Perhaps we are in a transitional phase, and a deeper, more unified cycle has yet to arrive.

Author: napkin

Translation: Deep Tide TechFlow

In 2021, the market's reflexivity was primarily driven by several mainstream narratives (such as DeFi and NFTs) and abundant liquidity.

However, to this day, the market exhibits obvious fragmentation characteristics.

Why does this cycle have breadth but no depth?

It has been a while since I wrote something here, but I want to take advantage of the arrival of 2025 to simply share some recent thoughts, as an update from an ordinary market enthusiast.

That said, this content does not constitute any investment advice. In this "casino clown world" we call cryptocurrency, please be sure to conduct your own due diligence and in-depth research before investing.

Preface

As we continue to explore this cycle, one thing is clear: it is completely different from the market in 2021. At that time, market reflexivity was driven by a few mainstream narratives and abundant liquidity, creating strong upward momentum. Now, the market is fragmented into multiple small narratives, with new hot coins and concepts emerging daily, but liquidity has been diluted to the extreme. Reflexivity still exists, but its influence is dispersed across countless tokens and narratives, leading to a market that is "broad but not deep": many assets are slightly rising, but few can sustain an upward trend.

In this article, we will explore how reflexivity manifests in this new environment, analyze why liquidity has become the "invisible killer" of this cycle, and discuss my market positioning at this stage.

What stage is this cycle in?

I tend to believe we are on the edge of the bottom, or have already hit the bottom (of course, this is just to comfort my holdings). Almost every sector has experienced a significant pullback this year, with the AI and Memes sectors being the hardest hit, down 80%-90%.

By now, you may have felt the market's fragmentation and thin liquidity in your daily pursuit of narratives and searching for the "next hot coin." Since the beginning of this bull market (although most people prefer to set the starting point at the days after the FTX incident in November 2022 or January 2023, I tend to view January 2024 as the beginning of a new paradigm), we have witnessed an explosive growth of narratives beyond BTC, ETH, and DeFi.

Animal Themes

As the progenitor of meta-narratives, "animal coins" remain active. Although Dogecoin and Catcoin should have their own categories, as they have spawned countless subcategories, sub-subcategories, and even sub-sub-subcategories.

Real World Assets (RWA)

This is a favorite in traditional finance (TradFi), cleverly packaged as "fundamental" trading rather than mere imitation hype. Representative projects include: $ONDO, $PRCL, $CPOOL, etc.

AI (Intelligent Agents)

In the first half of 2024, the AI narrative mainly revolved around projects like $RNDR, $NEAR, $FET, $AGIX, etc. Subsequently, "truth terminals" emerged, and now the AI narrative has almost completely shifted to intelligent agents and their frameworks. Representative projects include: $VIRTUAL, $ARC, $AIXBT, $AI16Z, $pippin, $AVA, etc.

DeFAI (Decentralized AI)

This is a small branch within AI but has developed into a large independent category. Now, intelligent agents can perform DeFi tasks and have formed their own subcategories. Representative projects include: $GRIFFAIN, $ANON, $GRIFT, $BUZZ, etc.

Presidential Themes

This category needs little explanation. Representative projects include: $TRUMP, $MELANIA, $BARRON, $KAI, etc.

Web2 Founders Narrative

If you are often active on Crypto Twitter (CT), you have definitely seen this narrative. Web2 founders embark on a "redemption journey" in the crypto space. Representative projects include: $VINE, $JELLY, etc.

The narratives still in the spotlight are just the tip of the iceberg. But you may have forgotten that just a few months ago, we also experienced narratives like "hat coins" (wifhats), celebrity coins, zoo themes, cute animal coins, "euthanasia animal coins," quant coins, baby coins, elderly coins, young coins, TikTok coins, and so on. These narratives keep emerging, and the list continues to grow.

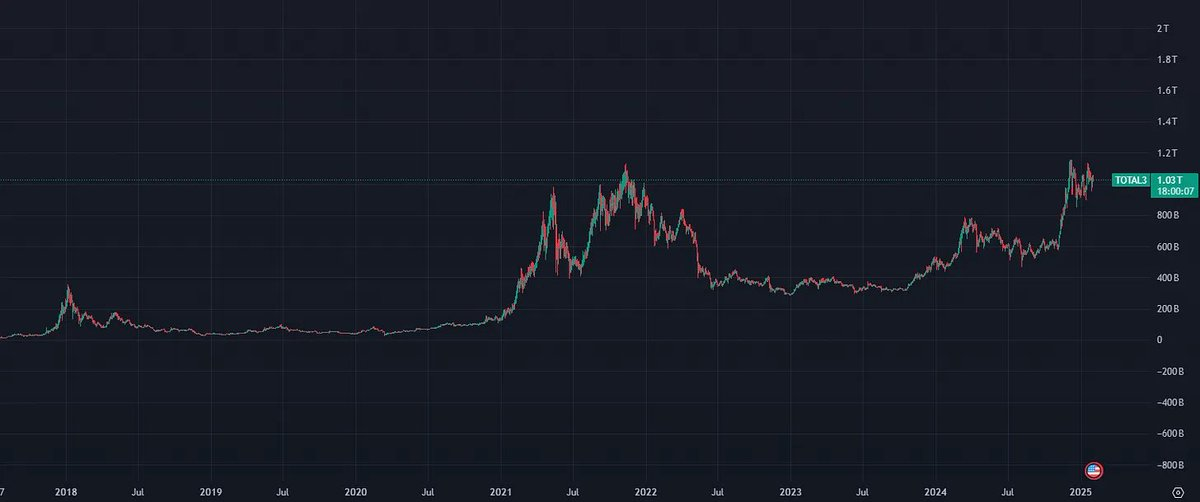

From a broader perspective, we can focus on several key indicators: TOTAL3, BTC.D, and stablecoin supply.

TOTAL3

TOTAL3 refers to the total market capitalization of the crypto market (excluding BTC and ETH), which essentially reflects the total value of all altcoins, stablecoins, and meme coins. Currently, this indicator is close to the peak in November 2021.

BTC.D

BTC.D represents Bitcoin's market share, currently stabilizing at 58%, down from 61% in November 2024.

From November 2024 to January 2025, the market has experienced a "altcoin season" primarily driven by on-chain activity, especially around AI and meme coins. During this period, BTC.D decreased, while TOTAL3 surged significantly, and the stablecoin supply also increased, currently nearing $215 billion.

Reflexivity in Past Cycles

George Soros defined reflexivity as a theory that the positive feedback loop between expectations and economic fundamentals can lead to price trends significantly and persistently deviating from the equilibrium price. This phenomenon is often described as "prices drive narratives, rather than narratives driving prices."

The crypto market provides a perfect environment for reflexivity:

Lack of a clear valuation framework: Completely reliant on pure speculation;

Low liquidity: Market funds are relatively thin;

Attention economy: Collective hype from opinion leaders (KOLs) on Crypto Twitter (CT), TikTok, and Telegram groups.

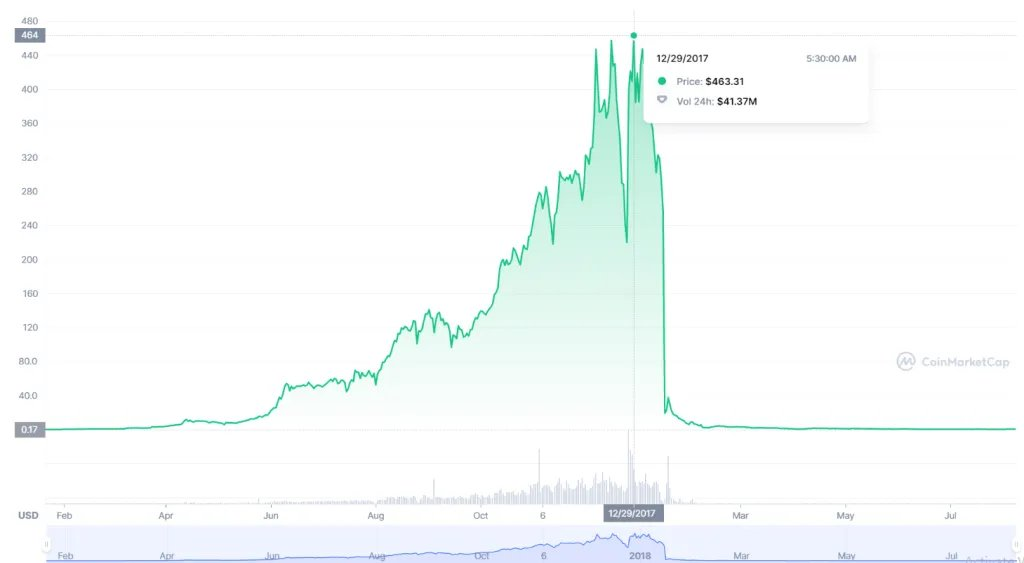

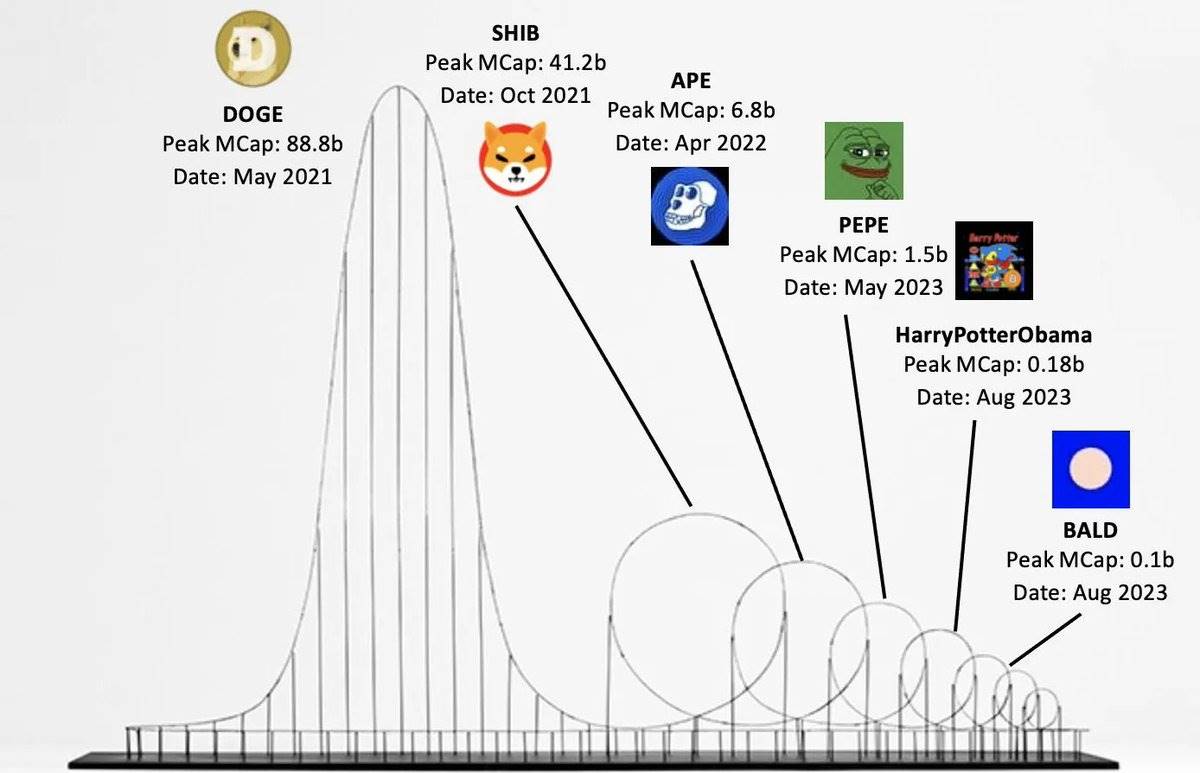

The ICO boom emerged in 2017; 2020 was the year of DeFi yield farming; and in 2021, meme coins and NFTs made their debut. From January to May 2021, Dogecoin ($DOGE) achieved nearly a 200-fold increase.

Dogecoin is a perfect case to showcase the reflexivity of the crypto market and the overall changes from the past to the present. It has no fundamental valuation framework but became the pioneer of what we now call "meme coins."

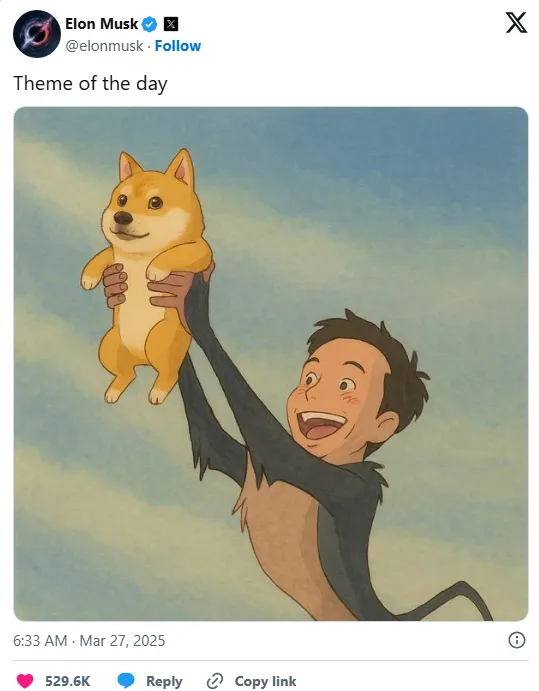

High-profile support, especially from public figures like Elon Musk, ignited a self-reinforcing feedback loop.

Although the liquidity of stablecoins at that time was comparable to current levels, the flow of funds was directed to fewer outlets, creating a "crowded theater" effect—capital and speculative behavior were highly concentrated in Dogecoin. Additionally, the novelty of the market and retail-driven frenzy, combined with stimulus checks during the pandemic and boredom from lockdowns, further lowered the market's skepticism, allowing meme culture to dominate.

Most impressively, all of this was almost entirely driven by retail spot demand rather than leveraged derivatives. When Dogecoin's price peaked, the open interest (OI) was only about $60 million; today, the price is only half of its historical high, but the open interest has exceeded $1.5 billion.

Current Reflexivity

The crypto market in 2024 breaks past trends, with Bitcoin remaining strong while most altcoins struggle to gain traction.

The market seems to be suffering from "Attention Deficit Hyperactivity Disorder" (ADHD), with investors jumping from one shiny new narrative to another, making it difficult for any single trend to gain sustained momentum.

Although today's stablecoin liquidity is comparable to that of 2021, the reflexivity effect has been diluted, making it hard to maintain amidst numerous narratives. These narratives include artificial intelligence (AI), decentralized physical infrastructure (DePIN), real-world assets (RWAs), and over 100 meme coins. The main reasons for the weakening of reflexivity are as follows:

Fragmentation of capital: Funds are dispersed across hundreds of low-market-cap tokens, weakening the strength of the reflexivity feedback loop.

Saturation of leverage: An increasing number of traders are using perpetual contracts (perps), making open interest (OI) a key indicator.

Increased risk awareness: The market trauma of 2022 (such as the LUNA collapse and the FTX incident) has made investors more wary of the hype surrounding "dumb money."

The ultimate fate of most new tokens or narratives resembles the price chart of Bitconnect, experiencing a brief frenzy before rapidly collapsing.

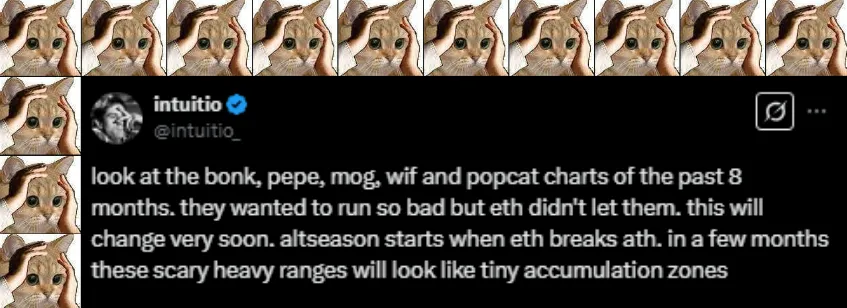

The traditional notion of "altcoin season" seems elusive in the current market.

The strong trend of funds rotating from Bitcoin (BTC) to altcoins has not played out as expected.

@intuitio_ points out that, unlike previous market cycles, this time the performance of Ethereum and other altcoins has significantly lagged… (Yes, Ethereum has never broken its all-time high).

Today's market structure is characterized more by breadth: many tokens have experienced brief, slight increases, but market confidence in any single token appears shallow and lacking depth.

To illustrate the degree of market fragmentation, we can look at the situation at the end of 2024: Bitcoin's dominance rose to levels not seen since early 2021. By January 2025, Bitcoin's dominance reached 65%. All of this occurred while the total market capitalization of the crypto market continued to grow, indicating that the performance of other tokens was comprehensively lagging.

Although there are many tokens in the market with some activity, few can sustain enough momentum to outperform Bitcoin. In fact, the Altcoin Season Index remained in the "Bitcoin Season" range for most of 2024.

Attention Economics

In the current crypto market cycle, "attention" has become the most sought-after asset. Fundamental analysis and traditional tokenomics have taken a backseat, replaced by memes, viral moments, and reflexive speculation.

This phenomenon is referred to as "Attentionomics," where the value of many tokens relies more on attracting attention than on their underlying value.

In a market fragmented by thousands of tokens, human attention is the only truly scarce resource. Projects that successfully attract attention often see their price performance rise accordingly.

As @redphonecrypto states:

"In Attentionomics, a token's ability to attract attention is more important than any other metric. The stronger the ability to attract attention, the greater the potential for price appreciation. This ability can be assessed through some very real and identifiable factors."

Attention Flywheel

In today's social media-driven crypto market, "Attentionomics" can be summarized as a self-reinforcing "attention flywheel." This cycle typically follows a similar process:

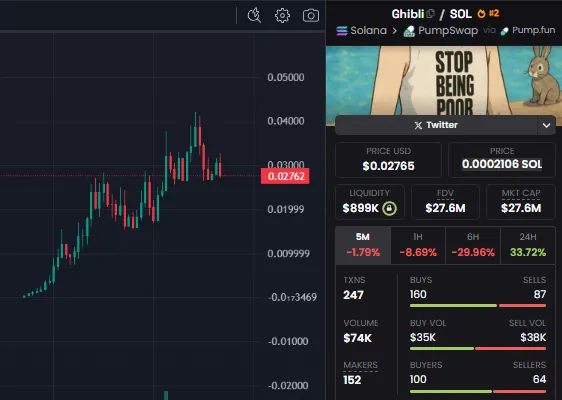

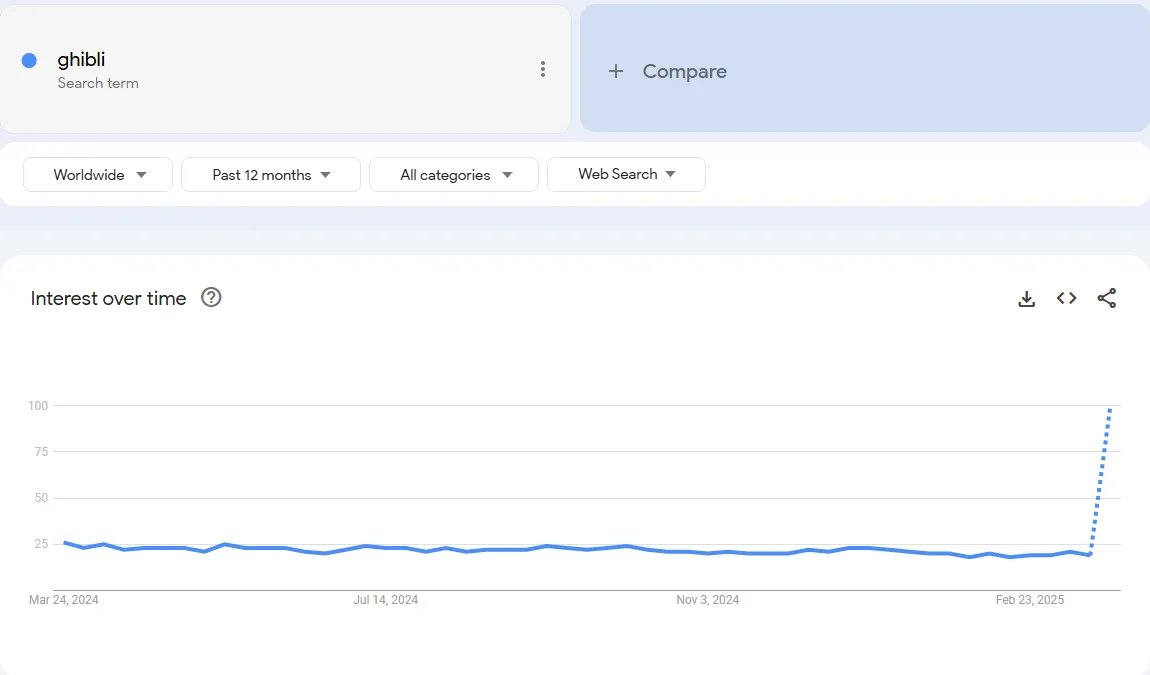

Viral Catalyst: A meme or event sparks new narratives and curiosity, prompting someone to mint a token. For example, "Ghiblification" is a classic case.

Early speculators flock to the token, causing its price to skyrocket. In the crypto space, price itself is content. Charts showing prices that have increased tenfold within hours begin circulating on social media, generating widespread attention.

The price surge is seen as proof of the meme's "strength," attracting even more attention. Viral posts bring in a larger wave of second-wave buyers who do not want to miss the next "moonshot." Liquidity floods in, further driving up prices, while imitators (Beta tokens) begin to emerge in the market.

This feedback loop—Attention → Price → More Attention—can often unfold rapidly, sometimes completing within just a day after the meme's birth.

Mainstream Expansion: If the frenzy grows to a sufficient scale, it will transcend the confines of the cryptocurrency space. Media coverage, exchange listings, or celebrity endorsements further amplify this dissemination effect, creating value through viral spread.

This reflexive cycle means that attention itself becomes a form of potential energy. As Cobie, a celebrity in the crypto space, puts it:

"People always talk about scarcity in crypto. Whether it's achieving digital scarcity through NFTs or the idea that 'there are 55 million millionaires globally, but only 21 million Bitcoins.' But in reality, the only truly scarce resource in crypto is attention. Capital seeking risk is absolutely not scarce."

Projects or tokens that win the "attention lottery" can easily see explosive growth in market capitalization, a phenomenon that is relatively rare in traditional finance (TradFi).

The Rise of Shitposts: From Jokes to Wealth Codes

Looking back, many of the hottest tokens between 2024 and 2025 were essentially "shitposts with a price feed."

For example, $ROUTINE was born purely for humor (and profit) around a trending topic. Ironically, this blatant "self-deprecation" did not deter investors; rather, it became part of its appeal, aligning perfectly with the ironic humor in crypto culture.

However, attention-driven projects often have short lifespans. To address this, some of the most successful meme projects have begun attempting to give their tokens actual utility or build infrastructure.

But the question is, is this attempt really useful?

Take $PEPE as an example; its team proposed developing a dedicated Pepe Chain and related products, trying to leverage its large community base. By creating a Pepe-themed Layer 2 network or decentralized exchange (DEX), $PEPE holders could have more token use cases beyond just buying and selling. This is a strategy to kickstart a real platform user base through "brand" recognition.

The so-called "utility" of many meme projects often serves as a flimsy excuse after a price surge. Some DEXs or merchandise stores associated with meme brands may exist, but they typically do not significantly enhance the intrinsic value of the tokens. Ultimately, this "utility" is often just a weak packaging of the community's speculative impulses.

In these projects, attention remains the core driving force, while the products play a supporting role.

The Capital Game of Musical Chairs

What happens when attention cannot stay for long? The answer is: traders enter an endless rotation game.

In the crypto market, capital shifts from one sector to another or moves down the risk curve to purchase those "imitators" (Betas). This has become a mainstream strategy.

Since a single narrative rarely yields sustained 10x returns (especially for investors who missed the main wave), the optimal solution is to capture a series of smaller wave gains.

This is precisely how the meme "Euthanasia Coaster" was born.

We have witnessed the practical operation of this phenomenon: after people made a fortune on $ROUTINE, profits quickly shifted to related tokens (like $SARATOGA, another meme token from the same viral video).

This hot money rotation is why we see some strange market cycles, such as all dog-themed meme coins surging together one week, then AI-related tokens the next week, followed by a sudden influx of random funds into established DeFi tokens (because someone says, "Hey, Yearn hasn't surged yet; maybe it's the next target").

This is a fast-paced reflexive game:

See the price rise,

Buy,

Push the price higher,

Then sell before the price turns down.

Round and round, repeat the process.

From Spot to Leverage: A Major Shift in the Market

From 2021 to now, a significant change has occurred in the crypto market—the role of leverage has become increasingly important.

The Dogecoin frenzy of 2021 was primarily driven by spot purchases. Millions of retail investors directly bought DOGE through Robinhood and Coinbase using their pandemic relief funds.

Today, a large portion of the market's momentum comes from derivatives, especially perpetual contracts (Perps) and options trading. Many crypto traders use margin to operate with high leverage on platforms like Binance and Bybit.

When the open interest (OI) is so large, price fluctuations can become extraordinarily volatile.

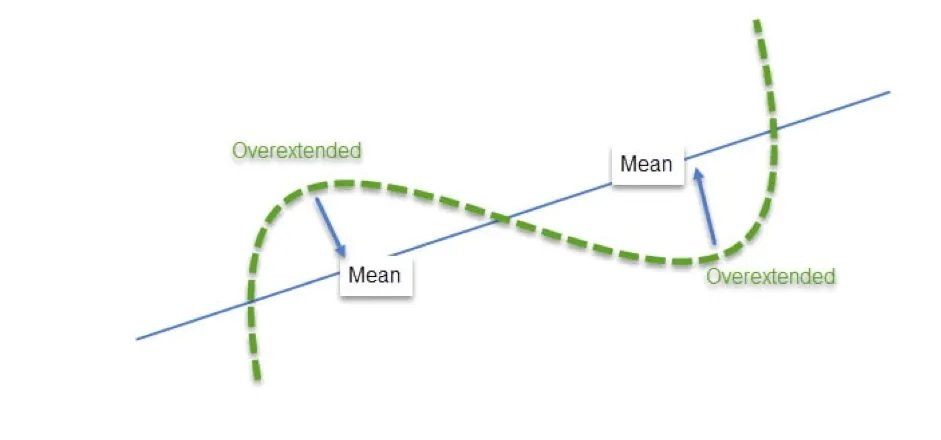

In November 2024, Bitcoin surged from $75,000 to $90,000 in just two days, with multiple short squeezes occurring during that time. This price explosion is a manifestation of the reflexive effect driven by leverage: shorts are forced to close = forced buying = price increase = more shorts being closed, and so on. However, this mechanism is a double-edged sword.

High leverage means high reflexivity, but it is often not healthy or sustainable.

We are beginning to see price fluctuations become more frequent and uncontrollable, far exceeding reasonable ranges. These fluctuations are typically driven by leverage but ultimately revert to the mean, as price increases are not based on stable new capital inflows. A key insight is that open interest can drive prices up, but this does not equate to new capital inflows. Ultimately, it resembles a player-versus-player (PVP) game.

For example, from November to December 2024, total open interest (OI) increased by about $70 billion, but stablecoin supply only grew by $30 billion.

The OI scale in 2024 far exceeds that of 2021, indicating that the reflexivity of this cycle is more mechanical than natural. When tokens surged in 2021, people bought and held with firm conviction. Now, when tokens surge, the more common scenario is traders shouting, "I've already gone long; don't let me get liquidated!" while their fingers hover over the sell button.

Summary

The current crypto market exhibits a cycle characterized by breadth, with many narratives and tokens experiencing bursts in their respective independent small cycles.

Perhaps we are in a transitional phase, with a deeper and more unified cycle yet to come. The foundation laid by institutions (such as ETF approvals, RWA integration, etc.) may ultimately ignite a broader bull market, driving significant capital into the altcoin market, with stablecoins' "dry powder" fully released, BTC.D (Bitcoin Dominance Index) declining, and ushering in a classic "altseason."

On the other hand, market fragmentation may have become the new normal, which could be a sign of the crypto market's increasing maturity. The crypto industry has grown large and diverse, and expecting everyone to flood into the same trade out of fear of missing out (FOMO) may no longer be realistic. The market no longer experiences the scenario of "all tokens rising together" as it did in 2017. Today, to survive in this market, selectivity, flexibility, and skepticism are more important than ever.

Regardless of where the market heads, reflexivity will always exist, albeit in different forms and degrees. The challenge (and opportunity) lies in identifying which feedback loops are merely transient hype and which may evolve into larger trends.

When you think a narrative has ended, it comes back again.

Who would have thought that "Trump meme coins" would become a hot topic? Yet, they have indeed emerged.

When you believe an asset is "too big to fail," it may fall even harder (like ETH continuing to decline from a price of $1,800).

As the market continues to evolve, I will keep in mind the lessons learned from this cycle: stay flexible, but also know when to observe and maintain skepticism towards every narrative.

I admit that "more breadth, less depth" sounds like a complaint, but it also reflects the current state of a market maturing in unpredictable ways. Perhaps in the next phase, market depth will return; or we may further fragment into more small echo chambers. However, for those who are prepared, there will always be opportunities; and for the careless, traps are everywhere.

Reflexivity has not disappeared; it has simply become more complex.

Stay safe, stay sharp, and when your meme coin turns into an apartment, don't forget to guard your freedom. Finally, I would like to conclude this piece with a classic quote from @mgnr_io:

“In subjective trading, the most correct position is often to be flat.

Do nothing. There are five opportunities a year, and there is free money on the ground,

Pick it up, and then continue to do nothing.

That is the way to achieve excess returns.”

Best wishes!

Disclaimer

The content of this article is for general informational purposes only, based on current facts and sources, and should not be considered professional advice. Please conduct your own research and consult qualified advisors before making any decisions. The author is not responsible for any consequences arising from the information in this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。