This article is mainly about how to leverage points on Gearbox.

Author: Mugglesect

Translation: DeepTechFlow

Introduction

Starting from Ether.Fi, the most effective LRT strategy for earning EigenLayer and other points is now online. This article focuses on how to leverage points on Gearbox and provides you with a points cost calculator.

How to Leverage Points on Gearbox?

Gearbox allows users to borrow real assets, up to 10 times their collateral, to create leverage. Because these assets are real, they can be further deployed to DeFi protocols, giving leverage to any allowed activity. If re-collateralized, these borrowed assets can simply be exchanged for weETH (Ether.Fi) to obtain leveraged EIGEN and Ether.Fi points. Subsequently, through other integrations, you can earn more on top of this.

This is thanks to Gearbox's innovation - Credit Accounts (CA), which act as leveraged smart contract wallets. The funds you borrow and the assets you collateralize are sent to a CA you open. The CA is programmed to only allow these funds to be used for specific assets, protocols, and pools to ensure that the borrowed funds are not at risk.

In the event of a loss, when a user's loss depletes their collateral, the position will be liquidated, and the borrowed funds will automatically return to the lending pool. This ensures that Gearbox's lenders will never face bad debts.

However, this is not limited to re-collateralization.

Gearbox is the leverage layer of DeFi. Regardless of what protocol Gearbox integrates, it will automatically leverage, which is the evolution of on-chain credit and composability.

There are also Yearn, Convex, Balancer, Aura, and more.

What is the cost of points?

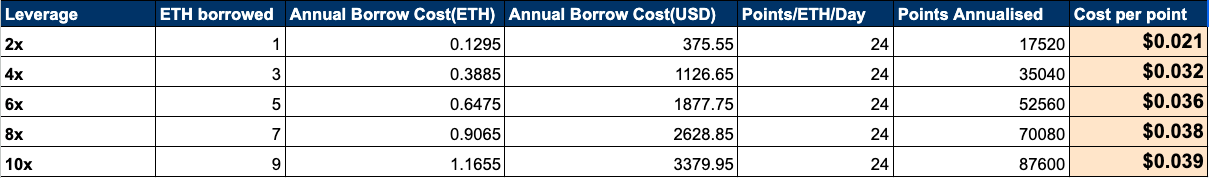

On Gearbox, EIGEN points are as low as $0.022. This is at a 17% borrowing rate. Any increase in the rate will make the points more expensive, and any decrease will make them cheaper. However, at the current 16.45% rate, Gearbox offers the cheapest EIGEN points and the best Whales arbitrage.

You can find out the exact cost of your EIGEN points by entering your leverage in the calculator below and updating the parameters (borrowing rate and ETH price). Click here to access the calculator.

How is this calculation done?

To calculate the cost of points, we need two things: 1. Net borrowing cost 2. Total points earned

The net borrowing cost depends on

Borrowing rate on Gearbox

Collateral APY obtained from re-collateralization

Subtract the collateral APY from the borrowing rate, and that is the net rate you pay. Multiply it by the value you borrow, and that is your annualized cost.

To find out the points you earn, re-collateralize 1 ETH can yield 1 EIGEN point per hour, or 8,760 points per year. Multiply 8,760 by your leverage, and that is the Eigen points you will earn annually.

Simply divide these points by the cost, and you will get the answer.

Note: Both points and borrowing costs are linear over time. This means the cost remains constant (except for rate fluctuations) and does not depend on time.

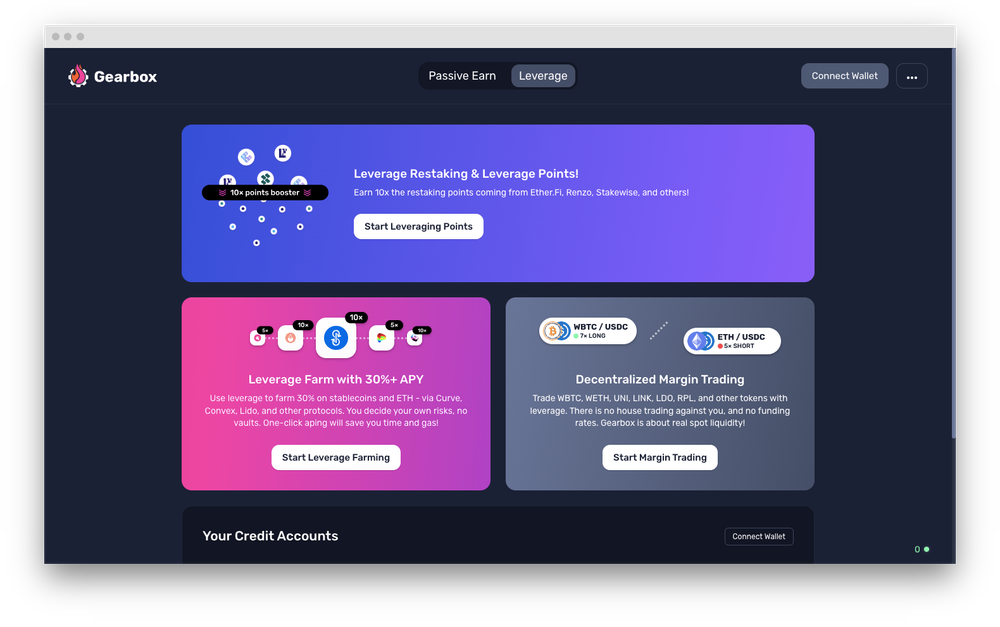

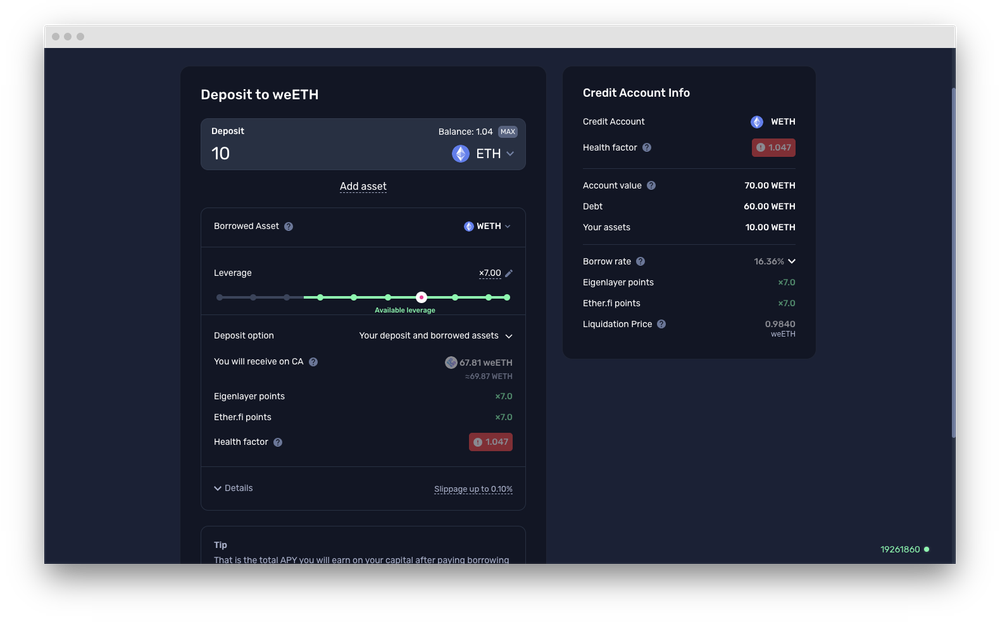

How do I open a position?

First, visit https://app.gearbox.fi/accounts

Then:

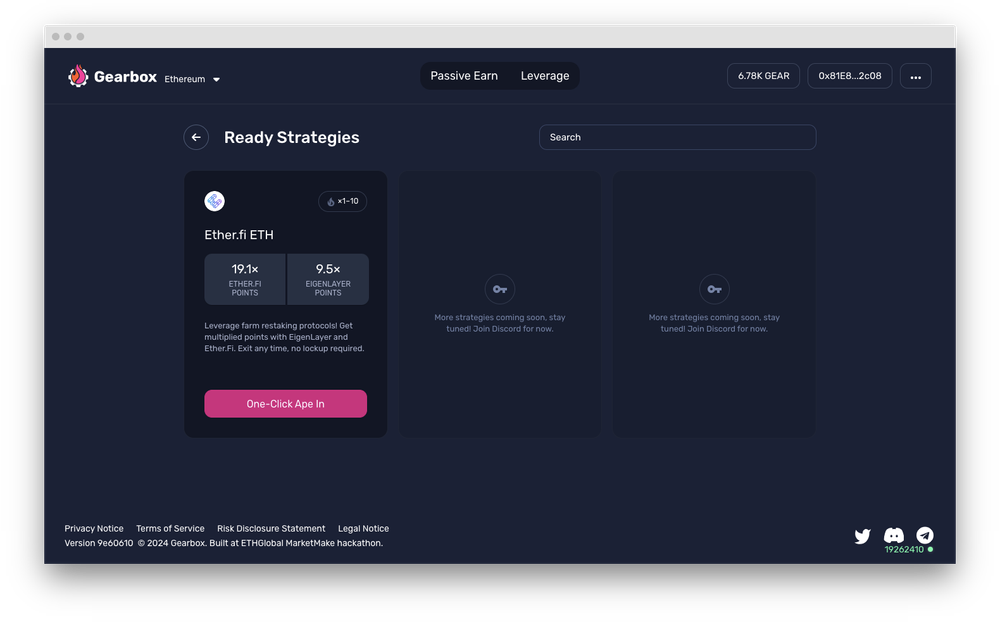

- Choose the leverage re-collateralization option: Currently limited to Ether.Fi, more options will be available in the future.

Mint DegenNFT: To ensure security, only wallets with a history and requested access can enter. If you have requested access, you should be able to mint NFT from the popup window after entering the strategy page. If not, you can request access here. If you hold old DegenNFT from V2, you should also be able to use it. DegenNFT is an SBT that allows specific users to open a credit account.

Choose your leverage: Customize your position based on your risk tolerance. The page also displays borrowing rates, liquidation prices, and other information to help you make wise decisions. All these details are up to you, all parameters are up to you!

- At the bottom of the page, click "Open position".

That's it! With the help of account abstraction, Multicall will now execute all necessary transactions at once.

But what if you want to close the position?

You can exit at any time!

The beauty of Gearbox's leverage re-collateralization and leveraged points is that you can exit at any time. Whether it's collateralized for a week, a month, or just 5 hours, you can close your credit account and end it.

You should note the following:

These leverage re-collateralization derivatives (weETH, ezETH, etc.) are novel things, and they do not have hundreds of millions of dollars in liquidity, so there may be some degree of volatility. Make sure you understand your liquidation price and keep an eye on it. This is especially important when comparing entry and exit prices. If you encounter a slight decoupling at entry and exit during the recovery, you will earn more ETH.

The borrowing rate you pay to Gearbox is not fixed, but the fluctuation is not significant. Just keep an eye on it to understand your cost basis and don't let your leveraged position sit idle for months.

The rewards you earn in EigenLayer and other points will be available for collection in your credit account. If you close it, someone else will receive these rewards. You can simply reduce your debt to a minimum (currently the minimum debt is $50,000) and pay a very small fee while waiting for these rewards to be distributed. Technically, you can completely cancel a leveraged re-collateralization position. During the waiting period for the distribution of rewards from the relevant protocols, you can switch to holding some StETH or Yearn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。