China Raises Tariffs on the U.S. to 125%! Will U.S. Stocks React Again in Tandem with BTC?

Macroeconomic Interpretation: The smoke of Sino-U.S. trade friction once again envelops the global financial market. On April 10, the Tariff Commission of the State Council announced an increase in the tariff rate on imported goods originating from the U.S. from 84% to 125%. This "nuclear-level" countermeasure may still have an impact after the U.S. stock market opens in the evening. The S&P 500 index fell close to the 7% circuit breaker line the next day, marking the largest single-day volatility since March 2020. Dramatically, the annualized volatility of the S&P 500 soared to 169%, exhibiting a volatility surge twice that of Bitcoin (83%), showcasing a "volatility explosion" in traditional financial markets.

In this capital market battle, every action in the Trump administration's policy toolbox pulls at investors' nerves. Economists point out that the massive budget bill passed by the House of Representatives is pushing the debt ceiling to historical highs, a fiscal policy akin to "buying rockets with a credit card," laying the groundwork for unlimited quantitative easing. More intriguingly, just hours before announcing the suspension of tariffs, Trump tweeted a mysterious message using the abbreviation "DJT," causing the stock price of his media company to surge 22% in a single day. This operation, reminiscent of a plot from "House of Cards," sparked intense debate in Congress over insider trading.

The crypto market presents a unique landscape amid the policy storm. Bitcoin's price has been on a roller coaster, plummeting to $78,464 after breaking through the $82,000 high, completing an extreme move from peak to trough within 24 hours. Ethereum, too, faced a battle at the $1,500 mark due to whale sell-offs and the sUSD decoupling event. Data shows that the market's fear index remains high, and the construction of an options moat reflects investors' deep vigilance against black swan events.

Breakthrough developments at the policy level inject a strong dose of confidence into the crypto industry. Trump signed the first U.S. cryptocurrency bill, abolishing the IRS's tax reporting requirements for DeFi platforms, a "regulatory easing" move that has decentralized finance practitioners cheering, "Spring has come." Republican Senator Cruz called it a "victory for innovation freedom," while Grayscale timely released an expansion list covering 26 digital assets, from APT to TON, from AI projects to storage protocols, reflecting the industry's evolutionary expansion.

In this global capital migration, Bitcoin is showcasing its unique strategic value. As the 10-year U.S. Treasury yield soared to 4.45% and the dollar index fell below the 100 mark, the store of value attribute of digital gold began to shine. However, some institutions warn that the market's "bullish impulse" regarding an economic recession may be overly hasty—historical data shows that Bitcoin often faces sell-offs after the Fed's first rate cut, a "policy sweet trap" worth being cautious about.

The current market is undergoing a triple transformation: the "de-dollarization" demand driven by geopolitical games, institutional arbitrage triggered by regulatory framework reconstruction, and the quantitative accumulation of Web3 infrastructure. Data from the options market may best illustrate the issue—BTC implied volatility remains stable at 50%, while ETH's short- to medium-term IV stays high at 80%. This volatility canyon phenomenon suggests that smart money is deploying more flexible hedging strategies within the Ethereum ecosystem.

As traditional financial markets tremble under the shadow of tariffs, the crypto world is demonstrating its survival wisdom. Now, buying stocks requires referencing the president's Twitter, while buying Bitcoin only requires monitoring on-chain data. Behind this jest lies a deep recognition of decentralized value. Although the road ahead is still fraught with policy landmines and market reefs, the resilience exhibited by crypto assets may be writing a new narrative of wealth in the digital age.

Industry Hotspot Analysis:

U.S. crypto regulation has reached a landmark turning point, as Trump today officially signed a bill abolishing the IRS's regulatory rules for DeFi, marking the first specialized cryptocurrency legislation in U.S. history, which is of great significance. This rule originated from the "DeFi Broker Rule" proposed by the Biden administration in 2024, requiring DeFi platforms without centralized operating entities to fulfill the same tax reporting obligations as traditional financial institutions, needing to submit 1099 tax forms for users.

We believe this repeal bill demonstrates a rare consensus between the two parties. The proposal initiated by Republican Senator Cruz passed the Senate with an overwhelming vote of 70:28, and the House version also received bipartisan support, reflecting concerns in U.S. politics that excessive regulation may stifle Web3 innovation. Notably, the legislative body directly halted the regulatory policies of the executive branch through the special procedure of the "Congressional Review Act," highlighting the structural shift in the discourse power of crypto regulation.

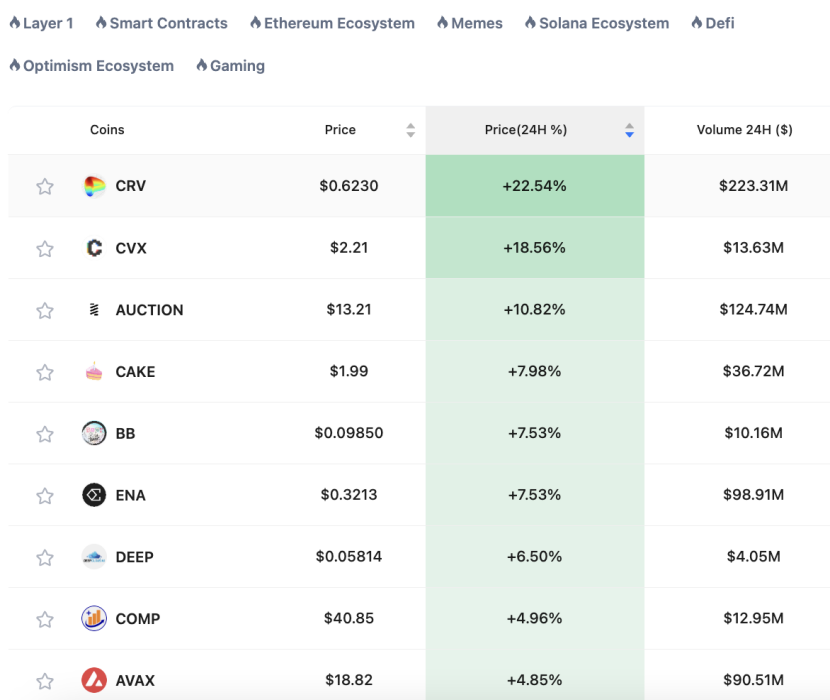

According to Coinank data, the market responded immediately, with the DeFi concept sector experiencing a broad rally. CRV, CVX, AUCTION, CAKE, BB, and ENA led the gains, with CRV surging over 18% shortly after the bill's signing, breaking through the key price level of $0.6. Investors should pay attention to trading opportunities in these strong coins throughout the day. This reflects a positive expectation from capital regarding regulatory easing, as the removal of tax reporting obligations may lower the compliance costs for DeFi protocols, attracting more liquidity back to the on-chain ecosystem. However, caution is warranted regarding the long-term impact of policy shifts; while a relaxed regulatory environment may benefit short-term development, it could also delay the industry's compliance process, laying the groundwork for subsequent systemic risks.

This legislative breakthrough marks a shift in U.S. crypto regulation from "defensive regulation" to "strategic support," creating experimental space for decentralized finance through institutional innovation. This policy shift may reshape the global crypto industry landscape, allowing the U.S. to regain initiative in the Web3 technology competition while also providing an important reference case for regulatory framework design in other countries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。