This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished.

From Sunday through Friday morning, Bitcoin and most other crypto assets have seen relatively muted price action. I like to think this reflects a collective breather—from market participants, pundits, policymakers, and world leaders—after three intense weeks of tariff-driven global trade maneuvering. Personally, I hit exhaustion at the end of last week, barely able to skim the US-China tit-for-tat headlines, let alone read the full stories. My co-hosts on this week’s episode of Token Narratives shared this feeling.

I think this post on X by Eric Balchunas supports my idea that at least market participants are rather exhausted, or overstimulated:

Powell kills the Fed Put, China’s gonna cause COVID-era supply chain issues, predictions of declining GDP revisions, and one economist calling for another 2008 and yet… $SPY is up pre-market (not a lot but its up) and still +4% since Cramer’s Black Monday prediction. Wild.

The biggest news of the week was Jerome Powell’s speech Wednesday at an Economic Club of Chicago event in which he directly addressed the tariffs, Trump’s calls for Powell to cut interest rates, and more. In his speech, Powell made it clear the Fed will not be intervening in markets any time soon. Utilizing a little humor, Powell commented on the rising level of uncertainty:

As that great Chicagoan Ferris Bueller once noted, ‘Life moves pretty fast.’ For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance.

Markets didn’t seem to like Powell’s statements, dropping after the speech. However, in the broader context of the past couple of weeks, the market reaction was unremarkable and recovered afterwards.

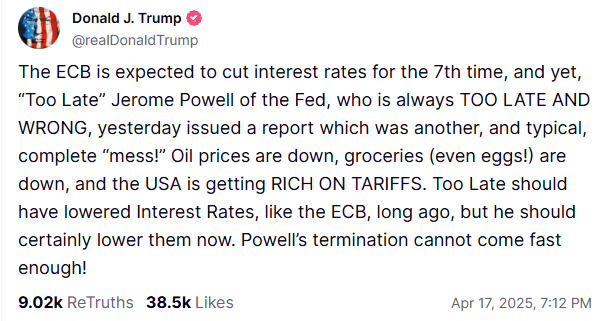

Trump definitely did not like Powell’s comments, posting on Truth Social that, “Powell’s termination cannot come fast enough.”

As is the case with nearly every incendiary thing Trump does, his post sparked a flurry of speculation on whether the U.S. president will take the legally dubious step of attempting to fire Powell. Trump is truly a master of continuously generating attention and “newsworthy” stories. I’ll refrain from adding to this story for the time being.

The biggest story in crypto was Mantra’s OM token collapse. OM was a top 25 token that dropped 90% from a $5.9 billion to $500 million market cap in about 90 minutes. That’s the sexy headline anyway, because a drop of that magnitude in such a short time frame indicates it was never worth nearly that much. Details are emerging of fishy or fraudulent tokenomics and price action. For example, potentially lying about the circulating supply and manipulating the price of that constrained, highly illiquid supply. Coffeezilla’s interview with the CEO is worth a watch if this kind of thing piques your interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。