In-depth analysis of investment opportunities in Twenty One.

Author: Jack Inabinet

Translation: Deep Tide TechFlow

The integration of traditional finance and cryptocurrency is accelerating, and this trend is particularly evident in the emergence of Twenty One. Twenty One is a new entity focused on Bitcoin, preparing to go public through a SPAC (Special Purpose Acquisition Company) backed by Cantor Fitzgerald.

With well-known companies like SoftBank from Japan involved and plans to hold over $4 billion worth of Bitcoin as its financial reserve, Twenty One positions itself as the next evolution of MicroStrategy's Bitcoin accumulation strategy. But can it live up to expectations and achieve a high premium?

Some believe this is a breakthrough moment for Bitcoin's application on corporate balance sheets, with the public market valuing this opportunity at three times the intended Bitcoin holdings. Meanwhile, others express concerns about the complex capital structure, asymmetric incentives, and the profound impact on retail investors.

Today, we will delve into the investment opportunities presented by Twenty One.

What is Twenty One?

Superficially led by CEO Jack Mallers, who founded a Bitcoin payment application called Strike in 2017, Twenty One promotes itself as a "unique vehicle focused on Bitcoin," which will engage in "advocacy for Bitcoin" and "explore future expansions into Bitcoin-native financial products."

While Twenty One's mission statement may seem confusing at first glance, the company is very similar to Michael Saylor's MicroStrategy, both serving as vehicles for Bitcoin accumulation aimed at increasing the amount of Bitcoin attributable to individual shareholders.

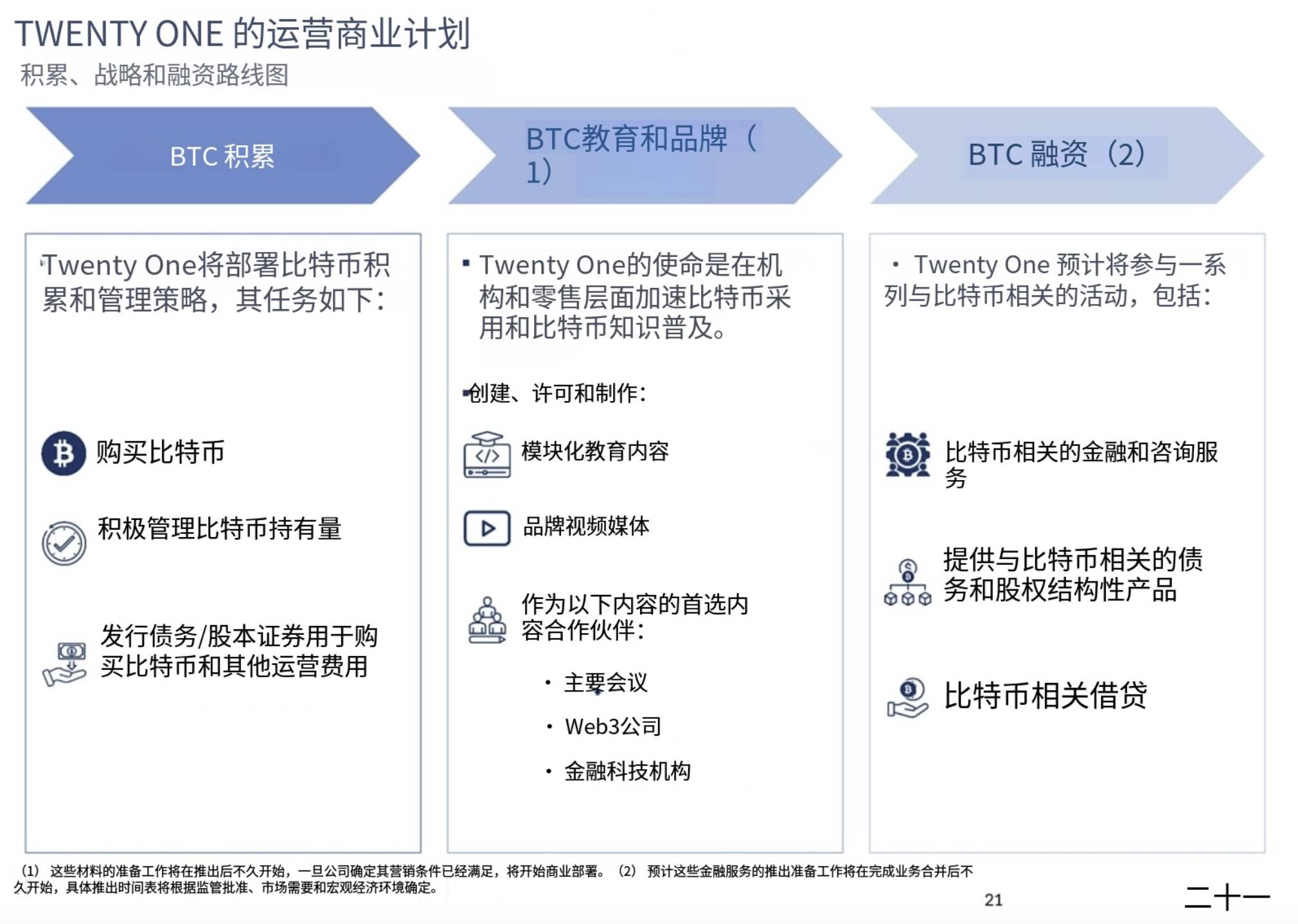

According to a submission to the U.S. Securities and Exchange Commission (SEC), like MicroStrategy, Twenty One will acquire Bitcoin through the issuance of debt and equity. Slightly different from its predecessor, Twenty One also plans to create Bitcoin educational content (such as YouTube videos) and participate in "various Bitcoin-related activities," including Bitcoin-related financial consulting services and lending its Bitcoin.

Source: SEC

Translation: Deep Tide TechFlow

According to Twenty One's estimated assumptions, its initial financial reserve will consist of 42,000 Bitcoins—valued at just over $4 billion at current market prices. While Mallers is the leading figure of the company, he is far from alone in this endeavor…

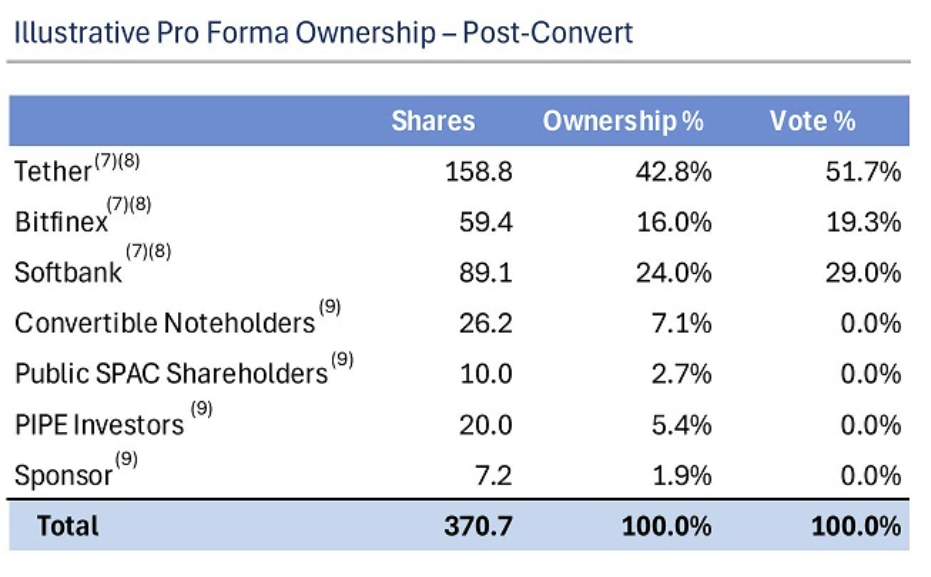

Stablecoin issuer Tether and cryptocurrency exchange Bitfinex (both subsidiaries of the British Virgin Islands-registered holding company iFinex) will contribute 36,213 Bitcoins to Twenty One. In exchange, these two companies will collectively receive 58.8% of Twenty One's equity and 71% of the voting rights; of which, Tether alone will hold 51.7% of the absolute voting rights.

Of the Bitcoins contributed by Tether and Bitfinex, nearly one-third is provided on behalf of SoftBank Group, a Japan-based technology investment firm. It is reported that SoftBank will pay Tether $462 million to indirectly hold a 24% stake in Twenty One. This transaction amount reflects the market value of the Bitcoins indirectly contributed by SoftBank and is expected to yield automatic profits for SoftBank, provided that Twenty One's stock trades at a premium above its net asset value as anticipated.

Currently, this transaction has not been officially completed, but it is expected that Twenty One will be acquired by Cantor Equity Partners. Cantor Equity Partners is a SPAC that will trade on NASDAQ under the ticker "CEP" starting in mid-August 2024 and is associated with Cantor Fitzgerald, a financial services company led by U.S. Secretary of Commerce Howard Lutnick (who holds a 5% stake in Tether through convertible bonds).

The SPAC process allows Twenty One to reduce the SEC regulatory burden required for going public by merging with an existing publicly traded stock. In exchange, Cantor Equity Partners will inject $100 million in cash into the merged balance sheet, while CEP shareholders will receive 2.7% equity in Twenty One without voting rights.

Additionally, investors participating in the initial convertible bond issuance will receive 7.1% equity in Twenty One at the cost of contributing $340 million; while investors through PIPE (Private Investment in Public Equity) will receive 5.4% equity on favorable terms (for example, they can purchase shares at the net asset value of Bitcoin, while public SPAC shareholders must buy CEP stock at market price). These two sales are expected to raise approximately $500 million in cash, which will flow to Tether to pay for the Bitcoins contributed on behalf of investors.

As the "sponsor" of the transaction, Cantor Fitzgerald will receive convertible bonds worth $45 million and 3.8 million shares of Twenty One stock, which collectively represent 1.9% equity in Twenty One.

Source: SEC

What is the conclusion?

Many in the Bitcoin community view the launch of Twenty One as a pivotal moment that could mark the beginning of widespread Bitcoin adoption on corporate balance sheets. This is especially true considering SoftBank's involvement—a globally recognized venture capital firm known for identifying transformative trends (such as artificial intelligence) before investor frenzies.

In its submission to the SEC, Twenty One positions itself as a superior vehicle for Bitcoin accumulation compared to MicroStrategy. For investors looking to easily achieve passive Bitcoin accumulation, the smaller scale of Twenty One may make it easier to raise funds to purchase Bitcoin, a viewpoint directly articulated in Twenty One's investor materials.

As of the close on Thursday, April 24, Cantor Equity Partners (CEP) had a market capitalization of $317 million, with a cash balance of $100 million. While the increasing adoption of Bitcoin among large financial institutions may be reassuring, the favorable terms allowing institutional investors to participate at cost price leave critics skeptical.

Ultimately, Tether appears to be the biggest winner in this arrangement; the stablecoin issuer stands to gain nearly $1 billion in cash and billions of dollars worth of Twenty One shares by injecting Bitcoin into the SPAC. In this way, Tether effectively extracts funds from institutional players looking to distribute Bitcoin-backed stocks at a premium to retail investors, without having to sell tokens on the open market.

SPACs have gained a notorious reputation in recent years, regarded as one of the worst stock market investments of the past decade. While simply going public may be profitable for insiders and sponsors, the math of this investment approach rarely favors retail investors in the secondary market. Since 2009, such investments have experienced persistently poor returns across all industries. For retail investors who invest in Twenty One for the long term, their returns may be affected by the majority shareholders attempting to exit their investments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。