原文作者:ChandlerZ,Foresight News

NFT 交易平台 X2Y2 于 3 月 31 日发布公告,确认将在 2025 年 4 月 30 日正式停止运营。该平台在三年运营期间曾创下 56 亿美元的总交易量。

X2Y2 的 CEO 在声明中指出,NFT 市场交易量已从巅峰期下降了 90%。他表示:「市场平台的生死取决于网络效应,是时候放下并打造一些更具持久价值的东西了。 」

团队强调这并非彻底告别,而是战略转型。过去一年,他们一直在探索 AI 领域,特别关注 AI 与加密技术的融合可能性。他们计划开发一个由 AI 驱动的去中心化平台,旨在持续创造价值,而非仅仅追随市场趋势。

CEO 坦承,由于 X2Y2 代币与其 NFT 业务紧密相连,这一转变可能会影响代币价格,但他对团队新方向的长期价值持乐观态度。

X2Y2 在初期通过低交易费用和无版税策略吸引了大量用户,但随着市场竞争加剧,其优势逐渐减弱。2023 年 X2Y2 的平均市占率为 8.79%,其在 2023 年初拥有相对较高的市场份额,但到年末市占率低至可忽略不计。

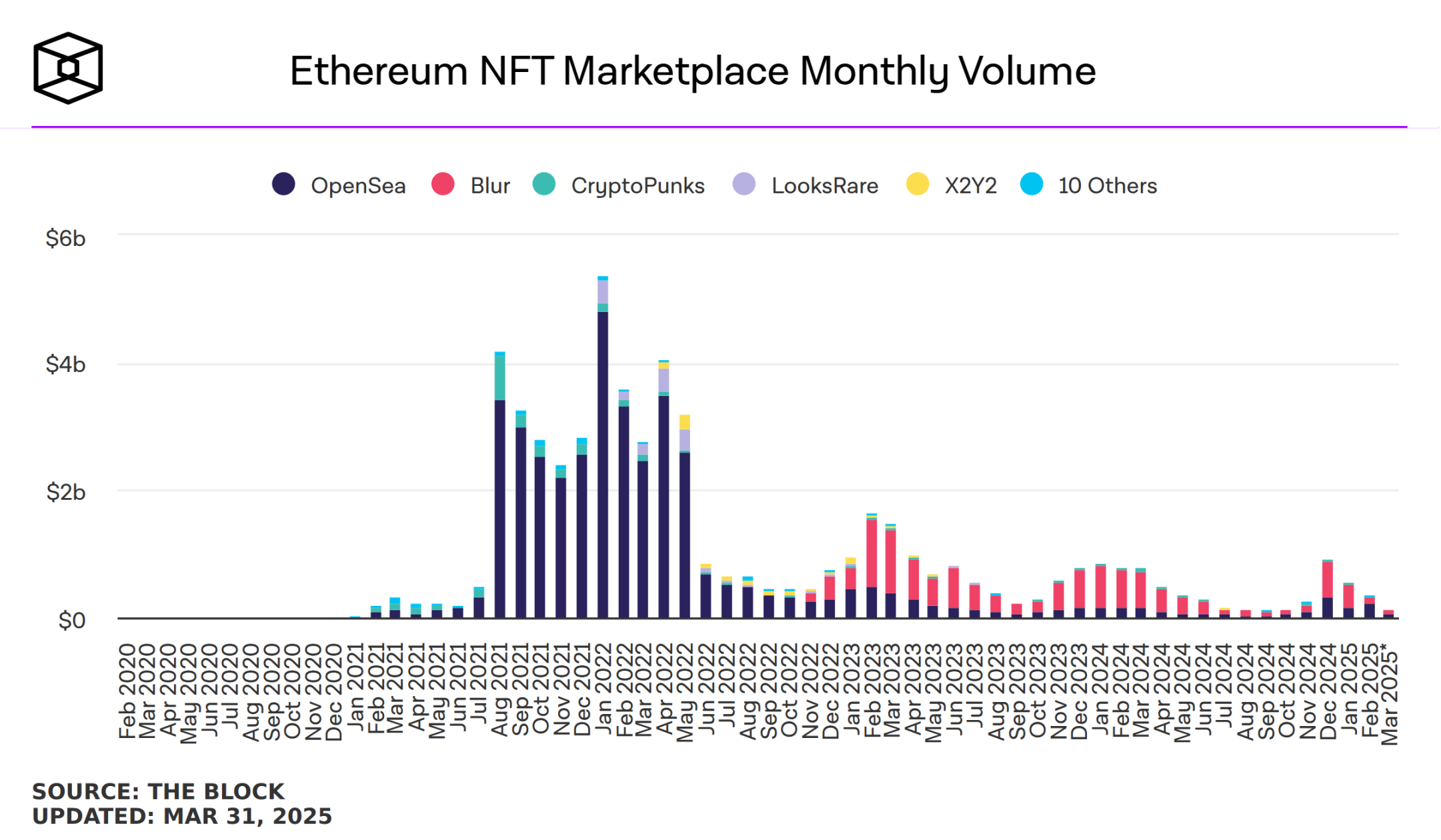

X2Y2 的衰落并非孤例,而是整个 NFT 行业低迷的缩影。根据 The Block 的数据,由于主要平台活动的普遍萎缩,今年 3 月基于以太坊的 NFT 月交易量几乎跌至近年来的最低点。OpenSea、Blur、LooksRare 和 X2Y2 等主要市场的活跃度持续下降,进一步印证了 NFT 行业正面临严峻挑战。

低迷的 NFT 市场

2021 年至 2022 年间,NFT 市场作为区块链产业的重要分支迅速崛起,成为继 DeFi 之后推动以太坊网络增长的核心动能。在交易活跃、用户涌入和资本注入的三重驱动下,OpenSea、CryptoPunks、BAYC 等蓝筹 NFT 项目快速催生出一个超千亿美元估值的新兴市场。但自 2022 年下半年起,NFT 交易量开始断崖式下滑,蓝筹项目价值大幅缩水,整个赛道陷入流动性危机。

根据 The Block 的数据仪表板,3 月基于以太坊的 NFT 的月交易量几乎跌至近年来的最低水平,降至 1.39 亿美元,较 2 月份的 3.47 亿美元下降 59.9%,几近接近 2021 年 6 月以来的最低交易量。

2021 年,NFT 交易额达到顶峰,单月最高超过 50 亿美元。这段时间是 NFT 概念首次大规模破圈时期,以 CryptoPunks、Bored Ape Yacht Club(BAYC)等高价值项目为代表的 NFT 项目大量涌现。而在 2022 年后,整体市场迅速回落,单月交易额明显下降,平均维持在 10 亿美元左右。同期 Blur 平台异军突起,迅速抢占市场份额,甚至一度超过 OpenSea,形成明显的竞争格局。

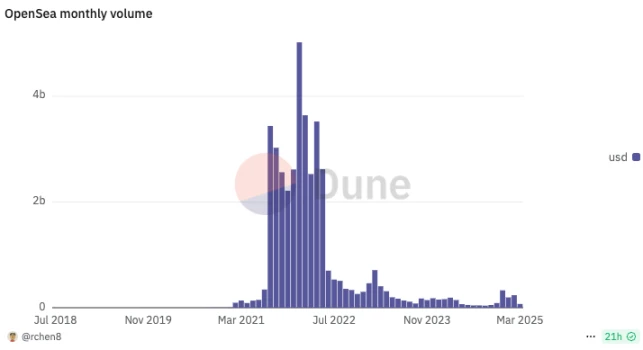

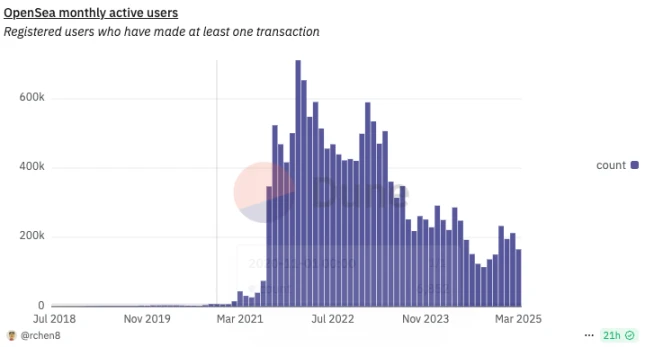

根据 Dune Analytics 的数据, OpenSea 曾主导 NFT 市场,并以 100 亿美元的估值获得投资机会,2022 年初交易额峰值甚至接近月 50 亿美元,成为 NFT 繁荣期的象征。

2023 年后,OpenSea 的交易额明显缩水,用户和资金大幅流失,市场占有率明显下滑。市场逐渐进入理性甚至过冷阶段。3 月,OpenSea 活跃用户下降 22%,至 16.5 万。

扶不起的 ETH

3 月 31 日,ETH/BTC 比率跌至 0.02193,为五年来的最低点。今年以来,ETH 相对于 BTC 已下跌了 39%,这是比特币奖励减半后 12 个月内 ETH 首次表现逊于 BTC。

根据 Glassnode 的数据显示,上一次 ETH 表现如此逊于 BTC,是在 2019 年第三季度,当时该比率跌至 0.0164,季度跌幅达 46%。这种历史性的表现再次揭示了以太坊在面对市场周期的变化时,缺乏足够的内生增长动力来支撑其价值的稳定。

ETH/BTC 比率的下跌,折射出以太坊面临的深层次困境。DeFi 和 NFT 曾贡献以太坊 75% 的链上活动,当两者同时遇冷,缺乏新叙事接力。NFT 市场崩盘和以太坊 Gas 费的急剧下滑,直接影响了 ETH 的内在经济动力。作为一度是以太坊链上高频应用的最大来源,NFT 市场的冷却,链上的交易需求大幅缩减,导致 Gas 费收入下降。

此时,ETH 所依赖的经济模式,即通过高 Gas 消耗促进网络价值的方式,显然遇到了瓶颈。而随着 DeFi 项目的调整、蓝筹 NFT 的价值蒸发,ETH 的价值基础也随之摇晃。

此外,ETH/BTC 比率的下跌也与以太坊的技术路径相关。尽管以太坊的 PoS 转型解决了能源消耗等问题,但它并未在根本上解决以太坊价格表现的关键因素,市场需求的可持续性。以太坊的成功转型,虽然在长远来看为网络带来了更高的效率和更低的成本,但在短期内,其对 ETH 价格的影响却微乎其微,尤其是在整体市场环境不景气的背景下,ETH 的价值表现显得更为疲软。

ETH 未来的困境与突破:新增长点的探索

面对当前的困境,以太坊亟需寻找新的增长点以恢复其在加密领域中的领导地位。NFT 市场的失速为以太坊带来的负面效应难以短期逆转,网络的活跃度下降、Gas 费收入萎缩、资产信用的系统性危机,使得以太坊的经济模型在市场动荡中失去了平衡。

ETH/BTC 比率的持续下行和市场信心的流失,预示着以太坊生态在经历 NFT 市场崩盘后需要新的突破和重生。以太坊是否能够突破当前的困境,重新获得市场的青睐,仍需时间的考验,而能否在新兴资产类别与区块链技术创新中找到突破口,决定了 ETH 未来的命运。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。