Author: PSE Trading Intern

This year, the asset issuance protocols on the Bitcoin chain have become the focus of discussion, all of which belong to metadata protocols, defining an asset by recording some information in a Bitcoin transaction. The differences lie in the different record positions and recording methods, which determine the differences in the protocols.

1. What is a Metadata Protocol

Blockchain is a linked list structure with hash pointers, essentially a database maintained by distributed nodes. Satoshi Nakamoto decided to create Bitcoin by recording transaction data encrypted by elliptic curve and hash functions on the blockchain. The key point here is that as long as there is a way to record where an address transferred how much of which asset, and can succinctly verify the legitimacy of the asset source, that the asset has not been spent, and the transaction signature is legitimate, creating a digital asset is possible.

In the early days of Bitcoin, people thought of recording this information in the op_return output, inheriting the security of Bitcoin, and issuing new assets directly on the Bitcoin chain without a new chain. This is the colored coin protocol, the first metadata protocol in history. Unfortunately, the concept of colored coin protocol was too advanced at the time, and there were doubts about whether Bitcoin had value. The more convincing approach at the time was to establish a new blockchain and find a new "ledger" to record the transfer of assets.

2. BRC-20: Witness Field New Paradigm

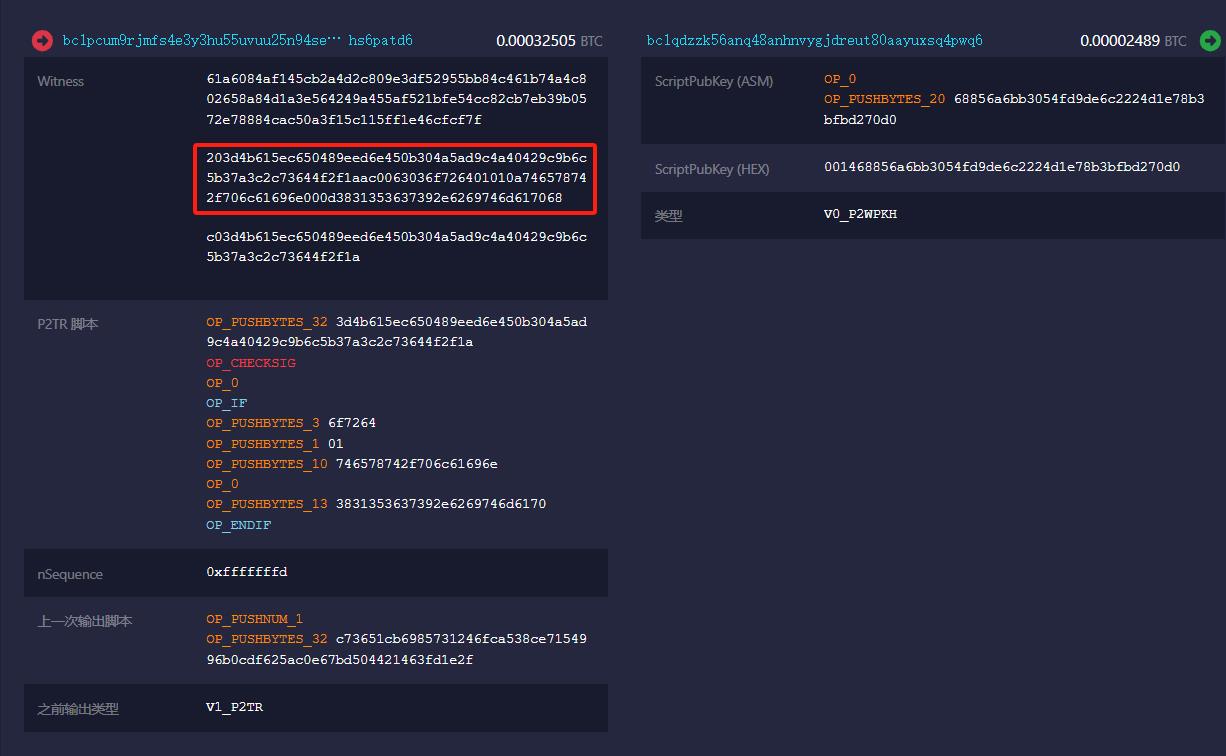

In February 2023, the appearance of the Ordinals protocol once again opened people's imagination about the Bitcoin ecosystem. The Ordinals protocol assigned a number to each satoshi mined in order, and by recording arbitrary data in the witness field of a Bitcoin transaction, calling it an inscription, and defining the owner of the first satoshi of the UTXO that has this inscription.

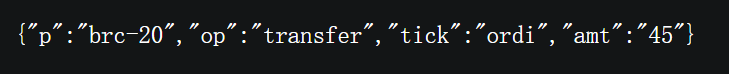

Since any data can be placed in the witness field, it is natural to put text data containing transaction information in the witness field. This is the BRC-20 series protocol, which puts text data including the protocol version number, operation type, name of the issued asset, and transfer quantity into the witness field of a Bitcoin transaction input, thereby defining the deployment, inscription, and transfer of a BRC-20 asset.

The BRC-20 protocol has sparked enthusiastic responses, with main assets such as \(Ordi\) and \(Sats. Ordi is the first token of the BRC-20 protocol, deployed on March 8th this year, and fully inscribed in less than two days, with a total supply of 21 million. Its market value reached 6.3 billion USD in May, and is currently around 4.1 billion USD. The popularity of Ordi has led to the continuous deployment of various BRC-20 assets, the most representative of which is \(Sats, deployed on March 9th, with a total supply of 21 trillion, and not fully inscribed until September 24th. Sats' market value once surpassed $Ordi, and is currently around 2.7 billion USD.

After BRC-20, a series of asset issuance protocols based on Ordinals began to appear, but they do not have fundamental differences, all of them involve putting metadata into the witness field. Their biggest advantage is the freedom of deployment, public inscription, simplicity, high transparency, with all information publicly available on the chain, allowing everyone to see exactly what they are trading on the chain. These characteristics have created a hot atmosphere for BRC-20, with "gamblers" entering one after another, deploying or inscribing assets they believe will increase many times over.

On the other hand, the BRC-20 series asset issuance protocol has made Bitcoin transaction fees very expensive, which is naturally good news for large miners, but for small nodes maintaining the Bitcoin state, the on-chain footprint of the BRC-20 series protocol is significant, and it will generate a large number of UTXOs with an amount of 546 satoshis, causing their operating costs to soar.

3. Runestone: Retro op_return Reappearance

Casey Rodarmor, the founder of the Ordinals protocol, tweeted on September 26, 2023, proposing a new concept for a metadata asset issuance protocol called Runes (later renamed Runestone). Casey stated that the original intention of the Ordinals protocol was to create a beautiful "art gallery" in Bitcoin, but the frenzy of BRC-20 is endangering Bitcoin, and no one can stop the gamblers from participating in gambling. Therefore, he proposed the idea of establishing a cleaner metadata asset issuance protocol so that gamblers can continue gambling without creating a large number of UTXOs and increasing the burden on nodes.

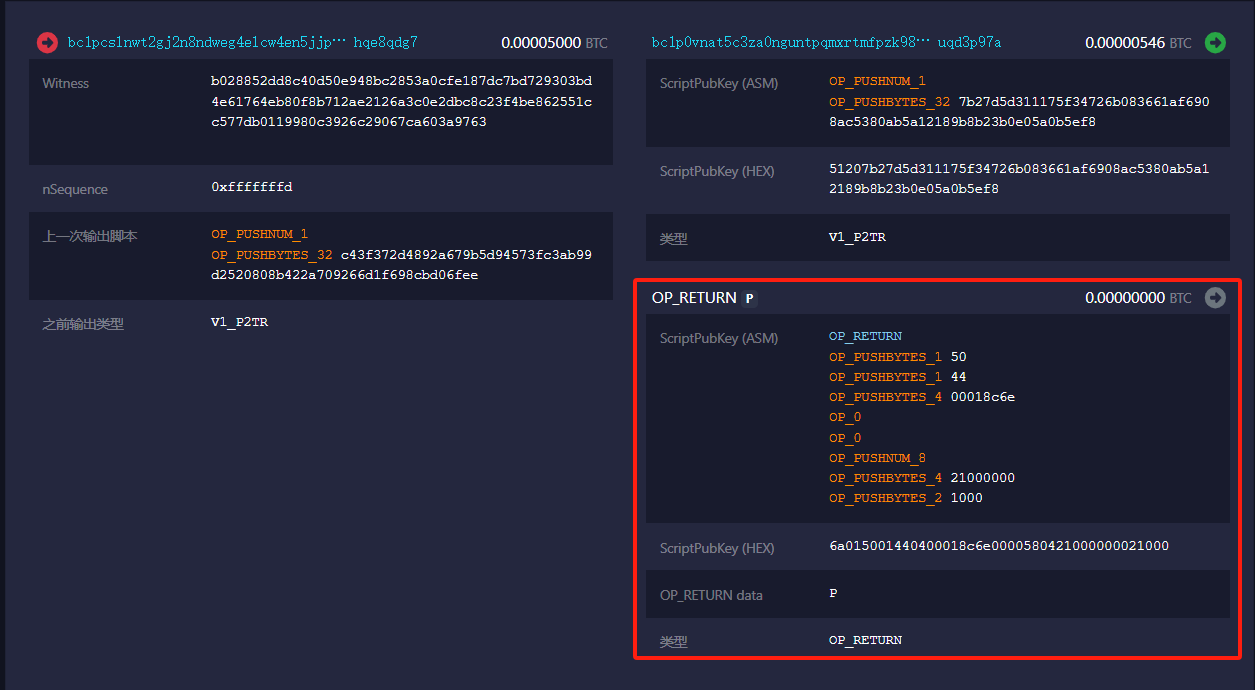

Runestone is a replica of the colored coin protocol from the early days, by recording the metadata that defines the asset in the op_return output of a Bitcoin transaction. op_return is a special Bitcoin script opcode, and any instructions after op_return will not be executed, so UTXOs containing op_return are considered to be unspendable forever, and can be removed from the UTXO set to reduce node maintenance costs. Therefore, any information can be recorded in the op_return output (this output does not need to contain Bitcoin), and the on-chain footprint is relatively clean, with a relatively small burden on nodes.

The concept of Runestone has sparked intense discussions, but unfortunately, Runestone has not been implemented to this day. However, Benny, the founder of TRAC, quickly implemented a similar asset issuance protocol called the Pipe Protocol, which is also a metadata asset issuance protocol that stores data in the op_return output. The Pipe protocol inherits Casey's desire to create a clean on-chain footprint for asset issuance, while also inheriting the core concept of the BRC-20 protocol, which is the freedom of deployment and public inscription. This is not part of Runestone's plan, as Casey clearly believes that the freedom of deployment and public inscription is the main cause of congestion on the Bitcoin blockchain. Therefore, in Casey's vision, Runestone will be an asset issuance protocol led by the project party in the form of an airdrop, but the market clearly prefers the freedom of deployment and public inscription.

The first token of the Pipe protocol \(Pipe was deployed on September 28th, with a total supply of 21 million, and the current market value is around 30 million USD.\) Although Pipe adopts the form of public inscription, it is one of the few tokens with the project party's tokens. The TRAC team stated that \(Pipe will be governed by\) Tap, and \(Tap is the first token of the TAP protocol, another asset issuance protocol similar to BRC-20, developed by the TRAC team, and\) Tap will be governed by $Trac, which is a BRC-20 token.

Protocols like Runestone and Pipe have the major limitation of limited storage space in op_return, which does not have a significant impact on homogeneous assets, but presents a clear constraint for non-fungible assets.

4. Taproot Asset Protocol: Achieving Significant Expansion through On-Chain Commitments

There have always been attempts to issue assets on the Bitcoin chain. For some very idealistic cypherpunks, they do not believe that issuing speculative assets for "gamblers" and miners to revel in is necessary. They strive to avoid the impact of asset issuance protocols on the normal use of the Bitcoin network, and to achieve this, they spend more time developing more complex technologies.

The Bitcoin Lightning Network development team Lightning Labs began developing a stablecoin protocol called Taro in April 2022, renamed to Taproot Asset in May 2023, and officially launched the first mainnet version of Taproot Asset on October 19, 2023. Lightning Labs' vision is to combine the Lightning Network to issue stablecoin assets, thereby achieving global foreign exchange trading and replacing fiat-dominated retail payment systems in local areas.

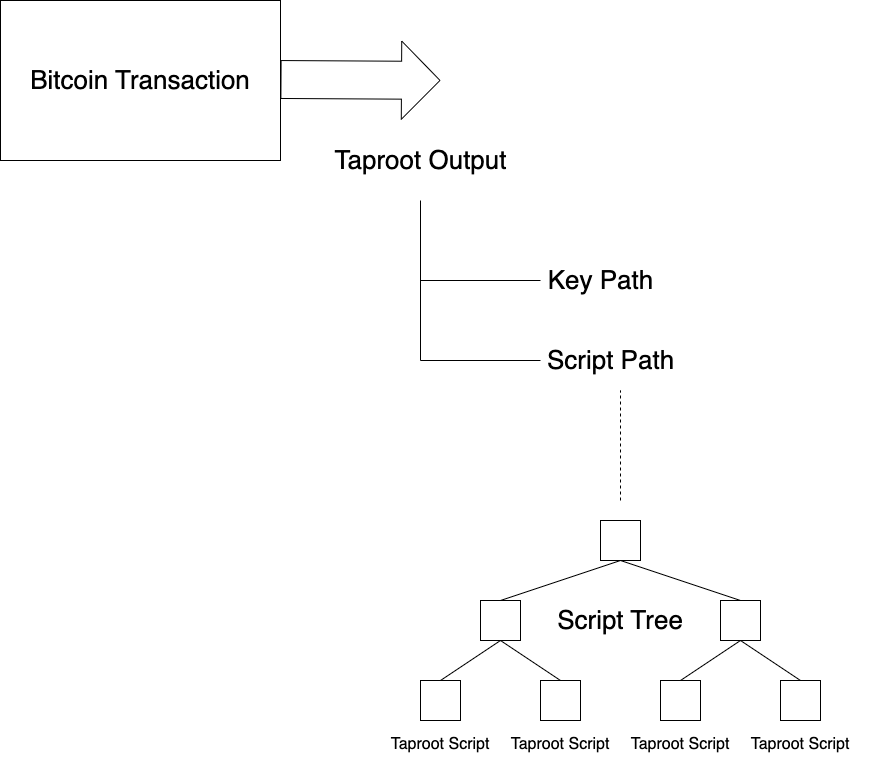

The Taproot Asset protocol is also a metadata asset issuance protocol, but Taproot Asset does not store data in the witness field of transaction inputs or in the op_return output. In fact, Taproot Asset does not directly store data on the chain, but commits the data to a script path of a P2TR type UTXO. Therefore, from the result, a deployment and transaction of Taproot Asset will leave almost no footprint on the chain, because to observers, it is just a regular Bitcoin transaction to a Taproot address.

So, is this secure? The answer is yes, because every transfer of Taproot Asset requires the submission of a Merkle proof of the metadata. If there is a double spend or unexpected change, the resulting root hash value will be different from the expected one and will be rejected.

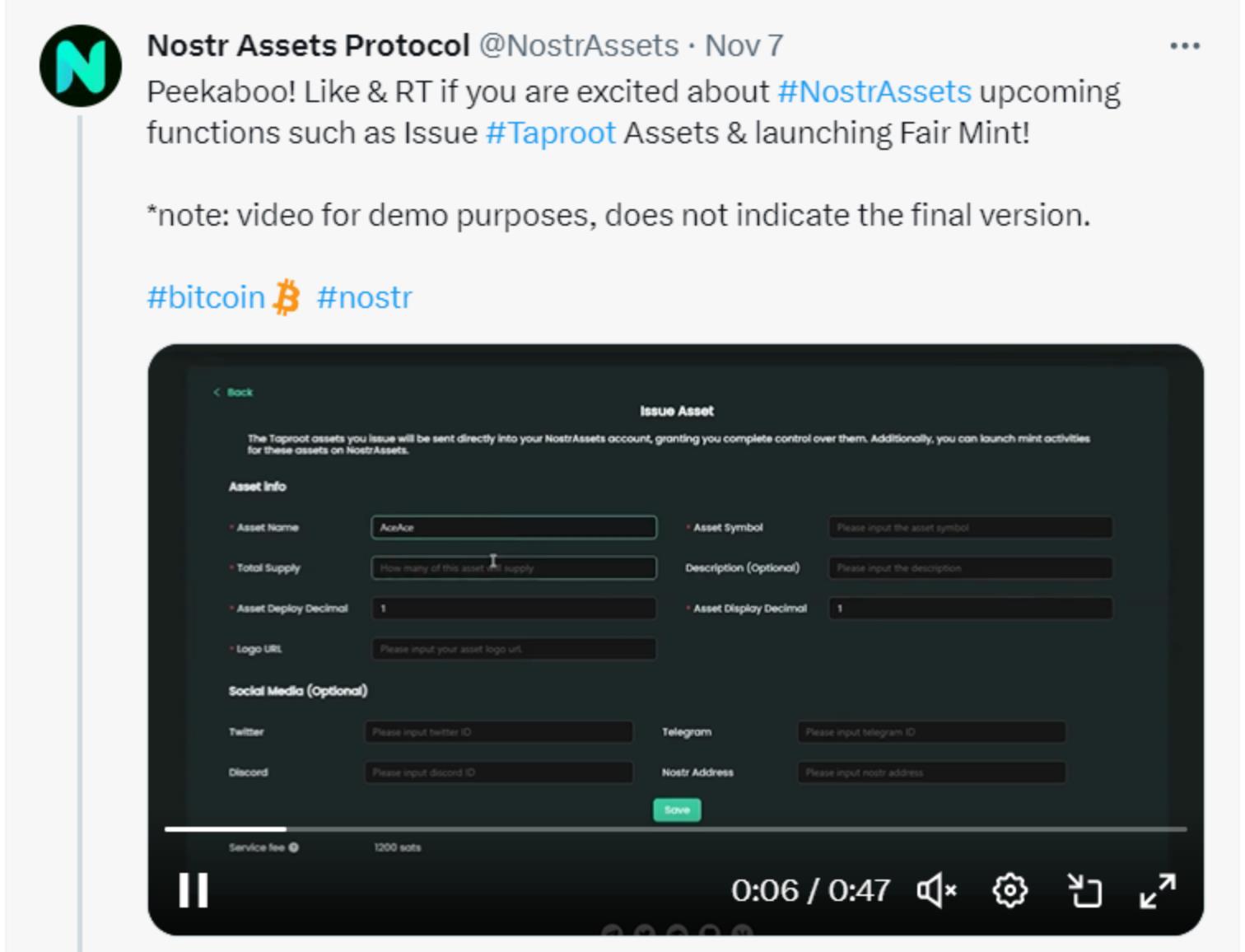

Due to the technical complexity, there are not many assets currently issued through the Taproot Asset protocol. The most notable one is the Nostr Assets Protocol, which is a Bitcoin ecosystem project that combines the Nostr protocol, Taproot Asset protocol, and the Lightning Network. Its first tokens, Trick and Treat, each have a supply of 2.1 billion, with only 20% released through airdrops, while the rest is held by the Nostr Assets team. Trick and Treat are assets issued through the Taproot Asset protocol, and the Nostr Assets team has stated that they will develop a public inscription method in the future to allow people to freely deploy and inscribe Taproot Asset protocol tokens on the project platform.

However, Taproot Asset is not a perfect solution. It is technically too complex, which is not conducive to user understanding and trust, and may have unexpected vulnerabilities. Additionally, the verification cost index of Taproot Asset is increasing, which is a significant cost for both users and third-party institutions. Most importantly, Taproot Asset does not store metadata on the chain, so users need to locally store this metadata or entrust a third-party institution like Universe to store this data.

5. BRC-20 Wave, Runestone & Taproot Asset: Pros and Cons?

BRC-20 Series vs. Runestone Series

1. The biggest advantage of the Runestone series protocol compared to the BRC-20 series is also the biggest disadvantage of the BRC-20 series - heavy on-chain footprint. BRC-20 generates a large number of abandoned UTXOs because the BRC-20 protocol uses an account model to maintain the ledger, which requires maintaining how much assets each "account" holds. Therefore, holders need to inscribe "Transfer" every time they transfer, to specify the amount to be transferred to the target address. The Runestone series protocol, on the other hand, uses a UTXO model similar to Bitcoin for maintaining the ledger, marking the amount to be transferred to the target address and the change to oneself during the transfer. This design has two benefits: it greatly reduces the on-chain footprint, reducing the pollution of asset issuance protocols to the Bitcoin chain, and it lowers the cost and simplifies the operation for off-chain indexers.

2. The Runestone series protocol is more conducive to large-scale airdrop issuance. This may not be what "gamblers" want to see, but perhaps it is what institutional investors would like to see. However, this is not absolute, as the Pipe protocol also supports the public inscription format that "gamblers" like.

3. The BRC-20 series has a larger storage space. The BRC-20 series based on the Ordinals protocol stores data in the witness field of transaction inputs, and these information can enjoy SegWit discounts. Therefore, theoretically, as long as the data put into the witness field is large enough, a transaction close to 4MB in size can be created (the largest Ordinals NFT is 3.94MB in size, almost occupying the entire block). With the introduction of recursive inscription technology, even larger non-fungible assets can be created. The Runestone series will face a limitation of op_return 80KB in size, which restricts the issuance of non-fungible assets through them, and even when issuing fungible assets, too large-scale transactions cannot be released at once.

Taproot Asset Protocol vs. Previous Two Series

The complex design of Taproot Asset is aimed at reducing on-chain footprint and being compatible with the Lightning Network, carrying a completely different mission. However, as an open-source protocol, it will be hyped by "gamblers" as long as it can. Therefore, here we only compare Taproot Asset protocol with the previous two series from this perspective.

1. Similar to the previous two series, Taproot Asset also requires the introduction of third-party trust. The previous two series require trust in off-chain indexing, while Taproot Asset requires trust in Universe for storing and verifying metadata. However, there are differences: the data structure of Taproot Asset ensures the simplicity and reliability of Universe verification in design, but considering the complexity of Taproot Asset, it makes it difficult for users to understand and trust, and the verification cost of Universe still remains uncertain. Moreover, there has been a significant investment in the construction of off-chain indexing for the BRC-20 series. Therefore, it can be speculated that in the short term, the slow construction and user acceptance of Taproot Asset Universe may lead to higher overall costs. However, in the long run, the overall cost of Taproot Asset Universe may be lower than that of the BRC-20 series.

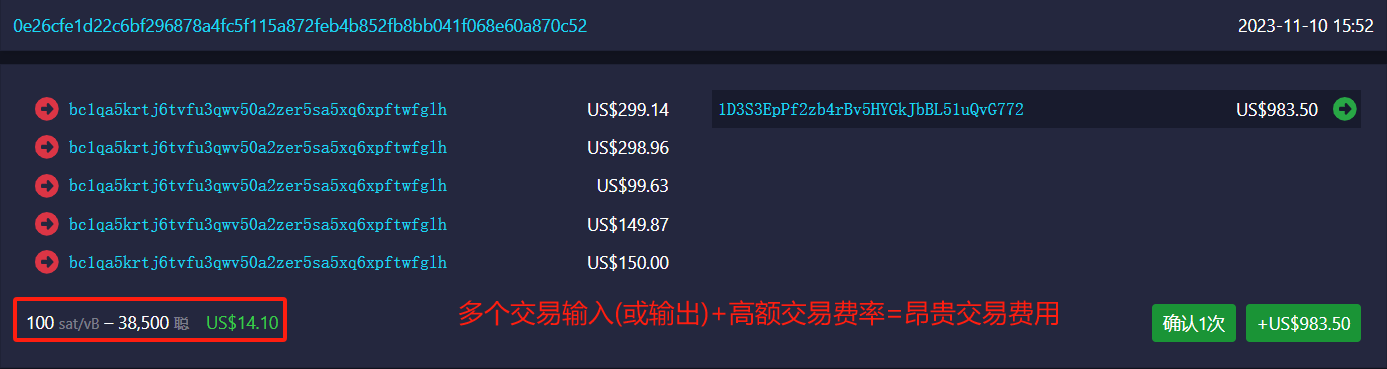

2. Lightning Labs paved the way for Taproot Asset to integrate with the Lightning Network in technical details during development, which is the biggest advantage of the Taproot Asset protocol compared to the previous two series. Taproot Asset can transact on the Lightning Network, further reducing its on-chain footprint, not pushing up Bitcoin network fees, and allowing traders to avoid high transaction fees. Currently, the BRC-20 series, on the one hand, leads to expensive Bitcoin network fees, and on the other hand, users may incur over $10 in transaction fees when trading BRC-20 series assets due to fragmented UTXOs in their wallets.

3. Similar to the Runestone series, the Taproot Asset protocol is more conducive to large-scale airdrop issuance. However, this is not absolute, as the Nostr Asset Protocol promises to support public inscription.

4. However, in terms of the ability to issue non-fungible assets, the Taproot Asset protocol is not as good as the previous two series and the Ordinals protocol. Just as Musk recognized, the previous two series and the Ordinals protocol write data to the blockchain, with every pixel of each image being written to the blockchain. Non-fungible assets issued through Taproot Asset only commit to the chain, and the specific data is stored locally or by Universe. If for any reason the data is lost, the hash value committed to the chain will be meaningless.

6. Conclusion

The main differences between different metadata protocols lie in the different recording locations, recording methods, and ledger maintenance methods of the data on the blockchain. These differences determine the characteristics of different protocols. Protocols that record data in the witness field, such as the BRC-20 series protocol, although have sufficient data space, have a heavy on-chain footprint, and its account model generates a large number of abandoned UTXOs, burdening the nodes. Protocols that record data in op_return, such as the Runestone or Pipe protocols, have made improvements in this regard. The Taproot Asset protocol, which commits data to the chain, has the cleanest on-chain footprint, but its technical complexity is not conducive to user understanding and trust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。