DEX, Never Truly Understood

In the entire cryptocurrency financial system, DEX has always played a thought-provoking role.

It seems to be always online—no downtime, no censorship, no exit scams—but it has long remained on the fringes: complex interfaces, insufficient liquidity, and a lack of storytelling. It is neither the center of KOL topics nor the first choice for hot projects to settle in. When DeFi exploded, it was the "alternative" to CEX, and after the return of the bear market, it became a "legacy of the DeFi era" focusing on "security and self-custody"—as if, when the industry is more focused on new narratives like public chains, AI, RWA, and inscriptions, DEX has long lost its sense of existence.

However, when we extend the timeline and unfold the structure, we find that DEX has been quietly growing and beginning to shake the underlying logic of on-chain finance.

Just as the once-popular Uniswap is merely a historical node, the derivatives that emerged from the historical tide, such as Curve, Balancer, Raydium, and Velodrome, are also just its transformations. And when we observe all the AMMs, aggregators, and L2 DEX evolutions, what is actually driving them is a self-evolution process of a distributed financial foundation.

Therefore, I attempt to step away from the perspectives of "product comparison" and "track trends" and return to the historical long line to clarify its structural evolution logic:

How DEX has transformed from a tool to a structural evolution logic on-chain;

How it has absorbed financial mechanisms and ecological goals from different eras;

And why, when we talk about Launch, project cold starts, and community self-organization today, we cannot avoid DEX.

This is a history of DEX evolution, an observation of decentralized "functional spillover," and an unfolding of an entire historical path. Therefore, I also attempt to answer a question that is becoming increasingly difficult to avoid today:

When we talk about Web3, why does every project today inevitably involve DEX?

I. A Brief History of DEX Over Five Years: From Marginal Role to Narrative Hub

1. First Generation DEX: An Expression of Decentralization (EtherDelta Era)

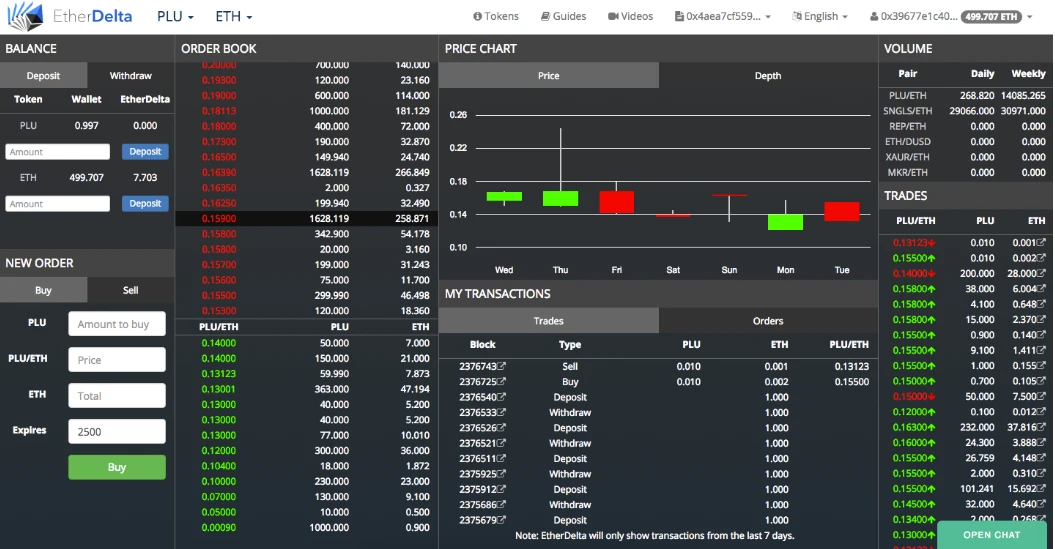

Around 2017, when centralized exchanges were at their peak, a group of crypto geeks quietly launched a strange experiment on-chain: EtherDelta.

Compared to contemporaries like Binance and OKEx, EtherDelta can almost be described as a disaster-level trading experience: trading required manually inputting complex on-chain data, interaction delays were extremely high, and the user interface was comparable to primitive web pages from the last century, almost deterring ordinary traders.

However, from day one, the birth of EtherDelta was not just about usability; it aimed to completely break free from "centralized trust": trading assets are entirely controlled by users, and order matching is completed entirely on the Ethereum chain, without the need for intermediary custody or trust in third parties. Ethereum founder Vitalik Buterin even publicly expressed his expectations for this model, believing that on-chain decentralized trading is one of the true applications of blockchain.

Although EtherDelta itself eventually faded from view due to technical and user experience challenges, it left an undeniable path in blockchain history: DEX began to evolve from merely a trading tool to a practical expression against centralization.

It may not have been the darling of the market at the time, but it planted the genetic seeds for future projects like Uniswap, Balancer, and Raydium: user asset self-custody, order matching on-chain, and no need for custodial trust—these characteristics became the foundational framework for the continuous evolution, derivation, and expansion of DEX in the future.

2. Second Generation DEX: A Shift in Technical Paradigms (The Emergence of AMM)

If EtherDelta represented the "first principles" of decentralized trading, then the birth of Uniswap provided the first scalable implementation path for this ideal.

In 2018, Uniswap launched v1 and introduced the automated market maker (AMM) mechanism on-chain for the first time, completely breaking the limitations of traditional order book matching models. Its underlying trading logic is simple yet revolutionary—x * y = k: this formula is the core innovation of Uniswap, allowing liquidity pools to price automatically without counterparties or order books. As long as you deposit one asset into the pool, you can automatically receive another asset according to a constant product curve. No counterparties, no order books, no matching; trading behavior equals pricing behavior.

The breakthrough of this model lies in the fact that it not only solves the chicken-and-egg problem of early DEXs where "no one is placing orders" means no trading can occur, but it also fundamentally changes the source of liquidity for on-chain trading: anyone can become a liquidity provider (LP), injecting assets into the market and earning fees.

The success of Uniswap also inspired innovations in other AMM mechanism variants:

Balancer introduced multi-asset + custom weight pools, allowing projects to set their own asset weights and distributions;

Curve designed optimized curves to address the high slippage issues of stablecoins, enabling lower-cost asset exchanges;

SushiSwap added token incentives and governance mechanisms on top of Uniswap, initiating the narrative of "liquidity mining + community sovereignty";

These variants collectively propelled AMM DEX into the "protocol productization" phase. Unlike the first generation of DEXs, which were primarily driven by ideology and had rough forms, the second generation of DEXs began to exhibit clear product logic and user behavior loops: they not only facilitate trading but also serve as the structural foundation for asset circulation, the entry point for user participation in liquidity, and even a part of project ecosystem initiation.

It can be said that starting with Uniswap, DEX truly transformed into a "product" that could be used, could grow, and could accumulate users and capital—no longer just an accessory to concept implementation, but beginning to become the structure builder itself.

3. Third Generation DEX: From Tool to Hub, Functional Expansion and Ecological Integration

After entering 2021, the evolution of DEX began to move away from a single trading scenario, entering a "fusion phase" of functional spillover and ecological integration. In this phase, DEX is no longer just a "place to swap tokens," but gradually grows into the liquidity core of the on-chain financial system, the entry point for project cold starts, and even the coordinator of ecological structures.

One of the most representative paradigm shifts during this period is the emergence of Raydium.

Raydium was born on the Solana chain and is the first DEX to attempt a deep integration of the AMM mechanism with on-chain order books. It not only provides liquidity pools based on constant product but also synchronizes trades to Serum's on-chain order book, forming a liquidity structure that coexists "automated market making + passive order placement." This model combines the simplicity of AMM with the visible price hierarchy of order books, significantly enhancing capital efficiency and liquidity utilization while maintaining on-chain autonomy.

The structural significance of Raydium is that it is not just "AMM optimization," but DEX's first attempt to introduce a "CEX experience" through distributed reconstruction on-chain. For new projects in the Solana ecosystem, Raydium is not just a trading venue but also a launchpad—covering everything from initial liquidity to token distribution, order book depth, and project exposure, it serves as a hub linking primary issuance and secondary trading.

During this phase, functional explosions extend far beyond Raydium:

SushiSwap added trading mining, governance tokens, community governance, and "Onsen" incubation pools to the Uniswap model, forming a governance-oriented DEX ecosystem;

PancakeSwap combined features like chain games, NFT markets, and on-chain lotteries to achieve DEX platform operations on the BNB Chain;

Velodrome (Optimism) introduced "inter-protocol liquidity scheduling" based on the veToken model, allowing DEX to become a coordinator between protocols rather than just serving users;

Jupiter connected multiple DEXs and asset paths in the Solana ecosystem through a path aggregator role, becoming a true "on-chain cross-protocol aggregator."

The common feature of this stage is that DEX is no longer the endpoint of a protocol but a relay network connecting assets, projects, users, and protocols.

It must undertake the "terminal interaction" of user trading, embed the "initial traffic" of project issuance, and simultaneously connect a complete set of on-chain behavior systems such as governance, incentives, pricing, and aggregation.

From then on, DEX shed its identity as an "island protocol" and became a hub primitive in the DeFi world—a highly adaptable and composable on-chain consensus component.

4. Fourth Generation DEX: Transformative Growth in the Multi-Chain Tide, Aggregation, L2, and Cross-Chain Experiments

If the evolution of the first two generations of DEXs was a mutation of technical paradigms, and the third stage of Raydium was an attempt to stitch together functional modules, then starting in 2021, DEX entered a more difficult-to-categorize phase: it is no longer led by a specific team in "version upgrades," but rather the entire on-chain structure compels it to adaptively transform.

The first to feel this change were the DEXs deployed on Layer 2.

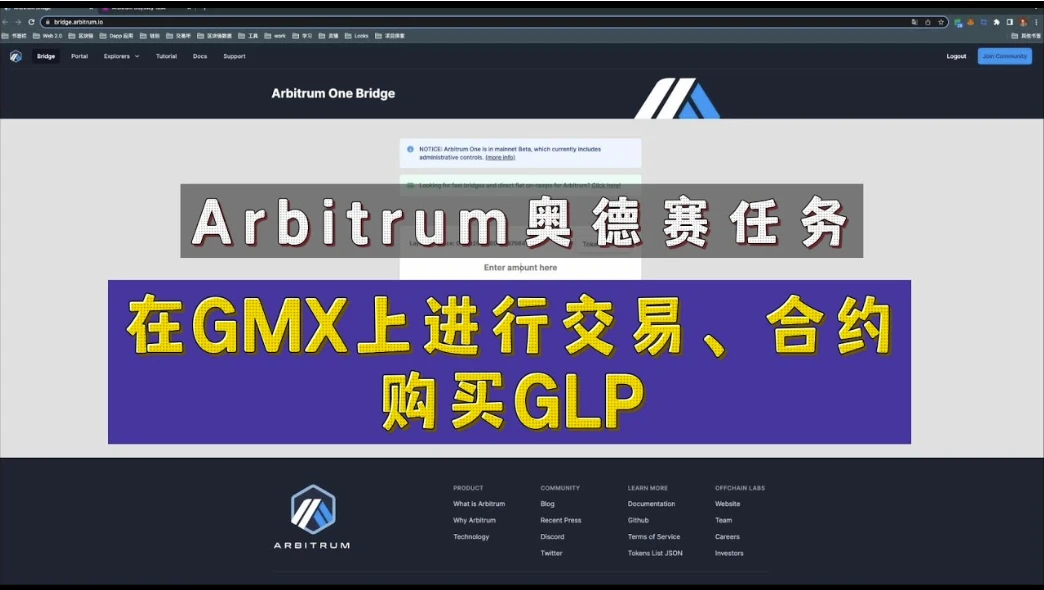

After the launch of Arbitrum and Optimism mainnets, the high gas costs of transactions on Ethereum were no longer the only option, and the Rollup structure began to become the soil for the growth of the new generation of DEXs. GMX adopted a pricing model based on oracles + perpetual contracts on Arbitrum, responding to the "AMM is insufficient to solve depth" problem with a minimalist path and a structure without LP pools. Meanwhile, on Optimism, Velodrome attempted to establish a governance coordination mechanism for liquidity incentives between protocols using the veToken model. These DEXs no longer pursue universality but take root in specific chains as "ecological supporting facilities."

At the same time, another type of structural patch is also taking shape: aggregators.

As the number of DEXs increased, the issue of fragmented liquidity quickly magnified, and users gradually faced a new decision-making burden regarding "where to trade" on-chain. From the launch of 1inch in 2020 to later platforms like Matcha and Jupiter, aggregators took on a new role: they are not DEXs, but they coordinate the liquidity paths of all DEXs. Particularly, Jupiter's rapid rise on the Solana chain is due to its precise filling of gaps in path depth, asset transitions, and trading experiences.

However, the structural evolution of DEX did not stop at on-chain adaptation. After 2021, projects like ThorChain and Router Protocol emerged, proposing a more radical proposition: can trading parties complete swaps without being on the same chain? These "cross-chain DEXs" began to attempt to solve inter-chain asset circulation issues through self-built verification layers, message relays, or virtual liquidity pools. Although the protocol structures are much more complex than single-chain DEXs, their emergence signals that the evolutionary path of DEX has moved away from a specific public chain and into an era of inter-chain protocol collaboration.

At this stage, DEXs are difficult to classify by "type": they may serve as liquidity entry points (1inch), protocol coordinators (Velodrome), or inter-chain swapping mechanisms (ThorChain). They are not "designed" like the previous generation but are more like structures that have been "squeezed out."

At this point, DEX is no longer just a tool; it has become an environmental response—a product that adapts to network structural changes, asset cross-chain transitions, and inter-protocol incentive games. It is no longer a "product update" but a manifestation of "structural evolution."

II. When Pricing, Liquidity, and Narrative Converge: How DEX "Enters" Launch

Looking back at the development paths of the first four generations of DEXs, it is not difficult to notice one thing: their continuous evolution has never been due to a more clever function design, but rather their constant response to real on-chain needs—from matching and market making to aggregation and cross-chain, each transformation of DEX naturally fills a structural gap.

At this stage, DEX is no longer just a "functional point" on a specific chain; it resembles a "default adaptation layer" following structural changes on-chain. Whether projects want to incentivize, protocols need to attract traffic, or cross-chain wants to aggregate, DEX plays an increasingly significant role in "dispatching" and "coordinating."

However, as it takes on more roles, DEX inevitably encounters another structural dilemma that has long existed but remained unaddressed:

To go on CEX, one needs to list tokens, negotiate resources, and build communities; to go on-chain, one must build pools, find liquidity, and initiate circulating assets. These seemingly scattered issues ultimately converge into a core problem: who will provide the launch structure for new projects?

In the early crypto market, Launch was often a resource operation dominated by centralized exchanges: the rhythm of token listings, price guidance, user distribution, and promotional nodes were all controlled by the platform. While this model was efficient, it also brought issues such as high entry barriers, lack of transparency, and excessive centralized power.

As DEX gradually mastered pricing, liquidity, user mobilization, and community mechanisms, it began to structurally possess the capability to accommodate all the elements required for Launch—and all of this was not because DEX aimed to conduct Launch, but because it naturally grew into the shape of Launch through its functional and ecological evolution.

It never "announced" its intention to enter the primary market financing scene, but at a certain historical stage, DEX naturally took on the three core structures of project cold starts: liquidity, pricing, and community.

This is not a product strategy but a result of structural logic spillover.

After Uniswap introduced AMM, we saw for the first time a price discovery mechanism that did not require order placement or matching parties. In other words, DEX transformed "market consensus" into "on-chain functions," where price formation no longer relied on matching but was directly determined by the supply and demand relationship of the asset pool. This pricing structure is precisely one of the most challenging issues for project cold starts: when a token is newly launched, lacking liquidity and secondary trading depth, what it needs most is an automatic, permissionless price discovery mechanism.

Subsequently, liquidity pools became the distribution channel for early incentives. Project teams injected tokens with mainstream assets (like ETH or USDC) into the pool, using the pool's depth to support early price stability while guiding users to join liquidity provision through trading fees and liquidity mining. Users are not "investors" but "participants"; projects are not "issuing tokens" but "releasing pools."

Taking Raydium as an example, this "DEX as Launch platform" logic is particularly direct. It is not only a liquidity protocol on Solana but also embeds the AcceleRaytor module, allowing projects to conduct on-chain cold starts through liquidity pools and initial sales. There are no complex review processes, no intermediary platform controlling the token listing rhythm, and even no mandatory KYC barriers. Everyone can pre-purchase shares through Raydium, trade in advance, and engage in games during primary price fluctuations.

AMM not only facilitated liquidity and pricing but also, in a sense, restructured community mobilization: the trading logic of DEX is inherently composable, participatory, and co-constructive. This also means that from the first day a project goes live, it exists in an environment where community and trading mechanisms intertwine, turning token issuance into a social release.

Thus, DEX is no longer a "distribution channel" or "post-chain tool" for the primary market but has fundamentally taken on all key paths of Launch from its root structure. It does not rely on custody, publicity, or permission control; it solely relies on the mechanism itself to create a closed loop for early project issuance.

Therefore, Launch is not a "functional module" of DEX but rather a structural byproduct that it naturally grew. As a decentralized trading mechanism, when DEX is used in the early stages of a project, it naturally becomes a landing point for the primary market.

III. From Distribution to Design: The On-Chain Rewriting of Launch Mechanisms

The earliest Launch models were actually very simple—once the pool opened, the token was considered launched.

The "free listing" mechanism on Uniswap gave rise to the first batch of IDO (Initial DEX Offering) projects: project teams directly injected tokens into trading pairs, forming liquidity pools with ETH or USDC, and user purchasing behavior itself constituted primary issuance. There were no schedules, no qualification reviews, and no centralized control; the only barriers were on-chain speed and information asymmetry.

This mechanism greatly released the freedom of token issuance but also came with issues like extreme slippage, front-running bots, and price anchoring deficiencies. The entire process resembled an open speculative sprint rather than a true financing design.

As problems became apparent, some projects began to experiment with more controllable mechanisms, such as the Balancer LBP (Liquidity Bootstrapping Pool).

The core logic of LBP is to artificially set extreme initial price weights (e.g., 90% tokens / 10% USDC) during the early launch phase and gradually adjust to normal ratios over time. The price automatically declines under the mechanism design, aiming to suppress early FOMO and front-running by bots.

In theory, it makes prices more rational, providing users with a more equal opportunity to participate. However, in practice, LBP's resistance to capture remains limited, and the difficulty of price curve design is high, posing a significant user education barrier. It is like a "programmable roadshow of the DEX era," but it does not truly solve the question of "who should participate."

Another type of solution is the Fair Launch model, such as the one practiced by Camelot on Arbitrum.

The idea behind Fair Launch is: no longer preset prices, but rather a public, participatory deposit window to raise funds, set prices, and distribute tokens. The amount of USDC you invest directly determines the proportion of tokens you receive. Everyone can participate, with proportional distribution and no need for front-running, which sounds "fairer."

But the real challenge lies in: "fair" to whom? For retail investors, the lack of price anchoring and exit mechanisms still poses participation risks; for project teams, fundraising efficiency is unstable, and market depth is uncontrollable, which may not be better than traditional IDOs. Fair Launch reflects more of an expression of "governance philosophy" rather than a structural efficiency improvement.

At the same time, in more radical DEXs like Jupiter and Velodrome, we begin to see some mechanisms deeply tied to internal governance structures:

Jupiter's LFG activities introduce holding thresholds and pre-interaction, turning "qualifications" into a form of on-chain behavioral proof;

Velodrome uses veNFT + bribe mechanisms to transform liquidity incentive rights into a voting and negotiation process between protocols, making project launches not just about issuing tokens but about "entering liquidity governance games."

The common feature of these mechanisms is that Launch is no longer an "issuance-purchase" action but a reconstruction of structural relationships.

When a project goes live, it is not just a signal for trading to begin but a layered consensus process entering the governance structure of DEX, user system, and liquidity distribution. You are not trading the tokens you bought; you are trading the network order you are about to join.

However, this also brings more complex risks: issues like bot arbitrage, community expectation manipulation, black-box price design, and liquidity inducement attacks are emerging one after another. The more sophisticated the mechanism, the more "God's perspective" the designers have, and the less users can understand and control.

Launch is no longer an event but rather a dynamic system. It not only tells you "how to issue tokens," but also implicitly contains the basic methodology for how projects organize governance, allocate liquidity, and guide user mindsets.

IV. Speculating the Future of DEX: Iterative Evolution from Liquidity Facilities to Consensus Starters

If early DEXs were designed to make on-chain trading possible, then after five years of evolution, DEX is slowly approaching another question: besides trading, what else can it initiate?

The natural growth of Launch mechanisms has transformed DEXs from platforms for facilitating asset circulation into hubs for accommodating projects, guiding liquidity, and reshaping early consensus. However, as more projects choose to start on DEXs, these platforms are facing new systemic challenges: who should have the right to participate in Launch? How to filter real users? How to avoid liquidity fraud?

Under this pressure, a more granular participation mechanism seems to be emerging.

On-chain identity systems, particularly reputation mechanisms built on ZK (zero-knowledge proof) technology, have become a possible answer. Unlike traditional KYC, which requires exposing privacy, ZK identities allow users to prove they meet certain conditions (such as holding duration, on-chain interaction history, or participation in a specific protocol) without disclosing specific information. Launch is no longer simply about "snatching," but rather a filtering process based on on-chain behavior and reputation.

If this structure holds, future DEX Launches may evolve from "open the gates, whoever is fast gets in" to a new model of on-chain qualification proof + structured participation allocation. Tokens for early cold starts may only be distributed to those who genuinely meet specific community standards.

Looking further ahead, DEXs might even develop a kind of "on-chain YC" structure.

YC (Y Combinator) plays a role in the Web2 world by screening, investing in, and incubating early projects. In the DEX space, as pricing mechanisms, liquidity distribution, user screening, and incentive guidance components gradually mature, DEXs could very well become an integrated platform for cold starts of Web3 projects—serving as both a funding pool and a community entry point, as well as a liquidity market.

At that point, DEXs may not only be trading platforms or simple Launchpads but the starting point of an entire on-chain project incubation system: a consensus launcher.

Of course, this path will not be simple.

As DEXs internalize Launch functions as standard ecological configurations, it will inevitably lead to new cutthroat competition:

Who can filter out the highest quality projects?

Who can form the tightest user communities?

Who can provide the most effective liquidity guidance and subsequent support?

Launch, which was once a cold start issue for projects, has now transformed into a life-and-death question that DEXs must answer for themselves.

When that time comes, we may need to ask again:

If every DEX becomes a Launch platform, will Launch itself lose the early trust it once represented?

V. Conclusion: From "Self-Custody" to "Co-Creating Financial Structures," DEX Returns to Freedom

As we re-examine the path of DEX, it is easy to forget its original form—less practical, less lively, and less "market-oriented." It was a small experiment led by geeks, simply trying to prove that asset exchange could be done without custody, without relying on platforms, and without trust.

Now, as we see DEXs capable of supporting project cold starts, liquidity governance, cross-chain routing, Launch structures, and even becoming entry points for users to understand finance, we should look back and recognize that all of this is not the result of some grand design by a project, but rather a product of the self-evolution of the entire on-chain structure.

DEX has not "actively upgraded"; it has merely responded continuously to changes in the surrounding system, constantly filling structural gaps. It has neither written a plan nor drawn clear boundaries, yet through AMM, aggregators, ZK identities, and governance bindings, it has gradually transformed itself into a connector and launcher of the ecosystem.

It has never left trading, but it is no longer solely for trading. It has not exited the center but has slowly retreated into the structure.

The evolution of DEX has never been a one-time functional leap but an ongoing protocol reconstruction.

In this process, what it has truly preserved is still that initial essence: not tokens, not gas fees, and not slippage, but the ability for users to freely participate, collaborate, and shape their own financial order on-chain.

So when we ask again, "Why does every project escape DEX?" perhaps the answer is not "must," but rather—there is no better starting point.

The future of DEX may not lie in trading itself, but in how it allows us to redefine collaboration.

References

[1] EtherDelta. A decentralized peer-to-peer cryptocurrency exchange built on Ethereum.

[2] Vitalik Buterin. On Decentralized Exchanges and the Future of Trustless Finance.

[3] Uniswap Team. Uniswap V2 Whitepaper, 2020.

[4] Balancer Labs. Balancer Whitepaper: Automated Portfolio Manager and Trading Platform.

[5] Curve Finance. Technical Documentation, Curve DAO, 2020.

[6] SushiSwap. SushiSwap Migration Plan & Governance Model, Sushi Community, 2020.

[7] Raydium. Raydium Protocol & AcceleRaytor Overview, Solana Ecosystem, 2021.

[8] Velodrome. ve(3,3) Governance and Liquidity Routing on Optimism.

[9] Jupiter Aggregator. Solana DEX Aggregator: Routing and Token Swap Engine, 2022.

[10] PancakeSwap. Multifunctional DEX Platform on BNB Chain, 2021.

[11] GMX. Decentralized Perpetual Exchange on Arbitrum and Avalanche, GMX Docs.

[12] 1inch Network. 1inch Aggregation Protocol Whitepaper, 2021.

[13] Matcha (0x Project). User-friendly Trade Aggregator Interface.

[14] ThorChain. Cross-chain Liquidity Protocol for Native Assets, 2021.

[15] Router Protocol. Cross-chain Liquidity Routing Infrastructure.

[16] Balancer Labs. Liquidity Bootstrapping Pool (LBP) Mechanism.

[17] Camelot DEX. Fair Launch and Ecosystem Design on Arbitrum.

[18] Jupiter. LFG: Launch & Farming Guide for Solana Projects.

[19] Velodrome. veNFT Bribe System and Governance Liquidity Wars.

[20] Sismo. ZK-based Privacy-preserving Identity and Reputation System, 2023.

[21] Gitcoin. Gitcoin Passport: Composable Web3 Identity Layer, 2023.

[22] Y Combinator. Startup Incubation Framework for Seed-stage Projects, Referenced for conceptual analogy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。