Eliminating existing user experience friction, simplifying the interaction between end users and developers with on-chain applications, will bring a new wave of growth to cryptocurrency.

Author: Thanefield Research

Translation: Deep Tide TechFlow

Introduction

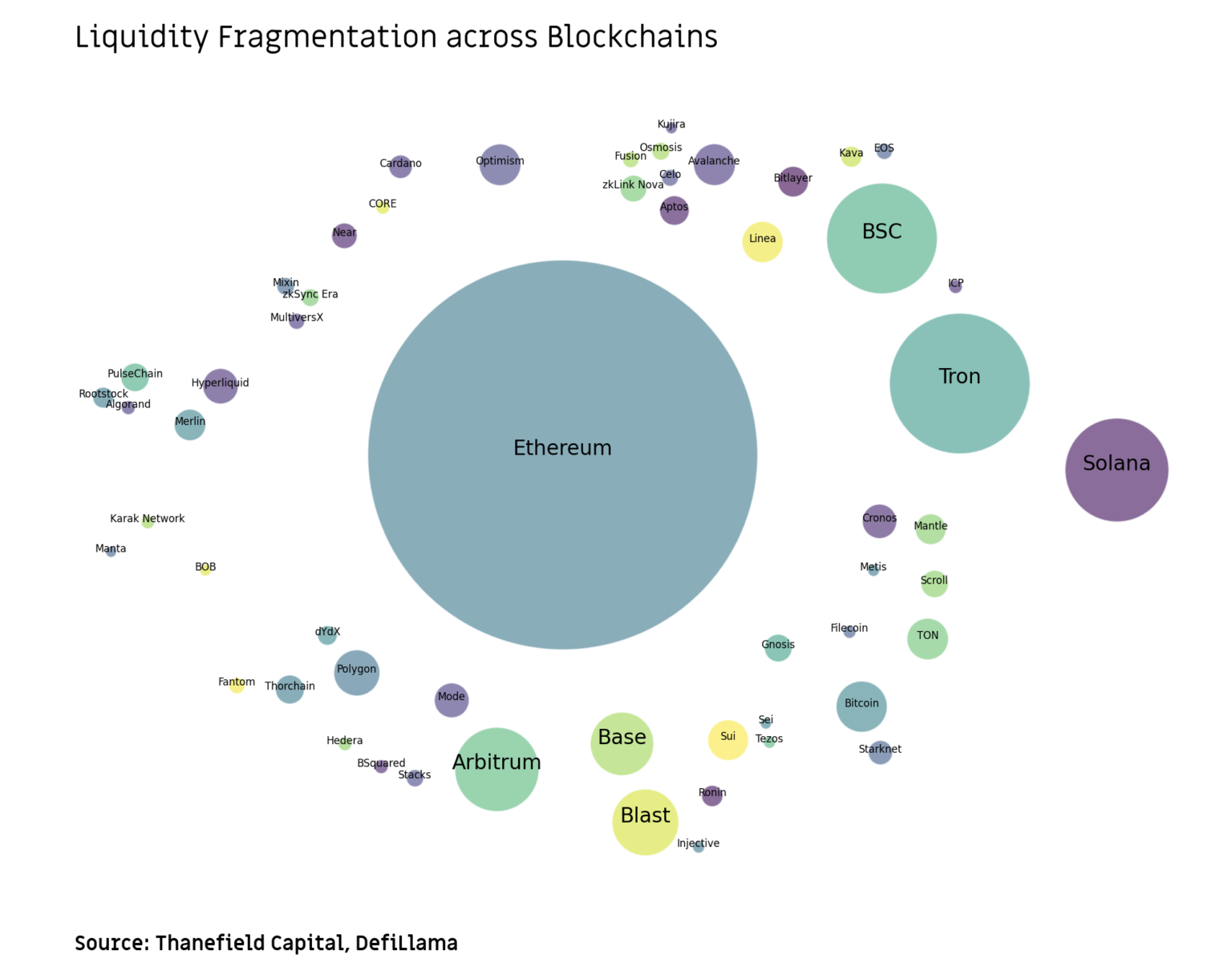

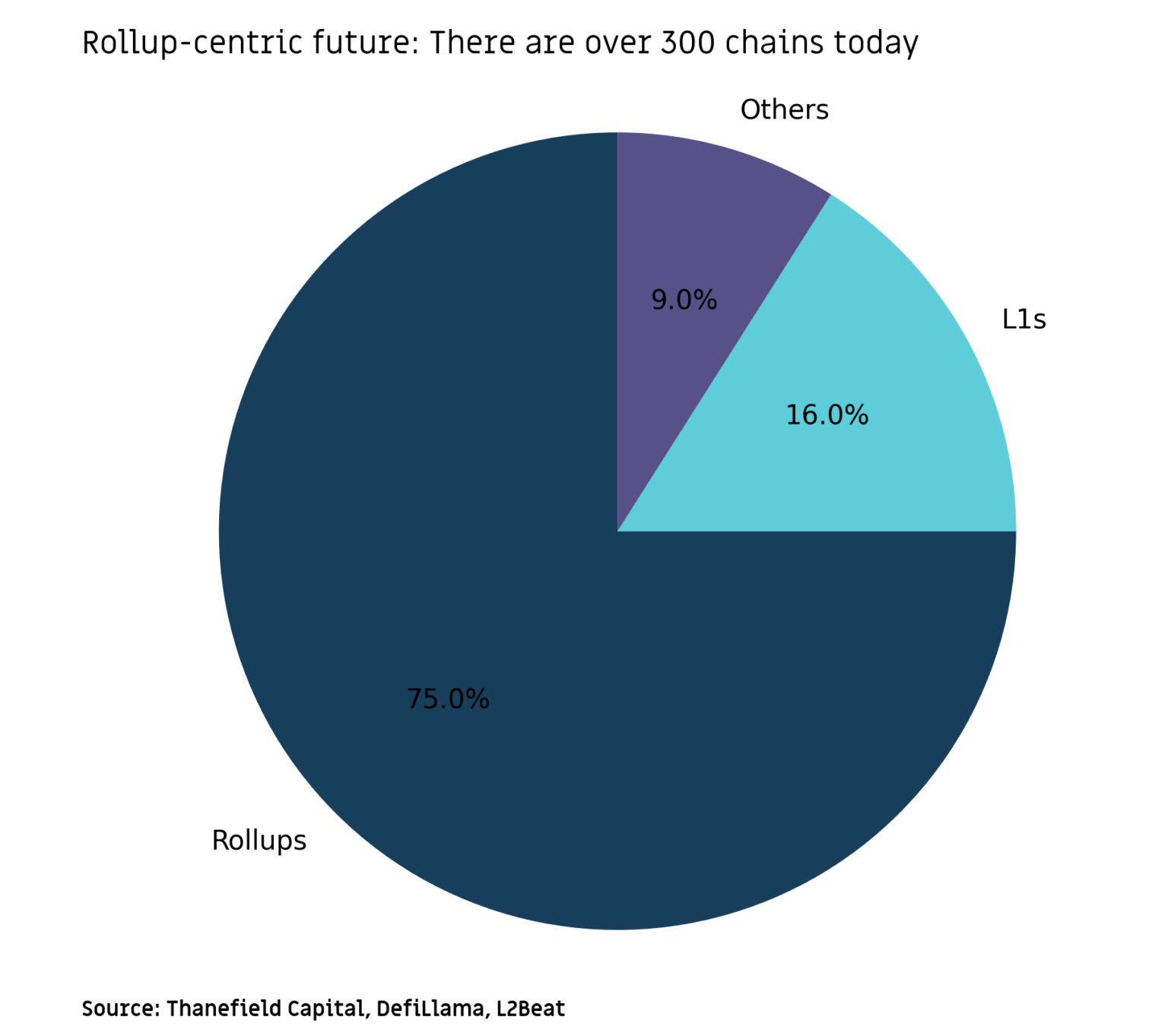

Against the backdrop of Ethereum's rollup-centric roadmap, the number of blockchains is exploding, and the surge in rollups and application chains validates the theory of multi-chain. While multi-chain expansion has its advantages, it also brings about the island effect, leading to liquidity and user dispersion across multiple environments. This makes it more difficult for users and developers to use blockchains.

For example, a typical user faces the following challenges when operating on three blockchains. First, they need to find a secure, economical, and fast bridge to transfer assets. If the bridge is poorly designed, users may pay excessive fees or have their assets frozen for a long time during the transfer.

In addition, users also need enough native tokens to pay for transactions on each blockchain. If users use non-native assets (such as stablecoins), this adds additional complexity. They also need to store and manage each mnemonic separately, further increasing friction and security risks.

Similarly, developers face higher complexity in ensuring cross-chain interoperability, effectively managing cross-chain liquidity, and integrating various infrastructure layers, significantly increasing development time.

Without significant improvements in user experience like chain abstraction solutions, these complexities will only worsen with the increasing number of blockchains and rollups.

We believe that chain abstraction is the key to addressing these challenges. By simplifying the experience for users and developers, it can unify dispersed environments, making blockchains more user-friendly and efficient for billions of people worldwide. Based on this idea, this article will explore various projects in the abstraction field that are helping to realize this vision.

Advanced Concepts of Chain Abstraction

Conceptually, chain abstraction aims to simplify the complexity of interacting with on-chain finance, hiding these complexities from end users and developers.

From a developer's perspective, the goal of chain abstraction is to enable developers to quickly and securely build chain-agnostic applications that can seamlessly run on all rollups without worrying about the underlying execution complexity.

From a user's perspective, the vision of chain abstraction is to enable users to interact with decentralized applications without needing to understand the cryptographic concepts behind them. Its purpose is to eliminate all technical complexity and provide an intuitive user experience.

A common analogy is how we interact with computer applications today. Despite the ubiquity of the internet in daily life, most users do not understand the technical details of HTTP, TCP/IP, and so on. Similarly, when building web applications, most developers do not need to deeply understand communication protocols because the browser environment has abstracted much of the underlying work.

However, for today's crypto users, funds on one chain cannot access applications on another chain without explicit bridging. Similarly, the choice of blockchain for deployment remains significant for developers.

Therefore, the current state of crypto is similar to early consumer computing. Chain abstraction will be the key force driving its transition to a seamless user experience of the modern internet.

Eliminating existing user experience friction, simplifying the interaction between end users and developers with on-chain applications, will bring a new wave of growth to cryptocurrency. This will drive mass adoption and expand the user base beyond the currently isolated web3 native community, covering billions of users worldwide.

Early signs of this vision are evident in Telegram, which has 9 billion users who can easily join the crypto world through a familiar interface. Similarly, Base users can set up smart wallets using password keys, avoiding the need to securely store 12-word mnemonics or pay gas fees, as their transactions can be sponsored by Coinbase.

While these two ecosystems are still in the early stages, their progress indicates that this vision is closer to reality than it seems and can be fully realized.

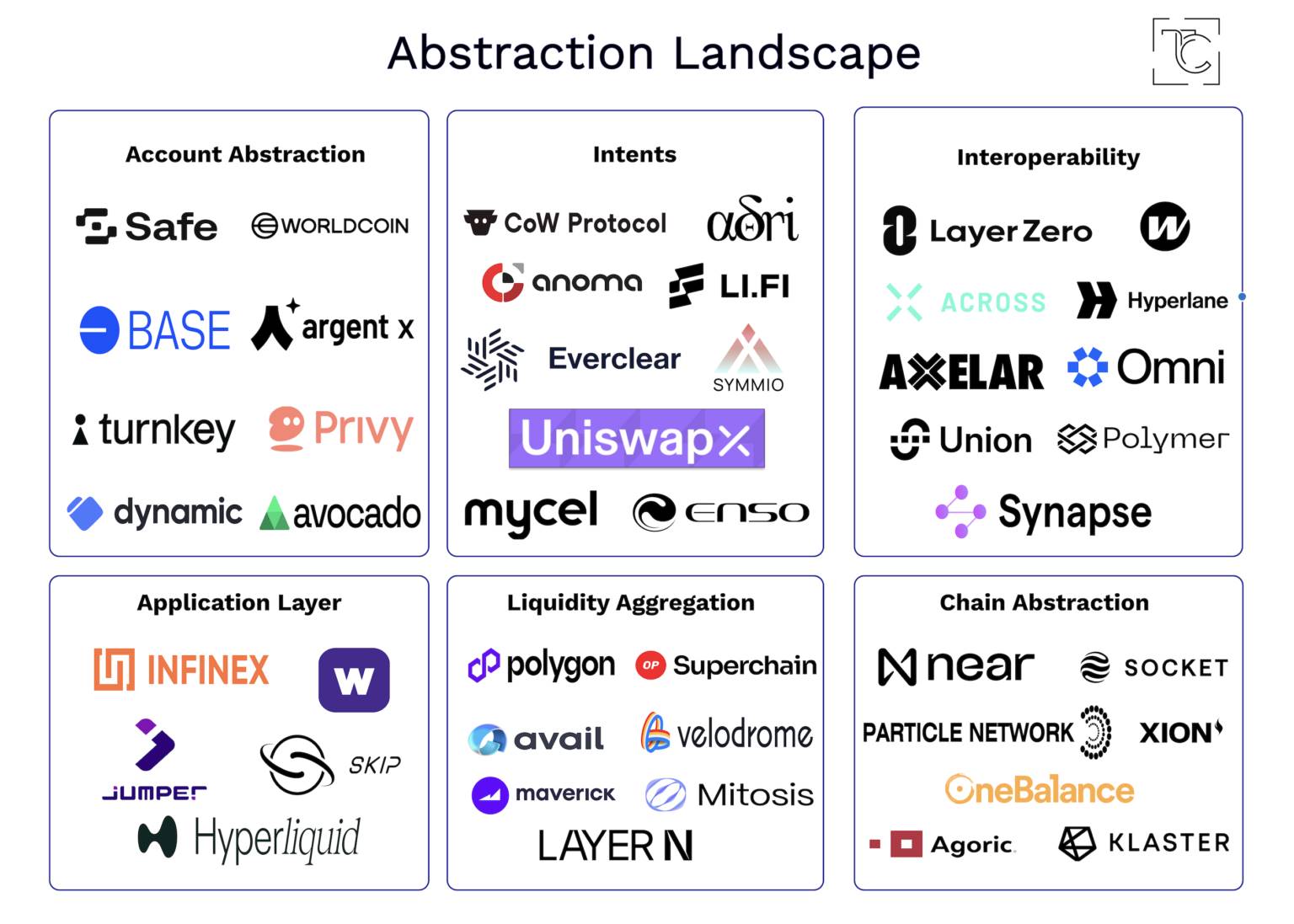

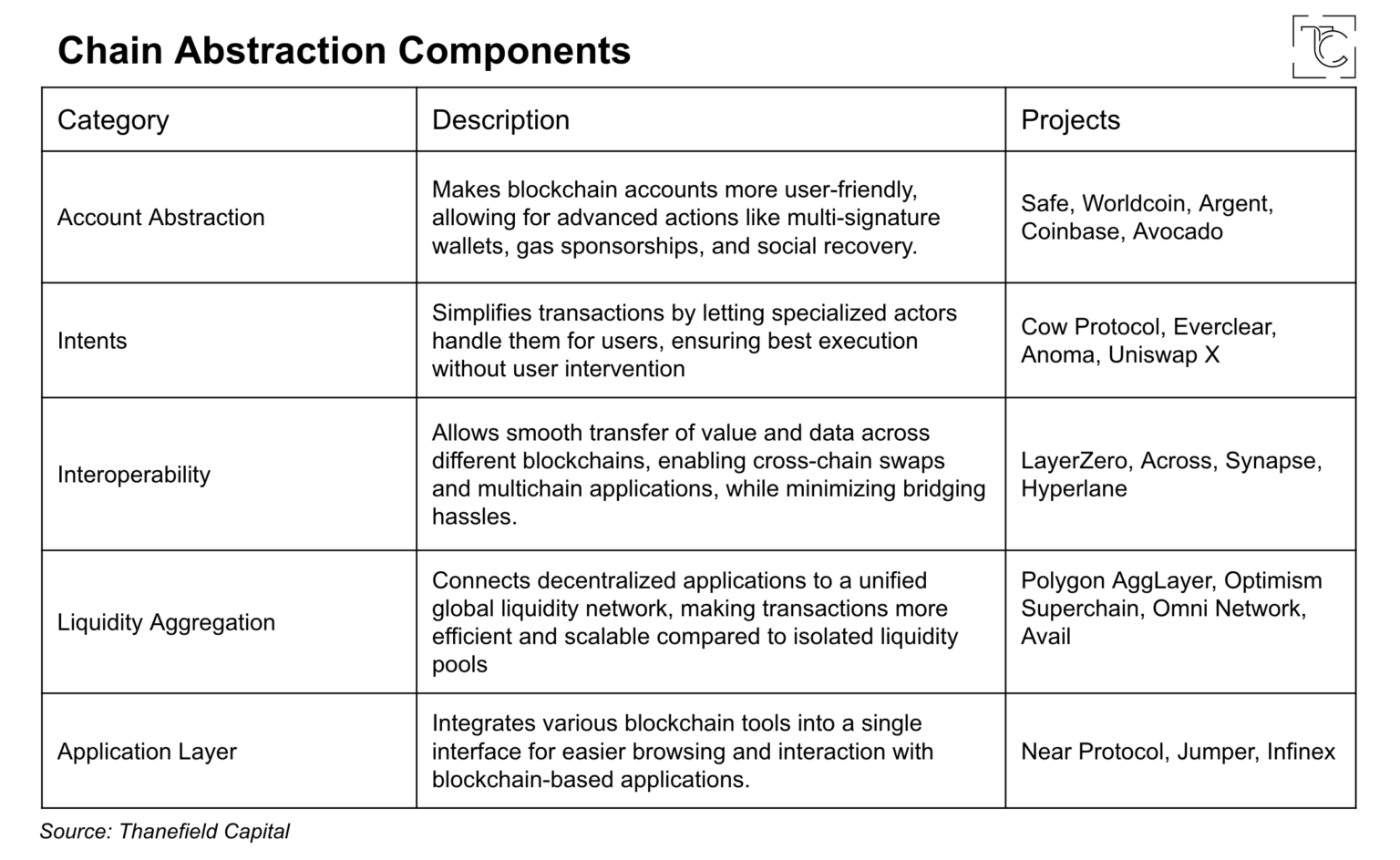

Components of Chain Abstraction

To achieve this high-level abstraction, breakthroughs are needed at multiple infrastructure levels. Below, we will first break down the building blocks of the abstraction stack, then delve into each category and focus on important projects and their design choices.

Account Abstraction

Account Abstraction (AA) introduces the concept of smart contract wallets to improve the user experience of using blockchain wallets. It aims to simplify the complexity of users using blockchain wallets, such as no longer needing to manage public/private key pairs. The concept of AA first appeared in the Ethereum community in 2016, as Ethereum core developers were dissatisfied with the limitations of existing wallets. Now, AA has become part of the Ethereum roadmap, with the ultimate goal of achieving fully native AA. Although implementations on different blockchains may vary, we will mainly discuss account abstraction in the Ethereum and EVM environments.

In most EVM-compatible chains, there are two types of accounts: Externally Owned Accounts (EOAs) and smart contract accounts. EOAs are traditional wallets, such as those accessed through Metamask. They are controlled by private keys and used to sign messages and interact with the blockchain. EOAs have several limitations that can significantly affect the Web3 experience for ordinary users, including managing private keys, needing to pay gas fees in native tokens, and being unable to perform atomic transactions.

Smart contract wallets are fully programmable and solve these user experience issues by introducing Web2 design principles (such as social login systems and account recovery). The method of implementing smart wallet functionality depends on the blockchain's design and the infrastructure on it. In Ethereum and most EVM chains, the network currently does not support native account abstraction, meaning only EOAs can sign messages.

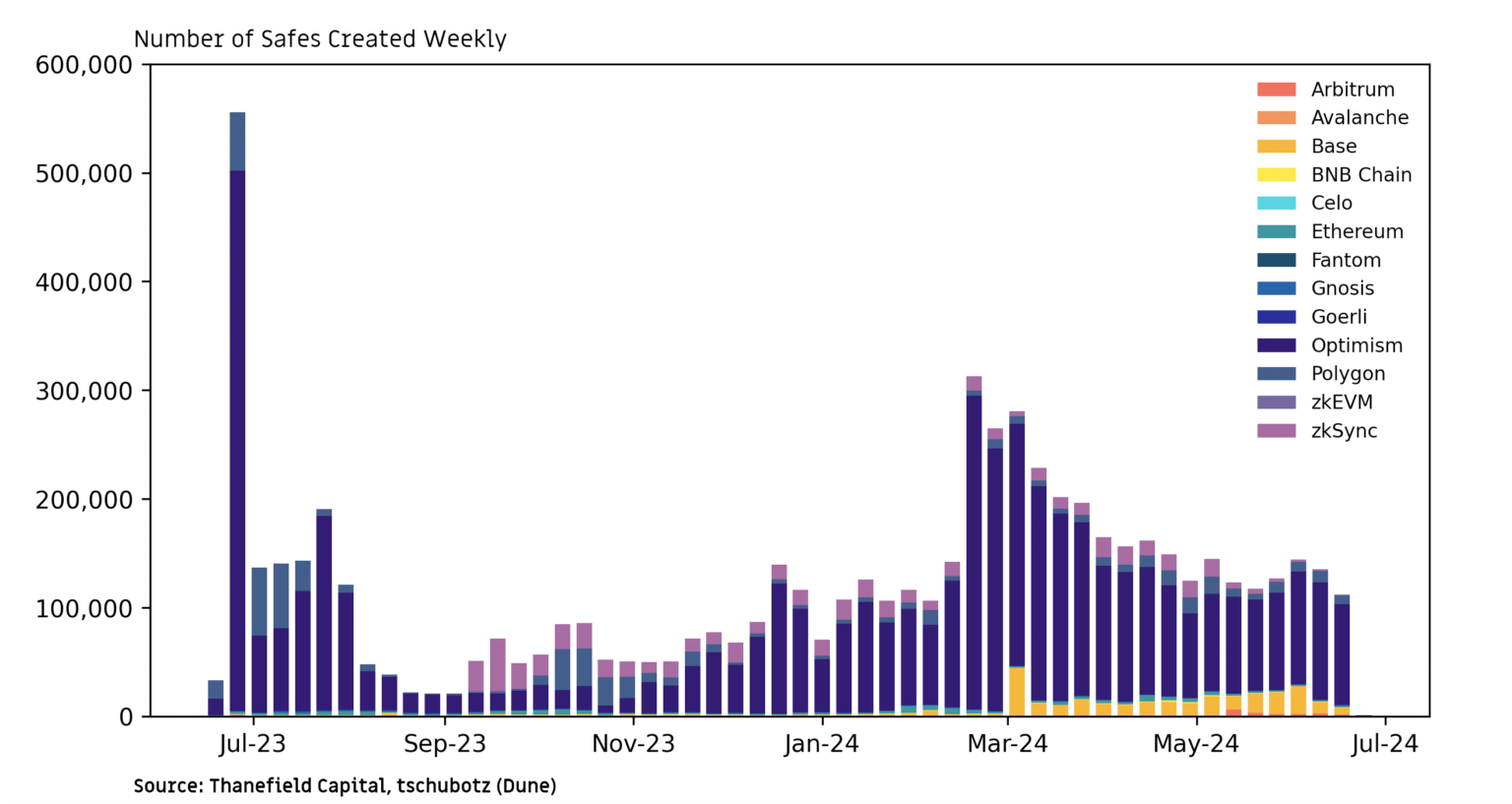

Currently, two smart wallet standards have been widely adopted and millions of accounts have been deployed: Safe, a pioneer in this field, and ERC-4337, a relatively new standard that relies on intent and additional off-chain infrastructure. The upcoming Pectra upgrade will also include EIP-7702, which advances the existing account abstraction framework, nearing its final stage, at which point EOAs will be able to transition to smart contract accounts.

Safe

As a pioneer and the most widely used smart wallet provider in the account abstraction field, Safe (formerly known as Gnosis Safe) was initially a multi-signature wallet. Today, it has evolved into a comprehensive smart wallet solution, becoming an essential part of Ethereum and EVM infrastructure. Safe has currently deployed nearly 10 million wallets and secured around $90 billion in assets across various EVM chains and rollups.

Safe adopts a modular architecture. Core components are integrated into the battle-tested Safe{Core} stack, while Safe modules introduce custom functionalities, enhancing overall functionality. This modular approach is similar to the use of hooks in Uniswap v4, where Safe modules ensure strong security at the core layer and simplify developer customization and integration. Developers can create modules or integrate existing modules to meet specific needs. For example, users can add or remove modules for password key authentication or quota management. Additionally, Safe includes an ERC-4337 module, making it compatible with this newer account abstraction standard and its related infrastructure.

ERC-4337

ERC-4337 is the standard currently used on Ethereum and most EVM chains, implemented on the Ethereum mainnet in March 2023. It serves as an intermediate step in the development of account abstraction and does not require modifications to the consensus layer protocol to be implemented. Instead, it leverages a concept called User Operations (UserOps), which are based on intent and combined with on-chain and off-chain infrastructure to facilitate and execute these operations.

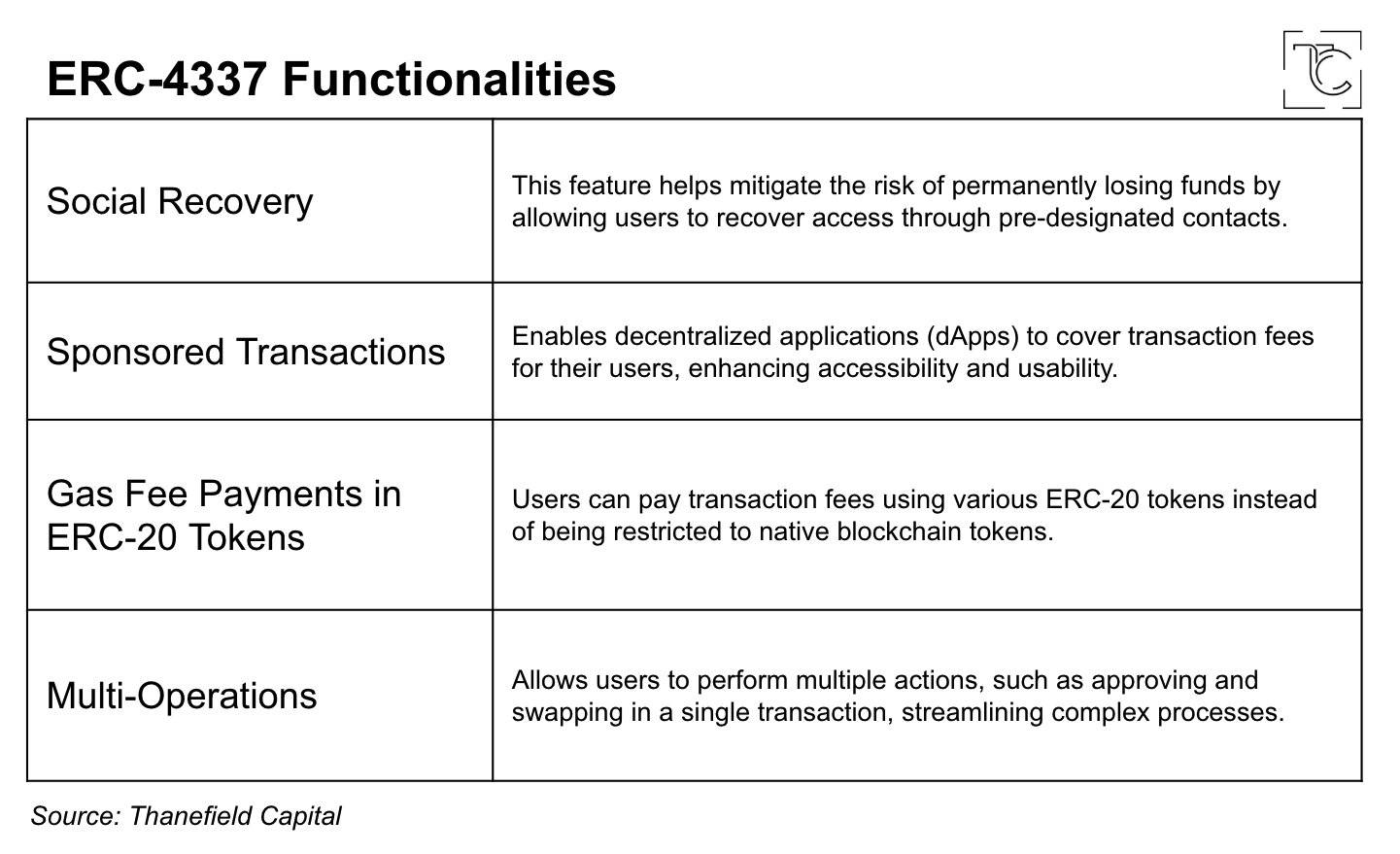

ERC-4337 brings significant improvements to the user experience:

ERC-4337 Transaction Flow

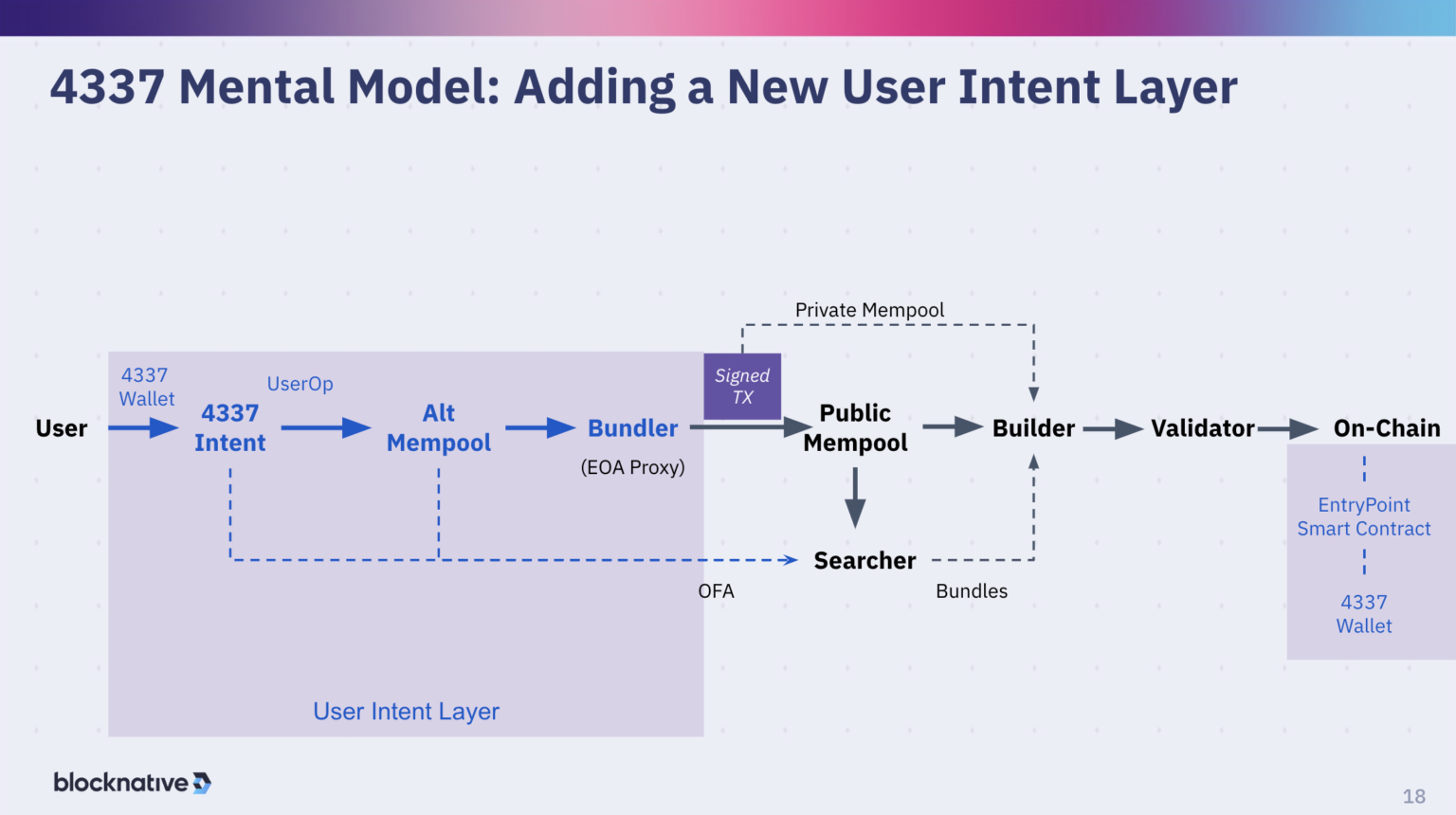

ERC-4337 introduces a new transaction flow without changing the consensus layer. This approach integrates some infrastructure components, making it different from the traditional EOA transaction cycle. The main difference lies in the steps before transaction signing, while the subsequent process remains unchanged. Key elements include User Operations (UserOps), Paymasters, Alt Mempools, Bundlers, and EntryPoint contracts.

In the ERC-4337 transaction cycle, users express their intent to perform specific actions on-chain through UserOps, rather than signing transactions directly. UserOps are managed in the Alt Mempool, which specifically handles UserOps and is different from the public mempool. Bundlers, similar to block producers, monitor the Alt Mempool and select UserOps based on priority fees to include in their bundles. These bundles are signed by the bundlers and submitted to the EntryPoint contract, a global contract on Ethereum specifically for all ERC-4337 operations to be executed. Paymasters can sponsor transactions or pay gas fees using ERC-20 tokens if necessary. Subsequently, transactions proceed as usual and are executed on-chain.

A visual representation of this process provided by Blocknative in this diagram is very helpful:

Adoption of ERC-4337

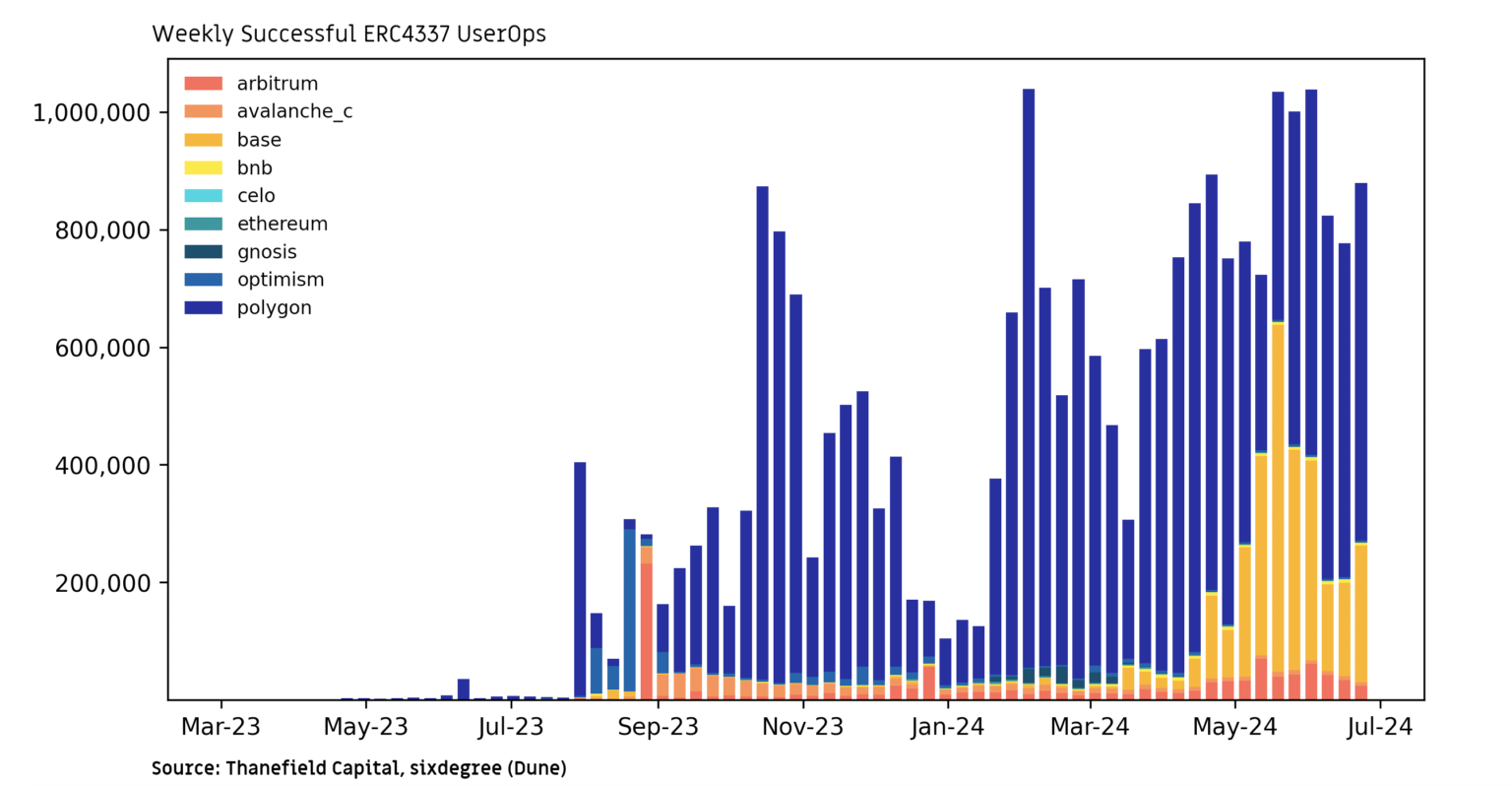

Since its deployment in 2023, ERC-4337 has been widely adopted on Layer 2 solutions and sidechains, especially on Base and Polygon. Over 5.5 million ERC-4337 wallets have been established, with an average of approximately 800,000 successful user operations per week.

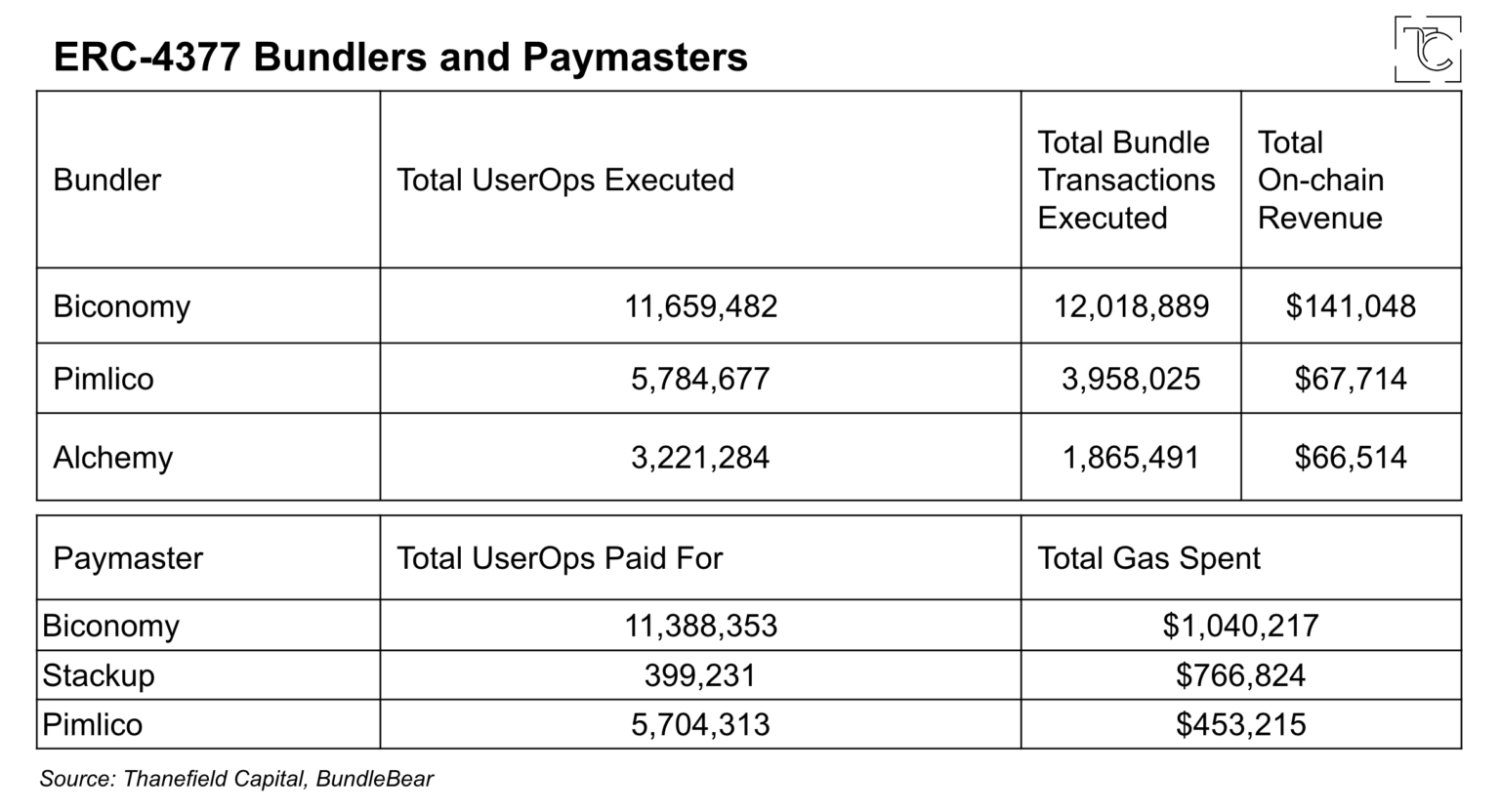

Coinbase is at the forefront of driving smart wallet development and adoption. On June 5th, Coinbase launched the Coinbase Smart Wallet, a new product adopting the ERC-4337 standard. This smart wallet offers several notable features, including password key authentication, sponsoring transactions for selected dApps on Base, and multi-account ownership. With Coinbase's strategic focus on bringing new users to the Base platform, the smart wallet is likely to become the primary wallet type on Base. Biconomy, Pimlico, and Alchemy are also emerging as key players in providing ERC-4337 infrastructure components, especially in bundlers and paymasters. The table below shows their dominance in the number of executed and paid user operations.

While these data are encouraging, ERC-4337 wallets have not yet seen widespread adoption on the Ethereum mainnet, with only two to three hundred active wallets per week. Safe wallets remain the primary standard for smart wallets on Ethereum. One of the main limitations of the ERC-4337 design is that it does not allow the conversion of existing EOA wallets into smart wallets. Additionally, the relatively high gas fees on the Ethereum mainnet make certain functionalities (such as sponsoring transactions) economically unfeasible.

EIP-7702

Following ERC-4337, EIP-7702 takes an important step towards fully native account abstraction. This proposal, drafted by Vitalik Buterin, quickly emerged as a response to the controversial EIP-3074, which had compatibility issues with future Ethereum account abstraction (AA) roadmap EIPs. Unlike the infrastructure-level operations of ERC-4337, EIP-7702 proposes changes directly at the protocol level. The proposal is expected to be included in the upcoming Pectra upgrade, roughly between the fourth quarter of 2024 and the first quarter of 2025.

EIP-7702 is considered one of the most important user experience improvement proposals in Ethereum's history. It enhances the ERC-4337 framework by introducing key features such as transaction batching, gas sponsorship, and temporary permissions for EOAs. Specifically, it introduces a new transaction type that allows EOAs to temporarily adopt smart contract code during a transaction and revert to their original state after the transaction is completed. The proposal ensures forward compatibility with existing ERC-4337 implementations and aligns with the long-term goals of Ethereum's AA roadmap.

Case Study: Worldcoin

Worldcoin is developing a protocol called "Human Authentication," aimed at enabling applications to verify that users are real humans and not AI-driven bots. This verification is achieved through World ID, a digital passport issued to users after scanning their irises using Orbs, a specialized device. Once obtained, World ID can serve as a universal authentication tool for various applications and services. In addition to identity verification, users can receive bi-weekly WLD grants distributed on-chain.

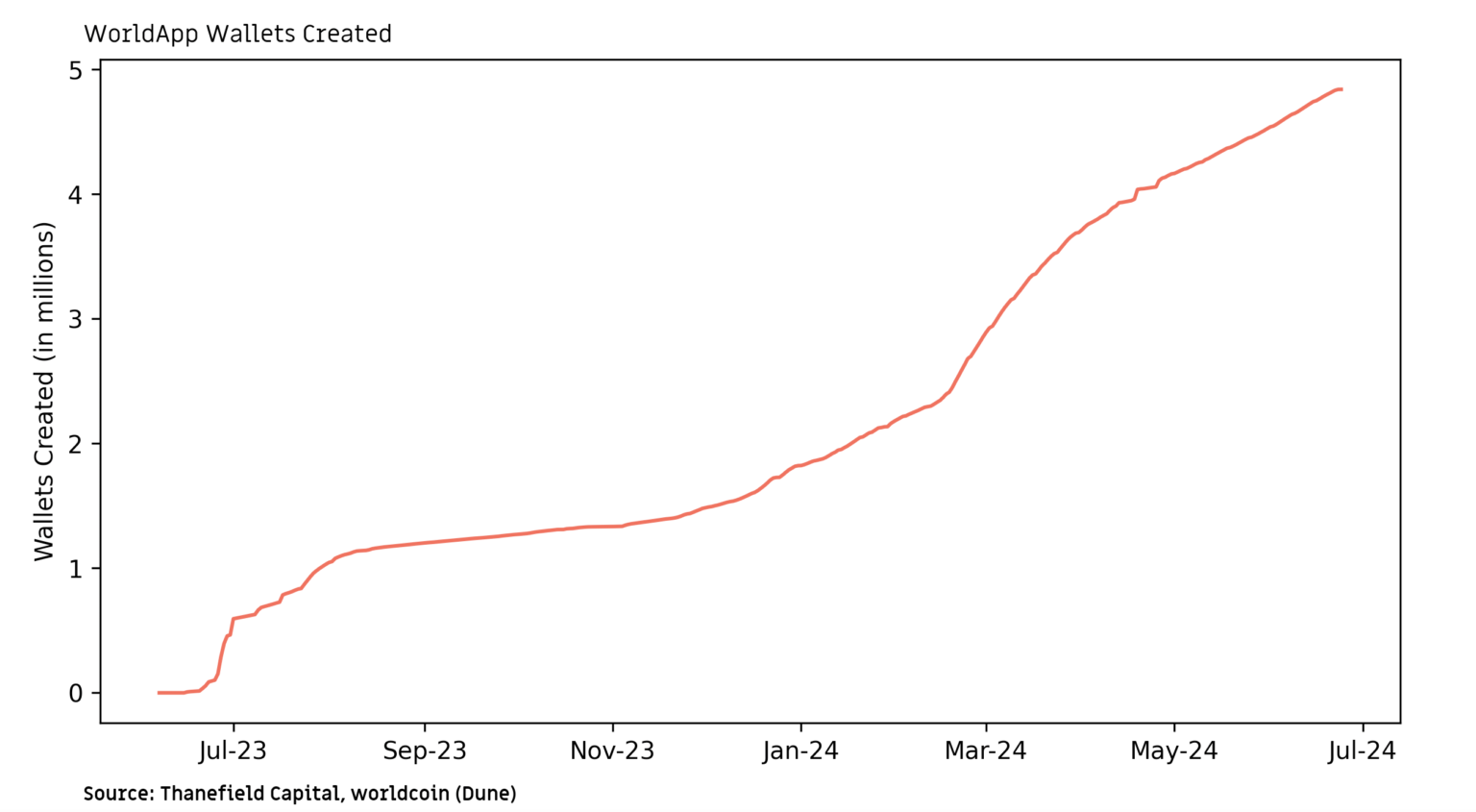

Worldcoin has successfully issued over 4.5 million World IDs, allowing users to verify their identity without any prior knowledge of blockchain technology. During registration, the World App automatically generates a Safe smart wallet for each user on the Optimism network in the background. This process completely abstracts the blockchain layer, providing a user experience similar to Web2 functionalities such as facial authentication, social recovery, and detailed account management.

WLD grants and World IDs are both stored in a self-custodial manner, ensuring that users retain control over their digital assets. In the case of Worldcoin, the Safe-supported smart accounts enable users to enjoy the benefits of self-custody and economic incentives provided by cryptocurrencies while experiencing a Web2-like user experience. As a result, the adoption of Web3 is impressive, with a large number of first-time Web3 users joining the Web3 space.

Interoperability, Liquidity Aggregation, and Intent

With the Ethereum rollup-centric roadmap and the proliferation of application-specific chains, the number of different blockchain platforms is rapidly increasing. This expansion underscores the necessity of robust cross-chain communication.

Some ecosystems have developed native interoperability solutions, providing standardized security models and implementing a certain level of chain abstraction within their domains. Notable examples include Polkadot's shared security architecture and Cosmos' IBC protocol. In the context of rollups, synchronous cross-chain message passing and atomic cross-chain interactions can be achieved through the use of a shared sequencer responsible for processing and ordering transactions and managing state. For example, Optimism has adopted this approach for its Superchain vision.

Despite these advancements, cross-chain communication, especially outside of these established ecosystems, remains a significant challenge due to the lack of native interoperability and widespread standardization. In this section, we will explore various architectural designs for interoperability in chain abstraction. Additionally, we will focus on leading projects in each vertical domain, showcasing how they are advancing blockchain connectivity.

Message Passing Systems

A classic approach to blockchain interoperability is to utilize a general message passing system, often relying on a set of external validators. In this design, users specify the desired outcome, and off-chain entities construct precise execution paths across multiple chains. This path is executed by a coordinated set of smart contracts and relayers. However, achieving atomic execution across multiple chains is inherently challenging due to the continuous generation of blocks and state changes on each chain. Even with a robust data availability layer maintaining the state of all integrated chains, navigating routes across multiple chains presents significant complexity.

The design and architecture of message passing systems vary widely. They can be modular or monolithic, permissioned or permissionless, support various chains, and be based on minting and burning mechanisms or liquidity pool operations. Developers face numerous trade-offs when integrating message passing systems into creating a stack of chain abstractions, with each system providing different levels of security guarantees and user experience. This diversity in design and functionality may hinder the adoption of universal standards, leading to further fragmentation in the ecosystem.

Currently, cross-chain aggregators such as Li.Fi and Socket have utilized simple message passing systems. These platforms integrate with numerous bridges and DEXs to simulate suggested routes for users. Once a route is chosen, it is executed in a strict sequence.

Intent-Based Design

In intent-based interoperability design, users only need to express the desired outcome without specifying the exact execution path as in traditional blockchain transactions. These intents are auctioned off to Solvers (off-chain entities) who bid for the right to execute these intents. The specific resolution of intents is not important; they can be partially or fully matched, or filled from the Solvers' own inventory. In this system, users specify the outcome, and experts compete to provide the best execution plan.

One key advantage of this approach, especially in the context of cross-chain asset transfers, is that it directly handles native tokens rather than IOUs, providing native security guarantees and enhancing overall security. Currently, intent-based applications primarily exist in bridges (such as Across and Synapse) and decentralized exchanges (such as Cow Swap, Uniswap X, and 1inch Fusion).

Recently, Across and Uniswap collaborated to propose the cross-chain intent standard ERC-7683, marking the first attempt to create an intent-based system to standardize a unified framework for cross-chain operations. Other notable developments include the recent release of a new version by Socket, focusing on modular order flow across chains, and Everclear (formerly Connext) announcing intent-based primitives, leveraging a solver network and an EigenLayer-based Optimistic Rollup to manage liquidity across blockchains.

However, implementing intent-based solutions faces significant challenges. Firstly, users need access to a cross-chain account—a smart account that manages keys in the background and enables cross-chain transactions. Additionally, standardization is a major obstacle; currently, each intent-based application must independently develop its infrastructure, including intent aggregation, matching, and auction models. This lack of standardization leads to fragmentation and inefficiency in the entire ecosystem.

Chain abstraction is a concept without technical specifications, and therefore can be implemented from many different perspectives. In our view, some of the most interesting attempts include Anoma's intent-centric architecture, Polygon's AggLayer, and NEAR's full-stack chain abstraction solution. We will delve deeper into these attempts.

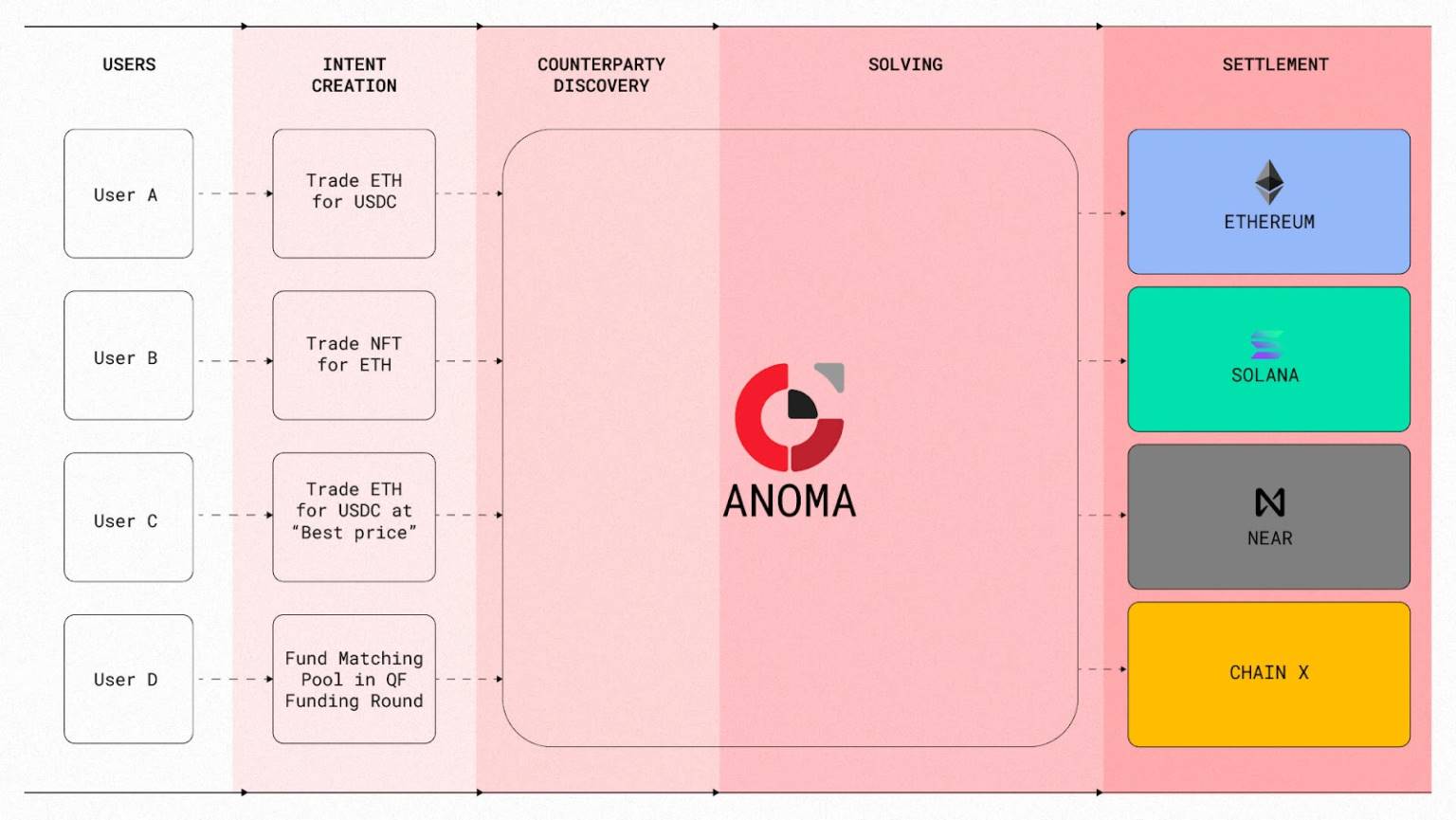

Case Study: Anoma

Anoma is a privacy-focused, intent-centric protocol designed to achieve decentralized trade discovery, resolution, and atomic multi-chain settlement. This platform is architecturally unique: unlike traditional blockchain systems that require users to specify execution paths, Anoma only requires users to define the final states they are willing to accept, expressed through programming commitments called intents. What sets Anoma apart is that these intents are composable and can be collectively resolved, regardless of their origin.

Anoma's transaction architecture includes the following steps:

Generic Intents: Anoma's architecture can handle any intent, not limited to specific applications or special cases. This flexibility allows for broad applications and interactions.

Trade Discovery: This is a decentralized process where individual intents propagate through the network, making them accessible to potential Solvers.

Resolution: At this stage, Solvers collaboratively combine and compute intents to find a valid solution, a transaction that can be executed and settled across chains.

Settlement: The solution is verified on-chain and ultimately confirmed. Anoma's intent-centric architecture supports settlement on its own sovereign L1 chain, other L1 chains, or any rollup settled on L1.

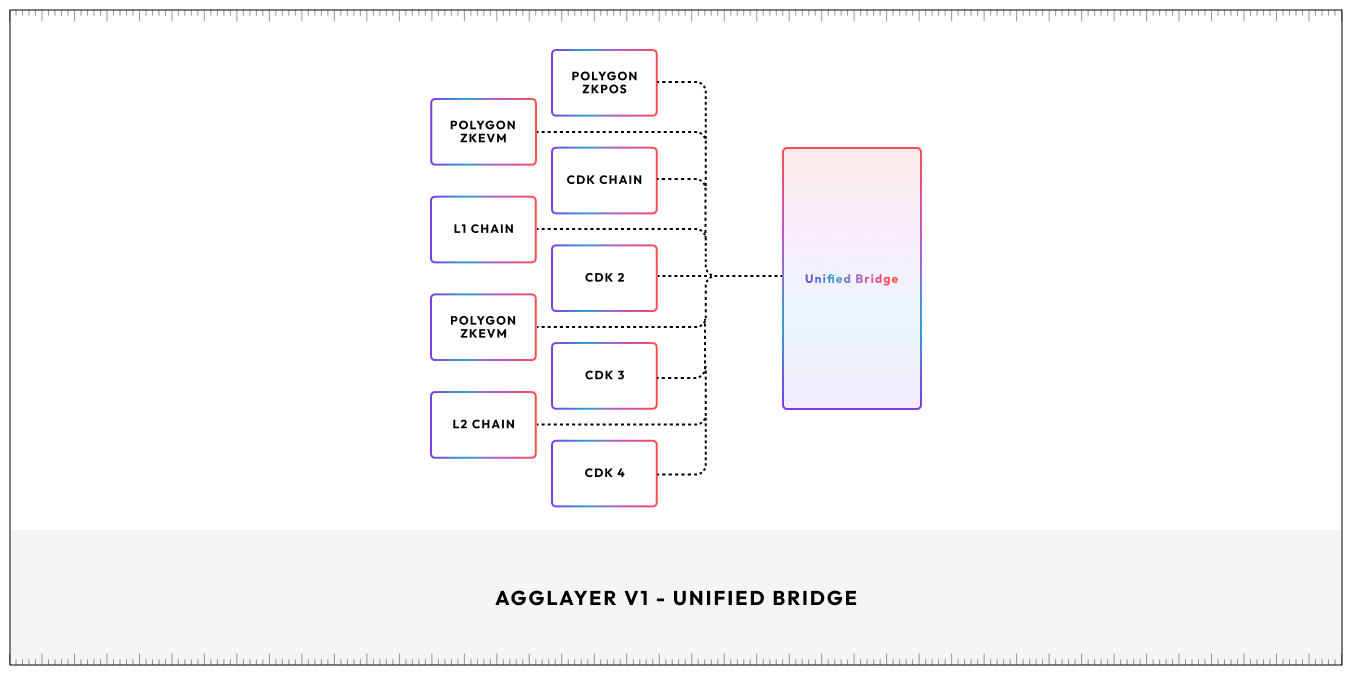

Case Study: Polygon AggLayer

Polygon's AggLayer is a system based on zero-knowledge (ZK) proofs, aimed at addressing interoperability and fragmentation issues between different rollups and Layer 1 (L1). By aggregating ZK proofs from all participating chains, this approach provides unified cryptographic security and atomic composability.

AggLayer introduces a unified bridging contract to bring interconnectedness into Ethereum. Each connected chain maintains a replica of this unified bridging root, enabling seamless cross-chain transactions. Additionally, AggLayer also features a message protocol bridge, establishing message queues for each chain, allowing them to maintain local outbound message queues protected by ZK proofs. This eliminates the need to lock tokens on one chain to interact with another. By issuing ZK proofs of events across multiple chains on Ethereum, AggLayer achieves a seamless user experience similar to a single ecosystem.

The Polygon CDK enables projects to launch ZK-based interconnected L2 or connect existing L1 to AggLayer, maintaining liquidity, users, and state. The first component of AggLayer went live in February 2024, marking a significant step for Polygon in creating an aggregated network of sovereign chains.

Case Study: NEAR Chain Abstraction Stack

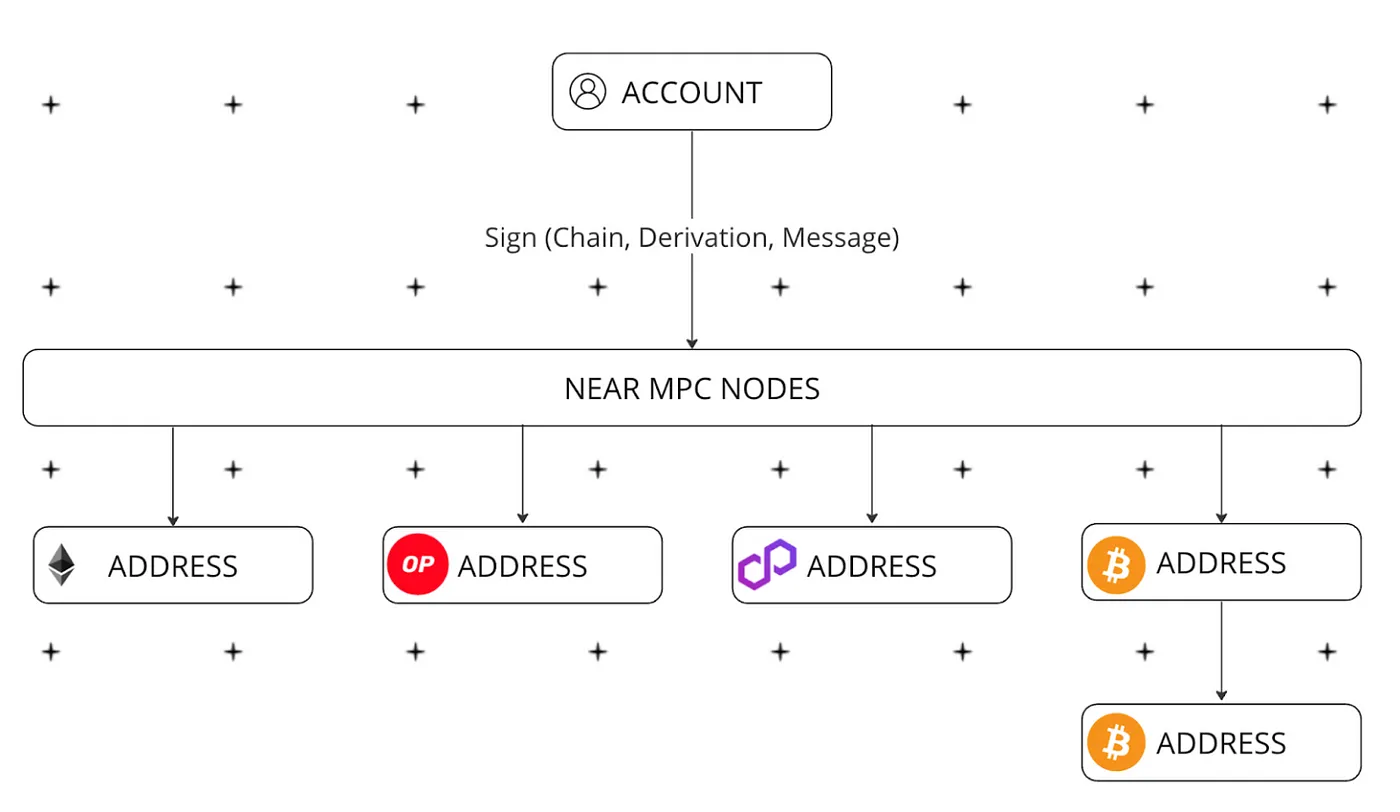

NEAR is developing a comprehensive chain abstraction stack for its blockchain and its surrounding ecosystem. The stack includes the following components:

Secure Aggregation Stack: This part includes NEAR DA (Data Availability), which collects the state of supporting chains. Additionally, it integrates zkWASM developed in collaboration with Polygon and utilizes fast finality provided by EigenLayer to enhance transaction processing speed.

Account Aggregation: Based on Multi-Party Computation (MPC), this component enables NEAR accounts to interact with external blockchains through request signature verification. The private keys of these third-party chain accounts are managed by validators of the NEAR network, serving as a decentralized signing service. This setup effectively binds accounts from different networks to a central NEAR "master account," securely managing all associated accounts.

Intent Layer: This layer includes relayers that execute complex cross-chain intents, facilitating more complex transactions and interactions across blockchain networks.

Application Layer: This layer integrates various web3 services into a user-friendly application, simplifying access and interaction with decentralized technology.

The visual representation of NEAR's account aggregation architecture is shown below:

Application Layer

Looking backward, the application layer is the final stage of chain abstraction, where infrastructure is integrated and presented consistently to developers and users.

Ideally, developers can easily build protocols that are not dependent on specific blockchains without the need to integrate various modular layers, reducing a significant amount of work. This means developers do not need to consider blockchain selection, cross-chain liquidity management, and data availability solution choices.

From the user's perspective, the ideal state is to interact with blockchain applications as smoothly as using other digital services, without the hassle of crypto-related issues such as gas fees and seed phrases. This requires simplifying the user interface, optimizing onboarding processes, and eliminating the need for users to understand underlying technologies, which are currently major barriers. Removing these barriers will significantly enhance the user experience and drive widespread adoption.

Before realizing this vision, tools need to be developed to integrate different infrastructures into a unified interface. Therefore, we believe chain abstraction is crucial for a good user experience.

Whoever controls the frontend has the most direct contact with users and can extract the most value from their order flow. While most attention and investment are currently focused on infrastructure, we believe the future focus will shift to higher layers of the stack.

Conclusion

There are currently nearly 300 chains with significant liquidity and on-chain performance, ranging from Layer-1 to Layer-3 solutions. This number continues to grow with no signs of slowing down.

One of the main drivers of this growth is the demand for scalability and sovereignty by applications, which can be achieved by having their own execution stack and economic system. For example, recently, ENS, Aave, and dYdX have launched their own rollups. Open-source technologies like OP Stack also make it cheaper and easier to build, deploy, and operate rollups, while Rollup-as-a-Service providers like Conduit and Caldera further reduce operational and technical overhead. Ironically, deploying a rollup today is often cheaper than transacting on Ethereum during the 2021 cycle.

For today's users, managing cryptocurrencies is often confusing and cumbersome, involving tasks such as safeguarding seed phrases, signing multiple transactions for simple tasks, handling assets on different chains, bridging these assets, and finding the best prices on various DEXs. While rollups offer the potential for scaling without sacrificing security and decentralization, their adoption adds complexity from the perspectives of users and developers. Simply implementing them would worsen the user experience.

Modern chain abstraction tools address this issue, making cryptocurrencies more accessible and feasible for a wider audience. Due to their proximity to users, winners in this field will gain significant value. As on-chain applications generate increasing revenue, the market will recognize the importance of owning the frontend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。