Key Points

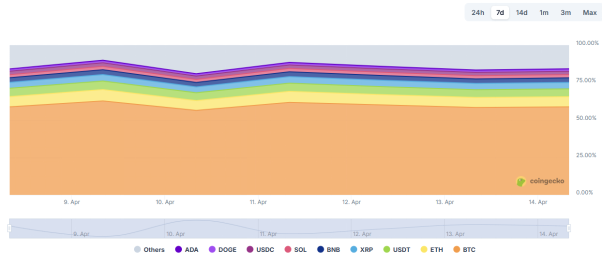

The total market capitalization of global cryptocurrencies is $2.77 trillion, up from $2.6 trillion last week, with a weekly increase of 6.54%. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $35.36 billion, with a net outflow of $713 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.28 billion, with a net outflow of $82.47 million this week.

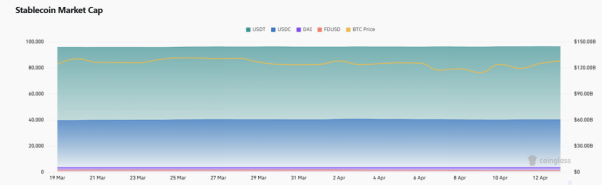

The total market capitalization of stablecoins is $236 billion, with USDT having a market cap of $14.44 billion, accounting for 61.2% of the total stablecoin market cap; followed by USDC with a market cap of $60.1 billion, accounting for 25.5%; and DAI with a market cap of $5.36 billion, accounting for 2.27%.

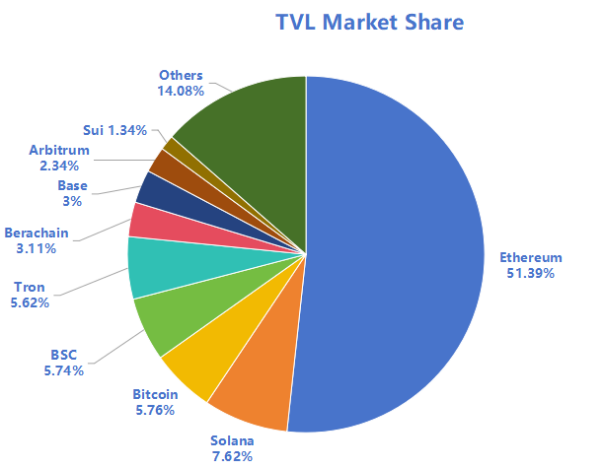

According to DeFiLlama data, the total TVL of DeFi this week is $89.4 billion, down 1.1% from last week. By public chain classification, the top three public chains by TVL are Ethereum with a share of 51.39%; Solana with a share of 7.62%; and Bitcoin with a share of 5.76%.

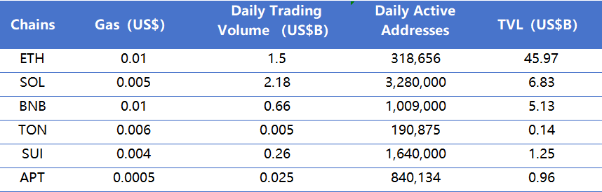

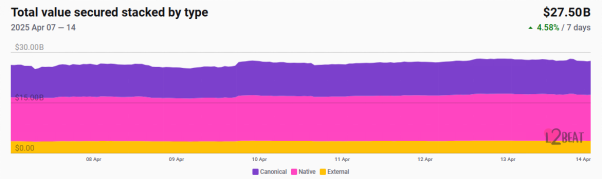

From on-chain data, the daily transaction volume of Layer 1 public chains shows an overall downward trend this week, with Solana and Sui experiencing some growth, where Solana increased by approximately 32% compared to last week; in terms of transaction fees, Ethereum decreased by 50% compared to last week. In terms of daily active addresses, aside from Solana and Binance SmartChain showing some growth, other public chains are on a downward trend, with Binance SmartChain increasing by 15.8% compared to last week. In terms of TVL, the overall change is minimal, with Ethereum decreasing by 3.2% compared to last week. This week, the total TVL of Ethereum Layer 2 is $27.5 billion, up from $26.29 billion last week, with an overall increase of 4.58%.

Innovative projects to watch: QuoteChain: An AI-driven content chain where users can publish any content on Solana, evaluated, quoted, and recognized by AI; Hokko: An NFT trading platform based on the Sui blockchain, supporting the purchase, sale, and exploration of digital collectibles like IkaChanNft, SquidKey, and Rootlet; LEO.FUN: A meme perpetual contract platform where traders can earn trust points through profitable trades, unlocking leverage of up to 300 times. Additionally, traders can also earn commissions.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Ratio

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Ratios

5. Decentralized Finance (DeFi)

7. Stablecoin Market Cap and Issuance Status

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Weekly Increase

1. Major Industry Events This Week

2. Major Events Happening Next Week

3. Important Investment and Financing from Last Week

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Ratio

The total market capitalization of global cryptocurrencies is $2.77 trillion, up from $2.6 trillion last week, with a weekly increase of 6.54%.

Data Source: cryptorank

As of the time of writing, the market cap of Bitcoin is $1.68 trillion, accounting for 60.58% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $236 billion, accounting for 8.49% of the total cryptocurrency market cap.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is 31, indicating fear.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $35.36 billion, with a net outflow of $713 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.28 billion, with a net outflow of $82.47 million this week.

Data Source: sosovalue

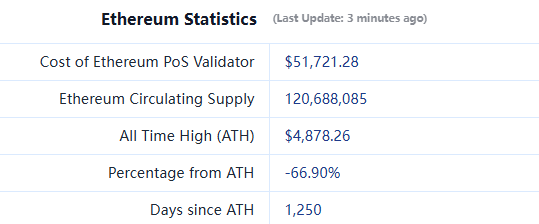

4. ETH/BTC and ETH/USD Exchange Ratios

ETHUSD: Current price $1,617, historical highest price $4,878, down approximately 66.9% from the highest price.

ETHBTC: Currently at 0.019155, historical highest at 0.1238.

Data Source: ratiogang

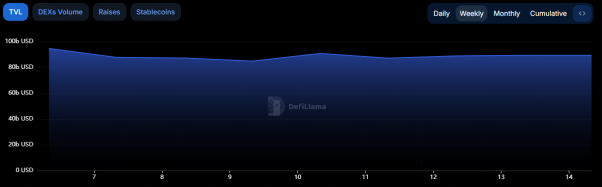

5. Decentralized Finance (DeFi)

According to DeFiLlama data, the total TVL of DeFi this week is $89.4 billion, down 1.1% from last week.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum with a share of 51.39%; Solana with a share of 7.62%; and Bitcoin with a share of 5.76%.

Data Source: CoinW Research Institute, defillama

Data as of April 13, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the daily transaction volume, daily active addresses, and transaction fees of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of April 13, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, the daily transaction volume shows an overall downward trend, with Solana and Sui experiencing some growth, where Solana increased by approximately 32% compared to last week; in terms of transaction fees, Ethereum decreased by 50% compared to last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, aside from Solana and Binance SmartChain showing some growth, other public chains are on a downward trend, with Binance SmartChain increasing by 15.8% compared to last week. In terms of TVL, the overall change is minimal, with Ethereum decreasing by 3.2% compared to last week.

Layer 2 Related Data

● According to L2Beat data, the total TVL of Ethereum Layer 2 is $27.5 billion, up from $26.29 billion last week, with an overall increase of 4.58%.

Data Source: L2Beat

Data as of April 13, 2025

● Arbitrum and Base occupy the top positions with market shares of 33.51% and 31.5%, respectively, with overall market share remaining stable.

Data Source: footprint

Data as of April 13, 2025

7. Stablecoin Market Cap and Issuance Status

According to Coinglass data, the total market cap of stablecoins is $236 billion. Among them, USDT has a market cap of $144.4 billion, accounting for 61.2% of the total stablecoin market cap; followed by USDC with a market cap of $60.1 billion, accounting for 25.5%; and DAI with a market cap of $5.36 billion, accounting for 2.27%.

Data Source: CoinW Research Institute, Coinglass

Data as of April 13, 2025

According to Whale Alert data, this week the USDC Treasury issued a total of 250 million USDC, and the Tether Treasury issued a total of 1 billion USDT, with a total stablecoin issuance of 1.25 billion this week, down from 1.902 billion last week, representing a decrease of approximately 34.3% in stablecoin issuance.

Data Source: Whale Alert

Data as of April 13, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Weekly Increase

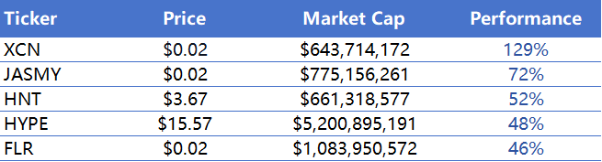

The top five VC coins with the highest increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of April 13, 2025

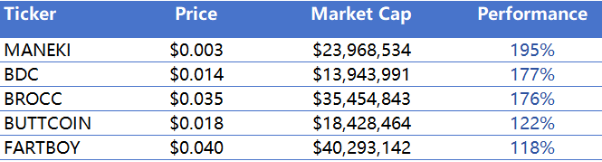

The top five Meme coins with the highest increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of April 13, 2025

2. New Project Insights

QuoteChain: An AI-driven content chain where users can publish any content on Solana, which will be evaluated, quoted, and recognized by AI.

Hokko: An NFT trading platform based on the Sui blockchain. It supports the purchase, sale, and exploration of digital collectibles such as IkaChanNft, SquidKey, and Rootlet.

LEO.FUN: A meme perpetual contract platform where traders can earn trust points through profitable trades, unlocking leverage of up to 300 times. Additionally, traders can earn commissions.

III. Industry News

1. Major Industry Events This Week

Sky, formerly known as MakerDAO, has a sub-DAO in its ecosystem called Spark. It launched the Spark Rewards program, which will initially distribute $6 million in RED in collaboration with RedStone. The first event will be conducted in partnership with the oracle provider RedStone. Participants in the RED Season program will provide cbBTC (a wrapped version of Bitcoin created by Coinbase) to the SparkLend smart contract on the Ethereum mainnet in exchange for RedStone's RED tokens. Approximately 11.5 million RED tokens, valued at about $6 million, are expected to be distributed in this event.

Mind Network has opened airdrop claims and announced its token economic model, with 7.5% of the total supply allocated for the TGE airdrop. The airdrop claim period is 30 days, with a total token supply of 1,000,000,000 tokens, of which 24.9% is in initial circulation, and the total airdrop allocation is 75,000,000 FHE (7.5% of the total supply). Additionally, Mind Network has opened FHE staking functionality.

Curve founder has extended the lock-up period for his veCRV holdings to 4 years. Curve founder Michael Egorov stated that he has once again extended the lock-up period for his veCRV holdings to 4 years and publicly disclosed the specific transaction for the extension.

Ethereum co-founder Vitalik Buterin shared a simplified privacy roadmap for Ethereum L1. This includes ideas for practically improving user privacy on Ethereum without changing its consensus, focusing on four types of privacy: on-chain payment privacy, partial anonymization of on-chain activities within applications, on-chain reading privacy, and network anonymity.

The RWA protocol Paimon Finance has partnered with venture capital firm UGF to tokenize its equity positions in SpaceX and Figure AI. The collaboration will enable UGF's venture portfolio to be tokenized, starting with shares in SpaceX and Figure AI. Paimon's platform will convert UGF's equity positions into blockchain-based tokens, allowing for partial ownership and secondary trading. Paimon Finance aims to bring tokenized real assets into DeFi, providing institutional-grade RWAs such as private credit, venture equity, and aircraft leasing.

2. Major Upcoming Events Next Week

KernelDAO announced that the KERNEL token will undergo TGE on April 14. KernelDAO is a comprehensive multi-chain re-staking ecosystem focused on providing re-staking solutions for various mainstream crypto assets such as ETH, BTC, and BNB. Through its three core products, Kelp, Kernel, and Gain, KernelDAO offers users a solution to "maximize returns while maintaining asset liquidity."

The Genesis license sale for the decentralized, scalable AI chain Matchain will begin on April 14, offering 100,000 utility-focused licenses tied to the platform's self-sovereign identity system MatchID.

The airdrop claim deadline for the Solana-based liquid staking protocol Sanctum is April 14, 2025. Sanctum allows users who stake SOL natively or use liquid staking tokens (LST) to leverage a powerful unified liquidity layer.

The consumer-grade public chain Morph is launching a Black NFT staking user rights upgrade program, with free minting of Platinum SBT available on April 21. Morph will allow users who complete staking before the snapshot time to qualify for free minting of Platinum SBT. Each staked Black NFT can be exchanged for one free minting opportunity. This minting event does not include physical cards, but users holding Platinum SBT will enjoy the same rights, including eligibility for the Morpho TGE airdrop. Key timelines are as follows: staking deadline is April 20, snapshot time is April 21, and open minting time is April 21.

3. Important Investment and Financing from Last Week

Hidden Road raised $1.25 billion, with investors including Ripple, and previously received investments from Castle Island, Coinbase Ventures, Wintermute, and others. Hidden Road is a global credit network for institutional investors. Its quantitative-driven platform provides real-time risk management and seamless credit services across platforms, products, and asset classes. The company offers prime brokerage, clearing, and financing services for traditional and digital assets. (April 8, 2025)

Blackbird raised $50 million, with investors including Spark Capital, Andreessen Horowitz, Coinbase, and others. Blackbird is a Web3 loyalty and payment company focused on leveraging the direct connection between restaurants and customers. Blackbird provides restaurants with a fully customizable loyalty program platform and a consumer application designed to make every customer feel like a true VIP, no matter where they dine. (April 8, 2025)

Meanwhile raised $40 million, with investors including Framework Ventures, Fulgur Ventures, and Wences Casares. Meanwhile is a life insurance company that allows cryptocurrency payments for premiums and claims, with its core financial products priced in Bitcoin. Amongrous's AI system enables users to easily apply for BTC life insurance policies, providing a tax-advantaged way to activate part of the insured's Bitcoin. (April 10, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。