关键要点

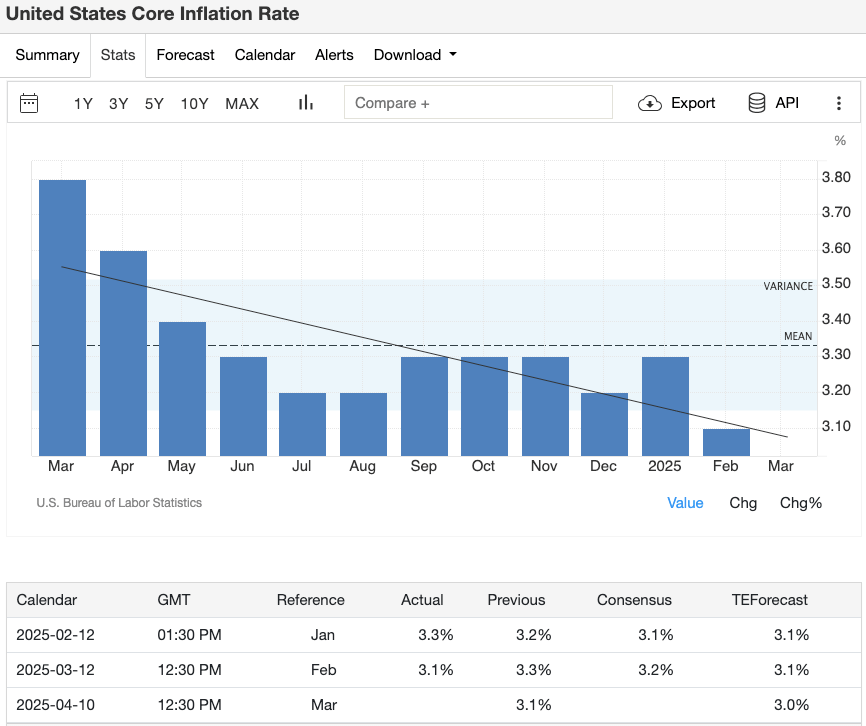

全球宏观经济驱动因素:4月的重要经济数据(就业、通胀、GDP)及各国央行决策将显著影响加密货币,数字资产已与整体风险情绪高度联动。

央行政策趋势:多国央行正在转向宽松政策或维持利率不变,通常会促进风险偏好,有利于比特币及主要山寨币。

美国“关税解放日”:4月2日美国将公布新的关税措施,严厉的关税可能引发避险情绪,而较温和的政策则有望提振市场情绪。

市场波动关键窗口:加密货币交易员需关注4月4日、10日、16日、17日及30日,这些日子的经济数据与政策信号可能带来市场动荡,应提前制定风险对冲和管理策略。

2025年4月全球经济事件密集,美國就业报告、中国一季度GDP、各大央行决议,以及可能改变全球市场局势的美国关税政策,都将左右市场情绪。对加密货币交易员而言,宏观事件的重要性已超越以往,比特币和其他数字资产日益与全球金融市场紧密联动。理解利率变化、通胀数据以及地缘政治走势如何影响风险偏好,是交易员成功应对加密货币价格波动的关键。

目录

4月2日 – 美国“关税解放日”

4月4日 – 美国就业报告

4月9日 – 美联储(FOMC)会议纪要

4月10日 – 美国消费者物价指数(CPI)

4月30日 – 美国一季度GDP及核心个人消费支出(Core PCE)

4月初 – 欧元区通胀初值(Flash CPI)

4月17日 – 欧洲央行(ECB)利率决议

4月15–16日 – 英国经济数据

4月下旬 – 欧元区一季度GDP

4月16日 – 中国一季度GDP

贸易及通胀数据

4月无日本央行(BoJ)会议

4月下旬 – 日本消费者物价指数(CPI)

4月1日 – 澳大利亚央行(RBA)

4月9日 – 新西兰央行(RBNZ)

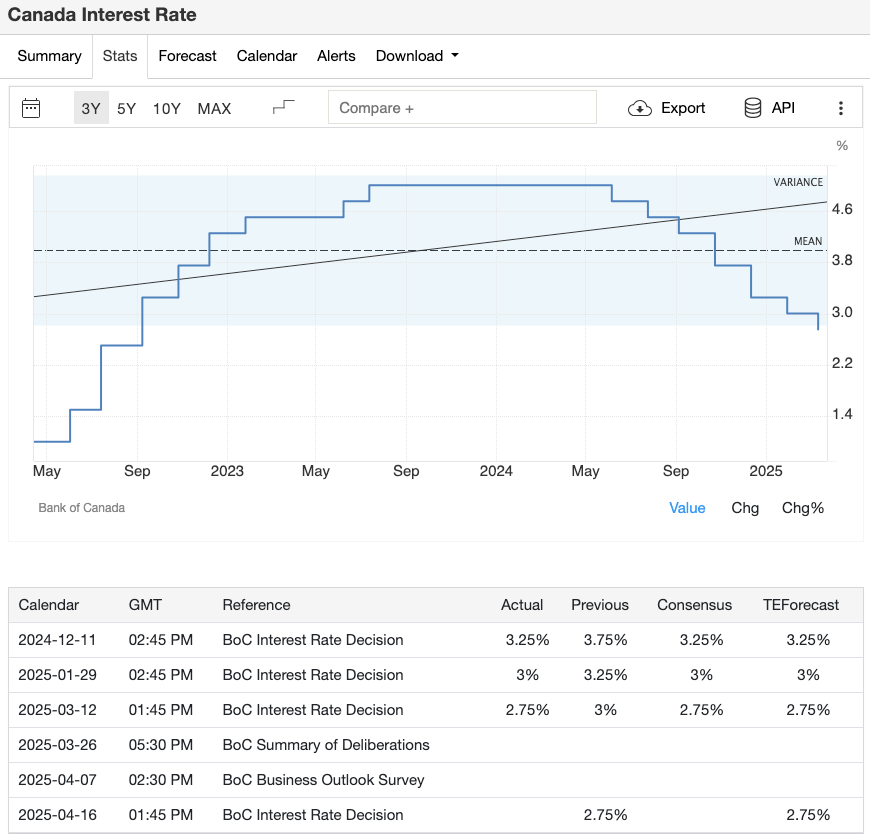

4月16日 – 加拿大央行(BoC)

4月3日 – OPEC+会议

4月21–23日 – 国际货币基金组织(IMF)与世界银行会议

宏观经济背景分析

2025年,全球经济扩张速度显著放缓,此前两年疫情后的强劲复苏已趋于平淡。2023至2024年间飙升的通胀压力在各国紧缩货币政策及能源价格稳定下明显缓解。同时,贸易争端、地区冲突等地缘政治的不确定性依然造成市场波动。

在欧洲,乌克兰长期冲突的后续影响仍然波及能源市场和政府财政决策,尽管紧张局势较此前几年有所缓和。同时,多国央行倾向降息或暂停加息,以维持经济增长并避免通胀卷土重来。

曾经相对独立的加密货币市场,如今对宏观政策变化格外敏感。当央行转向宽松,风险偏好升温,会推动资金进入比特币、以太坊等数字资产;反之,如果通胀再次抬头或出现重大地缘政治风险,交易员往往会从投机资产撤退,转投更安全的投资工具。

为何宏观因素仍对加密货币至关重要?

虽然部分人视比特币为避险资产,但到2025年,比特币往往与股市及其他风险资产同步波动。机构投资者根据全球流动性和市场情绪频繁调整资产配置。当央行采取鸽派立场时,包括加密货币在内的风险资产通常受益;反之,意外的鹰派政策或悲观经济数据则会导致数字资产与传统市场同步下跌。

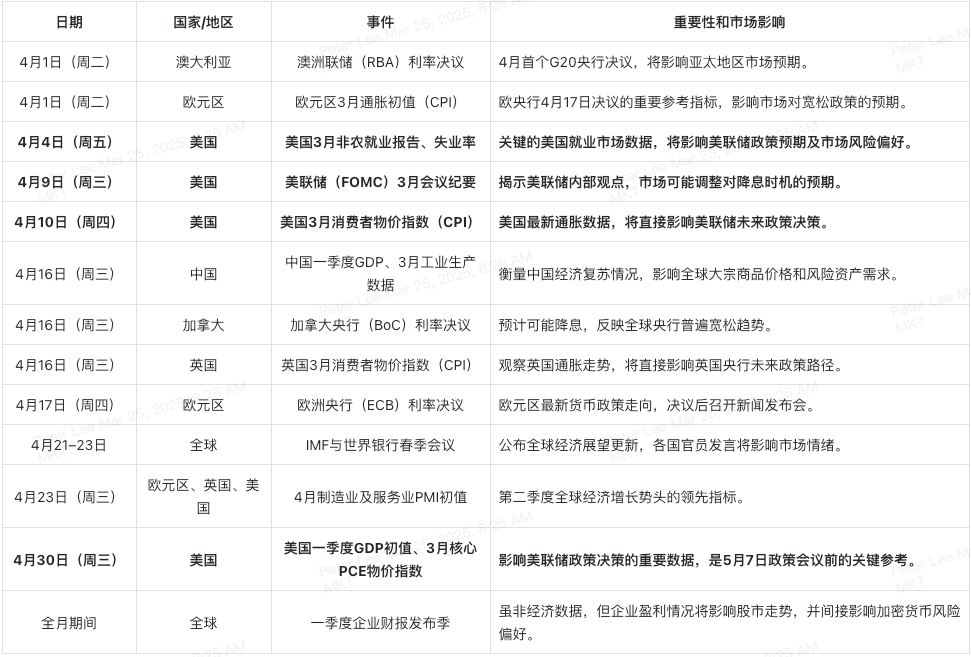

全球经济在疫情后经历了爆发式增长,目前增长势头已明显降温。虽然2023–2024年的通胀高峰已过去,但美国新关税政策和潜在能源风险依然值得高度警惕。以下为4月重点事件、对整体市场的潜在影响,以及加密货币交易员需要重点关注的时间点:

美国篇:主导全球市场情绪

4月2日 – 美国“关税解放日”

美国前总统特朗普计划于4月2日宣布新的“对等”关税措施。市场担忧此轮关税规模可能较大,加剧贸易摩擦、通胀风险并拖累经济增长,对股市及加密货币造成利空。但如果政策力度较为温和,市场则可能迎来缓和反弹。加密市场全天候交易,将迅速反映此类重大消息。

Image Credit: Bloomberg

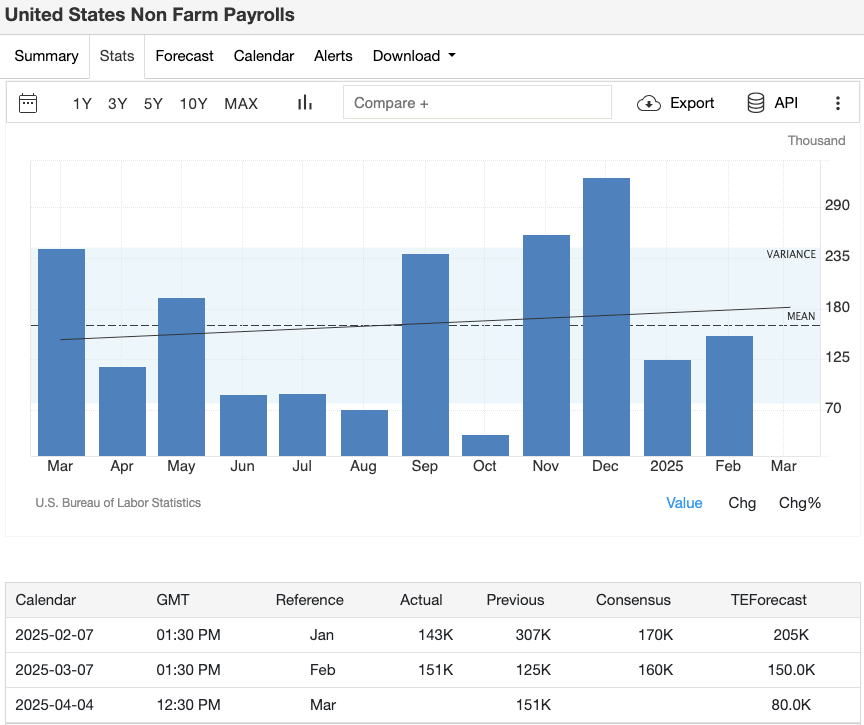

4月4日 – 美国就业报告

美国非农就业报告通常影响市场对美联储利率路径的预期。如果就业数据较差,可能引发衰退忧虑,但也可能增加市场对美联储进一步放松政策的期望,对加密资产影响复杂。而意外强劲的就业数据可能降低市场的降息预期,短期内给比特币及山寨币带来压力。

Image Credit: Economic Calendar

4月9日 – 美联储(FOMC)会议纪要

美联储4月没有议息会议,交易员将密切关注3月的会议纪要,以了解官员们对通胀和经济风险的看法。如果官员们倾向于进一步紧缩政策,市场可能重新调整降息预期。加密货币通常在货币政策宽松的预期下表现较佳。

Image Credit: Inside the Hood

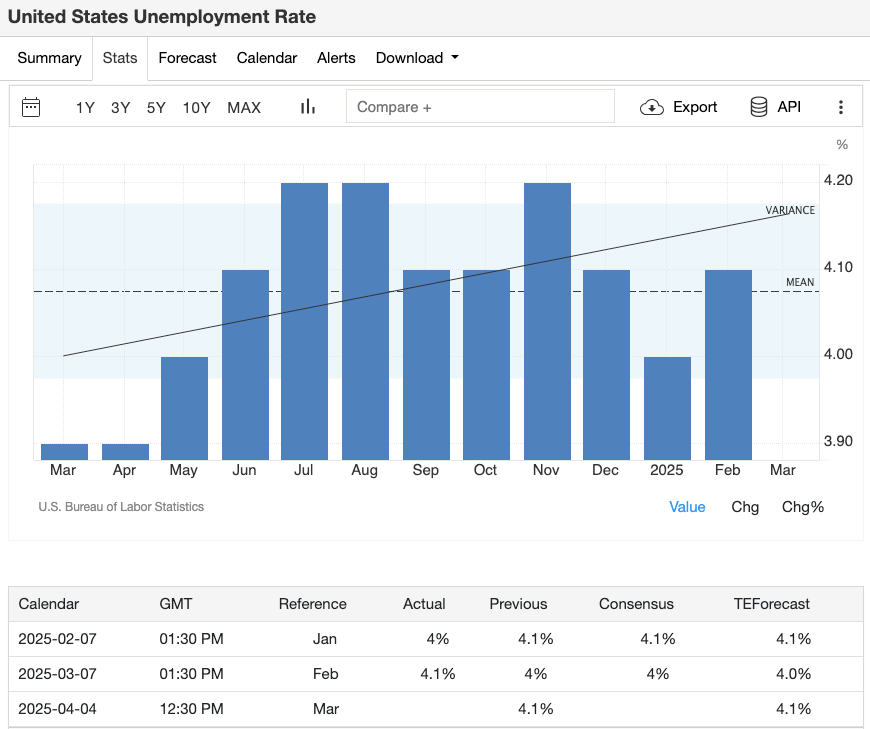

4月10日 – 美国消费者物价指数(CPI)

美国通胀数据依旧是关键指标。2月同比增幅温和至2.8%,为美联储暂停加息提供空间。但如果3月通胀数据出现回升,则可能削弱市场对近期降息的预期。加密货币市场通常受益于充裕的流动性,一旦市场担心政策转紧,加密资产价格波动将加大。

Image Credit: Economic Calendar

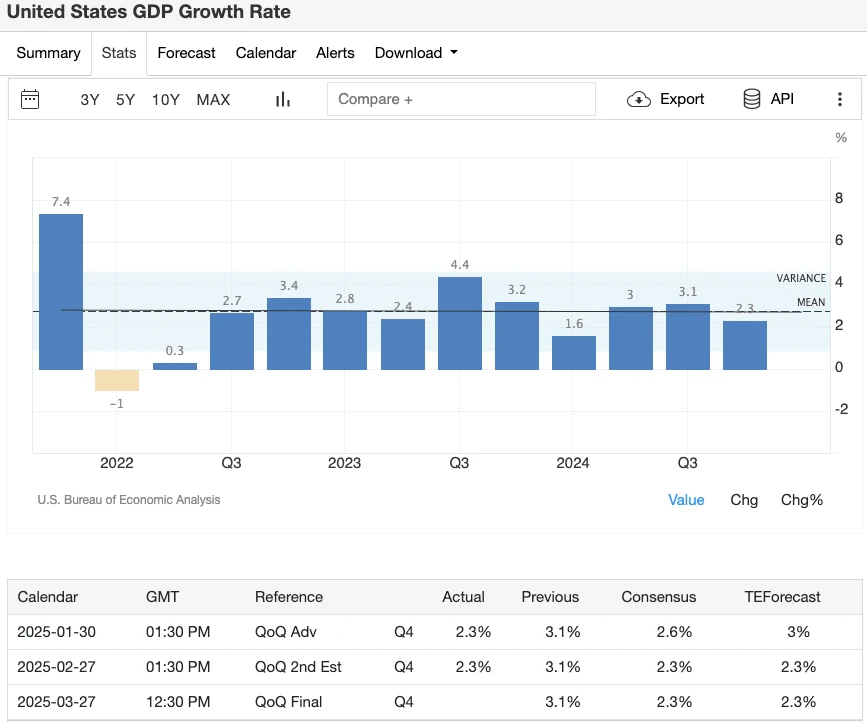

4月30日 – 美国一季度GDP及核心PCE

4月底将公布美国一季度GDP初值和美联储密切关注的核心个人消费支出物价指数(PCE)。若GDP数据疲弱,市场可能再度担忧衰退风险,同时美联储的鸽派观点可能进一步增强。此外,如果核心PCE显示通胀压力较弱,市场可能提前押注降息。这些数据将对5月初美联储政策决策产生决定性影响,并带动加密市场走势。

Image Credit: Economic Calendar

欧洲与英国篇:货币宽松、通胀与经济增长

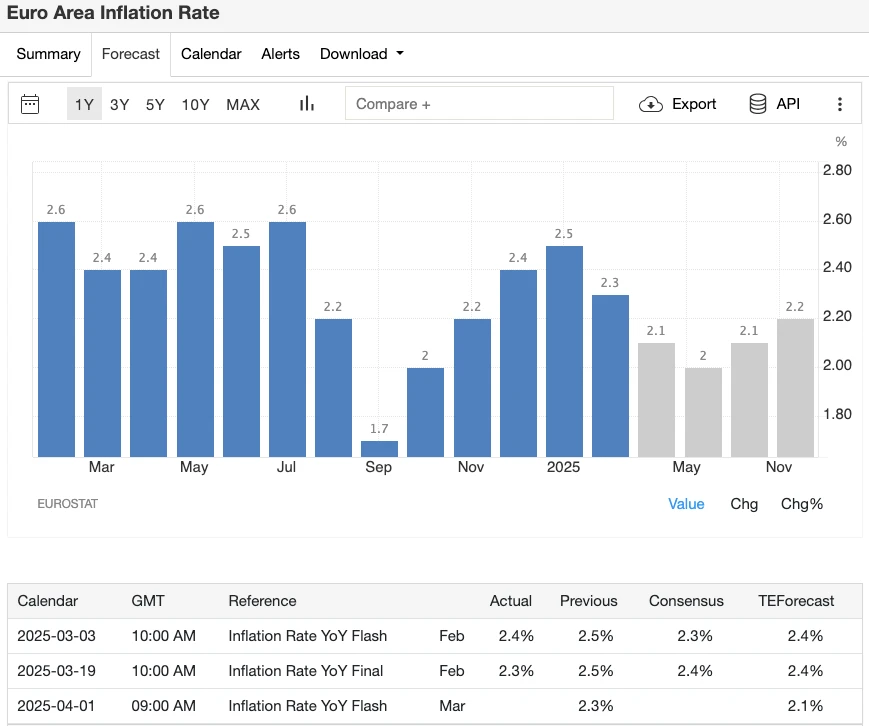

4月初 – 欧元区通胀初值(Flash CPI)

欧元区通胀近期已降至约2–3%,明显低于前几年水平。如果此次数据继续疲软,将强化市场对欧洲央行(ECB)维持宽松货币政策的预期,有利于包括加密资产在内的风险资产上涨。但如果通胀数据意外升高,欧洲央行可能转为谨慎态度。

Image Credit: Economic Calendar

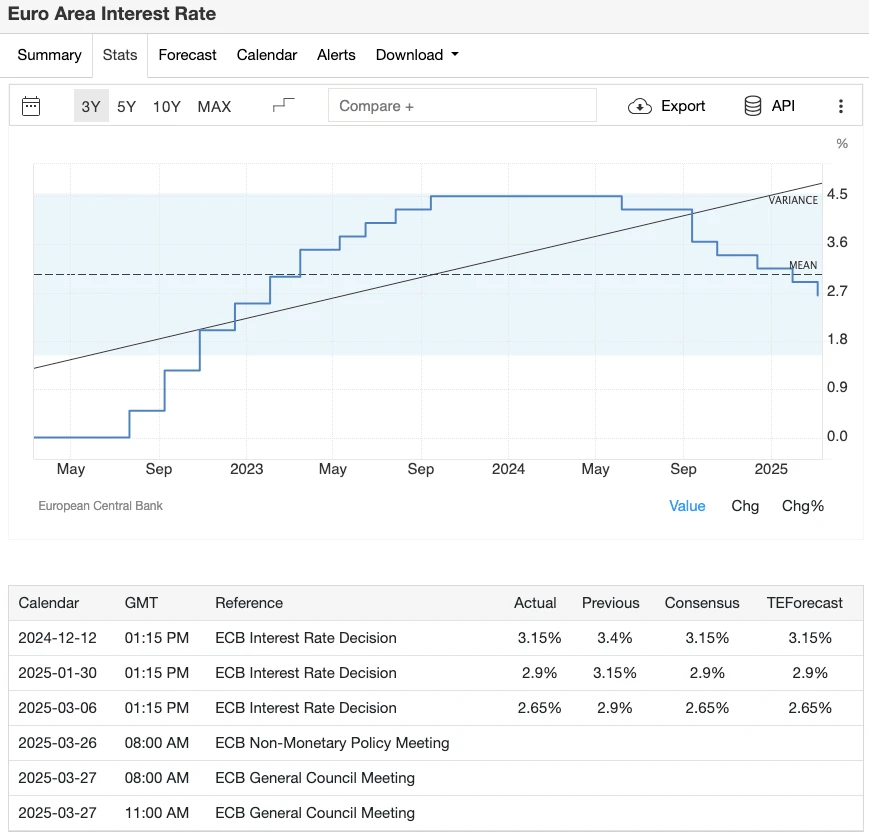

4月17日 – 欧洲央行(ECB)利率决议

欧洲央行在3月已将存款利率下调至2.65%。市场预计此次决议可能按兵不动或再小幅降息。鸽派(宽松)立场有助于市场流动性,通常利好加密市场;但若央行意外转向鹰派(收紧政策),则可能引发市场避险情绪,对加密资产不利。

Image Credit: Economic Calendar

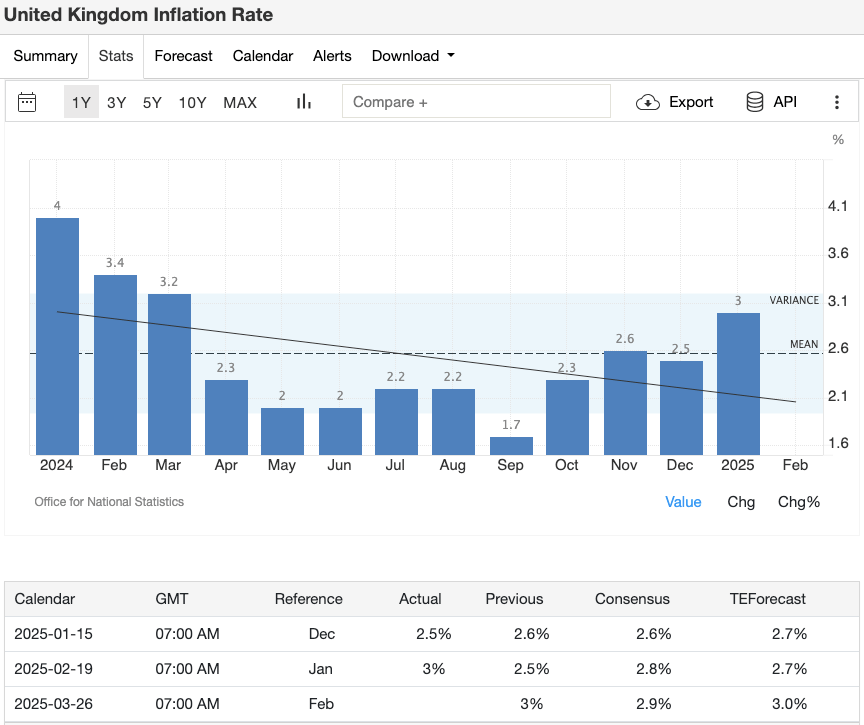

4月15–16日 – 英国通胀与就业数据

英国将在4月15日至16日发布3月份消费者物价指数(CPI)和就业市场数据。这些数据将进一步明确英国央行(BoE)下一步的政策路径。目前英国通胀率维持在3%左右,加上稳健的工资增长,限制了央行进一步降息空间。但若数据意外疲弱,可能增加央行采取更宽松措施的可能性,间接刺激英国市场对加密货币的需求。

Image Credit: Economic Calendar

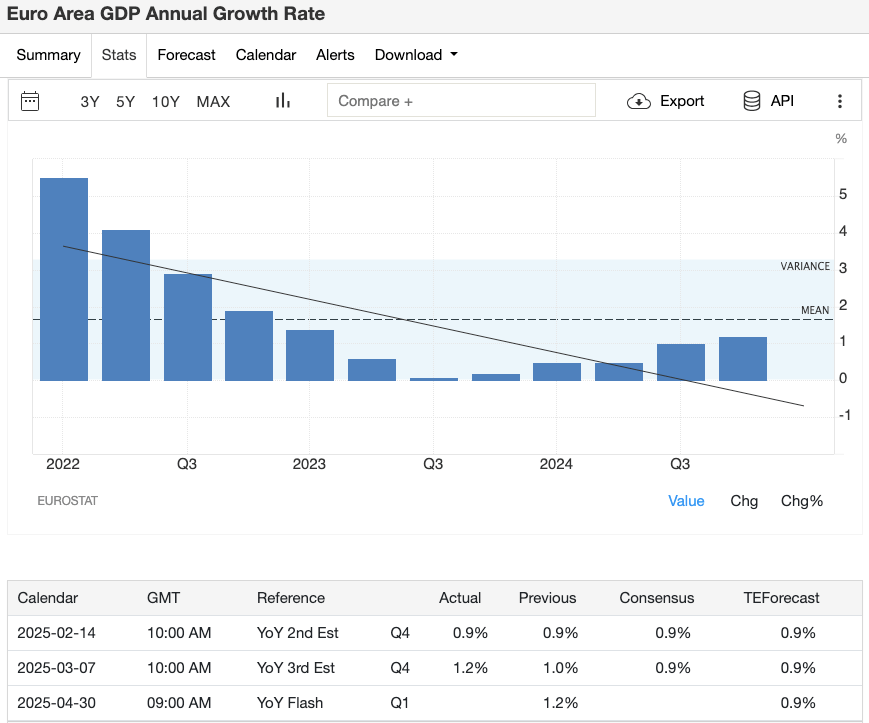

4月下旬 – 欧元区一季度GDP数据

预计4月底公布的欧元区第一季度GDP数据将显示经济增长是否维持在0.9%左右。若GDP表现弱于预期,将加剧市场对经济衰退的担忧;反之,更强的数据则可能降低市场对欧洲央行进一步宽松行动的预期。这两种情况都会显著影响风险情绪,并波及加密货币市场走势。

Image Credit: Economic Calendar

中国篇:一季度GDP数据与全球市场联动效应

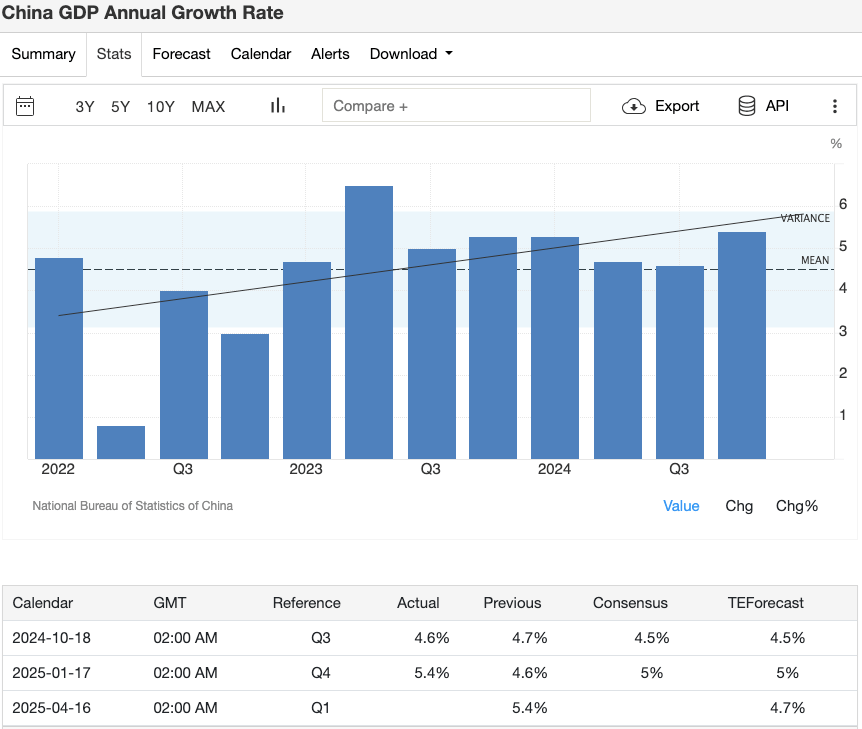

4月16日 – 中国一季度GDP

中国一季度GDP数据是全球需求的重要风向标。政府设定的增长目标为4%左右,但分析师普遍预测实际增速可能接近5%。若GDP数据强劲,将提升全球大宗商品及包括加密资产在内的风险资产需求;若数据明显低于预期,尤其伴随中美贸易摩擦升温,可能令市场情绪受挫。

Image Credit: Economic Calendar

4月中旬 – 贸易与通胀数据

4月中旬,中国将公布贸易余额、工业生产及通胀数据。如果出口数据表现强劲,意味着外需稳健;低通胀环境也将为政策层进一步宽松提供空间。加密货币交易员密切关注中国经济数据,任何额外的刺激政策或供应链调整,都可能影响全球经济增长的预期。

Image Credit: CNN

日本篇:4月政策按兵不动,聚焦5月央行动向

4月无日本央行(BoJ)议息会议

日本央行下一次货币政策决策定于5月1日公布。然而,本月央行官员的讲话或发布的数据仍可能影响市场对收益率曲线控制政策(YCC)的预期。当前日本通胀保持在约3%的水平,市场关注央行何时会退出超宽松货币政策。任何政策转向迹象,都可能影响全球债市和日元汇率,间接影响加密货币市场。

Image Credit: CNBC

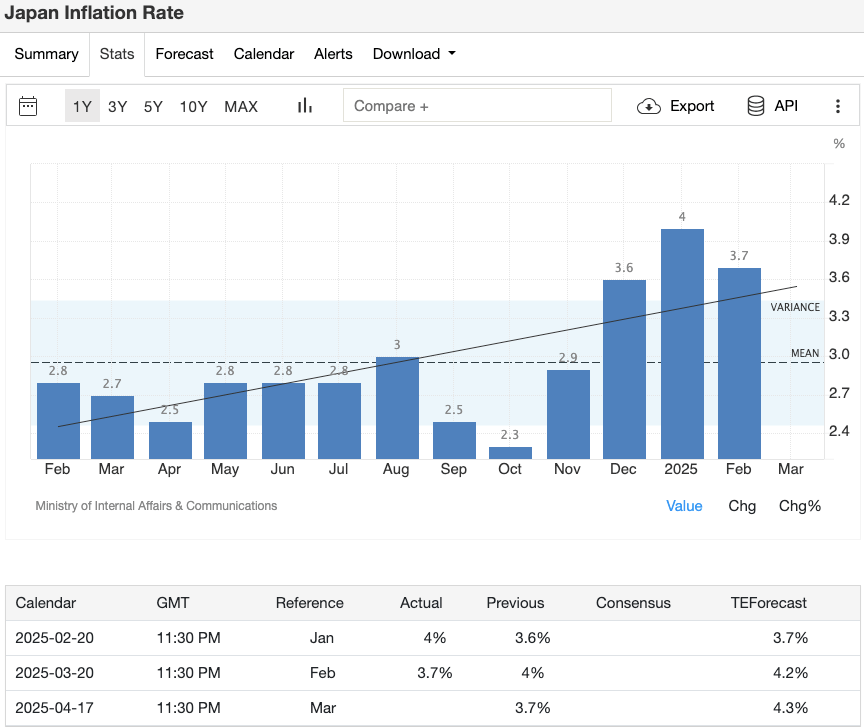

4月下旬 – 日本消费者物价指数(CPI)

如果日本3月份CPI继续维持在目标上方,市场对央行可能收紧政策的猜测将升温;反之,若通胀数据回落,则可能进一步确认央行将维持宽松立场。两种情况都会波及外汇市场,影响整体市场风险偏好,并传导至加密货币市场走势。

Image Credit: Economic Calendar

其他央行与重要国际事件

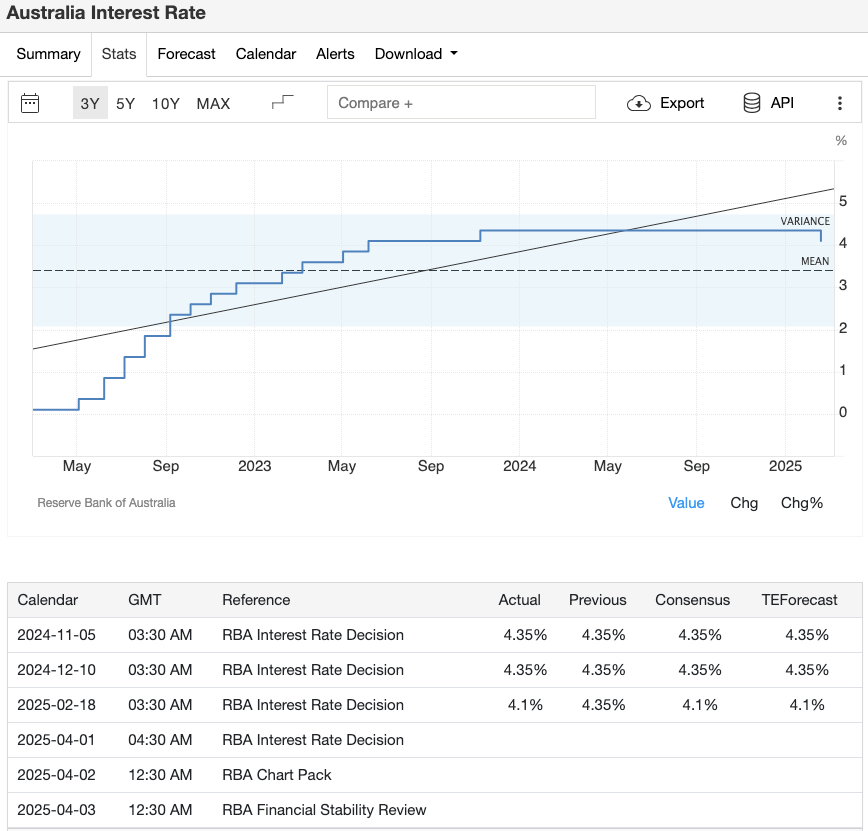

澳大利亚(RBA,4月1日)与新西兰(RBNZ,4月9日)

随着两国国内通胀逐渐降温,澳洲和新西兰央行均已暂停加息。如果央行释放未来可能降息的信号,将强化市场对全球央行宽松政策趋势的预期,通常有利于包括加密货币在内的风险资产表现。

Image Credit: Economic Calendar

加拿大央行(BoC) – 4月16日

加拿大央行已将利率下调至2.75%,预计4月可能进一步降息至2.50%。此鸽派政策体现了全球央行整体趋向宽松的趋势,有利于加密市场的表现。

Image Credit: Economic Calendar

OPEC+ 会议 – 4月3日

石油输出国组织(OPEC+)将于4月3日召开会议讨论产量政策。如果决定减产,油价可能上升,增加通胀压力;若产量维持或提高,则有助于控制通胀水平,为各国央行维持宽松货币政策创造条件,有利于加密货币市场表现。

Image Credit: Leadership.ng

IMF与世界银行春季会议 – 4月21至23日

全球各国财政部长和央行官员将齐聚华盛顿,讨论全球经济增长前景。IMF可能对经济增长预测进行调整。如果预测悲观,或对贸易和债务风险发出警告,将对市场造成负面影响;反之,如释放经济稳定增长的积极信号,将有利于市场风险情绪。

Image Credit: Pakistan & Gulf Economist

加密货币市场动态:关键考量因素

通胀与利率

当通胀水平保持温和,各国央行就有空间降息或维持利率不变,通常对加密货币形成利好。但若通胀意外攀升,央行可能再度趋向收紧政策,不利于比特币及其他加密货币。

市场风险偏好(Risk-On vs. Risk-Off)

加密货币在市场风险偏好(Risk-On)阶段通常与股市一同上涨。若贸易冲突加剧、地缘政治风险升温,或经济数据不佳,市场转向避险(Risk-Off)时,加密货币市场可能面临下跌风险。

与股票市场的相关性

许多机构投资者将比特币视作类似科技股的资产类别,股市的剧烈波动往往也会在加密市场同步体现。

关税政策关注点

如果4月2日美国关税政策出乎意料地严厉,可能将盖过其他经济数据对市场的影响;反之,如政策力度温和,则可能引发市场的舒缓情绪,利好各类风险资产,包括加密货币。

加密货币交易员策略建议

保持市场敏感性

交易员应密切关注4月重要经济事件日期,包括美国就业报告(4月4日)、美国CPI(4月10日)、中国GDP(4月16日)、欧洲央行会议(4月17日)和美国GDP与PCE通胀数据(4月30日)。加密市场反应迅速,尤其在非传统交易时段更易出现剧烈波动。

管理市场波动风险

利用期权和期货等工具在重大事件前后进行风险对冲布局。合理设置止损单,避免意外数据或政策消息引发的大幅亏损。

关注美元和债券收益率走势

当美元走强或债券收益率上升时,资金可能撤出比特币等风险资产;反之,收益率下跌时,市场风险偏好提升,一般利好加密货币价格。

快速应对市场变化

加密市场24小时不间断交易,因此交易员需时刻保持警惕,尤其当重大消息或事件发生在股市闭市期间时,更要随时准备采取行动。

结语

2025年4月对全球金融市场将是一个重要节点,各大央行政策、经济数据密集发布,以及美国重要的关税政策出台,都将对市场情绪产生深远影响。加密货币交易员应密切关注这些事件的发展趋势,因为数字资产对通胀走势、货币政策变化及地缘政治紧张局势高度敏感。

若通胀保持稳定、美国关税政策相对温和,市场风险偏好可能增强,推动比特币和主流币种继续上涨;但若通胀意外回升、关税措施加剧或经济数据低迷,市场风险偏好则可能受挫。交易员只有持续关注宏观经济动态,实施谨慎的风险管理,并深入理解这些因素对数字资产的影响,才能在这个关键月份有效地把握市场趋势,甚至为2025年中期市场走向提前布局。

另外,关注加密货币与传统市场(尤其是股票和利率市场)的相关性,能帮助交易员快速判断数字资产的市场反应。密切关注就业、通胀、GDP数据及央行政策沟通的具体日期,也将有效协助交易员把握市场波动带来的投资机会。

快速链接

关于XT.COM

成立于2018年,XT.COM目前注册用户超过780万,月活跃超过100万人,生态内的用户流量超过4000万人。我们是一个支持800+优质币种,1000+个交易对的综合性交易平台。XT.COM加密货币交易平台支持现货交易,杠杆交易,合约交易等丰富的交易品种。XT.COM同时也拥有一个安全可靠的NFT交易平台。我们致力于为用户提供最安全、最高效、最专业的数字资产投资服务。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。