilling, researchers suggested a 30% reduction in staking yield. However, the specific number depends on Ethereum's staking rate. Considering the continuous increase in staking rate since February, researchers believe that theoretically the proposed reduction in yield should be higher. The implementation of this proposal only requires simple code changes and will suppress staking economic incentives by reducing issuance rewards in the short term. The proposal aims to serve as a temporary measure paving the way for long-term solutions, such as target policies.

Long-term, staking rate targets: Implementing a new ETH issuance curve, the higher the staking rate exceeds the target rate (e.g., 25% of the total supply of staked ETH), the higher the cost for validators to stake and earn rewards. This idea is based on research by Elowsson, Dietrichs, and Schwarz-Schilling. There are several mechanisms to achieve the target rate, each differing in the schedule of issuance and the degree of issuance reduction. For more detailed information on the issuance curve under the staking rate target model, please read this Ethereum research article.

None of the above proposals will be included in the next Ethereum hard fork, Pectra. However, Ethereum developers are likely to push for proposals to change ETH issuance in subsequent upgrades. So far, there has been significant controversy within the Ethereum community regarding issuance changes, and no widespread consensus has been reached. Major objections to issuance changes include concerns that reducing staking income will harm the profitability of large staking providers and individual stakers operating on Ethereum; proposals affecting issuance lack sufficient research and data-driven analysis. It is currently unclear what the exact target staking rate to achieve MVI should be, and whether achieving this target through issuance changes will reduce concerns about centralization in staking allocations or exacerbate the issue by driving away independent stakers. To address some concerns about the long-term profitability of independent stakers on Ethereum, Ethereum co-founder Vitalik Buterin shared preliminary research in March 2024, focusing on adding new anti-correlation rewards and penalties to control the operation of fewer validators.

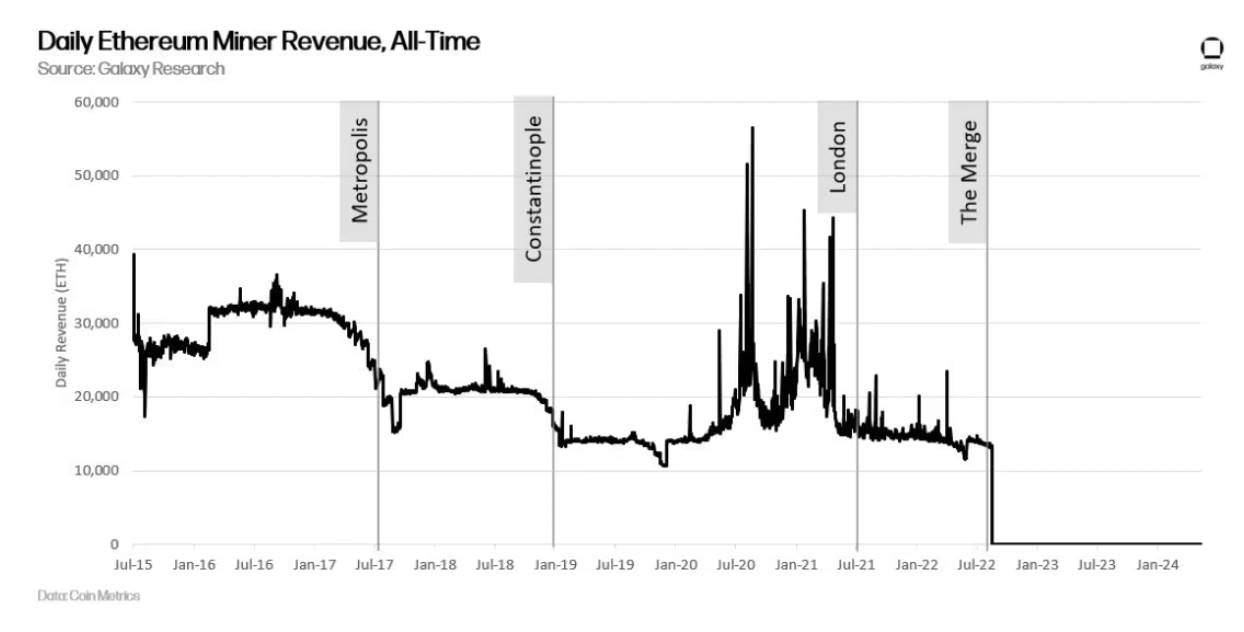

Since the launch of the Ethereum proof-of-stake beacon chain in December 2020, its monetary policy has remained unchanged. However, before the merge with the beacon chain, Ethereum's monetary policy underwent several revisions in its approximately seven-year history. The initial block reward for Ethereum was set at 5 ETH per block. In the Metropolis upgrade in September 2017, it was reduced to 3 ETH. Then, in the Constantinople upgrade in February 2019, it was further reduced to 2 ETH. Subsequently, in the London upgrade in August 2021, rewards miners received from transaction fees were burned, and then in the merge upgrade in September 2022, mining rewards were completely abolished on the network.

Under the proof-of-stake consensus mechanism, changes to Ethereum's monetary policy may be more controversial than changes to network issuance under proof-of-work, as the user base affected by the changes is much broader. Unlike miners, issuance changes affect an increasingly larger group of stakeholders, including ETH holders, staking service providers, liquidity staking token issuers, and restaking token issuers. As the base of stakeholders involved in protecting Ethereum's interests continues to expand, Ethereum developers are less likely to change Ethereum's monetary policy as frequently as in the past. The controversial nature of this discussion may lead to increasing rigidity in staking-related policies and rewards over time. Therefore, as the staking industry built on Ethereum continues to develop and mature, the window of opportunity to change the Ethereum codebase is narrowing and is unlikely to last for an extended period.

Conclusion

The staking economy built on Ethereum is still in its infancy. When the beacon chain was first launched in 2020, users staking ETH could not guarantee the withdrawal of ETH or the transfer of funds back to Ethereum. When the beacon chain merged with Ethereum in 2022, users gained additional rewards from staking through transaction priority fees and MEV. When the staking ETH withdrawal feature was enabled in 2023, users could finally exit validators and profit from staking operations. There are a series of other changes coming up on the Ethereum development roadmap that will impact staking businesses and individual stakers. While most of these changes will not affect the economic incentives of staking, such as increasing the maximum effective balance for validators in the Pectra upgrade, some will.

Therefore, it is crucial to carefully assess the risks and rewards of staking on Ethereum as the development roadmap of Ethereum continues to evolve and is implemented through hard forks. With a much larger base of stakeholders involved in the staking economy on Ethereum compared to the PoW era, changes in staking dynamics over time may become more challenging to execute. However, Ethereum is still a relatively new proof-of-stake blockchain, and significant changes are expected to occur in the coming months and years, requiring careful consideration of the impact of changing staking dynamics on all relevant stakeholders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。