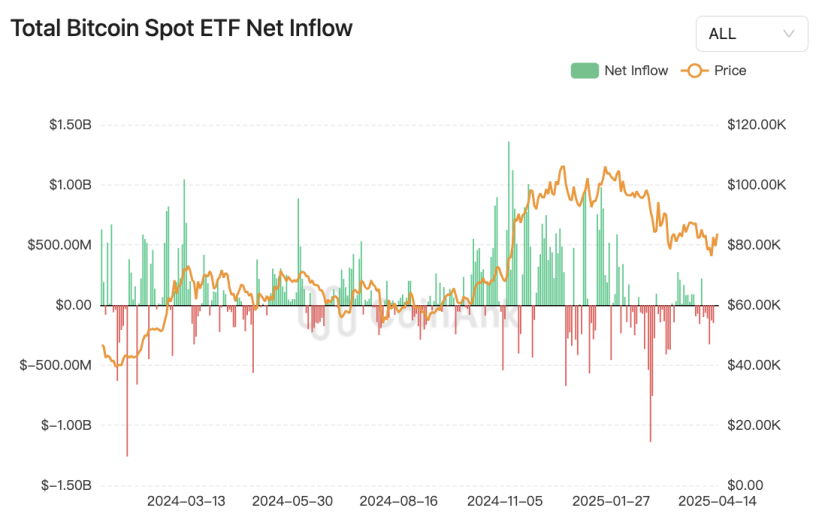

Analysis of the Safe-Haven Logic Behind the Surge in Short-Term U.S. Treasury Yields: BTC ETF Saw Over $800 Million Net Outflow in April, Possibly Setting a Historical Monthly Record!

Macroeconomic Interpretation: As global capital markets tremble under the tariff hammer of the Trump administration, the crypto world is playing out a fascinating drama. A recent survey by Bank of America shows that 82% of fund managers believe the global economy is heading into recession, marking the most pessimistic outlook in 30 years. Amid this pessimism, traditional capital is fleeing U.S. stocks at a record pace—over the past two months, the net reduction in U.S. stock allocations has reached 53 percentage points, the largest drop in history. Interestingly, amidst this "abandoning U.S. stocks for U.S. Treasuries" safe-haven wave, Bitcoin has quietly shown remarkable resilience: the price on March 15 was $85,300, and a month later it was $85,600, with a volatility of only 0.035%, akin to a stabilizing force in turbulent waters.

The market's division is not only reflected in asset allocation. Data from Coinank shows that Bitcoin ETFs experienced over $800 million in outflows in April, seemingly confirming the pessimistic narrative of "institutional flight." However, a closer look reveals that the stablecoin market is bubbling beneath the surface—USDT's market cap is approaching $14.6 billion, and USDC remains firmly at $6 billion. This seemingly contradictory phenomenon actually reveals the sophisticated balancing act of institutional investors: absorbing short-term safe-haven funds through the U.S. Treasury market (for instance, the three-month Treasury yield has risen to 4.225%) while maintaining strategic positions in the crypto ecosystem. When the trade war evolves into a protracted conflict, no one truly wants to exit the market; they merely change their posture while waiting for dawn.

The luster of digital gold shines ever brighter in the annals of history. Over the past 14 years, Bitcoin has achieved a return rate of 7.2 million%, dwarfing the S&P 500's 306% increase. Even when shortening the observation period to two years, Bitcoin's 173% return still outperforms gold's modest performance. More intriguingly, only 24% of Bitcoin's circulating supply is currently in an unrealized loss state, a figure that often signals a halftime break rather than a final whistle during past correction cycles. Bitcoin is shedding the camouflage of a risk asset and gradually donning the golden armor of a safe-haven asset.

The deep structural evolution of the market is providing footnotes for this transformation. Institutional reports indicate that Tether dominates the crypto lending space with a 73% market share, and its $8.2 billion collateralized lending balance has built a solid liquidity moat. The entry of traditional financial giants adds to the drama—Cantor Fitzgerald, linked to the U.S. Secretary of Commerce, has entered the market with $2 billion, seemingly planting Wall Street's flag in the crypto world. Meanwhile, the "Bitcoin Strategic Reserve" plan being brewed by the Trump team adds a geopolitical flavor to this asset revolution. The remarks of its advisor, Bo Hines, are thought-provoking: while global central banks scramble for gold, we choose to hoard the digital hard currency of the 21st century.

The smoke of the semiconductor war may provide new annotations to the crypto narrative. The U.S. Department of Commerce's national security investigation into chips and downstream products unexpectedly reveals a new dimension in the battle for computing power. When the fundamental components of silicon-based civilization become bargaining chips in the trade war, the hash rate defense of the Bitcoin network may gain more strategic consideration—after all, those who control computing power can wield influence in the blockchain world.

Bitcoin is undergoing an unprecedented identity reconstruction. It serves as a volatility ballast in institutional asset allocation, a digital chip in geopolitical games, and a proof of computing power in technological revolutions. As traditional markets cycle through the Möbius strip of "recession expectations-policy games," the crypto ecosystem has quietly woven a multidimensional value network. When the storm arrives, the best safe haven is often built in unexpected places. This time, however, the bricks and tiles of the safe haven are forged from hash algorithms, and its coordinates are hidden within the immutable distributed ledger of the blockchain.

BTC Data Analysis:

Data from Coinank shows that Bitcoin spot ETFs listed in the U.S. have seen a cumulative outflow of over $800 million since April, possibly setting a historical second-highest monthly outflow. During the same period, U.S. Treasury auctions have been met with enthusiastic responses, with the three-month Treasury yield rising to 4.225%. Institutions continue to increase their holdings of short-term U.S. Treasuries as a hedge against the market uncertainties brought about by Trump's tariff policies.

We believe that the significant net outflow from Bitcoin spot ETFs in April stands in stark contrast to the rising safe-haven demand reflected in short-term Treasury yields, indicating that the crypto market is facing various structural shocks under macroeconomic uncertainty:

Reconstruction of Risk Appetite and Liquidity Drain: The market turmoil triggered by Trump's tariff policies (such as the simultaneous decline of U.S. stocks and Treasuries, and the Treasury sell-off) has forced institutional investors to reassess the stability of their asset allocations. The rise in three-month Treasury yields reflects a surge in short-term safe-haven demand, while the outflow from Bitcoin ETFs indicates a temporary failure of its "digital gold" narrative, with traditional safe-haven tools exhibiting significant siphoning effects. Notably, although long-term U.S. Treasury securities (like the 30-year bond) have seen yields soar due to sell-offs, short-term Treasuries have become the preferred choice for institutions due to their liquidity advantage, relegating crypto assets to a source of liquidity supplementation in this process.

Divergence of Institutional Strategies and Cost Optimization: The Bitcoin ETF shows characteristics of capital migration: Grayscale's mini trust (BTC) is attracting funds against the trend, while the flagship product GBTC continues to see outflows, reflecting institutions optimizing their holding costs through low-fee tools (0.15% vs 1.5%). This divergence indicates that core allocation funds have not completely exited, but the withdrawal of short-term arbitrage funds has exacerbated market volatility. On-chain data shows that the proportion of Bitcoin long-term holders (LTH) has risen to 76.3%, providing a buffer against ETF outflows.

Policy Transmission and Market Resilience Testing: The crypto market is undergoing a "de-leveraging" stress test: the scale of ETF fund outflows is equivalent to 2.3 times the average daily miner sell-off, yet Bitcoin's price remains above the critical support level of $75,000, demonstrating the resilience of underlying capital accumulation. However, if Treasury yields continue to rise and pressure risk asset valuations, the crypto market may face further correction pressures. Attention should be paid to the Federal Reserve's interest rate cut expectations (currently a 42% probability for September) and the resonance window for reversing ETF fund flows.

Future Path Projection: If Trump's tariff policies ease or demand for U.S. Treasuries rebounds, institutions may restart their allocations to crypto assets; conversely, if Treasury sell-offs trigger systemic risks, Bitcoin may strengthen its safe-haven attributes in tandem with gold. The current market is in a phase of "policy risk pricing" and "liquidity rebalancing," where short-term volatility may remain high, but the long-term trend towards institutionalization has not reversed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。