Collapse Employment!

Author: Gao Zhimou

As the market speculates on the Federal Reserve's path to interest rate cuts, analyses from top investment banks and Federal Reserve officials point to an increasingly clear conclusion: to truly pull the trigger on interest rate cuts, the hesitant Federal Reserve may need to focus not on the subtle fluctuations in inflation data or the short-term noise of tariff policies, but rather on a more direct and potentially harsher signal—the significant deterioration of the labor market.

For Trump (or anyone holding this position) who desires lower interest rates, a weak job market may be the most effective catalyst to achieve that goal.

Goldman Sachs Perspective: "Significant Upward Pressure" on Unemployment Rate as Action Signal

Goldman Sachs strategist Dominic Wilson explicitly stated in his report that the "sharp deterioration" of the labor market is key to a shift in Federal Reserve policy. He emphasized, "Any significant upward pressure on the unemployment rate will see the Federal Reserve firmly turn to action (rate cuts)."

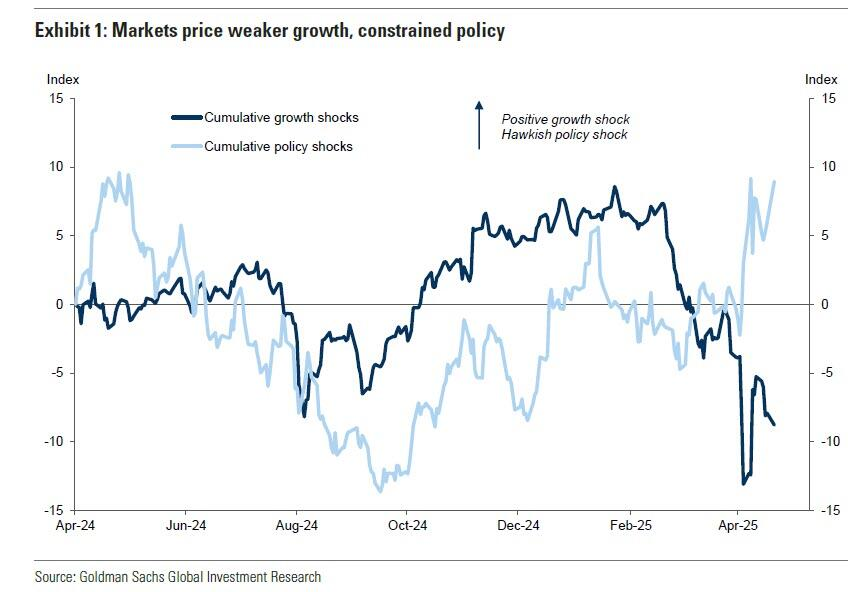

Wilson analyzed that although the suspension of mutual tariffs on April 9 briefly halted the economy's slide into recession, the fundamental risks have not been alleviated. The high uncertainty caused by policies, low consumer and business confidence, and the pressure on real income growth mean that the U.S. economy "still has a high likelihood of falling into recession."

Goldman Sachs predicts that if a full-blown recession occurs, the S&P 500 index could drop to around 4600 points, high-yield bond credit spreads could exceed 600 basis points, and short-term Treasury yields could fall below 3%.

At the same time, the recent market turmoil (including the bond market) has exposed financial vulnerabilities that remain a hidden risk. The ultimate impact of tariffs on inflation and employment will take time to manifest, which may keep the Federal Reserve in a "recession watch" mode for the next two to three months. The uncertainty surrounding trade and fiscal policy paths, combined with the need to anchor inflation expectations, makes it difficult for the Federal Reserve to act decisively.

Based on this, Goldman Sachs believes that even if there are short-term disruptions caused by tariffs leading to inflation, "any significant upward pressure on the unemployment rate will prompt the Federal Reserve to take firm action."

They assess that a recession could "easily" trigger the Federal Reserve to cut rates by about 200 basis points in the short term, a magnitude "significantly exceeding the market's current pricing." In other words, the upward pressure on the unemployment rate caused by a surge in unemployment numbers may be the key factor forcing Federal Reserve Chairman Powell to take action.

Federal Reserve Officials Confirm: Focus on the "Speed of Unemployment Rate Increase"

Recent remarks by Federal Reserve Vice Chairman Christopher Waller provide internal confirmation of the above viewpoint. He also views the labor market as a key variable.

Waller acknowledged that the full impact of tariffs may not be clear until the second half of 2025 and tends to believe that their impact is a "one-time price level effect" (i.e., temporary inflation).

He added, "It takes courage to face the price increases caused by tariffs and view them as a temporary phenomenon"—this statement hints at the complexity of making such judgments in the current environment, especially considering potential political factors.

So, what could prompt the Federal Reserve to act quickly? Waller's answer aligns with Goldman Sachs: employment data. He stated that he "would not be surprised" if tariffs lead to more layoffs and a higher unemployment rate. More importantly, Waller emphasized that the focus of the Federal Reserve will be on the "speed of the unemployment rate increase," rather than its absolute level. He believes:

"Tariffs could quickly push up the unemployment rate."

This logic is also supported by Minneapolis Federal Reserve economist Javier Bianchi, who believes that tariffs are essentially a "negative demand shock" with deflationary effects. This further supports the view that the Federal Reserve should "look through" short-term inflation and implement expansionary monetary policy (rate cuts) to avoid worse economic consequences.

Waller finally warned that the current reliance on data may put the Federal Reserve at risk of "action lag" again (similar to 2021 but in the opposite direction). Once the rising unemployment rate drives the economy down, "significant rate cuts may follow."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。