在加密货币领域,投资者总是在寻找兼具高收益与低风险的投资机会。近日,波场TRON创始人、火币HTX全球顾问孙宇晨在社交媒体上力荐一种新型挖矿组合——sTRX+USDD,称其为“2025必挖币圈神矿”,年化收益可达15%-20%甚至更高。那么,sTRX+USDD究竟是什么?为何被誉为“神矿”?本文将客观分析其优势,并提供参与指南,帮助读者理解这一投资机会。

JustLend链上质押:sTRX+USDD,开启“链上印钞机”

JustLend是波场Tron生态中的主力借贷协议,此前上线了支持TRX质押铸造sTRX的功能。先简单介绍一下sTRX和USDD的基本概念:

- sTRX(Staked TRX):即质押的TRX,是用户通过将TRON网络的原生代币TRX质押后获得的凭证。质押TRX不仅能赚取网络使用费的收益,还能参与铸造其他资产。

- USDD:一种去中心化的稳定币,与美元1:1挂钩,通过质押sTRX等资产铸造,其收益由系统补贴提供。

在币圈待久了,见过太多来去匆匆的“高收益项目”,也踩过无数“锁仓跑路”的坑。但这次,真的有点不一样。让孙哥手敲近千字“种草”的“sTRX+USDD”挖矿,通过JustLend质押TRX获得sTRX,再用sTRX铸造USDD并存入平台赚取双重收益的策略。那么,“sTRX+USDD”何以封神?以下从多个角度分析其“神矿”特质。

“sTRX+USDD”封神六要素,全都在这里了!

1. 零锁仓!资金完全自由

老实说,这年头真不敢碰还要锁仓的挖矿项目了。sTRX+USDD最打动人的一点就是——不锁本金、不设门槛,随时进出,灵活至上。今天挖,明天走,后天回来都OK,短线党和风险厌恶型用户的福音。真正实现了“赚了就走,想走就走”,这也是为什么一大波社区用户在实操后感慨:终于等到一个不绑架资金的DeFi玩法了。

2. 年化高达15%-20%以上,还能跑大资金

收益是投资者最关心的指标之一。据孙哥透露,sTRX+USDD组合目前的年化收益率在15%-20%以上,且有进一步上涨潜力。且支持大额资金进出,适合散户也适合机构。在其他DeFi项目动辄小水池的限制下,sTRX+USDD堪称“大水池里的高收益”,是高收益与规模兼容性的少见组合。

3. 收益来源扎实,没那种塌方风险

收益的可持续性是衡量挖矿项目的重要标准。相比说塌就塌的“画大饼”型项目,sTRX+USDD的收益模型非常清晰:

- sTRX部分:源于TRON网络的使用费。每笔转账、DApp调用都在消耗能量,而这些资源则由质押的TRX提供。所以收益稳定、真实,跟TRON链上活跃度正相关,活跃时年化高达30%,低时也有8%-9%。

- USDD部分:来自系统补贴,年化稳定在8%左右,以USDD直接到账。因USDD与美元挂钩,无需担心价格波动,也无需频繁卖出变现。

所以说它是“躺赚型”的被动收入来源,真没毛病。

4. 极致安全:DeFi玩法集大成者的稳健设计

说实话,币圈这么多年,大家对“安全”两个字早就麻了。但这套玩法堪称币圈挖矿的“集大成者”:sTRX的安全性依托于TRON网络的繁荣生态,就像你买了长江电力的股,每天分电费;只不过这回你“供能量”,平台给你分TRX;USDD的安全性则来自系统性补贴+稳定币机制,不涉及炒币、无人为干预,全流程链上执行。

整套逻辑不依赖第三方平台、不怕项目跑路或价格剧烈波动,可以说是目前极少数让人“睡得着觉”的挖矿方式。

5. 保留TRX上涨空间,一鱼两吃

与传统“质押即锁仓”的机制不同,sTRX是“质押生成衍生资产”——也就是说,你把TRX质押生成了sTRX,但TRX本体还在后台跑收益,价格上涨你也能享受。

TRX作为TRON网络的原生代币,历史表现强劲,长期持有者可通过sTRX同时享受既赚利息又吃行情的双重福利。

6. 高可组合性玩法,适配所有用户画像

sTRX+USDD神矿最后一个“封神因素”是玩法足够灵活,你大可以根据风险偏好自由选择:

- 你可以只质押sTRX,赚取TRX收益;

- 也可以只铸造并存入USDD,吃USDD补贴;

- 更可以像KOL们一样两者结合,实现收益最大化。

而且全程无锁定、闪兑通畅(火币HTX App就能一键换币),调整仓位或增减资金都极为便捷。这套组合几乎适配所有用户画像:新手、老韭菜、主流资产持仓者,人人都能找到适合自己的姿势。

手把手实操:如何参与sTRX+USDD挖矿?

了解了“神矿”的优势后,以下是具体的参与步骤:

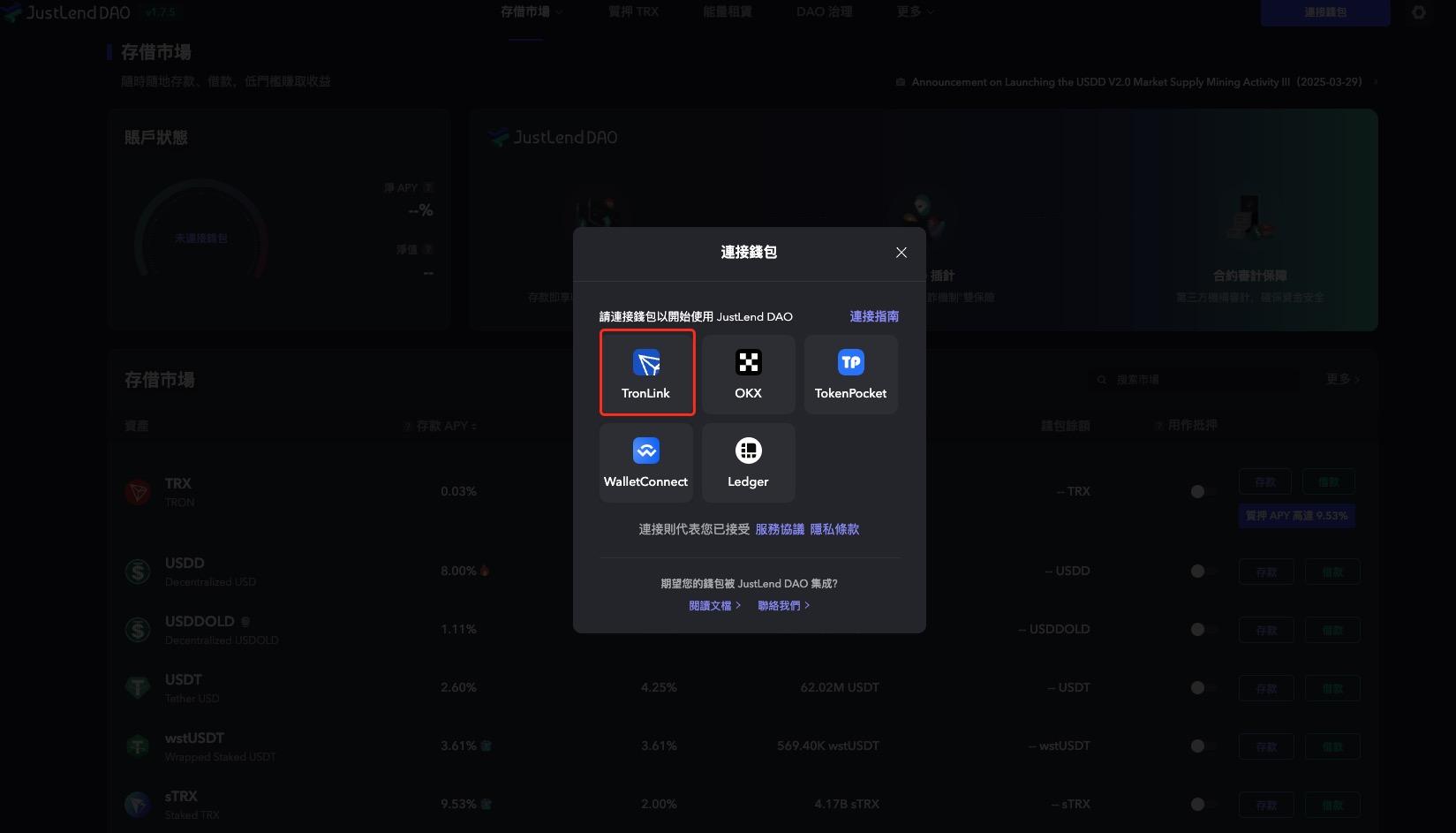

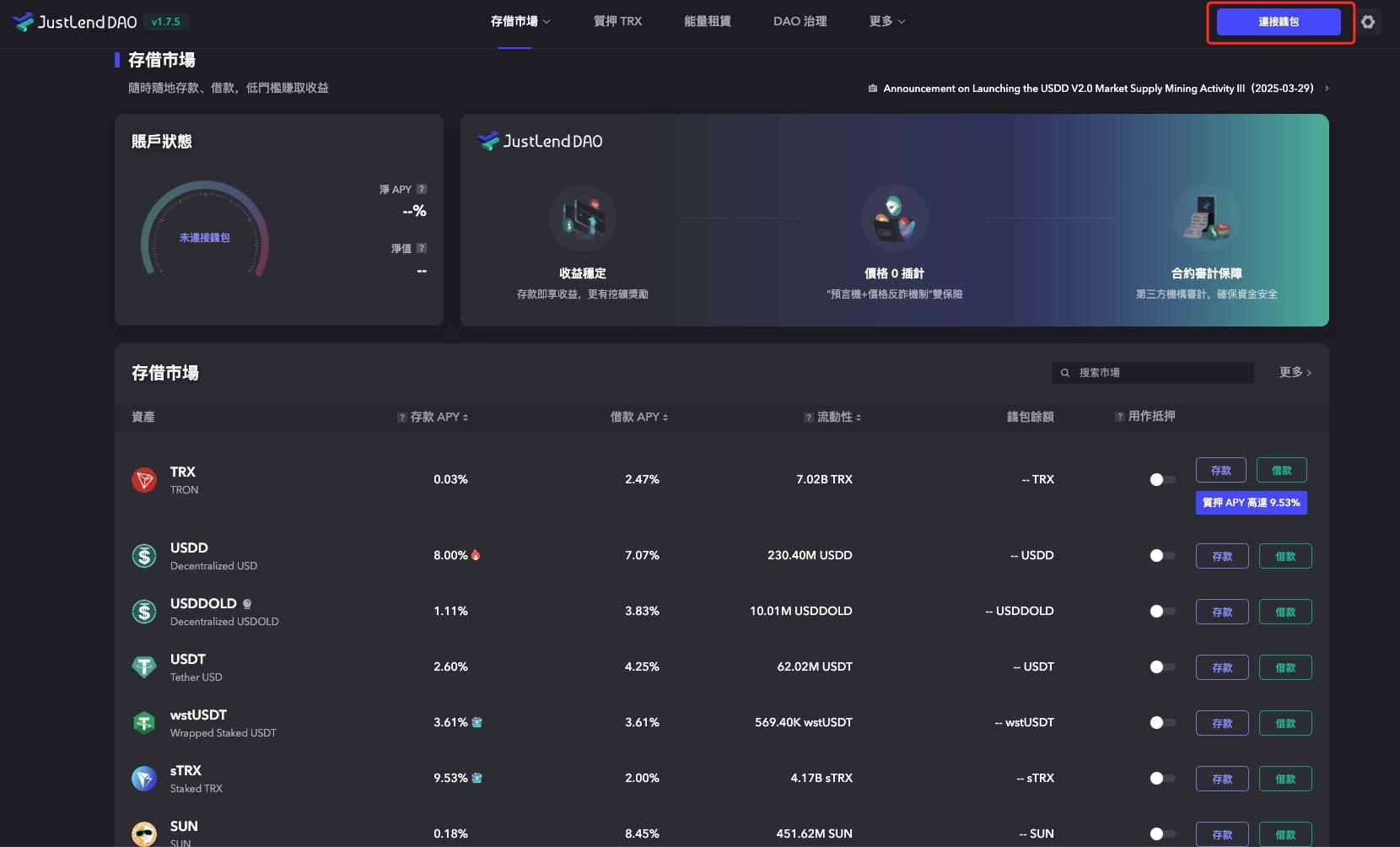

1. 访问JustLend官网(https://justlend.org/ ),并连接钱包,选择Tronlink钱包。

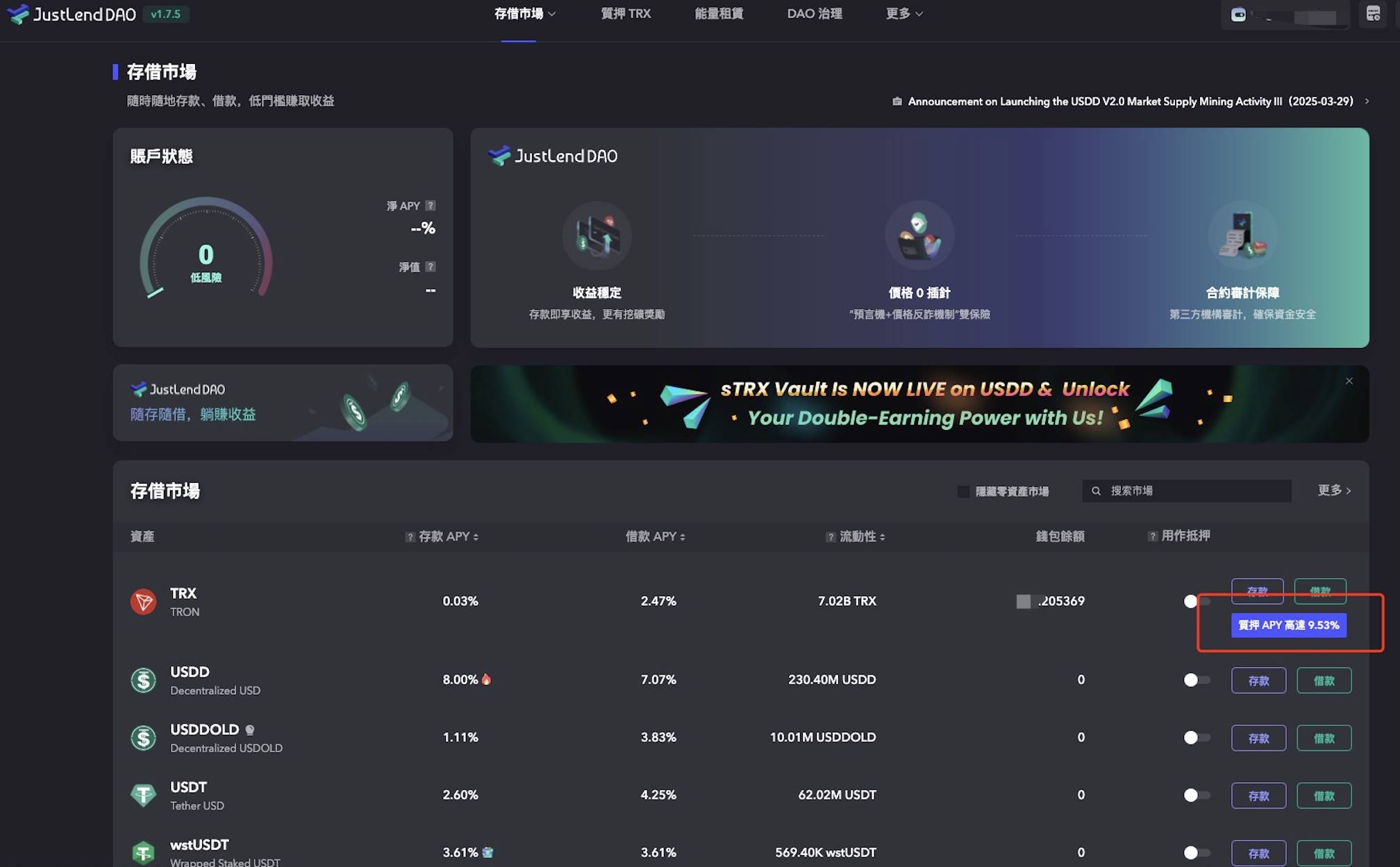

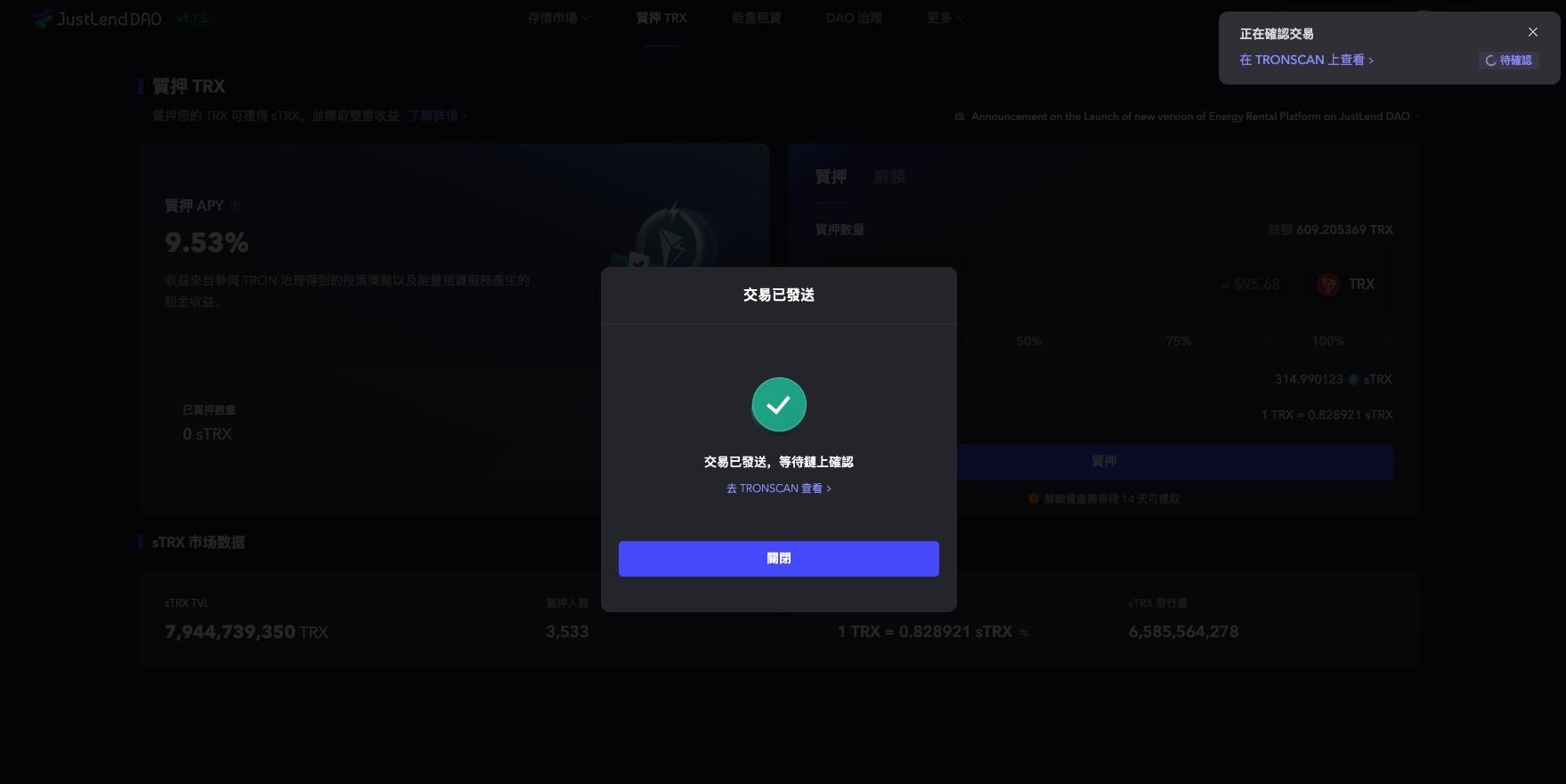

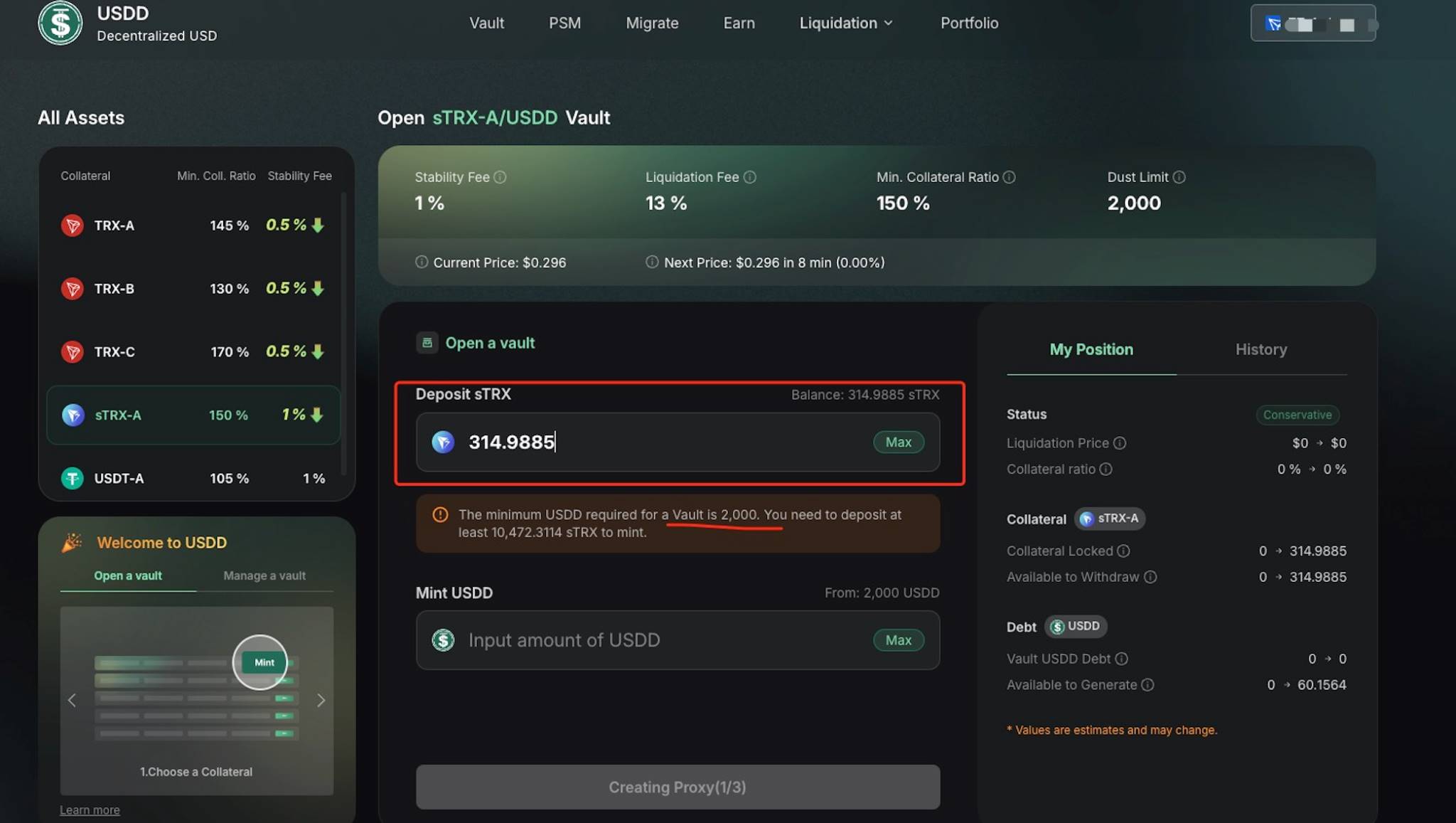

2. 质押TRX获取sTRX:在“Staked TRX”页面质押TRX。听劝!为避免多次质押损耗Gas费,建议一次性质押至少10473 sTRX。

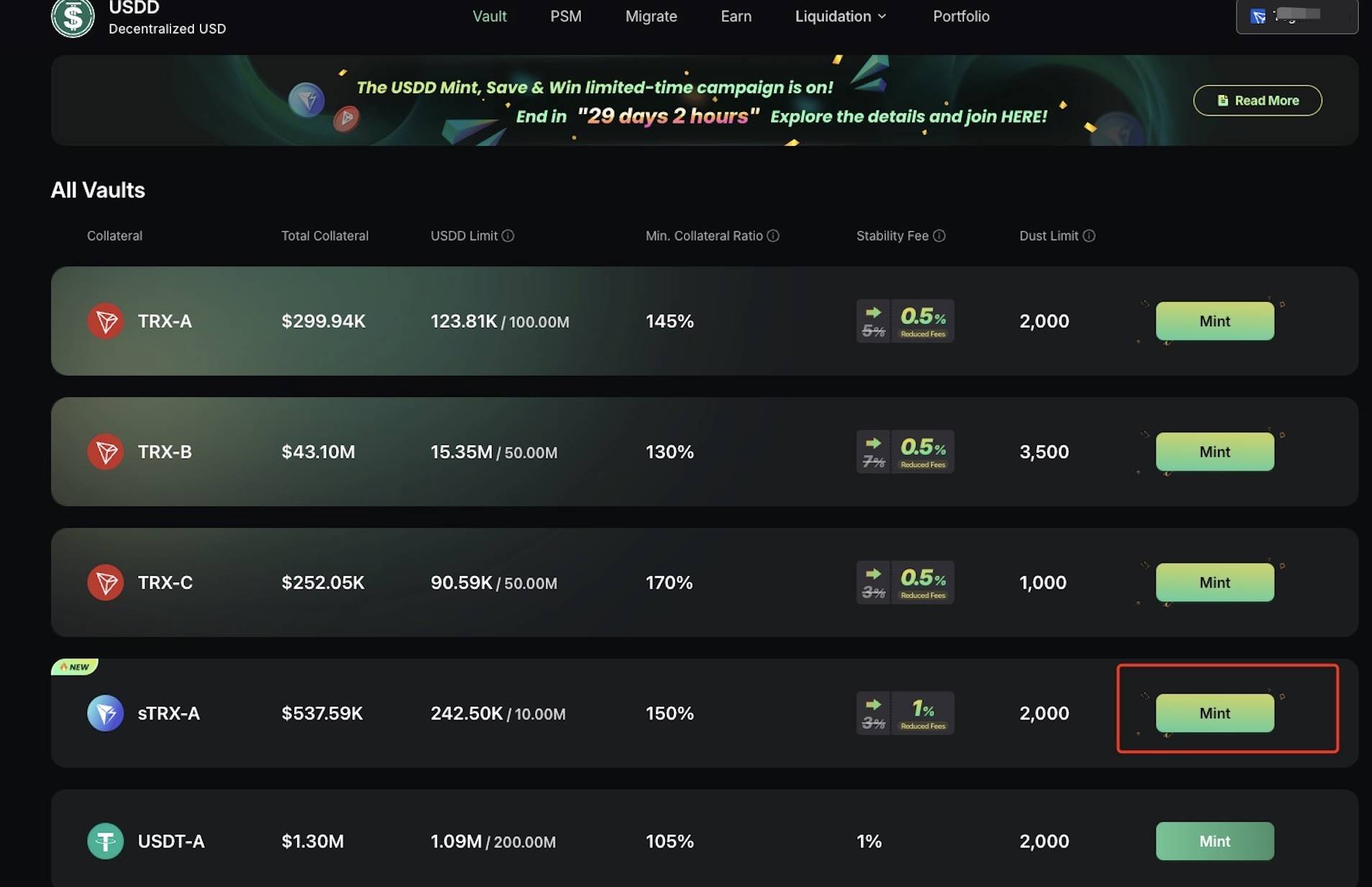

3. 铸造USDD:前往USDD官网(https://usdd.io/ ),选择“sTRX-A”,点击“Mint”功能,用sTRX作为抵押品铸造USDD。需注意,铸造USDD要求150%抵押率,即100U的sTRX可铸造约66.67U的USDD。

(注意:这里我最开始只有几百 sTRX 是不够的!!!建议一次性质押获得至少10473 sTRX)

4.存入USDD赚取收益:返回JustLend官网,在存款界面存入USDD,即可享受约8%的年化收益,加上sTRX的收益,总年化可达15%以上。

总结一下操作路径:TRX → sTRX → USDD → USDD质押,一条链上打通的资金路径。当你需要TRX或USDD,火币HTX 站内的闪兑功能已经准备就绪。

火币HTX 闪兑功能:链上玩家的“能量补给站”

因为开始质押时TRX不够用,我去火币HTX App 用闪兑功能换了一些TRX回来质押,别说还挺丝滑的。目前,火币HTX App 支持参与链上“神矿”的关键工具:

- USDT ↔ TRX 闪兑功能:币种间快速兑换,链上操作前轻松补齐筹码

- USDT ↔ USDD 1:1闪兑:0手续费、0滑点,用户可通过闪兑功能或资产页入口进行兑换,避免滑点和时间成本

除此之外,火币HTX已上线了多项USDD赚币产品,如“USDD灵活赚”、“USDD锁仓赚”,年化收益在10%至20%不等,灵活参与、收益稳健。

写在最后:如果你正在找一个能“长期做、稳定赚、不容易塌”的DeFi项目,真的可以认真研究一下这套组合

综合来看,sTRX+USDD以其零锁定、高收益、稳定来源、高安全性、上涨潜力和灵活组合六大优势,确实具备“2025必挖神矿”的潜质。JustLend、sTRX、USDD 的三位一体组合,正在构建一个全新的稳定收益网络。它不是短期爆发、也不靠FOMO,而是一套可跑全周期的稳健系统。

对于追求收益的投资者,这是一个不容忽视的机会。然而,鉴于链上质押的完全去中心化特点,参与者需谨慎操作,确保资金安全,选择可靠的存储方式。无论是新手还是老手,sTRX+USDD都值得一试——或许,这正是币圈下一个财富风口。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。