作者:张雅琦

市场正从"美国例外论"转向"美国否定",美银全球策略师Michael Hartnett建议投资者逢高卖出美股,逢低买入国际股票与黄金。

Hartnett在其24日发布的研报中表示,近期资金流向显示,美国股票录得8亿美元流出,而黄金流入33亿美元。表明市场对黄金的偏好正在增加。

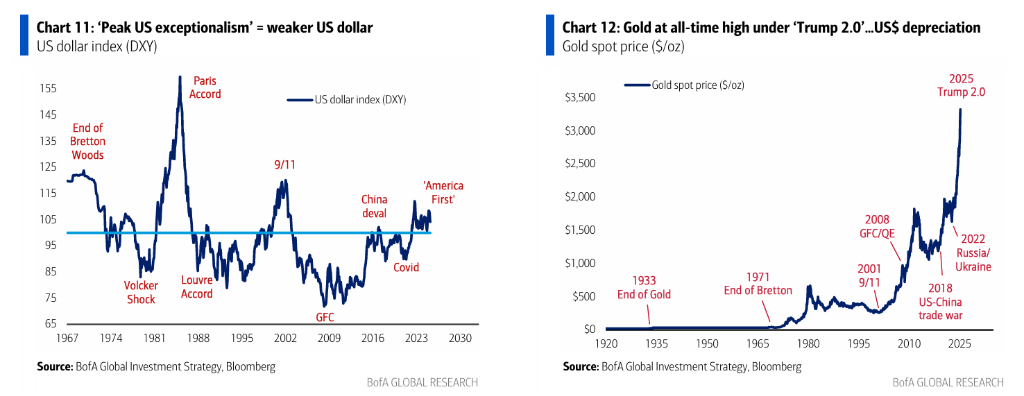

随着全球经济的再平衡,资金从美国市场流向其他地区,尤其是新兴市场和欧洲。这种资金流动趋势对黄金价格形成支撑。今年以来,黄金表现最佳(+26.2%),政府债券(+5.6%)和投资级债券(+3.9%)紧随其后,而美股下跌3.3%。而美国家庭股票财富今年已缩水约6万亿美元。

Hartnett建议,“Stay BIG, sell rips”,即做多债券(Bonds)、国际股票(International Stocks)和黄金(Gold)。投资者应该在美股市场反弹时逢高卖出,而不是盲目追涨。

Hartnett:市场正处于历史性转折点

Hartnett表示,年初至今,金融资产表现显示出明确趋势:黄金领涨(+26.2%),债券表现良好(政府债券+5.6%,投资级债券+3.9%),而美股(-3.3%)和美元(-8.5%)显著下跌。

近期资金流向显示,所有地区股票市场均录得流入(欧洲34亿美元,新兴市场10亿美元,日本10亿美元),唯独美国股票录得8亿美元流出;黄金流入33亿美元。

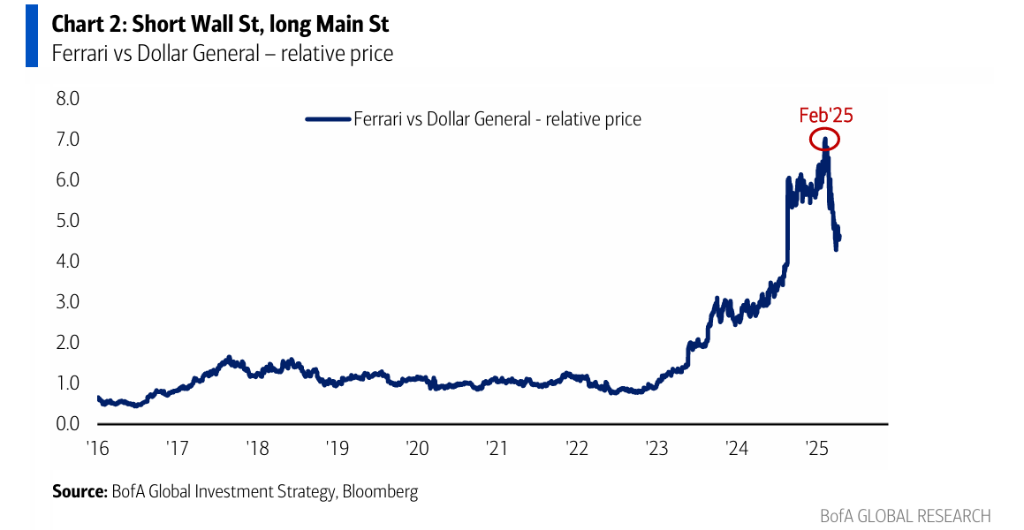

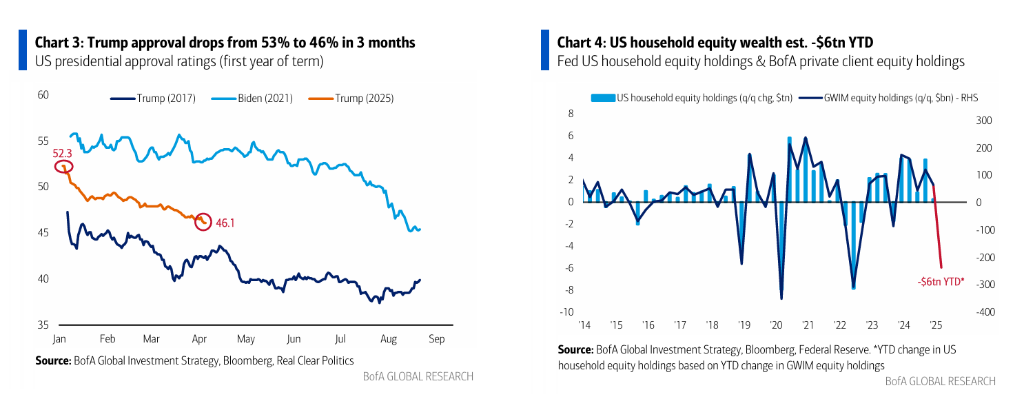

当前趋势表明,华尔街与主街的关系正在重新平衡。美银的数据显示,美国家庭股票财富今年已缩水约6万亿美元,美国私人部门金融资产与GDP的比率从6倍多下降到5.4倍。

Hartnett认为,这一变化标志着"我们从未如此繁荣"的时代——低利率、超30万亿美元全球政策刺激、9%的美国政府赤字和AI繁荣——正走向尾声。

三个关键转变驱动因素

Hartnett认为,当前市场修正由"3B"因素触发:

-

债券(Bonds):美国国债收益率实现自2009年5月以来最快的50个基点上升

-

民众基础(Base):特朗普支持率从53%下降到46%

-

亿万富翁(Billionaires):科技巨头市值蒸发超过5万亿美元

而要扭转"卖出反弹"趋势,市场需要三个因素:

-

降息:美联储降息预期(市场预期6月18日FOMC降息预期为65%,7月30日会议100%降息)

-

关税:特朗普关税政策缓解

-

消费者:美国消费者支出保持韧性

全球重新估值与美元弱势

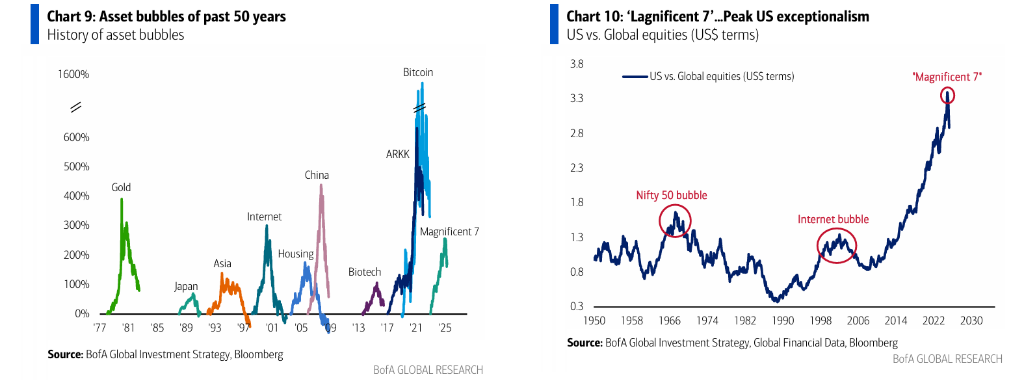

Hartnett表示,2025年大趋势是股票和信贷估值达到峰值。历史上,标普500市盈率:

-

20世纪平均为14倍(世界大战、冷战、大萧条、滞胀时期)

-

21世纪平均为20倍(全球化、科技进步、宽松货币政策时期)

-

2020年代上半期,20倍成为市盈率底线

-

未来可能20倍成为市盈率上限

Hartnett认为,美元资产持续贬值是最清晰的投资主题,黄金价格飙升正是这一趋势的明显信号。美元贬值趋势将有利于大宗商品、新兴市场和国际资产(中国科技、欧洲/日本银行)。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。