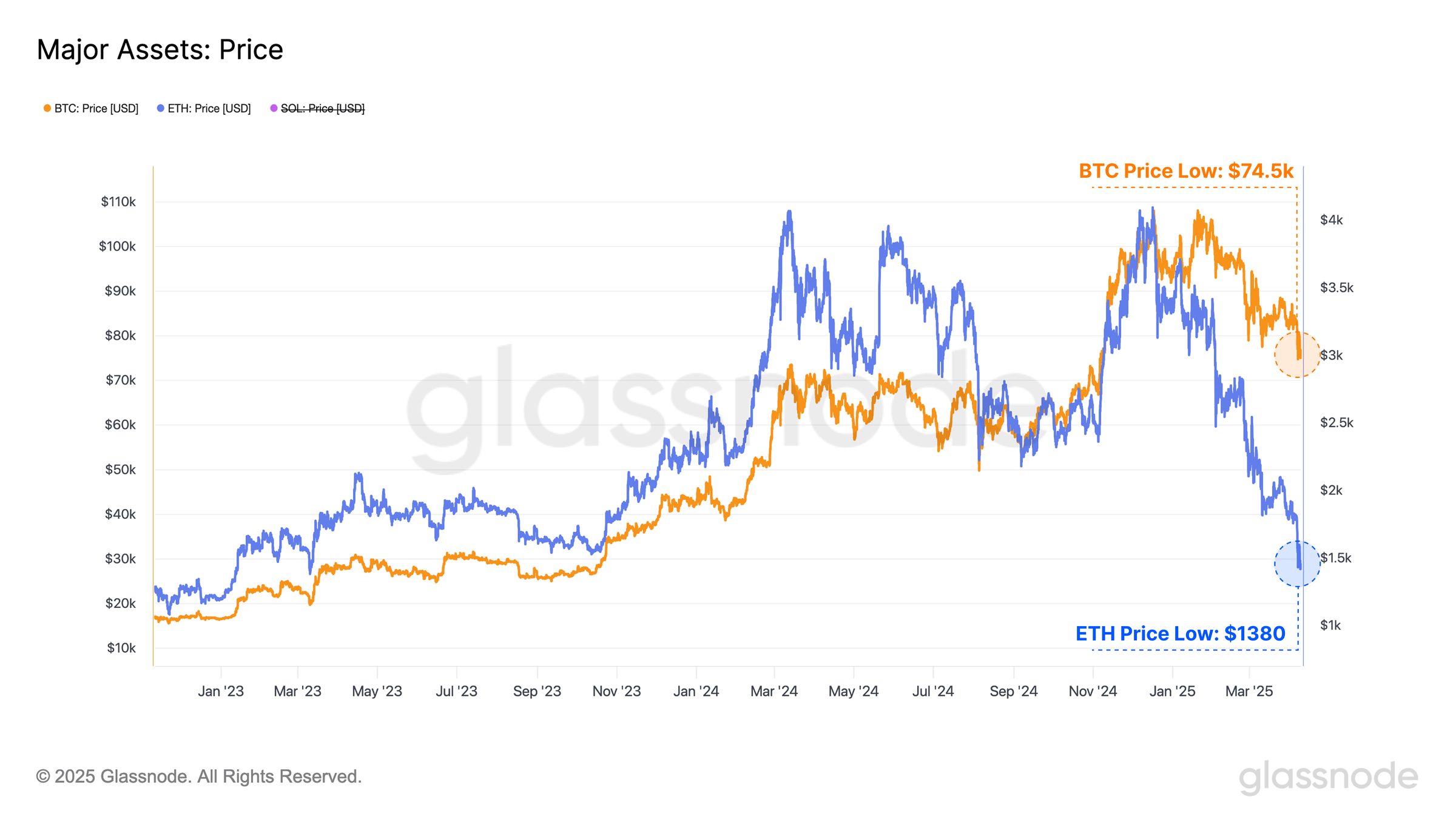

Global financial markets faced steep declines last week following U.S. President Donald Trump’s “Liberation Day” tariff announcement, with digital assets absorbing significant losses, according to a report by blockchain analytics firm Glassnode. Researchers UkuriaOC and Cryptovizart noted the tariffs—paired with a weaker U.S. dollar and fiscal tightening—catalyzed a liquidity crunch, driving bitcoin ( BTC) to $74,500 and ethereum ( ETH) to $1,380, their lowest levels since early 2023.

The report highlighted a near-halt in capital inflows to major digital assets, with bitcoin’s monthly net inflows collapsing from $100 billion to $6 billion. Ethereum fared worse, reversing from $15.5 billion in inflows to a $6 billion outflow. Glassnode tied this to bear fatigue, as loss-taking events diminished during successive price drops, suggesting short-term capitulation may be peaking.

“Loss-taking events across bitcoin and ethereum appear to be reducing in scale with each price leg lower, suggesting investors may be approaching a degree of near-term seller exhaustion,” Glassnode’s executive summary states.

Glassnode researchers detail that bitcoin’s realized capitalization—tracking net capital absorbed—surged 117% to $870 billion since November 2022, far outpacing ethereum’s 32% growth to $244 billion. Analysts emphasized this disparity underscores ethereum’s weaker cycle performance, with its market value-to-realized-value (MVRV) ratio sinking below 1.0 in March, signaling widespread unrealized losses.

Bitcoin’s MVRV remained above 1.0, reflecting comparatively resilient investor profitability. Ethereum’s struggles were further evident in its ratio against bitcoin, which plummeted 75% to 0.0196 since September 2022—the lowest since January 2020. Glassnode called this sustained underperformance “atypical” in bull markets, noting no prolonged ETH outperformance phases occurred in this cycle.

The altcoin sector, Glassnode’s report shows, faced a 40% contraction since December 2024, erasing $417 billion in value. Losses were broad-based, with even bitcoin posting negative three-month returns. Glassnode observed $240 million in bitcoin and $564 million in ethereum losses during peak sell-offs, though the scale has since tapered.

Technical and onchain models identified the $65,000-$71,000 zone as critical for bitcoin. A sustained break below this range—aligning with the Active Realized Price ($71,000) and True Market Mean ($65,000)—could force a “super-majority” of investors underwater, risking sentiment-driven sell-offs. Glassnode stressed that reclaiming $93,000 is essential to restarting upward momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。