Original Title: "Ethereum's Short Squeeze: Can CME Basis Collapse, Rate Cuts, and the Pectra Upgrade Propel ETH Beyond $3000?"

Original Author: Alvis

I. Market Phenomena and Data Retrospective: Price Leap from $1385 to $1750

On April 23, 2025, Ethereum (ETH) staged a thrilling return to value. Its price surged from an annual low of $1385 on April 6 to break through the $1750 mark on April 23, achieving a cumulative increase of 26.3% within two weeks, with a single-day peak increase exceeding 10%. Coinglass data shows that over the past 24 hours, Ethereum liquidations exceeded $120 million.

This round of increase includes the release of liquidity from the closure of short-term market arbitrage positions, as well as a reshaping of risk appetite under expectations of a shift in macroeconomic policy. Long-term value support must also be sought from the endogenous dynamics of blockchain ecosystem evolution.

From a technical perspective, after ETH broke through $1600 on April 9, it consecutively pierced through two key resistance levels at $1688 and $1700. The daily MACD indicator formed a golden cross above the zero axis, confirming a short-term bullish trend.

The weekly level is even more noteworthy: the middle band of the Bollinger Bands (approximately $1720) was strongly broken.

The ETH/BTC exchange rate rebounded from a historical low of 0.01765 to 0.0191, indicating a restoration of market confidence in the Ethereum ecosystem.

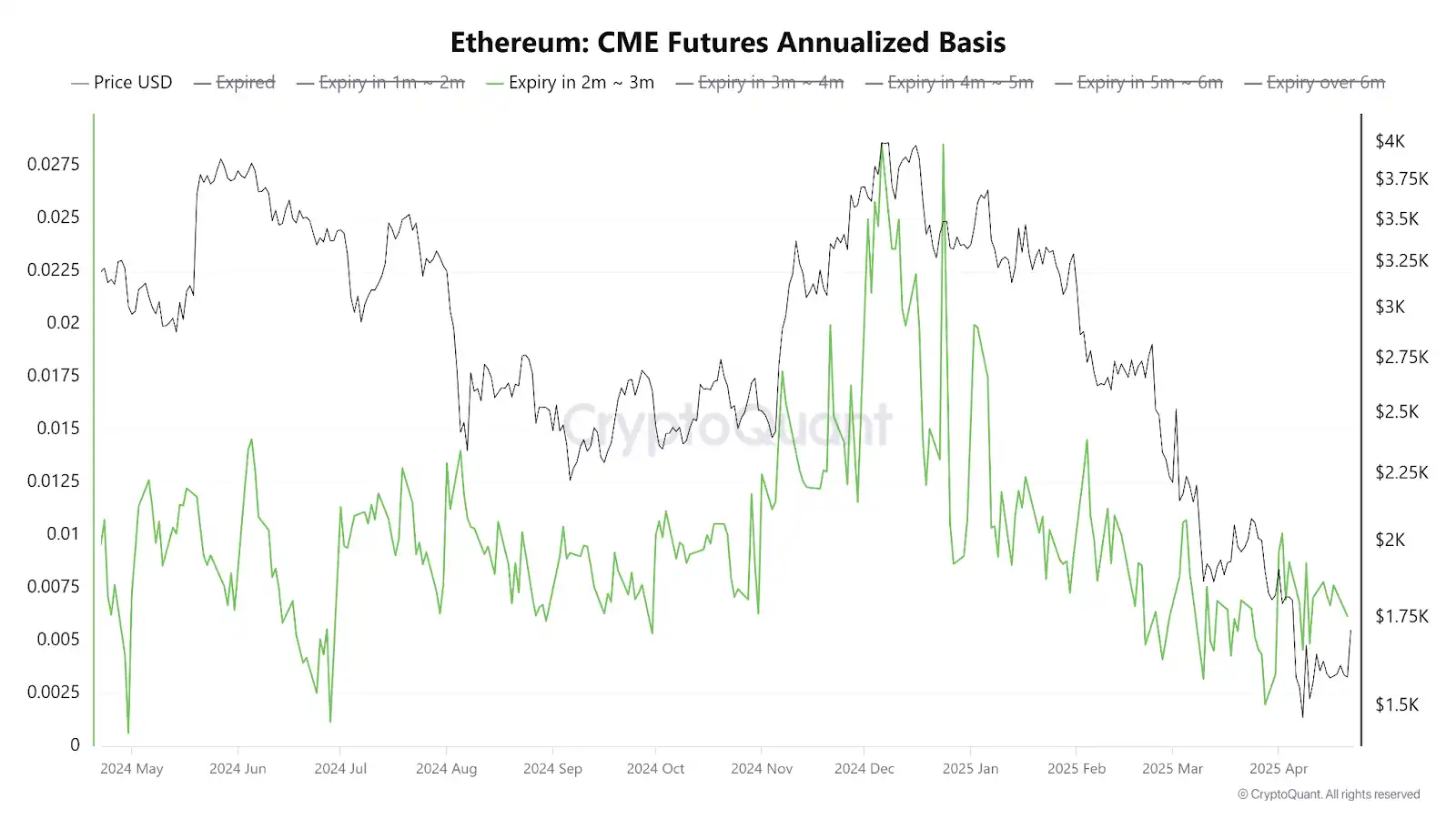

During this process, the ETH basis on the Chicago Mercantile Exchange (CME) plummeted from 20% in November 2024 to 5% in April 2025, marking the exhaustion of short-selling momentum dominated by arbitrage capital, clearing the way for price rebounds.

II. Deconstructing the Surge: Triple Drivers of Arbitrage Closure, Macro Shift, and Ecological Recovery

1. Arbitrage Capital Clearance Triggered by Basis Convergence

ETH CME Futures Annualized Basis

The essence of the CME basis (the difference between futures and spot prices) is the market's pricing of future liquidity.

In the fourth quarter of 2024, a basis level of 20% far exceeded the concurrent U.S. Treasury yield, attracting hedge funds to construct arbitrage combinations of "buying spot ETFs + shorting futures." The sustainability of this strategy relies on two premises: first, the basis must remain high enough to cover capital costs, and second, market liquidity must be sufficient to support position rolling. However, the risk asset sell-off triggered by Trump's tariff policy (with ETH dropping to $1385 on April 6) led to a rapid narrowing of the basis to 5%. After the arbitrage profit space disappeared, institutions were forced to sell spot ETFs to close positions, further exacerbating the price decline.

Once arbitrage capital withdrew, ETH pricing power returned to the supply-demand relationship of the spot market. According to Glassnode on-chain data, the accumulation of 824,000 ETH around $1,546 became a key support level, and the accumulation behavior of whale addresses in this area (such as a single withdrawal of 6,528 ETH from Bitfinex) indicates that value investors are beginning to enter the market.

2. Macro Policy Shift and Risk Appetite Recovery

The dramatic change in expectations for Federal Reserve monetary policy constitutes another core variable. After Trump pressured Powell to "immediately cut interest rates" on April 17, market predictions for a June rate cut probability surged from 32.8% to 61.8%.

This shift caused the U.S. dollar index to drop to a year-to-date low of 98.2790, enhancing the safe-haven attributes of gold and cryptocurrencies as non-dollar assets. Notably, this round of ETH's rise resonated with the three major U.S. stock indices (Dow Jones +2.66%, Nasdaq +2.7%), reflecting a trend of global capital rebalancing from a "cash is king" strategy to risk assets.

The easing of geopolitical risks further catalyzed the surge. U.S. Treasury Secretary Yellen's statement about "the potential cooling of the U.S.-China tariff war" reduced market concerns about supply chain shocks. From a behavioral finance perspective, this expectation adjustment caused ETH's beta coefficient (relative to market volatility) to drop from 1.2 to 0.9, with declining risk premium requirements pushing the valuation center upward.

3. Endogenous Value Reconstruction of the Ethereum Ecosystem

Technological upgrades and ecological expansion form the long-term value support. The Pectra upgrade, set to launch on April 25, introduces EIP-7732 (account abstraction optimization) and Layer 2 expansion plans, reducing the cost of a single transaction to below $0.001 and increasing TPS (transactions per second) to 20,000.

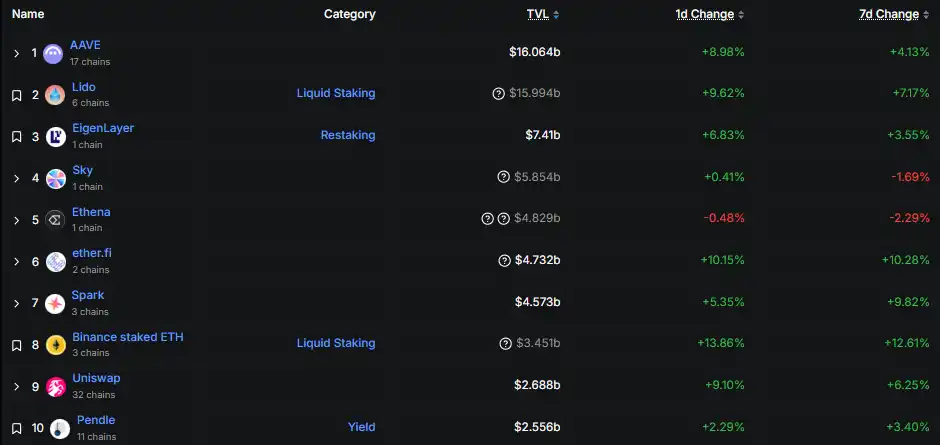

This directly stimulated the recovery of DeFi locked value (TVL): as of April 23, the TVL of Ethereum DeFi protocols reached $46.7 billion, an 18% increase from the March low, with leading protocols like MakerDAO and Aave contributing 60% of the increment.

The structural inflow of institutional funds is also crucial. In BlackRock's $500 million RWA (real-world assets) tokenized fund, 47% of the underlying assets are cleared through the Ethereum network, demonstrating traditional finance's recognition of Ethereum as a settlement layer.

Additionally, the U.S. SEC's anticipated approval of Ethereum spot ETFs through staking may trigger a similar capital siphoning effect as seen with Bitcoin ETFs in 2024. According to 10x Research models, this could bring in at least $5 billion in net inflows.

Future Trend Projection: Path Selection from Resistance Breakthrough to Trend Reversal

Short-term (1-3 months) price movements depend on the effectiveness of the $1688 support level.

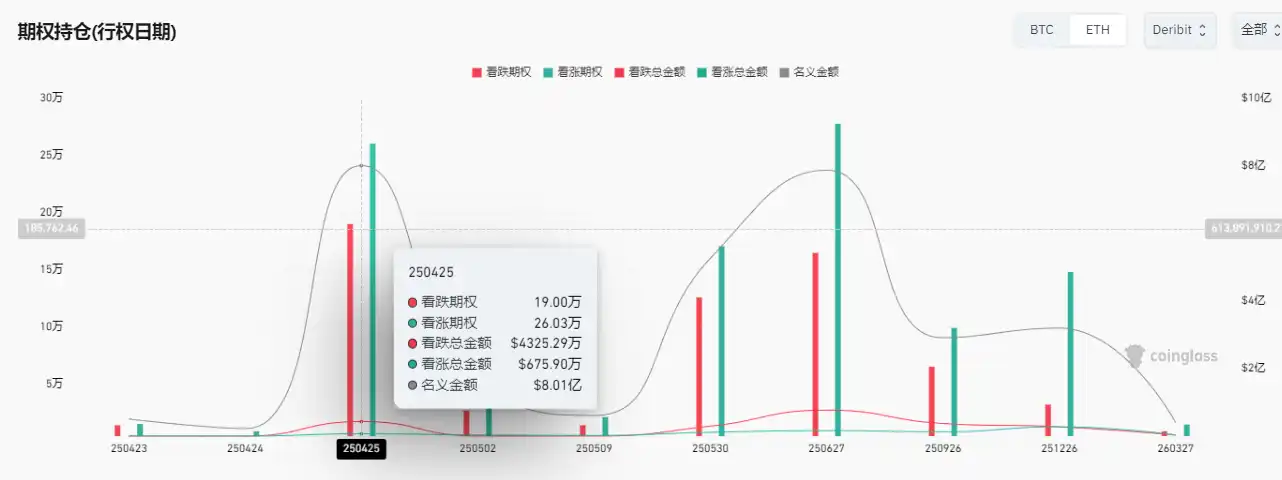

According to options market data, in the ETH contracts expiring on April 25, the open interest (OI) for put options with a strike price of $1700 is 12,000 contracts, necessitating vigilance against concentrated short attacks before the CPI data release (on April 25). If the support holds successfully, the upward targets could be $1830 (upper band of the weekly Bollinger Bands) and $1930 (Fibonacci 61.8% retracement level).

Mid-term (6-12 months) attention should be paid to two major catalysts:

1. Start of the Federal Reserve's Rate Cut Cycle: If a 25 basis point rate cut occurs in June, according to the Capital Asset Pricing Model (CAPM), ETH's expected return will rise from the current 12% to 18%, attracting about $2 billion in allocation funds.

2. ETF Staking Approval and RWA Expansion: If Ethereum spot ETFs are approved for staking, based on historical Bitcoin ETF data, the inflow scale in the first week could reach $800 million to $1.2 billion.

The long-term (2-3 years) value center will depend on the complete implementation of Ethereum upgrades. Once sharding technology is fully implemented, network throughput is expected to reach 100,000 TPS, and gas fees will drop to nearly zero, giving Ethereum an absolute advantage in the Web3.0 infrastructure competition.

Conclusion: Seeking Certainty Amid Uncertainty

Ethereum's recent surge is not merely a technical rebound but the result of multiple cyclical resonances: the release of short-term liquidity from arbitrage capital clearance, the reshaping of risk premiums due to monetary policy shifts, and technological upgrades solidifying long-term value foundations. In the critical range of $1688-$1800, investors should be wary of increased volatility risks but should pay more attention to whether the ETH/BTC exchange rate can break through the strong-weak dividing line of 0.03—this will be the core signal confirming the revaluation of Ethereum's ecosystem value.

As Austrian School economist Hayek said, "The process of denationalizing money must inevitably be accompanied by the diversification of the measure of value." As the infrastructure of decentralized finance, Ethereum's price fluctuations are essentially a consensus evolution process regarding a new type of value storage medium. In this historic process, rational investors must identify signals amid noise and capture trends amid volatility to remain undefeated in the wave of the digital economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。