本文来自:0xDíaz

编译|Odaily星球日报(@OdailyChina)

译者|Azuma(@azuma_eth)

Pendle(PENDLE)已成为了 DeFi 中占据主导地位的固定收益协议,使用户能够交易未来收益并锁定可预测的链上回报。

2024 年,Pendle 推动了 LST(流动性质押代币)、再质押、收益型稳定币等主要叙事的发展,其本身也成为资产发行者的首选启动平台。

2025 年,Pendle 将扩展到 EVM 生态之外,演变为 DeFi 的全面固定收益层,瞄准新的市场、产品和用户群体,覆盖原生加密货币市场以及机构资本市场。

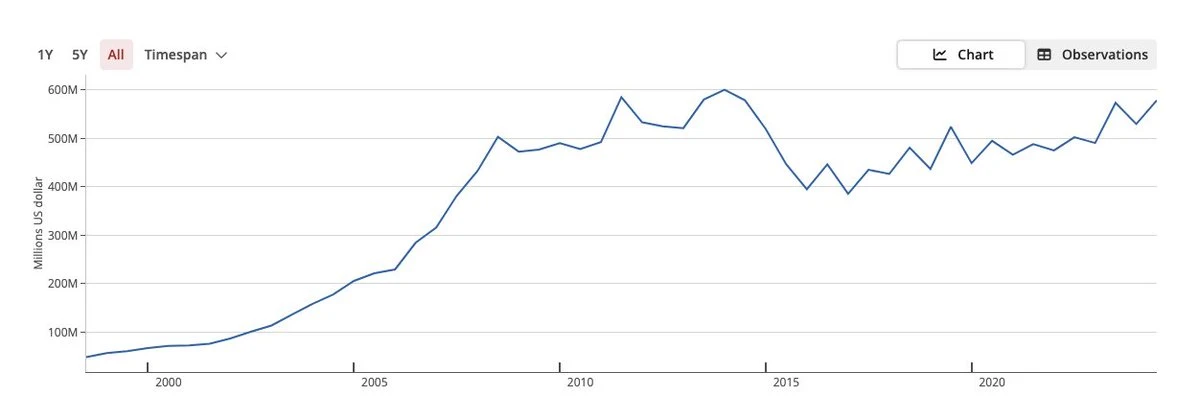

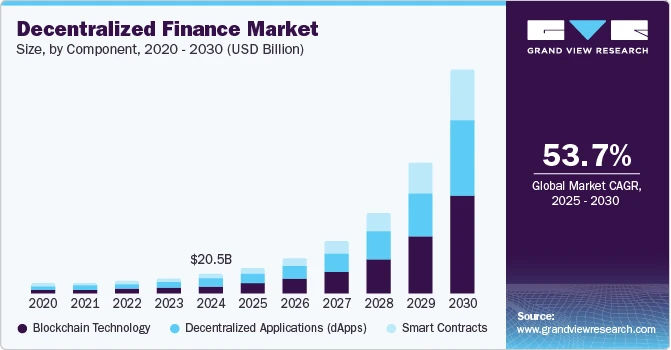

DeFi 世界的收益衍生品市场可类比为传统金融(TradFi)世界中最大的细分市场之一 —— 利率衍生品。这是一个超过 500 万亿美元的市场,即便是占据该市场的极小比例,也代表着数十亿美元的机会。

大多数 DeFi 平台仅提供浮动收益,这不免会让用户暴露于市场波动之中,但 Pendle 却通过透明且可组合的系统引入了固定利率产品。

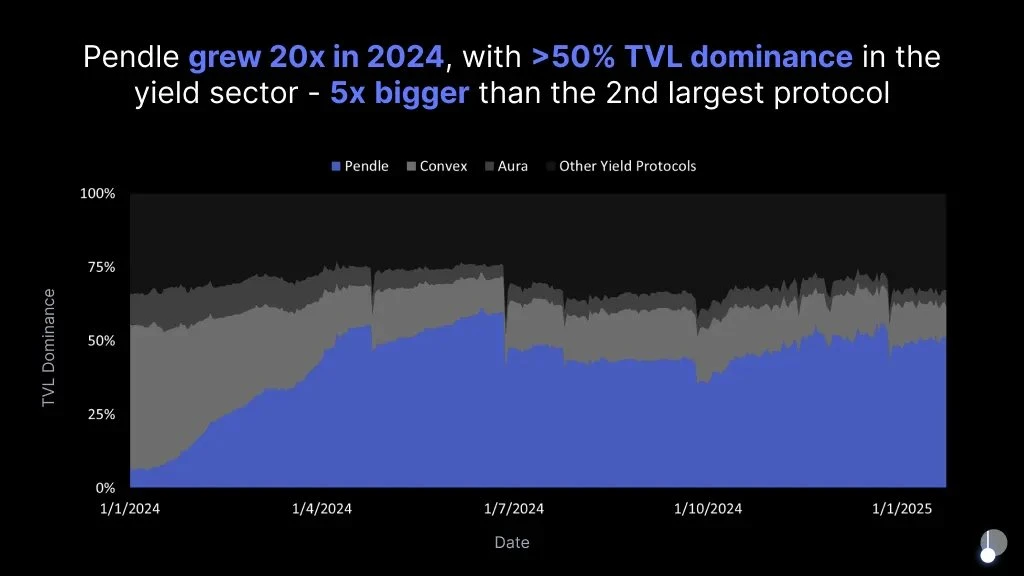

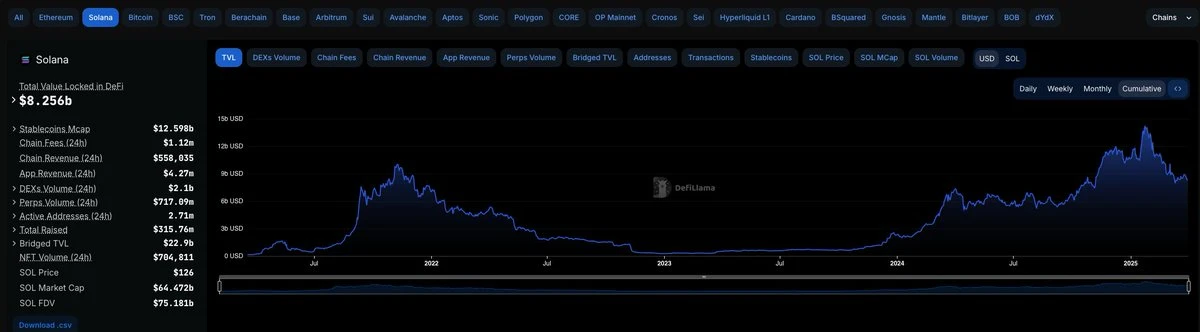

这一创新重塑了价值 1200 亿美元的 DeFi 市场格局,使 Pendle 了成为占据主导地位的收益协议。2024 年,Pendle 的 TVL 增长超过了 20 倍,目前其 TVL 占据了 yield 市场的过半份额,是第二大竞争对手的 5 倍之多。

Pendle 不仅仅是一个收益协议,它已演变为 DeFi 的核心基础设施,驱动着那些头部协议的流动性增长。

寻找契合点:从 LST 到 Restaking

Pendle 通过解决 DeFi 中的一个核心问题 —— 收益的波动性和不可预测性 —— 获得了早期的市场关注。与Aave或Compound不同,Pendle允许用户通过将本金与收益分离来锁定固定回报。

随着流动性质押代币(LST)的兴起,Pendle 采用率激增,以帮助用户释放质押资产的流动性。2024年,Pendle 又成功捕捉再质押(Restaking)叙事 —— 其 eETH 资金池上线仅数日便成为了平台内规模最大的池子。

如今的 Pendle 已在整个链上收益生态中扮演着关键角色。无论是为波动资金费率提供对冲工具,还是作为生息资产的流动性引擎,Pendle 在流动性再质押代币(LRT)、真实世界资产(RWA)及链上货币市场等增长领域都具有独特优势。

Pendle V2:基础设施升级

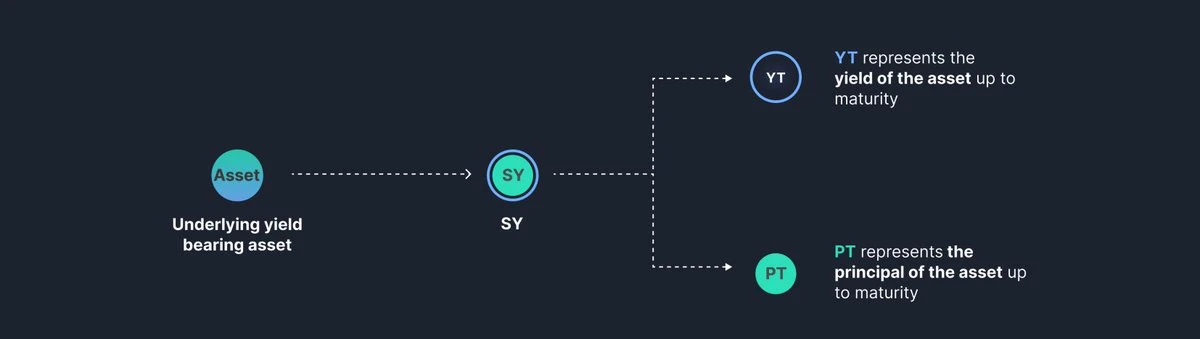

Pendle V2 引入了标准化收益代币(SY),以统一生息资产的封装方式。这取代了 V1 零散、定制化的集成方案,实现了“本金代币”(PT)和“收益代币”(YT)的无缝铸造。

PendleV2 的 AMM 专为 PT-YT 交易设计,提供了更高的资本效率和更优的价格机制。V1 采用通用 AMM 模型,而 V2 引入了动态参数(如rateScalar和rateAnchor),可随时间调整流动性,从而缩小价差、优化收益发现并降低滑点。

PendleV2 还升级了定价基础设施,在 AMM 中集成了原生TWAP 预言机,取代了 V1 依赖外部预言机的模式。这些链上数据源降低了操纵风险,提高了准确性。此外,PendleV2 增加了订单簿功能,在 AMM 价格区间超出时提供了备用的价格发现机制。

对于流动性提供者(LP),PendleV2 提供了更强的保护机制。资金池现在由高度相关的资产组成,且 AMM 设计最大程度减少了无常损失,尤其是对持有至到期的 LP 而言更是如此 —— 在 V1 中,由于机制不够专业化,LP 的收益结果更难预测。

突破EVM边界:进军Solana、Hyperliquid与TON

Pendle 计划向 Solana、Hyperliquid 和 TON 的扩张,标志着其2025年路线图的关键转折点。迄今为止,Pendle 始终局限于 EVM 生态 —— 即便如此,Pendle 还是在固定收益赛道占据了超 50% 的市场份额。

然而,加密货币的多链化已成趋势,通过 Citadel 战略突破 EVM 孤岛,Pendle 将触达全新的资金池与用户群。

Solana 已成为 DeFi 与交易活动的主要枢纽 —— 1 月 TVL 创下 140 亿美元的历史峰值,拥有强大的散户基础,以及快速增长的 LST 市场。

Hyperliquid 凭借着垂直整合的永续合约基础设施,TON 则依托着 Telegram 原生用户漏斗,两大生态增长迅速,但都缺乏成熟的收益基础设施。Pendle 有望填补这一空白。

若部署成功,这些举措将大幅扩展 Pendle 的可触达市场总量。在非 EVM 链上捕获固定收益资金流,可能带来数亿美元的增量 TVL。更重要的是,此举将巩固 Pendle 不仅作为以太坊原生协议,更是跨主要公链的 DeFi 固定收益基础设施的行业地位。

拥抱传统金融:构建合规化收益接入体系

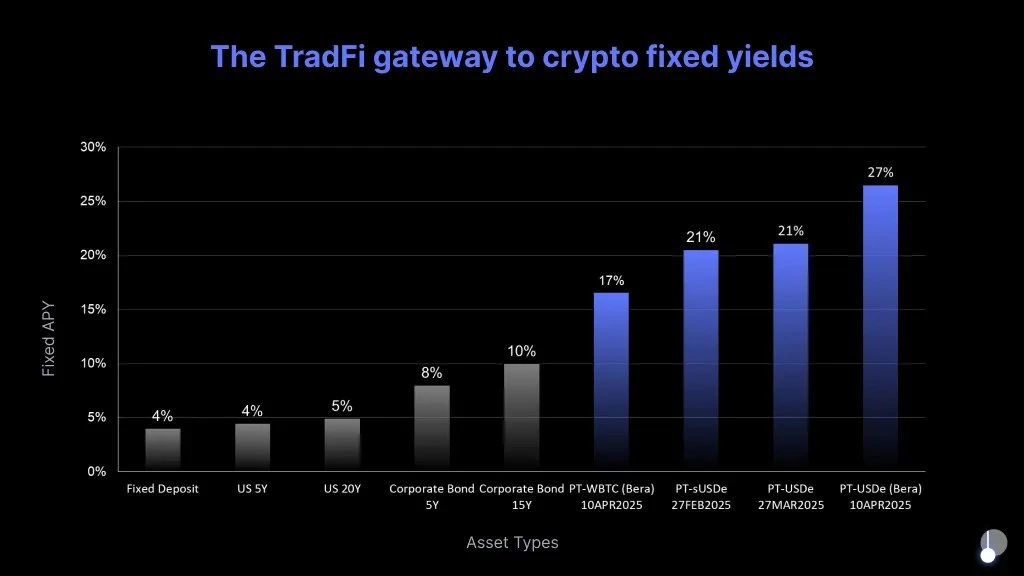

Pendle 2025 年路线图中的另一关键举措是推出专为机构资金设计的 KYC 合规版 Citadel。该方案旨在通过提供结构化、合规化的加密原生固收产品接入渠道,将链上收益机会与传统受监管资本市场相连接。

该计划将与 Ethena 等协议合作,由持牌投资经理管理独立 SPV 架构。这种设置消除了托管、合规及链上执行等关键摩擦点,使机构投资者能够通过熟悉的法律架构参与 Pendle 收益产品。

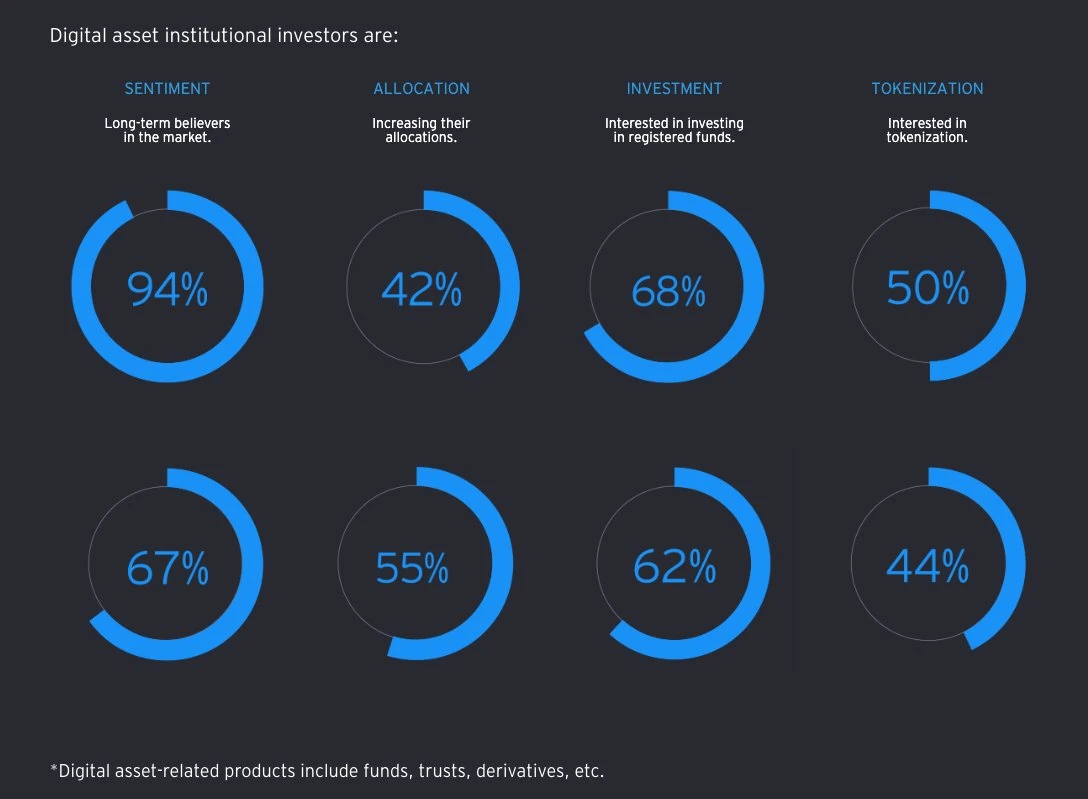

全球固收市场规模超过 100 万亿美元,即便机构资金仅向链上配置极小比例,也可能带来数十亿美元的资金流入。安永-帕特侬 2024 年调研显示,94% 的机构投资者认可数字资产的长期价值,超半数正在增加配置。

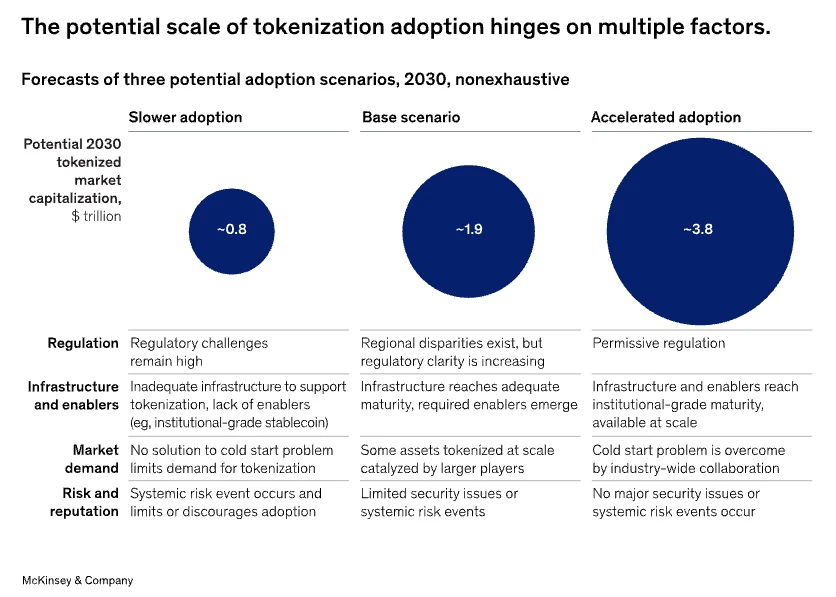

麦肯锡预测,2030 年代币化市场规模或将达 2-4 万亿美元。Pendle虽非代币化平台,但通过为代币化收益产品提供定价发现、对冲及二级交易功能,在该生态中扮演关键角色——无论是代币化国债还是生息稳定币,Pendle 均可作为机构级策略的固收基础设施层。

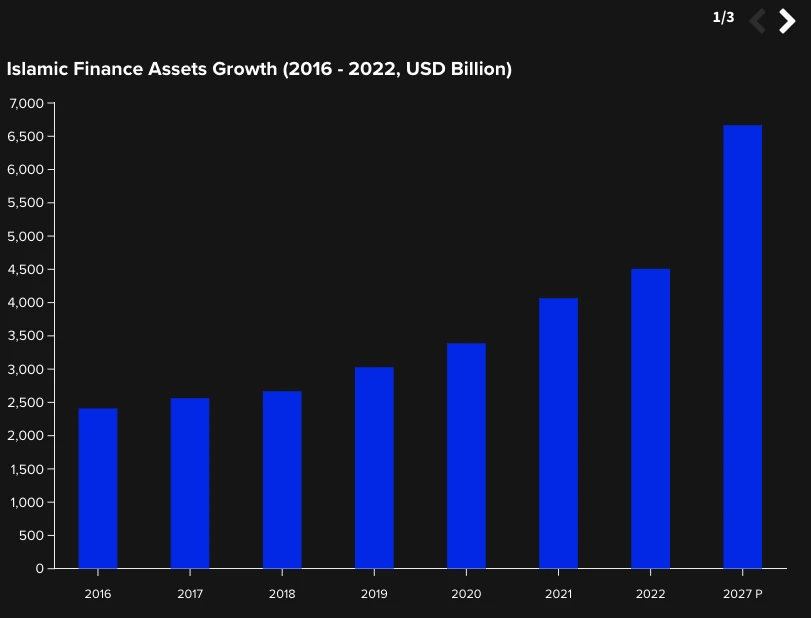

伊斯兰金融:4.5万亿美元的新机遇

Pendle 同时计划推出符合伊斯兰教法的 Citadel 方案,服务规模达 4.5 万亿美元的全球伊斯兰金融市场 —— 该产业覆盖 80 余个国家,过去十年保持 10% 的年均复合增长率,尤其在东南亚、中东及非洲地区发展迅猛。

严格的宗教限制长期阻碍穆斯林投资者参与DeFi,但 Pendle 的 PT/YT 架构可灵活设计符合伊斯兰教法的收益产品,其形态可能类同于伊斯兰债券(Sukuk)。

若成功落地,该 Citadel 不仅能拓展 Pendle 的地域覆盖,更将验证 DeFi 适配多元金融体系的能力——从而巩固 Pendle 作为链上市场全球固收基础设施的定位。

进军资金费率市场

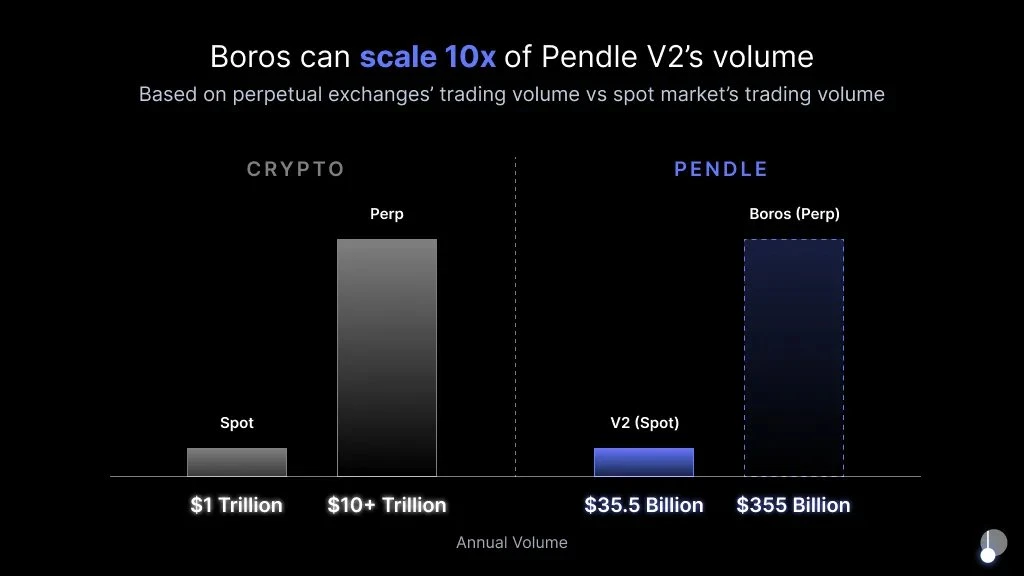

Boros 作为 Pendle 2025 路线图中最重要的催化剂之一,旨在将固定利率交易引入永续合约资金费率市场。尽管 Pendle V2 已确立其在现货收益代币化市场的主导地位,但 Boros 计划将其业务版图扩展至加密领域规模最大、波动最剧烈的收益来源 —— 永续合约资金费率。

当前永续合约市场未平仓合约超 1500 亿美元,日均交易量达 2000 亿美元,这是一个规模庞大但对冲工具严重不足的市场。

Boros 计划通过实现固定资金费率,为 Ethena 等协议提供更稳定的收益 —— 这对管理大规模策略的机构至关重要。

对 Pendle 而言,这一布局蕴含着巨大价值。Boros 不仅有望打开数十亿美元规模的新市场,更实现了协议定位的升级 —— 从 DeFi 收益应用蜕变为链上利率交易平台,其功能定位已堪比传统金融中 CME 或摩根大通的利率交易台。

Boros 还强化了 Pendle 的长期竞争优势。不同于追逐市场热点,Pendle 正在为未来的收益基础设施奠定基础:无论是资金费率套利还是现货持有策略,都为交易者和资金管理部门提供了实用工具。

鉴于目前 DeFi 和 CeFi 领域均缺乏可扩展的资金费率对冲方案,Pendle 有望获得显著的先发优势。若成功实施,Boros 将显著提升Pendle 的市场份额,吸引新用户群体,并巩固其作为 DeFi 固定收益基础设施的核心地位。

核心团队与战略布局

Pendle Finance 由匿名开发者 TN、GT、YK 与 Vu 于 2020 年中创立,已获得 Bitscale Capital、Crypto.com Capital、Binance Labs 及 The Spartan Group 等顶尖机构投资。

融资里程碑:

私募轮(2021年4月):募资370万美元,参投方包括 HashKey Capital、Mechanism Capital 等;

IDO(2021年4月):以0.797美元/代币价格融资1183万美元;

Binance Launchpool(2023年7月):通过币安Launchpool分发502万枚PENDLE(占总供应量1.94%);

Binance Labs 战略投资(2023年8月):加速生态发展与跨链扩张(金额未披露);

Arbitrum 基金会资助(2023年10月):获161万美元用于Arbitrum生态建设;

The Spartan Group战略投资(2023年11月):推动长期增长与机构采用(金额未披露)。

生态合作矩阵如下:

Base(Coinbase L2):部署至Base网络,接入原生资产并扩展固定收益基础设施;

Anzen(sUSDz):上线RWA稳定币sUSDz,实现与现实世界收益挂钩的固定收益交易;

Ethena(USDe/sUSDe):集成高APY稳定币,接入加密原生收益并强化DeFi协同;

Ether.fi(eBTC):推出首个BTC原生收益池,突破ETH资产边界;

Berachain(iBGT/iBERA):作为首批基础设施入驻,通过原生LST构建固定收益框架。

代币经济模型

PENDLE 代币是 Pendle 生态系统的核心,兼具治理功能与协议交互权限。通过将生息资产拆分为本金代币与收益代币,Pendle 开创了收益管理新范式 —— 而PENDLE正是参与和塑造这一生态的关键工具。

关键数据如下(截至2025年3月31日):

价格:2.57美元

市值:4.106亿美元

完全稀释估值(FDV):7.252亿美元

流通量:1.6131亿枚(占最大供应量57.3%)

最大供应量:281,527,448枚

通缩机制:自2024年9月起,PENDLE周排放量以1.1%速率递减(初始周排放量216076枚)。经过29周调整,当前周排放量已降至约156783枚。该通缩计划将持续至2026年4月,此后协议将转为2%的年化通胀率以维持长期激励。

vePENDLE 治理模型

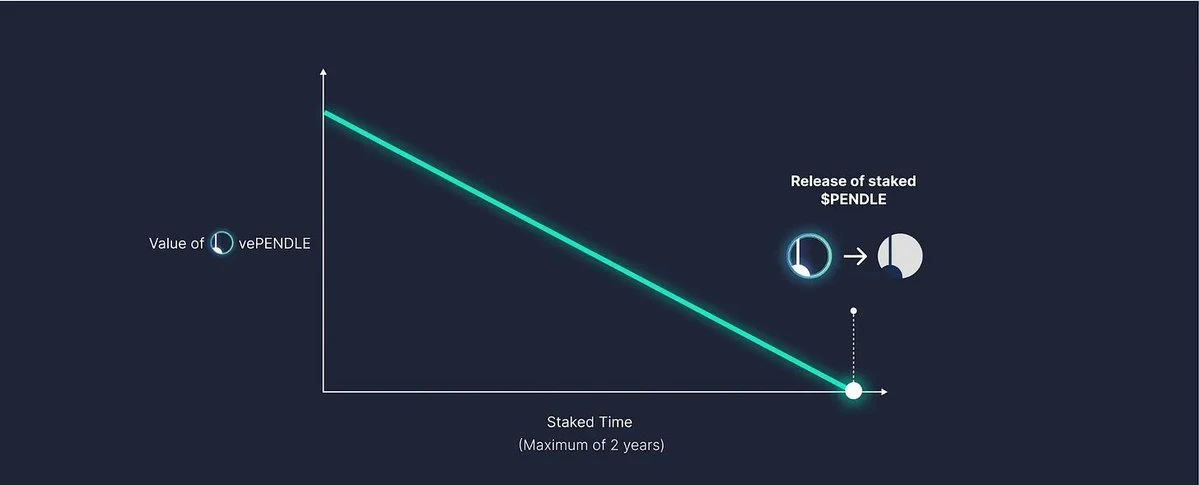

Pendle 通过 vePENDLE 改善了治理和去中心化。用户通过可通过锁定 PENDLE 获得 vePENDLE,锁定期越长(最长两年)、锁定数量越多,获得的 vePENDLE 就越多。随着时间推移,vePENDLE 会线性衰减至零,此时锁定的 PENDLE 将被解锁。

这种锁定机制减少了流通供应量,有助于价格稳定,并与生态系统的长期激励保持一致。

vePENDLE 持有者的好处包括:

参与协议决策的投票权

收益费用分配

专属激励和空投

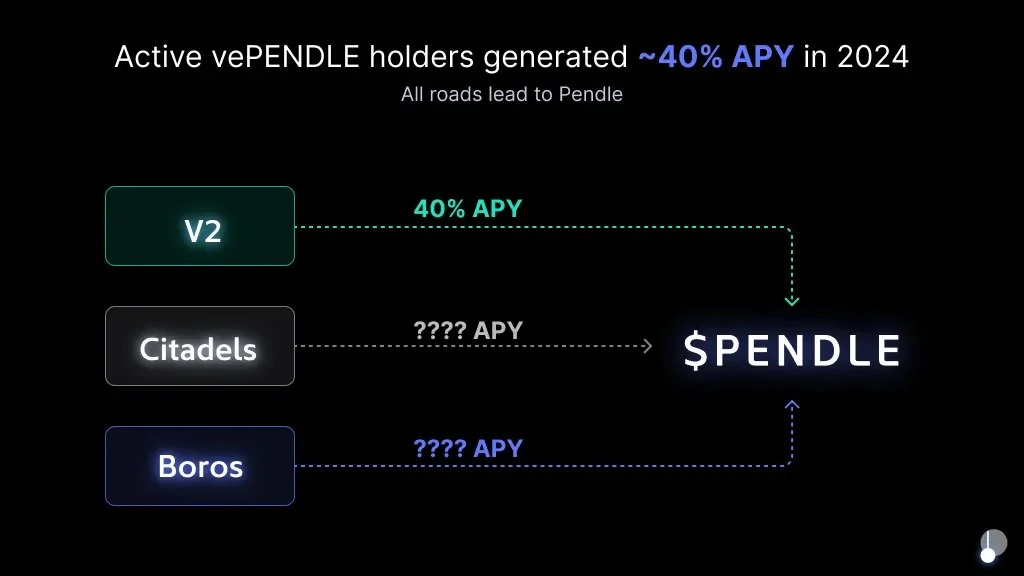

2024 年,活跃的 vePENDLE 持有者平均获得了约 40% 的年化收益率(APY),这还未计入 12 月单独分发的 610 万美元空投。

Pendle 的收益飞轮

Pendle 通过以下三重渠道吸收价值:

协议费用:生息代币收益的 3% 注入国库;

交易手续费:每笔交易收取0.35%(0.3% 归 LP,0.05% 归国库);

收益分成:YT 部分收益直接分配给 vePENDLE 持有者;

随着 V2、Citadel 和 Boros 的推进,更多价值将流向vePENDLE持有者,进一步巩固其生态核心地位。

主要风险与挑战

尽管 Pendle 在 DeFi 生态系统中已占据优势地位,但仍面临若干风险。该平台的复杂性仍是其广泛采用的障碍,尤其是对于不熟悉收益交易机制的用户而言。若要实现新一轮增长,Pendle 需要持续简化用户体验,降低 PT、YT 和固定收益策略的学习曲线。

Pendle 的总锁仓价值(TVL)高度集中于 USDe,这使得协议对单一资产及其资金动态的依赖性较强。在牛市条件下,USDe 提供诱人的收益。但如果资金费率下降或激励转向其他领域,资本可能会流出,进而影响 Pendle 的整体TVL和使用率。

其他需要考虑的因素包括智能合约风险、预言机可靠性以及底层资产的市场波动。某些资金池的低流动性也可能导致滑点或用户退出时的资本效率降低。

此外,Pendle 近期的增长部分得益于空投和积分激励。随着这些计划逐步退出,持续的动能将更多依赖于协议的核心实用性、多元化收益来源以及 Boros 和多链 Citadels 等产品的持续推出。

结语

尽管市场周期常导致投资者情绪和关注度波动,但 Pendle 始终秉持长期愿景持续建设。Pendle 可定制的固定收益策略处于DeFi创新前沿,可帮助用户有效管理波动、对冲风险并获取稳定收益 —— 这使得 Pendle 天然成为了传统金融与链上市场可组合性的桥梁。

展望未来,Pendle 2025 年的路线图为更广泛的采用和更深的流动性铺就了清晰路径。后续的发展关键在于用户体验的简化以及超越短期叙事的能力。

随着稳定币市场增长和代币化资产的激增,Pendle 有望成为推动下一波资产发行的固定收益层,其近期的强劲表现反映了市场需求和市场信心。若执行顺利,Pendle 或将成为 DeFi 固定收益未来的核心支柱。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。