The spring of one group of people is inevitably the winter of another group.

Written by: Deep Tide TechFlow

On April 23, as Trump announced a reduction in tariffs on China, this news reignited market sentiment.

Investor confidence in risk assets quickly rebounded, with BTC quietly rising by 7%, bringing the price back to $94,000.

Everything seemed to have returned overnight.

BTC is now one step closer to breaking the historical high of $100,000 set at the beginning of the year, with Twitter filled with expectations for a new bull market. Traders in the secondary market are busy chasing prices up and down, and the market seems to have returned to the frenzied spring of 2021.

However, this return of sentiment does not belong to everyone.

They are lively, while primary investors may remain silent in the face of signs of a bull market.

The Bull Market Dies in Lockup

The news of BTC returning to $94,000 has excited secondary market investors, but for primary market investors, this celebration feels like a distant dream.

Most of their tokens are locked up and cannot be freely traded, and the market performance over the past year has caused them significant losses.

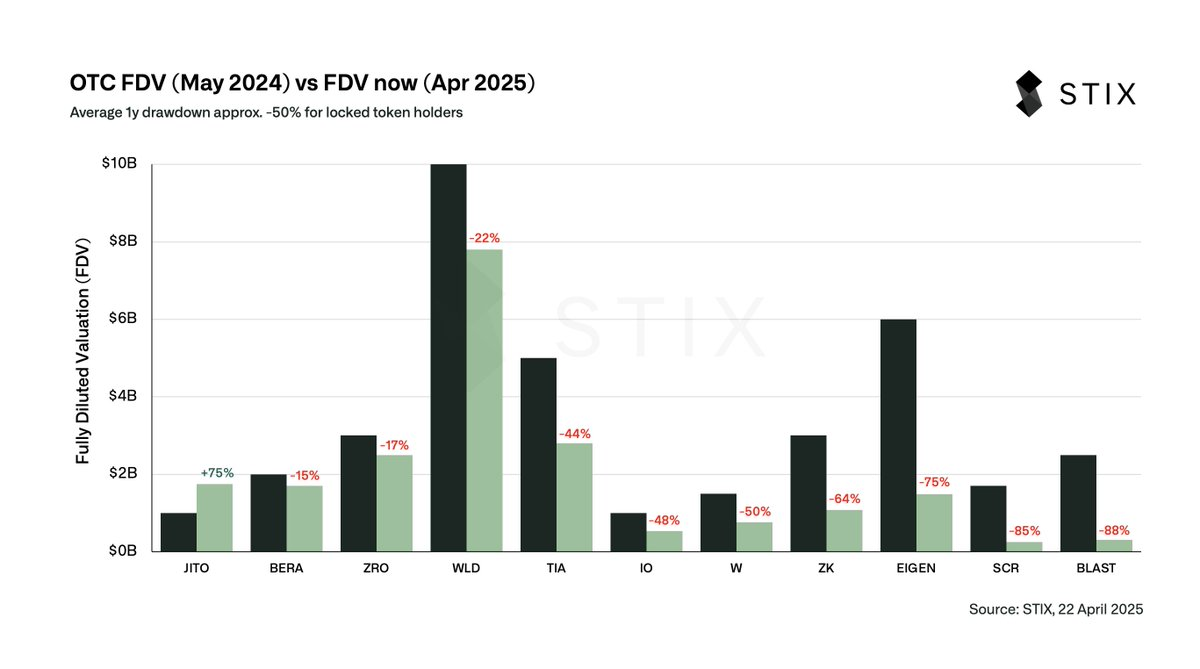

A chart from STIX (@stix_co) reveals this harsh reality.

@stix_co is a platform focused on cryptocurrency OTC (over-the-counter) trading, providing liquidity support for locked tokens.

The chart compares the valuation changes of several tokens in May 2024 and April 2025: May 2024 represents the valuation of these tokens during OTC trading (the price at which primary investors could sell while locked), while April 2025 represents the actual valuation of these tokens in the public market (the current market price).

The results show that, on average, the valuations of these tokens have dropped by 50% within a year.

Let's look at a few specific examples.

BLAST had an OTC valuation of $250 million last year, but its current market valuation is only $30 million, a drop of 88%; EIGEN fell from $600 million to $150 million, a drop of 75%; SCR fared worse, dropping from $170 million to $25.5 million, a staggering decline of 85%.

Almost all tokens have seen significant declines, with JTO being the only exception, rising from $10 million to $17.5 million, an increase of 75%.

But this is just an exception, overshadowing the overall bleak situation.

In simple terms, if these primary investors did not sell their tokens through OTC trading last year, the average value of their holdings has been cut in half, with some even worth only 10-20%.

For background knowledge, OTC trading refers to private transactions that primary investors can engage in before tokens are unlocked, usually at a discount.

Taran mentioned in the post linked above that last year, these tokens were traded OTC at about 80-90% of their valuation.

This means that if they had sold last year, they might have only lost 10%-20%, or even broken even. But some investors chose to hold for a year, waiting for the unlock, only to find that the average value of their tokens had dropped by 50%, with some even losing 70-80%, leading to a significant reduction in wealth.

You might say that their investment cost was low, and even with such a drop, they still made a profit.

But the problem lies in the concept of opportunity cost in economics. As an investor, what is more painful than earning less (and possibly even losing) is the theoretical loss of opportunity cost.

In an ideal scenario, Bitcoin (BTC) has risen by 45% over the past 12 months.

If primary investors had sold their tokens last year and converted to BTC, their money might have increased to 1.45 times its original value.

But now, the value of their tokens is only 0.5 times, and even after unlocking in the future, they might have to sell at a 50% discount, ultimately worth only 0.25 times.

In other words, compared to BTC's increase, their actual loss is as high as 82.8%; even in dollar terms, they have lost 75%.

It's like watching others make a fortune while the assets in your hands shrink.

For them, the "bull market" may have already died in lockup.

Locking up for a year and losing half is frustrating because:

After researching, comparing, identifying, and investing in projects, it would have been more cost-effective to simply hold BTC.

In the classic investment book "A Random Walk Down Wall Street," there is a famous "gorilla throwing darts theory."

Author Burton Malkiel proposed that if a gorilla were blindfolded and randomly threw darts to select a stock portfolio, its long-term returns might not be worse than those of carefully selected portfolios by professional investors.

This theory was originally used to satirize the ineffectiveness of over-analysis in the stock market, but it feels particularly ironic when applied to the cryptocurrency market today.

Primary investors spend a lot of time and energy researching white papers, analyzing project prospects, and even locking up for a year to seek high returns, but the result may be: it would have been better to just throw darts at Bitcoin.

BTC has risen by 45% over the past year, while their locked tokens have, on average, dropped by 50% or more.

The entire valuation and investment logic of altcoins may need to be reshaped.

Spring Will Not Return

Will the next wave of cryptocurrency altcoin strategies still involve lockups?

VCs enter at low prices, and the lockup mechanism was originally designed to protect early projects from early investors selling off in large quantities, leading to price crashes. However, data from the past year shows that this mechanism has also imposed significant risks on primary investors.

The original post of the chart mentioned that over $40 billion in locked tokens will be unlocked in the future, which means the market may face greater selling pressure. If new tokens continue to be locked at high valuations, investors may again fall into the vicious cycle of "locking up for a year and losing half."

Clearly, the lockup strategy is no longer suitable for the current market environment.

Will primary investment in the cryptocurrency market still be hot? Can the spring of primary investment return? From the current situation, the answer may not be optimistic.

In recent years, the high valuations of altcoins have often been based on market frenzy and liquidity premiums, but as the market matures, investors are beginning to pay more attention to the actual value and liquidity of projects.

The high risks of locked tokens deter primary investors, and more people may choose projects that are more transparent and liquid.

Some emerging trends are already evident: shorter lockup periods, lower valuation multiples, or even directly issuing memes to reduce the bubble in primary investment;

Of course, it is also possible that it is just old wine in new bottles, where the primary logic still exists under the more equitable appearance of meme coins, creating a situation that obscures the presence of primary investment.

For the entire cryptocurrency market, a more transparent mechanism has become particularly important. The lockup mechanism also needs to find a better balance, protecting early projects while not imposing excessive risks on investors.

However, the question arises: if primary investors do not lose, secondary investors do not lose, and retail investors do not lose, then who will lose?

Cryptocurrency tokens do not produce value; they transfer value; if someone profits, someone must incur a loss.

The spring of one group of people is inevitably the winter of another group.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。