投资概览

Bittensor是一个受比特币网络启发,基于子网架构和博弈论的通用激励平台。比特币通过代币的增发来激励矿工完成SHA256的计算,维护网络的可用性。Bittensor通过增发激励子网矿工提供各种资源,包括AI推理、数据存储、GPU算力、带宽等。

1.团队方面:三位核心成员均是计算机背景,Ala 更偏学术研究和 AI 算法,Jacob 擅长机器学习和区块链架构,Garrett 具备工程落地和产品开发经验,整体上是一个较强的技术创业组合。

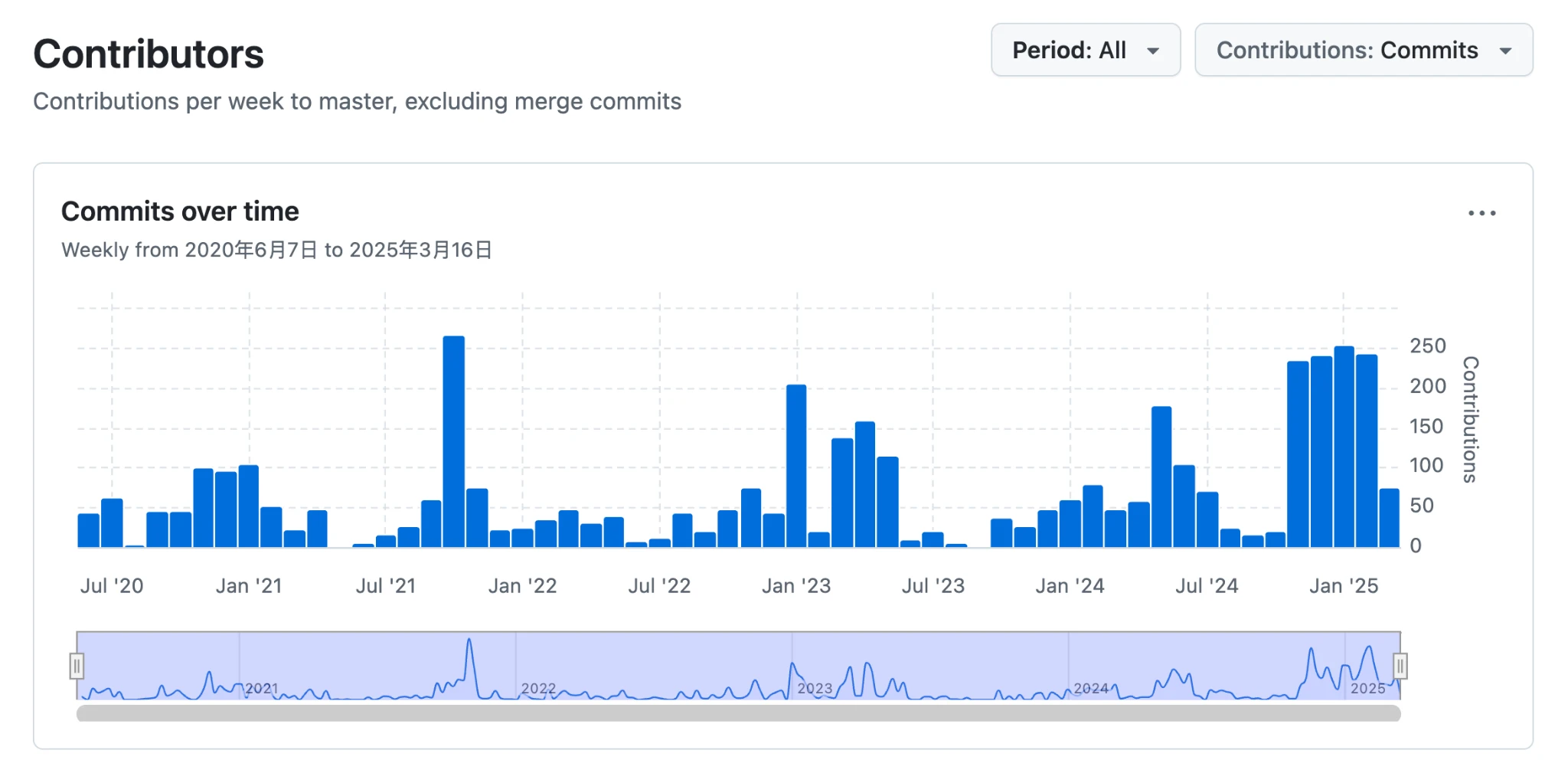

2.开发进展方面:一直维持着正常的开发进度,在最近三个月其开发频率有所提升。

3.产品方面:创新的代币经济学,只有子网团队通过项目的质量提升进而提升子网代币的价格才能获得激励。在Bittensor的博弈论机制下,子网之间在竞争下提供最优的资源,包括量化模型表现、GPU算力价格、存储性价比、折叠蛋白质发现速度等。

4.生态发展方面:生态目前子网项目80个,生态数量呈现加快增长的趋势。但是有大量重复和相似的业务。

5.叙事方面:Bittensor与AI、DePin、公链等叙事关联性较强。

风险:

1.基础设施匮乏,市场营销和社区支持不足,导致不透明性较高。

2.生态重复性较高,缺乏外部独立开发团队,一个Labs可能构建高达五六个子网项目。进而导致Labs无法专注于某个项目,使得在竞争下输给外部独立的竞品。

3.TAO的机制设计复杂,涉及多个细节,散户的学习成本高,对项目方的知识储备要求也较高。

Bittensor的生态发展呈现加速的趋势,其架构较为独特,目前还没有高度相似的竞品出现,大部分AI产品都是子网项目的竞品。对于其生态的发展,我们抱有乐观的态度,不像Allora和Sentiment,矿工只能提供大模型,Sahara AI只能提供数据,Bittensor的子网(矿工)更像是多个国家在一套世界体系下进行,Bittensor奖励发展好的国家,每个国家具体要发展的业务都是完全自由的,但是又不能超出Bittensor设定的世界观。而评定标准就是各个国家的货币是否值钱。在这套更开放和子网有自己代币的独特激励架构下,是有机会走出亮眼的生态。我们也看到陆续有包括YZi Labs等VC开始投资Bittensor生态。

基本概况

1.1 项目简介

Bittensor是一个受比特币POW网络启发,基于子网架构和博弈论的通用激励平台。比特币通过代币的增发来激励矿工完成SHA256的计算,维护网络的可用性。Bittensor通过增发激励子网矿工提供各种资源,包括AI推理、数据存储、GPU算力、带宽等。通过博弈论和代币激励,构建一个良性竞争的环境,以提供分布式的众包服务。

1.2 基本信息

注:信息来源CoinMarketcap & Coinglass,统计日期2025年3月17日

2 项目详解

2.1 团队背调

Jacob Robert Steeves: Founder,毕业于 西蒙弗雷泽大学,获得应用科学学士学位,主修数学与计算机科学。在校期间,他曾参与 ACM-ICPC 编程竞赛,并在 2014 年的西北美赛区获得第 8 名的成绩。 Jacob的职业发展经历涵盖了机器学习研究(Knowm)、算法开发(Google)以及去中心化技术领域的探索(Bittensor)。他的工作领域主要围绕机器学习、分布式计算和加密技术,还有传统科技企业的经验。

Ala Shaabana: Co-Founder,毕业于 University of Windsor计算机学士以及McMaster University博士学位。其职业发展经历涵盖了软件开发(firmCHANNEL、VMware、Instacart)、大学学术研究。他的工作领域涉及计算机科学、机器学习和分布式计算,既有企业研发经验,也有学术研究背景。

Garrett Oetken:CTO,毕业于爱达荷大学(University of Idaho)主修计算机科学,职业发展经历涵盖了软件开发(Safeguard Equipment)、人工智能研究与技术创业(Quantum Star Technologies、Opentensor Foundation)。他的工作领域涉及 AI、计算机视觉、自然语言处理和分布式计算。

Opentensor是Bittensor的开发团队,Opentensor Foundation创立于2023年3月,总员工数约为40人,近六个月减少3%,平均在职时间为1.3年。三位核心成员均是计算机背景,Ala 更偏学术研究和 AI 算法,Jacob 擅长机器学习和区块链架构,Garrett 具备工程落地和产品开发经验,整体上是一个较强的技术创业组合。

2.2 资金/融资情况

Bittensor从未公开过在一级市场的融资情况。目前公开可查的是Polychain,DCG以及DAO5数百万美元的OTC代币交易。

2.3 代码

Contributors, source:Github

Opentensor的Github主库Tensor的开发进展良好,在2025年第一季度的代码库更新明显加速。

2.4 产品

2.4.1 产生背景

Bittensor的产品构思始于对比特币网络的解读,在Bittensor的视角中,比特币网络通过代币经济激励来促使全球矿工运行算法来维护整个网络的可用性。但是比特币网络贡献的计算资源是非常初级和单一的。Bittensor受此启发,激励矿工提供更宽泛的数字资源或者在AI时代下的智能计算资源。在比特币网络中,所有的矿工都运行同一个算法SHA256,但是在Bittensor中,矿工可以运行不同的算法或者提供不同的资源(AI推理、数据存储、算力、带宽等),而这些又可以进一步抽象成一个去中心化的市场,通过Bittensor统一的激励机制给予奖励。

2.4.2 产品介绍

Bittensor是一个开源平台,参与者可以生产数字商品,包括算力、存储空间、AI推理和训练、蛋白质折叠、金融市场预测等等。Bittensor 由不同的子网组成。每个子网都是一个独立的矿工社区(生产商品的人)和验证者(评估矿工的工作)。子网创建者负责管理激励机制,TAO的质押者可以通过质押TAO来支持特定验证者。

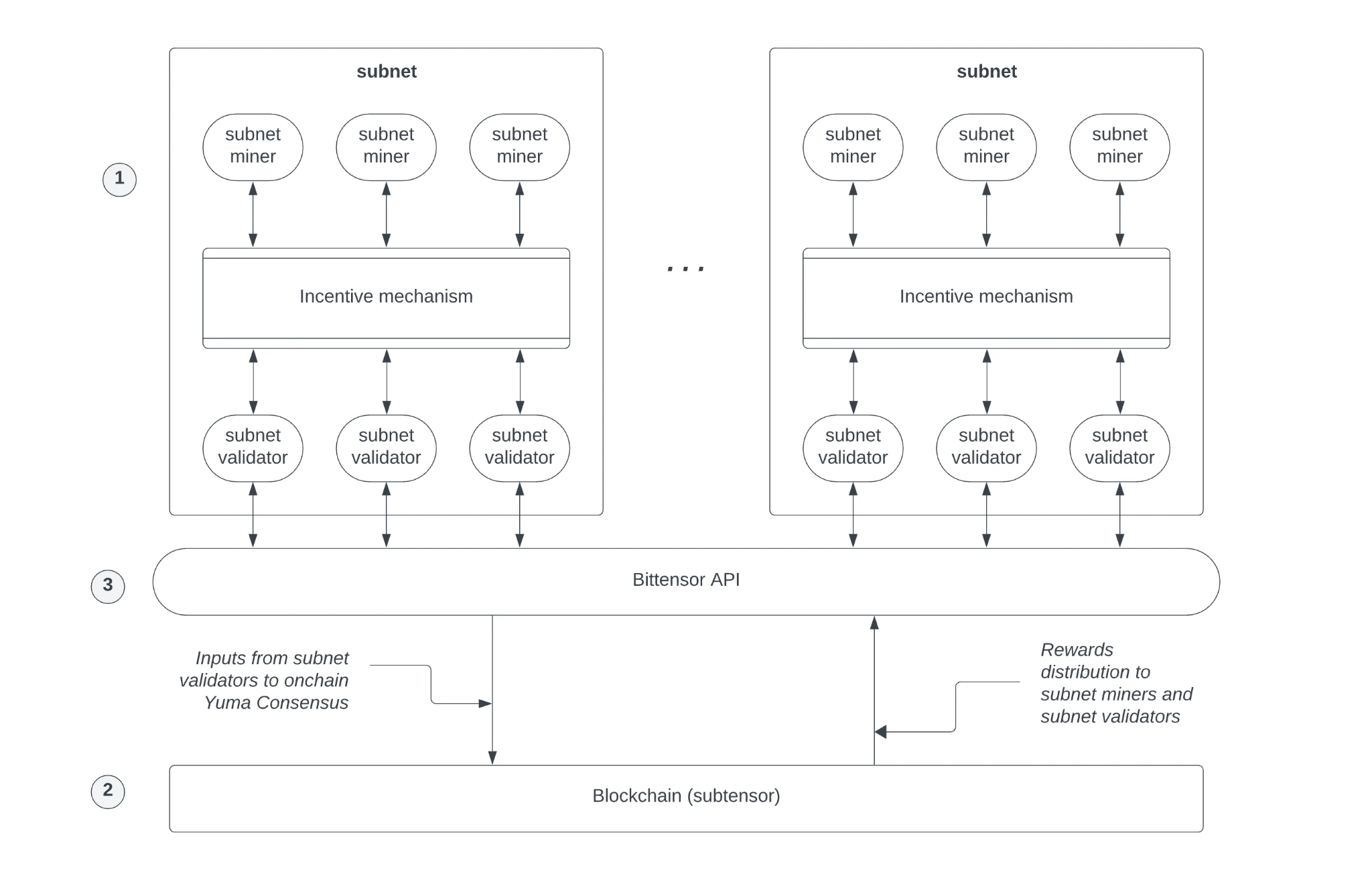

TAO的架构,图源:Bittensor

TAO由上图所示的几个组件构成:

1.子网。每个子网都是一个基于激励的竞争市场,生产一种与人工智能相关的特定数字商品。由生产商品的矿工和根据子网特定标准衡量矿工工作以确保其质量的验证者社区构成。

2.Bittensor主网充当记录系统,其代币TAO则作为参与子网活动的激励,Bittensor 区块链记录矿工、验证者和子网创建者的余额和交易。

3.Bittensor API,支持子网内矿工和验证者之间的交互,并允许各方根据需要与区块链进行交互。

每个子网都有两个角色,矿工和验证者。

矿工

●在 Bittensor 的理念中,“矿工”并不是只跑算力挖 PoW,而是能为 AI 模型提供训练或推理资源(或其他数字商品,如数据带宽等)。

●不同子网可能针对不同任务(NLP、CV、多模态等),矿工可选择适合自己硬件/算法的子网加入,贡献资源、获得激励。

验证者

●验证者依然要维护 Bittensor 主链的安全,进行打包区块、验证交易等(参考 Polkadot/Substrate 的机制),让网络保持正常运转。

●同时也有子网级别的验证者,帮助校验子网内部是否遵守共识规则、防止恶意行为。

子网的流动性

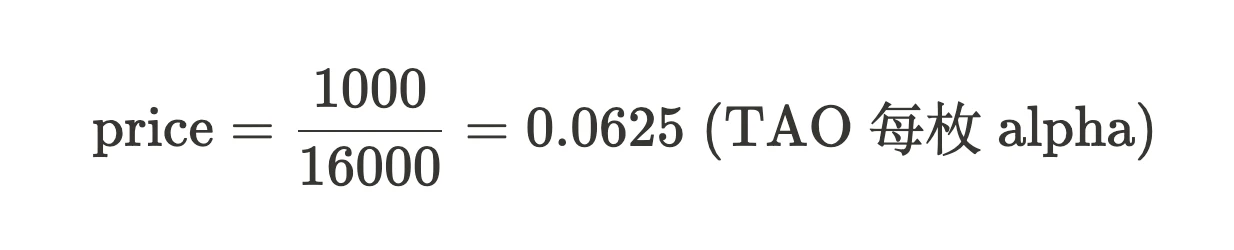

Bittensor引入的关键机制就是每个子网都有自己的AMM机制。这个AMM Pool拥有两个代币储备,一个包含 TAO主网本身的代币,另一个就是子网自己的代币(我们统一视为Alpha Token)。子网代币是需要将TAO代币质押到子网储备中才能购买。比如,假设池子中有1000枚TAO,和16000枚子网Alpha代币,那么根据公式

这意味着一枚alpha token 价值0.0625枚TAO,当大家看好Alpha代币时,就会通过TAO购买Alpha,这样其Alpha在供应中减少,而TAO增多,促使Alpha的价格上涨。值得注意的是,网络在每个区块也会按一定规则给子网“注入”一部分新的 TAO 和新的子网代币,这部分也会影响代币的价格。

但是子网代币具体如何发行的,以及TAO如何激励子网的,就与我们接下来介绍的Bittensor的最新dynamic TAO机制有关。

2.4.3 技术细节

过去,Bittensor的关键技术是其Yuma Consensus算法,该算法旨在解决一个问题——如何在去中心化的网络中,针对“AI 模型贡献”达成共识并进行激励分配,同时抵御节点们的串通作弊等行为。该算法不仅仅负责验证者的共识投票,还负责确定哪个子网应该获得多少的TAO激励。但是:

1.验证者无法全面评估大量子网,导致打分不准确、冷漠或被贿赂;

2.子网可能私下向验证者“行贿”,拉高投票;

3.值得更多激励的优质子网,可能在不公平环境下被冷落。

因此,Bittensor构建了一个改进的机制来评价子网的贡献,其被称为dynamic TAO。DTAO 新思路:把“哪个子网应拿更多代币增发”交给市场,通过 在每个子网上发行一种子网代币 (Alpha) 并结合 AMM 池,由市场价格来评判子网价值。如果子网越有前景,子网代币价格越高、每次增发获得的 TAO 比例也就越高,同时Alpha token增发激励也会越多。

举个例子,比如我们有两个子网Subnet A和Subnet B,每个区块增发一枚TAO。

1.Subnet A和Subnet B在上线之时,便有了其子网的代币分别为alphaA和alphaB以及价格P_a和$P_b,如果没有特殊配置一般是1:1的TAO和子网代币,同时Alpha代币的总量和TAO一样也维持在2100万枚的Cap。

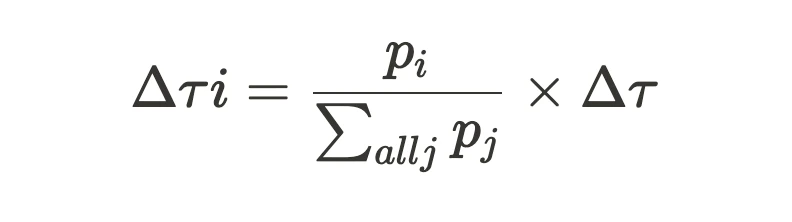

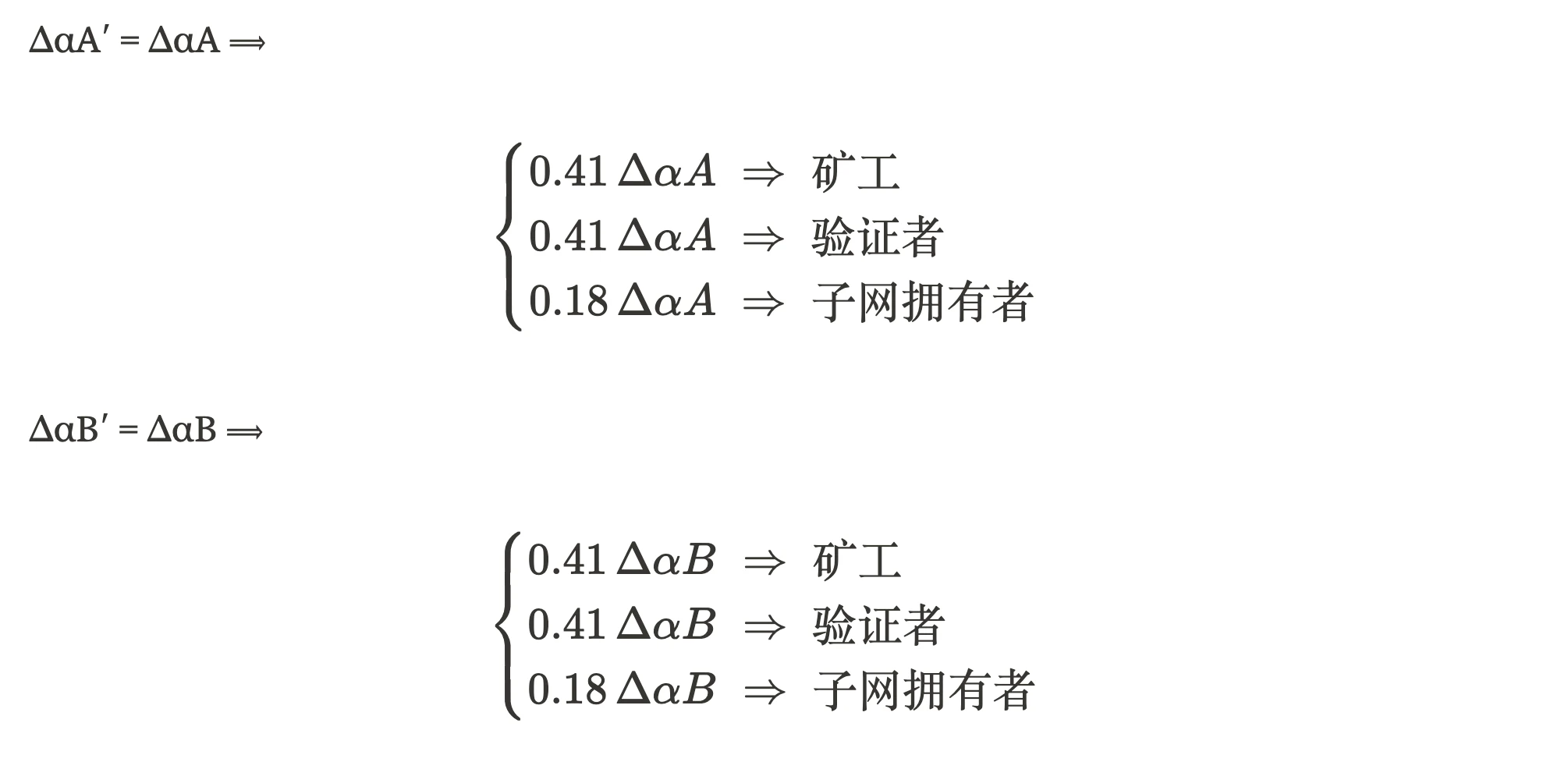

2.每个子网所能获得的 TAO 总注入量Δτ,与其代币价格在“全网代币价格之和”中的占比成正比。公式一般是:

因此,假设两个子网的价格P_a 和P_b分别为1 TAO和1 TAO,那么每个区块增发后,子网可以获得0.5Δτ,如果市场更看好alphaA,则市场就会向A子网AMM池中注入更多的TAO。

要保持 AMM 池子价格稳定,子网也会得到相应的 Alpha 注入。通常做法:

1.先算出Δαi —— “在维持当前价格 pi 的前提下,需要注入多少 Alpha”

2.若算出的值超过子网的Alpha 发放上限(cap),则实际注入值被截断(只注入到 cap 为止)。

在 DTAO 规则中,除了注入到池子里的这部分 Alpha,还会有同等数量的 Alpha代币直接分发给子网角色,以替代过去发 TAO 的方式。

●矿工(Miners)占 41%

●验证者(Validators)占 41%

●子网拥有者(Subnet Owner)占 18%

注入池子是为了维持价格;分发给节点是为了激励生态角色。Alpha token是保留起来的,等一次Tempo时间(360个区块)以后一次性发放,避免过于零碎的发放奖励。矿工负责提供子网的算力、存储、推理等功能,唯一能获得的代币就是这个增发的机制,验证者负责校验。

这里有一个比较常见的问题是:每一次TAO的注入,虽然Alpha代币配套增发到AMM中,这一部分的池子的价格是维持恒定的,但是又额外增发相对应的代币会导致额外的抛压。这个是类似于比特币的矿工奖励机制,AMM池子TAO和ALpha代币的等比例的注入是为了让子网代币的流动性加深市场,滑点低,市场定价更加准确,代币持有人更有信心。而alpha代币等比例的增发奖励,是为了奖励其高质量的矿工和子网开发者。实际上由于代币总量限制在2100万,所以子网代币也不会无限的增发,而是无限趋近于2100万枚。类似于比特币矿工和比特币增发机制一样。

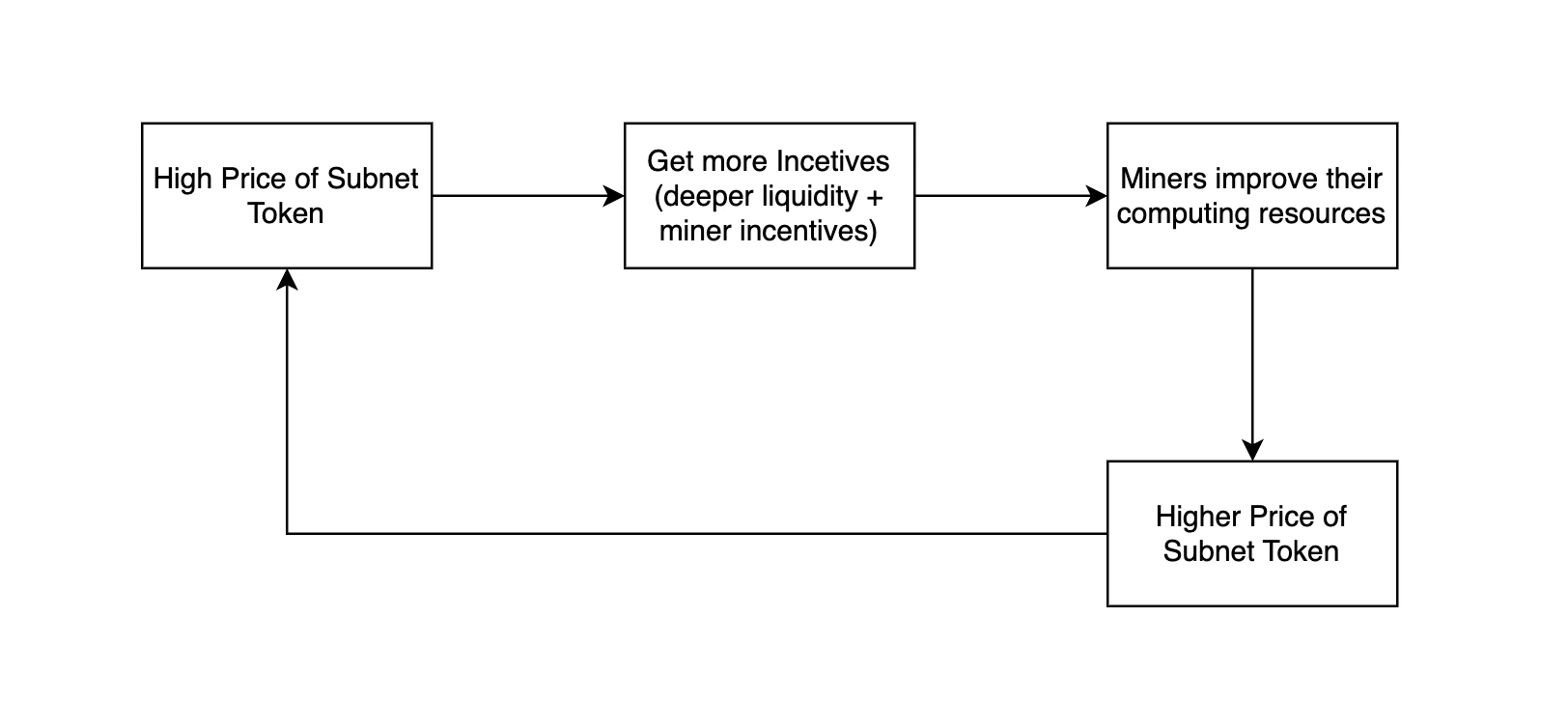

正向循环机制

在新的Dynamic TAO的架构下,这里有一个正向的反馈循环,来激励子网开发者构建,他们往往指望增发来获得更公平和透明的奖励。这套激励能较好的防止刷票行为,因为刷票需要使用真金白银推高子网的价格,而只有基本面好的价格能长期稳定在较高水平,较差子网如果靠刷票拉高子网价格,首先其不可持续,其次本身对于子网持币者也乐见其成。

3 发展

3.1 过去

3.2 现在

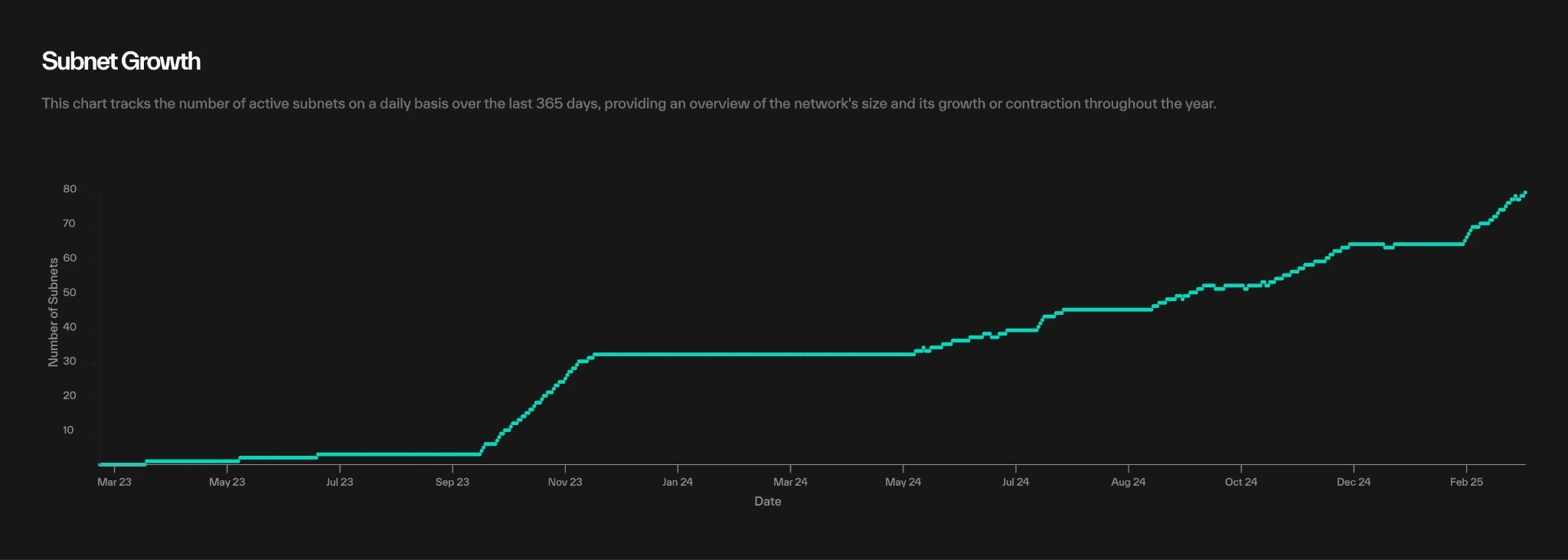

Subnet Growth, source: taostats

子网上线于2023年10月,经历了1年半的发展,Bittensor目前有80条子网(包括Root子网),且生态呈现快速增长的趋势。截止3月23日,生态的总市值为1.65B,子网代币的24小时总交易量为47.66m。

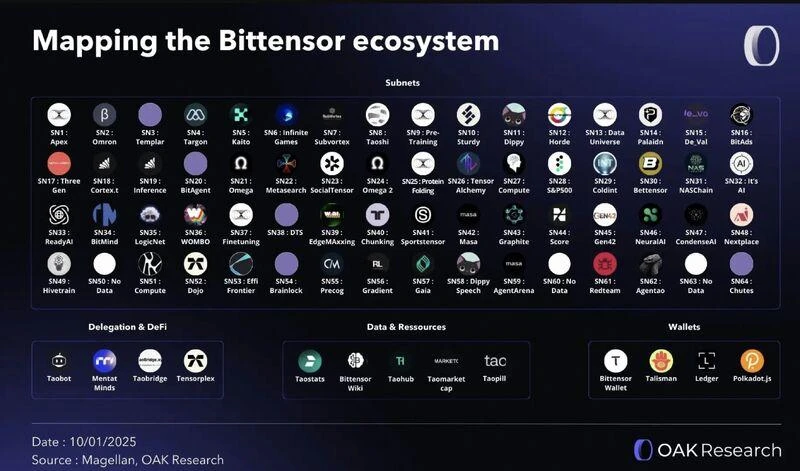

3.2.2 生态发展

Bittensor ecosystem, source: OKA Research

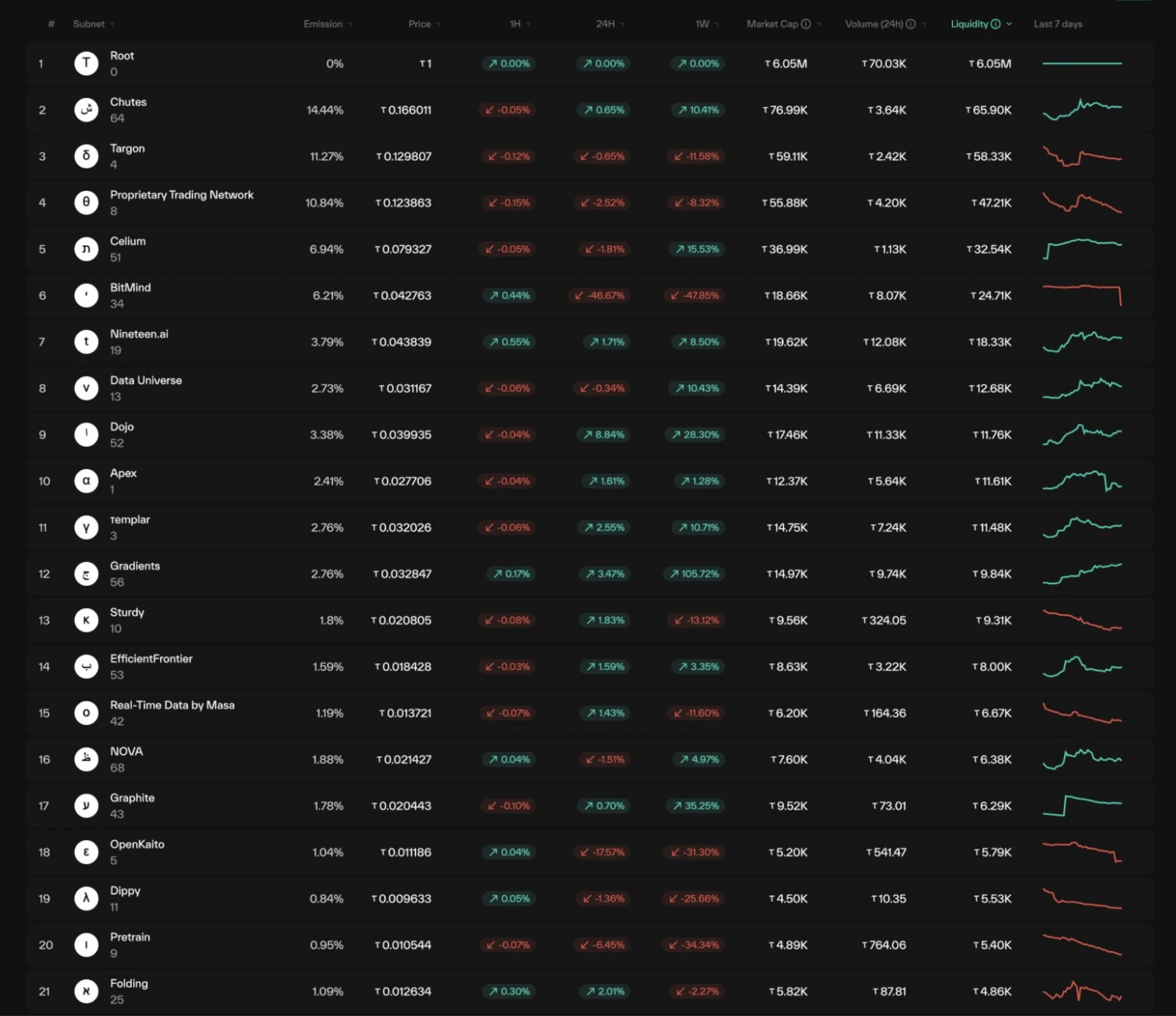

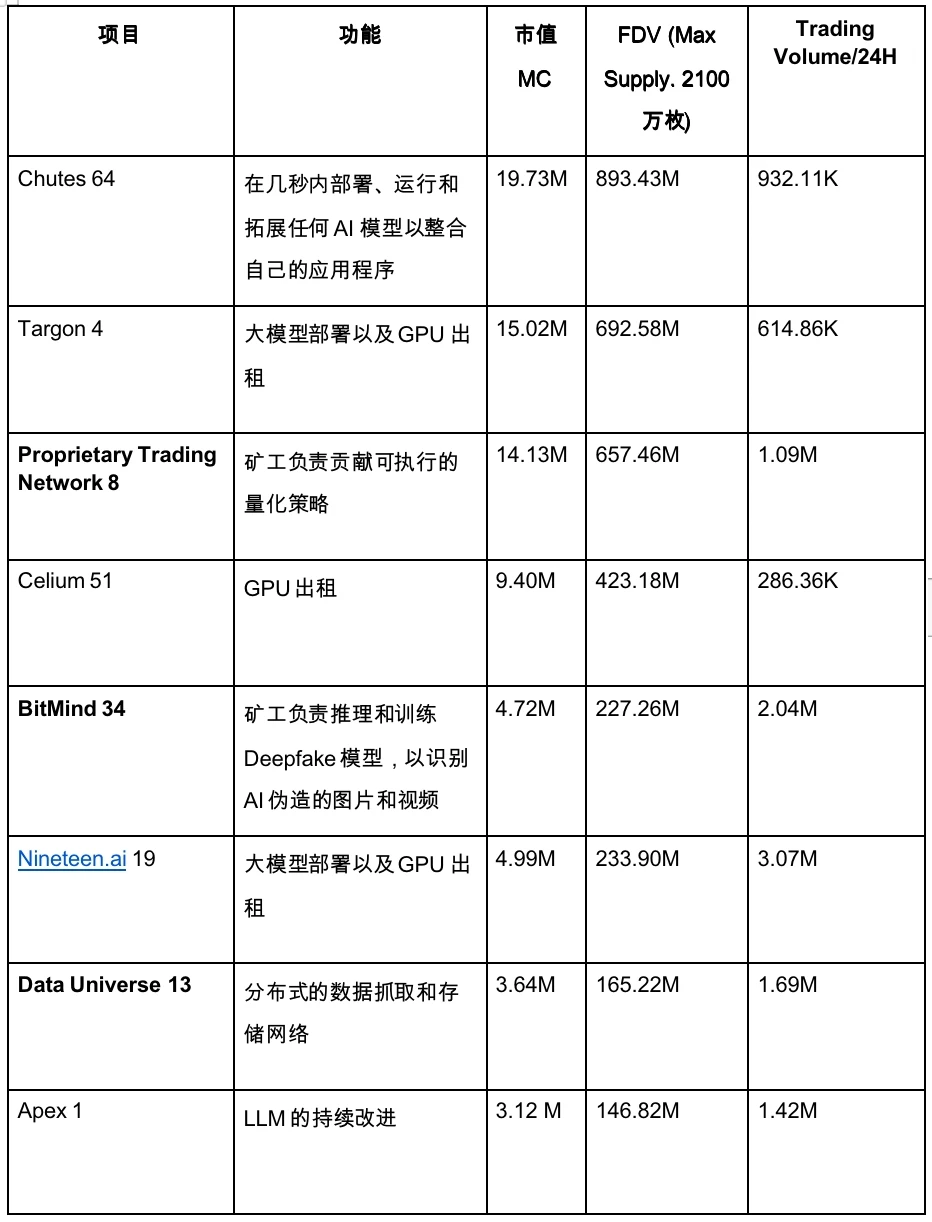

Top20 rankings by Liquidity, source:Taostates

我们统计了除去Root网络(也就是Bittensor过去的代币分发机制,依赖于验证者来确定贡献,目前已经废除)的前20名,按照AMM Pool中的流动性排名。这可以反映长期以来的价值积累和认可。

Bittensor的生态重复性很高。在20个项目中有11个项目都是利用现存的GPU进行大模型的预训练、训练、微调和推理。但是我们在生态中也能够看到Subnets适用去中心化的GPU来进行包括蛋白质、图论、大模型的运算。值得注意的是,我们发现其子网许多生态都是由同一工作室研发如Microcosmos(#1 #9 #13 #25 #37),Rayon Labs(#64 #19 #Gradients),在生态方面可能仍然缺乏足够的独立开发者团队。

在生态的真实效用方面,确实有一些社区的声音,值得我们反思。比如:

1.Bittensor自从dynamic TAO主网上线后,其演变成了一个去中心化的通用的激励网络,由于Root子网的正式下线(失去中心化的调控),同时机制依赖于子网的市值高低,会导致一些如MEME代币获得激励,从而使得网络的长期愿景失效。

2.有些专注于推理的LLM子网,大量矿工带来了效率低下和冗余。同时子网自身激励机制和推理质量判断的水平不一,矿工倾向与使用同一种模型,而避免被误判。

我们认为,问题一确实值得注意,可以引入更多的机制去判断价值或者重新引入一个DAO组织来避免一些有损网络的事情。而对于问题二,我们认为这说明了该子网的所有人,并没有做好相关的工作,那么该子网如果失去了价值,其价格和激励也会逐步降低,所以这方面可以依据市场的自主调节。如果以一个非常长远的眼光来看,Bittensor这种通用激励网络网络仍然有其意义所在,在生态部分,我们将论述其适合的应用场景。

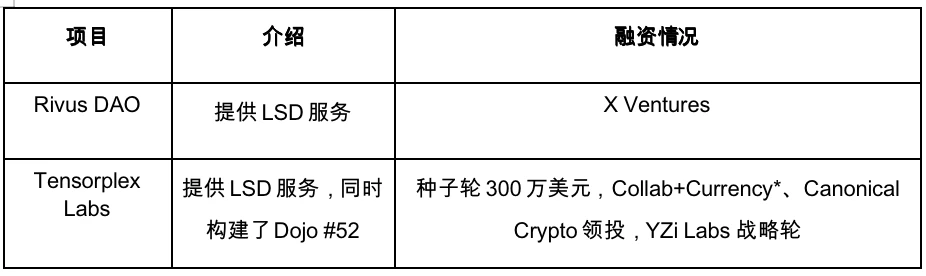

在资本的支持方面,Bittensor生态也在逐步扩大,我们看到了陆续有项目获得了VC的融资。比如:

3.2.2 社交媒体

Bittensor与社区之间的联系较少,除了Discord外,没有官方的社区交流渠道,同时也缺乏市场宣发的动作。

3.3 未来

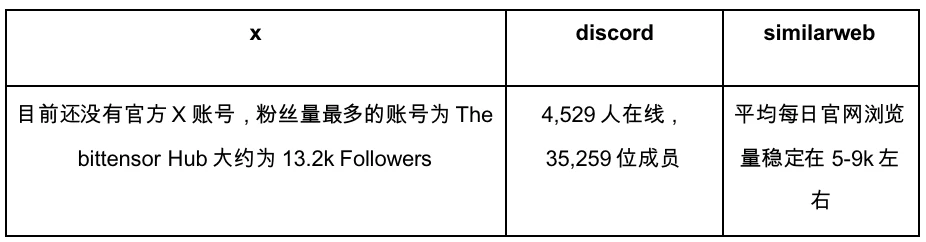

团队成员X, source:const

官方Blog在去年就已经停止更新,也没有官方的2025 Roadmap,团队对于开发者的重视程度远超社区。Founder在X上有大致概述其接下来的目标包括:阈值签名、时间锁定加密、可验证函数、ZK-SNARKs、同态加密和多方计算。这些密码学工具是希望帮助开发者重新设计网络激励系统。

4 经济模型

4.1 代币分配

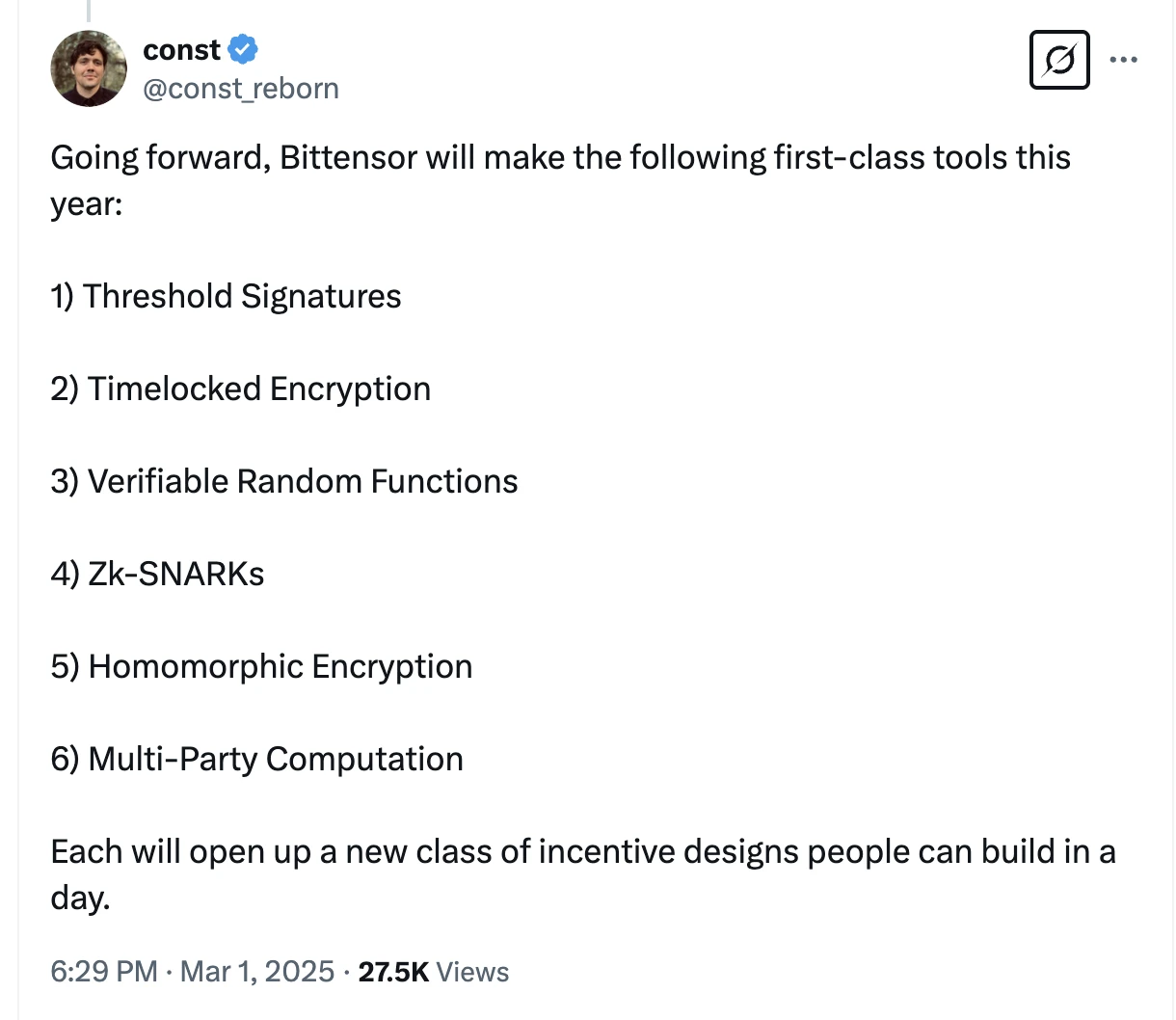

Vesting Schedule, source: Defillama

Finney 网络于 2023 年 3 月 20 日启动,此时第一批矿工可以上线挖矿。Bittensor也和比特币一样,完全没有团队和VC的一级市场份额。代币总量2100万枚,目前已经挖出36.95%(大约为850万枚),剩余68.05%等待挖出。每一个区块会挖出一个TAO,一个区块为12秒,一天大约挖出7200个TAO,按照250美元的价格,大致在180万美元(现货交易量每日在$96.62M)。

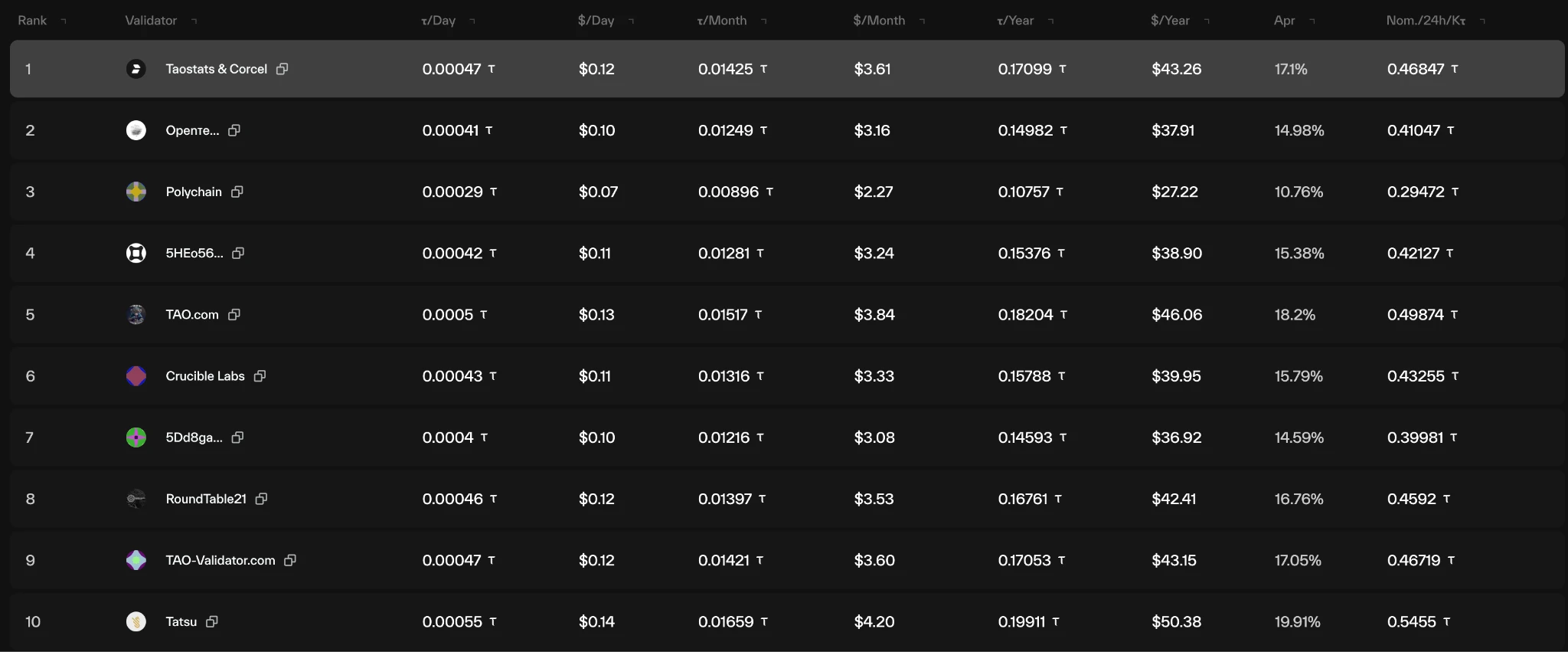

Staking Validators, source: Taostates

目前一共6,143,675枚TAO被质押(占流通代币总量的72.3%),质押挖矿的平均年化回报率大约在15%-17%之间,相比之下,Solana的APR为7.5%,NEAR为9.2%,Ethereum为2.9%。

TAO的代币经济学是完全和BTC一致,整个网络的价值就是TAO的价值,TAO的代币经济学完全用于网络的验证者分发和子网的激励,同时完全释放需要几百年的时间,整个网络维持着稳定而缓慢的释放节奏。

4.2 代币用途

●治理与投票

●注册费用(矿工、验证者、子网)

●回收机制:TAO有一个独特的回收机制。TAO网络是一个通用的激励网络。代币回收机制就是将奖励的TAO放回奖励池。网络中回收的TAO主要来自两个地方:新矿工和验证者的注册费用以及关闭注册的子网。

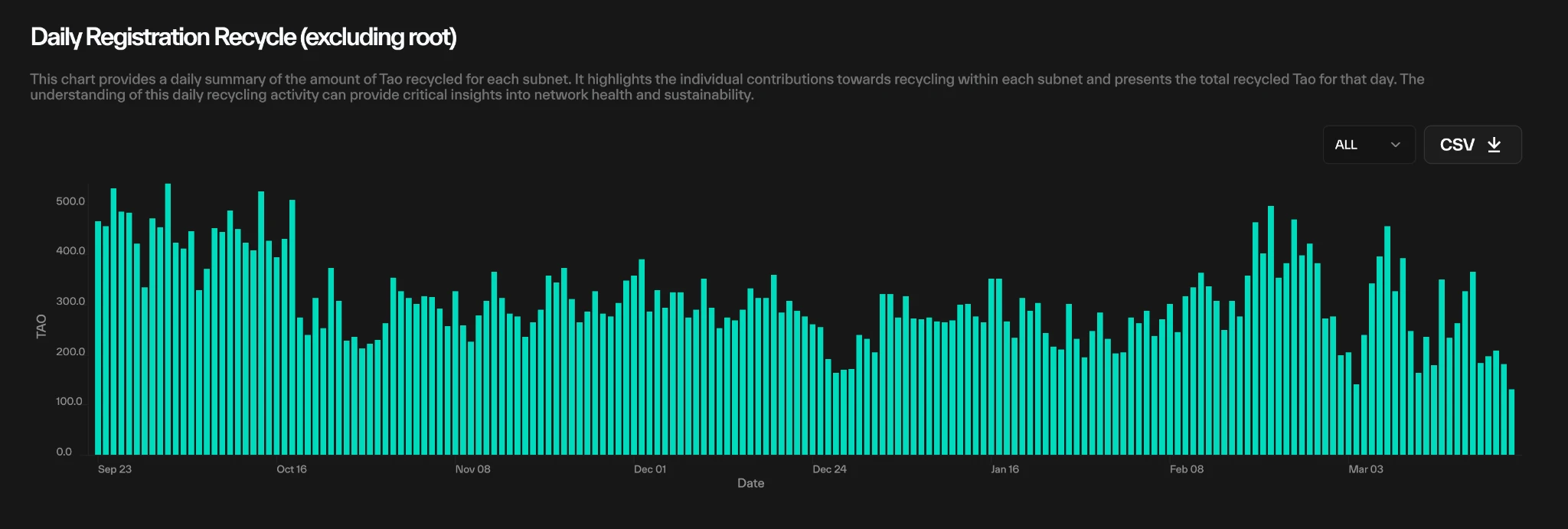

Registration Recycle, source: Taostates

上图是每日的回收情况,这个回收图表可以部分反映对生态的关注程度,平均每日回收的TAO在150-300之间。

4.3 持币地址

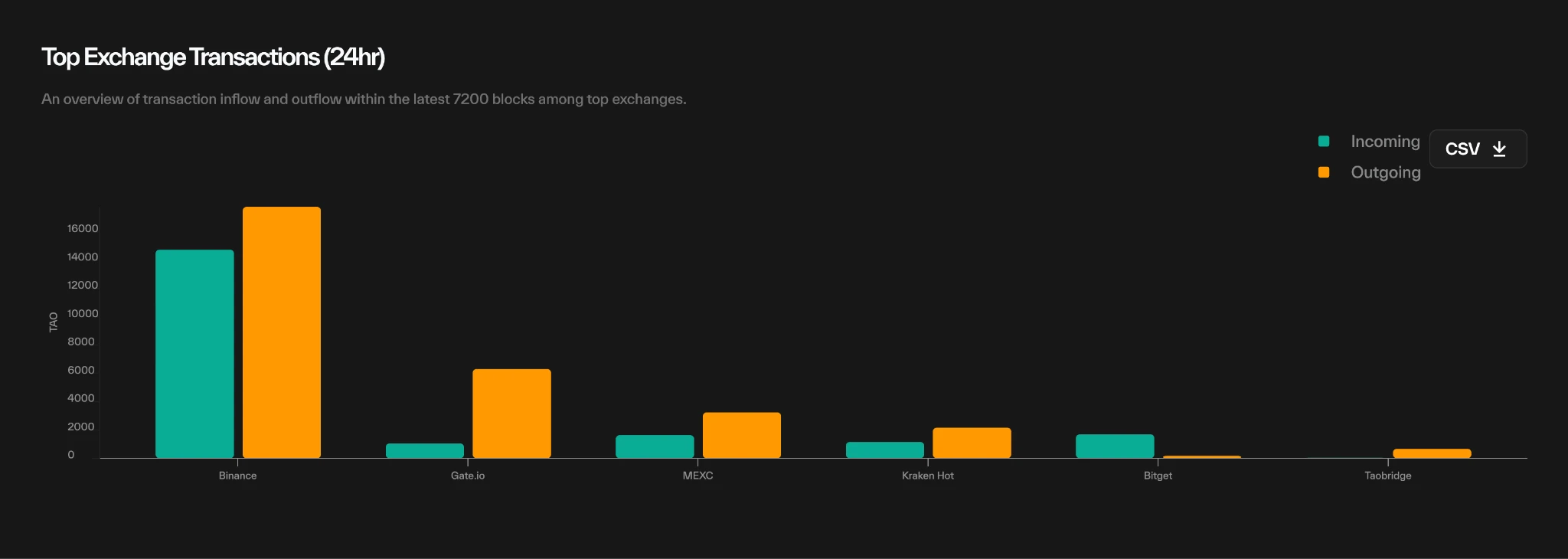

Exchange Transactions, source: Taostates

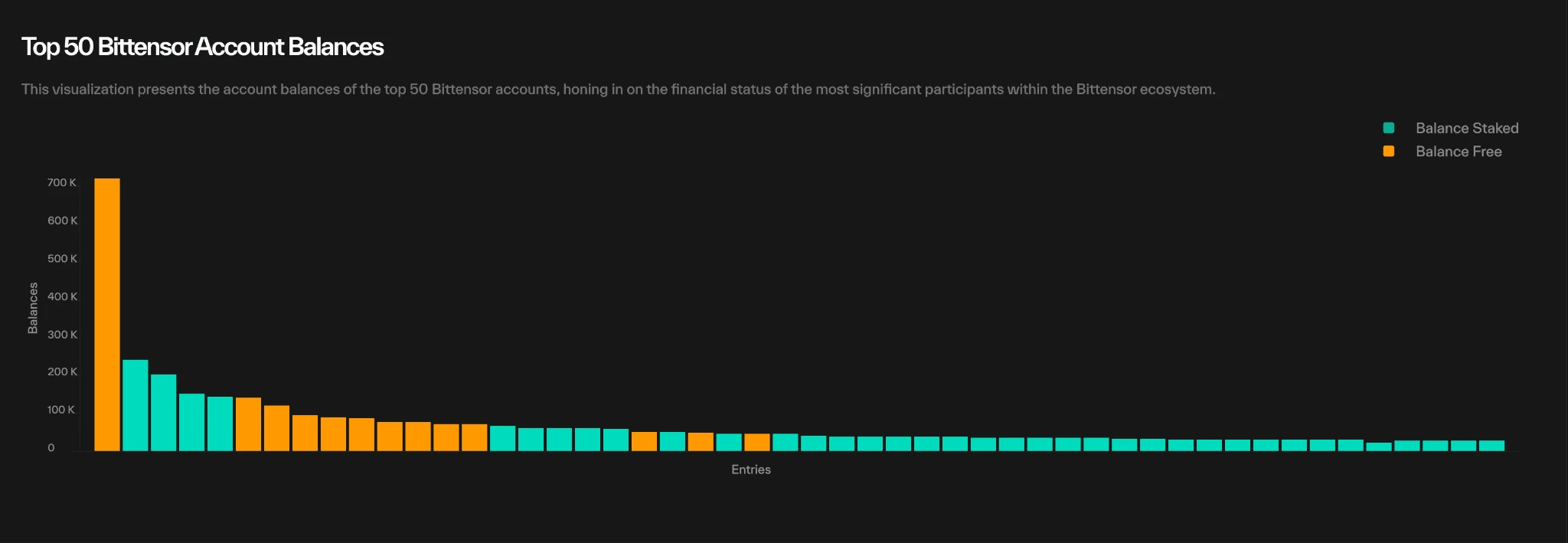

Top50 Balance, source: Taostates

Top50的持币地址量大概占据流通筹码的30%左右,在交易所中交易量最大的是Binance,远超过其他交易所的交易量之和。单一可验证持币地址最多的是MEXC。

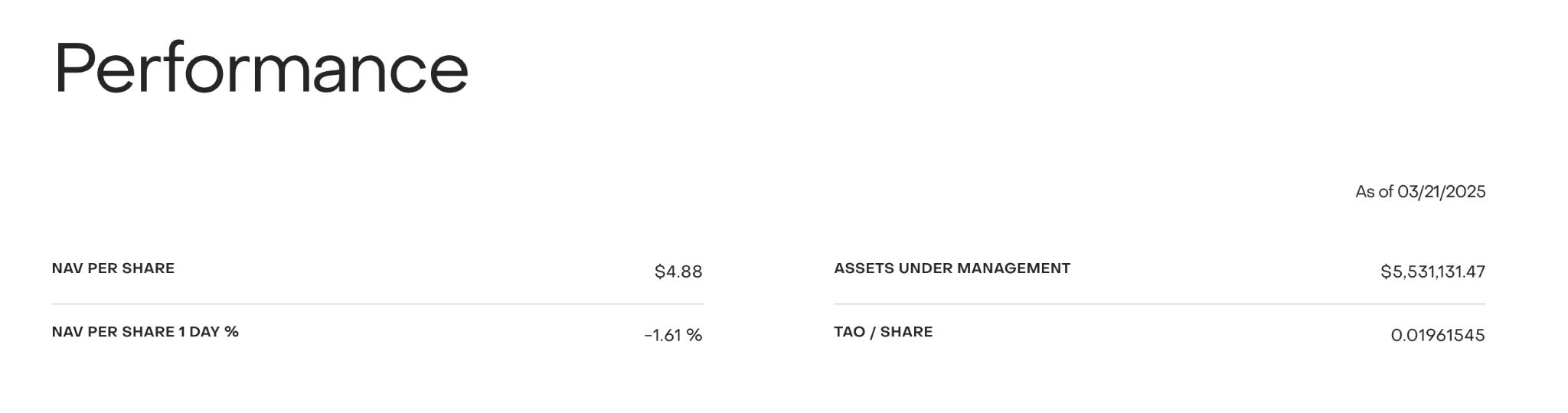

TAO Trust, source: Grayscale

在ETF方面,Grayscale持有价值550万美元的TAO。

5 市场与竞争

Bittensor采用类似于BTC的释放机制,完全无预留。业务方面采用博弈论构建具备竞争性质的多任务去中心化解决方案,包括GPU市场、科学研究、数据分布式存储和索引、AI分布式训练和推理等一系列应用场景。 Allora、Sentient(主要提供模型推断)、Sahara AI(主要提供众包数据)被视为其竞争对手但是Sentient和Sahara AI更像是子网的竞争对手,而Allora被视为最相似的在架构层面的主要竞争对手。

5.1 市场与上下游概览

在讨论Bittensor的市场和需求时,我们认为其业务模式与众包类似。在Web2世界有类似的例子,比如Scale AI。其业务模式就是聘请东南亚的低成本的工人为互联网数据打标签以分发给有数据需求的公司训练自己在特定领域的大模型,目前公司的估值已经超过了140亿美元。众包模式相比于中心化运营的好处是低成本、高灵活性,而中心化运作更加稳定和规范。去中心化本身的弊病就是效率,这肯定是无法和中心化进行比较的。因此,Bittensor的子网所贡献的多为闲置资源,但这些资源并非毫无价值,实际上,许多闲置资源仍未充分发挥其潜在价值。与此同时,一些公司为了应对资源需求大且业务周期较短的项目,会选择将部分任务外包给第三方,以实现资源的高效利用和成本的合理控制。

5.2 赛道项目介绍

Allora:

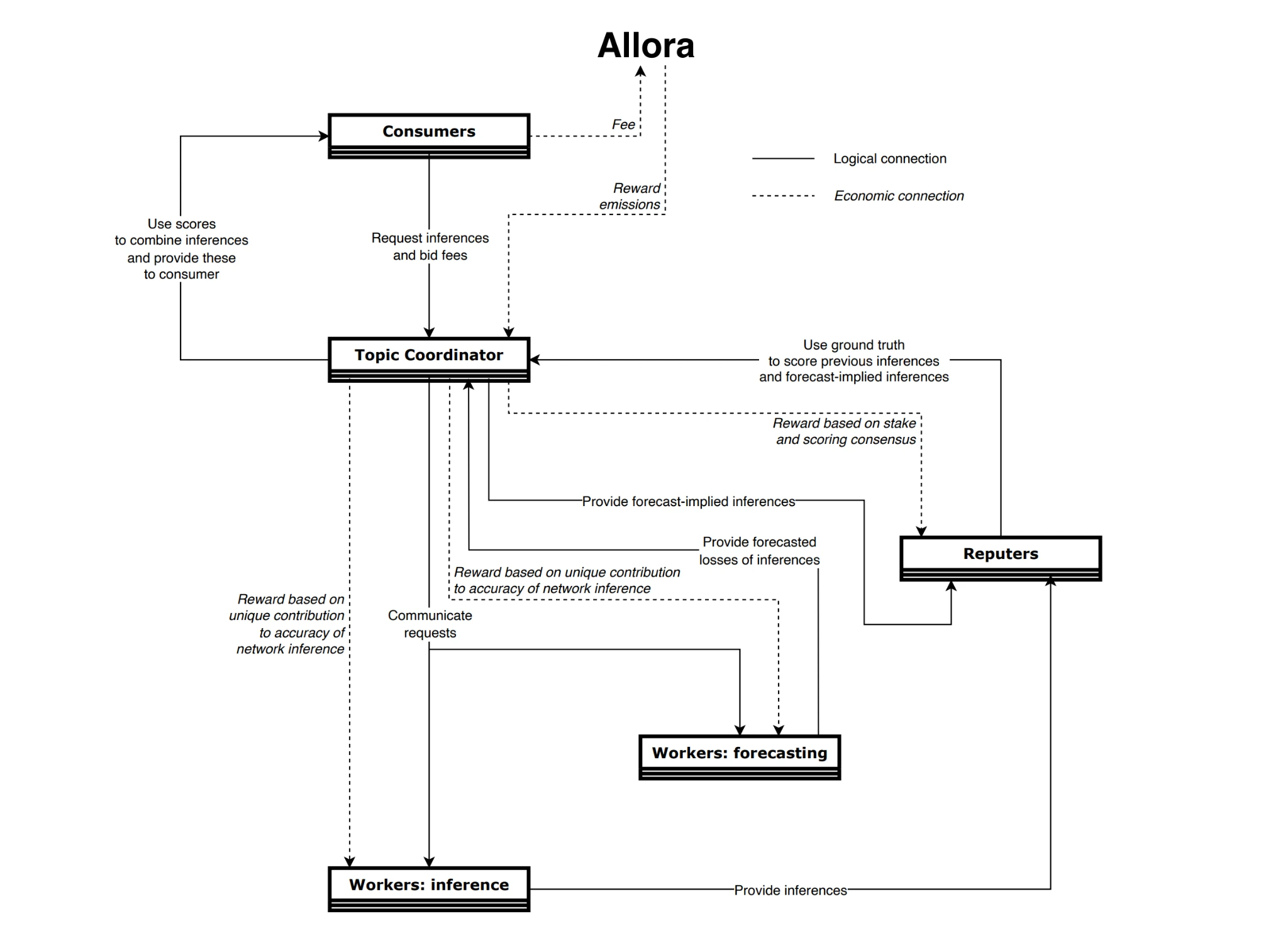

Allora是由社区构建的自我完善的AI网络。参与者通过网络贡献,验证者使用情境感知推理技术来评估网络参与者的贡献。在Allora语境下,网络参与者包括工作者(提供特定资源,Bittensor里面的矿工),信誉者(评估工作质量,Bittensor废弃的Root网络验证者),验证者(通过Cosmos架构负责实例化Allora网络的大部分基础设施),消费者(对网络众包资源的需求开发者)。

Allora Structure, source: Allora

在Allora的架构中,一共有三个主要的组件在处理Consumer的请求,Workers: Inference负责生成用户请求,Workers:forecasting 负责评估推断可能的损失,然后Reputers结合两种Workers的结果给到TopCoordinator,Top Coordinator负责对Consumer直接进行交互。

这里的要点在于,Workers:Foecasting这个组件是一个全局组件,他能够获得Inference Workers的结果。比如在预测某个token的价格表现场景下,Forecasting Worker根据最终的结果以及当前Inference Worker的推断得知,A Worker在这个场景下表现的好,B Worker可能更适合预测天气。这就是Allora在白皮书强调的Context-aware技术,Context-aware技术的核心是Forecasting Worker的存在,会评估Inference Worker在不同场景下的表现。

5.3 竞品要素对比

Allora和Bittensor做的事情大致相同,都是通过博弈论发现最好的Worker。但是主要的区别在于:

矿工质量评估方法

Bittensor采用代币经济学的方式,通过价格自主发现的方式(子网代币价格)来衡量补贴的额度,项目的主要目标是提升子网的代币价格,这样就可以获得子网代币的增发奖励。

Allora的评估方式是采用目前非常流行的:Shapely方式——如果没有,网络预测会变差多少,来评估Worker的贡献。Reputers在事件发生之后,会给出一个公正的loss,可以给下一次Forecasting Worker进行使用,也可以评估Forecast Worker的公正程度。假设少一个Worker,根据某个公式,loss变得越大,那么贡献就越大,奖励就越多ƒ。

这里存在一个比例,可能某个Worker的贡献度10%,另一个为20%。他们根据比例共享一个称为奖励池,Forecasting Worker和Reputer、Validator也会根据在网络中的贡献,共享这个奖励池,该奖励池来源于每次区块的增发。

生态开放度

Bittensor的生态开放性显著高于Allora。在Bittensor生态中,子网开发者拥有高度的自主性,可以自由提供任何希望提供的服务,同时需要自行寻找目标客户。相比之下,在Allora生态中,矿工的角色被明确限定为提供大模型服务,可能专注于金融领域,也可能擅长预测分析。此外,Allora的生态对接通常由其集体统一安排。所以Allora更像是一个可以自我调整的大模型集群同时提供实时的数据,类似于迪拜岛。而Bittensor更像多个岛屿之间构建了跨海大桥,每个岛屿都有自己的货币和主要产业。

社区和资本支持

Allora在社区建设和资本支持方面明显更具优势。Bittensor没有寻求外部融资,而Allora获得了接近3300万美元的融资,领投方包括Framework Ventures*, CoinFund*, Blockchain Capital*,Polychain以及Archetype。Bittensor除了Discord外没有任何社区和论坛,Allora TG、X、Discord、Forum等都较为齐备。总的来说,在Bittensor的理念受BTC都影响更大,更倾向于由社区自发主导。

代币经济学

Bittensor的子网能够发行自己的代币,但是Allora的矿工只能提供模型,并且完全使用同一个Allora代币。Bittensor代币为Fair Launch,但是Allora有大量的团队和VC预留。两者都采用了比特币的释放模型,同时每四年减半一次。

总的来说,Bittensor的架构更加独特,带来了更加开放的生态可能性。但是Allora生态合作的速度会快于Bittensor,Bittensor需要独立的开发者进行开发,限制了生态的规模。严格来说,市面上仍然未有和Bittensor类似的竞品,Bittensor的子网作为独立项目运作,拥有自主发行代币的机制,这进一步凸显了其生态的独特性与自主性。

6 风险

1.基础设施匮乏,市场营销和社区支持不足,导致不透明性较高。

2.生态重复性较高,缺乏外部独立开发团队,一个Labs可能构建高达五六个子网项目。进而导致Labs无法专注于某个项目,使得在竞争下输给外部独立的相似项目。

3.TAO的机制设计复杂,涉及多个细节,散户的学习成本高,对项目方的知识储备要求也较高。

参考文档

《Bittensor (TAO) : A comprehensive presentation of a protocol combining AI and blockchain》:https://oakresearch.io/en/reports/protocols/bittensor-tao-presentation-protocol-combining-ai-blockchain

《Bittensor Docs》:https://docs.bittensor.com/

《THUBA 研报 | Bittensor:音乐何时停止》:https://foresightnews.pro/article/detail/67830

《Demystify Bittensor :How's the Decentralized AI Network?》:https://www.trendx.tech/news/comprehensive-analysis-of-the-decentralized-ai-network-bittensor-1215435

《Reflexivity Research》:https://x.com/reflexivityres/status/1843319486138474552

免责声明:

本内容不构成任何要约、招揽、或建议。您在做出任何投资决定之前应始终寻求独立的专业建议。请注意,Gate.io及/或 Gate Ventures可能会限制或禁止来自受限制地区的所有或部分服务。请阅读其适用的用户协议了解更多信息。

关于 Gate Ventures

Gate Ventures 是 Gate.io 旗下的风险投资部门,专注于对去中心化基础设施、生态系统和应用程序的投资,这些技术将在 Web 3.0 时代重塑世界。Gate Ventures 与全球行业领袖合作,赋能那些拥有创新思维和能力的团队和初创公司,重新定义社会和金融的交互模式。

官网:https://ventures.gate.io/

Twitter:https://x.com/gate_ventures

Medium:https://medium.com/gate_ventures

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。