原文作者:蒙奇 | 编辑:蒙奇

1、比特币市场

在2025年3月22日至3月28日期间,比特币具体走势如下:

3月22日:比特币市场波动幅度收窄,整体呈现震荡整理态势。当日价格变动较小,从83,599美元小幅上涨至84,436美元,市场情绪较为平稳。

3月23日:比特币价格早间自84,018美元升至84,272美元,随后回落至83,794美元,短暂跌破84,000美元支撑位后迅速反弹。晚间市场出现明显拉升,价格突破84,338美元后迅速上涨至84,936美元,最终进一步冲高至85,302美元,市场活跃度明显提升。

3月24日:比特币价格开盘小幅回调至84,847美元,但随后延续上涨趋势,突破关键阻力位,一度升至86,394美元。尽管随后短暂回落至85,585美元,但市场多头情绪主导,比特币价格持续上扬,并突破此前震荡区间,最终攀升至本周最高点88,740美元。

3月25日:比特币在88,300美元附近盘整后出现大幅回调,最低触及86,436美元。随后,价格小幅反弹至86,844美元,但未能站稳,短暂调整后再次回升,最终回涨至88,154美元,市场表现较为剧烈。

3月26日: 比特币延续前日上涨动能,进一步冲高至88,447美元。然而,市场随后出现两轮回调,价格分别下探至87,283美元和87,117美元。尽管如此,比特币仍迅速回升至88,241美元。晚间市场波动加剧,价格自88,241美元大幅跳水至86,598美元,随后小幅回升至86,800美元附近。

3月27日:市场空头力量增强,比特币价格跌破86,000美元关键支撑位,最低触及85,929美元。但随后迅速反弹至87,373美元,短暂调整后再度下探至86,602美元,最终回升至87,667美元,市场呈现剧烈震荡格局。

3月28日:比特币价格振幅缩小,价格在86,895-87,590美元区间内震荡整理,基本维持在 86,800美元以上。

总结

本周,比特币的整体走势呈现先上突破的态势,然而在后半周,多空力量多次交锋,市场呈现震荡整理。前半周,市场承压,价格维持在84,630美元以下,直至3月23日和24日,价格突破了这一关键区间,24日成功突破阻力位后,25日 经历了短期的回调整理。

截至目前,比特币价格稳定在87,220美元附近,市场情绪逐渐趋于平稳。未来的关键关注点将是比特币能否进一步突破当前的关键阻力区域,若突破成功,可能为进一步上涨打开空间。

比特币价格走势(2025/03/22-2025/03/28)

2、市场动态与宏观背景

资金流向

1. 交易所资金流动

比特币现货ETF资金流向:

根据SoSoValue的数据,截至2025年3月28日,比特币现货ETF的资金流向表现出显著增长。具体数据显示,3月27日(美东时间)比特币现货ETF的总净流入金额为8906.38万美元,标志着该市场连续10日呈现净流入状态。

在具体ETF表现方面,富达比特币ETF(FBTC)表现尤为突出,其3月27日单日净流入达9713.73万美元,累计历史净流入已达115.63亿美元。紧随其后的是贝莱德比特币ETF(IBIT),其单日净流入为396.75万美元,历史总净流入为399.46亿美元。

相比之下,Invesco与Galaxy Digital联合推出的比特币ETF(BTCO)在同一天出现净流出,单日净流出金额为695.19万美元,目前BTCO的历史总净流入为9818.45万美元。

截至本文发布时,比特币现货ETF的总资产净值(AUM)为982.88亿美元,ETF的净资产比率(即市值占比)为5.67%。同时,该市场历史累计净流入已达363.38亿美元。

交易所交易量变化:

2025年3月23日,Binance交易所的比特币交易量突破22,500 BTC,进一步体现了市场参与度的显著提升。这一数据表明,市场活跃度正在持续增长,投资者的参与意愿亦呈现上升趋势。

2、机构与鲸鱼账户的资金动向

3月24日至3月25日,链上数据表明部分机构资金开始加仓,比特币巨鲸,持有 100 至 1 万枚 BTC 的地址总数开始上升,自 16600 个增至 17889 个。在此阶段净增持,支撑了比特币的上行趋势。

3月26日至3月27日,部分鲸鱼账户开始减持,比特币在交易所的存量上升,表明短期获利了结的趋势明显。这一现象与衍生品市场的资金流向一致,市场空头力量增强,导致比特币价格出现大幅回撤。

技术指标分析

移动平均线(MA): 50日移动平均线(MA50)在3月22日上穿200日移动平均线(MA200),形成“黄金交叉”,通常被视为看涨信号,预示长期上涨趋势的可能性。

相对强弱指数(RSI): 在3月22日,RSI回落至50,显示多空力量均衡,短期上涨动能减弱。

随机指标(Stochastic): 在3月22日,Stochastic指标显示市场处于震荡状态,短期上涨动能减弱。

布林带(Bollinger Bands):3月15日至3月25日,布林带显著扩张,上轨达到90,000美元,下轨为80,000美元,反映出市场波动性的增加。

成交量:3月23日,比特币在Binance的交易量达到22,500 BTC,以太坊在3月24日达到120万ETH,显示出市场参与度的提升。

市场情绪

1、市场情绪指标分析

恐惧与贪婪指数(Fear & Greed Index): 根据coinmarketcap数据,3月25日,该指数从前几日的27上升至34,反映出市场情绪一直处于恐惧。

2、投资者行为与市场动态

交易量变化: 3月23日,Binance交易所的比特币交易量达到22,500 BTC,显示出市场参与度的提升。

空头头寸清算: 3月26日,比特币价格达到87,100美元,导致大量空头头寸被清算,市场情绪因此得到改善。

宏观经济背景

2025年3月22日至3月28日期间,比特币价格的上涨受到了以下具体数据的支持:

标普500指数回升:3月25日,标普500指数上涨1.7%,突破了200日移动均线(200DMA)。这一突破为市场提供了回暖的技术支撑,增强了风险资产的吸引力。

美联储利率预期:根据CME“美联储观察”,市场预计美联储在5月维持利率不变的概率为86.4%,降息25个基点的概率为13.6%。此类宽松预期增强了市场的风险偏好,有助于资金流入比特币等非传统资产。

然而,在3月28日的新闻中,关税威胁拖累了美股与比特币市场,带来了新的不确定性:

特朗普关税威胁:特朗普宣布对所有非美国制造汽车征收25%关税,并警告若加拿大和欧盟联合反制,将面临更严厉关税报复。这一强硬表态令市场的恐慌情绪升温,导致美股连续第二日下跌。标普500收跌0.33%,道指跌0.37%,纳指跌0.53%。加密市场也普遍下跌,比特币受美股低开拖累跌破8.6万美元,但随后随美股反弹,跌幅收窄,截稿时报87,216美元,24小时跌0.4%。

市场关注2月PCE通胀数据:市场目前聚焦今晚20:30将公布的2月PCE通胀数据,预期PCE通胀同比为2.5%,核心PCE可能升至2.7%。若数据继续强劲,可能延后市场对降息时间的预期。此外,特朗普的“对等关税”政策的最终定调也备受关注,可能对市场情绪产生进一步影响。

3、哈希率变化

在2025年3月22日至3月28日期间,比特币网络哈希率呈现波动,具体情况如下:

3月22日,哈希率波动较小,维持在800至850 EH/s之间。次日,哈希率首先小幅上升至891.27 EH/s,随后回落至806.07 EH/s。3月24日,哈希率出现较大波动,从807.75 EH/s迅速攀升至1073.38 EH/s,随后略微回落至989.16 EH/s,最终迅速下降至801.75 EH/s。3月25日,哈希率进一步回落至753.03 EH/s,随后持续上升,并最终达到了880.44 EH/s。3月26日,哈希率进一步上升至959.06 EH/s,回落至819.21 EH/s后再次小幅上升至857.36 EH/s。3月27日,比特币全网哈希率出现波动,首先下降至767.72 EH/s,随后回升至858.80 EH/s,经过小幅回调后再次攀升至916.41 EH/s。截至3月28日 撰稿时,哈希率稳定在895 EH/s 附近,维持在较高水平。

本周,哈希率整体表现出较大的波动性,尤其是在 3月24日,出现了显著的上升。这一变化可能与矿工算力的调整、市场情绪波动以及能源供应的不稳定性等因素密切相关。

后续走势的关键因素将包括全网算力分布\即将进行的 挖矿难度调整,以及更广泛的宏观市场环境变化,这些都可能对哈希率的稳定性产生深远影响。因此,需持续关注这些因素的动态变化,以更好地预测未来哈希率的走势。

比特币网络的哈希率数据

4、挖矿收入

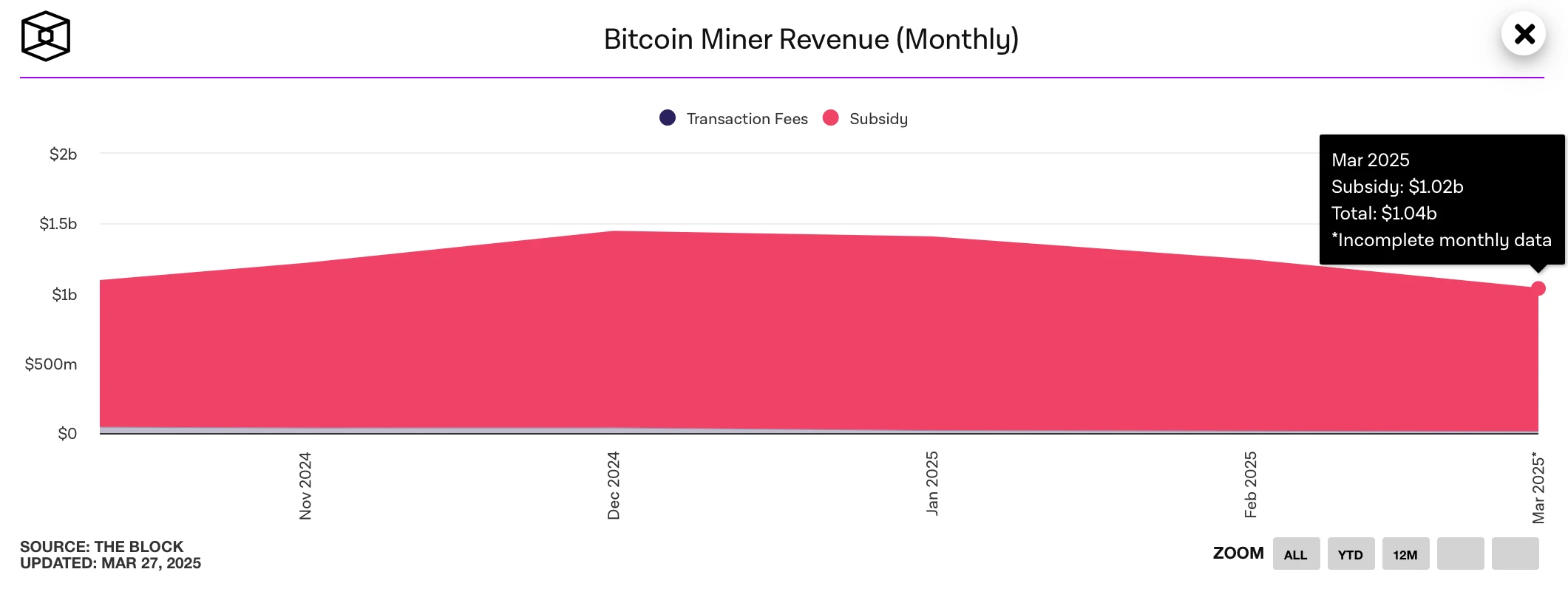

根据The Block的数据,2025年3月,比特币矿工的总收入约为10.4亿美元,较2月的12.4亿美元下降16.12%。这一降幅主要受比特币价格波动影响,同时,由于矿工竞争加剧,3月份挖矿难度上调2.88%,进一步压缩了矿工的利润空间。

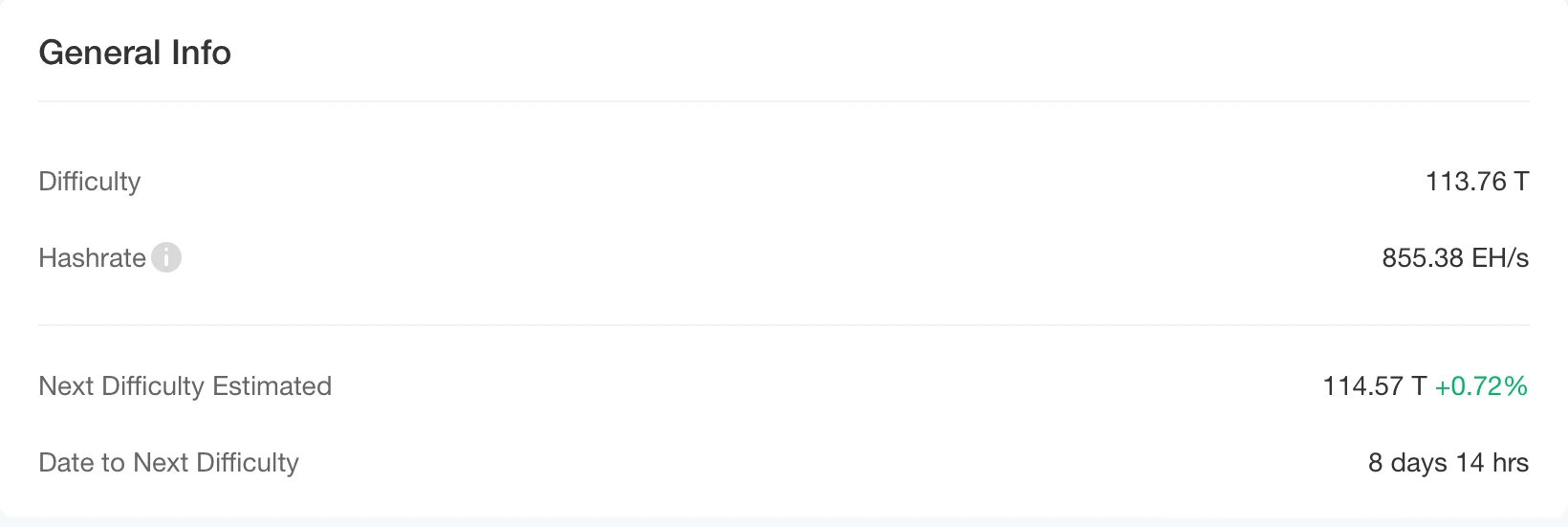

尽管挖矿难度持续攀升,哈希价格仍保持在相对稳定的水平。根据Cointelegraph 3月23日的数据,比特币挖矿难度在区块高度889,081上调1.4%,达到113.76万亿,高于前一周期的112.1万亿。然而,比特币哈希价格(即矿工每单位算力的日均收入)仍保持在约48美元/PH/s。截至3月28日,哈希价格为48.71美元/PH/s,处于本周的中等水平。

来自TheMinerMag的报告指出,当哈希价格低于50美元时,使用Antminer S19 XP和S19 Pro等较旧矿机的矿工可能面临运营压力。较旧的矿机能效较低,加之交易手续费收入的下降,可能导致部分矿工盈利能力下滑,甚至被迫暂停运营,直至升级至更高效的ASIC矿机或市场环境改善。

综合来看, 3月份比特币矿工的整体收益受挖矿难度上调及比特币价格波动的双重影响而有所下降。虽然哈希价格相对稳定,但对于依赖老旧矿机的矿工而言,盈利压力依然较大,行业可能会出现部分算力优化或设备升级的趋势。未来,矿工的盈利能力仍将取决于比特币价格走势、交易手续费水平及挖矿难度的进一步变化。

比特币矿工月度收入数据

5、能源成本和挖矿效率

根据CloverPool的数据,截至撰稿时,比特币全网算力已达到约 855.38 EH/s,当前挖矿难度为 113.76 T。按照当前趋势,预计在下次难度调整(约8天后),比特币挖矿难度将进一步上调约0.72%,达到 114.57 T。难度上调意味着单位算力所能挖掘的比特币数量减少,进而影响矿工的收益率和能效比。与此同时,随着挖矿设备的不断升级,整体挖矿效率得到优化,部分矿工可能会选择更高能效的ASIC矿机,以降低单位算力的能耗成本。

根据 MacroMicro 最新数据估算,2025年3月26日,比特币的生产总成本约为 85,204.87 美元,而挖矿成本与市价比值(Mining Cost-to-Price Ratio)为 0.98。这一比值接近 1,表明当前市场价格(约 86,000 美元)与挖矿成本基本持平,意味着矿工的利润空间受到挤压。当该比值接近或高于 1 时,部分运营成本较高的矿工可能面临亏损风险,尤其是依赖较低能效矿机的个体或小型矿场。

在这样的背景下,矿工的策略调整变得至关重要。一方面,部分矿场可能选择 优化电力采购成本,通过迁移至电价更低的地区或采用可再生能源降低运营成本。另一方面,矿工可能会加快 硬件升级,使用更高效的ASIC矿机,以在算力竞争加剧的环境下保持盈利能力。此外,若比特币价格进一步上涨,即使挖矿成本趋于高位,矿工的盈利能力仍有望维持,但若价格出现大幅回调,部分高成本矿工或将面临关闭矿机或调整运营模式的压力。

综合来看,比特币挖矿的盈利能力正处于关键节点,市场价格、挖矿难度以及电力成本的动态变化,将直接决定矿工的生存空间和行业整体算力布局。未来,随着市场波动和难度调整,挖矿行业或将迎来新一轮的算力重组与产业升级。

比特币挖矿难度数据

6、政策和监管新闻

美国各州比特币立法进展加速,多州推进储备与自托管权益保障

肯塔基州正式签署《比特币权利法案》——2024年3月24日,肯塔基州州长正式签署HB701法案,保障居民使用自托管钱包、运行区块链节点的权利,并明确此类行为不受金钱传输许可和证券监管约束,同时限制地方政府对相关技术活动的歧视性管理。

俄克拉荷马州众议院通过战略比特币储备法案——2024年3月25日,俄克拉荷马州众议院投票通过战略比特币储备法案,该法案允许该州将10%的公共资金投资于比特币或市值超5000亿美元的数字资产,旨在提升州政府资金储备的多样性和长期收益潜力。

北卡罗来纳州比特币投资法案将创建投资管理局,推动5%基金投资数字资产——2024年3月25日,Bitcoin Laws 披露了北卡罗来纳州的比特币投资法案细节。该州众议院法案HB506将创建北卡罗来纳州投资管理局(NCIA),由州财政部长领导,并授权该机构将州内各基金的5%投资于数字资产。HB506法案并未真正创建“比特币储备”,其概念与佛罗里达州的HB487和SB550较为接近,即允许州级公共基金投资比特币,但未规定强制持有。

南卡罗来纳州比特币储备法案将允许部署州资金的10%投资比特币,上限为100万枚BTC——3月28日消息,据 Bitcoin Laws 发文,南卡罗来纳州比特币储备法案(H4256 法案)将允许州财政部长将州资金的10%投资于比特币。比特币储备的上限为100万枚BTC。该法案由众议员 Jordan Pace 提出。

26个州已推出比特币储备法案,占比超50%——截至2024年3月26日,美国已有26个州推出比特币储备法案,意味着全美超过一半的州正在考虑比特币作为政府资产配置的一部分,部分州提议将最高10%的州资金分配到加密资产中。此外,威斯康星州已成为首个购买比特币ETF的州,截至2024年第四季度,持有量达5.88亿美元。

这些立法进展表明,美国多个州正积极推动比特币合法化,并在政府资金配置和居民使用权方面提供更明确的法律保障。

7、矿业新闻

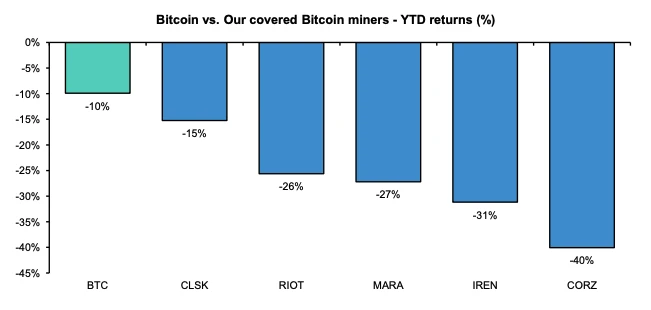

伯恩斯坦下调多家上市比特币矿企目标价,仍维持BTC年底20万美元目标价格不变

3月20日消息,经纪公司伯恩斯坦下调多家上市比特币矿企目标价,包括 IREN、CleanSpark 和 Riot Platforms,因为今年迄今为止这些公司的股价表现远不及 BTC。分析师 Gautam Chhugani 解释说,比特币矿企今年经历了痛苦的调整,下跌 20-40%,而比特币下跌了 10%,总体而言,上市矿企的价格走势令人失望,去年第四季度没有显著的上涨,今年迄今的表现比比特币的调整还要糟糕。

不过,伯恩斯坦分析师维持了比特币年底前 20 万美元的目标价格不变。

相关图片

巴基斯坦提议利用剩余能源进行比特币挖矿

3月24日消息,巴基斯坦提出利用其过剩能源来挖掘比特币,这标志着其从先前反加密货币立场的重大转变。此项提案由新成立的加密委员会(Crypto Council)首席执行官Bilal Bin Saqib 于2025 年3 月21 日的首次会议上提出。会议包括立法者和巴基斯坦央行行长等高层人士参与。该计划旨在建立巴基斯坦稳健的加密生态系统,吸引外国投资,并将该国定位为主要的加密货币枢纽。这一变化发生在政府此前受特朗普政府等全球支持加密政策影响而反对加密货币之后。该提案符合国际趋势,拥抱数码资产,预示巴基斯坦数码时代的新篇章。

微软削减数据中心计划,Bitfarms等比特币矿企股价下跌

3月27日消息,微软因担忧AI算力供应过剩,取消在美欧部分数据中心投资,导致当日多家加密矿企股价下跌4%-12%,包括Bitfarms、CleanSpark、Marathon等。分析称此举加剧矿企对AI业务依赖,而比特币减半后收益下降已对行业造成压力。微软计划转向改造现有中心设备,预计2025年下半年进一步放缓扩建。

8、比特币相关新闻

全球企业与国家比特币持仓情况(本周统计)

港亚控股:3月20日,港亚控股(01723.HK)购入10枚比特币,总价667.12万港元(约85.85万美元)。目前公司累计持有18.88枚BTC,总价值约172万美元。

Metaplanet:3月25日,Metaplanet追加购入150枚比特币,总额约18.86亿日元。截至目前,公司累计持仓3,350枚BTC,购入总额约422.16亿日元。

KULR:3月25日,美股上市公司KULR以88,824美元/枚的价格增持56.3枚BTC,累计持仓668.3枚BTC,总购入金额约6,500万美元,平均持仓成本97,305美元/枚。

富达(Fidelity):3月25日,富达通过其比特币ETF(FBTC)增持688.547枚BTC,总价值约6,020万美元。

The Blockchain Group:3月27日,法国科技咨询公司The Blockchain Group以约81,550欧元(约87,874美元)每枚的价格购入580枚比特币,此次交易后公司比特币持仓总量达到620枚,按当前市场价格估值超过5420万美元,成为全球第28大企业比特币持有者。

KULR:3月25日,美股上市公司KULR以88,824美元/枚的价格增持56.3枚BTC,累计持仓668.3枚BTC,总购入金额约6,500万美元,平均持仓成本97,305美元/枚。

IMF首次将比特币等数字资产纳入全球经济报告框架

3月23日消息,国际货币基金组织(IMF)3 月 20 日发布第七版《国际收支手册》(BPM7),首次将加密货币等数字资产纳入全球经济报告框架,为该手册自 2009 年以来的首次更新。根据新框架,数字资产分为可替代代币和不可替代代币,并根据其是否承担相关负债进一步分类:

-比特币等无背书资产被归类为非生产性非金融资产,归类为资本账户;

-稳定币等由负债支持的数字货币被视为金融工具;

-ETH、SOL 等平台代币如果跨境持有,可能被归类为类股权工具;

-质押和加密货币收益活动被视为股息收入来源;

-挖矿和质押相关服务被认定为可出口计算机服务。(CrowFund Insider)

IMF 计划在 2029-2030 年前推动 BPM7 和最新国民账户体系的广泛采用。

白宫官员:美国有可能利用其黄金储备购买更多比特币

3月24日消息,特朗普总统数字资产顾问委员会执行董事 Bo Hines 在接受采访时表示,美国可以利用其黄金储备的收益来购买更多比特币。根据 Hines 的说法,此举可能是增加该国比特币储备的预算中性方式。Hines 引用了参议员 Cynthia Lummis 提出的 2025 年比特币法案,该法案主张美国在五年内获得 100 万枚比特币,约占比特币总供应量的 5%。购买比特币将通过出售美联储的黄金证书来筹集资金。

《富爸爸穷爸爸》作者:害怕犯错让穷人错失财富机会,错过比特币或成最大遗憾

3月24日消息,《富爸爸穷爸爸》作者 Robert Kiyosaki 在 X 平台发文表示,比特币迎来历史性财富机遇,但许多人因 FOMM(害怕犯错)而错失良机。他认为,FOMO 的投资者将积累世代财富,而 FOMM 人群则会等到比特币突破 20 万美元后才感叹“太贵了”。

比特币支持者,如 Jeff Booth、Michael Saylor、Samson Mow 等人,长期看好比特币的财富效应,而传统教育体系则让许多人害怕失败,最终错失机会。

Arthur Hayes:预测比特币在回测76,500之前先突破110,000

3月24日消息,BitMEX 联合创始人 Arthur Hayes 在 X 平台发文称,预测比特币将在重新测试 76,500 之前先突破 110,000,理由是美联储正在从量化紧缩(QT)转向为国债实施量化宽松(QE),而关税不再重要,因为“通胀是暂时的”,这是杰伊·鲍威尔(Jay Powell)所说的。他表示将在下篇文章中详细阐述这一观点。

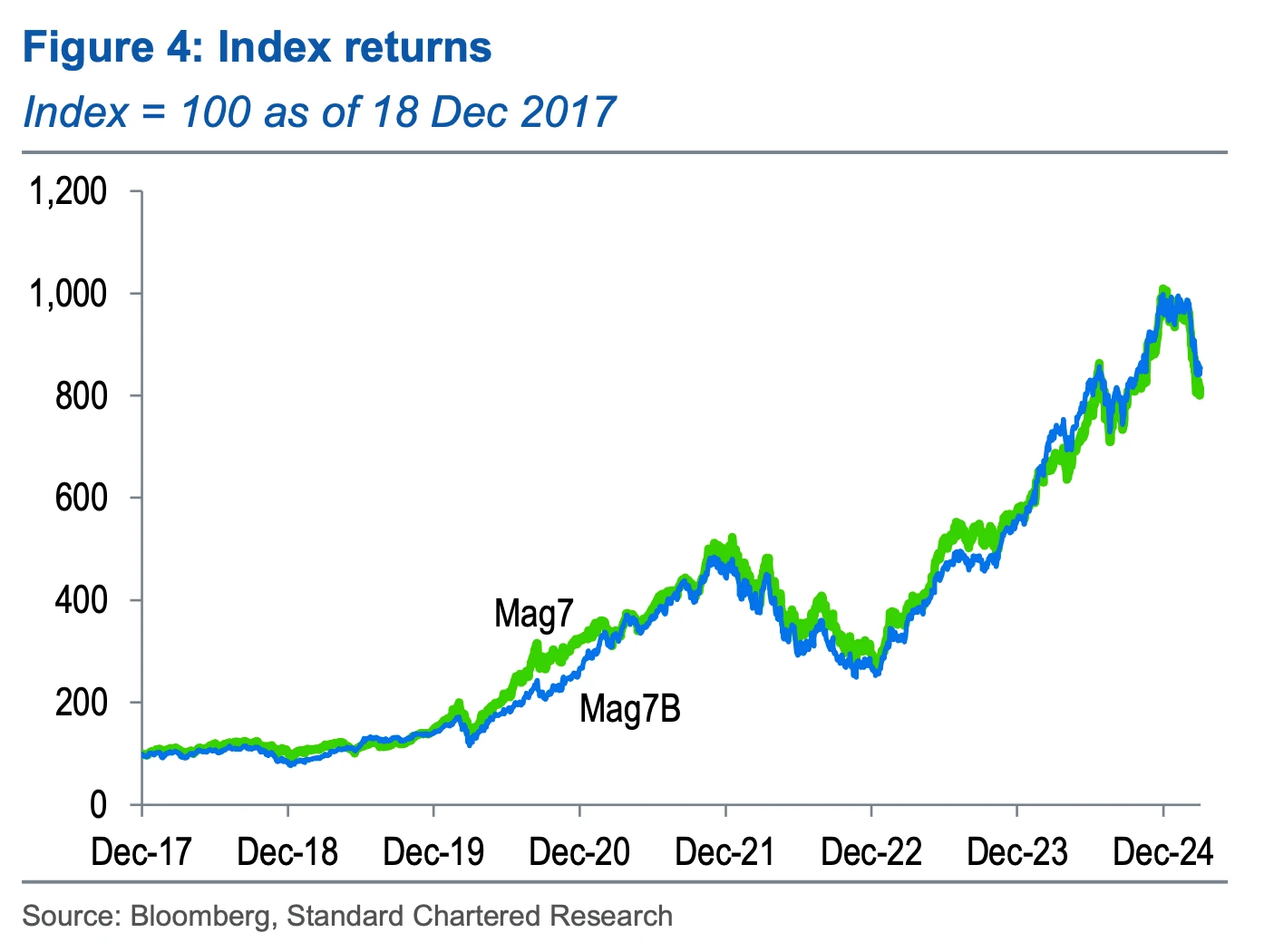

渣打银行:比特币取代特斯拉后回报更高,波动性更低

3月25日消息,渣打银行构建了一个假设性指数“Mag 7B”,用比特币取代特斯拉,发现其回报率更高,波动性更低。比特币与纳斯达克的相关性较高,可能成为科技股投资组合的一部分。自 2017 年 12 月以来,Mag 7B 的表现比 Mag 7 好 5%,且在过去 7 年中,Mag 7B 每年回报率平均高出 1%。比特币的加入使得投资组合波动性降低,信息比率更高。随着比特币交易变得更为便捷,预计会吸引更多机构资金。

相关图片

Michael Saylor预计BTC将成为价值200万亿美元的资产类别和全球结算层

3月25日消息,Strategy创始人Michael Saylor预计到2024年BTC将成为价值200万亿美元的资产类别,并且成为人工智能驱动互联网时代的全球结算层,美国采用比特币战略储备将巩固其主导地位,迫使其在全球范围内采用。Strategy已利用 330 亿美元积累了超过500,000枚比特币使用可转换债券和优先股等创新金融工具为其企业比特币资金提供资金,同时在财务上设计了一个自我维持的价格上涨周期。

Michael Saylor已表示,在他去世之前会销毁BTC,而不是捐出这些资产,因为这种做法是一种更合乎道德、更合理的慈善形式并且将赋予比特币“经济永生”,可以让比特币网络中的每个人都变得更加富有和强大。

T. Rowe Price高管称当前是配置比特币的“绝佳时机”

3月26日消息,据CoinDesk报道,管理资产逾1万亿美元的T. Rowe Price全球科技投资组合经理Dominic Rizzo在拉斯维加斯Exchange大会上表示,目前比特币价格接近平均挖矿成本,是具吸引力的配置时点。他还建议投资者可通过Coinbase、Robinhood等股票或区块链相关企业间接布局数字资产。

Bitwise CIO:现在是历史上以风险调整后的价格购买比特币的最佳时机

3月27日消息,Bitwise 首席投资官 Matt Hougan 表示,现在是历史上以风险调整后的价格收购 Bitcoin 的最佳时机,因为几乎所有的生存威胁(包括监管)都已被消除。随着美国建立战略比特币储备,Hougan 认为,最后一个主要风险已转变为长期验证。

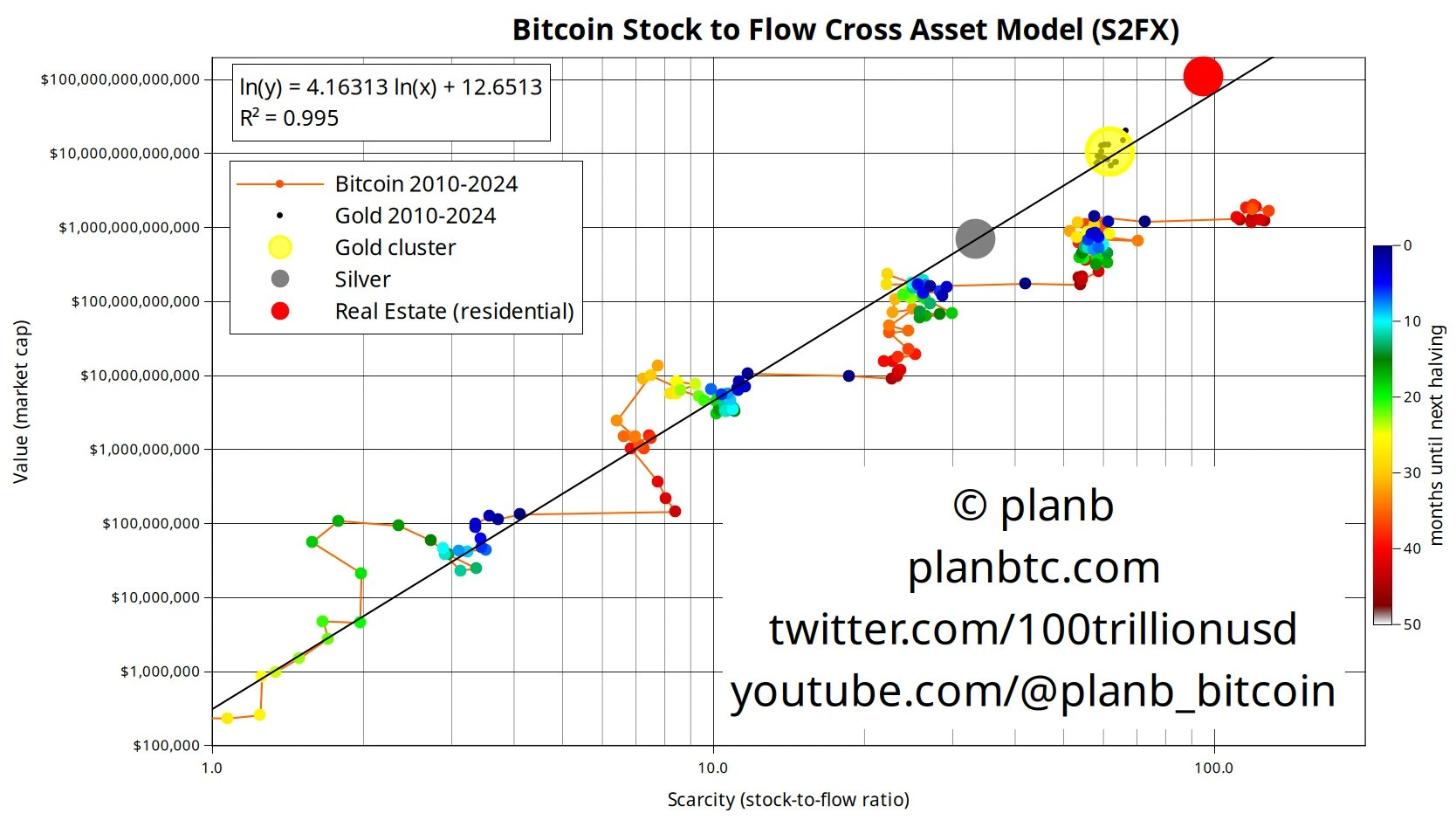

PlanB:与黄金和房地产市场相比,比特币被严重低估

3月28日消息,分析师 PlanB 在 X 平台发文表示,“比特币相较于黄金和房地产市场显得极度低估。目前,比特币市值为 2 万亿美元,而黄金市值高达 20 万亿美元。此外,比特币的稀缺性(S2F 比率)达 120 年,远超黄金的 60 年。让我们拭目以待,本轮减半周期将带来怎样的变化。”

相关图片

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。