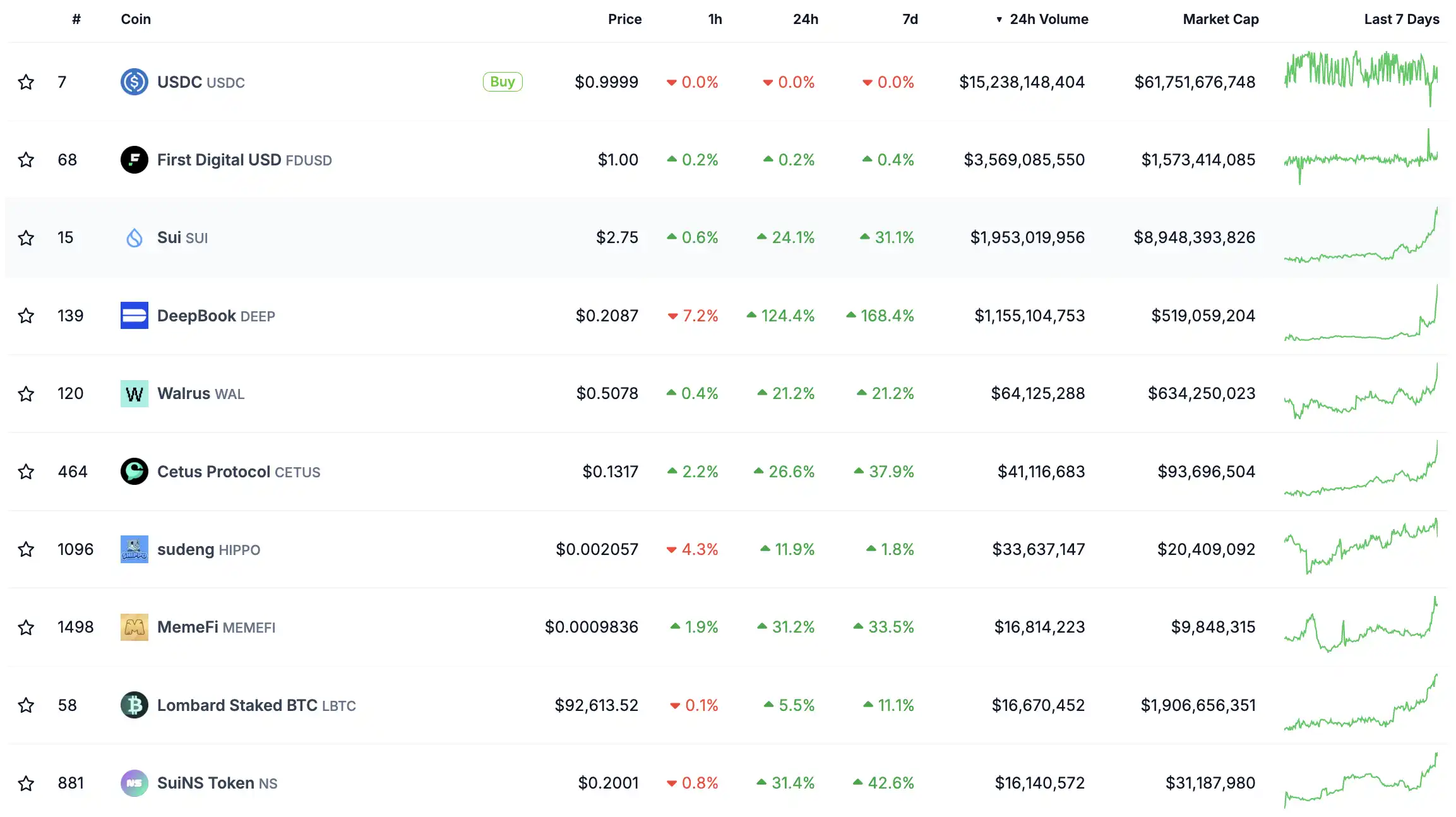

After the market welcomed both Trump and Musk's "surrender," the crypto market also rose in response to the stock index futures. Amidst a sea of green, the SUI ecosystem tokens stood out with significant double-digit gains. According to market data, the overall increase of the SUI ecosystem reached as high as 23.1% in 24 hours, with leading projects like DeepBook even exceeding 120% in gains.

Data source: coingecko

From being known as the twin star of Move alongside Apt to being included in the strategic reserves of the Trump family fund WLFI, SUI's strategy has gradually shifted from gaming to trading chains. Last month, the walrus project released an airdrop, and participants in the airdrop after the TGE expressed that they "received less than expected." The CPO of Walrus's parent company, MystenLabs, previously stated that Walrus would be one of the largest airdrops in history. The result was that, while it may not have been the largest, its marketing objectives were achieved.

Since then, MystenLabs's layout has been basically prepared, with SUI and the storage public chain Walrus advancing each other on-chain, developing the SUI native order book integrated with DeepBook to provide liquidity. The Kiosk's built-in royalty protocol makes GameFi more extensible, while the SUI Name Service "domain," Getstashed "mobile payment," and SUI Wallet "wallet," combined with technologies like Enoki and zkLogin, create a friendly environment for ecological projects wanting to build on mobile.

In addition to the official surrounding ecosystem, which projects in the SUI ecosystem are worth ambushing as the market warms up? Let's explore.

DeFi Sector

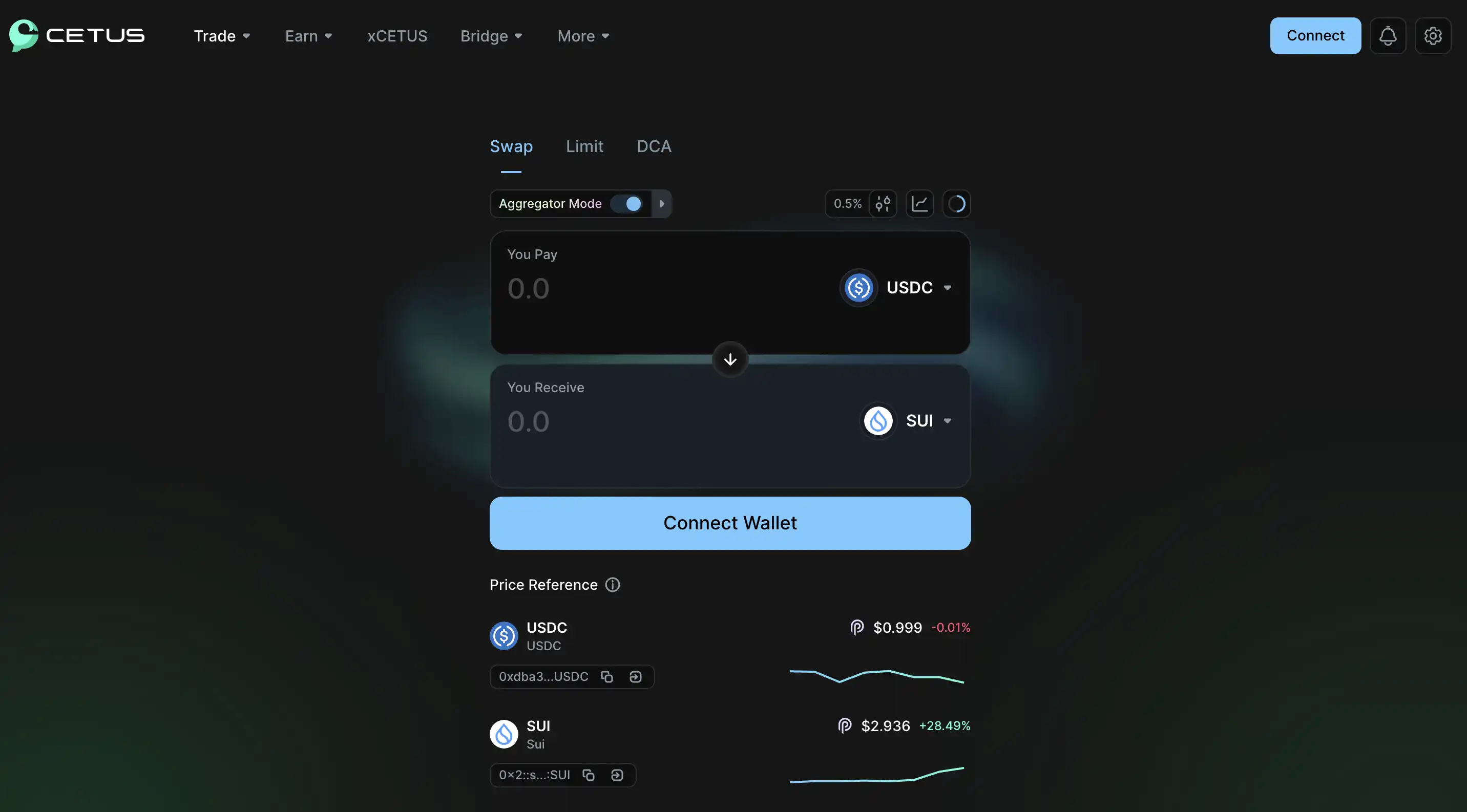

As an early liquidity protocol on Sui, Cetus's platform token $CETUS saw a single-day increase of 25% amid the overall rise of the SUI ecosystem, with its market cap nearly doubling in the past two weeks. The platform primarily provides exchange functions with limit orders, as well as tools like mining, liquidity pools, and treasury. Its DeepBook interface offers a direct path for ordinary users to access Sui's native liquidity layer.

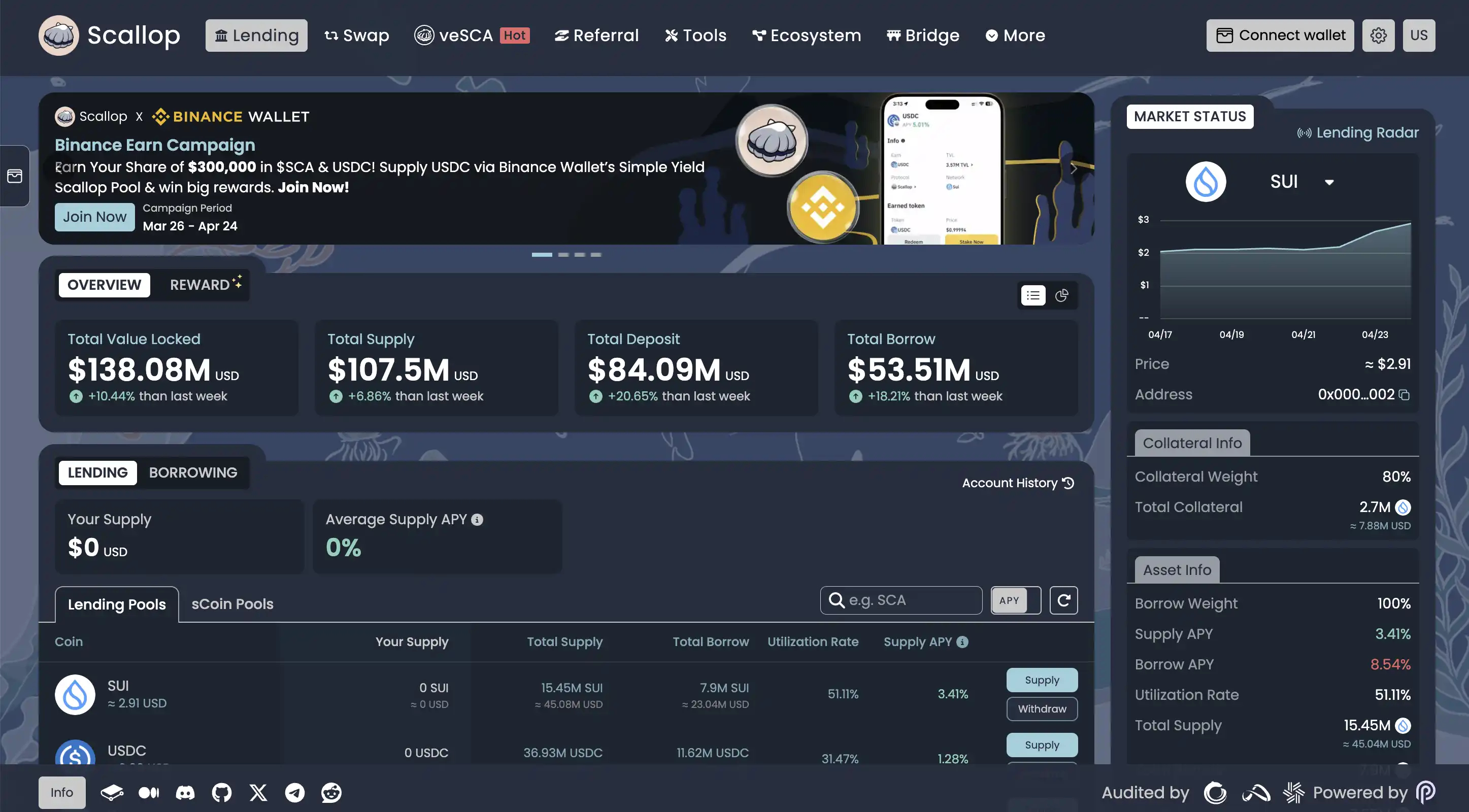

The lending platform Scallop is another early Sui DeFi protocol that allows users to deposit SUI into pools to earn interest or participate in more complex lending strategies. In addition to lending, Scallop now also supports exchange functions and provides cross-chain bridge capabilities.

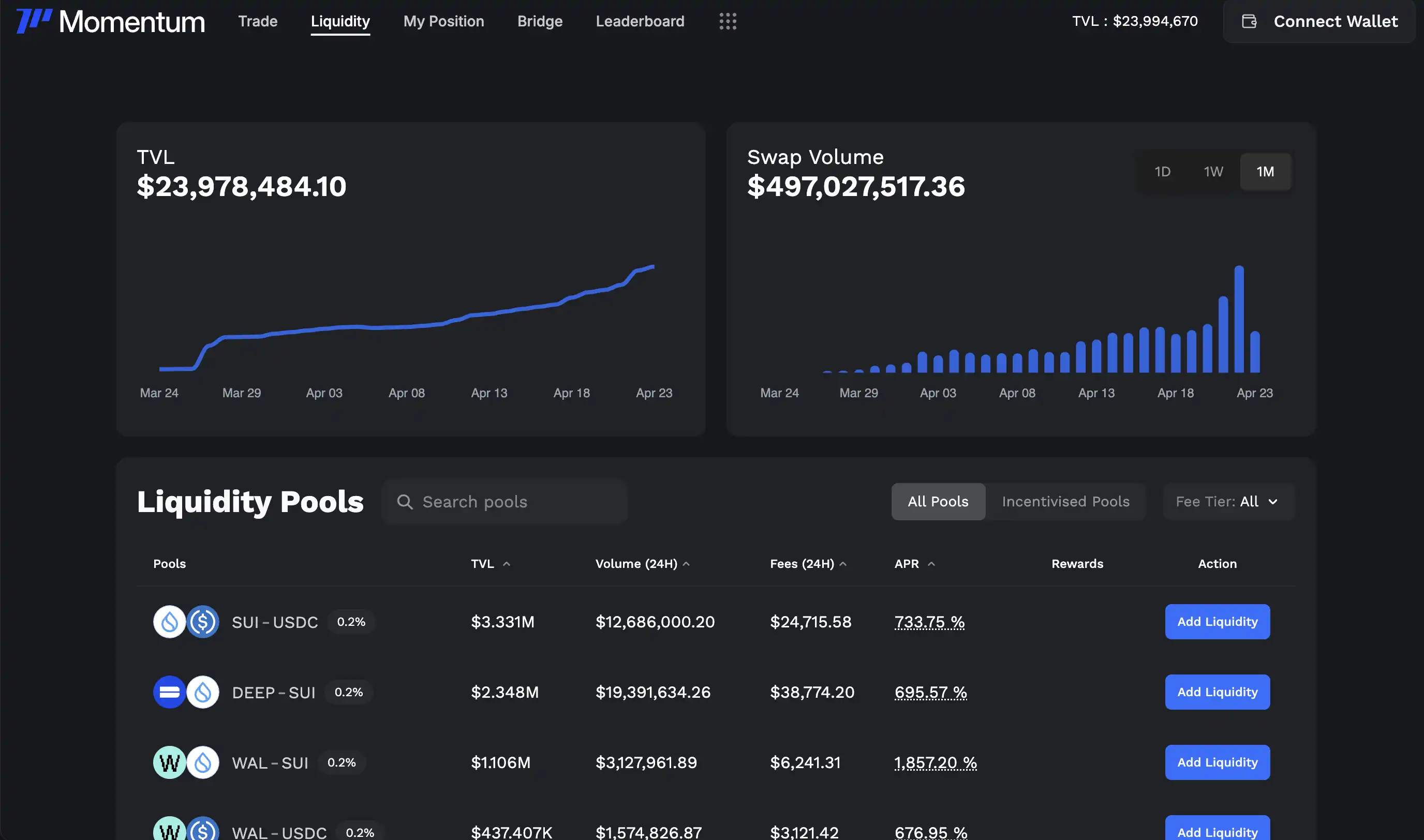

Founded by former Meta employee Wendy Fu and backed by VCs like Jump Crypto, Coinbase Ventures, and Amber Group, Momentum serves as the largest stablecoin integration platform on SUI. Some liquidity providers for stablecoin trading pairs have quite good APRs, and there are also expectations for airdrops.

An integration platform for DeFi dApps and wallets on SUI, PawtatoFinance serves as a dashboard for the SUI DeFi ecosystem. It was a finalist in the first Sui Pitch Day, an event where project teams present to a jury of VCs and investors to secure funding.

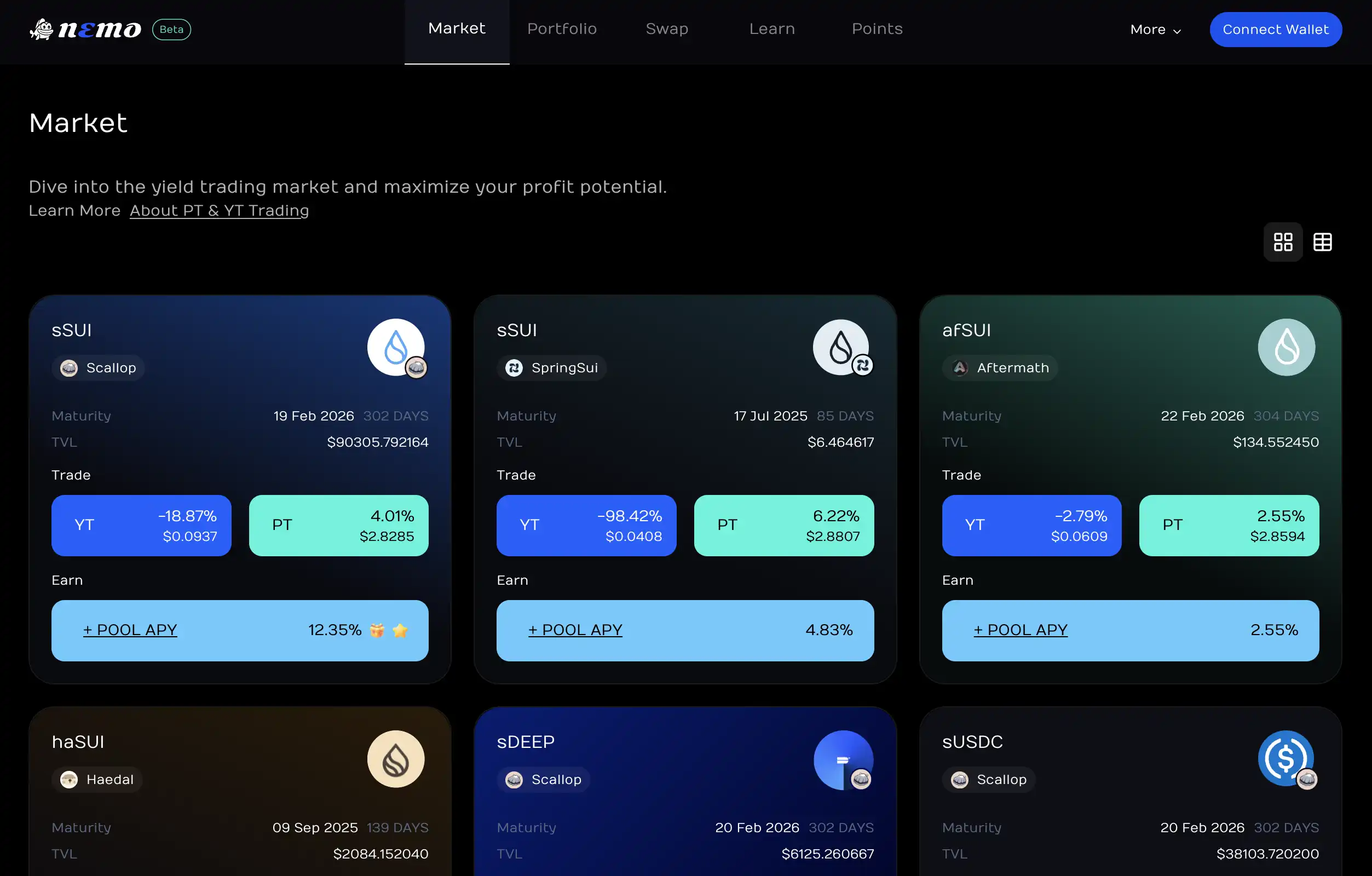

Nemo is a native yield trading platform where users can go long on yields or hedge yield risks. It was also a finalist in the Sui Pitch Day and previously received support from Sui Grants and the Hydropower acceleration program.

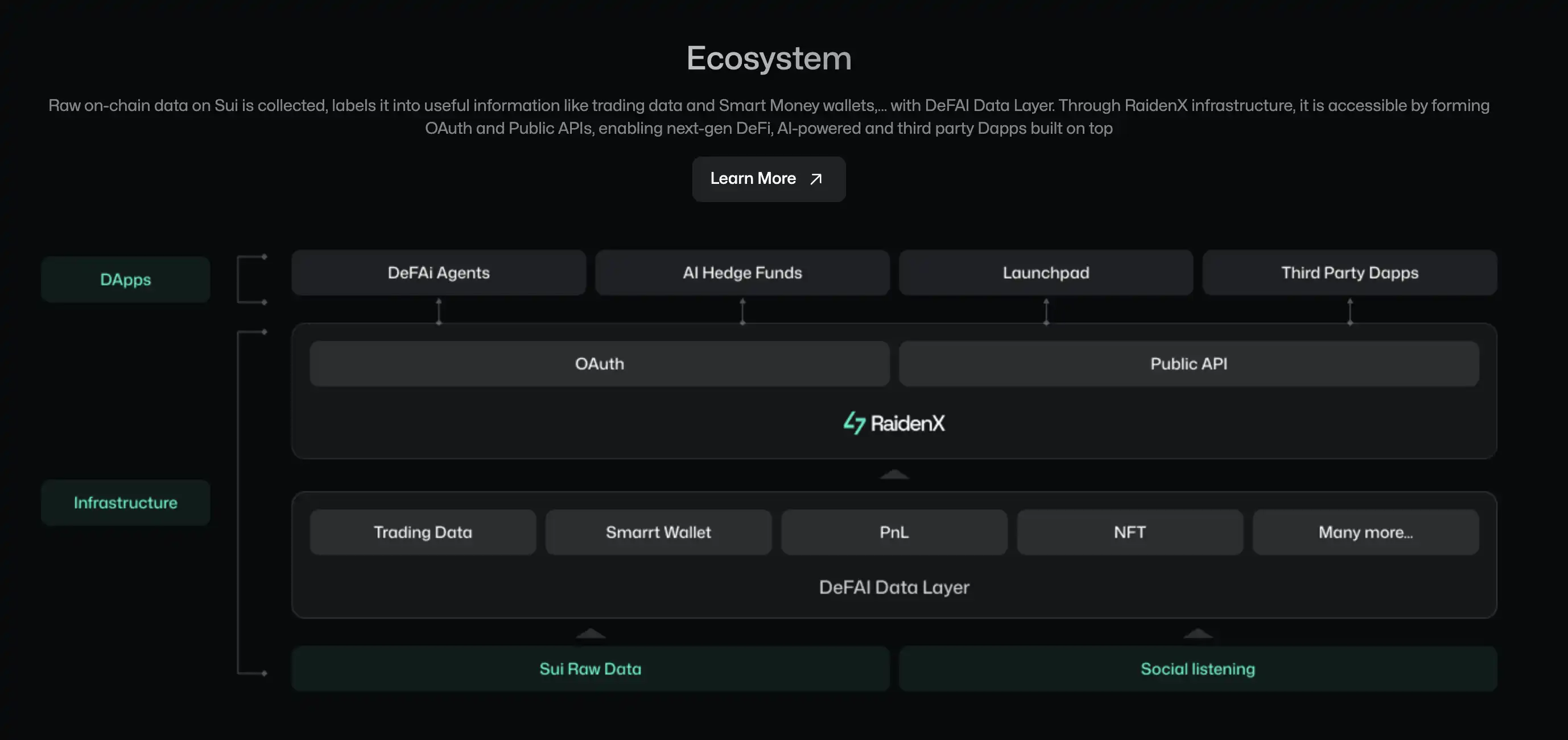

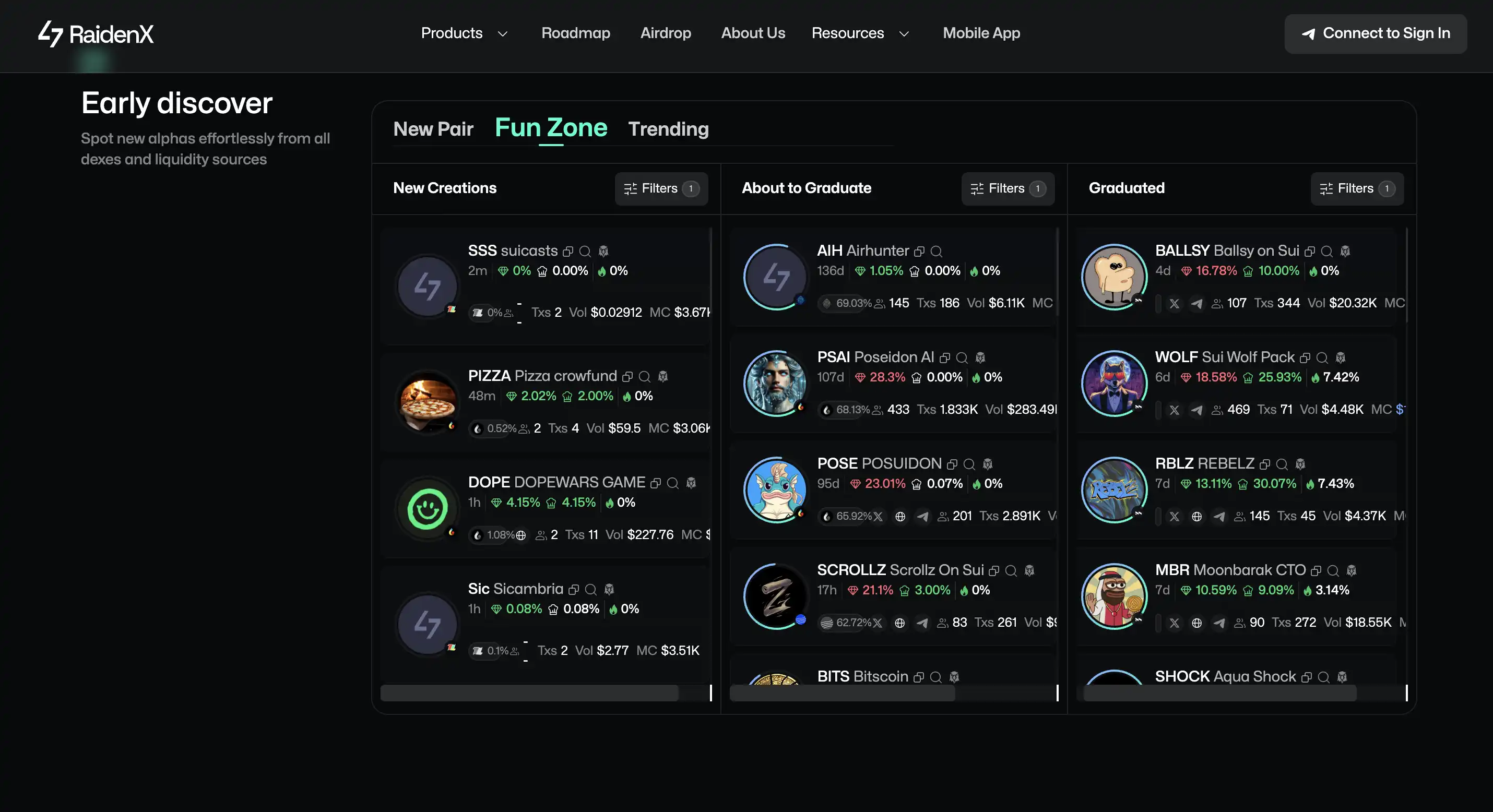

In this cycle, the MemeCoin ecosystem on SUI has yet to explode. After the previous cycle's $Hippo surged to a peak market cap of $30 million, not many Meme projects have emerged, resulting in limited support from well-known TradingBots. Therefore, the native RaidenX on SUI has taken up the mantle in this field. Besides integrating trading, the project is also expanding its layout, developing as a TradingBot and as infrastructure for DeFAI.

AI Related

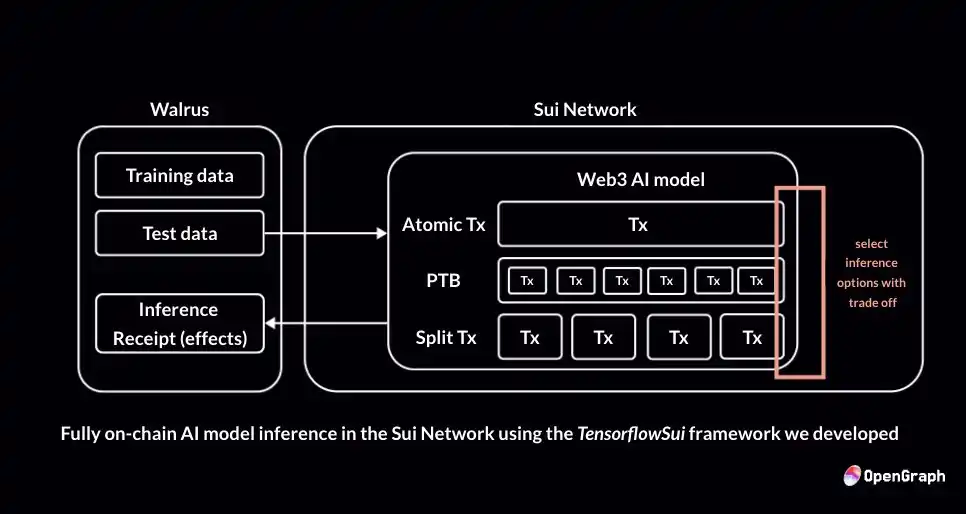

OpenGraph is a complete end-to-end technical framework for AI Agents deployed on Sui and Walrus, providing on-chain model deployment, on-chain inference execution, and on-chain result storage.

ZO is an AI perpetual contract protocol developed by Sudo Finance, equipped with AI Agents that can provide personalized trading advice and manage portfolios. Users can also intervene with the Agent SDK to integrate their own AI Agents for trading.

RockeeAI is an integrated Agent for DeFAI, capable of functioning across various aspects of DeFi. Users can interact directly with the AI agent through an application, requesting relevant data on project details, contract addresses, token prices, and yield strategies. The AI agent collects information from multiple trusted sources and presents it to users in an easily understandable manner.

Additionally, it can perform automatic trading based on users' natural language and retrieve the latest market data to provide market analysis. It also integrates data from social media platforms, news media, and community platforms like Telegram, Discord, and Reddit to analyze off-chain factors related to community sentiment.

NFT Market

SuiFrens is an NFT officially issued by Mysten, aimed at showcasing the extensibility of the Move system. It has two features: first, the NFT implements dynamic rendering, meaning holders can put on or take off accessories at any time, and creators and brands can freely create accessories within SuiFrens. Second, it has a breeding system for NFTs, allowing holders to mix any two SuiFrens they own or have permission to use. During the mixing process, each offspring has a high chance of inheriting existing traits from its parents, while also having a chance of mutation, resulting in more combinations.

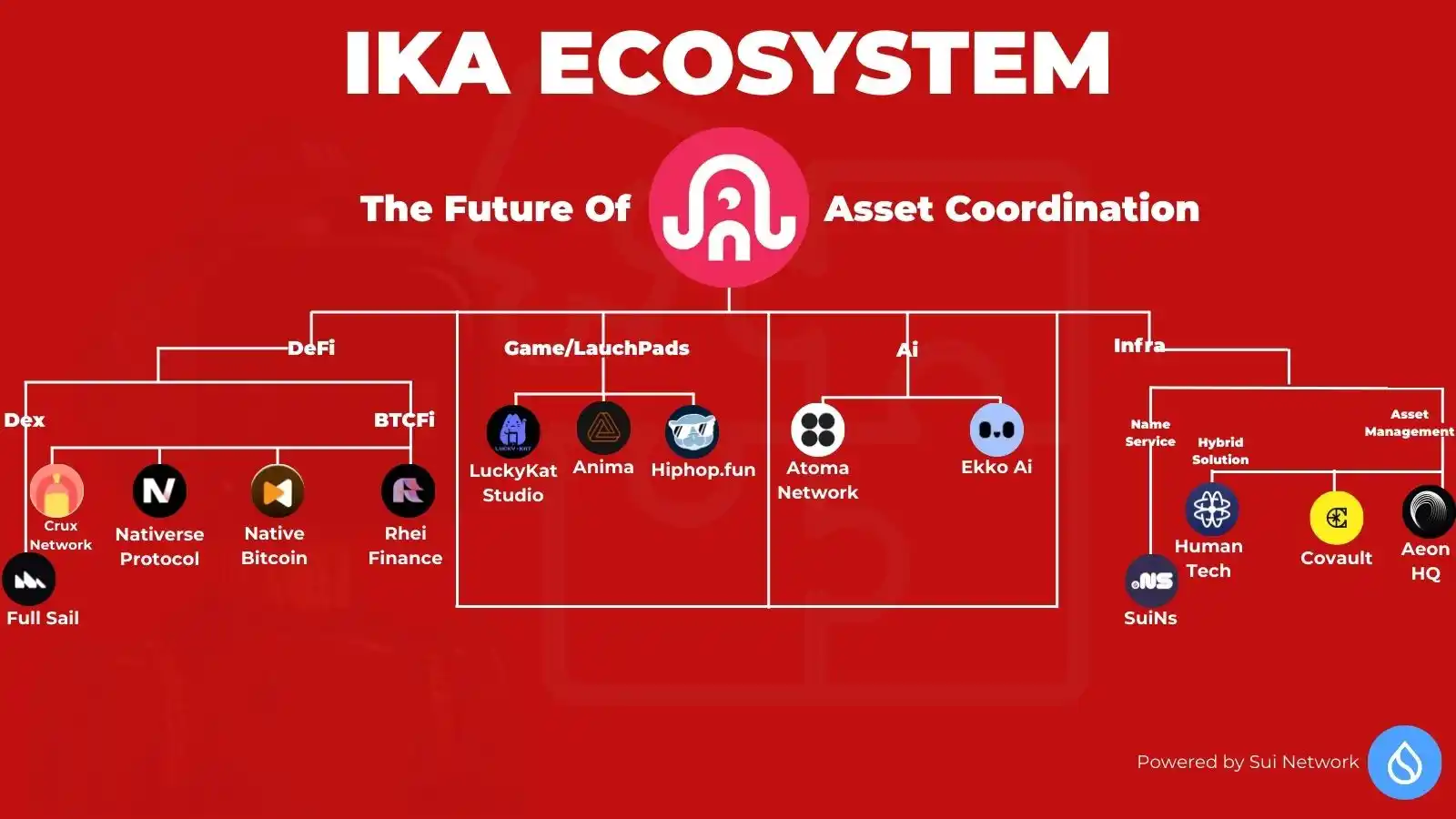

THE MF SQUID MARKET is an NFT issued by the MPC network IKA on SUI. The community believes it is related to the token $IKA that IKA will issue in the future. The current floor price is 42 SUI, and the daily trading volume on the Move multi-chain NFT platform TradePort has reached 7300 SUI.

As the native domain system of SUI, Sui Name Service converts complex blockchain addresses into human-readable names, with 400,000 domains already registered. Sui Name Service has now been acquired by the official MystenLabs and is developing as an important part of the SUI ecosystem development system. Its project token $NS has also performed exceptionally well during this rise in the SUI ecosystem, with its market cap increasing by 300% this month.

With the collective warming of the SUI ecosystem, many new projects have emerged on SUI. Backed by Move's technology, SUI's high throughput and low latency also make its future development prospects in payments and DeAI very promising. Rhythm BlockBeats will continue to track its new developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。