黑石和富达引领比特币ETF反弹

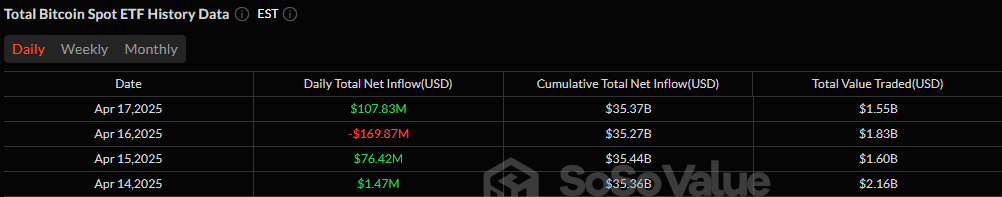

在损失1.7亿美元的前一天,比特币ETF再次找到了立足点,迎来了107.83百万美元的强劲流入,这对寻求在波动市场中稳定的多头来说是一个令人鼓舞的信号。12只美国现货比特币ETF中只有3只出现了任何变动,但这几只却承担了大部分的流入。

黑石的IBIT主导了这一行动,新增资本达8096万美元。富达的FBTC紧随其后,流入2590万美元,显示出在经历了中周的剧烈流出后,市场重新燃起了兴趣。最后,Hashdex的DEFI ETF也罕见地增加了965.51千美元的资金。

来源:Sosovalue

其余的ETF群体则保持静止,没有任何流入或流出活动。总交易量达到了15.5亿美元,到本交易结束时,比特币ETF的总净资产上升至945.1亿美元。

在以太坊方面,今天则是一片平静。所有9只美国现货以太坊ETF均记录为零净流动,没有流入,也没有流出。尽管在连续7天的损失后,缺乏红色可能看起来是一种解脱,但这也反映了以太坊投资者的观望情绪。

随着这一周的结束,市场参与者密切关注资本流动。目前,比特币显示出韧性迹象,但以太坊仍然徘徊在中立状态。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。