原文作者:0xTodd,Nothing Research 合伙人

前几天看到一个帖子说:「现在 Solana 质押量已经超过 ETH 质押量了,是不是意味着 Solana 链的安全性已经超过 ETH 了?」这个说法太有迷惑性了,以至于很多人真的相信。

其实不然。先看一些数据:

ETH 的质押数据是 34M ETH,价值 610 亿美金左右;Sol 的质押数据是 388 M SOL,价值 587 亿美金左右。

SOL 确实和 ETH 达到了同一级别,如果是前几天 ETH 反弹之前,甚至略低于 SOL。(数据来源:Beaconcha & Solana Beach)。考虑到两者的 PoS 机制攻击门槛都是 33% 左右,看似理论攻击难度一致。

33% 可以阻挠出块,51% 可以弄出新的最长链,67% 可以直接双花。但是实操难度上,攻击 ETH 的难度大幅超过 Solana。

PS:当然了,假设攻击 SOL 的成功率是 0.001%,攻击 ETH 的难度可能是 0.0001%,虽然相差很多,但是需要注意两者依然都属于极小概率事件。原因在于(1)节点集中度(2)Staking 基建成熟度。

一、节点集中度

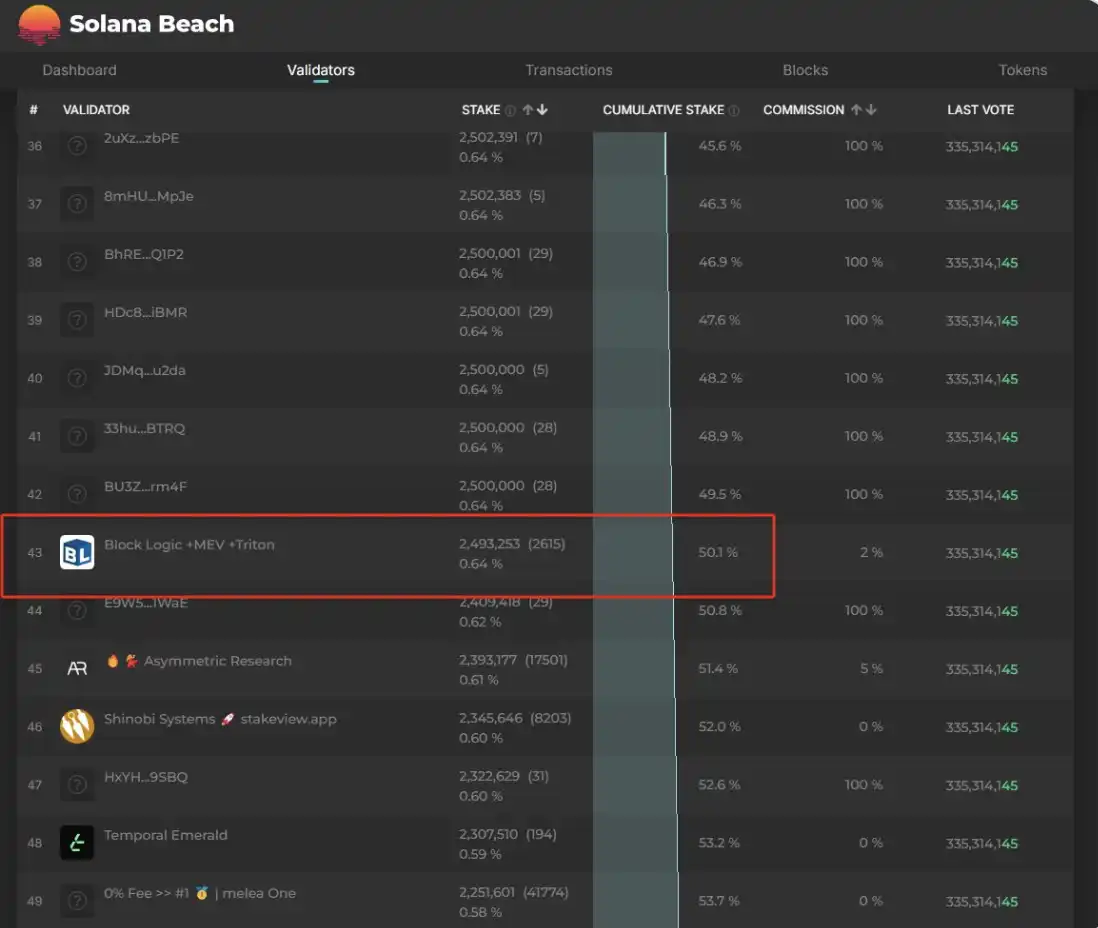

先来假设一个情况:有个神奇的黑客,利用 0day 漏洞,成功黑掉亚马逊和主流云服务商的机房。那么,控制 Solana > 50% 需要同时拿到前 43 名的节点。很难,但并非不可能。

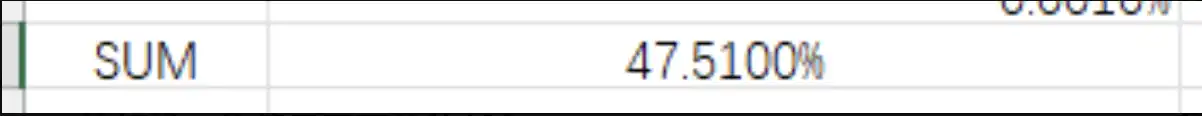

而 ETH 的话,单节点最多质押 32 ETH,因此需要拿到 1,187,000 个节点,听起来就是不可能的任务。当然了,这样算对 Sol 不公平,因为本质上 ETH 也是由众多节点运营商跑的,一个实体可能拥有上万个节点,那么,目前从 Rated 上收录的运营商来看…你会发现,所有登记在册的 ETH 节点运营商加一起也才 47.5%,甚至都摸不到 50% 的门槛。依然是不可能的任务。

原因是,ETH 作为远古公链,它是真的见过远古时代真的 PoS 攻击,对于防范这个潜在危险确实做了很多准备,比如鼓励散户参与质押。以太坊的 32 ETH 门槛并不高,而 Solana 对服务器要求很高,每月成本是 ETH 的 5-10 倍,而且这只是入门。所以,如果散户要盈亏平衡的话,至少要质押 10K SOL 以上,而且收益率还比 Jito 更低。

二、基建成熟度

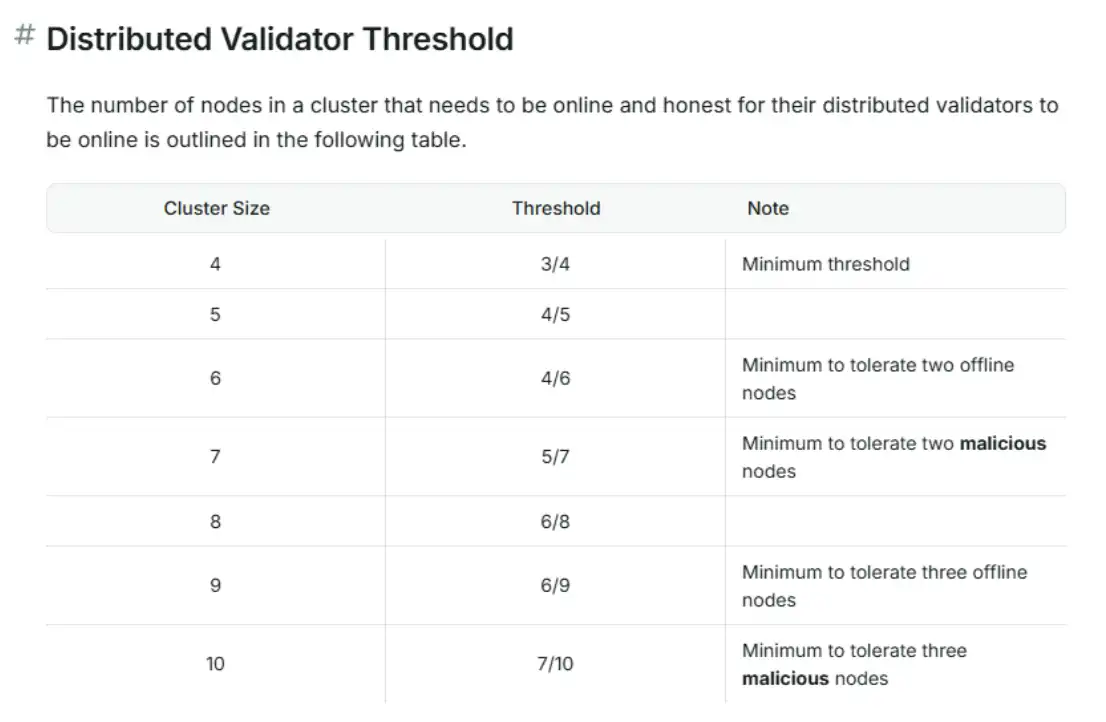

包括 @LidoFinance@Obol_Collective 在内的众多 ETH 的 Staking 基建,也同样做了很多功课。例如,Lido 要求节点们少用亚马逊的机房,多用小众机房。少使用主流客户端,多支持小众客户端。另外 Lido 还专门拿出 4% ETH 给 DVT 基建例如 Obol 和 SSV。Obol 的话,它是 DVT 技术。你可以把它理解为,你的节点由一个集群共同管理,而非单一实体。例如 4 个人共管节点,你可以要求它是一个 3/4,这样一旦某节点掉线,其他节点可以立刻顶上。如果你设为 10,那么你可以设 7/10,最多容忍三个节点掉线。

注意:在 ETH 以及大部分 PoS 链上,掉线也是【作恶】形式之一。如果 33% 节点掉线,链就会瘫痪。而且,Obol 的独特之处在于,它是通过一个客户端来实现集群的,因此你的私钥(碎片)不会被上传到链上,更加安全,这是通过 DKG 实现的(以后有空可以分享一下 DKG)。最近 Obol 刚上主网,感兴趣的也可以去挖一下,@ebunker_eth就可以。

所以,像 Obol 这些 ETH 专门为 Staking 准备的基建,是目前 Solana 不具备的。当然了,不是踩一捧一,两条链都非常安全。不过,尽管资金赌注已经来到了同一级别,但安全性上,由于节点集中度和基建成熟度,依然是 ETH 略胜一筹。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。