Macroeconomic Interpretation: The dual easing of the Federal Reserve and trade policies by the Trump administration, combined with institutional investors accelerating their allocation to crypto assets, has injected a strong boost for Bitcoin to break through key resistance levels, with traditional assets and the crypto market moving in tandem. We will analyze the direction of the crypto market from three dimensions: macro policy, capital trends, and market structure.

Trump's two key statements last night became a turning point for the market: first, he abandoned the threat to fire Federal Reserve Chairman Powell, alleviating market concerns about monetary policy uncertainty; second, he acknowledged that tariffs on China are too high and released expectations for negotiations, driving a broad rebound in risk assets. As a result, gold prices plummeted 3% in a single day, U.S. tech stocks and Chinese concept stocks collectively warmed up, and the correlation between the Nasdaq 100 index and Bitcoin significantly increased, with BTC approaching $95,000 during the day.

It is noteworthy that senior officials at the U.S. Treasury have recently frequently mentioned the concept of "digital gold," and the Trump team has openly supported cryptocurrencies as a new type of reserve asset. The shift in policy direction has directly stimulated institutional capital to accelerate its entry, with the 21 Capital fund, jointly initiated by institutions such as Cantor and SoftBank, attracting attention with its innovative model—this fund converts Bitcoin holdings into equity and issues shares at $10 each, implying an implicit valuation of $85,000 for Bitcoin. If this "securitization" operation model is approved by regulators, it could set a precedent for trillions of dollars of institutional capital to enter the market compliantly.

On-chain data reveals the subtle balance of market capital. Although Bitcoin's weekly increase reached 12% and ETF net inflows exceeded $1.5 billion in a week, data shows that the total market cap of stablecoins has not yet surpassed previous highs, indicating that retail capital has not yet entered the market on a large scale. This divergence is confirmed by the data from the two major stablecoin issuers, Tether and Circle: while USDT's market cap surpassed $145.3 billion, setting a new historical high, its 24-hour trading volume reached $84.9 billion, showing characteristics of institutional high-frequency trading; meanwhile, USDC's market cap growth reflects more of a demand for corporate-level capital accumulation.

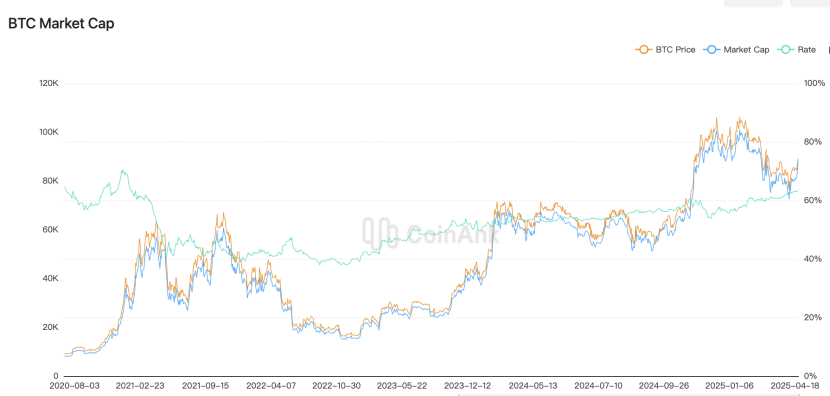

Changes in market structure are particularly evident in the trend of Bitcoin's market share. On April 23, the BTC.D index reached 64.67%, a new high since February 2021. Historical data shows that when Bitcoin's market share breaks the 60% threshold, it is often accompanied by two types of market evolution: either it continues an independent trend through a "vampire effect," or it becomes a precursor to the altcoin season. The current surge in open contracts in the derivatives market, combined with a moderate increase in funding rates, suggests that this round of market activity may break through the "institutional bull" script of 2021—traditional asset management giants like BlackRock have already reached 4.2% of the market circulation in spot ETF holdings, and if combined with the $300.8 billion in short-term U.S. Treasury bonds held by Berkshire Hathaway (accounting for 4.89% of the U.S. bond market) shifting towards crypto assets, it would fundamentally change the market liquidity structure.

Market data shows that Bitcoin is testing the key level of $95,000, with open contract volume increasing by 47% since the beginning of the month, but the perpetual contract funding rate remains in a healthy range of 0.01%-0.03%. This rare combination of "high leverage and low rates" reflects the risk control awareness of market makers and indicates that institutional investors are using options and other tools for position protection. From a technical perspective, the weekly MACD histogram has expanded for three consecutive weeks, and the RSI indicator has not yet entered the overbought zone, suggesting that a breakout above $95,000 may trigger trend-following signals from quantitative trading systems.

Market sentiment shows characteristics of "anxious optimism." Google searches for "Bitcoin" have increased by 320% compared to historical averages, but the social media sentiment index shows that retail investors' confidence index in breaking previous highs is only 58%, significantly lower than 82% during the same period in 2021. The fundamental reason for this cognitive gap lies in the change of market participants: Coinank data shows that the number of addresses holding more than 1,000 BTC has increased by 21% compared to 2023, while the growth rate of addresses holding less than 1 BTC has dropped to a nine-month low, indicating that the dominance of this round of market activity has shifted from retail to institutional investors.

The synergistic effect between the crypto market and tech stocks is noteworthy: the correlation between crypto assets and tech stocks has reached a new high. Since the Federal Reserve signaled interest rate cuts, Bitcoin's excess return relative to the Nasdaq 100 index has reached 15.9%, and this divergence further expanded after Tesla announced the acceleration of humanoid robot mass production. The Robot ETF (159770) has risen over 11% in nearly 11 trading days, and its constituent stocks have shown a seesaw effect with crypto mining stocks—when tech stocks rise more than 2% in a single day, the Bitcoin volatility index drops by 12%, indicating that some quantitative funds are engaging in volatility arbitrage between the two asset classes.

This synergistic effect has received new annotations at the regulatory level. The U.S. SEC has recently accelerated the compliance review of "AI + blockchain" projects, with four of the first six projects approved for filing involving decentralized computing power trading protocols. The marginal improvement in regulatory attitudes has led institutions like BlackRock to clearly list "crypto-native AI projects" as a key allocation direction in their quarterly reports, and this strategic adjustment may drive the market from a purely monetary narrative to the discovery of application value.

Currently, there are three major potential risk points in the market: the liquidity shock that may be triggered by the U.S. Treasury yield curve inverting again, the liquidity siphoning effect after Bitcoin's market share breaks the 70% threshold, and regulatory uncertainty during the U.S. election cycle. However, data from the derivatives market shows that institutional investors are hedging these risks through cross-cycle derivatives combinations—the premium rate for Bitcoin futures expiring in May remains high at 18%, while the premium rate for contracts expiring in December has plummeted to 9%, forming a unique "near high, far low" term structure, a pattern that typically appears before significant technical breakthroughs.

From the perspective of capital flow, in the past two weeks, 63% of the institutional funds flowing into cryptocurrencies have been allocated to products with a lock-up period of six months or more, indicating that professional investors are firmly optimistic about the medium- to long-term trend. As the market oscillates around the $95,000 mark, the momentum for a breakout is continuously accumulating under multiple favorable catalysts, and Bitcoin may be writing a new narrative different from any previous cycle.

BTC Data Analysis:

Coinank data shows that Bitcoin's market cap share (BTC.D) surged to 64.67% this morning, reaching a cycle peak and setting a new high since Q1 2021, significantly above the three-year average of 53%. Historical cycle patterns indicate that when BTC.D breaks the 60% threshold, it often triggers a transition from "siphoning effect" to "overflow effect": after the dominant rate broke 70% in 2019 and 2021, the altcoin market achieved average quarterly gains of 312% and 189%, respectively. However, the current market environment has three heterogeneous factors: the proportion of institutional holdings has exceeded 23%, the stablecoin market cap is in a contraction cycle, and the number of open contracts in derivatives has reached a historical peak, which may change the traditional rotation rhythm.

This surge in dominance reveals an upgrade in capital switching preferences: weekly net inflows into Bitcoin spot ETFs reached $940 million, forming a "one-way street for institutional funds"; meanwhile, the funding rate for altcoin futures hit an extreme negative value of -0.15%, reflecting that leveraged funds are being forced to reduce positions. Notably, the negative correlation between BTC.D and the Nasdaq index has risen to -0.67, indicating that the crypto market is detaching from the traditional risk asset pricing logic.

Currently, with BTC's market share at a new high, there is a certain suppressive effect in the short term: the traffic share of the top 50 altcoin exchanges has shrunk to 11%, a new low since 2020, and a liquidity crisis may trigger a spiral decline in small and mid-cap projects. However, there are also structural opportunities: the Ethereum/Bitcoin exchange rate has reached a three-year low of 0.046, and historical data shows that this level has an 82% probability of triggering mean reversion. In terms of capital rotation, the market cap of stablecoins has increased by 2.3% to $161 billion, accumulating ammunition for a potential style switch. If BTC.D breaks the key resistance of 65%, it may replicate the "frenzied altcoin season" of Q2 2021.

The current market is in a phase of strengthening "Bitcoin standard," but on-chain data shows that the number of addresses holding more than 1,000 BTC has decreased by 7% month-on-month, indicating that whale accounts are beginning to diversify their allocations, which may lay the groundwork for a recovery in the altcoin market. Investors should pay close attention to the divergence trend between BTC.D and the stablecoin market cap, as this indicator has accurately predicted the market style switch in Q1 2023.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。